So we see a 130 dollars pop from that Weekly and Friday support near 6220 to end the session today near 6370.

因此,我们看到周线和周五支撑位 130 附近上涨 6220 美元,今天收盘价接近 6370。

For days ahead, I think this 6380/6330 area remains key.

在未来几天,我认为这个 6380/6330 区域仍然是关键。

I do think minus any material catalysts in week ahead, we could see range bound action here and if we are unable to close back above 6380 soon, we could revisit last week’s lows at some point.

我确实认为,如果减去未来一周的任何重大催化剂,我们可能会在这里看到区间波动,如果我们无法很快收回到 6380 上方,我们可能会在某个时候重新回到上周的低点。

We could see some rocky month or two ahead and I think we can see some abatement towards start of Fall.

我们可能会看到未来一两个月的动荡,我认为我们可以看到秋季开始时有所减弱。

My key level tomorrow will be 6392.

我明天的关键水平将是 6392。

Scenario 1: if we remain below 6392, we could retest 6330.

情景 1:如果我们保持在 6392 下方,我们可以重新测试 6330。

Scenario 2: My edge case on the session will be above 6392 or below 6330. We are now 6370.

情景 2:我在交易时段的边缘情况将高于 6392 或低于 6330。我们现在是 6370。

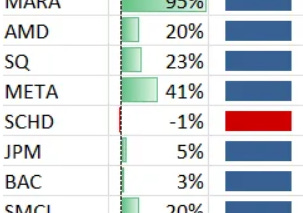

In some related markets we saw one of the best quarters by any public company ever by PLTR today. You will recall I was bullish on this at 150 just a few days ago, and at time of this post, it traded as high above 170 today post market.

在一些相关市场中,我们看到了今天 PLTR 有史以来所有上市公司中最好的季度之一。你会记得几天前我看好这一点 150,而在这篇文章发表这篇文章时,它的交易价格在今天盘后高达 170 以上。

Then we saw an amazing day in comm scope. It was up almost a 100% today, this was shared by me only few days ago at 7.

然后我们在通信范围内看到了令人惊叹的一天。今天几乎上涨了 100%,这是我几天前 7 点分享的。

~ tic ~抽搐

Disclaimer: This newsletter is not intended to provide trading or investment advice but solely for general informational & educational purposes. It represents the personal opinions of the author, shared publicly with you as a personal blog. Engaging in futures, stocks, or bonds trading involves significant risk, and there is no guarantee of profit. In fact, there is a possibility of losing one's entire investment. Utmost caution is advised. Your account can go to zero. The author does not guarantee any profit whatsoever, and the reader assumes the entire cost and risk of any trading or investing activities undertaken. The reader is solely responsible for making informed investment decisions. The owners/authors of this newsletter, its representatives, principals, moderators, and members are not registered as securities broker-dealers or investment advisors with the U.S. Securities and Exchange Commission, CFTC, or any other securities/regulatory authority. Consultation with a registered investment advisor, broker-dealer, and/or financial advisor is recommended. By accessing and utilizing this newsletter or any of its publications, the reader agrees to the terms set forth herein. Any screenshots used are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw, with whom the author has no affiliations. The information and quotes shared in this blog may contain inaccuracies, as markets are inherently risky and subject to unpredictable fluctuations. Additionally, the content of this blog is the intellectual property of the author, and its sharing or copying is strictly prohibited. By reading this blog, the reader accepts these terms and conditions and acknowledges that it is intended solely as a personal trading journal and nothing more.

免責聲明: 本时事通讯无意提供交易或投资建议,而仅用于一般信息和教育目的。它代表作者的个人观点,作为个人博客与您公开分享。从事期货、股票或债券交易涉及重大风险,并且无法保证盈利。事实上,有可能损失全部投资。建议格外小心。您的账户可能会归零。作者不保证任何利润,读者承担所进行的任何交易或投资活动的全部成本和风险。读者全权负责做出明智的投资决策。本时事通讯的所有者/作者、其代表、负责人、版主和成员未在美国证券交易委员会、CFTC 或任何其他证券/监管机构注册为证券经纪自营商或投资顾问。建议咨询注册投资顾问、经纪自营商和/或财务顾问。通过访问和使用本时事通讯或其任何出版物,读者同意此处规定的条款。使用的任何屏幕截图均由 Ninja Trader、FinViz、Think or Swim 和/或 Jigsaw 提供,作者与他们没有任何关系。本博客中分享的信息和报价可能包含不准确之处,因为市场本质上存在风险并受到不可预测的波动的影响。此外,本博客的内容是作者的知识产权,严禁分享或复制。阅读本博客,即表示读者接受这些条款和条件,并承认它仅用作个人交易日志,仅此而已。

Recommend Tic Toc's OrderFlow Newsletter to your readers

向您的读者推荐 Tic Toc 的 OrderFlow 时事通讯

期权、股票和期货领域最有先见之明的交易。