RDDT +13%:收入大幅超预期,达到 5 亿美元,市场预期为 4.25 亿美元,保守预估为 4.5 亿美元。

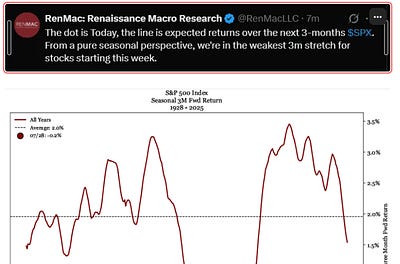

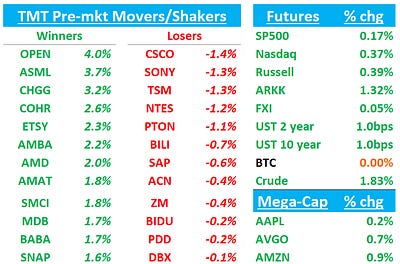

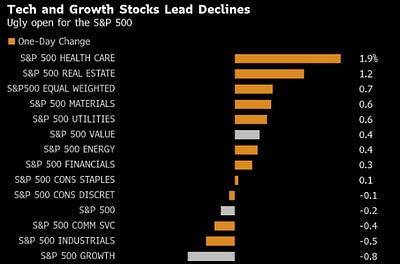

QQQs -40bps after being close to +1.5% at one point — price action continues to point to more digestion as we’re now in the toughest seasonal period of the year over the next month and half.

QQQs 在一度接近+1.5%后下跌 40 个基点——价格走势继续显示出更多的消化,因为接下来一个半月是全年最艰难的季节性时期。

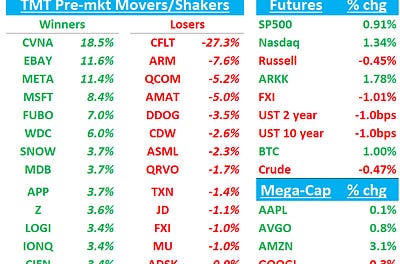

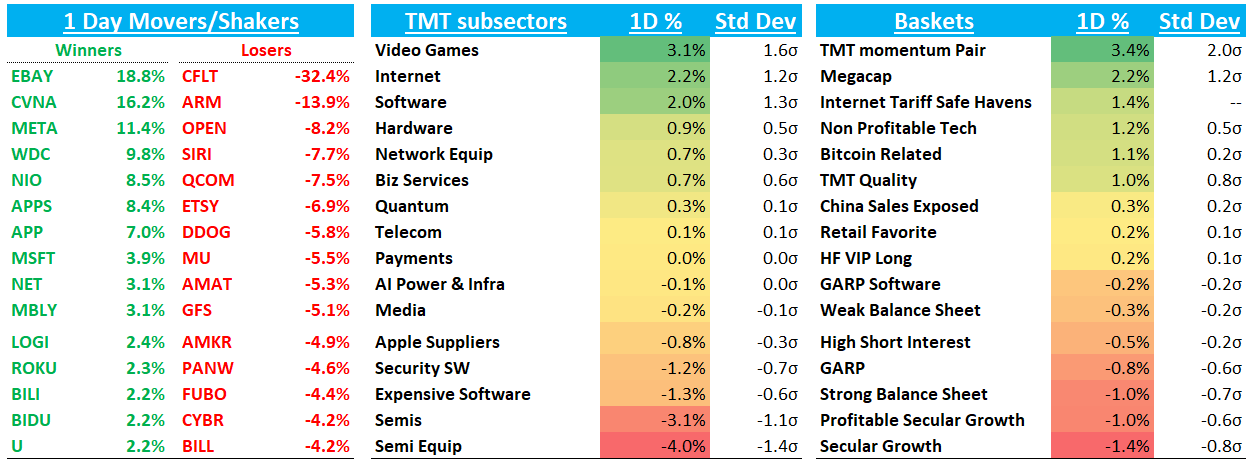

Bad news continues to be sold hard — just take a look at CFLT -32%, ARM -14%, COM -14%, or MU -5% among others today. Positioning & sentiment continue to play a more than average importance this earnings season — just take a look at the difference between META +12% where intra-q positioning skewed short given opex fears among the fast money crowd vs. the more long-crowded RBLX +9% and MSFT +4% fading on unarguably great prints as well. Read-throughs are acting similarly with AI semis not acting as well as one would expect given the capex guidance from MSFT/META and TI reporting that OpenAI $12 Billion in Annualized Revenue, breaking 700 Million ChatGPT WAUs— shows that even the AI trade is taking a big of a breather after what’s been a non-stop Hot AI Summer party. Rainy days Digestion can be a good thing in the hottest of summers.

坏消息继续被大幅抛售——看看今天的 CFLT 跌 32%、ARM 跌 14%、COM 跌 14%、MU 跌 5%等。持仓和情绪在本财报季的重要性超过以往——看看 META 上涨 12%,由于快钱群体对期权到期的担忧,季度内持仓偏空,与持仓较多的 RBLX 上涨 9%和 MSFT 上涨 4%但在无可争议的强劲财报后股价回落形成鲜明对比。相关反应也类似,尽管 MSFT/META 的资本支出指引和 TI 报告 OpenAI 年化收入达 120 亿美元、ChatGPT 月活跃用户突破 7 亿,AI 半导体表现却未如预期,这表明即使是 AI 交易在经历了持续火热的 AI 夏季派对后也在稍作喘息。炎热夏季中的阴雨天消化期,有时也是好事。

Positioning/Sentiment is mattering more on good news vs. bad however — bad prints are just being sold regardless — especially if it’s a bad quality company - regardless of positioning. That continues to skew the r/r to the downside this earnings season, as has been the case over the last several weeks.

在好消息与坏消息之间,仓位/情绪的影响更加显著——坏消息无论如何都会被抛售,尤其是对于质量较差的公司——无论仓位如何。这种情况在本财报季持续导致风险回报偏向下行,正如过去几周的情况一样。

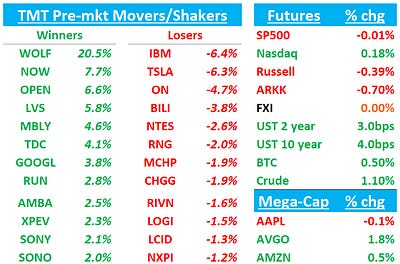

Some beats are even following through to the downside. Check out NOW breaking down:

有些超预期的业绩反而继续下跌。看看 NOW 的下跌表现:

Or NFLX: 或者 NFLX:

We’ll stick to what we said earlier this week:

我们将坚持本周早些时候所说的:

We all know the markets have been very frothy the past couple months and now we are seeing stocks going down on good news

(outside of AI semis) in the face of the seasonally weakest period for stocks. Adjusting net/gross/sizing somewhat doesn’t sound like a bad idea…focus on the highest quality/conviction ideas

我们都知道过去几个月市场非常活跃,而现在在季节性最弱的股票时期,除了人工智能半导体板块外,股票在利好消息面前反而下跌。适当调整净敞口/总敞口/仓位似乎是个不错的主意……重点关注最高质量和最有信心的投资标的。

We get a slew of earnings this afternoon from AMZN RDDT NET AAPL and COIN. Should be a fun end to an exciting week.

今天下午我们将迎来 AMZN、RDDT、NET、AAPL 和 COIN 的一系列财报。对于这个激动人心的一周来说,结局应该会很精彩。

Let’s get to it… 我们开始吧……

INTERNET 互联网

AMZN +2% as price action today has some worried given lack of follow through on some big beats (AMZN positioning skews more long than META was into the print, although maybe a tiny bit less than MSFT…GS has it at a 7 out of 10. I’d say prob say closer to 8 out of 10). AWS estimates probably ticked up overnight now closer to 17.5-18% vs the 17% going in before the Azure print.

AMZN 上涨 2%,由于一些重大超预期业绩未能持续推动股价,今日的价格走势让部分投资者感到担忧(AMZN 的持仓偏多,超过了 META 发布财报前的持仓水平,尽管可能略低于 MSFT……高盛给出的评分是 7 分(满分 10 分),我认为更接近 8 分)。AWS 的预期可能在隔夜有所上调,现在接近 17.5%-18%,而此前 Azure 财报发布前的预期为 17%。META +11.5% on one their best prints in years as Zuck backed up what he has been telling new recruits: our business model rocks and we can fund as much compute as you want. We wrote our thoughts this morning here … GOOGL -2% as some unwinding of the L GOOGL / S META trade

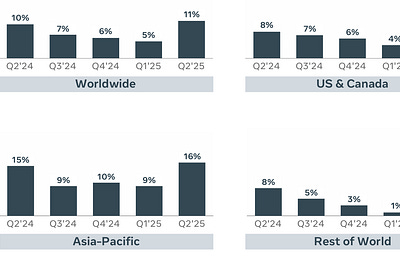

META 上涨 11.5%,创下多年来最佳业绩之一,扎克支持他一直对新员工所说的话:我们的商业模式非常出色,我们可以为你提供所需的任何计算资源。我们今天早上在这里写了我们的看法……GOOGL 下跌 2%,部分原因是 L GOOGL / S META 交易的平仓。RBLX +9%: Even long-time stubborn bear Doug Creutz at Cowen had to admit in the title of his note “That was pretty impressive".” Q2 bookings crushed at 51% y/y and non-GAG games grew +36% helping put a nail in the one-time hit bear case. Mgmt was adamant GAG’s hit status enhanced the success of other games rather than hinder it as 2nd tier games grew 90% y/y. Q3 Bookings +41% at a minimum much better than expected and while Q4 bookings guide implies a decel, we think its just mgmt being overly conservative and think its possible bookings could grow 50% 3 straight quarters. Yes, we all know comps get harder in CY26, but that’s a story for another time. In the meantime, stock continues to get re-rated higher. It’s a similar story to what happened to CVNA over the last several years where the shareholder base/perception of stock did a 180 — RBLX is no longer a 3p data tracking stock, but investors are appreciating the more durable nature of tailwinds. And that’s not to mention most tailwinds haven’t even really ramped: SHOP partnership, GOOGL Ad partnership, AAPL app store chg tailwinds, AI vibe content creation, IP License Manager, etc.

RBLX +9%:即使是 Cowen 的长期坚定看空者 Doug Creutz 也不得不在他的报告标题中承认“这相当令人印象深刻”。第二季度预订量同比暴增 51%,非 GAG 游戏增长 36%,这几乎打破了一次性冲击的看空论点。管理层坚称,GAG 的冲击地位增强了其他游戏的成功,而非阻碍,二线游戏同比增长 90%。第三季度预订量至少增长 41%,远超预期,虽然第四季度预订指引显示增速放缓,但我们认为管理层过于保守,预订量连续三个季度增长 50%是有可能的。是的,我们都知道 2026 年日历年比较基数会变难,但那是另一个故事。与此同时,股票持续被重新估值走高。这与过去几年 CVNA 的情况类似,股东基础和市场对股票的看法发生了 180 度转变——RBLX 不再是一个第三方数据追踪股票,投资者开始认可其更持久的利好因素。这还不包括大多数利好因素实际上还未真正启动:SHOP 合作、GOOGL 广告合作、AAPL 应用商店变动带来的利好、AI 氛围内容创作、IP 许可管理器等。EBAY +12% after biggest top line surprise in 19 quarters. 3p data here had been positive, but surprised to the upside with GMV +4% cc and q3 GMC guided +3-5% cc.

EBAY 上涨 12%,创下 19 个季度以来最大的营收惊喜。3p 数据一直表现积极,但 GMV 同比增长 4%(按可比口径),第三季度 GMC 指引为同比增长 3-5%,超出预期。RDDT +7% helped by META print and also news that GOOGL might be testing a RDDT specific section above the fold - link here

RDDT 上涨 7%,受益于 META 财报以及 GOOGL 可能测试 RDDT 专属首页上方版块的消息——链接在此。ETSY +7% couldn’t hold its post-EPS gains

ETSY 上涨 7%,但未能维持财报发布后的涨幅。Outperformance in some China names: VNET +2.5%; GSD +2.5%; BABA +2.4%

部分中国股票表现优异:VNET 上涨 2.5%;GSD 上涨 2.5%;BABA 上涨 2.4%。CVNA +16% on a clean beat and raise

CVNA 因业绩超预期并上调预期上涨 16%

SEMIS 半导体

MU -5% as the bad news on HBM continues to pile up — this time it was Samsung saying on their EPS call that HBM3E supply will exceed demand, feeding fears of oversupply in 2h/’26

MU 下跌 5%,因 HBM 的利空消息持续累积——这次是三星在其每股收益电话会议上表示 HBM3E 供应将超过需求,加剧了市场对 2026 年下半年供应过剩的担忧WDC +10% as co beat across the board and guided above.

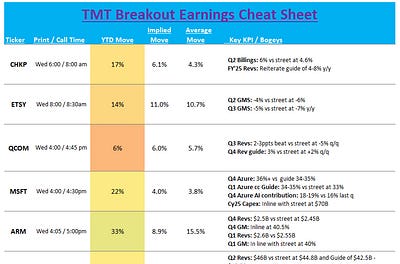

WDC 上涨 10%,公司全面超预期并给出高于预期的指引ARM -14% as Q2 EPS guide missed on higher opex and royalty revs came in below.

ARM 下跌 14%,第二季度每股收益指引因运营费用上升且授权收入低于预期而未达标CRWV +13% on Citi upgrade to buy with 50% upside to tgt on strengthening AI demand. Stock has been weak recently on fears of lock up coming due on Aug 15th.

CRWV 因花旗上调评级至买入,目标价上调 50%,受益于 AI 需求增强,股价上涨 13%。近期股价表现疲软,因市场担忧 8 月 15 日限售期届满。QCOM -7% print did nothing to shake bears with revs missing expectations

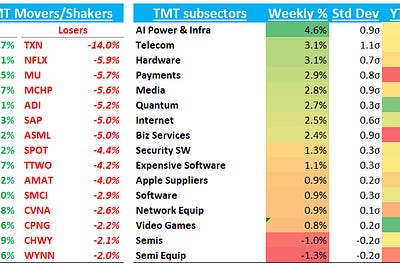

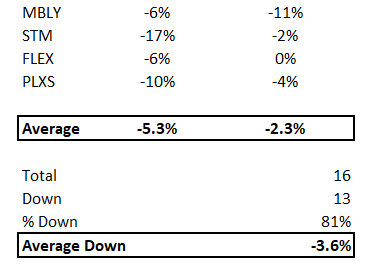

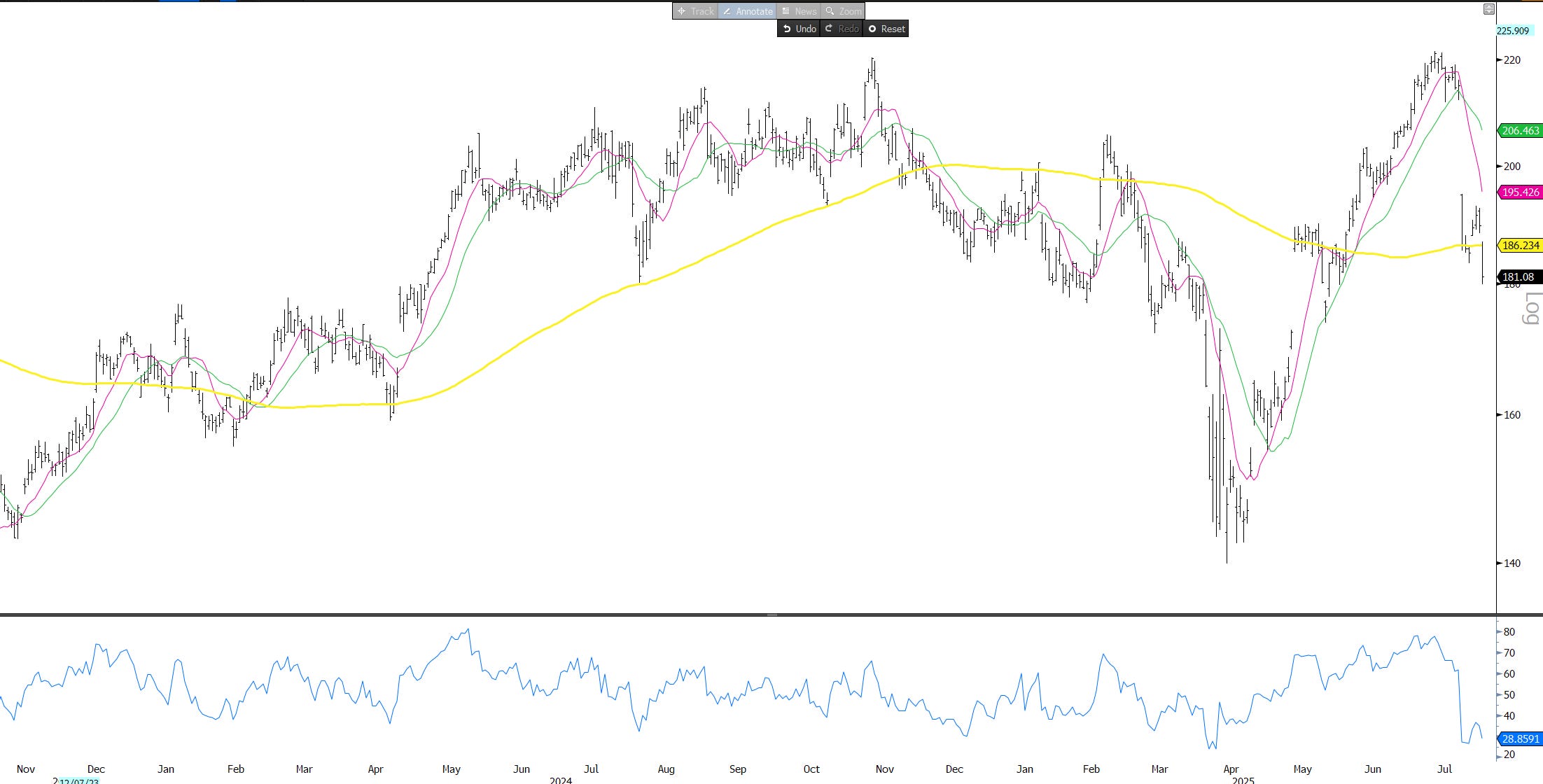

QCOM 下跌 7%,营收未达预期,未能动摇空头信心。Analog especially weak: ON -3.6%; TXN -3.7%; ADI -3%; MCHP -4%. The group continues to break down. Here’s the TXN chart, which looks similar to the others:

模拟信号尤其疲软:ON 下跌 3.6%;TXN 下跌 3.7%;ADI 下跌 3%;MCHP 下跌 4%。该板块持续走弱。以下是 TXN 的走势图,走势与其他公司类似:

SOFTWARE 软件

DDOG -6% after CFLT’s warning that a OAI is shifting from CFLT Cloud to a self managed deployment. Lots out there defending the name saying unlikely OAI moves any time soon as demand is through the roof, almost most admitting eventually a move makes sense. Most thinking contract comes due in Q4 so still going to be that overhang there on the next print even if they blow out numbers which complicates the set up right now

DDOG 下跌 6%,此前 CFLT 警告称 OAI 正从 CFLT 云转向自我管理部署。市场上有不少声音为该股辩护,认为 OAI 短期内不太可能转移,因为需求极为旺盛,几乎所有人都承认最终转移是合理的。大多数人认为合同将在第四季度到期,因此即使业绩大幅超预期,下次财报仍将面临压力,这使得当前形势更加复杂。CFLT -32% on a cloud rev decel and large customer optimizing spend, feeding bear case that it’s not hard to get rid of Kafka - recall that seeds were already planted after Linkedin, one of their first major customers, left CFLT for their own in house solution recently as well…MDB -1.5% and ESTC -4% - investors have been wanting to get more positive on the consumption group as a whole moving down the risk curve (SNOW +1.5% is highest quality name here) but this is putting some fear into nascent bulls.

CFLT 下跌 32%,原因是云收入增长放缓和大客户优化支出,支持了其不难摆脱 Kafka 的空头观点——回想一下,种子已经种下,继 Linkedin(其首批主要客户之一)最近转向自家内部解决方案后……MDB 下跌 1.5%,ESTC 下跌 4%,投资者一直希望对整体消费组持更积极态度,向风险曲线下游移动(SNOW +1.5% 是这里质量最高的股票),但这让初生的多头感到一些恐惧。MSFT +4% on another Azure accel and guide. We think Azure will continue to accel over the next couple of quarters, but pushback here is that these next two quarters will be as good as it gets and then MSFT will face significantly tougher comps. Fair point, but we don’t think we’re there yet. Stock continues to trade very much inline with the AI semi gruop

MSFT 因 Azure 的加速增长和指引上涨 4%。我们认为 Azure 在接下来的几个季度将继续加速,但反对意见认为接下来的两个季度将是最好表现,之后 MSFT 将面临显著更严峻的同比比较。这个观点有道理,但我们认为还没到那个阶段。该股继续与 AI 半导体板块走势高度一致。Unlike AI semis, infra names stronger: ORCL +1.6%; NET +3.5%; SNOW +1.6%

与 AI 半导体不同,基础设施板块表现更强:ORCL 上涨 1.6%;NET 上涨 3.5%;SNOW 上涨 1.6%