100+ Charts & Commentary on all major Markets — for your weekend reading.

100 多张图表及评论,涵盖所有主要市场——供您周末阅读。

“Don’t start the week without it”

“没有它,别开始新的一周”

New all-time highs — just like everyone predicted two months ago…

创历史新高——正如两个月前所有人预测的那样……

KEY TOPICS COVERED 涵盖的主要主题

In today’s report: 在今天的报告中:

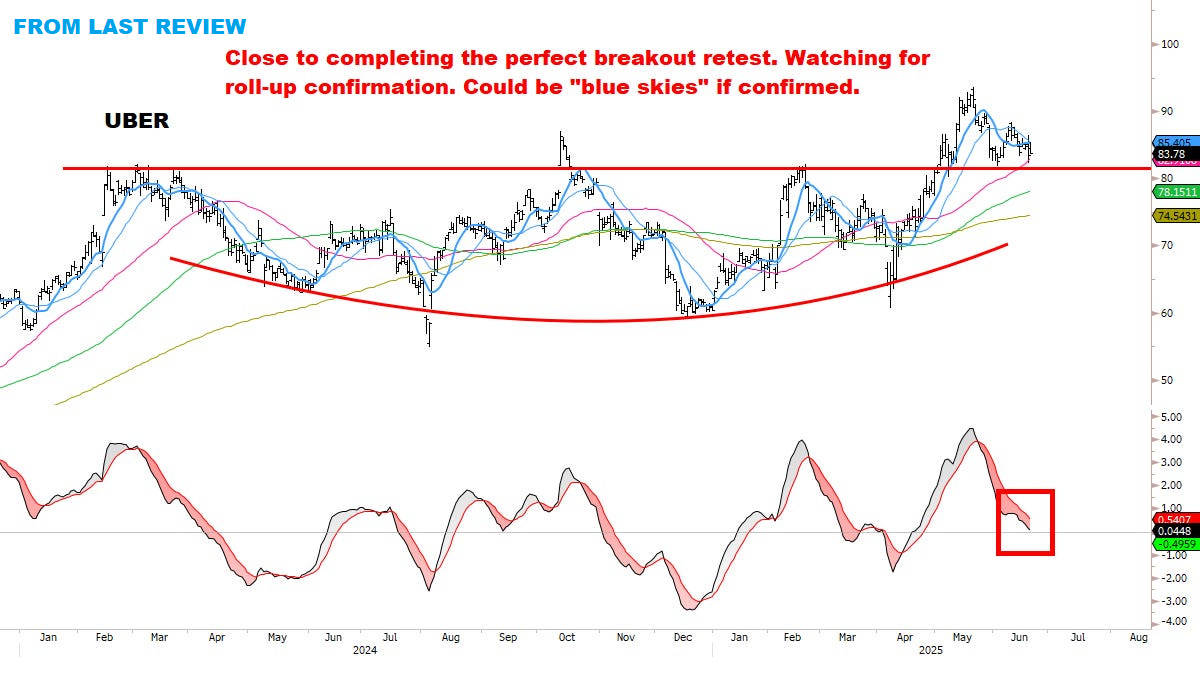

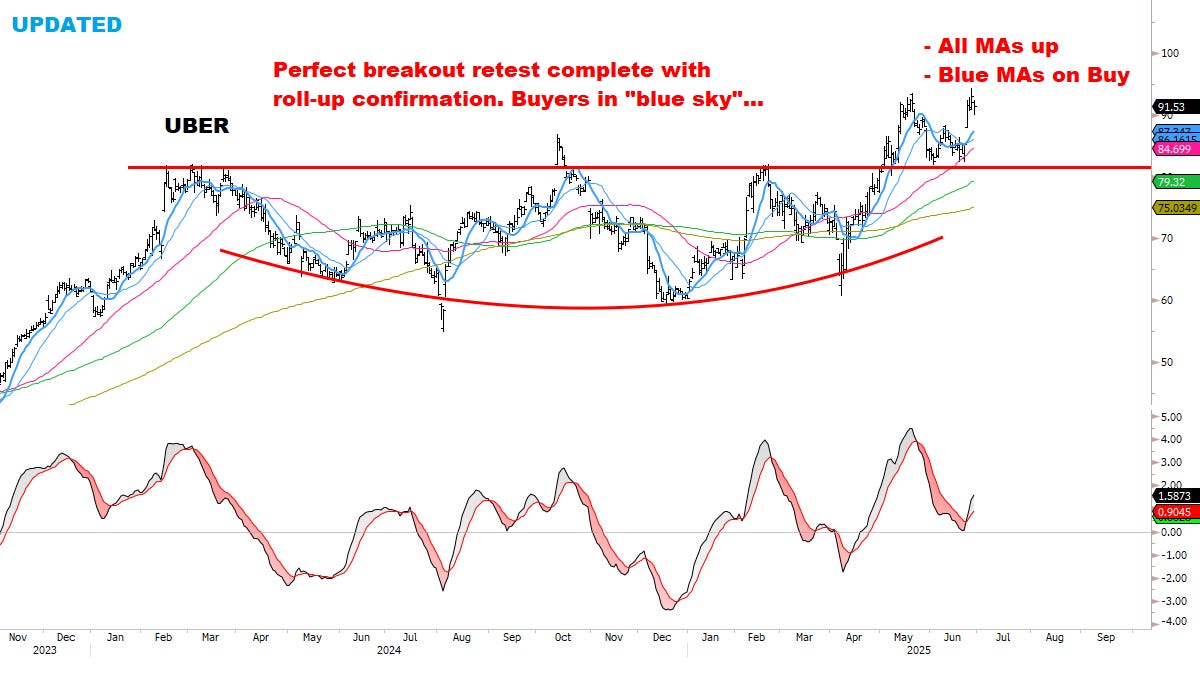

STOCKS: moving UP & OUT on schedule.

股票:按计划上涨并突破。

Last week I wrote: “many stocks still look great — ready to run UP & OUT”.

上周我写道:“许多股票仍然表现出色——准备上涨并突破”。This week was strong confirmation — our top names are *still* leading.

本周强力确认——我们的重点股票*仍然*领跑。SPECIAL UPDATE: How high can stocks go? Time to update an important topping signal I’ve been monitoring *for the right moment*. Keeping an eye on this (and other signals) closely.

特别更新:股票还能涨多高?是时候更新我一直在监控的一个重要顶部信号,等待“合适时机”。密切关注这一信号(以及其他信号)。Updated scans & targets: assessing (1) model signals, (2) market behavior, (3) individual stocks.

更新扫描与目标:评估(1)模型信号,(2)市场行为,(3)个股表现。Scanning for weakness / SHORTS.

扫描弱势/做空机会。

BONDS: Turning Bullish? 债券:转为看涨?

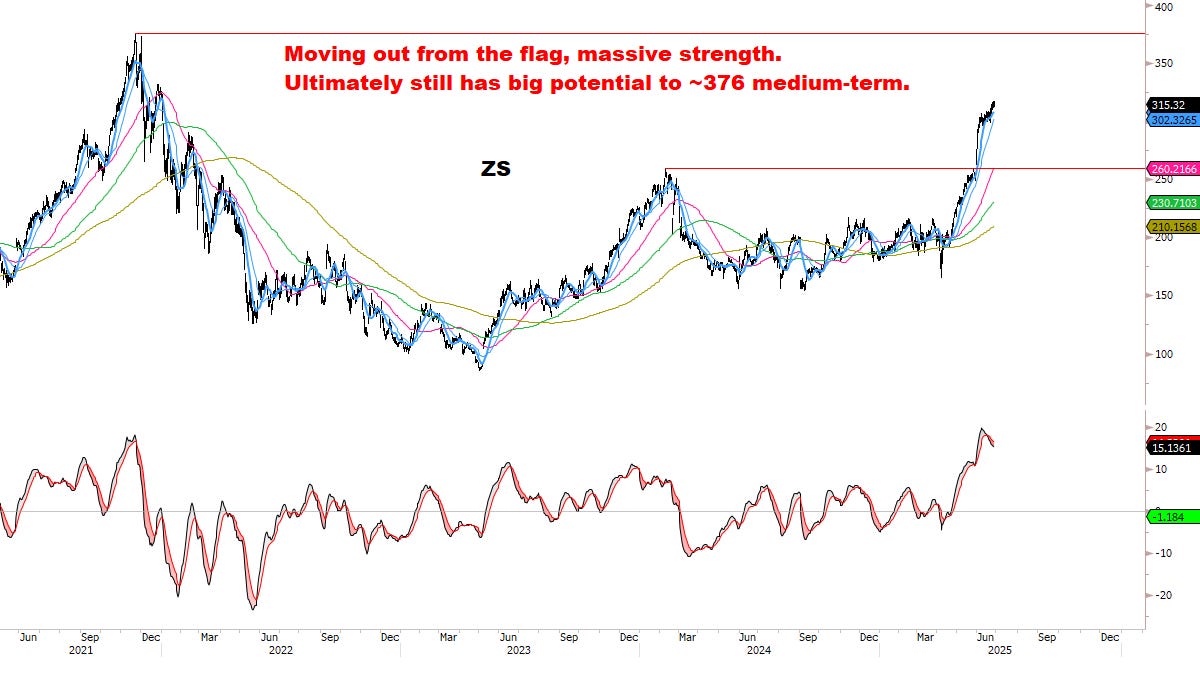

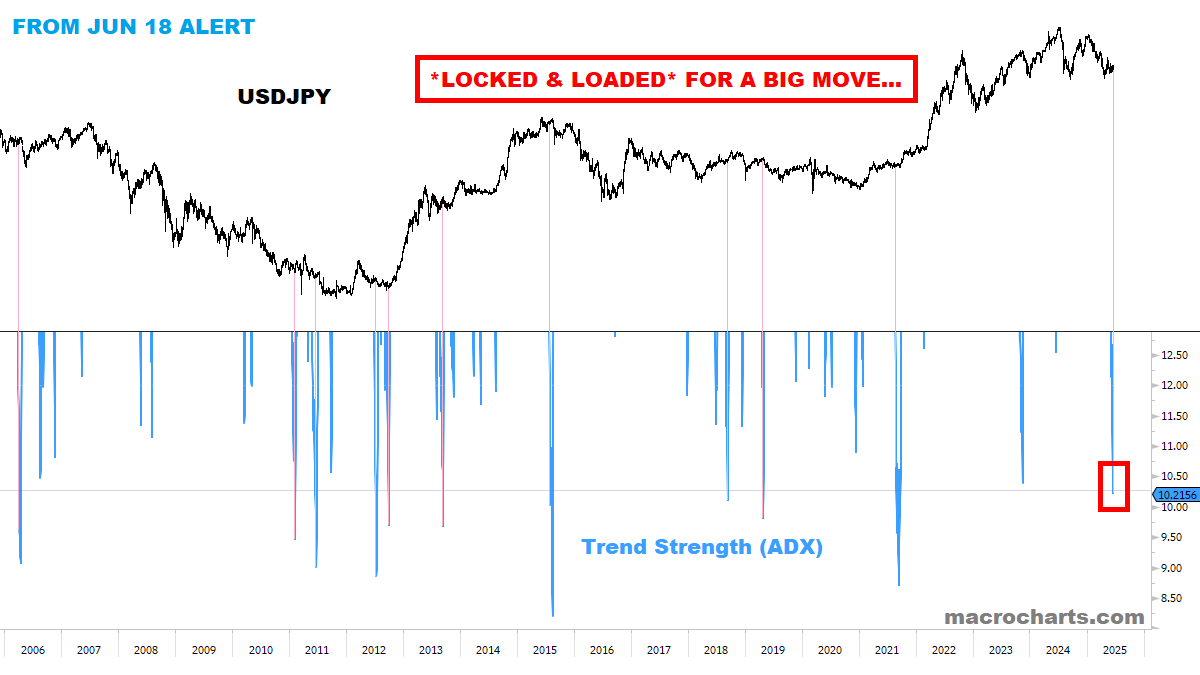

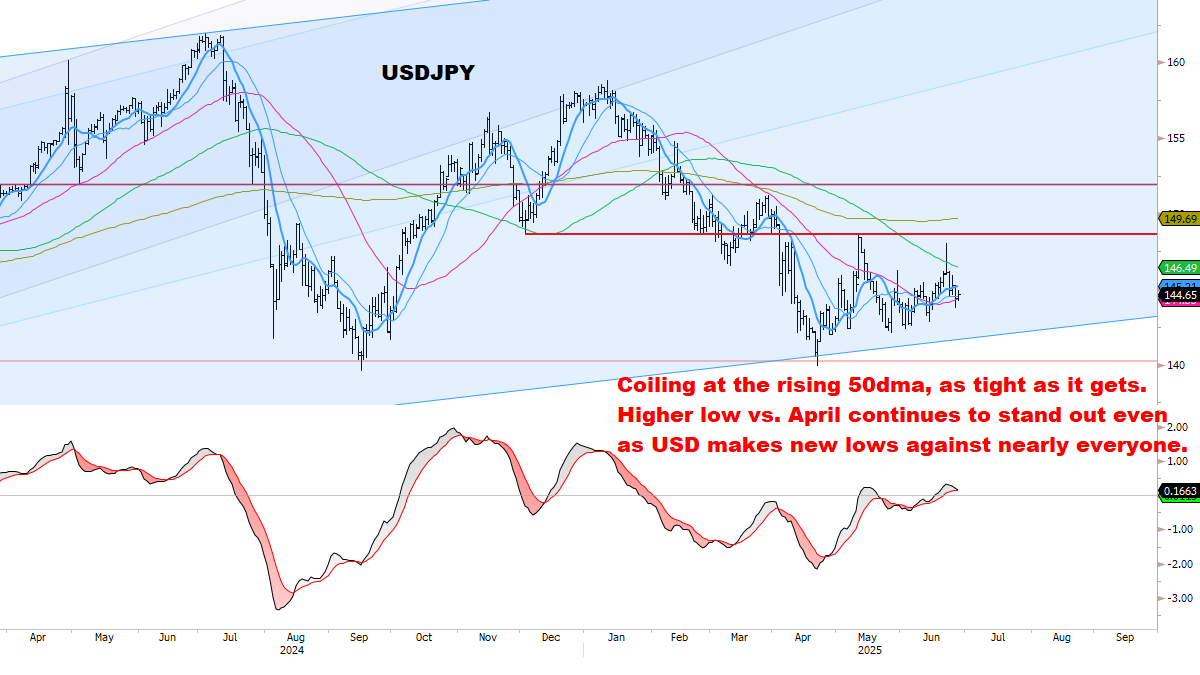

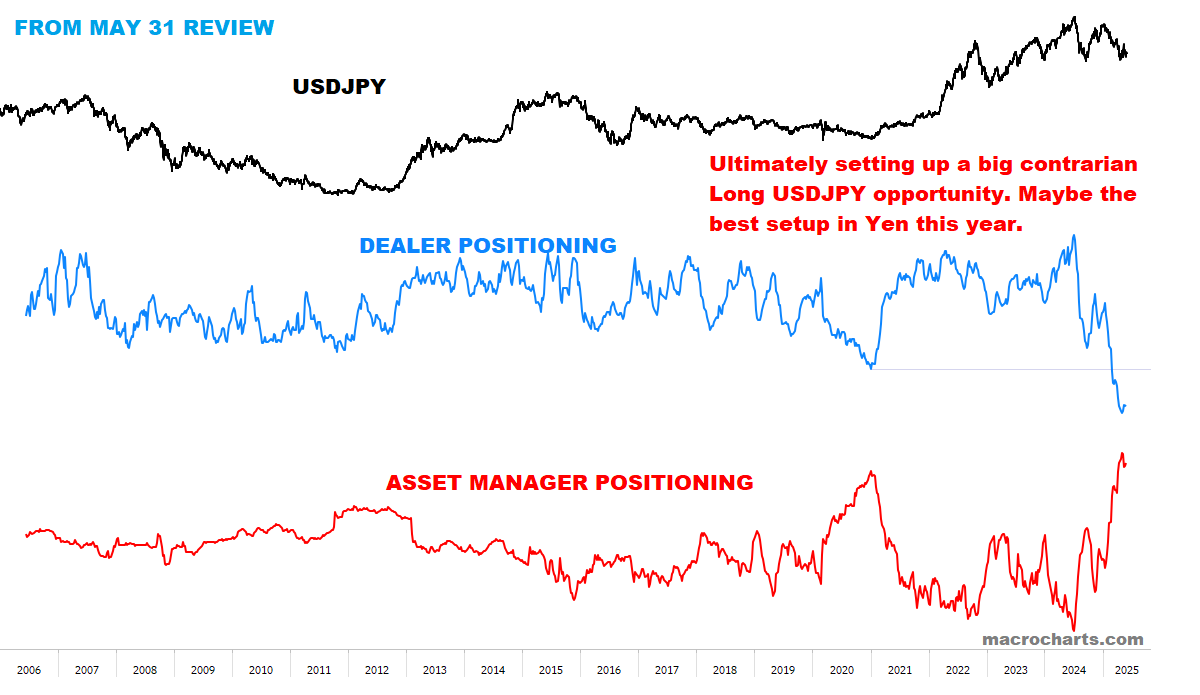

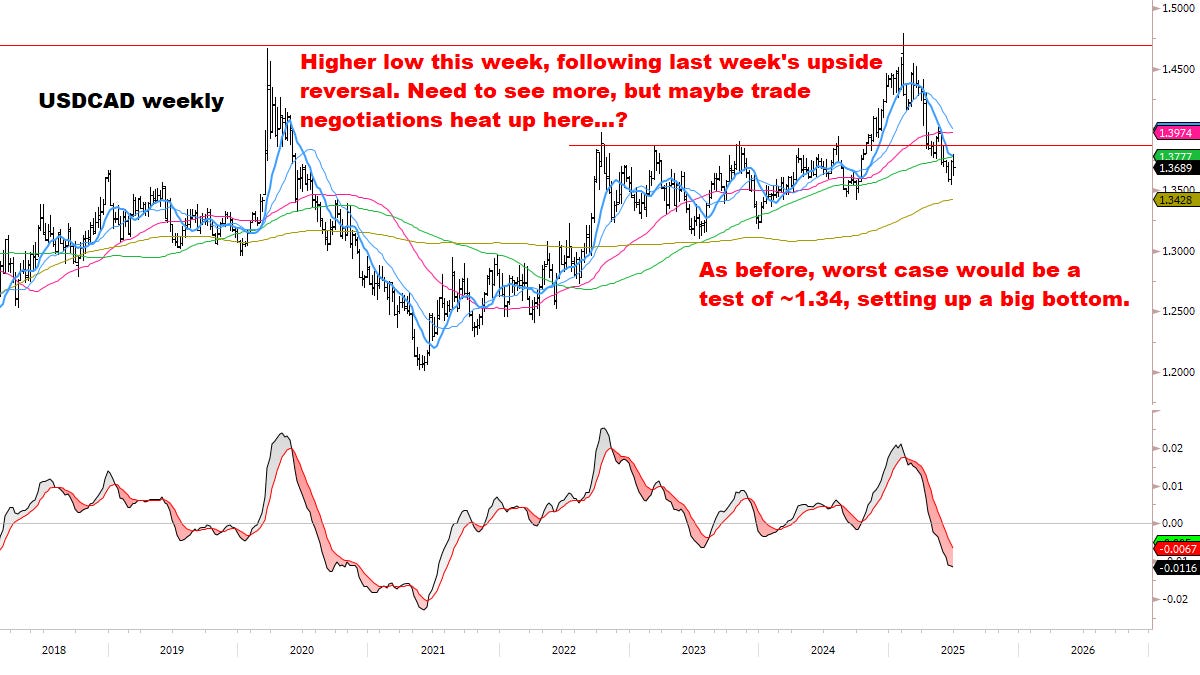

FX: Watching the Dollar closely.

外汇:密切关注美元。

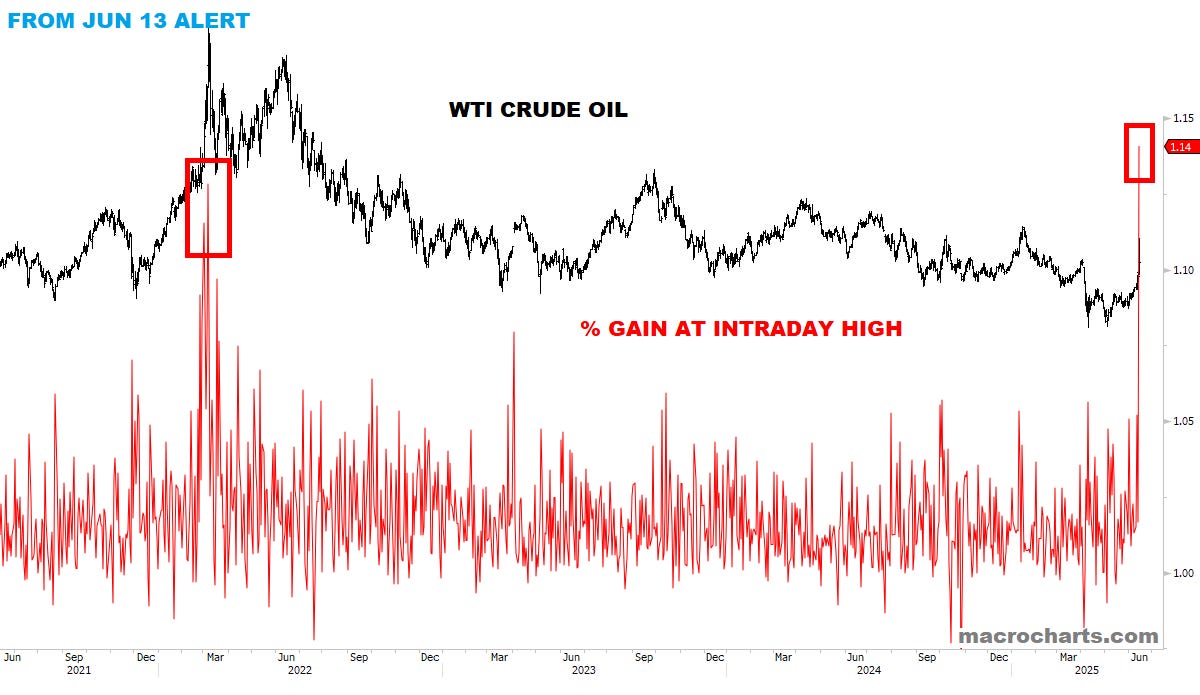

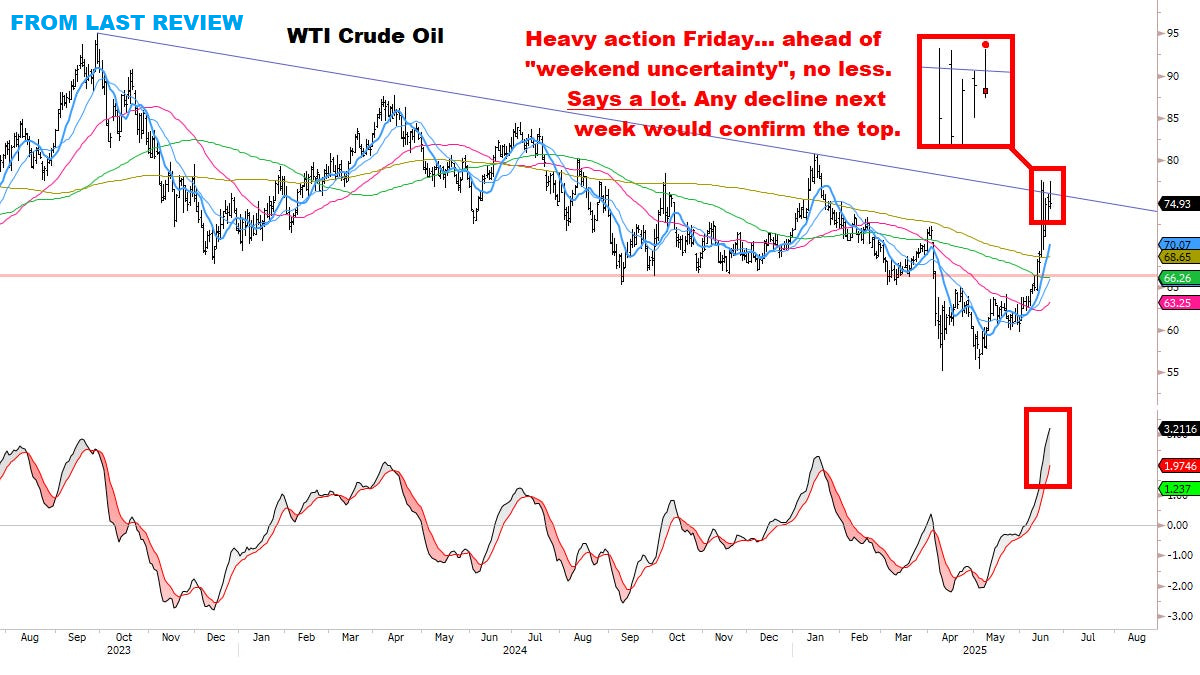

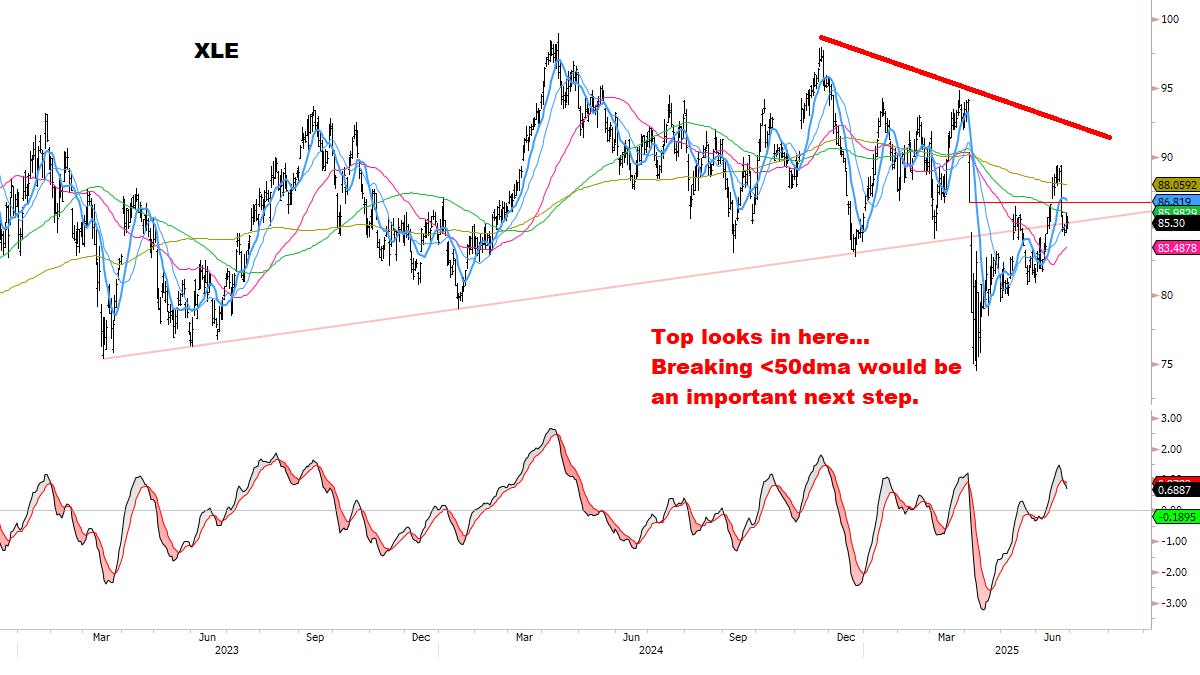

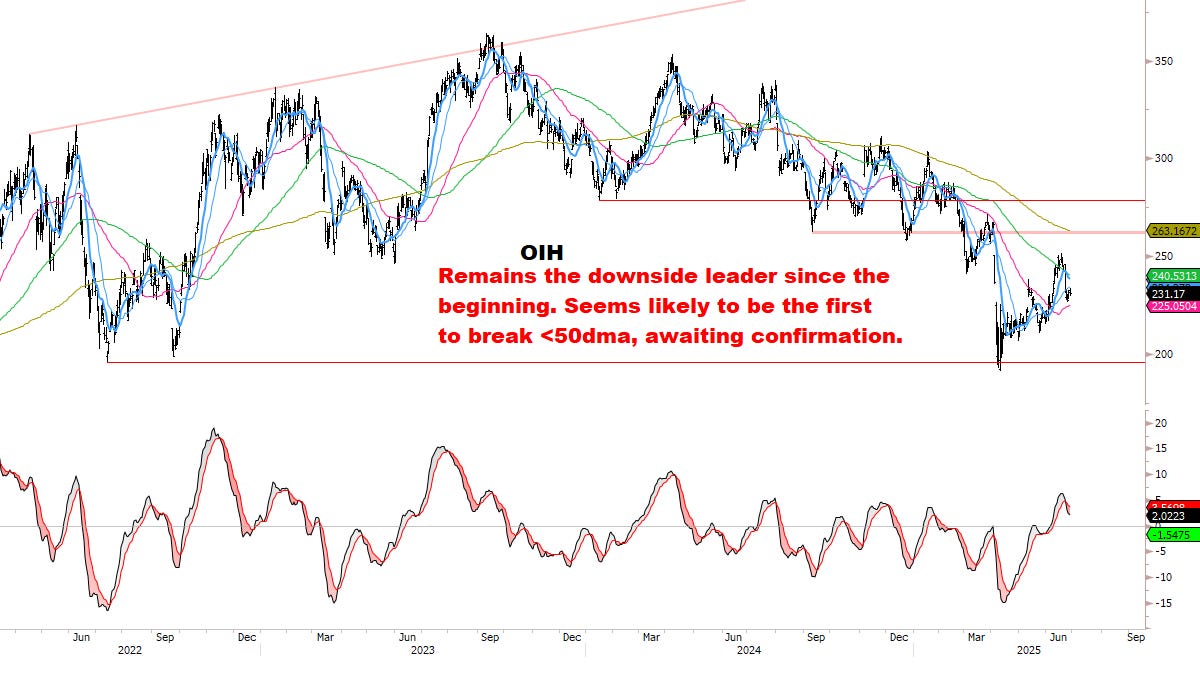

OIL: An important Top looks to be in.

石油:一个重要的顶部似乎已经形成。

METALS: Risking a Top. What do they know?

金属:冒着形成顶部的风险。他们知道什么?

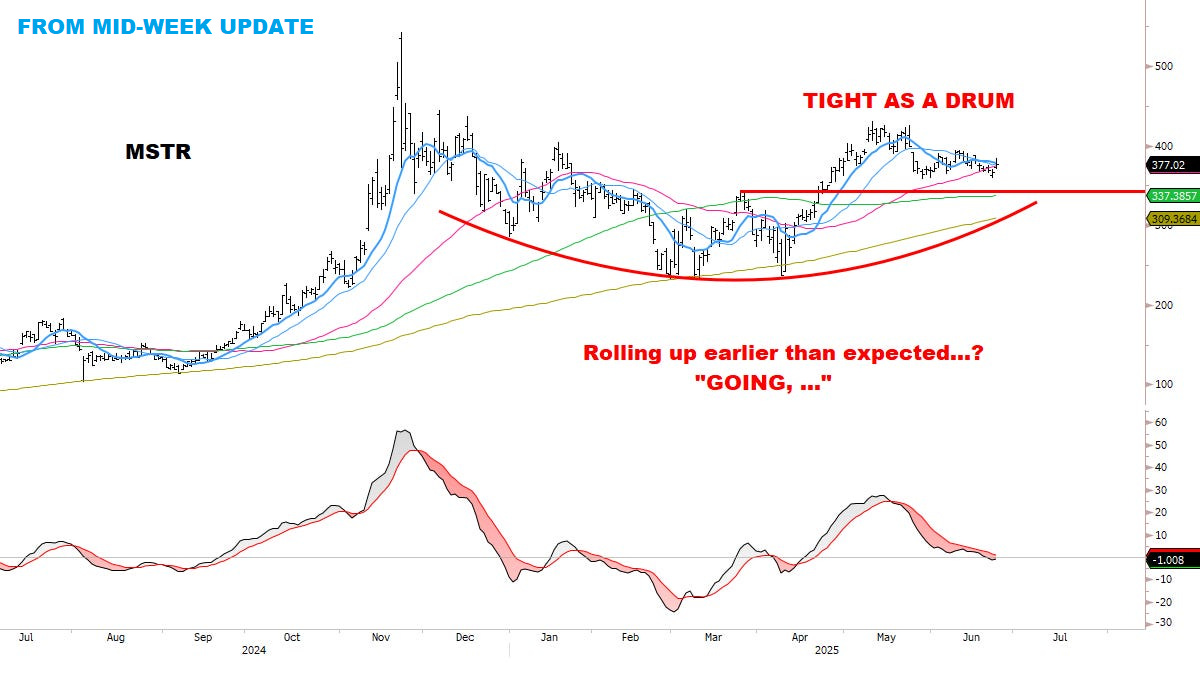

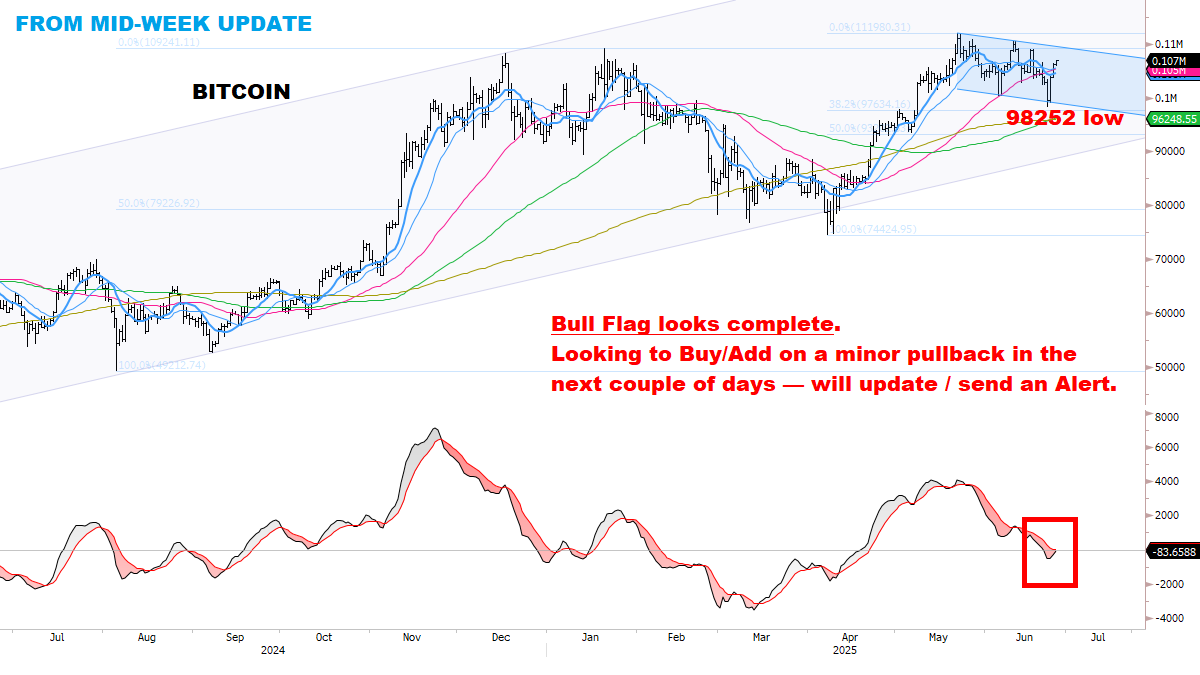

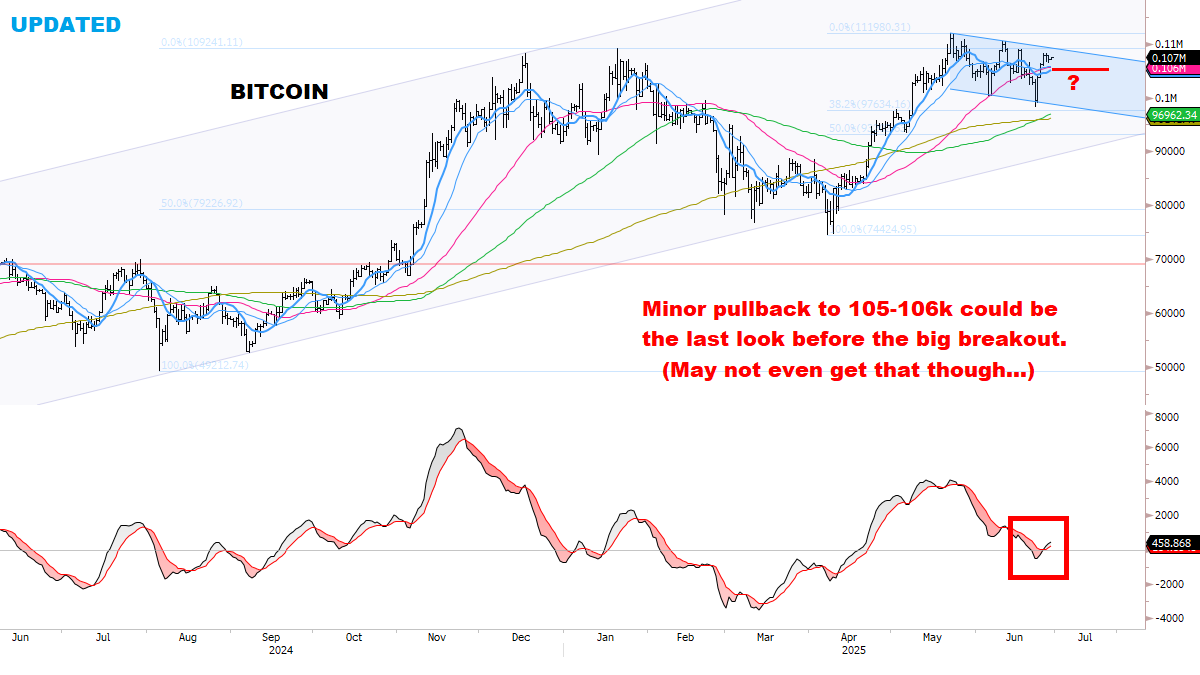

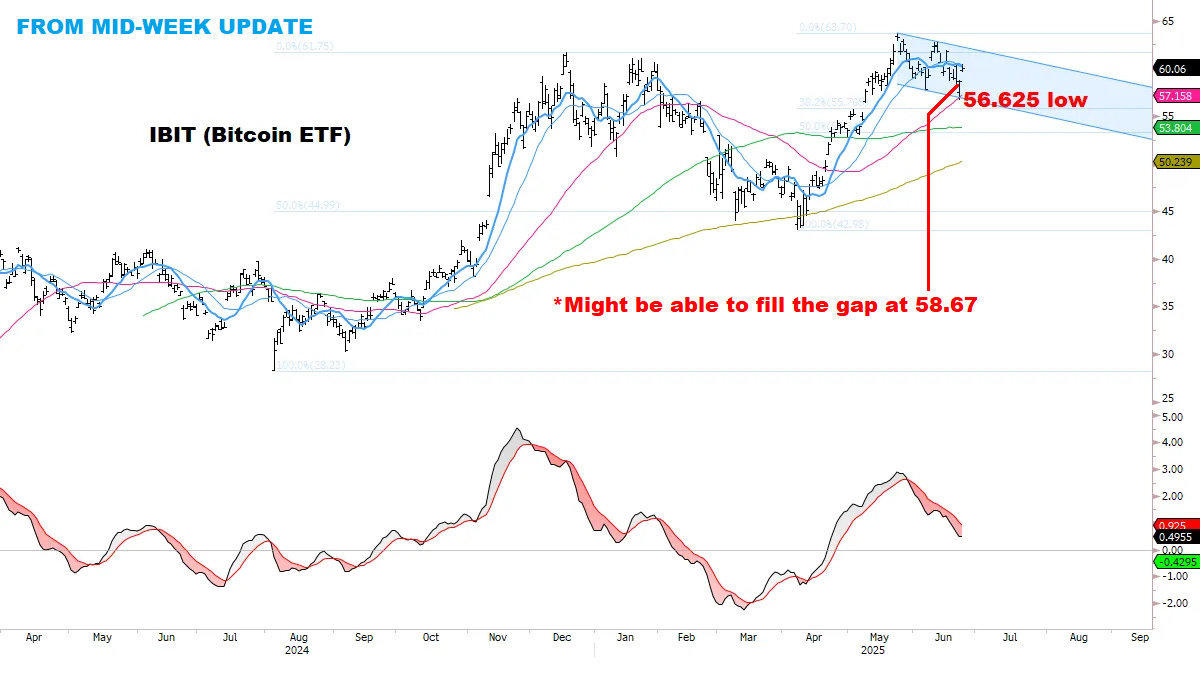

BITCOIN: Tracking the perfect sequence.

比特币:跟踪完美的序列。

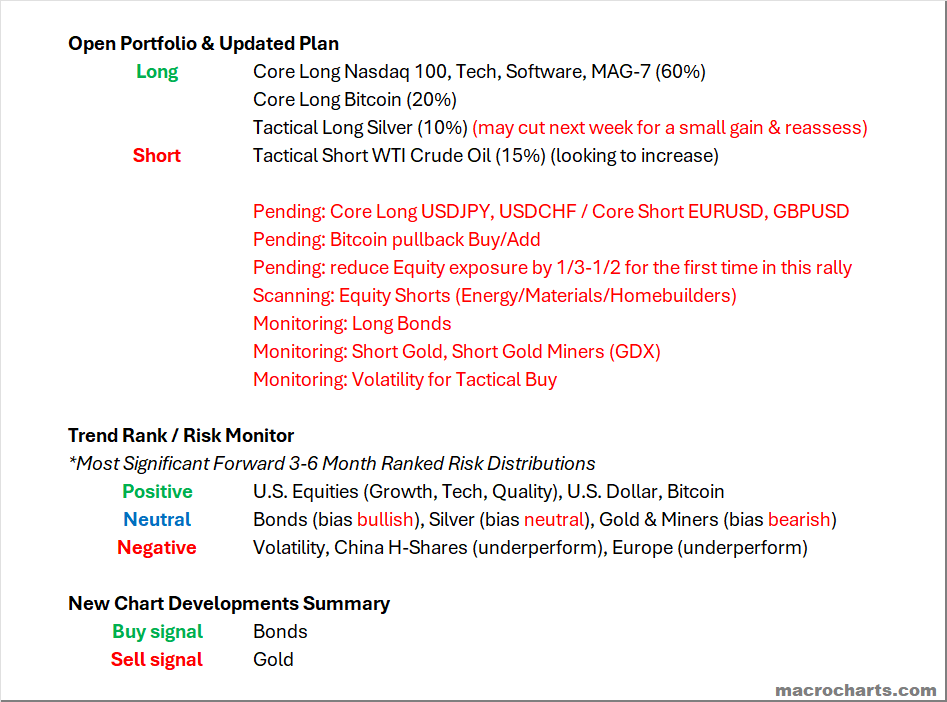

Open Portfolio & Updated Plan

开放投资组合及更新计划

Emphasizing: an open mind could be the difference between a great summer and an average one. It’s a strong year and I intend to keep pushing — eyes on the next big move.

强调:开放的心态可能是成就一个精彩夏天与平凡夏天的关键。今年形势强劲,我打算继续努力——目光锁定下一次重大变动。

*Several important changes to the Risk Monitor & Watchlist:

*风险监控与观察名单的若干重要变更:

CORE MODELS & DATA 核心模型与数据

STOCKS 股票

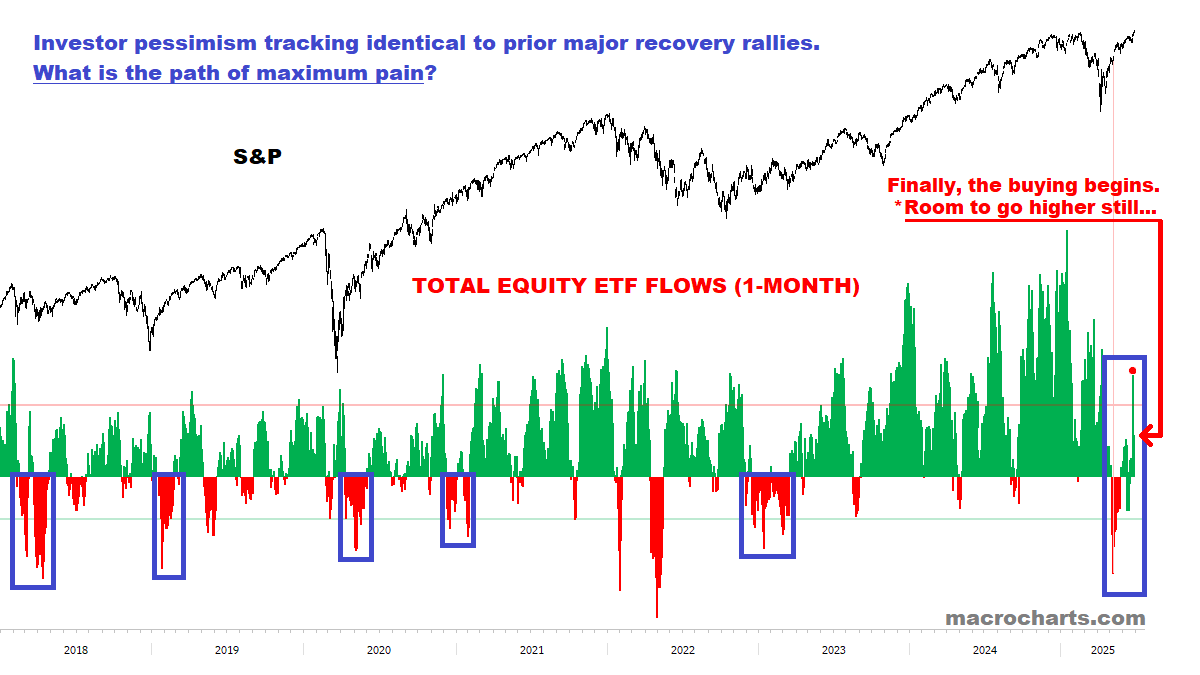

ETF Investors are finally joining the rally — as stocks break new highs.

ETF 投资者终于加入了反弹——随着股票创出新高。

Base case: flows should accelerate, for key reasons previously discussed.

基本情况:资金流入应会加速,原因之前已多次讨论。

If history is a guide, the path of maximum pain is for the market to grind higher over time, leaving sellers behind. Pullbacks could be limited in scope. This framework continues to be validated by the indexes.

如果以历史为鉴,最大痛苦路径是市场随着时间推移缓慢上涨,抛售者被甩在后面。回调可能范围有限。指数持续验证这一框架。

Institutions are also starting to Buy as stocks break new highs:

随着股票创出新高,机构也开始买入:

SPECIAL UPDATE: HOW HIGH CAN STOCKS GO?

特别更新:股票还能涨多高?

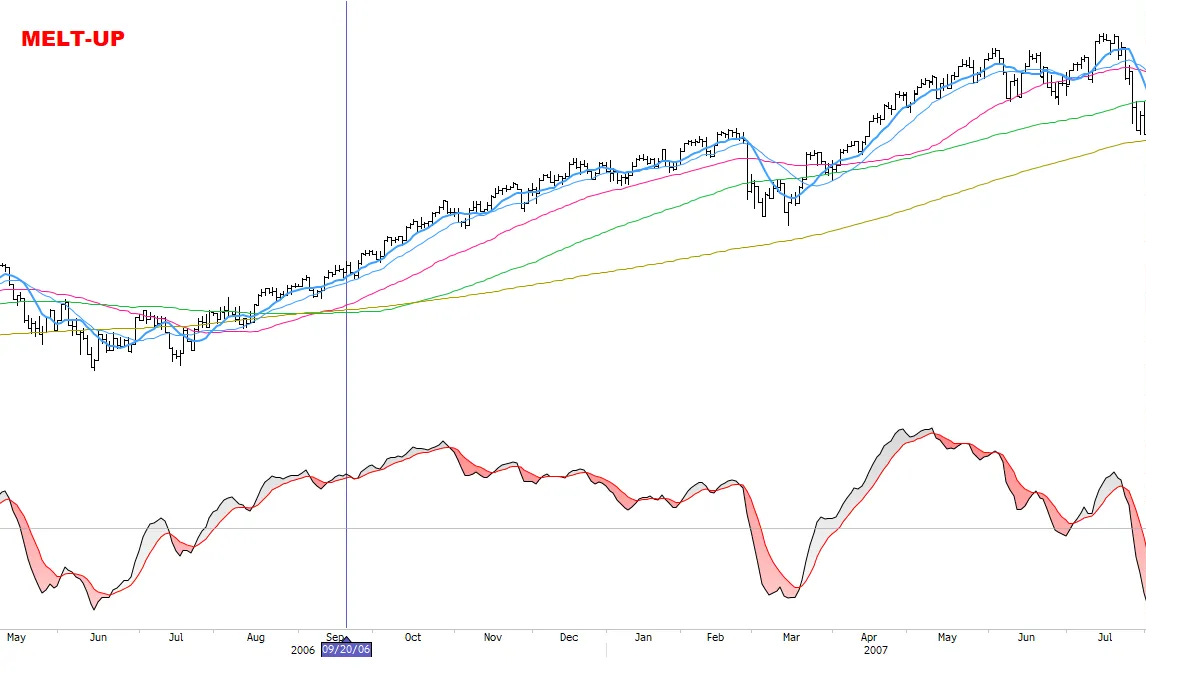

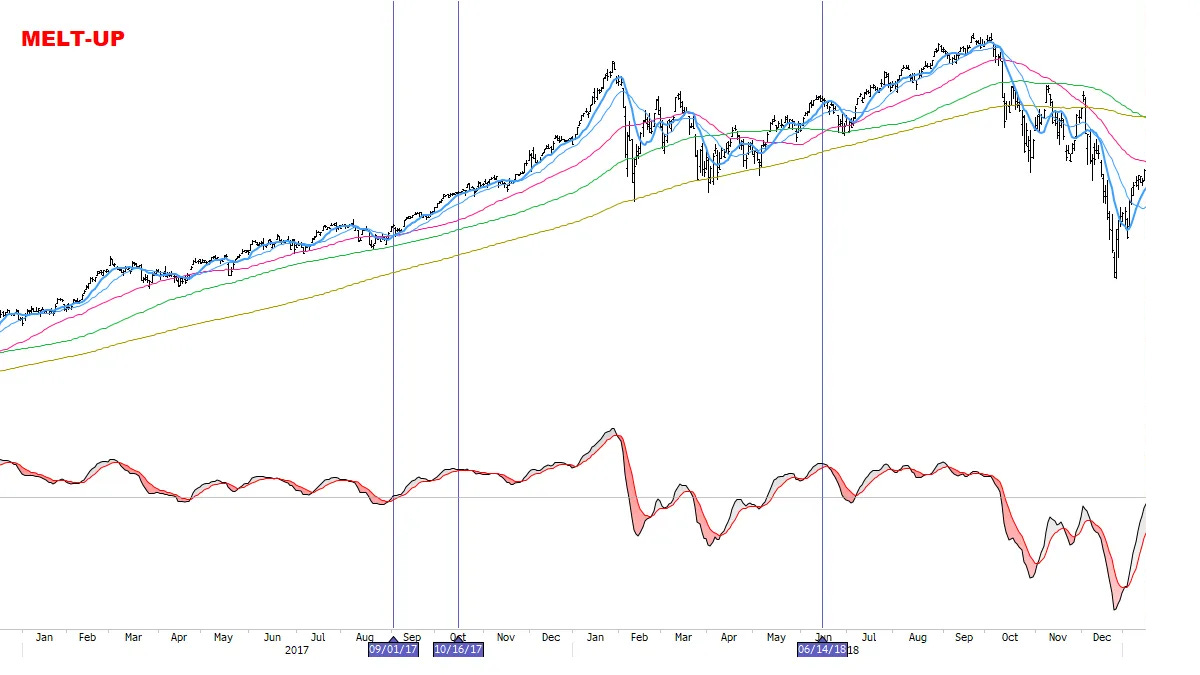

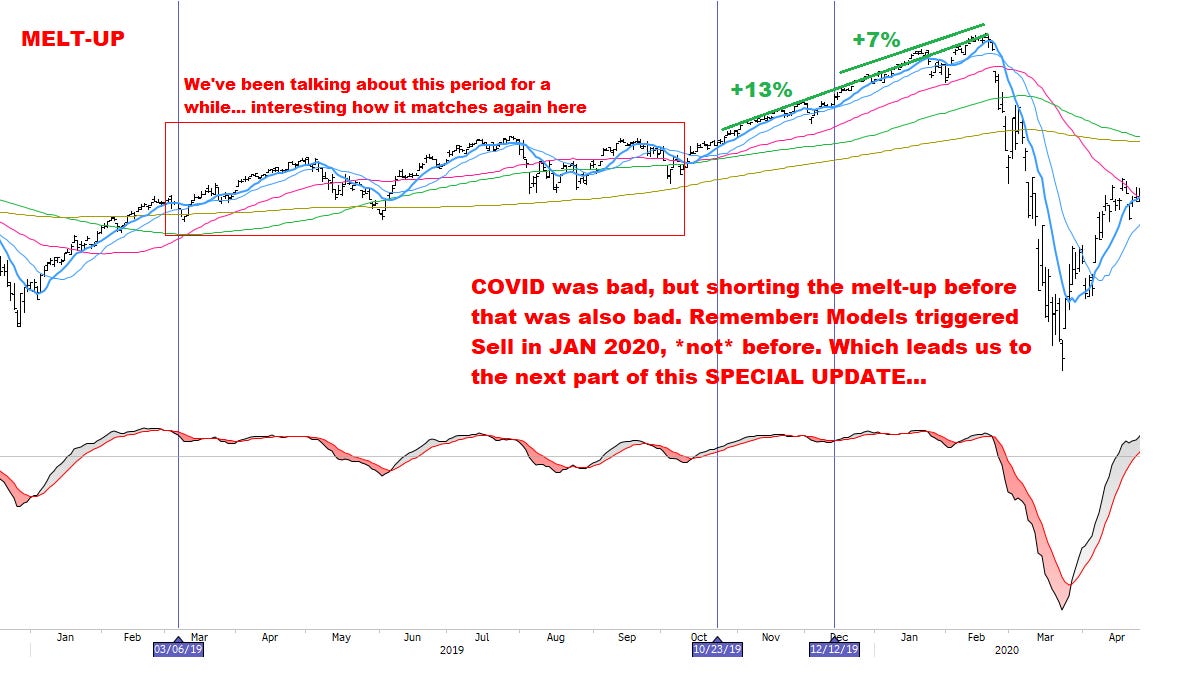

A Melt-Up developing: 一场熔断行情正在形成:

In Wednesday’s Closing Thoughts I wrote: “Stocks breaking to new highs with a LOT of money still massively underinvested… Our core scenario looks underway — and ready to accelerate”.

在周三的收盘思考中我写道:“股票突破新高,而大量资金仍严重低配……我们的核心情景正在展开——并准备加速。”Remember what I wrote in April: “at the April 7 bottom, some well-known bulls were publicly apologizing for their view. At the next top of importance, we could see “mea culpas” from some well-known bears. Such is the nature of the stock market.”

还记得我四月份写的内容吗:“在 4 月 7 日的底部,一些知名多头公开为他们的观点道歉。在下一个重要高点,我们可能会看到一些知名空头的‘认错声明’。这就是股市的本质。”Scanning social media this week, the usual pundits are STILL openly skeptical of the rally.

本周浏览社交媒体,常见的评论员仍然公开对这波反弹持怀疑态度。That’s *not* how tops are made…

顶部的形成*不是*这样的……

Critically, matching my estimate for potential buying of ~$100Bn (or more):

关键是,与我对潜在买入约 1000 亿美元(或更多)的估计相符:

Article published on Bloomberg this week:

本周彭博社发布的文章:

“Nomura's Charlie McElligott says his model is projecting more than $100 billion of equity buying over the next month, the most it has ever predicted. An avalanche of cash could be heading for the stock market over the next month or so, one Wall Street strategist said on Wednesday.

“野村证券的 Charlie McElligott 表示,他的模型预测未来一个月内股票买入力度将超过 1000 亿美元,是该模型有史以来预测的最高值。一位华尔街策略师周三表示,未来一个月左右可能会有一大笔资金涌入股市。”

That is the largest figure that the model has ever predicted since it was first deployed in 2004, McElligott said. McElligott said the model's output was largely driven by the looming drop in three-month realized volatility. Realized volatility is a widely used metric for measuring how volatile stocks have actually been over a given period.

麦克埃利戈特表示,这是自 2004 年该模型首次部署以来预测的最大数值。麦克埃利戈特称,模型的输出主要受即将出现的三个月实际波动率下降的影响。实际波动率是衡量股票在特定时期内实际波动程度的广泛使用指标。

McElligott told MarketWatch that, if anything, his model likely underestimates the size of the systematic universe. Most of the firms using these strategies are hedge-fund investors. That can make it difficult to assess the exact amount of capital they have available to deploy.

McElligott 告诉 MarketWatch,他的模型很可能低估了系统性交易领域的规模。使用这些策略的大多数公司都是对冲基金投资者,这使得评估他们可用资本的确切数量变得困难。

But in the past, when it has flagged a potential surge in buying from systematic traders, McElligott's model has presaged strong returns for stocks, particularly over the next month or two, as the chart below shows. The model has predicted gains over the short term with 100% accuracy, and strong excess returns — or returns beyond what should have been expected — as well.”

但在过去,当模型发出系统性交易者买入可能激增的信号时,McElligott 的模型预示了股票的强劲回报,尤其是在接下来的一两个月内,如下图所示。该模型在短期内预测涨幅的准确率达到 100%,并且还预测了强劲的超额回报——即超出预期的回报。

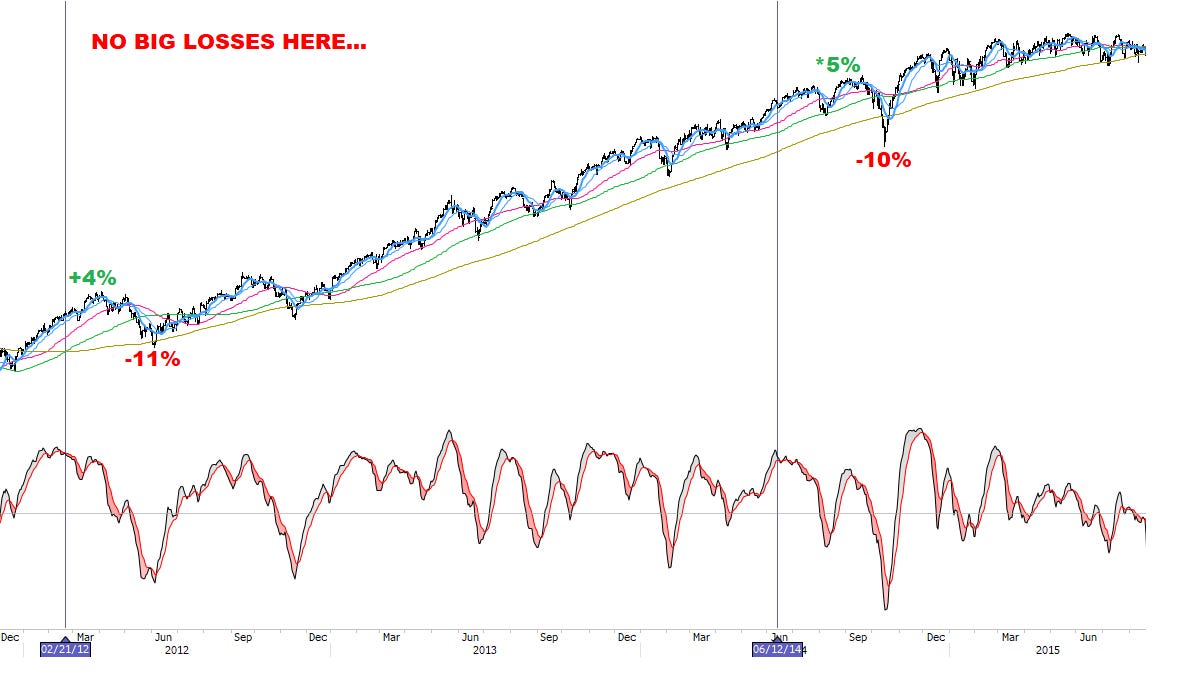

[BELOW: priors saw S&P higher 100% of the time 2-3 months out, with *significant “right tail” rallies*. This further supports my scenario for a low-volatility summer melt-up — as we’ve been discussing for a while. Again, the *perfect environment* for stock-picking.]

[以下:历史数据显示,标普指数在 2-3 个月后上涨的概率为 100%,且伴有显著的“右尾”反弹。这进一步支持了我关于低波动性夏季上涨行情的预测——正如我们已经讨论了一段时间的那样。再次强调,这是选股的*完美环境*。]

TABLE OF PRIOR MODEL RECORDS:

先前模型记录表:

CHARTS OF PRIOR MODEL RECORDS — note the *significant “right tail” rallies”:

先前模型记录的图表 — 注意显著的“右尾”反弹:

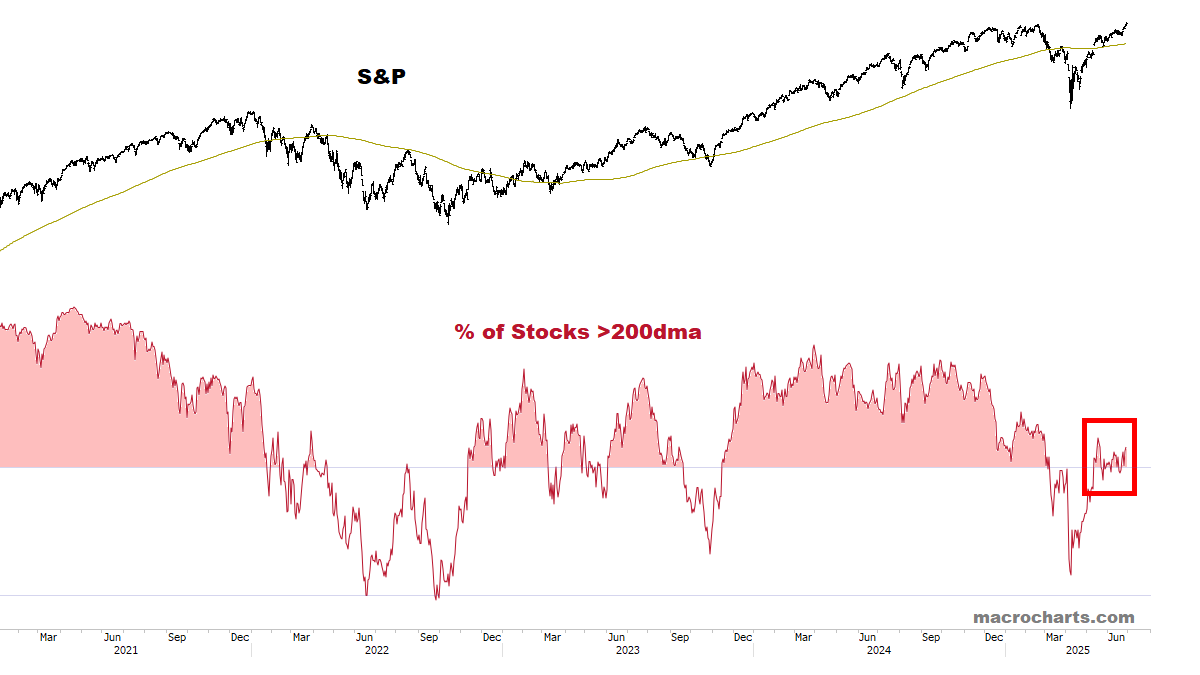

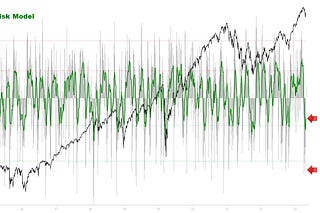

Core Risk Models have room to get overbought — *especially if a full-blown melt-up is underway.

核心风险模型有可能出现超买——尤其是在全面暴涨正在进行的情况下。

When THIS reaches topping range, I’ll raise cash and look to put on Tactical hedges. Not before.

当此达到顶部区间时,我将增加现金持有并寻求建立战术性对冲。不会提前。When the time comes, we’ll be sharing this with Subscribers only. No public sites or social media.

届时,我们将仅与订阅者分享此内容,不会在公开网站或社交媒体上发布。

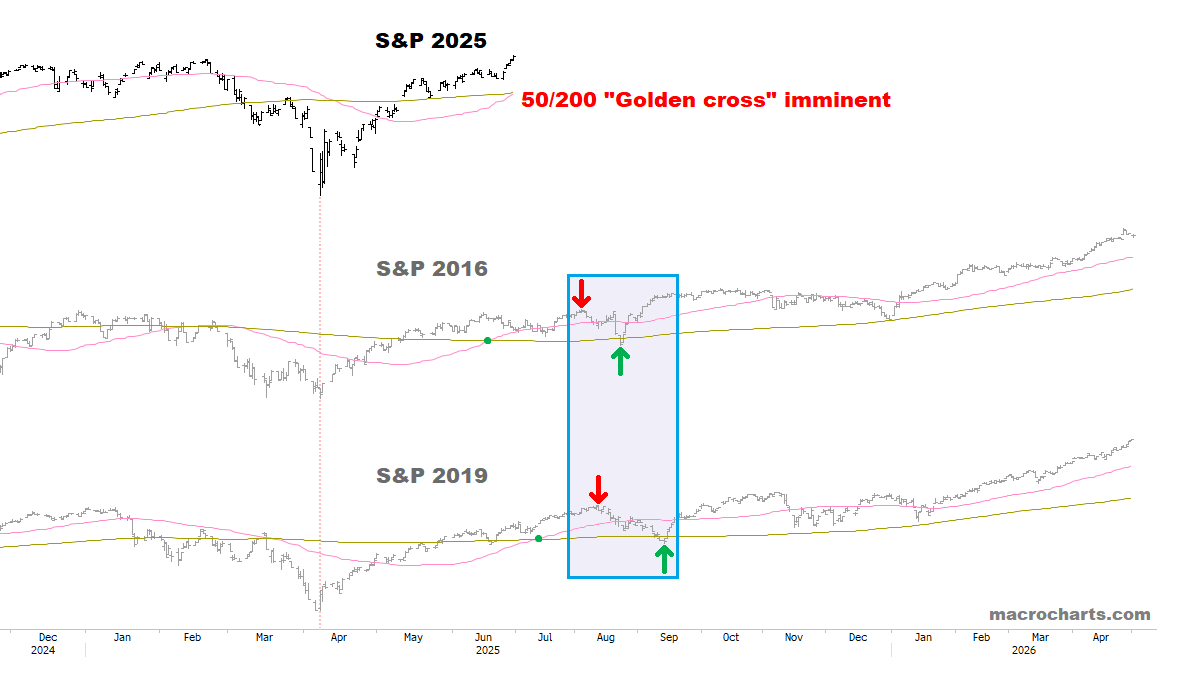

We continue to track this closely for an ideal top into late summer — note “Golden cross” is imminent:

我们将继续密切关注这一点,以期在夏末形成理想的顶部——请注意“黄金交叉”即将出现:

As discussed May 24: 如 5 月 24 日所述:

“If the sequence continues, dips should remain shallow for the next few weeks, with the market in a slight upward bias. Overall, a *perfect environment* for stock-picking. *Also: not yet an optimal setup to Short Indexes or buy Volatility.”

如果这一趋势持续,未来几周的回调应保持浅度,市场将略微偏向上涨。总体而言,这是一个*选股的完美环境*。*此外:目前尚未达到做空指数或买入波动率的最佳时机。*

*This framework continues to be validated by the market, and remains my base case for now.

*这一框架持续得到市场验证,目前仍是我的基本假设。

As always: an open mind could be the difference between a great summer and an average one. It’s a strong year and I intend to keep pushing — eyes open to the next big move.

一如既往:保持开放的心态可能是成就一个精彩夏天与平凡夏天的关键。今年形势强劲,我打算继续努力——睁大眼睛,关注下一次重大变动。

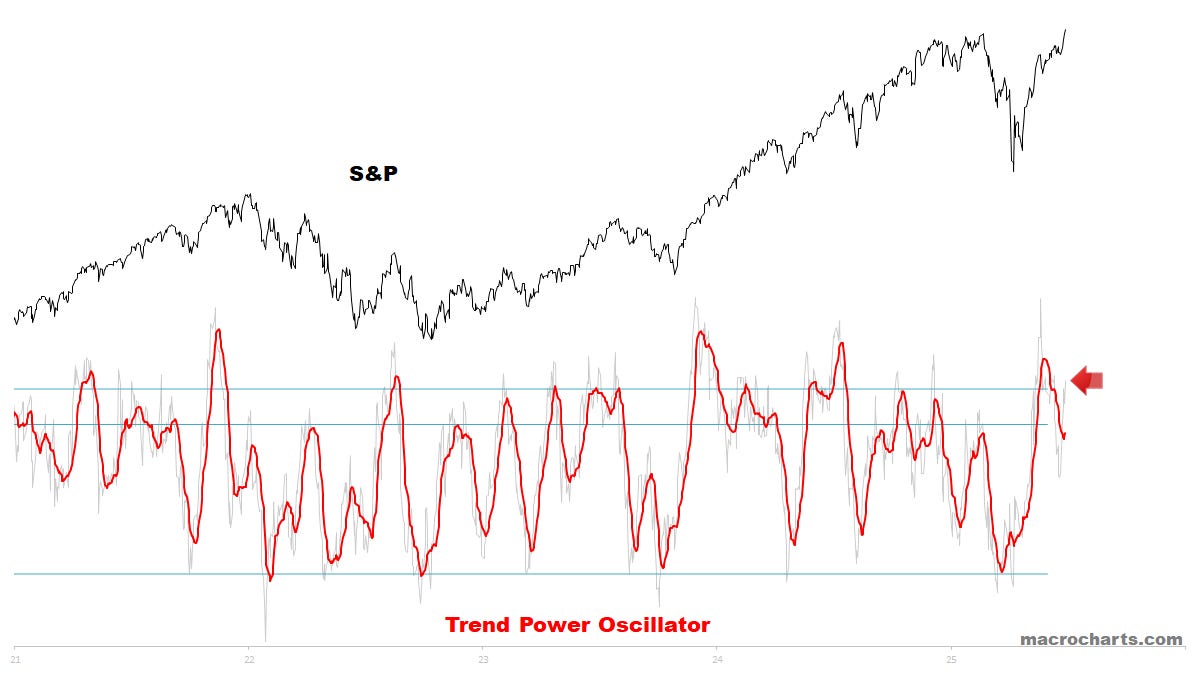

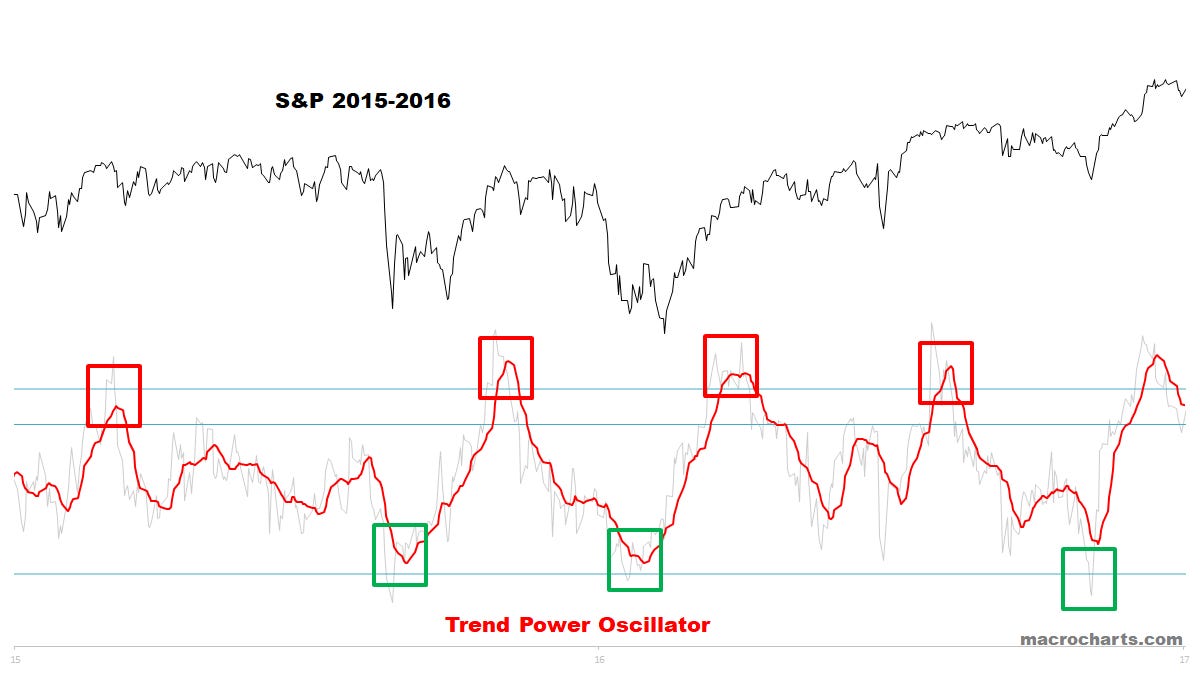

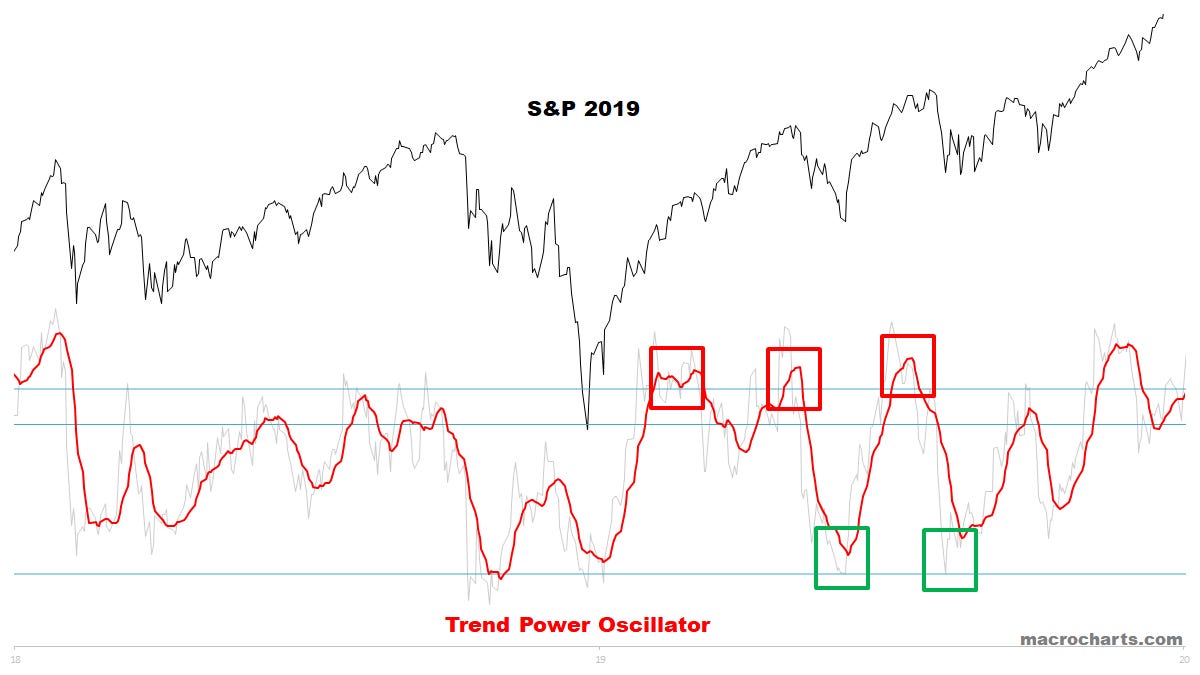

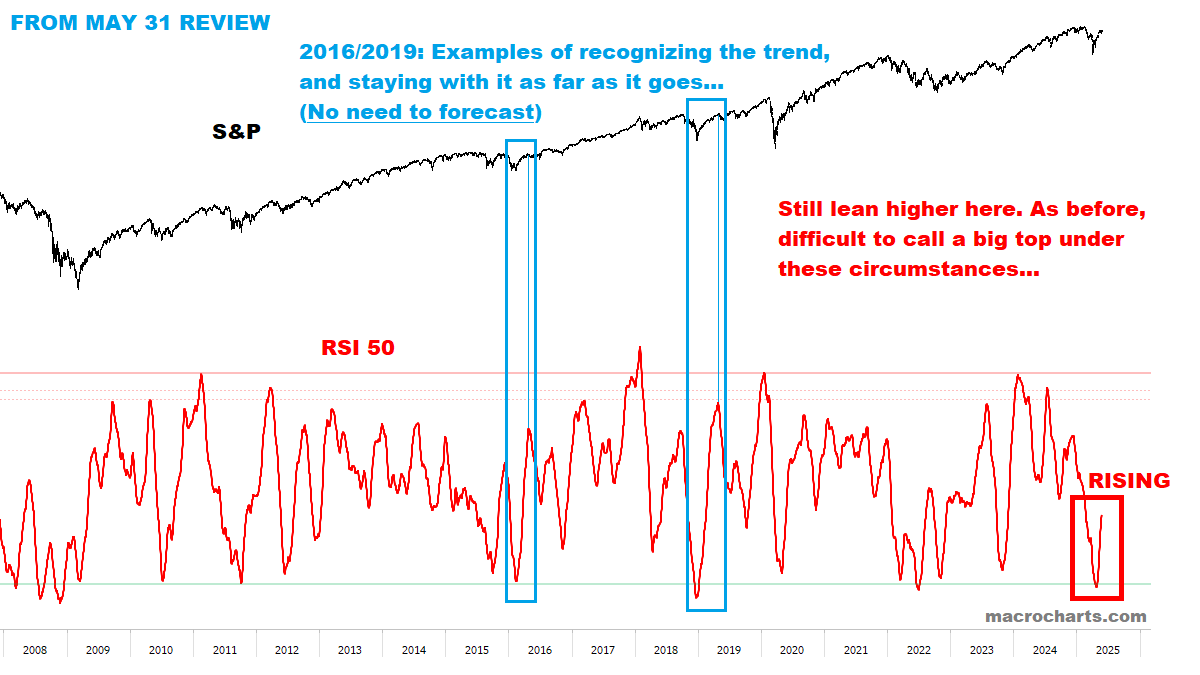

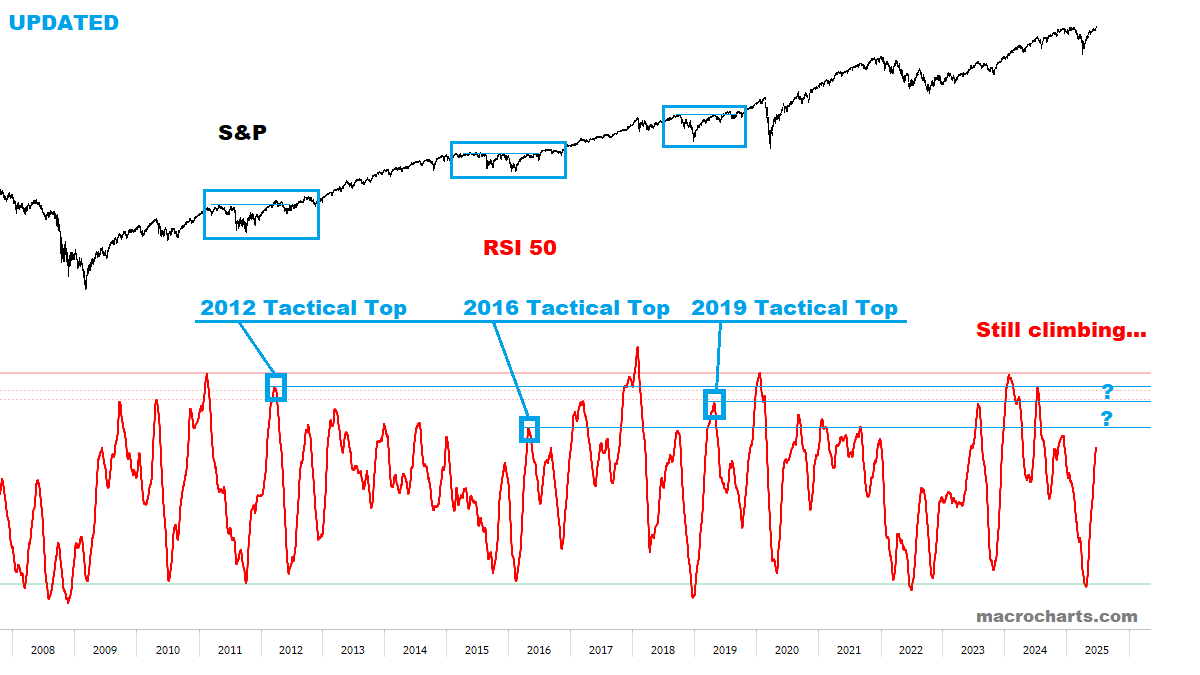

Trend Power Oscillator is moving to overbought again — still tracking the 2016/2019 scenario.

趋势能量振荡器再次进入超买区——仍在跟踪 2016/2019 年的情景。

When THIS reaches topping range, I’ll raise cash and look to put on Tactical hedges. Not before.

当此达到顶部区间时,我将增加现金持有并寻求建立战术性对冲。不会提前。When the time comes, we’ll be sharing this with Subscribers only. No public sites or social media.

届时,我们将仅与订阅者分享此内容,不会在公开网站或社交媒体上发布。

Remember: 记住:

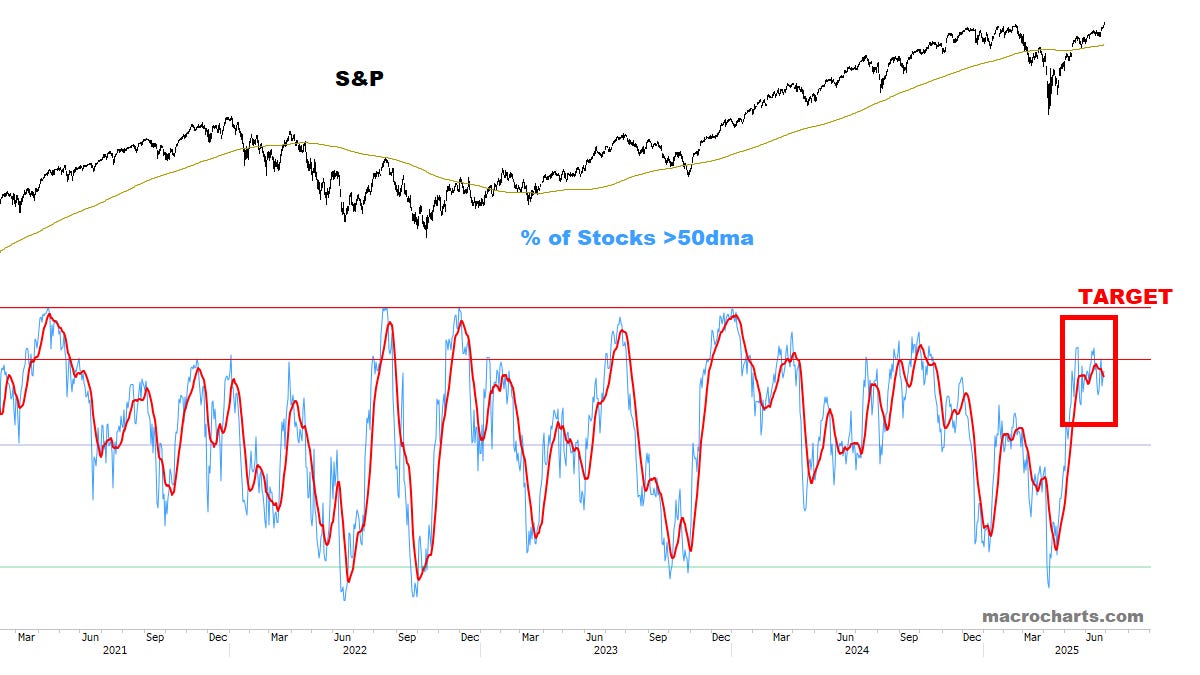

High-Low Oscillator has room to push to target range:

高低振荡器有空间推动至目标区间:

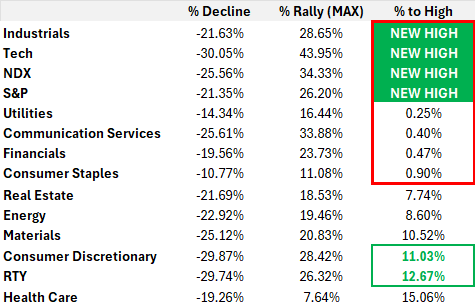

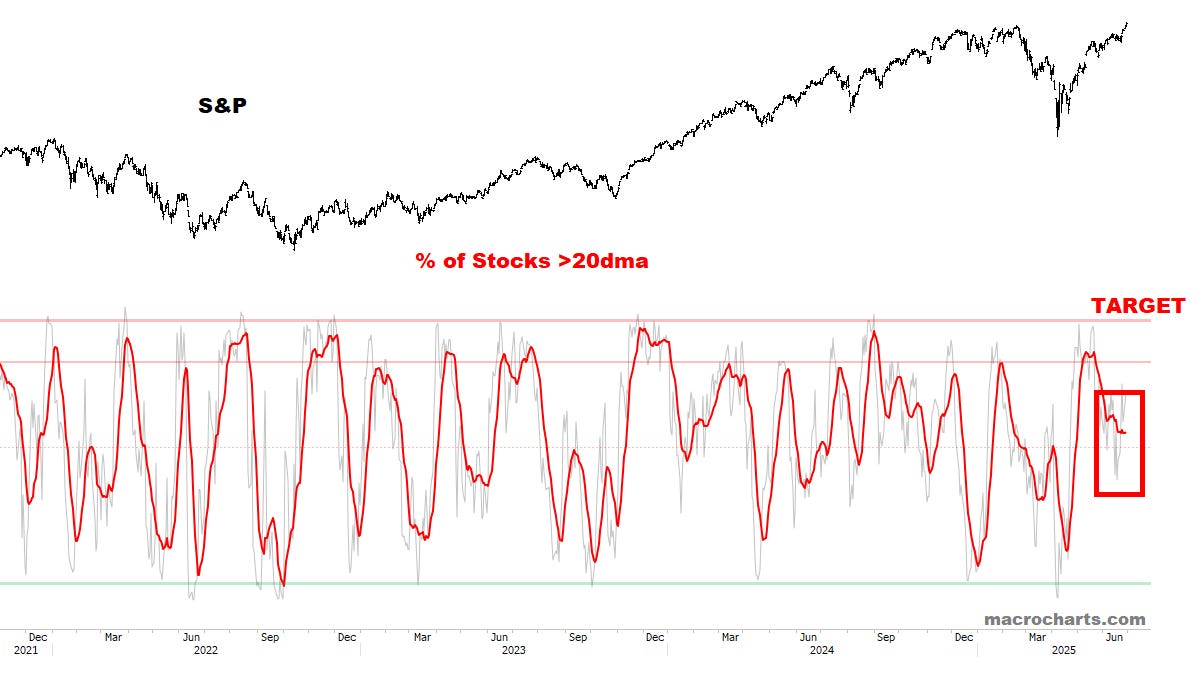

Reiterate: on track for new highs in all key areas, before a bigger correction is seen.

重申:在出现更大调整之前,所有关键领域均有望创出新高。

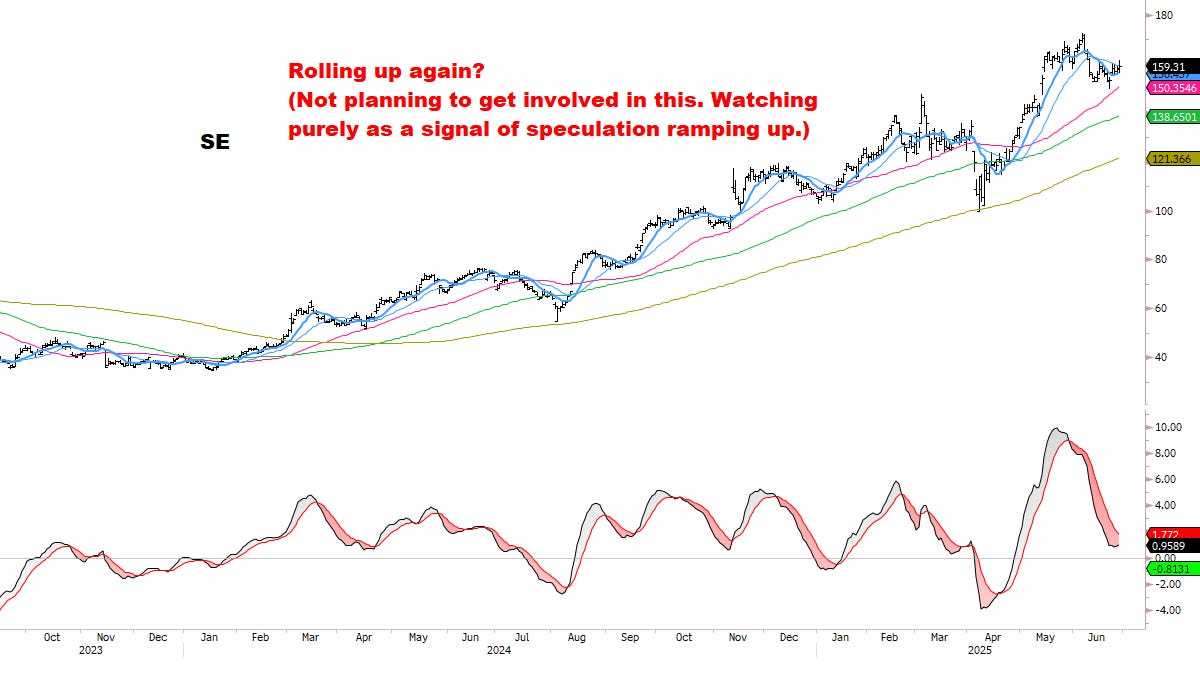

Base case: speculation and more importantly flows should ramp up rapidly as new highs continue to expand.

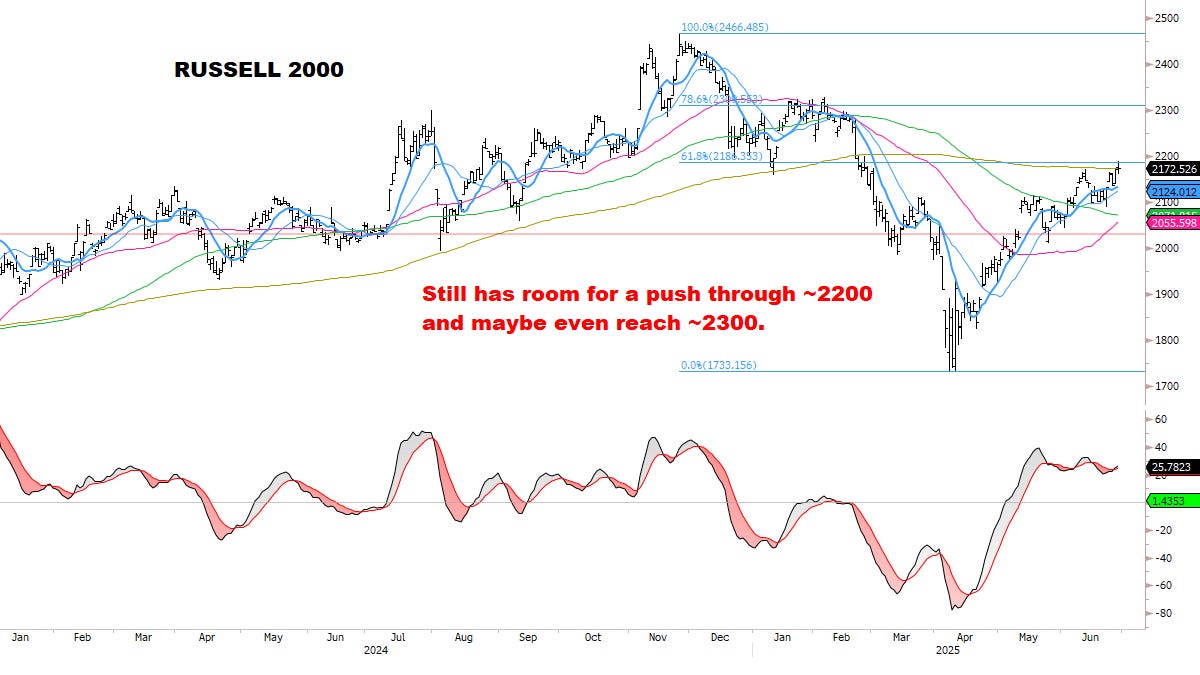

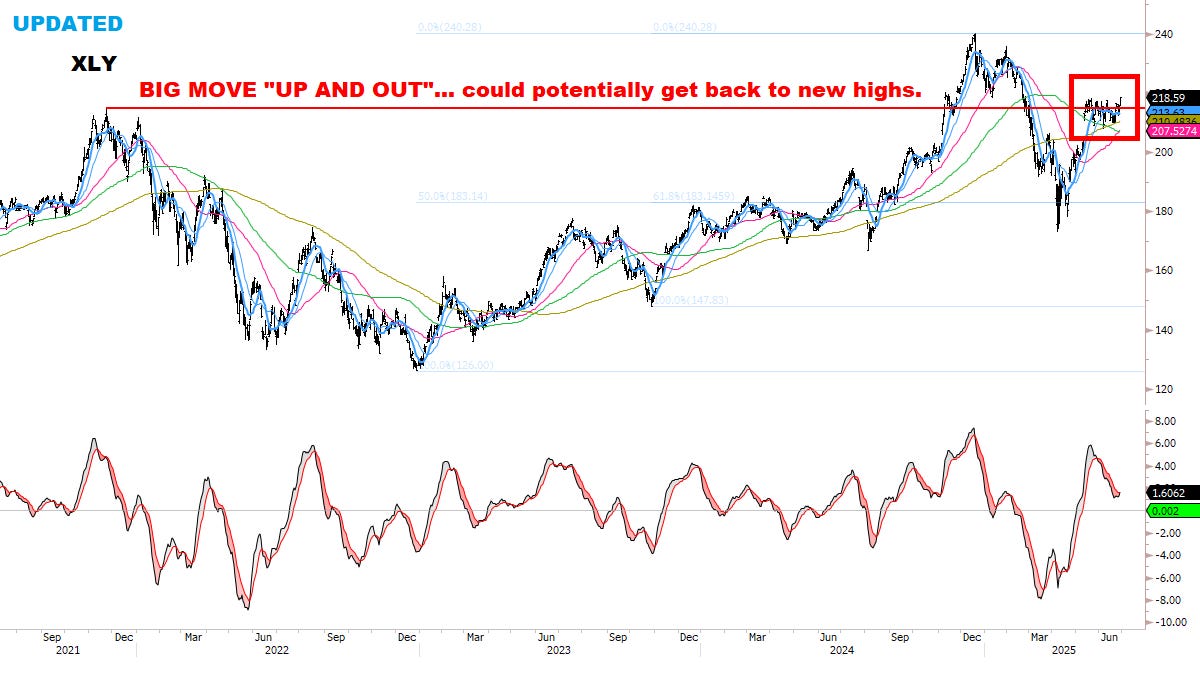

基本情况:随着新高持续扩大,投机活动以及更重要的资金流动应迅速增加。Consumer Discretionary and Russell are breaking out (see CHARTS section later) — both are joining the rally at a critical moment. They are now GREEN below, as they seem able to recover another chunk of their drawdown.

非必需消费品和罗素指数正在突破(见后文图表部分)——两者都在关键时刻加入了反弹。它们现在以下方绿色显示,似乎能够收复另一部分回撤。

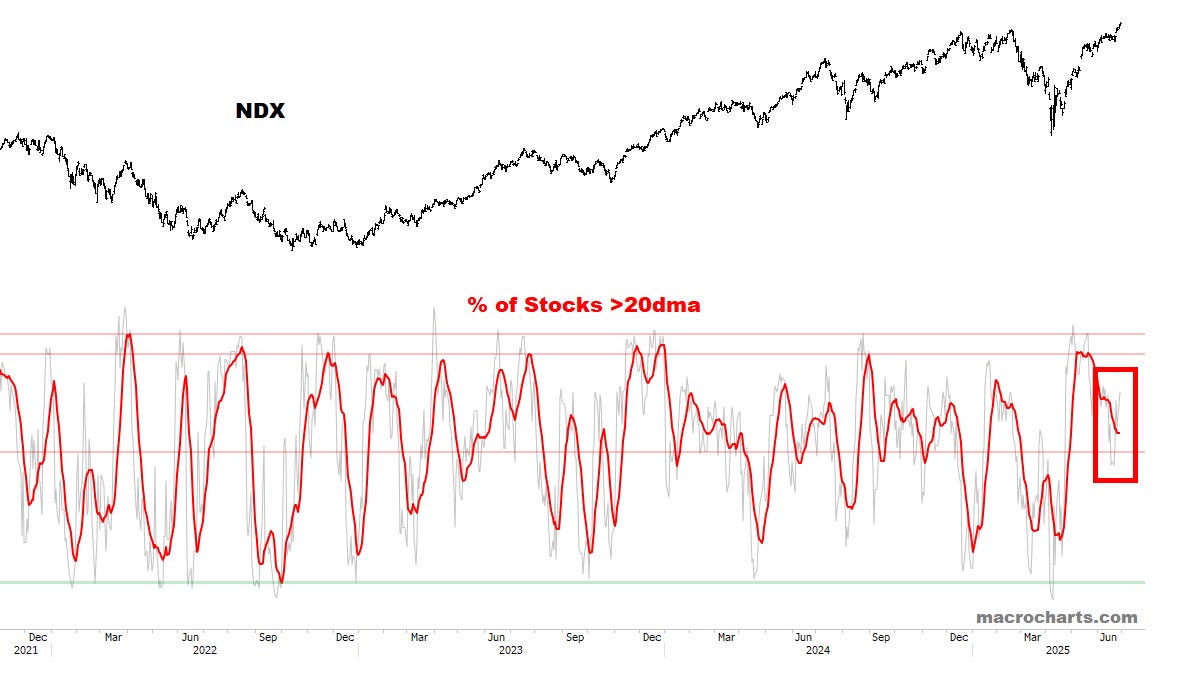

NDX is still showing significant strength — *an important bullish sign:

NDX 仍显示出显著的强势——这是一个重要的看涨信号:

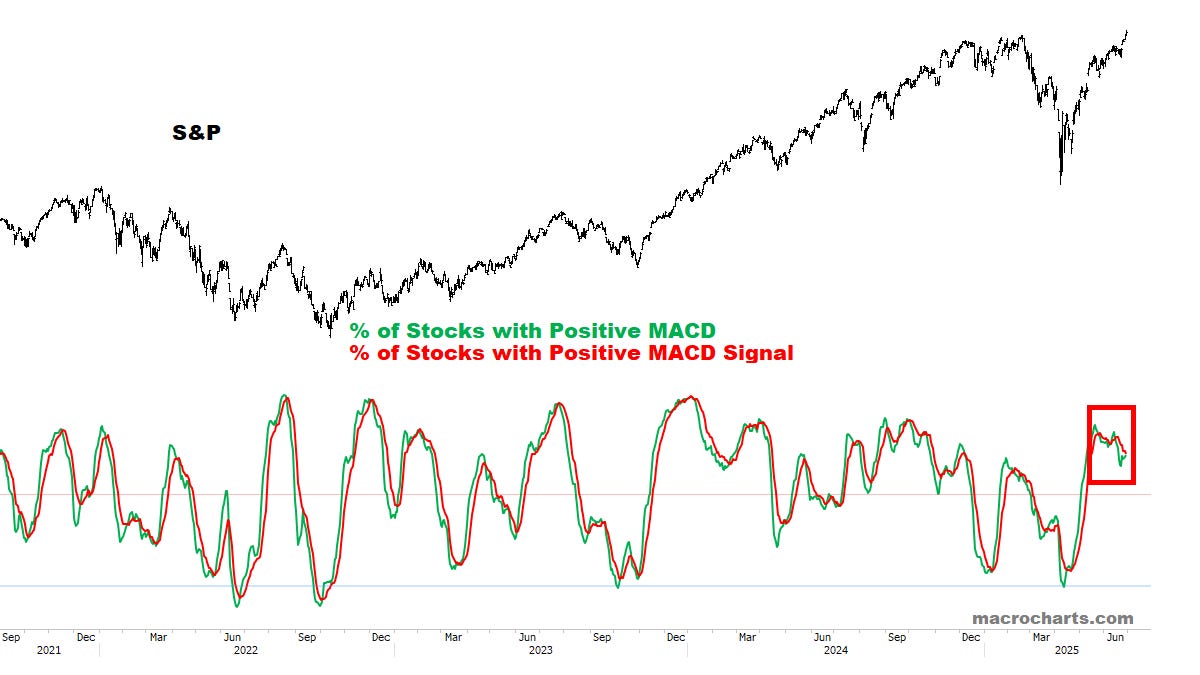

MACD Profiles are in pullback mode but may be rolling up again (normal rally behavior):

MACD 形态处于回调模式,但可能正在再次上升(正常的反弹行为):

Stocks with a Bullish Cross are turning UP from neutral range (Bullish):

处于看涨交叉的股票正从中性区间转为上升(看涨):

Long-term Breadth continues to expand bullishly:

长期广度持续看涨扩展:

Intermediate Breadth has room to get “historically overbought” — especially if a melt-up is underway (our base case).

中期广度还有空间达到“历史性超买”——尤其是在行情可能出现快速上涨的情况下(我们的基本假设)。

Short-Term Breadth is in position to turn back UP, which could target another push to “extreme overbought”:

短期广度指标有望回升,可能再次推动市场达到“极度超买”状态:

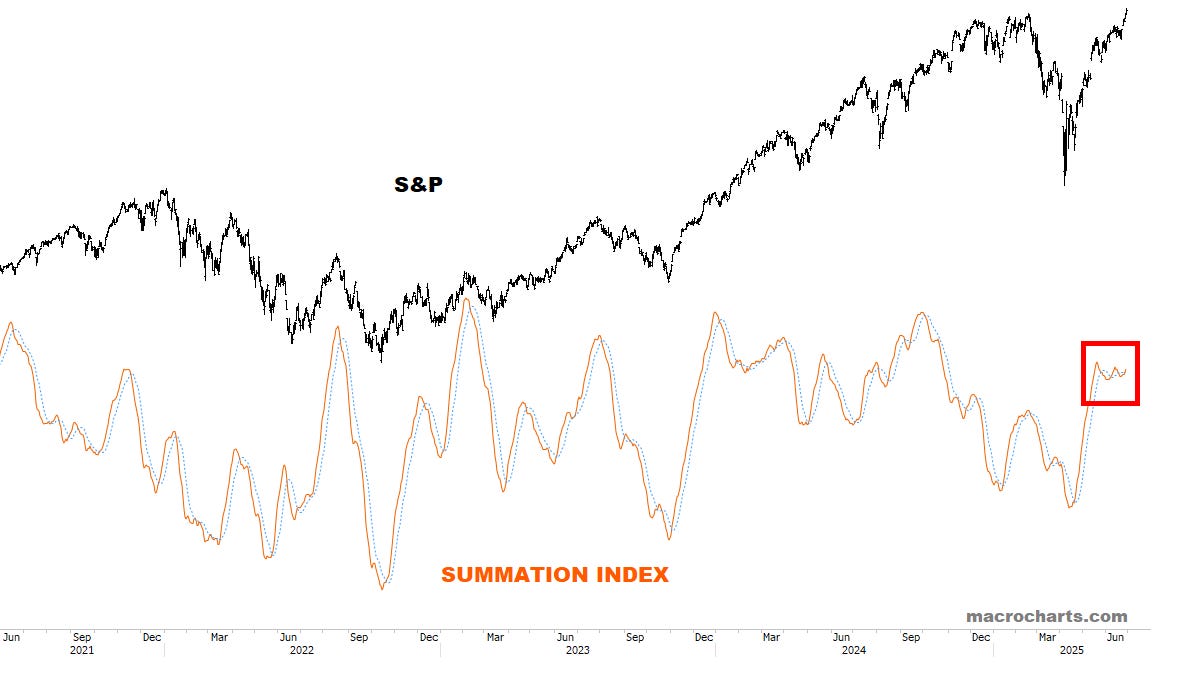

Summation Index is back on a Buy signal — this is classic “melt-up” behavior:

综合指数重新发出买入信号——这是一种典型的“熔断上涨”行为:

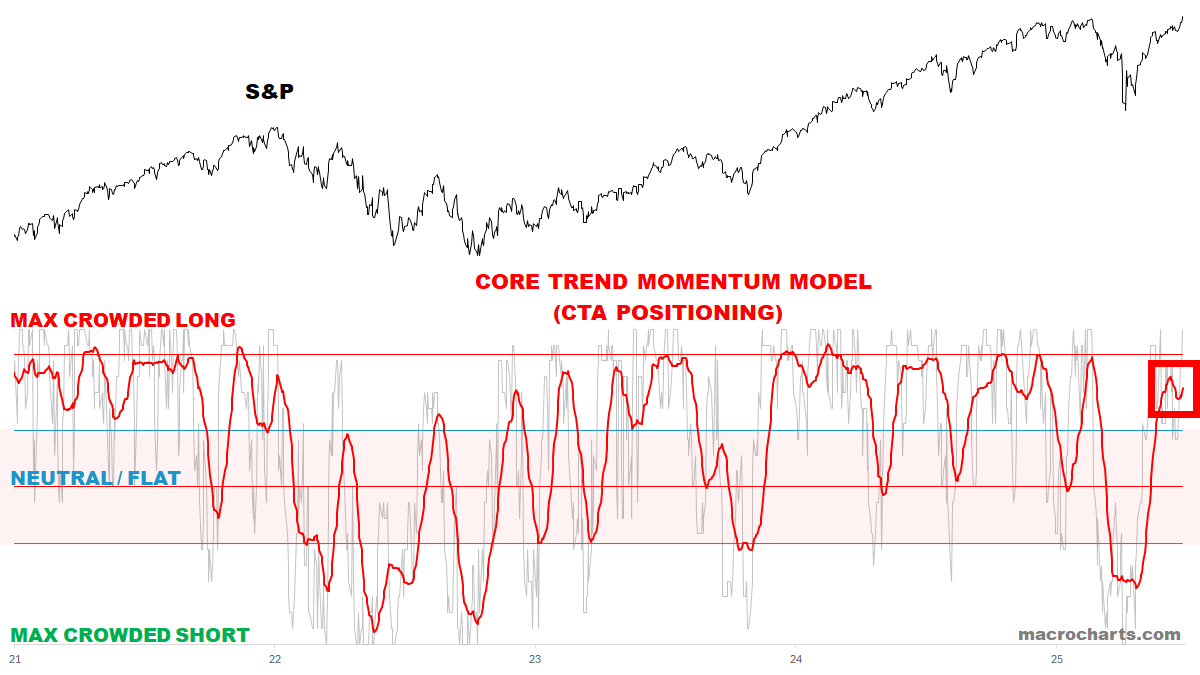

CTA Equity Trend positioning has room to get more extended:

CTA 股票趋势仓位还有进一步加仓的空间:

Option Skews have room to get more extended:

期权波动率偏斜还有进一步扩大的空间:

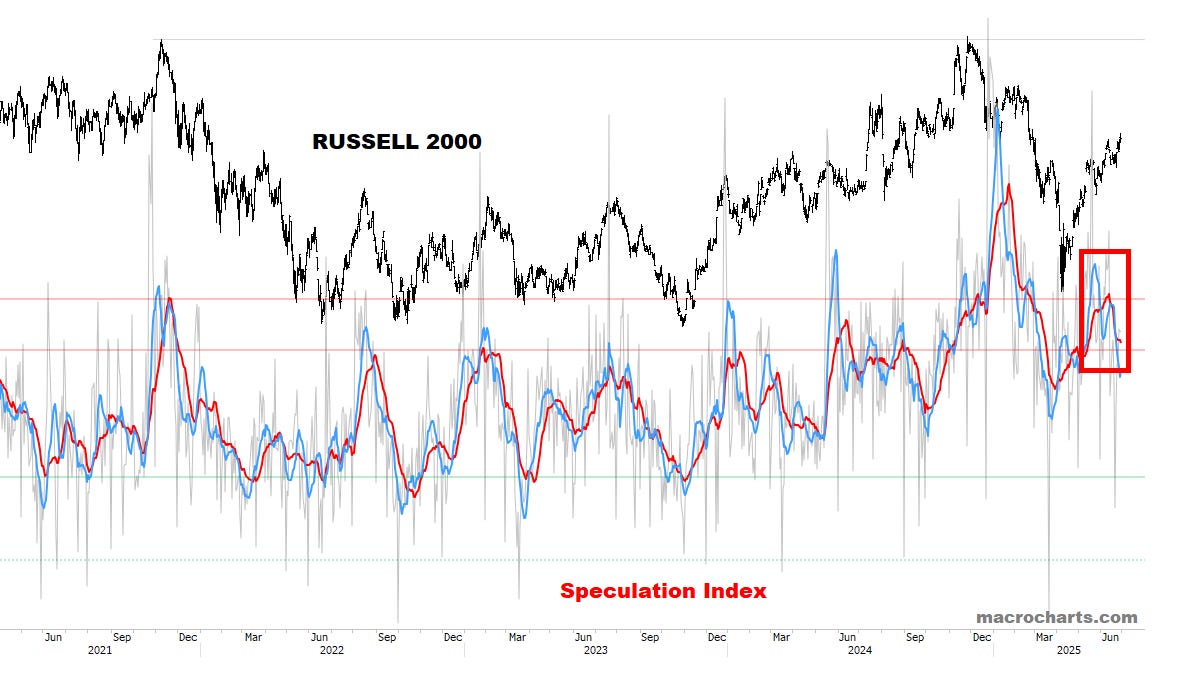

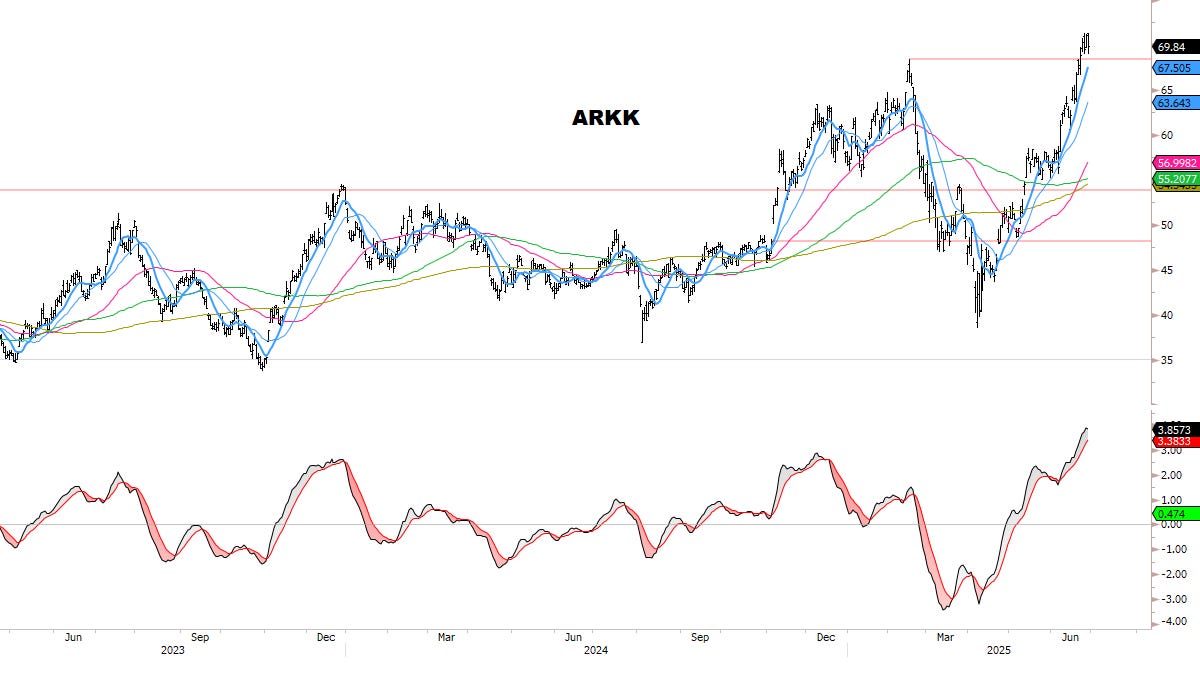

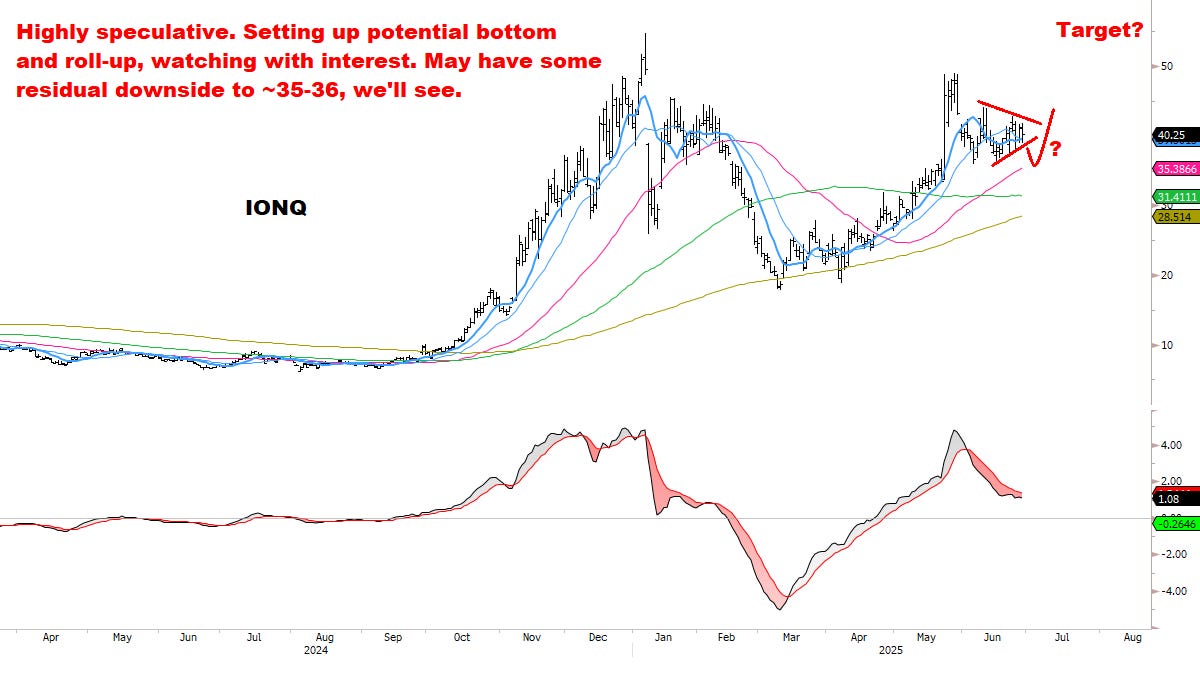

Speculation Index remains a concern — although the Russell chart looks constructive for a breakout (more on this later), I remain focused on Large-cap Growth/Tech for now:

投机指数仍然令人担忧——尽管 Russell 图表显示出突破的建设性迹象(稍后详细说明),我目前仍然关注大盘成长/科技股:

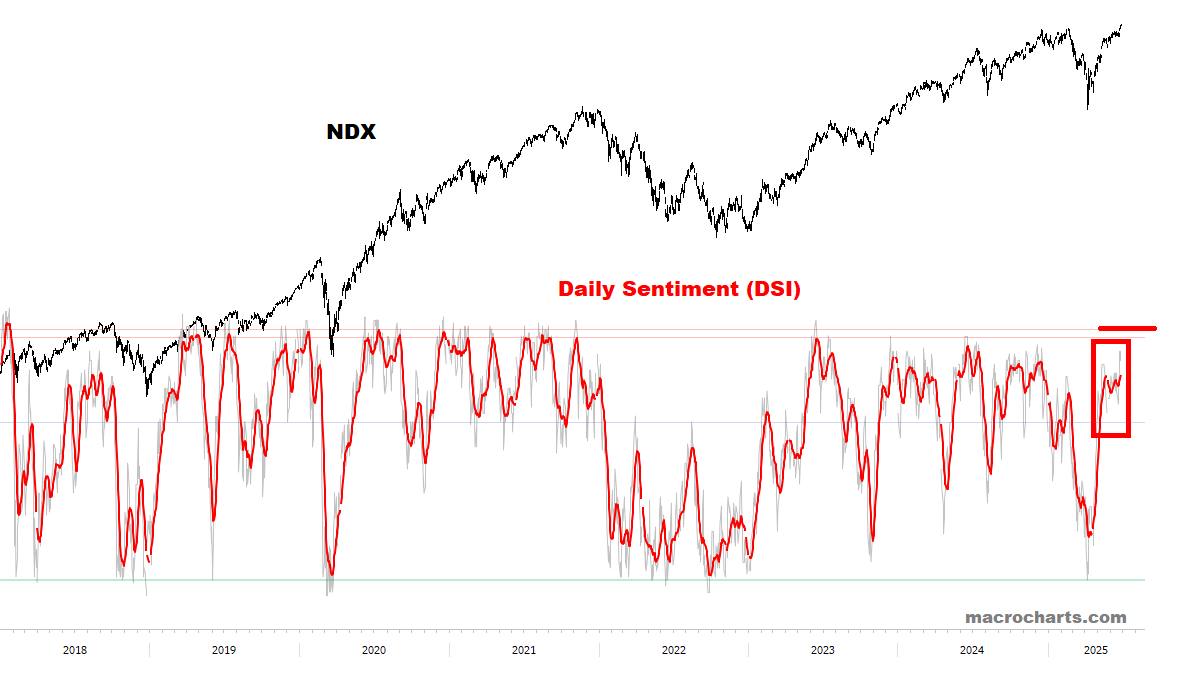

Equity Sentiment could spike higher if a summer melt-up is unfolding (our base case):

如果夏季行情正在展开(我们的基本假设),股票情绪可能会大幅上升:

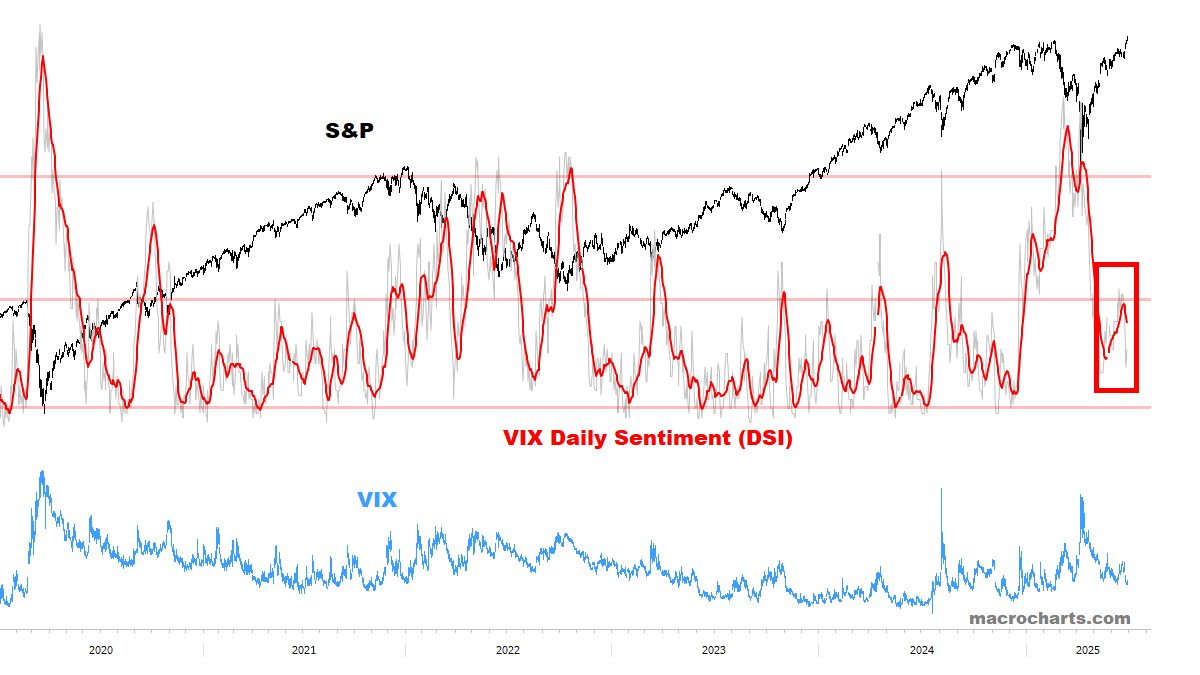

VIX Sentiment is turning DOWN from another top — and looks headed to our ideal targets (*much lower):

VIX 情绪正从另一个高点转为下跌——并且看起来正朝着我们理想的目标(*远低于此)前进:

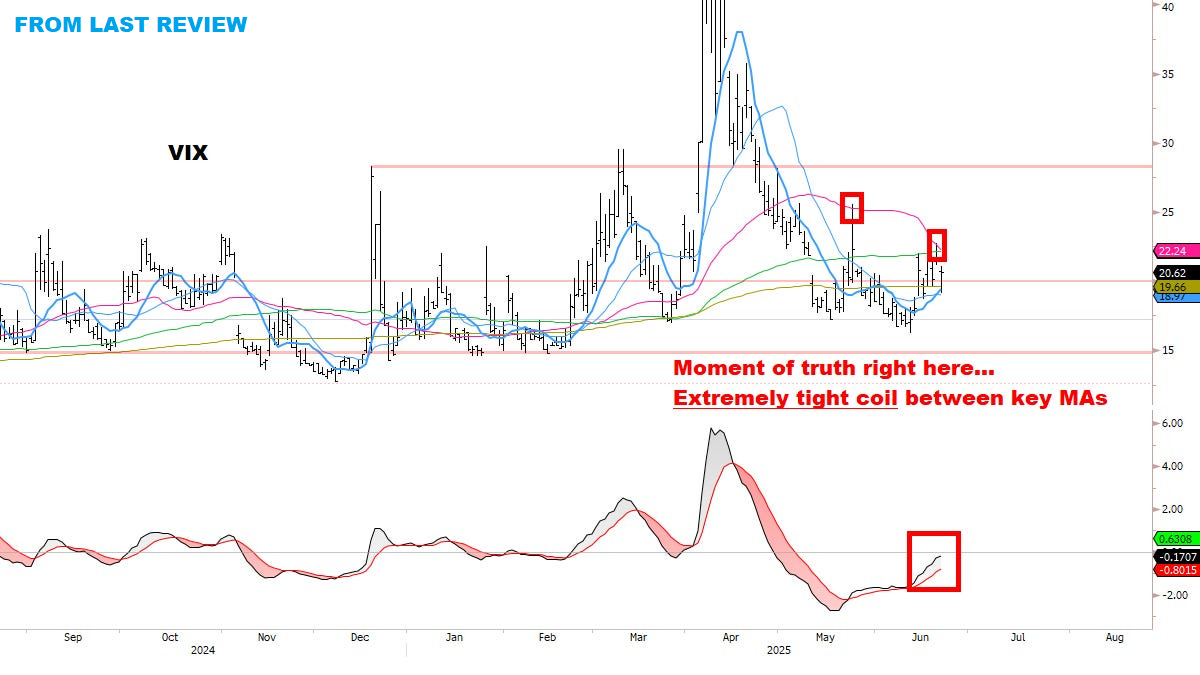

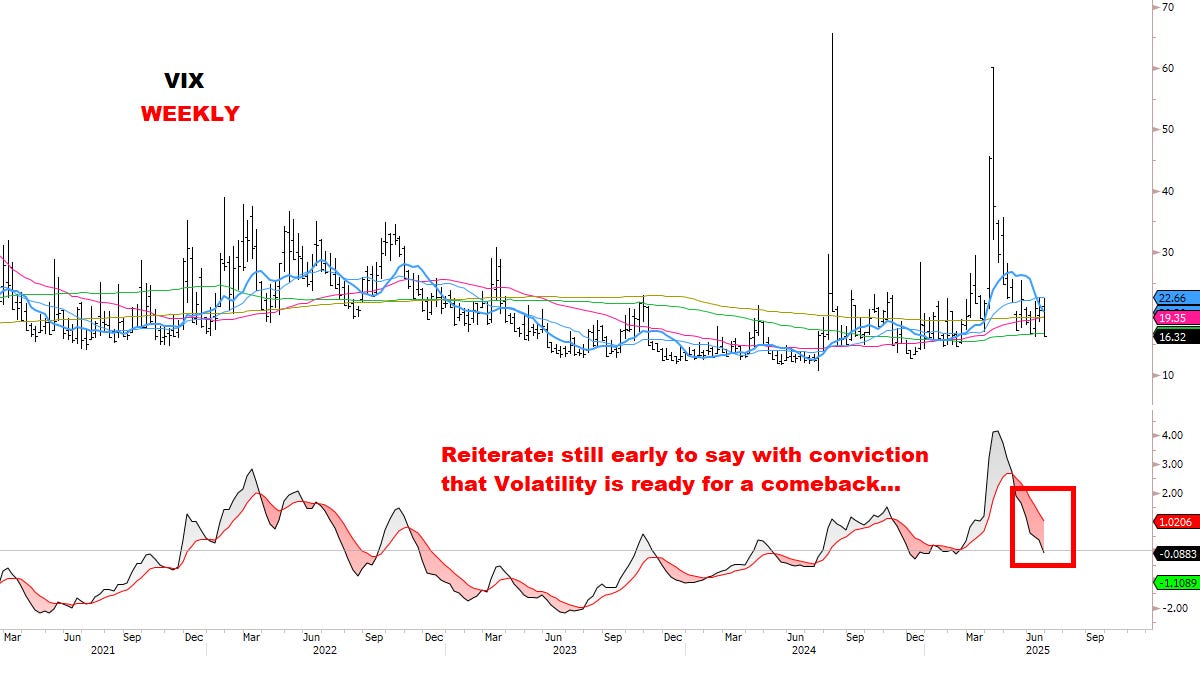

VIX — comments from last week: “forming a tight coil after testing ALL key moving averages. Think this should resolve lower”:

VIX — 上周评论:“在测试所有关键移动均线后形成紧密盘整。认为应向下突破”:

DOLLAR 美元

Watching closely for a potential bottom.

密切关注潜在的底部。

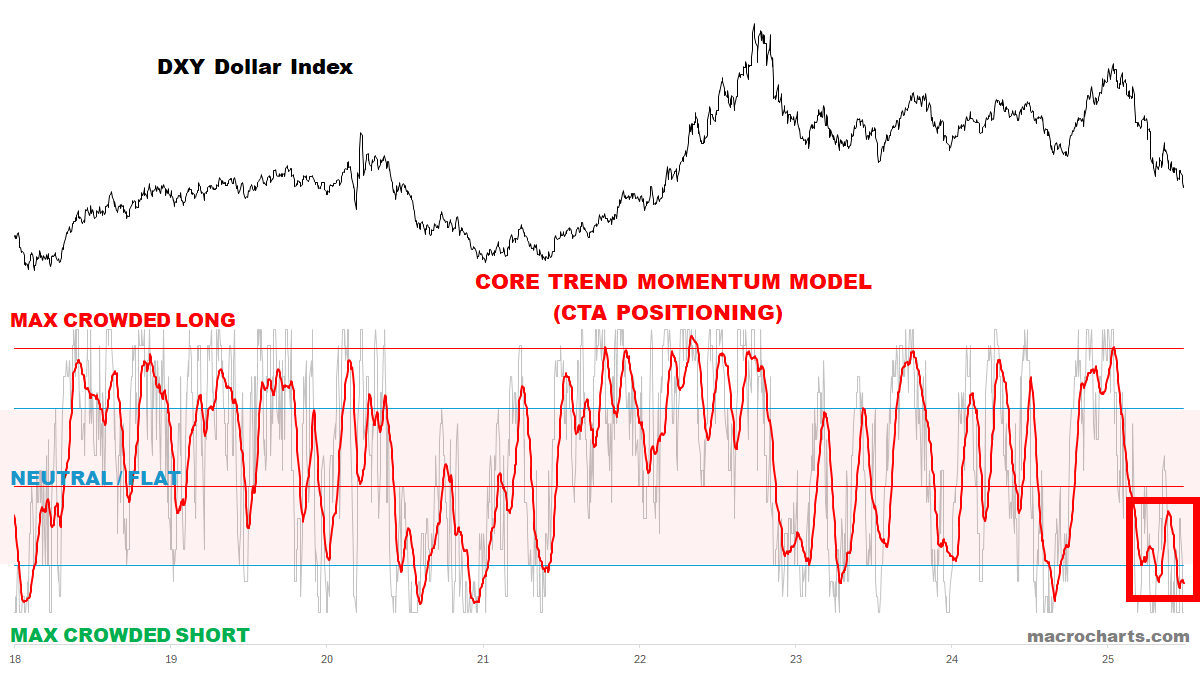

CTA Dollar Trend positioning is in bottoming range:

CTA 美元趋势仓位处于筑底区间:

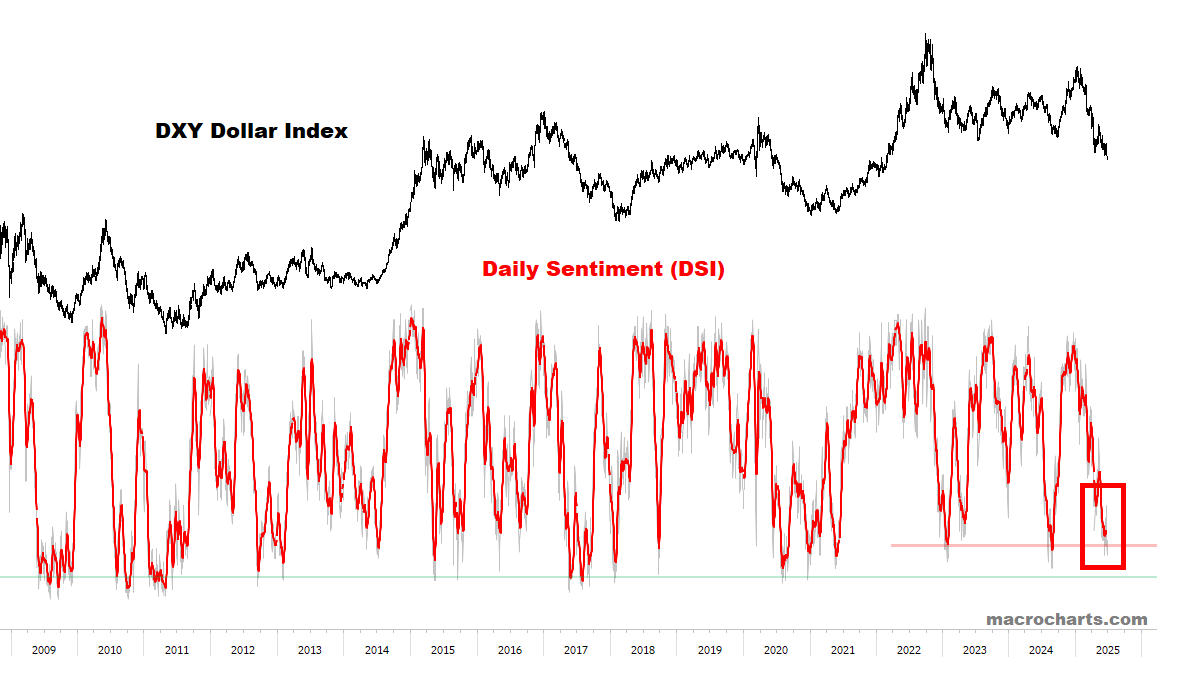

Dollar Sentiment is in capitulation range:

美元情绪处于投降区间:

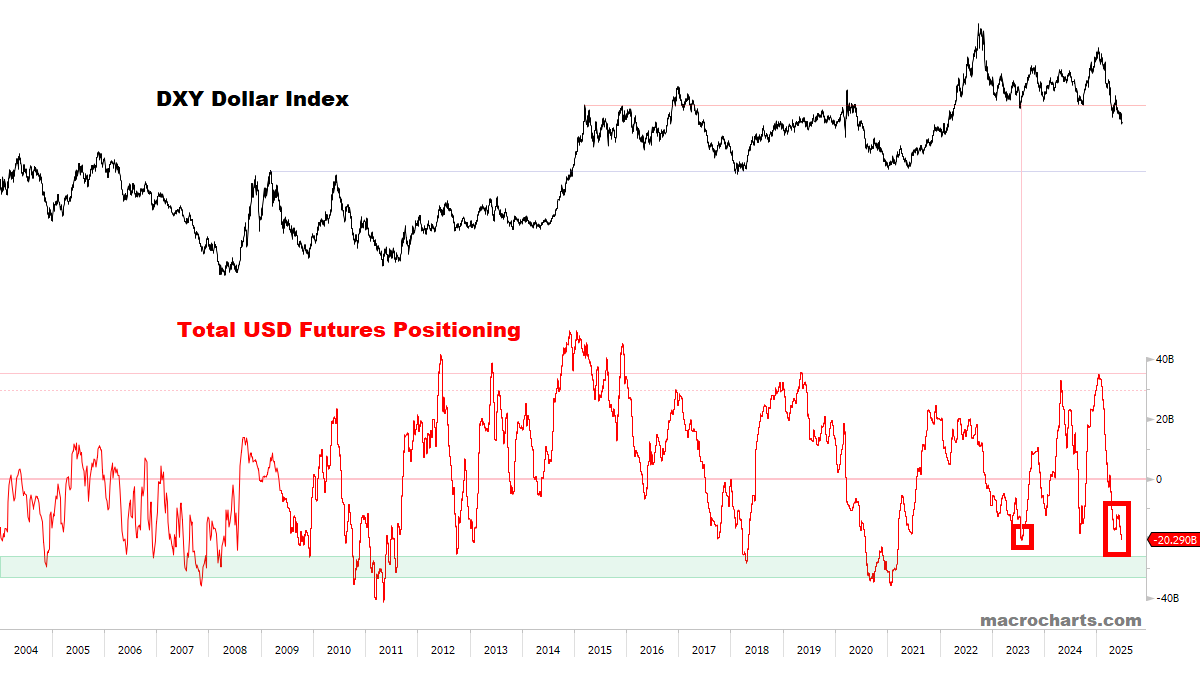

Dollar Net Short Positioning has broken -$20Bn, nearly tied with the JULY 2023 bottom.

美元净空头头寸已突破-200 亿美元,几乎与 2023 年 7 月的低点持平。

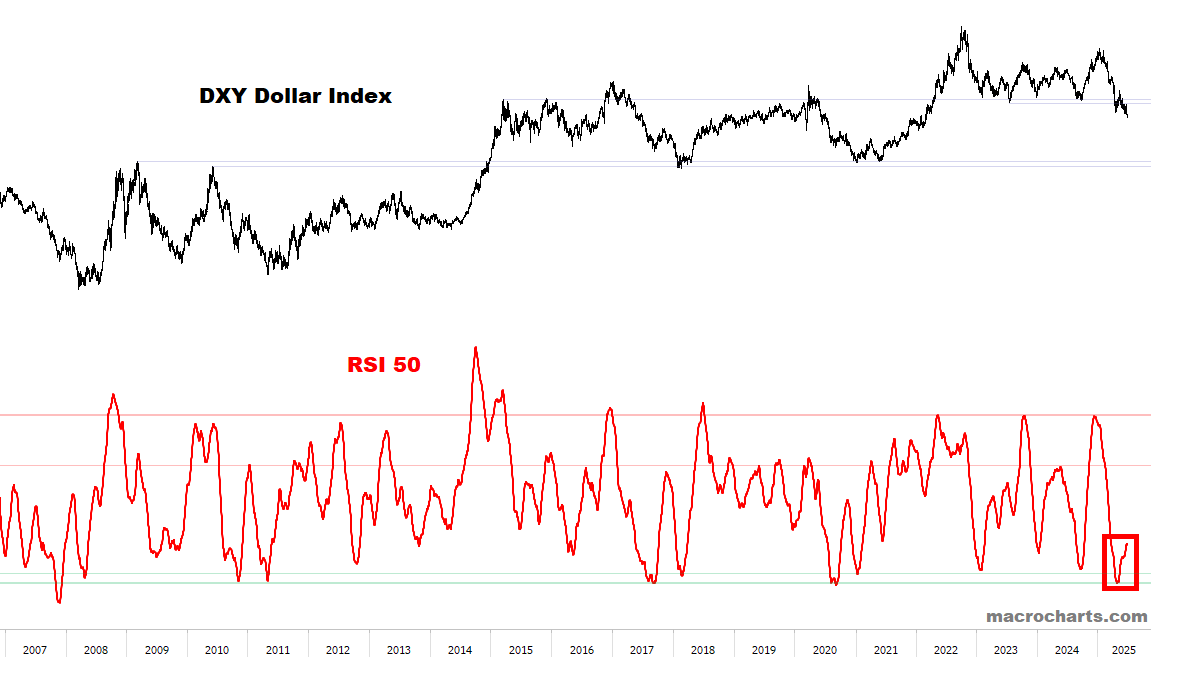

Big picture, the Dollar has significant room to recover:

总体来看,美元有显著的回升空间:

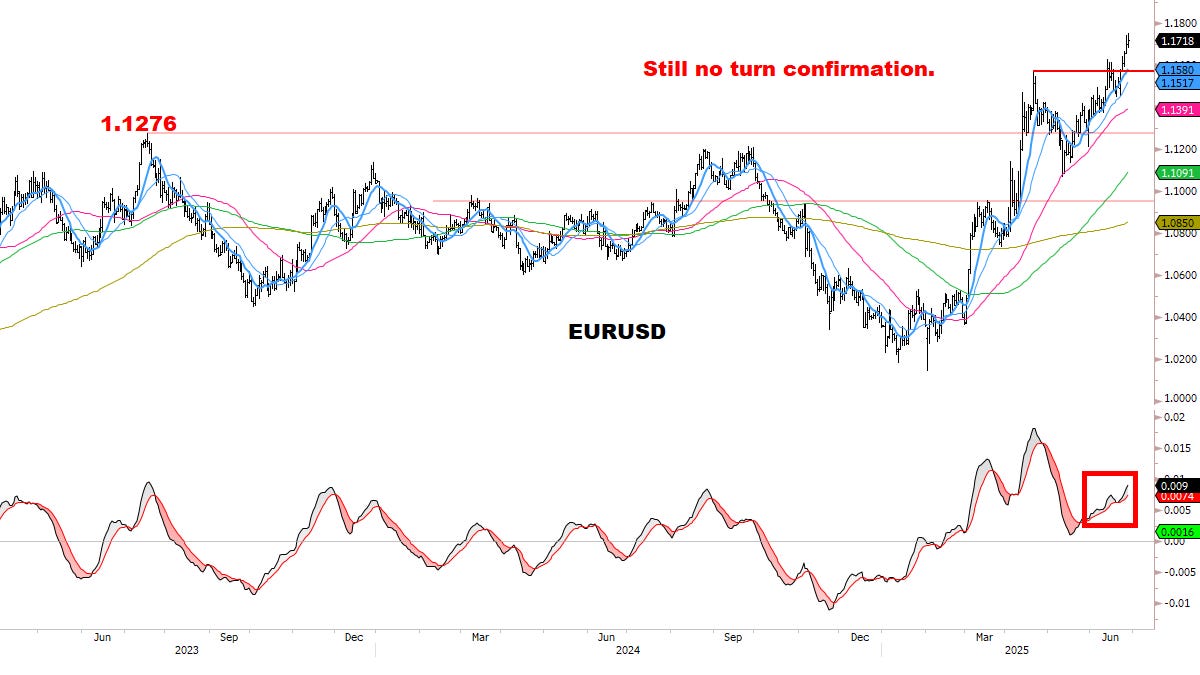

BONDS 债券

Turning Bullish? 转为看涨?

✅ Upgraded Bond bias to bullish.

✅ 将债券偏好升级为看涨。

✅ Added Bonds to Long candidate list.

✅ 将债券加入多头候选名单。

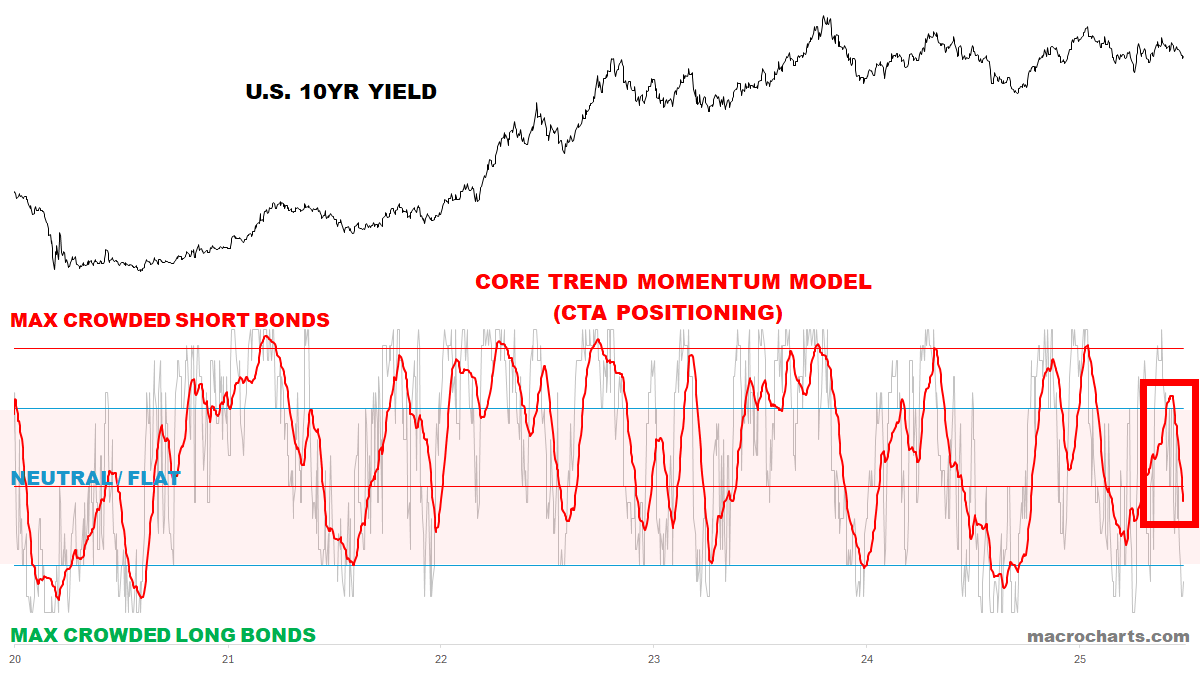

CTA Rates Trend positioning has already moved — but still has room to get extreme:

CTA 利率趋势仓位已发生变化——但仍有空间达到极端水平:

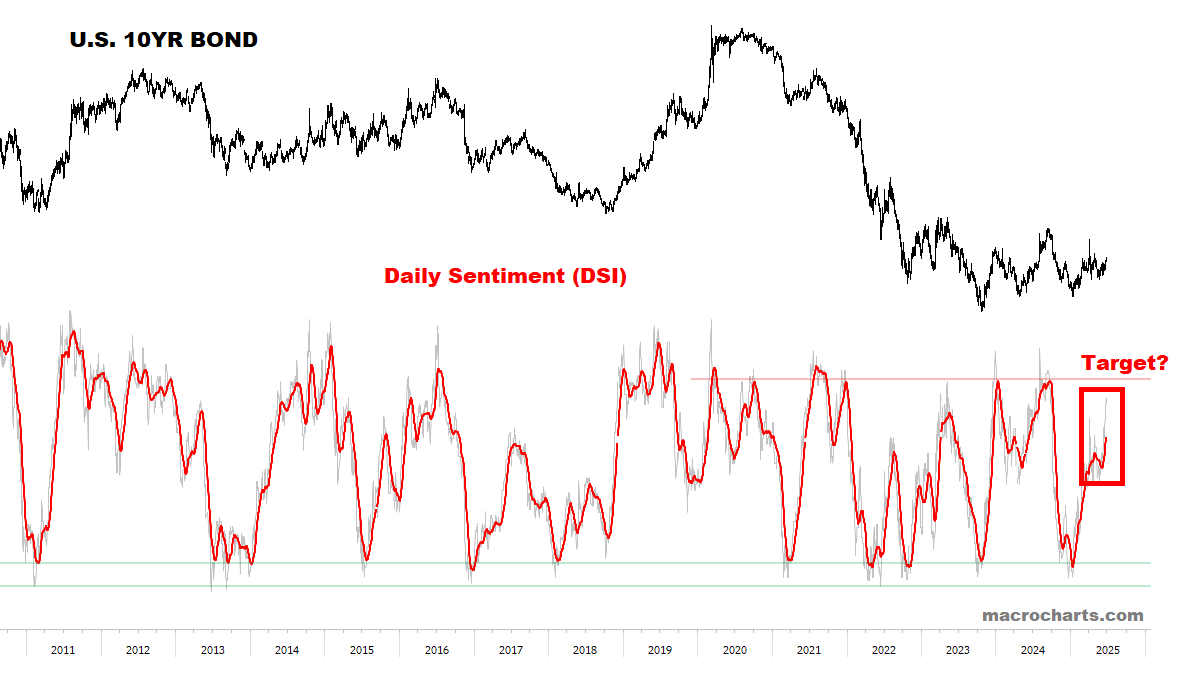

Bond Sentiment is trending higher and could push to overbought:

债券情绪呈上升趋势,可能推动至超买状态:

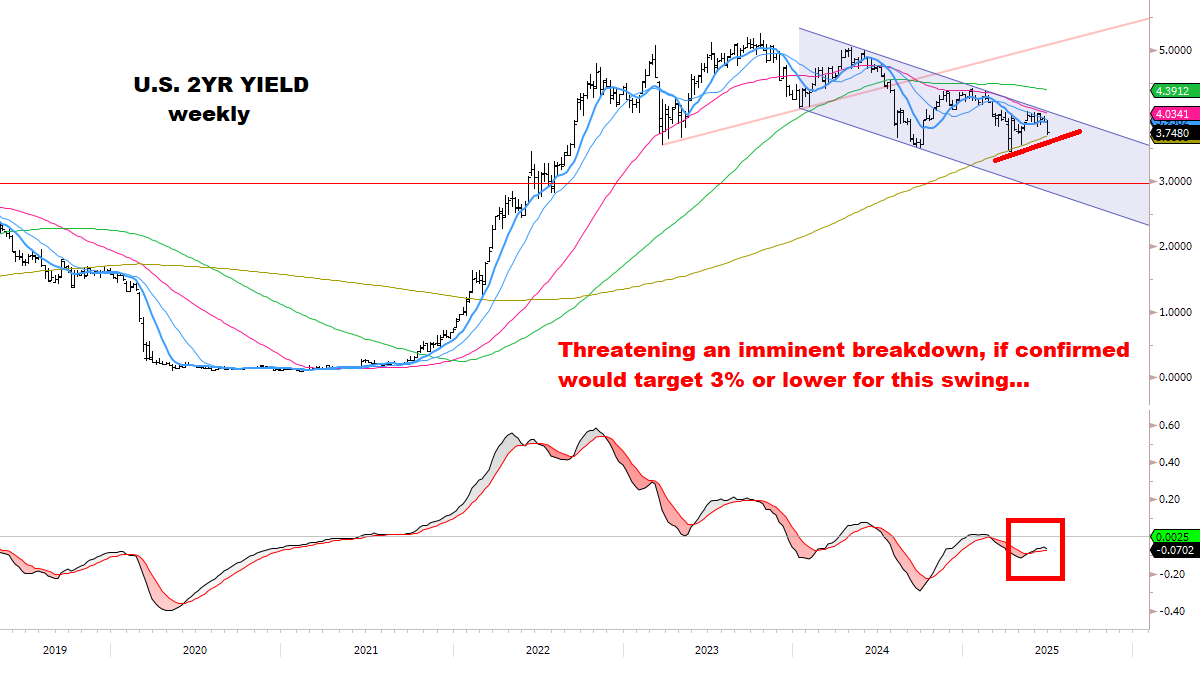

Buy signals are triggering (for Bond Prices) — what do Bonds know?

买入信号正在触发(针对债券价格)——债券知道什么?

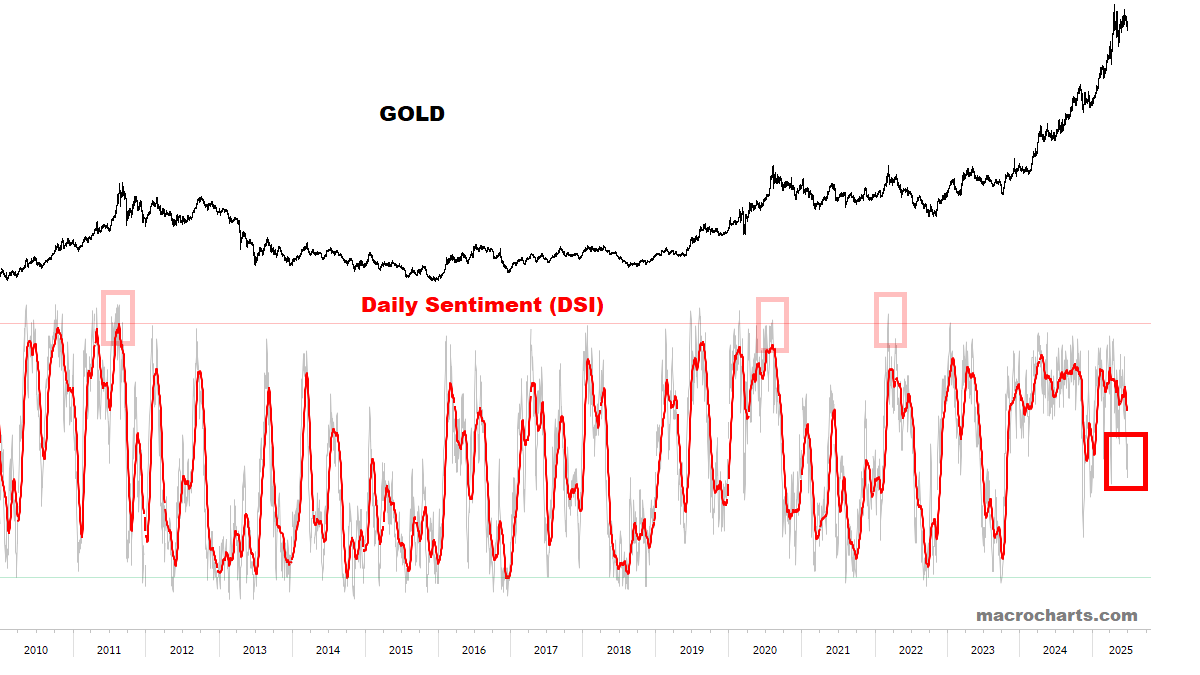

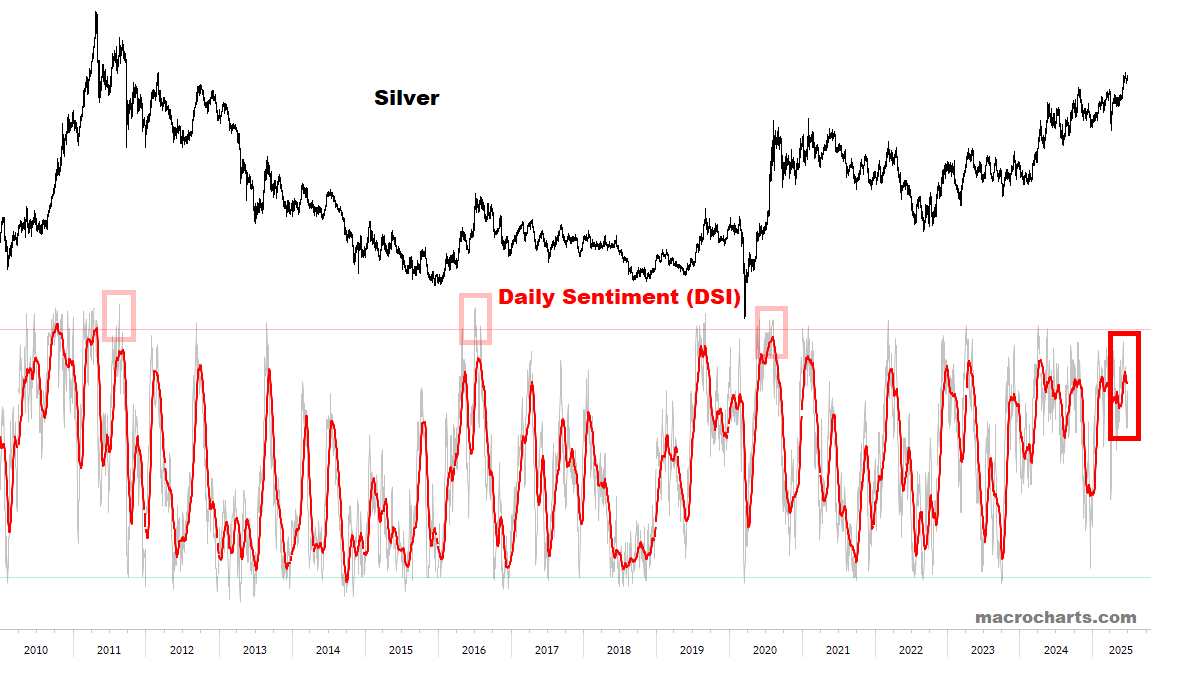

PRECIOUS METALS 贵金属

Risking a Top. What do they know?

顶点风险。他们知道什么?

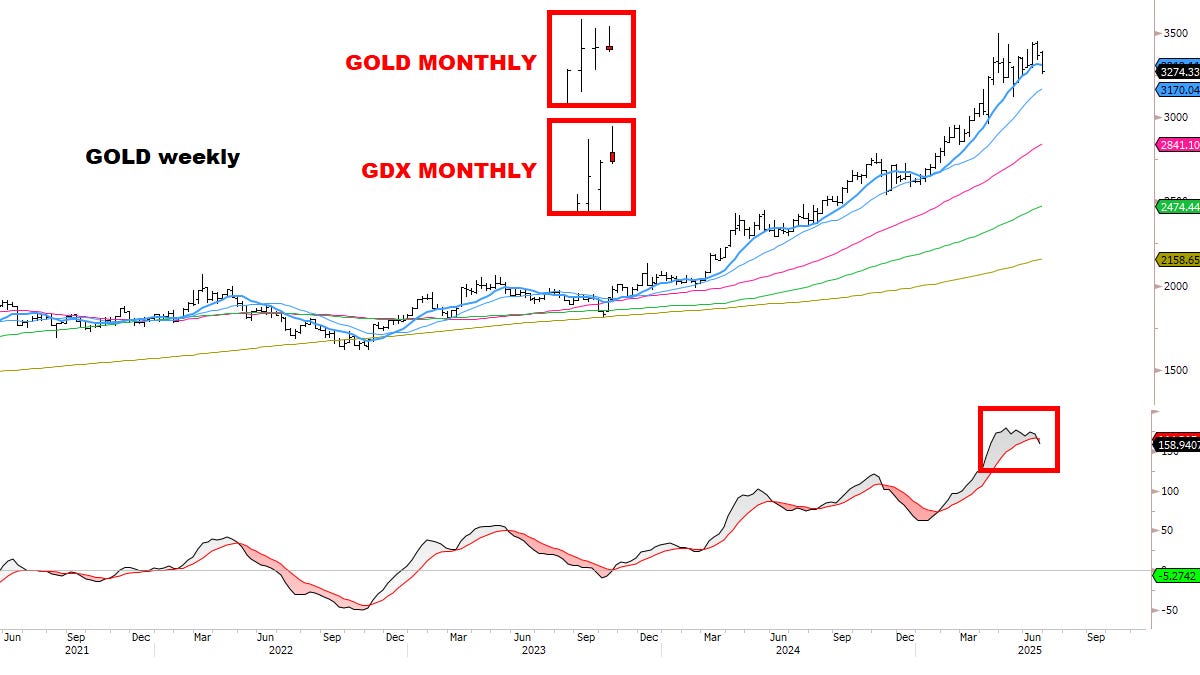

🔴 Downgraded Gold & Miners bias to bearish.

🔴 将黄金及矿业股的偏好下调至看跌。

🔴 Downgraded Silver bias to neutral.

🔴 将白银偏好下调至中性。

🔴 Added Gold and Gold Miners (GDX) to Short candidate list.

🔴 将黄金和黄金矿业股(GDX)加入做空候选名单。

🔴 May cut Silver position next week for a small gain.

🔴 可能在下周减持白银头寸以实现小幅获利。

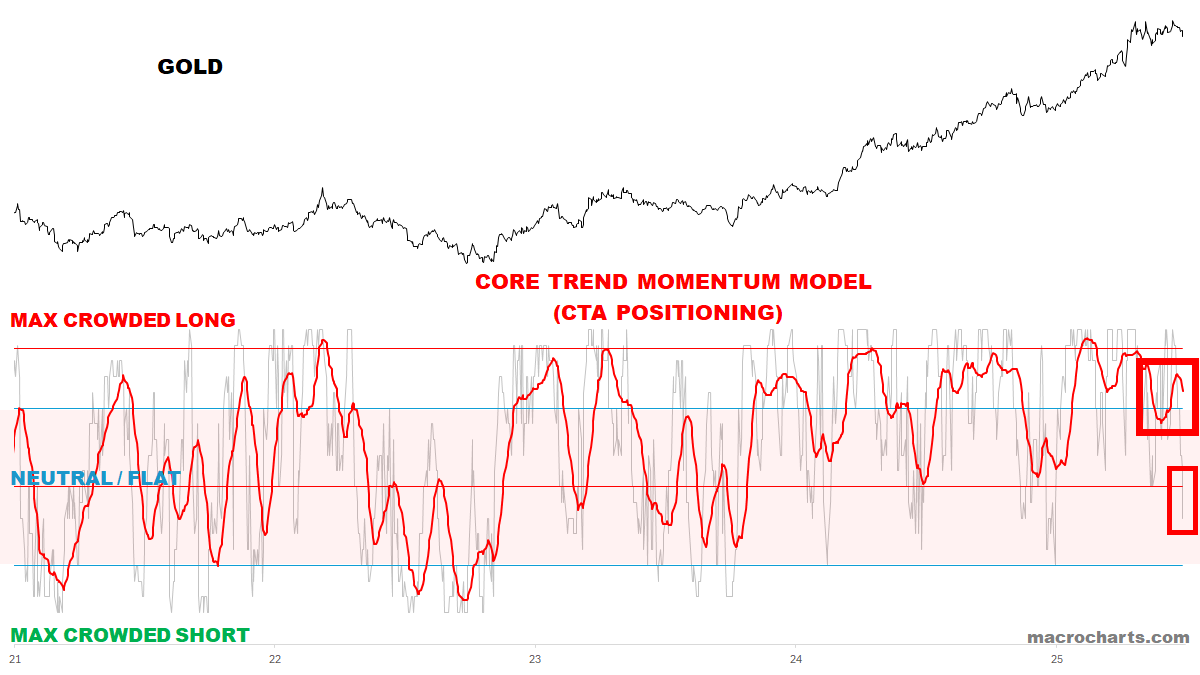

CTA Gold Trend positioning is vulnerable and turning DOWN again:

CTA 黄金趋势仓位脆弱,且再次转为下跌:

Gold has triggered a Weekly Sell — *despite the Dollar breaking down to the lowest in three years.

尽管美元跌至三年来最低,黄金仍触发了周线卖出信号。

*Important: pending JUNE close on Monday, Gold AND Gold Miners are potentially forming a MONTHLY Bearish Shooting Star — risking a Top.

*重要提示:待周一 6 月收盘,黄金和黄金矿业股可能正在形成月度看跌射击之星形态——存在顶部风险。

What does Gold know? 黄金知道什么?

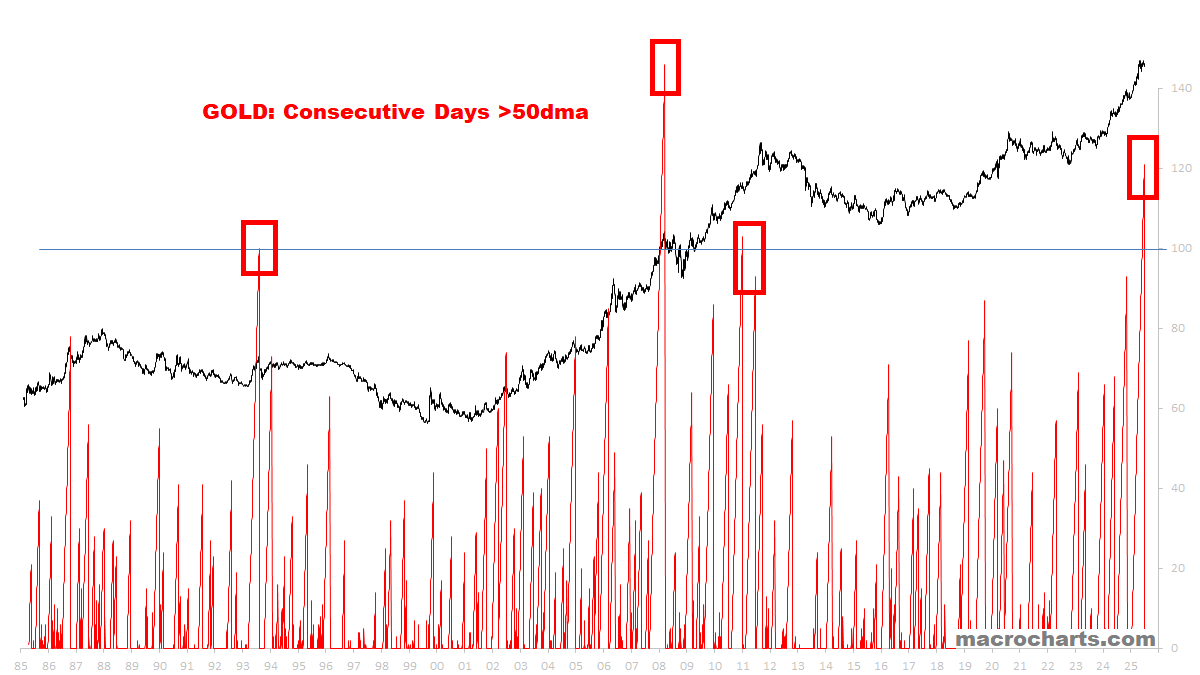

Even worse, Gold also broke its 50dma this week — which I’ve said is a *critical* line in the sand.

更糟糕的是,黄金本周也跌破了其 50 日移动平均线——我曾说过这是一个*关键*的分水岭。

A significant shift may be underway here:

这里可能正在发生重大转变:

What does Gold know? Is the Dollar bottoming?

黄金知道什么?美元是否正在触底?

Few good precedents: 少数良好先例:

1. Gold was 121 days above the 50dma, and broke down this week.

1. 黄金连续 121 天位于 50 日均线上方,本周出现下跌。

2. When this happened in 2011, Gold managed to rally a few more months but ultimately formed a major Top.

2. 2011 年发生类似情况时,黄金又上涨了几个月,但最终形成了一个重要的顶部。

3. In 2008, Gold topped on March 17 and then on March 19 Gold broke its 50dma (after being 146 days above it). The rest was history.

3. 2008 年,黄金在 3 月 17 日达到顶点,随后在 3 月 19 日跌破 50 日均线(此前已连续 146 天位于其上方)。其后发展众所周知。

4. In 1993, Gold peaked and corrected -17%, then spent three years in a sideways range which then led to a three-year breakdown.

4. 1993 年,黄金达到峰值后下跌了 17%,随后在一个横盘区间内徘徊了三年,最终导致了三年的下跌走势。

Related, Gold may also be tracking with 2016 — similar to Equities:

相关的,黄金价格也可能与 2016 年走势相似——类似于股票市场:

1. These may be small clues for now… but Gold has a tendency to top around mid-year, and then correct into year-end (until nobody cares about it anymore).

1. 这些目前可能只是一些小线索……但黄金往往在年中见顶,然后在年底前回调(直到没人再关心它为止)。

2. Maybe it doesn’t fall too much, but even the idea of Gold treading water for a few months is an extreme contrarian view here. Which says a lot about the prevailing mood.

2. 也许它不会跌得太多,但即使是黄金维持盘整几个月的想法,在这里也是极端的逆向观点。这说明了当前的市场情绪。

3. Maybe Gold is sensing a shift in the Dollar for the second half of 2025?

3. 也许黄金正在感知 2025 年下半年美元的转变?

4. If so, this could be THE biggest Macro surprise in the markets, and nobody seems ready — so we want to stay focused the next few weeks.

4. 如果是这样,这可能是市场上最大的宏观意外,而似乎没有人做好准备——因此我们希望在接下来的几周内保持专注。

Precious Metals Sentiment never got extreme but may be turning down:

贵金属情绪从未达到极端,但可能正在转向下行:

KEY TECHNICAL CHARTS 关键技术图表

A QUALITATIVE ASSESSMENT (CONTINUED)

定性评估(续)

On April 30 in “What’s Next For Stocks?”, I wrote:

4 月 30 日在《股票的下一步是什么?》中,我写道:

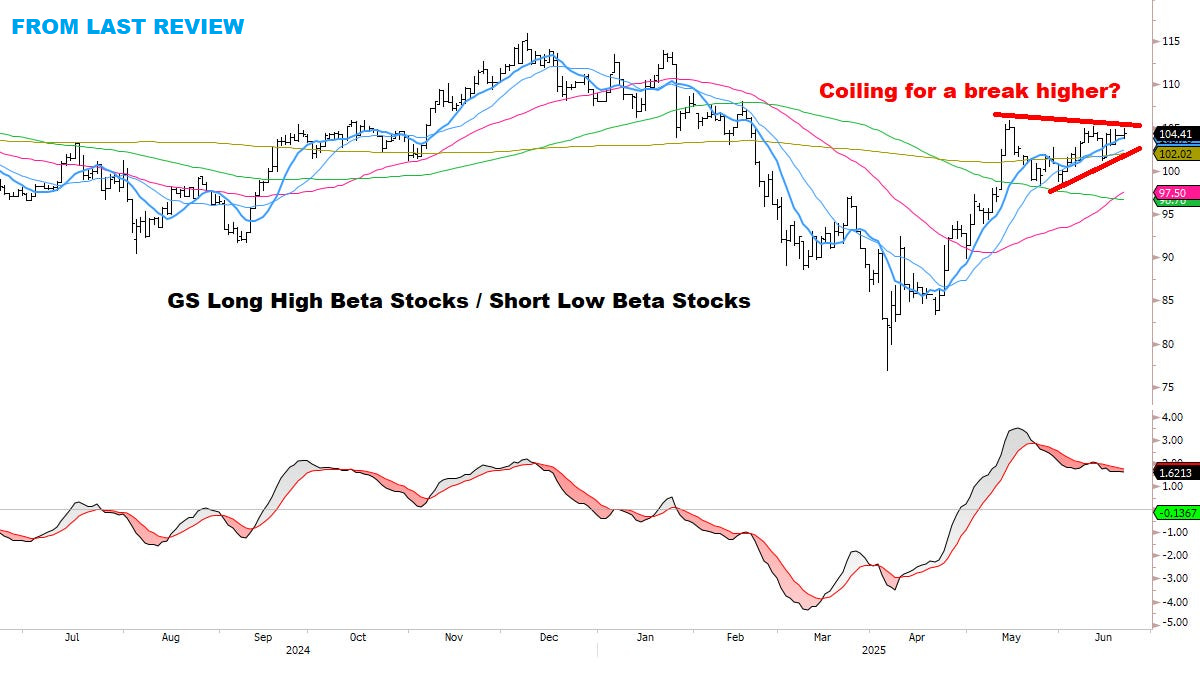

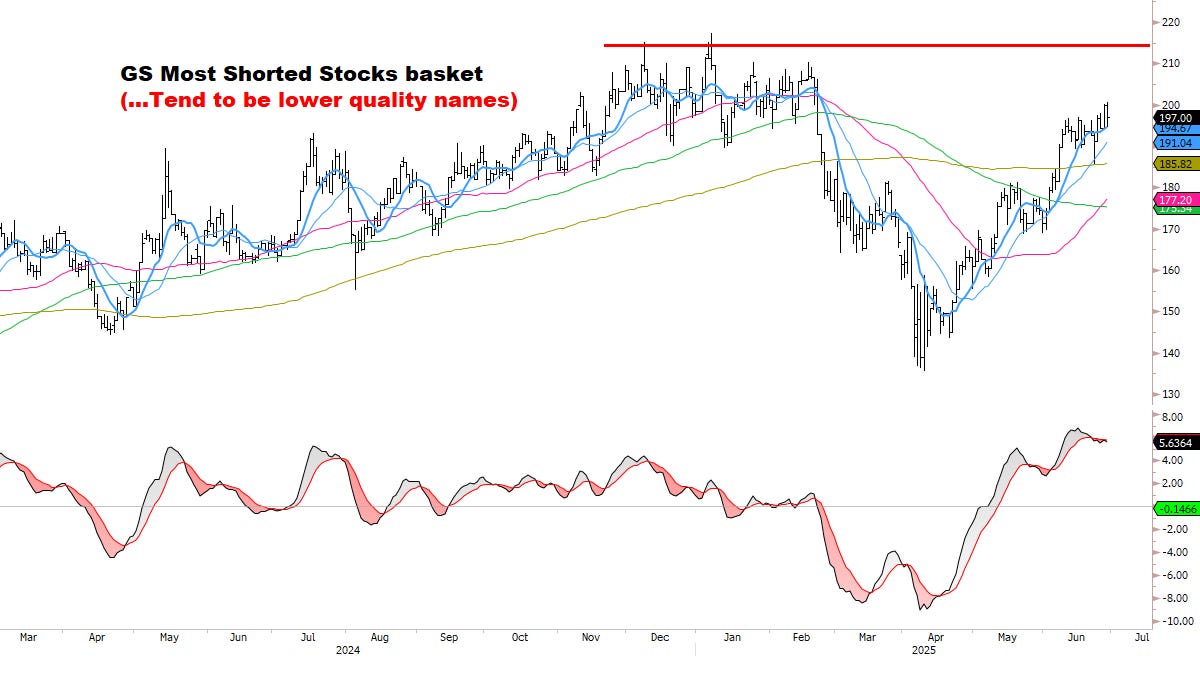

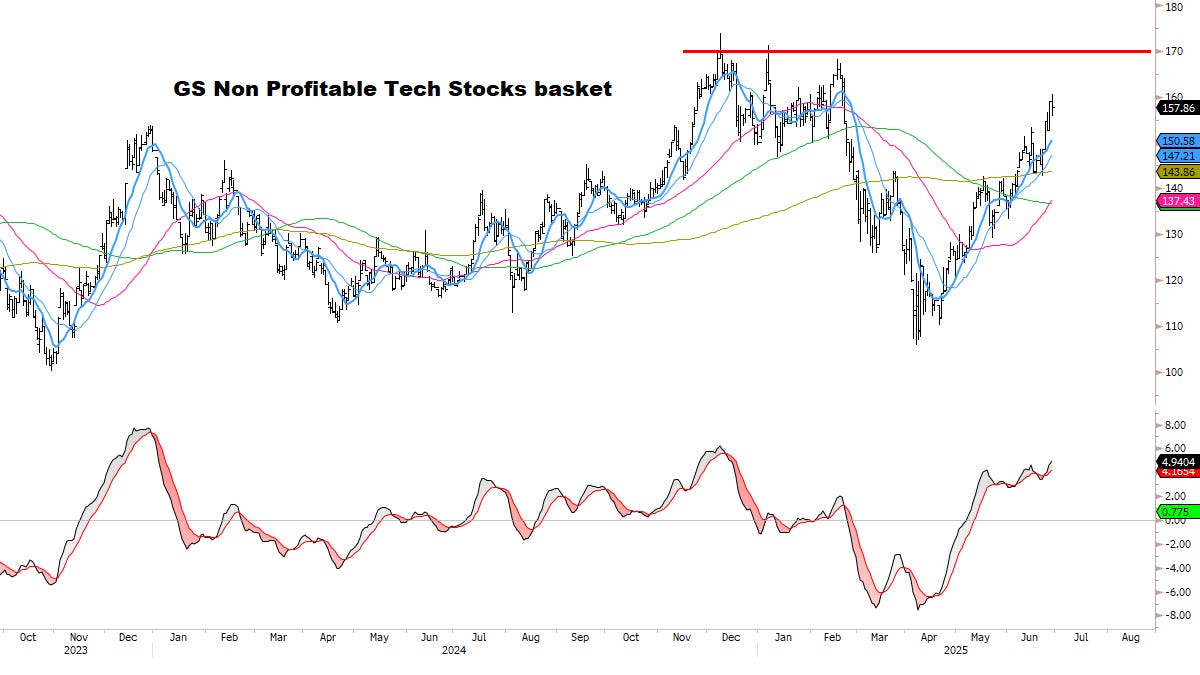

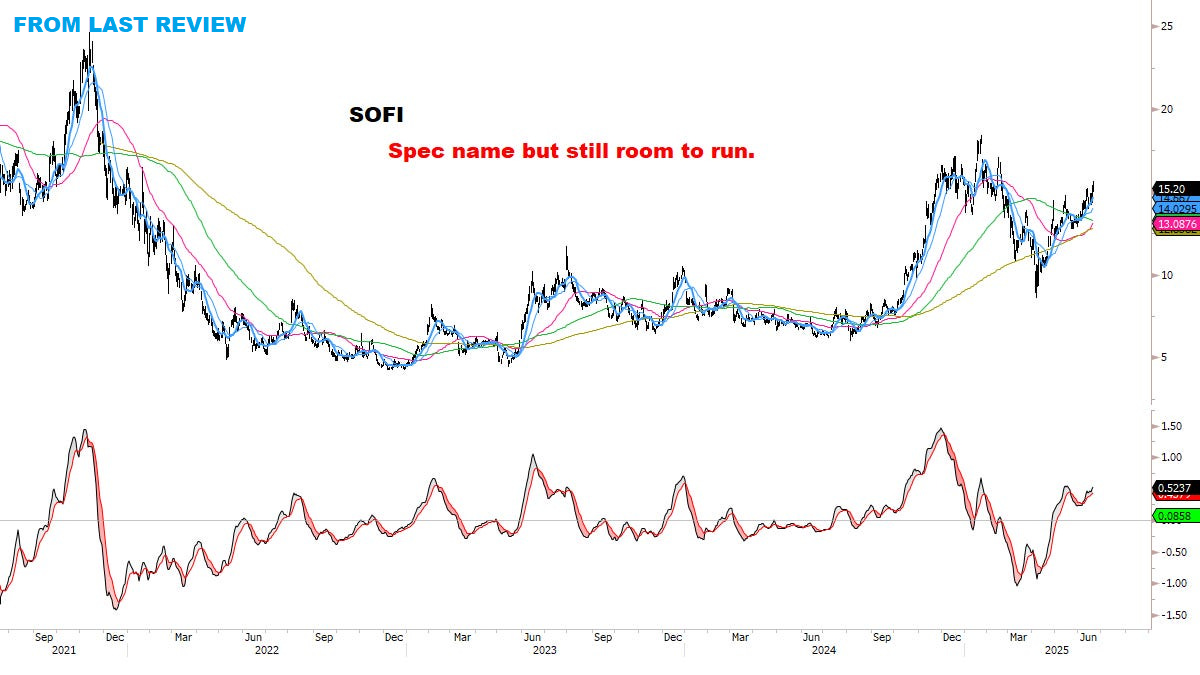

Inevitably, at some point in every rally, the wall of worry finally crumbles and even the garbage gets bought.

不可避免的是,在每一次反弹的某个时刻,担忧之墙最终会崩溃,甚至连垃圾股也会被买入。This extreme risk-seeking behavior is fueled by two forces: performance-chasing, and general FOMO taking over.

这种极端的风险偏好行为由两股力量推动:追逐业绩和普遍的害怕错过(FOMO)。Looking around today, quantitatively and qualitatively I don’t think we’re quite there yet. I also think it will be a much different market picture in a few weeks’ time.

从今天的情况来看,无论是定量还是定性分析,我认为我们还没有达到那个程度。我也认为几周后市场的情况将会大不相同。

Are we there yet? I still don’t think so.

我们到了吗?我仍然不这么认为。

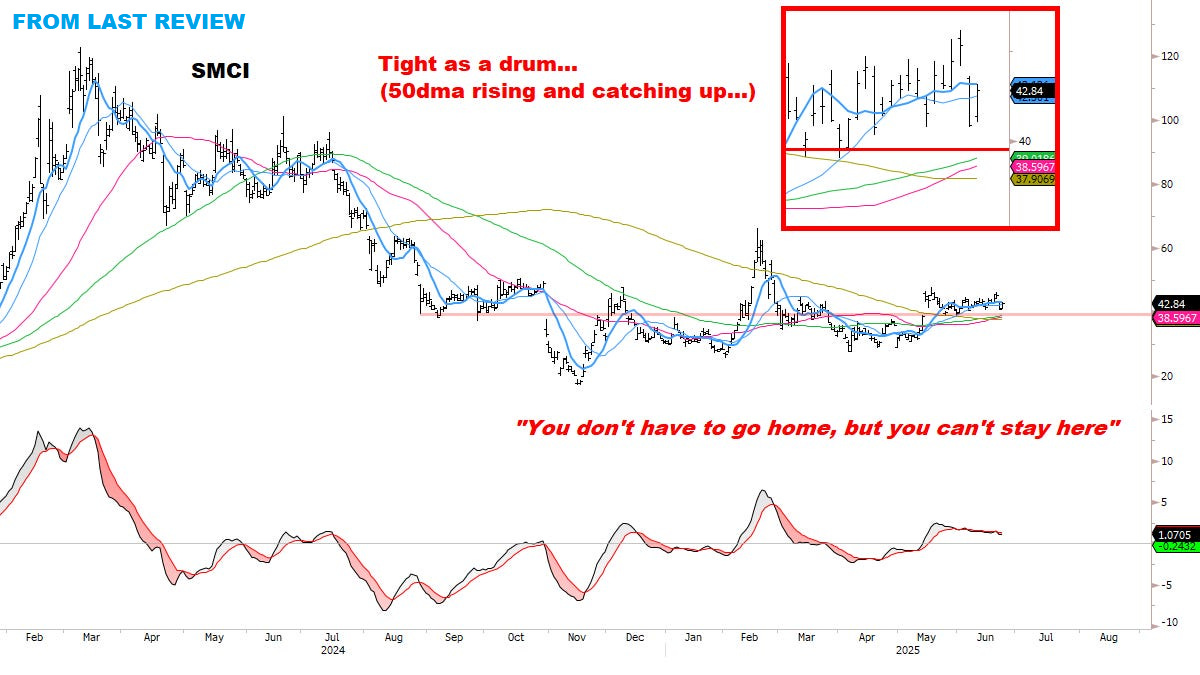

Things could get more frothy — in no particular order:

情况可能会变得更加泡沫化——无特定顺序:

Let the market say what’s next:

让市场来决定下一步:

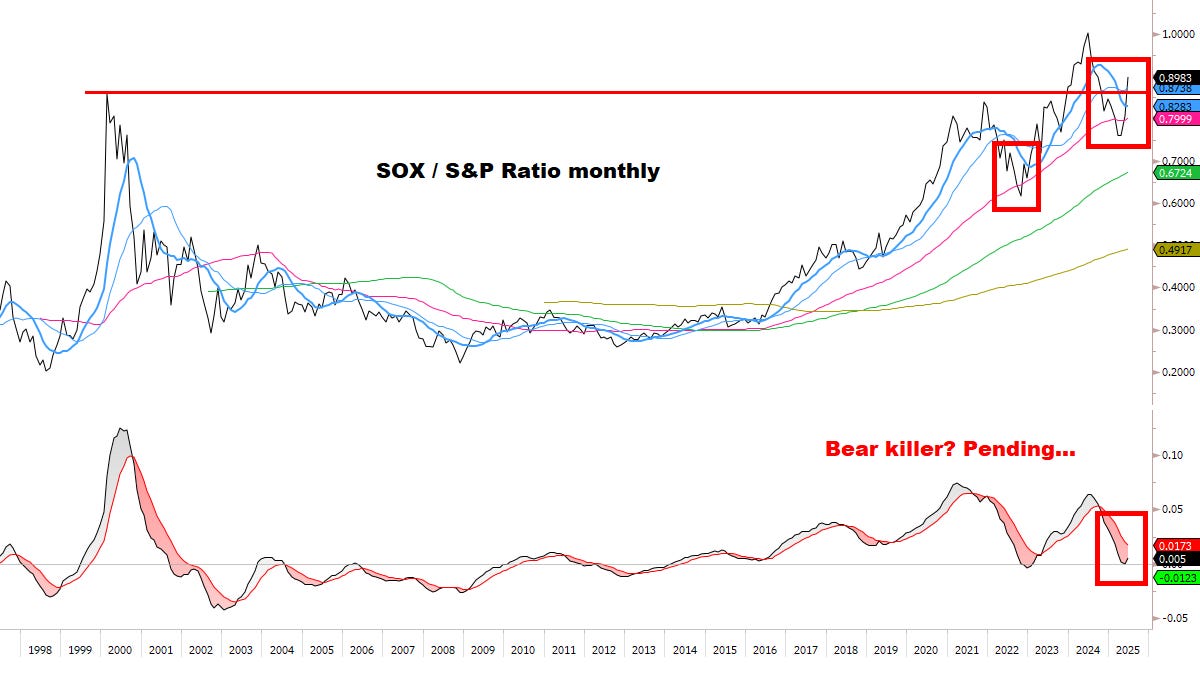

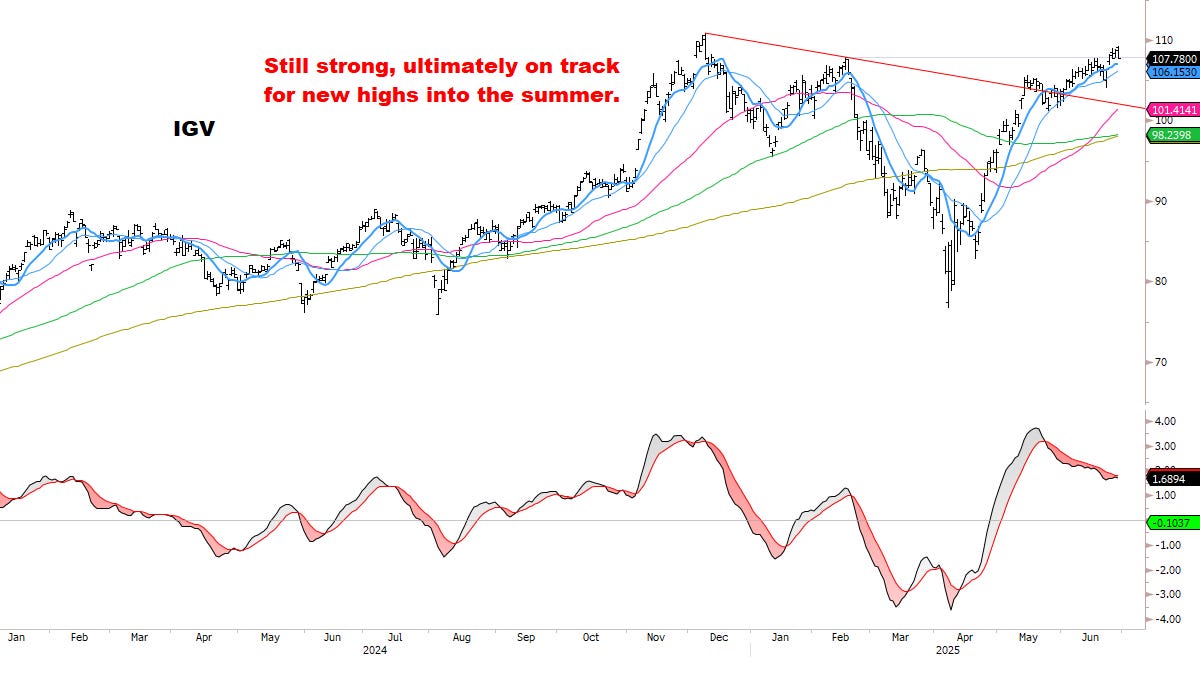

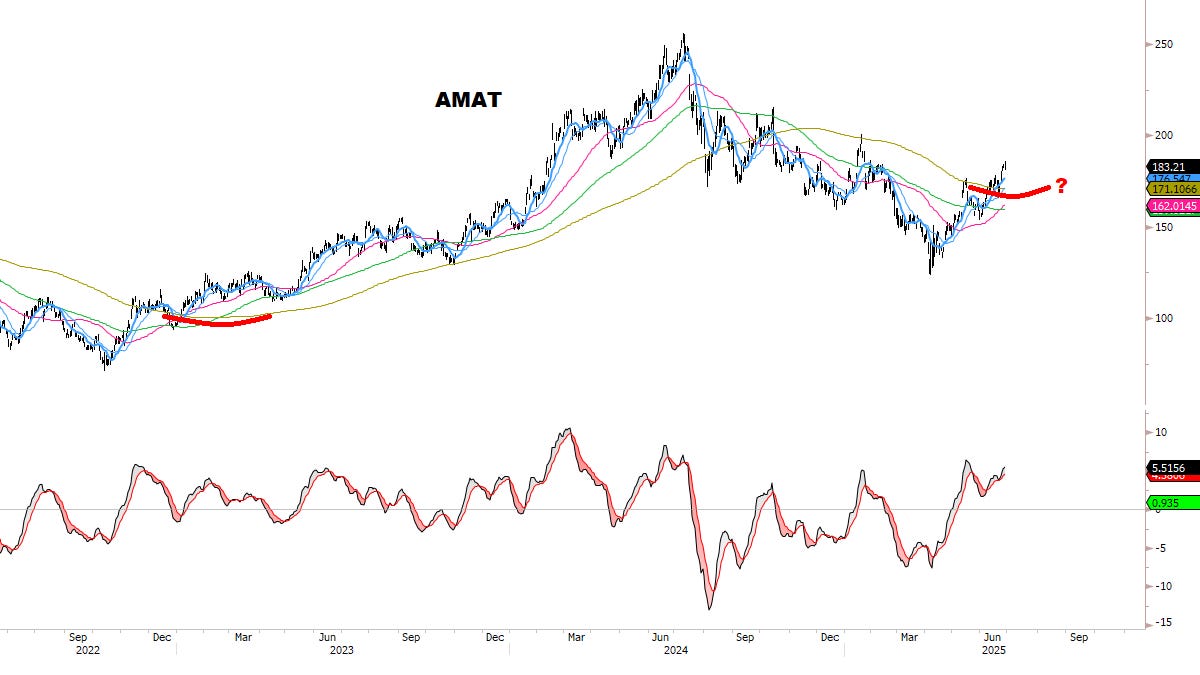

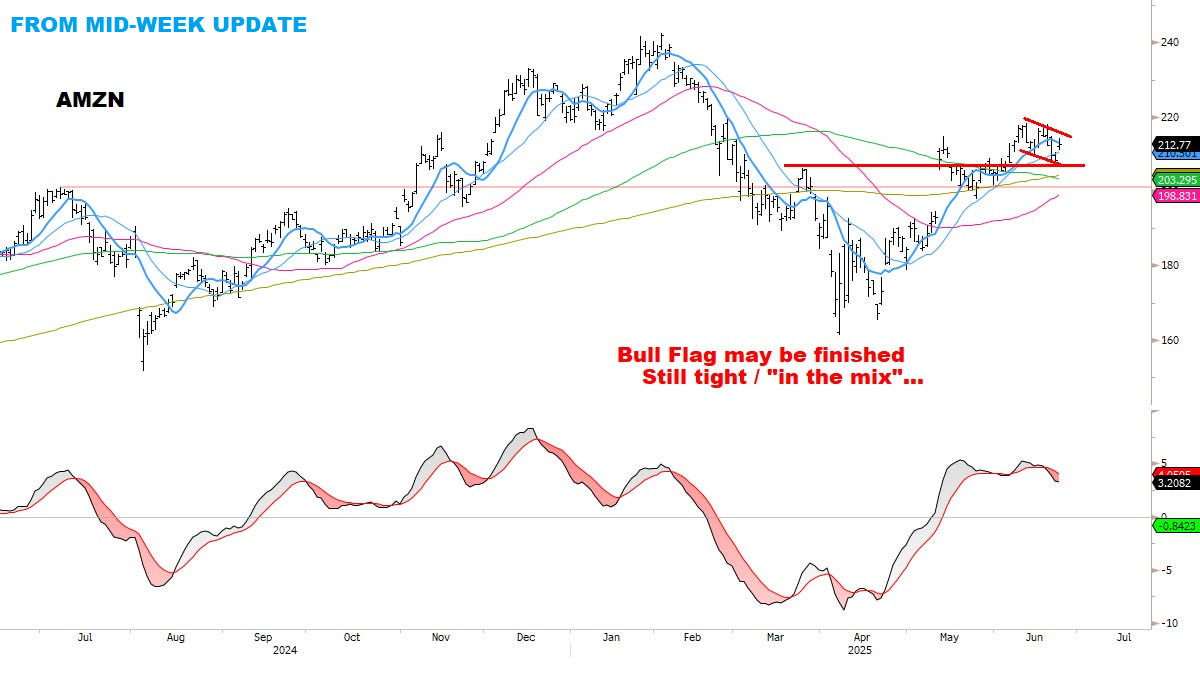

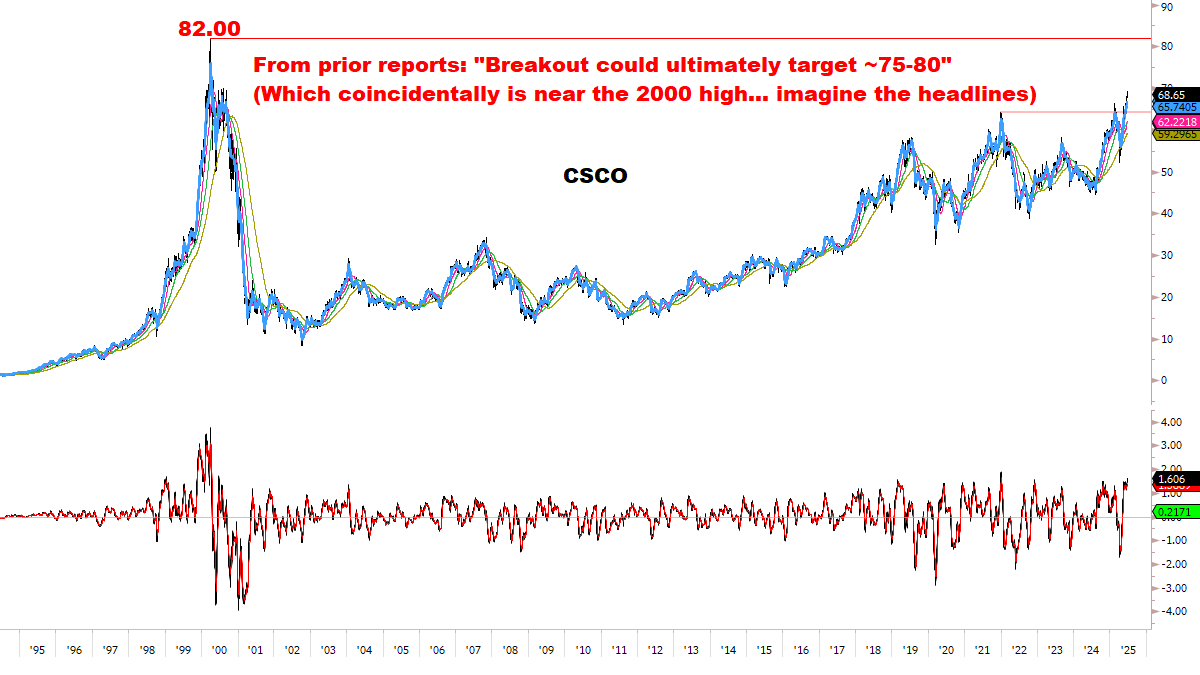

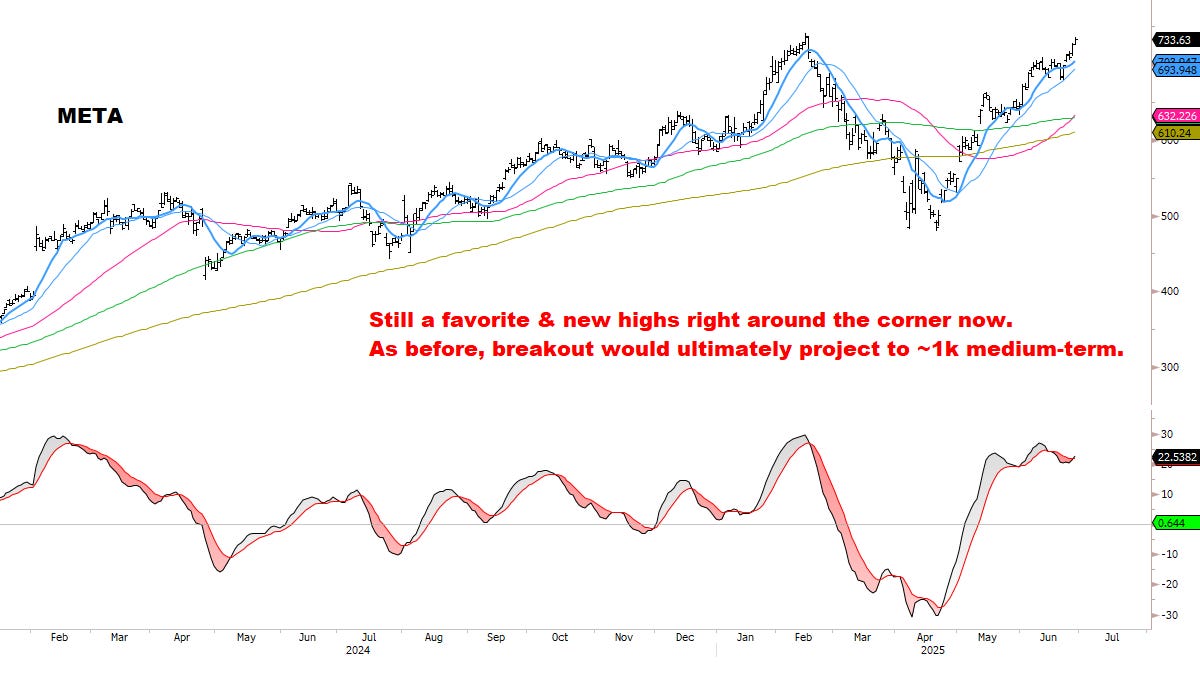

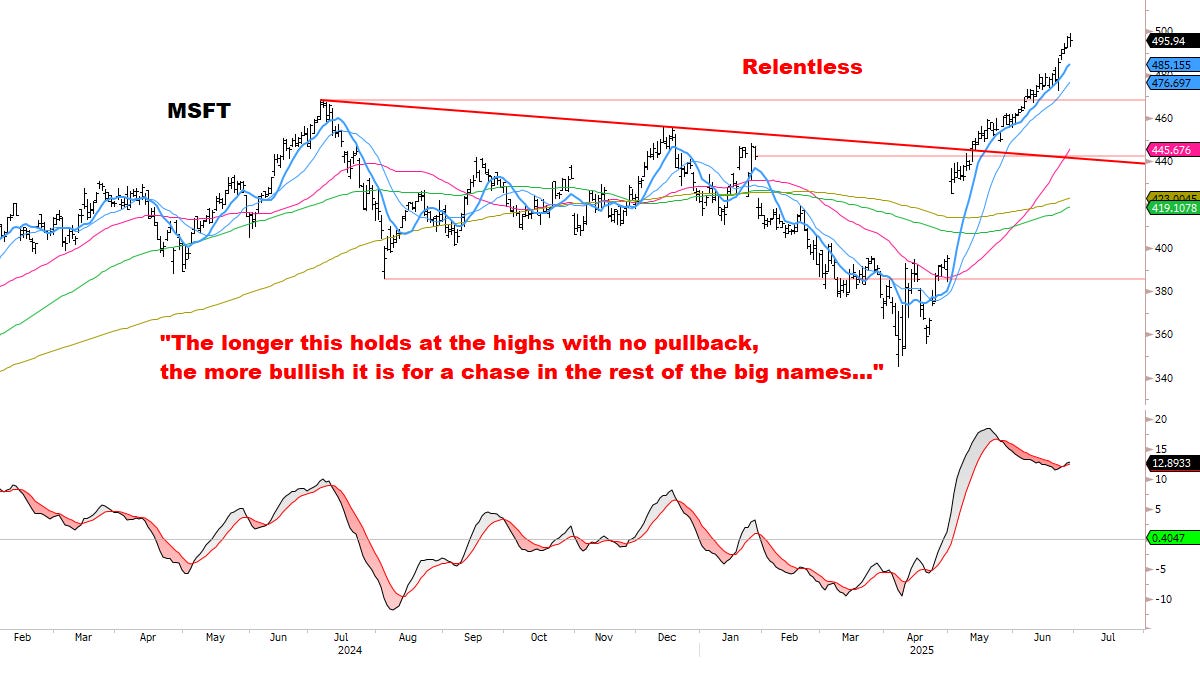

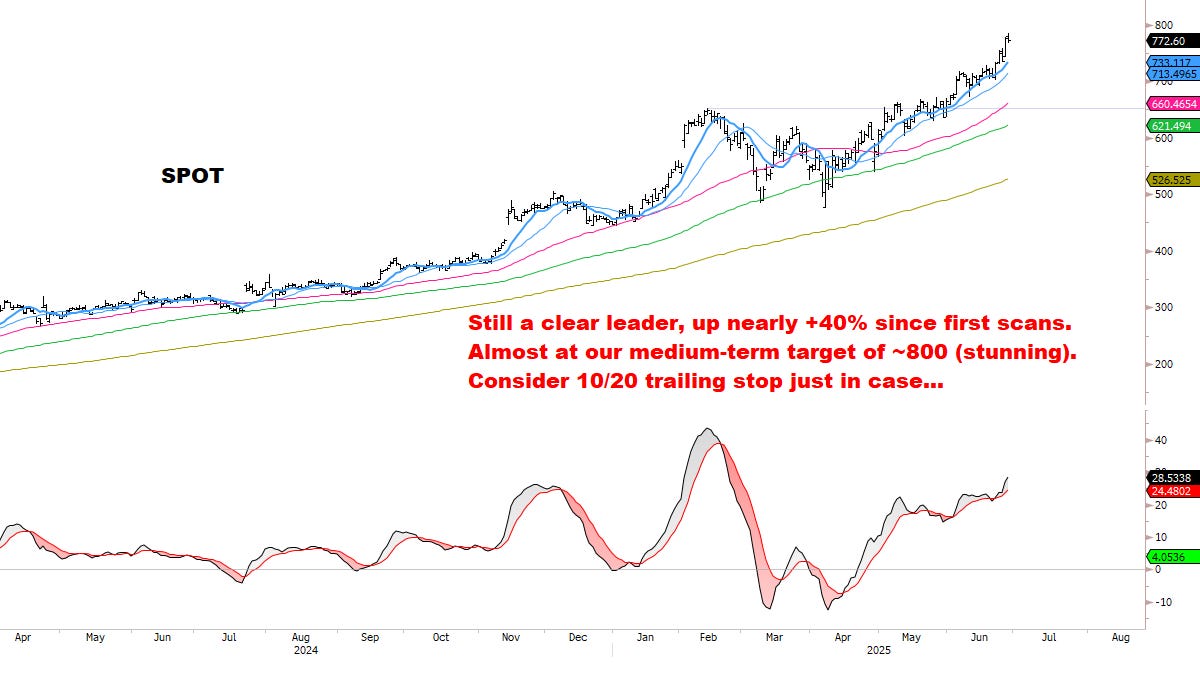

All key Sectors & Groups remain in good chart position: especially the leaders in Semis, Tech, Communication Services, and Software.

所有主要行业和板块的图表位置依然良好:尤其是半导体、科技、通信服务和软件领域的领头羊。Difficult to build a top while these leading areas continue to carry the market AND are moving in synch.

当这些领先领域继续支撑市场并同步移动时,顶部难以形成。Uptrends remain intact, with no bearish reversals in any major Index.

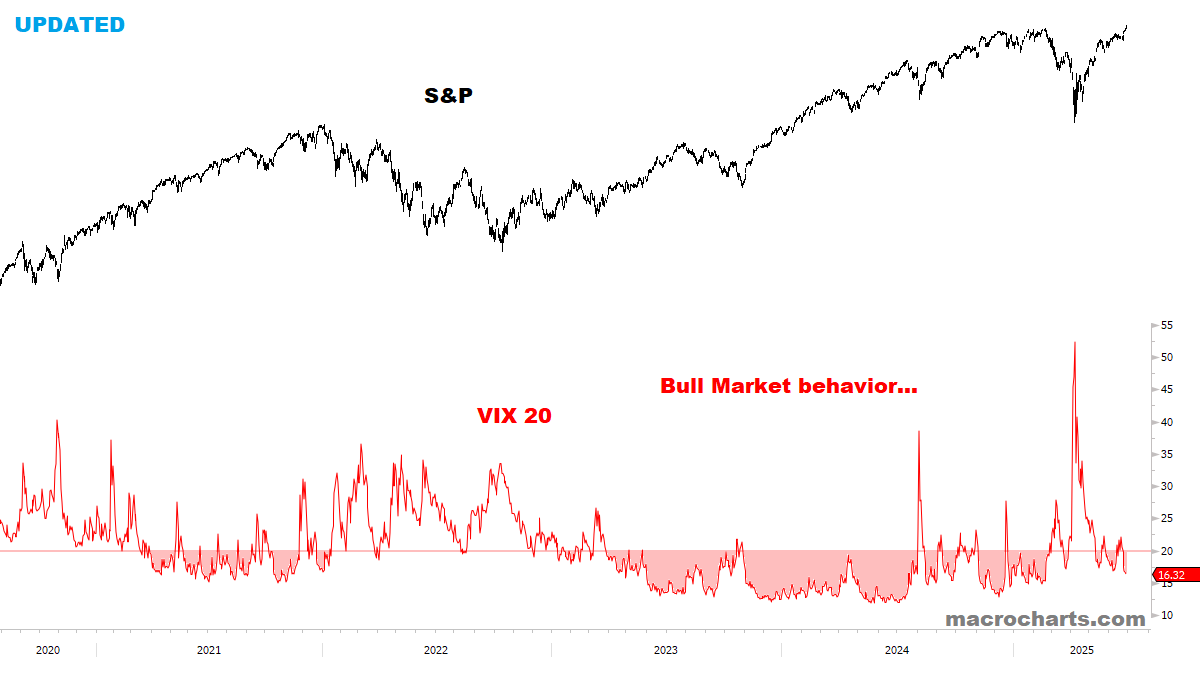

上涨趋势保持完好,所有主要指数均未出现看跌反转。VIX and Credit Spreads continue trending DOWN.

VIX 和信用利差持续下行。Max pain scenario remains: low-volatility summer grind to new highs.

最大痛点情景依旧:低波动性的夏季缓慢攀升至新高。

Updated Stocks Scan: 更新股票扫描:

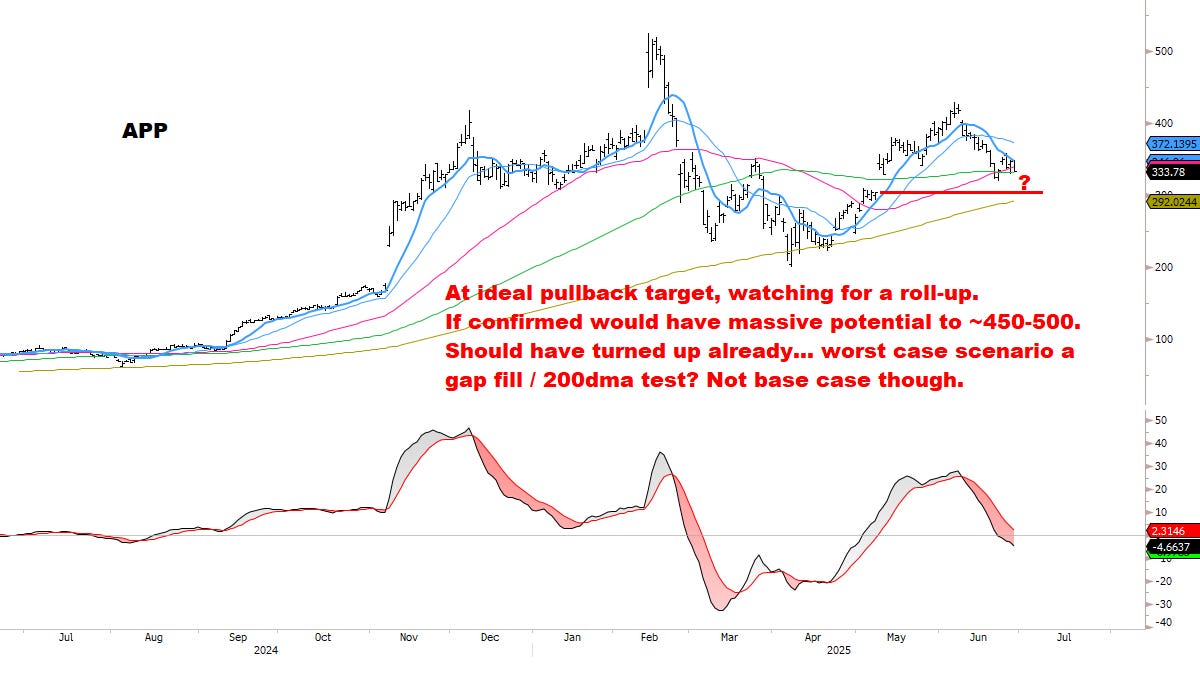

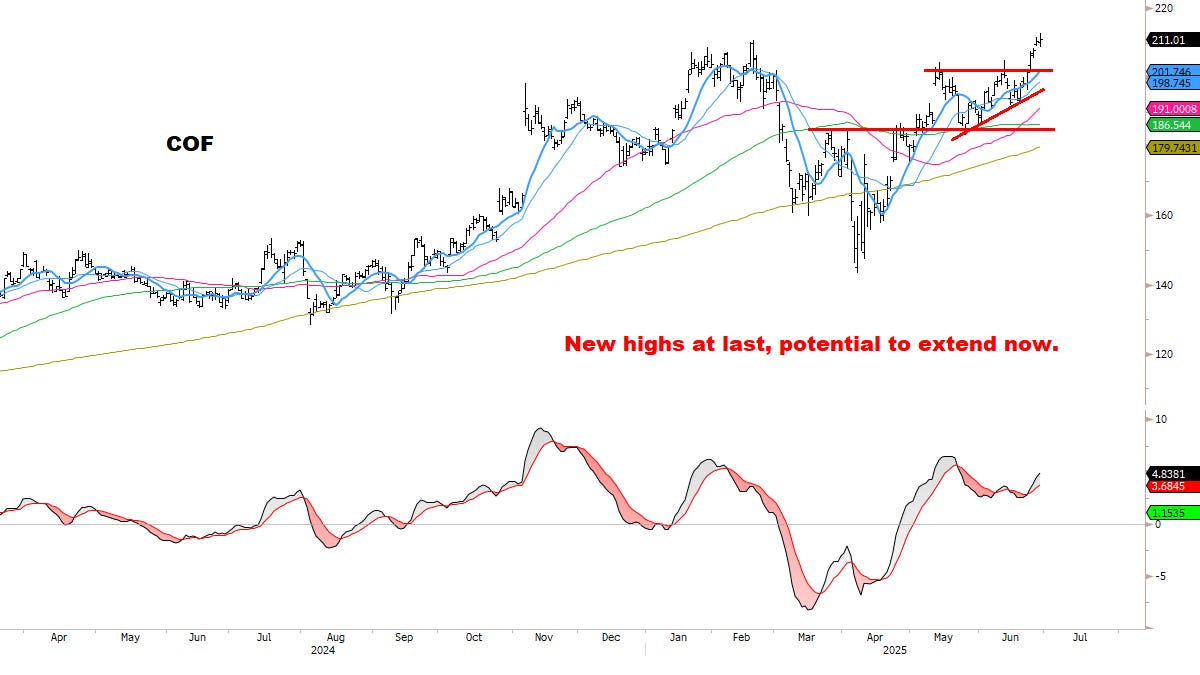

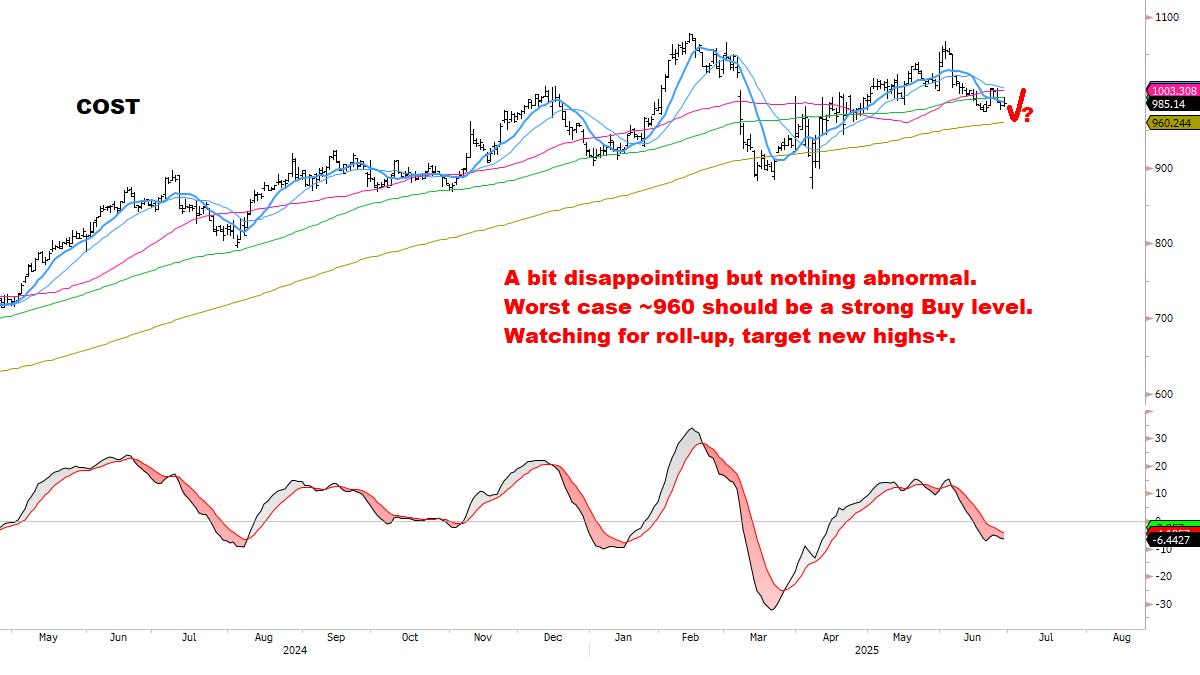

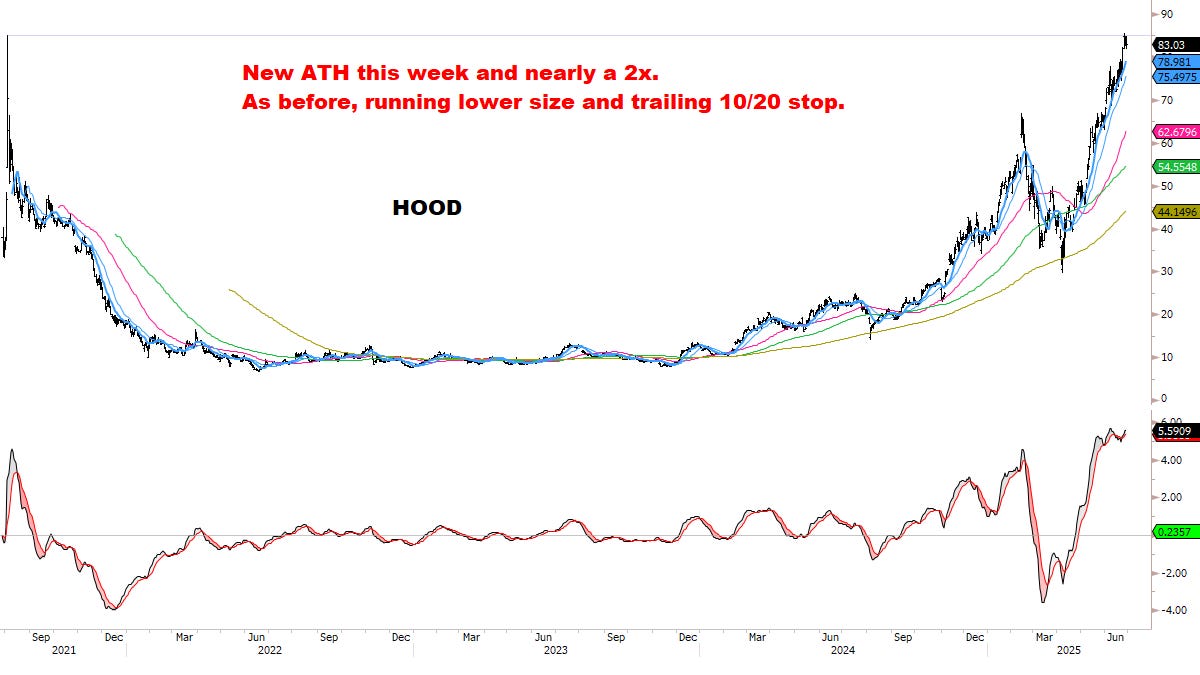

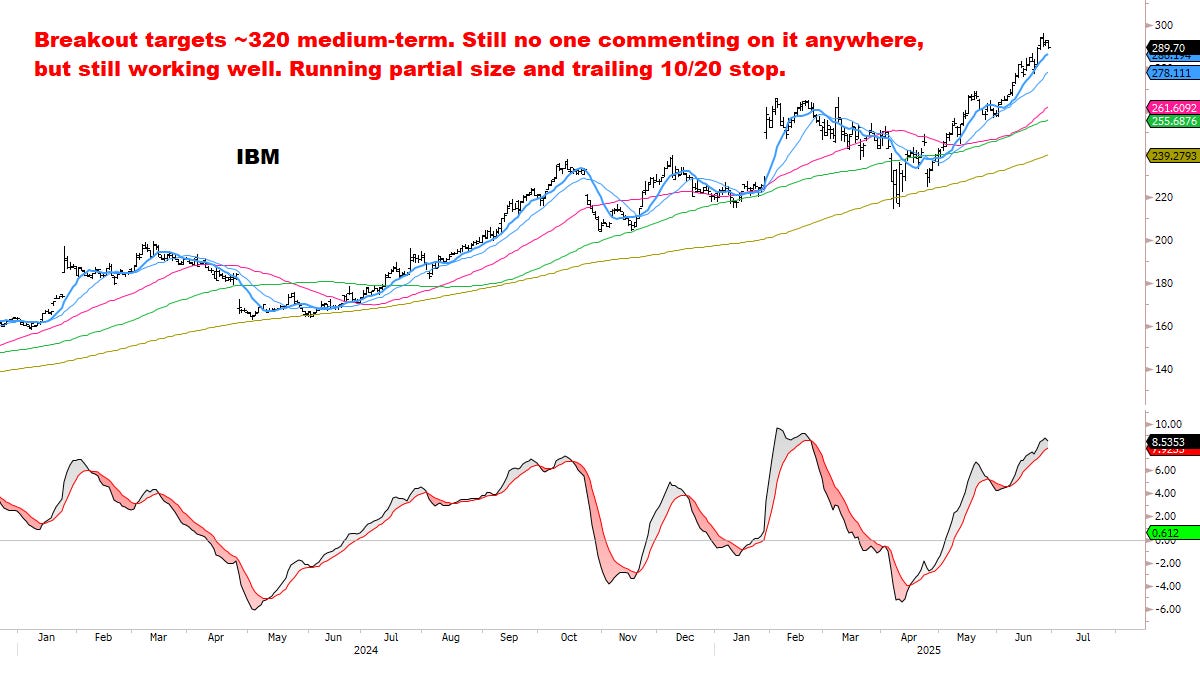

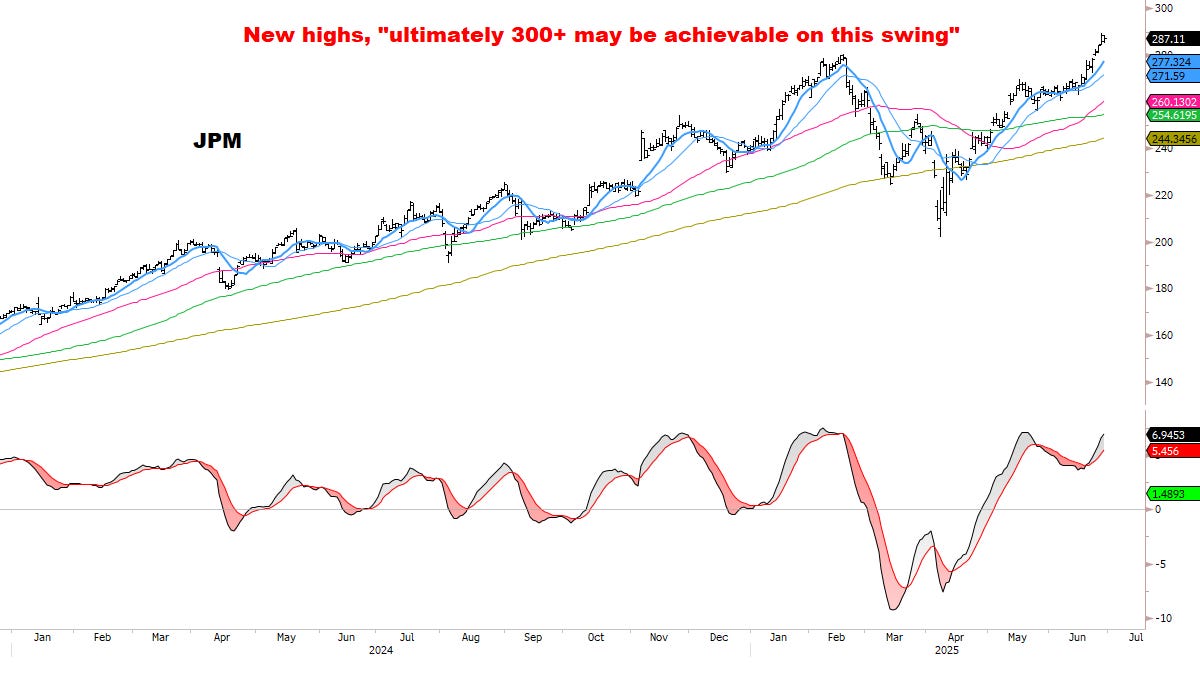

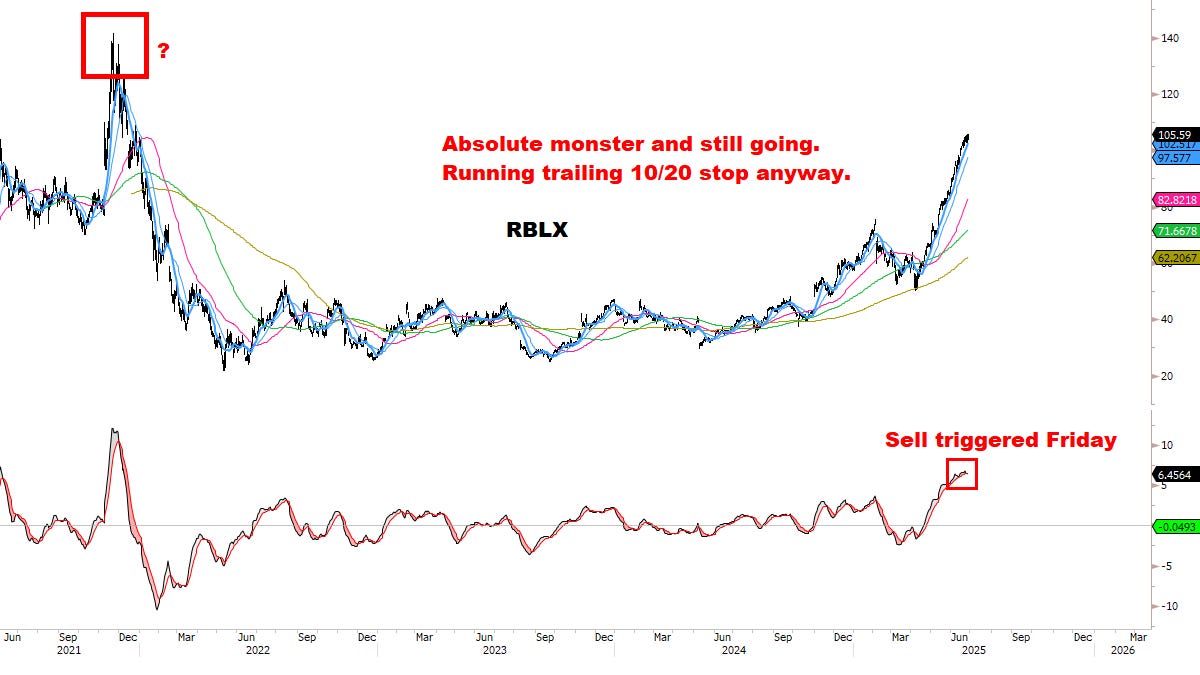

Through the end of June 2025, the average stock in our Core Watchlist is up +45%, with several names at/close to 2x — a strong outperformance relative to the market.

截至 2025 年 6 月底,我们核心观察名单中的平均股票上涨了 45%,其中有几只股票达到或接近 2 倍——相较于市场表现出强劲的超额收益。

As before, focused on: Stocks meeting strict criteria for (1) relative strength, (2) improving momentum, (3) defined risk. And building on this list as signals develop.

和以前一样,重点关注符合以下严格标准的股票:(1)相对强度,(2)动能改善,(3)风险明确。并随着信号的发展不断完善此列表。