This Week Could Reshape The Fed Narrative

本周可能重塑美联储叙事

By Peter Tchir of Academy Securities

作者:Academy Securities 的 Peter Tchir

Fed Week? Animal Spirits?

美联储周?动物精神?

While many are assuming the July 30th FOMC meeting is a “no-go” and the first rate cut isn’t likely until the September 17th meeting, that could be wrong. We will also touch on “Animal Spirts” in this report, as that will be the next driver for the economy, even more than the markets.

虽然许多人认为 7 月 30 日的 FOMC 会议不会有动作,首次降息可能要等到 9 月 17 日的会议,但这种看法可能是错误的。我们还将在本报告中讨论“动物精神”,因为这将成为推动经济的下一个动力,甚至比市场更重要。

But first, let’s revisit Academy’s Geopolitical content this week.

但首先,让我们回顾一下本周 Academy 的地缘政治内容。

- We start with Saturday night’s rapid assessment of the U.S. Strikes on Iran.

我们从周六晚对美国对伊朗打击的快速评估开始。 - This dovetailed into our weekend T-Report – A LOT of Moving Parts.

这与我们周末的 T 报告——众多变数——相呼应。- While that incorporated an update on the Middle East, it also highlighted other “moving parts” the market is dealing with – tariffs, who the President is being advised by, the Big Beautiful Bill, Russia and Ukraine, Questioning the Fed, and the Art of the Deal.

虽然报告中包含了中东局势的最新情况,但它也强调了市场正在应对的其他“变数”——关税、总统的顾问团队、大规模美丽法案、俄罗斯与乌克兰、对美联储的质疑,以及《交易的艺术》。 - These topics remain front and center for the economy and markets.

这些话题依然是经济和市场的焦点。

- While that incorporated an update on the Middle East, it also highlighted other “moving parts” the market is dealing with – tariffs, who the President is being advised by, the Big Beautiful Bill, Russia and Ukraine, Questioning the Fed, and the Art of the Deal.

- On Tuesday we published Peace Through Strength.

周二,我们发布了《以实力换和平》。- We cannot emphasize this report enough, as it consolidates our take on the attacks and the various paths forward. While a week might not seem like a long time (it does, though, lately), it has stood the test of time. Whatever competing narratives are playing out in the media, we believe this gets to the heart of the matter.

我们无法过分强调这份报告的重要性,因为它整合了我们对袭击事件的看法以及未来的各种可能路径。虽然一周时间看似不长(不过最近确实感觉很长),但它经受住了时间的考验。无论媒体上出现何种竞争叙事,我们相信这才是问题的核心所在。- Not only was serious damage done, but an incredibly powerful message was sent not just to Iran, but also to all of America’s adversaries.

不仅造成了严重的破坏,还向伊朗以及所有美国的对手传递了一个极其强有力的信息。

- Not only was serious damage done, but an incredibly powerful message was sent not just to Iran, but also to all of America’s adversaries.

- We cannot emphasize this report enough, as it consolidates our take on the attacks and the various paths forward. While a week might not seem like a long time (it does, though, lately), it has stood the test of time. Whatever competing narratives are playing out in the media, we believe this gets to the heart of the matter.

- Finally, we also published our latest Around the World, which has grown in size and scope commensurate with the expansion of our Geopolitical Intelligence Group, and the importance of geopolitical risks in today’s world.

最后,我们还发布了最新一期的《环游世界》,随着我们的地缘政治情报组的扩展以及地缘政治风险在当今世界的重要性,该刊物的规模和范围也相应扩大。

Digesting that information is enough, and we could almost stop here, but we want to reiterate our views on the Fed/rates and introduce our take on Animal Spirits.

消化这些信息已经足够,我们几乎可以在此打住,但我们想重申我们对美联储/利率的看法,并介绍我们对“动物精神”的见解。

Could This Week Re-Shape the Fed Narrative?

本周可能重塑美联储叙事?

We get a LOT of jobs data this week. In Getting The Fed to Get Ahead we argued that any “good” data had elements that went against the “good” narrative and that “bad” and even “ugly” data abounded.

本周我们将迎来大量就业数据。在《让美联储抢先一步》中,我们论证了任何“好”的数据都包含与“好”叙事相悖的元素,而“坏”甚至“糟糕”的数据比比皆是。

Nothing since we wrote that piece gives us any reason to assume the jobs data is better. Sure, the Establishment Survey Headline Number might beat again. This would defy statistical probability that so many economists with vast resources who forecast the number are wrong (only to be proven correct down the road when all the revisions hit). However, there is a real risk that the data is very disappointing (including our ongoing concerns about how seasonal adjustments are calculated).

自我们撰写该文以来,没有任何迹象表明就业数据会更好。当然,非农调查的头条数字可能再次超预期。这将违背统计概率,因为众多拥有丰富资源的经济学家预测该数字时往往错误(但在所有修正数据公布后最终被证明正确)。然而,数据极有可能令人失望(包括我们对季节性调整计算方式的持续担忧)。

Spending disappointed and even with relatively tame “whisper numbers,” the risk remains to the disappointing side on jobs data.

消费支出令人失望,即使“耳语数字”相对温和,就业数据仍存在令人失望的风险。

We also mentioned why we think the Fed’s inflation concerns related to tariffs are overstated in that report.

我们还提到了为什么我们认为美联储关于关税引发的通胀担忧被夸大了。

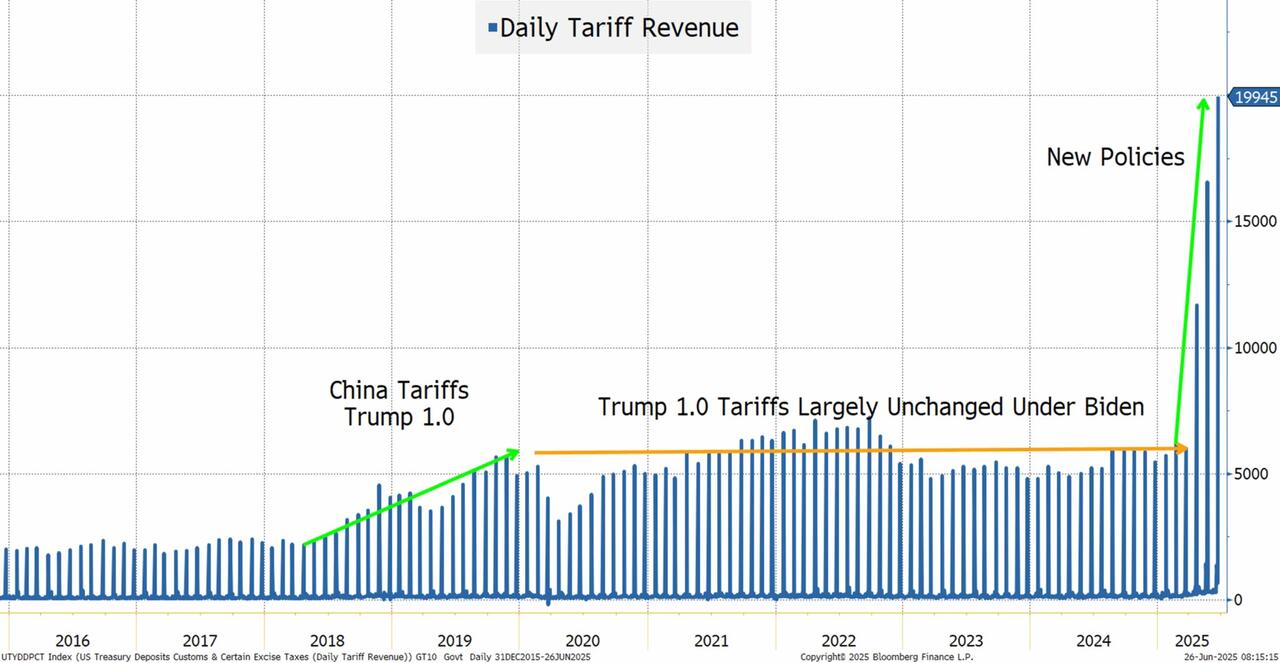

On Thursday, we added more arguments against the Fed’s overly cautious tariff inflation concerns in the Tariff Revenue Chart.

周四,我们在《关税收入图表》中补充了更多反对美联储过于谨慎的关税通胀担忧的论据。

- The tariffs collected so far are a drop in the bucket compared to the size of the economy.

迄今为止征收的关税与经济规模相比只是九牛一毛。 - Tariff mitigation strategies are being employed in many ways, which will reduce the cost of many tariffs and certainly delay the timing of anything that might be passed on to the consumer, well past the next few weeks (or even months).

多种关税缓解策略正在实施,这将降低许多关税的成本,并且肯定会推迟任何可能转嫁给消费者的费用时间,远远超过接下来的几周(甚至几个月)。

We fully expect the market to agree with our take by the end of this week’s data and news cycle.

我们完全预计市场将在本周的数据和新闻周期结束时同意我们的观点。

Own Duration 持有久期

We continue to like owning duration. Clearly everything we describe above (and our outlook of 3 to 4 cuts this year, potentially starting in July) supports that trade. In the aforementioned tariff chart, we highlight the revenue being generated by tariffs and why this is good for lowering bond yields.

我们依然看好持有久期。显然,上述所有描述(以及我们对今年 3 到 4 次降息的预期,可能从 7 月开始)都支持这一交易。在前面提到的关税图表中,我们强调了关税所产生的收入,以及为什么这有助于降低债券收益率。

There was recently some discussion about “dramatically scaling back the issuance of notes and bonds issued by the Treasury Department.”

最近有一些关于“显著缩减财政部发行的票据和债券规模”的讨论。

While we paraphrase a bit here (maybe a lot) there are some signs the administration may decide the Fed is wrong, yields are too high, and that they will issue only short-dated obligations!

虽然我们这里稍作(甚至大量)意译,但有一些迹象表明政府可能会认为美联储判断错误,收益率过高,并且他们将只发行短期债务!

- Go For It. 那就干吧。

- The T-Report has been advising companies to hold/manage their current debt issuance because we think rates can go lower.

T-Report 一直建议公司持有/管理当前的债务发行,因为我们认为利率可能会下降。 - The T-Report is advising asset managers to get long duration because we think rates should go lower.

T-Report 建议资产管理者加长久期,因为我们认为利率应该会下降。 - If the government asked for our opinion, we would support this decision.

如果政府征求我们的意见,我们会支持这一决定。 - We NEVER understood why the only borrower who didn’t take advantage of ZIRP was the U.S. government. Corporations locked in low yields for as long as possible. Individuals locked in low yields for as long as possible (it is why Fed cuts and hikes don’t translate to the consumer the way they once did, because most of America has mortgages under 3%).

我们从未理解为什么唯一没有利用零利率政策(ZIRP)的借款人是美国政府。企业尽可能锁定低收益率。个人也尽可能锁定低收益率(这就是为什么美联储的降息和加息不再像以前那样传导到消费者,因为大多数美国人的抵押贷款利率低于 3%)。

- The T-Report has been advising companies to hold/manage their current debt issuance because we think rates can go lower.

If this idea gains traction, look for curves to flatten and duration to outperform (and this is only in addition to all the other reasons why we have liked it).

如果这个想法获得认可,预计收益率曲线将趋于平坦,久期债券表现将优于短期债券(这只是我们喜欢它的众多理由之一)。

Sure, at 4.27%, 10s are not the “screaming buy” they were a few weeks ago, but they should drift toward 4.1%, with a lot of catalysts out there that could force any remaining shorts to cover.

当然,10 年期国债收益率为 4.27%,不再像几周前那样是“极具吸引力的买入”,但它们应该会向 4.1%靠拢,市场上有许多催化因素可能迫使剩余的空头回补。

Animal Spirits 动物精神

With U.S. stocks at all-time highs, we have seen animal spirits impact investors. It is unclear how much they have hit corporate America, or even the American consumer.

随着美国股市创下历史新高,我们已经看到动物精神影响了投资者。目前尚不清楚它们对美国企业,甚至美国消费者的影响有多大。

- Corporations seem content to invest heavily in AI. But how much is the average company investing away from that?

企业似乎乐于在人工智能领域进行大量投资。但普通公司在其他领域的投资有多少呢?- Small and midsize companies seem particularly constrained.

中小型企业似乎尤其受限。

- Small and midsize companies seem particularly constrained.

- The consumer data, while generally still strong, seems to be exhibiting some fault lines (not cracks, but fault lines).

消费者数据虽然总体仍然强劲,但似乎出现了一些断层(不是裂缝,而是断层)。 - With little pushback, we have discussed the concept that no matter what you think the current economy and policies do for your business, there is a bias to act slightly more conservatively.

几乎没有反对声音,我们已经讨论过这样一个观点:无论你认为当前的经济和政策对你的业务有何影响,行为上都有一种略微保守的偏向。 - One company’s expenses are another company’s revenue. Simplistic and trite, but real.

一家公司的支出是另一家公司的收入。虽然简单且陈词滥调,但却是真实的。

The market can continue to do well if the administration can unlock animal spirits in the economy. We seem to be on the cusp of that.

如果政府能够激发经济中的动物精神,市场可以继续表现良好。我们似乎正处于这一转折点。

- The attack on Iran gives a degree of confidence about the power of America. This can generate positive “vibes” and can undo some of the damage that has been done to the American Brand.

对伊朗的攻击增强了对美国实力的信心。这可以产生积极的“氛围”,并能扭转对美国品牌造成的一些损害。- The success of NATO getting more spending fits this narrative well.

北约成功增加开支与这一叙事非常契合。

- The success of NATO getting more spending fits this narrative well.

- The Big Beautiful Bill. We’ve argued that what actually gets passed is less important than getting something passed through “normal” legislation. Not executive order. The House and the Senate approving a bill and turning it into law is a big deal (heck, even a big, beautiful deal). There will be plenty of time to argue about the costs, the winners, the losers, etc., but getting this passed should help animal spirits.

宏伟壮观的法案。我们认为,实际通过的内容不如通过“正常”立法程序通过某项法案重要。不是行政命令。众议院和参议院批准一项法案并将其转化为法律是一件大事(甚至是一件宏伟壮观的大事)。关于成本、受益者、受损者等问题还有很多时间讨论,但通过这项法案应有助于激发市场活力。 - National Production for National Security. Deregulation. We will once again focus on this later in the week, but that could be the massive accelerant the economy needs.

国家安全的国家生产。放松管制。本周晚些时候我们将再次关注这一点,但这可能是经济所需的巨大催化剂。 - Tariffs are a wildcard. More pauses and even a few deals – all good. More threats, escalations, etc., and we could undo some of the good.

关税是一个变数。更多的暂停甚至一些协议——都是好事。更多的威胁、升级等,我们可能会抹杀一些好处。

Markets will need the “Animal Spirts” they have already exhibited to be picked up by the economy. There are plenty of reasons to believe that could occur, with tariff policy probably being the biggest threat (it shouldn’t be, but as we saw on Friday afternoon, it could be).

市场需要经济能够接力已经展现出的“动物精神”。有很多理由相信这可能会发生,而关税政策可能是最大的威胁(本不该如此,但正如我们周五下午所见,确实可能如此)。

Bottom Line 结论

The data on jobs, and the narrative on inflation this week, should heavily influence the Fed at the end of the month.

本周的就业数据和通胀叙事,应在月底对美联储产生重大影响。

Re-awakening animal spirits across the economy is probably necessary to justify current market levels, but this will depend on which direction the administration heads in on several fronts. Currently, they seem to be leaning towards steps that go towards changing caution to excitement.

重新唤醒整个经济中的动物精神可能是证明当前市场水平合理的必要条件,但这将取决于政府在多个方面采取的方向。目前,他们似乎倾向于采取将谨慎转变为兴奋的措施。

Have a great weekend and thank you for allowing Academy the opportunity to help you navigate these incredibly tricky times.

祝您周末愉快,感谢您给予 Academy 机会,帮助您应对这些极其棘手的时期。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

How Canada's Digital Tax Exposes Brussels' Globalist Playbook: A Trump Retaliation

加拿大数字税如何揭露布鲁塞尔的全球主义剧本:特朗普的报复

1 In 3 Americans Are Cutting Insurance Costs Just To Afford Food

三分之一的美国人正在削减保险费用以支付食物开销

Hartnett: These Are The Best Trades For The Second Half Of 2025

Hartnett:2025 年下半年最佳交易策略

NEVER MISS THE NEWS THAT MATTERS MOST

永远不错过最重要的新闻

ZEROHEDGE DIRECTLY TO YOUR INBOX

ZEROHEDGE 直达您的收件箱

Receive a daily recap featuring a curated list of must-read stories.

每日接收一份精选必读故事的摘要。