Odds Of A Powell Early Exit Decline After Double Dissent

鲍威尔提前离职的可能性在两次异议后下降

Authored by Simon White, Bloomberg macro strategist,

作者:彭博宏观策略师 Simon White

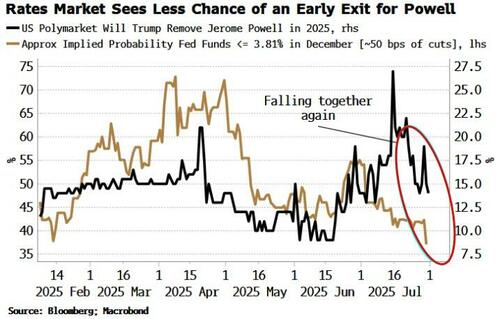

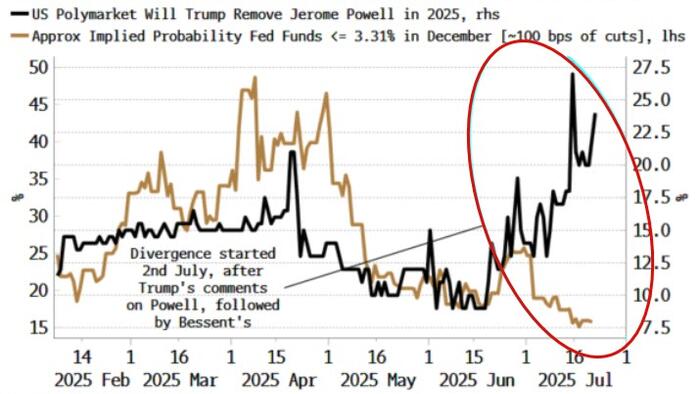

The implied probability in both the rates market and Polymarket that Federal Reserve Chair Jerome Powell leaves his post this year has fallen further after yesterday’s meeting.

在昨天的会议之后,利率市场和 Polymarket 中联邦储备主席杰罗姆·鲍威尔今年离职的隐含概率进一步下降。

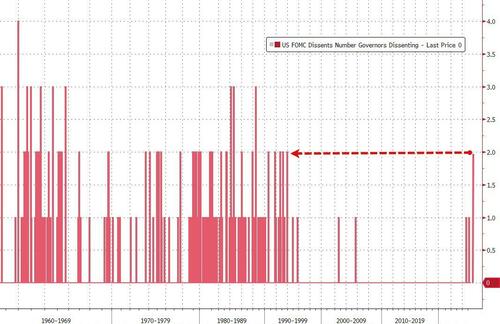

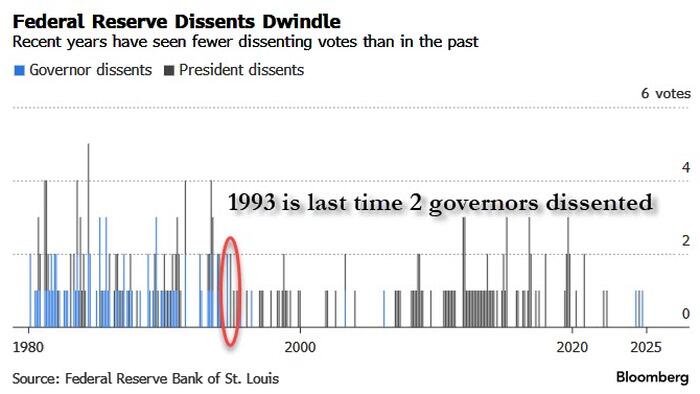

You have to go back to 1993 for the last time two Fed governors dissented at the same meeting.

你得追溯到 1993 年,才有上一次两位美联储理事在同一次会议上持异议。

Yesterday’s dual dissent from Christopher Waller and Michelle Bowman, who both voted for a rate cut, shows which way the wind is blowing.

昨天,Christopher Waller 和 Michelle Bowman 双双投票支持降息的双重异议,显示了风向的变化。

But Powell chose to stand firm, keeping rates on hold while it becomes clearer what the inflationary impact of tariffs will be.

但鲍威尔选择坚持立场,维持利率不变,同时等待关税对通胀影响变得更加明朗。

That appears to have bolstered his position as far as the market is concerned.

这似乎增强了他在市场眼中的地位。

Through July the Polymarket odds for an early departure for Powell in 2025 rose even as the market downplayed the risks.

截至七月,尽管市场淡化了风险,Polymarket 上鲍威尔 2025 年提前离任的概率仍有所上升。

But if we take the implied probability that fed funds is 50 basis points lower by December as the likelihood that Powell is ousted and replaced by an extremely enthusiastic dove, then both the rates market and the Polymarket appear in agreement that the chances of this are slimming.

但如果我们将联邦基金利率到 12 月下调 50 个基点的隐含概率视为鲍威尔被罢免并由一位极为积极的鸽派取代的可能性,那么利率市场和 Polymarket 似乎都一致认为这种可能性正在减少。

There was speculation that Bowman and Waller were emboldened in their vote for a rate cut as they have already seen today’s PCE data for June.

有猜测称,鲍曼和沃勒在投票支持降息时变得更加大胆,因为他们已经看到了今天发布的 6 月份 PCE 数据。

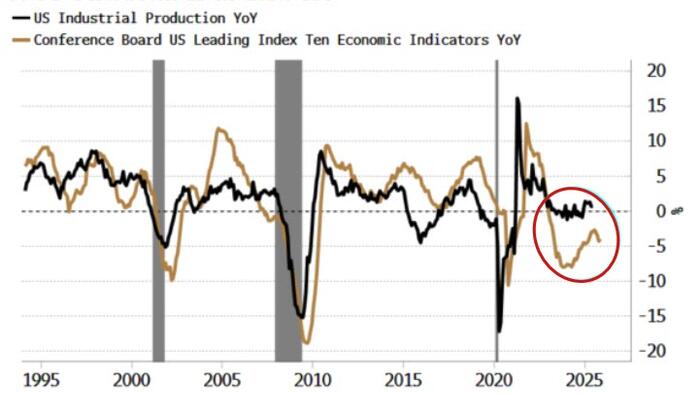

That would give a softer bias to the release. Nevertheless, there are multiple signs inflationary pressures are building again. Powell’s caution is justified, but the bulwark he is providing against higher yields will weaken as the dovish voices in the Fed get progressively more strident.

这将使数据发布偏向温和。然而,有多重迹象表明通胀压力正在重新积聚。鲍威尔的谨慎是合理的,但随着美联储内部鸽派声音日益强烈,他对抗更高收益率的防线将会减弱。

Want to know more? 想了解更多?

Fed Decision Preview: No Rate Cut But First Dual-Governor Dissent Since 1993

美联储决策前瞻:无降息,但自 1993 年以来首次出现双行长异议

Rates Market Downplays Powell Speculation That Won't Die Down

利率市场淡化对鲍威尔传言的关注,这些传言却迟迟不肯消退