Illustration: Tylor Macmillan

插图:泰勒·麦克米伦

The Waning Ambitions of China’s $1.3 Trillion Fund Giant

中国 1.3 万亿美元主权财富基金缩减全球布局

China’s $1.3 trillion sovereign wealth fund spent years as one of the most sought-after investors in the world. It owned massive stakes in Blackstone Inc. and Morgan Stanley, struck deals with Goldman Sachs Group Inc. and plowed tens of billions of dollars into funds across Wall Street.

中国 1.3 万亿美元规模的主权财富基金曾长期是全球最受追捧的投资者之一。它持有黑石集团和摩根士丹利的巨额股份,与高盛集团达成交易,并向华尔街各类基金投入了数百亿美元资金。

Today, China Investment Corp. is in retreat from the world’s largest economy, caught in the crosshairs as tensions with the US throw up investment roadblocks and Beijing seeks to lower risk by reining in the massive fund. CIC is reducing its exposure to US private assets, and had explored a sale of some fund stakes held with US private equity managers before pulling it, Bloomberg News reported this week.

如今,随着中美紧张关系竖起投资壁垒,以及北京方面试图通过控制这家巨型基金来降低风险,中国投资有限责任公司正从全球最大经济体撤出。据彭博新闻社本周报道,中投公司正在减少对美国私募资产的敞口,并曾考虑出售其与美国私募股权管理人共同持有的部分基金股份,但最终放弃了这一计划。

CIC’s diminished profile underscores the risk of the financial decoupling by the world’s two largest economies. While CIC continues to invest, its gradual pivot from the US curbs China’s influence on Wall Street, where for years the fund teamed up with so many financial titans. It also reduces a major source of capital for private equity firms, prompting them to turn more often to the Middle East and other deep-pocketed investors.

中投公司影响力的减弱凸显了全球两大经济体金融脱钩的风险。尽管中投仍在进行投资,但其逐步从美国撤资削弱了中国对华尔街的影响力——多年来该基金曾与众多金融巨头密切合作。这也减少了私募股权公司的一个重要资金来源,促使它们更频繁地转向中东和其他资金雄厚的投资者。

“The China label has cost CIC dearly,” said Li Jie, head of the foreign reserves research center at Beijing’s Central University of Finance and Economics. “The going will be tough for CIC in the next five to 10 years.”

"中国标签让中投付出了沉重代价,"北京中央财经大学外汇储备研究中心主任李杰表示,"未来五到十年中投的日子会很难熬。"

CIC’s battle to preserve its standing on Wall Street can be seen in the buyout stake sale it scrapped recently. The wealth fund hired investment bankers to sell $1 billion of positions, looking to reduce its exposure to mega-buyout firms like KKR & Co., TPG Inc. and Carlyle Group Inc. as part of a broader portfolio adjustment, people familiar with the matter said. The sale talks this year advanced just as President Donald Trump levied escalating tariffs on China, raising concerns CIC was reacting to the trade tensions.

中投为维持华尔街地位所做的挣扎,从其最近叫停的收购股权出售计划可见一斑。知情人士透露,这家主权财富基金聘请投行出售价值 10 亿美元的持股,作为整体投资组合调整的一部分,旨在减少对 KKR 集团、TPG 公司和凯雷集团等大型收购公司的风险敞口。今年出售谈判推进之际,正值特朗普总统对中国加征关税,引发外界担心中投是在对贸易紧张局势作出反应。

Top executives from private equity firms called CIC to check on the commitment of a long-time partner, some of the people said. Worried that the sale would draw attention to the fund’s retreat on the international stage, CIC canceled it, the people said. It may come back with a smaller stakes sale later, they said.

知情人士称,多家私募股权公司高管致电中投,确认这位长期合作伙伴的承诺。由于担心此次出售会引发外界关注该基金在国际舞台的退却,中投最终取消了交易。他们表示,后续可能会重启规模较小的股权出售。

“Our investment strategy is market oriented, with adjustments based on prudent risk management and commercial decisions,’’ the fund said in a statement to Bloomberg News, adding it doesn’t comment on “speculative’’ reports. “We remain committed to making investments worldwide that align with our long-term principles.”

该基金在向彭博新闻社发表的声明中表示:"我们的投资策略以市场为导向,根据审慎的风险管理和商业决策进行调整。"声明还补充称,不会对"猜测性"报道置评。"我们仍致力于在全球范围内进行符合长期原则的投资。"

CIC’s pullback has been years in the making, yet it’s poised to accelerate under Trump. The US is planning fresh barriers for Chinese funds like CIC, excluding them from a list of firms to be fast-tracked for foreign investment approval and restricting investment in some sectors. At the same time, Beijing is becoming cautious, wary of state investors like CIC taking on more exposure in the US as trade wars rage. The fund has also been hindered over the years by a shrinking foreign exchange stockpile and limited fresh capital that have diminished its role within China, contributing to staff turnover.

中投公司的战略收缩酝酿已久,但在特朗普任内或将加速。美国正计划对中投等中国基金设置新障碍,将其排除在快速审批外资准入的企业名单之外,并限制其投资某些行业。与此同时,北京方面也日趋谨慎,担心随着贸易战升级,中投等国有投资者在美国承担更多风险敞口。多年来,外汇储备缩水和新资本金补充受限也制约了中投发展,削弱了其在国内市场的影响力,导致人才流失加剧。

The restrained CIC is a far cry from when it burst on the scene in 2007, throwing a lifeline to Morgan Stanley as the Wall Street firm was reeling from a massive trading loss.

如今行事克制的中投与 2007 年横空出世时判若两人——当年这家中国主权基金向深陷巨额交易亏损的摩根士丹利抛出救命稻草。

2013 年 9 月,中投公司前总裁高西庆出席东京会议时的场景。摄影师:Tomohiro Ohsumi/彭博社

Leading bailout negotiations for CIC at the time was President Gao Xiqing, who was suffering after marathon meetings and a helicopter ride ushering him to Manhattan. At one point, the pain in his torso was so acute that he carried on talks while lying on the floor, surrounded by US executives desperate to secure Chinese capital. The fund eventually made a $6.8 billion investment in Morgan Stanley.

当时代表中投公司主导救助谈判的是总裁高西庆,他在经历了马拉松式的会议和乘坐直升机赶往曼哈顿后身体不适。有段时间他躯干疼痛剧烈,只能躺在地板上继续谈判,周围是迫切希望获得中国资金的美国高管们。最终该基金向摩根士丹利投资了 68 亿美元。

The crisis “gave me this feeling for the first time that we’ve now become the people being pursued,” Gao would later write.

高后来写道,这场危机"第一次让我产生这种感觉:我们现在成了被追逐的对象"。

It was a watershed moment for CIC, solidifying China’s ascent onto the global stage. China set up CIC in 2007 when its economy was booming with double-digit growth rates. Foreign exchange reserves had swelled sevenfold over a few years, adding pressure on the yuan. The fund’s mandate was to invest hundreds of billions abroad, both in public markets and in private deals. Starting with a $200 billion injection from the finance ministry, CIC’s assets have since ballooned to more than $1 trillion, second only to Norway’s sovereign fund.

这成为中投公司发展的分水岭,标志着中国正式登上全球舞台。中国在 2007 年经济以两位数增速蓬勃发展时成立了中投公司。当时外汇储备在几年内激增七倍,给人民币带来升值压力。该基金的使命是在海外进行数千亿美元投资,涵盖公开市场和私募交易。从财政部注资 2000 亿美元起步,中投资产规模现已突破 1 万亿美元,仅次于挪威主权财富基金。

Household Names 家喻户晓的名字

The early investments included a slew of household names in global finance and industry, reflecting CIC’s clout as a source of capital. CIC was one of the largest shareholders of Blackstone when the private equity giant went public during the global financial crisis, marking the fund’s first major investment outside China. CIC would later become a regular investor in Blackstone funds, injecting billions over the years. To cement the relationship, Blackstone co-founder Stephen Schwarzman paid frequent visits to meet China’s top officials. In addition to its $3 billion investment in Blackstone, the fund poured billions into companies ranging from Canadian miner Teck Resources Ltd., to Eutelsat Communications SA and power firm AES Corp.

早期投资涵盖全球金融与工业领域众多知名企业,彰显中投作为资本来源的影响力。当中投首次进行海外重大投资时,其曾在美国私募巨头黑石集团上市之际成为其最大股东之一。此后中投持续参与黑石基金投资,多年间注资达数十亿美元。为巩固关系,黑石联合创始人苏世民频繁访华会见中国高层官员。除对黑石 30 亿美元投资外,该基金还向加拿大矿业公司泰克资源、欧洲通信卫星公司及电力企业 AES 集团等企业投入巨资。

In a move that’s hardly imaginable now, CIC set up a fund with Goldman Sachs during a Trump visit to China in 2017. The venture originally pledged to invest as much $5 billion across US industries, though that was trimmed to $2.5 billion. After a few deals, including the purchase of rubber seal maker Boyd Corp. in 2018, the venture’s investment period has ended and it’s no longer pursuing deals.

如今看来几乎难以想象的是,中投公司曾在 2017 年特朗普访华期间与高盛共同设立基金。该合资企业最初承诺在美国各行业投资高达 50 亿美元,后缩减至 25 亿美元。在完成包括 2018 年收购橡胶密封件制造商博伊德公司等几笔交易后,该基金投资期已结束,不再寻求新交易。

Goldman’s overall policy toward China is to keep its head down amid tense US relations, a person familiar with the matter said. A representative for Goldman declined to comment.

知情人士透露,高盛对中国的整体政策是在中美关系紧张之际保持低调。高盛代表拒绝置评。

CIC’s US investments began to slow as relations worsened and a few bad bets rankled bosses in Beijing. After President Barack Obama’s administration challenged China’s export subsidies, Trump stepped up with broad trade tariffs and technology export curbs. The Biden administration then tightened restrictions on both Chinese investments in the US and American investments in China.

随着中美关系恶化以及几项失败投资激怒了北京高层,中投公司对美投资开始放缓。在奥巴马政府挑战中国出口补贴政策后,特朗普政府实施了全面贸易关税和技术出口限制。随后拜登政府又收紧了对华双向投资的管制。

North America Sees Little New Investment From China

北美地区鲜见中国新增投资

Fourth quarter's total was the lowest in at least five years

第四季度总额创至少五年新低

Source: Rhodium Group 来源:荣鼎集团

The fund has since unloaded many US assets, including its large shareholdings in Blackstone and Morgan Stanley. Direct and private deals have slowed, according to people familiar with the matter. Fully aware of the intense scrutiny in Washington, CIC has avoided investments that would require approval by the Committee on Foreign Investment in the US, or CFIUS, according to the people. Overall, alternative assets, which include private investments and hedge fund allocations, dropped to 48% in 2023 from 53% the previous year, below its 50% target, according to the most recent annual report.

该基金此后陆续减持了包括黑石集团和摩根士丹利大额股权在内的多项美国资产。知情人士透露,直接交易和私募交易均已放缓。由于深知华盛顿方面的严格审查,中投公司已避开需要获得美国外国投资委员会(CFIUS)批准的交易项目。最新年报显示,包含私募投资和对冲基金配置在内的另类资产占比从 2022 年的 53%降至 2023 年的 48%,未达到 50%的配置目标。

Read More: China Wealth Fund Sells Blackstone Stake Held Since 2007

延伸阅读:中国主权财富基金清仓持有 16 年的黑石集团股权

The private equity head of a Canadian pension fund said they seldom see CIC on co-investing deals anymore. In their view, the China fund has been edged out, especially since other big investors, including in the Middle East, have entered the market and can write large checks. Fund companies are trying to underplay their partnerships with China and CIC, the person said.

加拿大一家养老基金的私募股权负责人表示,如今在联合投资交易中已很少见到中投的身影。在他看来,这家中国主权基金正被挤出市场,尤其当中东等其他地区的大型投资者携重金入场后。该人士称,基金公司正试图淡化与中国及中投的合作关系。

“CIC’s direct investment in the US has dramatically decreased,” said Zoe Liu, a senior fellow for China studies at the Council on Foreign Relations in New York.

"中投公司对美国的直接投资已大幅减少,"纽约外交关系委员会中国研究高级研究员刘宗媛表示。

CIC said it made “calculated investments,” focusing on high-potential sectors including renewable energy and private credit, and was exploring opportunities in emerging markets, according to the latest annual report. More than 60% of CIC’s public equity investments were in the US as of 2023, the most recent year of disclosed figures. The fund returned an annualized 6.6% in the 10 years through 2023, beating its performance target by 31 basis points.

根据最新年报,中投表示进行了"审慎投资",重点关注可再生能源和私募信贷等高潜力领域,并正在新兴市场探索机会。截至 2023 年(最近披露数据的年份),中投超过 60%的公开股票投资在美国市场。该基金过去十年(截至 2023 年)的年化回报率为 6.6%,超出业绩目标 31 个基点。

Though CIC has gone more quiet in the US, that hasn’t stopped the fund from investing — and from global firms courting it. One financial executive who was visiting the fund last year in Beijing saw KKR’s Co-CEO Joe Bae in the lobby. CIC has also turned to the Middle East to scout for deals recently, while increasing ties with Indonesia’s sovereign fund.

尽管中投在美国市场趋于低调,但并未停止投资步伐,国际金融机构仍对其趋之若鹜。去年一位造访中投北京总部的金融高管曾在大堂见到 KKR 联席首席执行官乔·贝。中投近期也将目光转向中东寻找交易机会,同时加强与印尼主权财富基金的合作关系。

Meantime, roadblocks continue to mount for CIC in the US. In his America First Investment Policy released in February, Trump singled out China as a foreign adversary that has used its investments to gain cutting-edge technologies and leverage in strategic industries, in ways “both visible and concealed.” He pledged to use “all necessary legal instruments,” including the CFIUS, to restrict China from investing in a range of sectors, from technology to health care and energy.

与此同时,中投在美国面临的障碍持续增加。特朗普在 2 月发布的《美国优先投资政策》中,将中国单独列为"通过显性和隐性手段,利用投资获取尖端技术及战略产业主导权"的外国对手。他承诺动用包括美国外国投资委员会(CFIUS)在内的"一切必要法律工具",限制中国对科技、医疗保健及能源等领域的投资。

In another move aimed at keeping Chinese investors like CIC out, the US Treasury is working on a list of preferred investors that would be fast-tracked through CFIUS approval, the Treasury Department said last month. Chinese investment firms like CIC are likely to be excluded from that list, people familiar said.

美国财政部上月表示,为继续将中投公司等中国投资者排除在外,财政部正拟订一份优先投资者名单,这些投资者将快速通过美国外国投资委员会(CFIUS)的审批。知情人士称,中投等中国投资机构很可能被排除在该名单之外。

Read More: China Sovereign Fund Cuts US Private Assets Amid Trade War Risk

阅读更多:中国主权基金在中美贸易战风险下削减美国私募资产

A further headwind is the Trump administration’s efforts to ramp up its ability to make meaningful investments in strategic assets across the globe for geopolitical reasons. It has the Development Finance Corp., whose specific mandate is to be a counter to China’s Belt & Road Initiative, and is developing a policy to attract foreign investors as long as they sever ties with China.

另一个不利因素是特朗普政府正努力增强其出于地缘政治原因在全球战略资产上进行实质性投资的能力。美国政府成立了国际开发金融公司(DFC),其明确使命就是抗衡中国的"一带一路"倡议,并正在制定一项政策以吸引外国投资者——前提是他们必须与中国切断联系。

The US is even making plans for its own sovereign wealth fund to promote its economic and strategic leadership internationally, though that plan is on pause for now, Treasury Secretary Scott Bessent said last month. If created, the new fund would compete directly with CIC, especially in emerging industries, Li at Beijing’s Central University said.

美国甚至正在筹划建立自己的主权财富基金以提升其国际经济和战略领导力,尽管该计划目前处于暂停状态,财政部长斯科特·贝森特上个月表示。北京中央大学的李教授指出,若该基金成立,将与中投公司形成直接竞争,尤其是在新兴产业领域。

Private equity funds now have to do a lot more due diligence to make sure any investment with CIC doesn’t run afoul of US rules, said Victor Shih, a professor at the University of California, San Diego, who’s written three books on Chinese economics and politics.

加州大学圣地亚哥分校教授、曾撰写三本关于中国经济政治著作的史宗瀚表示,私募基金现在必须进行更严格的尽职调查,以确保与中投公司的任何投资都不违反美国法规。

“From a strictly compliance perspective, the US regulations probably have put a damper on some deals, especially technology related,” he said.

"从严格合规的角度来看,美国监管规定可能已经抑制了部分交易,尤其是涉及技术的交易,"他说道。

When it is able to make US investments, CIC faces the prospect of being shuffled into so-called side-car vehicles so it doesn’t co-mingle with other clients. A lawyer who represents sovereign wealth funds said that private equity groups have added language to investment documents in recent years as a way to isolate certain investors, including CIC. These carve outs are now becoming more common, and can help avoid triggering a CFIUS review.

当中投公司能够进行美国投资时,其面临被归入所谓"侧车"投资工具的安排,以避免与其他客户资金混同。一位代表主权财富基金的律师透露,近年来私募机构在投资文件中新增了隔离特定投资者(包括中投)的条款。这类特殊安排正变得越来越普遍,有助于避免触发美国外国投资委员会(CFIUS)的审查。

Read More: How Mideast Wealth Funds Draw Greater US Scrutiny Over China Ties

阅读更多:中东主权财富基金因与中国关系密切而面临美国更严格审查

CIC has its own challenges at home, too, as Beijing places limits on global investments. The National Development and Reform Commission in recent years has required CIC and other Chinese firms to pre-register outbound investments as it tightens scrutiny of deals. The government has discouraged some US investments by slowing or holding off its registration feedback, concerned about the safety of capital, the people said. CIC has become more cautious, fearing a worst-case scenario in which the US government freezes Chinese assets as it did to Russia, they said. The NDRC didn’t reply to a request seeking comment.

中投公司在国内也面临挑战,因为北京方面对全球投资施加了限制。近年来,国家发改委要求中投公司和其他中国企业在对外投资前进行预登记,以加强对交易的审查。知情人士称,出于对资本安全的担忧,政府通过延迟或暂缓登记反馈来阻止一些对美国投资。他们表示,中投公司变得更加谨慎,担心出现最坏情况,即美国政府像对待俄罗斯那样冻结中国资产。国家发改委没有回复置评请求。

The shift leaves CIC with fewer investment options, said Liu.

刘先生表示,这种转变使中投公司的投资选择减少。

“The biggest challenge for CIC to shift away from the US market is to find alternative markets or assets that can deliver equal financial return, political access, and other non-financial benefits,” she said. “There is no alternative at this moment.”

"中投公司撤离美国市场面临的最大挑战,在于寻找能提供同等财务回报、政治资源及其他非财务利益的替代市场或资产,"她表示,"目前尚无替代选择。"

CIC has lost some of its risk-taking swagger, said Shih, also director of the 21st Century China Center at the university in San Diego. Under former leaders Gao and Lou Jiwei, CIC had recruited experienced global finance experts and had billions to invest.

圣地亚哥分校 21 世纪中国中心主任史宗瀚表示,中投公司已失去部分冒险精神。在前任领导高西庆和楼继伟的带领下,中投曾招募经验丰富的全球金融专家,手握数百亿美元投资资金。

CIC was humbled on some of its early investments that didn’t perform well in the wake of the financial crisis. Some oil and gas bets suffered when commodity prices fell. A review by the National Audit Office in 2014 said mismanagement and a “dereliction of duty” led to overseas losses at CIC.

中投公司在金融危机后的一些早期投资表现不佳,使其遭受挫折。部分油气投资因大宗商品价格下跌而亏损。2014 年国家审计署的审查指出,管理不善和"失职"导致了中投公司的海外亏损。

Lost Money 亏损

Some bets took longer than expected to pan out. Blackstone delivered total losses of about 80% in the 18 months after its 2007 IPO. As Blackstone’s stock languished, former Chinese premier Zhu Rongji introduced Schwarzman to then CIC Chair Lou in 2008 as “the guy who lost your money,” Schwarzman recounted in his 2019 book, “What It Takes.” The investment delivered gains eventually and CIC divested over time as part of a broader stock portfolio adjustment.

部分投资项目的回报周期比预期更长。黑石集团在 2007 年上市后的 18 个月内累计亏损约 80%。据施瓦茨曼在 2019 年出版的《追求卓越》一书中回忆,当黑石股价持续低迷时,中国前总理朱镕基在 2008 年向时任中投董事长楼继伟介绍他时调侃道:"这就是那个让你亏钱的人"。这笔投资最终实现盈利,而中投公司随后逐步减持了这部分股份,作为整体股票投资组合调整的一部分。

2016 年 9 月,斯蒂芬·施瓦茨曼(左)与中国前副总理刘延东出席清华大学苏世民学者项目开学典礼。摄影师:Mark Schiefelbein/美联社

CIC’s Morgan Stanley bet went sideways as the stock tumbled after the bailout, leading to some buyer’s remorse. Gao said he regretted that CIC failed to request a clause that would have allowed the fund to lower its conversion price after the bank's shares fell. He cited a lack of experience for the mistake, calling it an “eternal pain in my heart,” according to a book the firm published in 2017.

中投公司对摩根士丹利的投资因股价在救助后暴跌而受挫,导致出现投资懊悔情绪。据该公司 2017 年出版的书籍记载,高西庆表示后悔当时未能在协议中加入股价下跌后可调低转股价格的条款,他将这一失误归咎于经验不足,称这是"心中永远的痛"。

These early mixed returns made CIC more cautious.

这些早期参差不齐的投资回报令中投变得更加谨慎。

Increasingly, they’re “not risk takers,” Shih said.

"他们越来越不愿承担风险了,"史宗瀚指出。

For CIC staffers, the frustrations are piling up. The urgency of its mandate to boost returns on China’s $3.29 trillion foreign reserves is weakening. The cash stockpile has fallen from its peak in 2014 as the yuan’s exchange rate becomes more flexible and its status as an international payment currency strengthens.

中投员工的挫败感与日俱增。其管理中国 3.29 万亿美元外汇储备以提高回报率的使命紧迫性正在减弱。随着人民币汇率弹性增强及国际支付货币地位提升,外汇储备规模已从 2014 年的峰值回落。

That’s undermining CIC’s role, leaving it with less fresh money to invest. Discussions on regular capital injections from the government have gone quiet, while plans to raise capital by selling bonds overseas have gone nowhere. As offshore investing grew more complex, a unit known as CIC Capital that oversaw billions of dollars in private equity and infrastructure investments was merged back into the main operations in 2022.

这削弱了中投公司的作用,导致其可用于投资的新资金减少。关于政府定期注资的讨论已陷入沉寂,而通过海外发债筹集资金的计划也毫无进展。随着海外投资环境日趋复杂,曾管理数十亿美元私募股权和基础设施投资的中投资本子公司于 2022 年被合并回母公司主体业务。

All of this is on top of the burdens that CIC was born with — the fund needs to make 300 million yuan ($42 million) every working day just to help repay interest on the special government bonds sold to raise its initial capital, former chairman Lou said when the fund was launched. Efforts to seek permission to invest in the domestic market have yielded nothing so far.

中投公司成立之初就背负着特殊使命——据前董事长楼继伟在基金成立时透露,该基金仅用于偿还初始资本金专项国债利息的日支付额就高达 3 亿元人民币(4200 万美元)。而申请获准投资国内市场的努力至今未果。

Scraping the Bottom 触及底线

CIC has had little extra cash to invest for more than a decade

中投公司十余年来几乎无额外资金可用于投资

Source: CIC annual reports

资料来源:中投公司年报

Note: The numbers were as of year end

中国主权基金巨头中投缩减在美投资 金融脱钩加剧——彭博社

注:数据截至当年年底

“I wouldn’t blame it all on US regulations,” Shih said, referring to CIC’s pullback. “The Chinese side has learned to be more careful. The pool of liquid assets they can deploy has shrunk pretty dramatically.”

"不能把责任全推给美国监管规定,"史实谈及中投收缩战略时表示,"中方已学会更加审慎行事。他们可调动的流动资产池已急剧萎缩。"

The fund even faces competition from within as Central Huijin Investment Ltd., CIC’s domestic arm that holds stakes in Chinese financial firms, rises in stature. It’s effectively now the “national team,” buying up Chinese stocks in down markets. There have been discussions about Huijin becoming the government’s overarching platform to manage both domestic financial holdings, and the overseas assets CIC holds, although there are no concrete signs that will happen anytime soon, people familiar said.

这家主权基金甚至面临"内部竞争"——随着中央汇金公司(中投旗下持有国内金融机构股权的子公司)地位提升,其实际上已成为救市"国家队",在股市低迷时大举买入 A 股。知情人士透露,政府曾讨论将汇金打造为统筹管理国内金融股权和中投海外资产的超级平台,但目前尚无具体实施迹象。

Other funds are diluting CIC’s mandate. The State Administration of Foreign Exchange’s investment arms are already big buyers of properties, while other sovereign investors like the Silk Road Fund and China Reform Holdings Corp. are investing in Belt-and-Road countries.

其他基金正在稀释中投公司的职能。国家外汇管理局旗下的投资机构已成为房地产大买家,而丝路基金、中国国新控股等其他主权投资者正专注于"一带一路"沿线国家的投资。

All these moves have curbed opportunities for the investment professionals that CIC had scoured the globe to hire. That, coupled with increased scrutiny and reduced compensation, have led to dozens of senior staff leaving in recent years for better offers at other firms, though the exodus has slowed of late.

这些变化限制了中投公司全球招募的投资专才施展拳脚的空间。加之监管趋严和薪酬缩水,近年来已有数十名高管为寻求更好待遇转投其他机构,不过近期人才外流速度有所放缓。

“There’s no need to actively expand CIC’s scale, as that would create more investment issues,” Li said. “A smaller ship is easier to maneuver.”

"没必要主动扩大中投规模,那样会产生更多投资问题,"李表示,"船小好调头。"

More From Bloomberg 更多来自彭博社的报道

Jane Street Boss Says He Was Duped Into Funding AK-47s for Coup

简街老板称被骗资助政变购买 AK-47 步枪

Trump Rejects Intel Assessment, Says Iran Atomic Sites Destroyed

特朗普驳斥情报评估 坚称伊朗核设施已被摧毁

Trump Truce Gains Ground as Nuclear Watchdog Seeks Iran Access

特朗普休战提议获进展 核监督机构寻求进入伊朗核查

Mamdani Stuns in NYC Mayoral Primary Race

马姆达尼在纽约市长初选中表现惊人

Israel Accuses Iran of Breaching Truce Trump Said Was in Effect

以色列指控伊朗违反特朗普声称已生效的停火协议

Top Reads 精选阅读

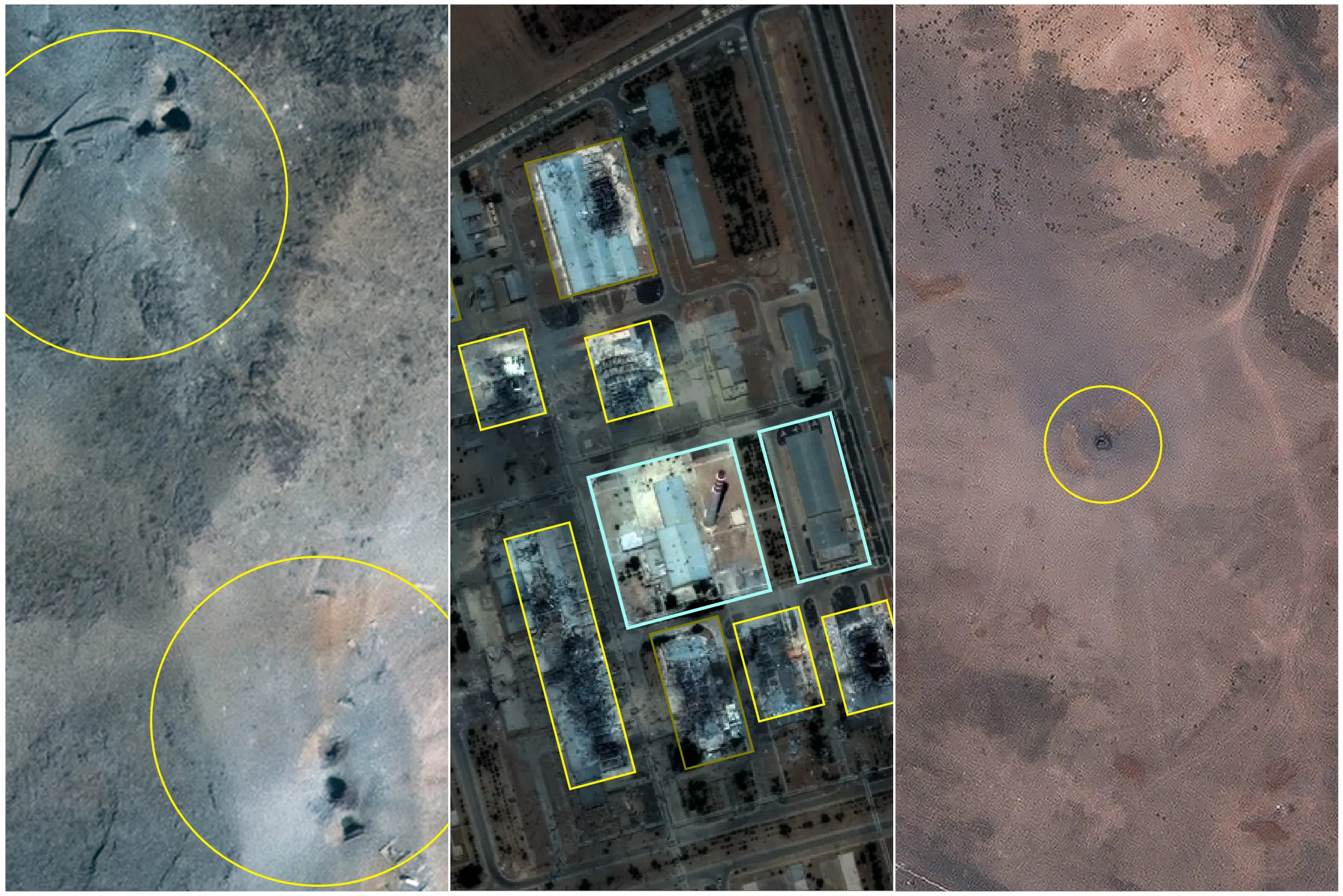

Satellite Images Suggest US Avoided Iran’s Nuclear Reactors

卫星图像显示美国避开了伊朗核反应堆

JPMorgan Traders Are Getting Shut Out of Private Credit Market

摩根大通交易员被拒于私募信贷市场门外

Satellite Images Question Trump’s Claim Iran’s Atomic Sites Destroyed

卫星图像质疑特朗普关于伊朗核设施被毁的说法

Satellite Imagery Shows Damage to Three Iranian Nuclear Facilities From US Strikes

卫星图像显示美国空袭对伊朗三处核设施造成破坏