Macro Melt-Up Sends Mega-Cap & 'Most Shorted' Stocks Soaring, 'Crypto Week' Win Elevates Ethereum

宏观大涨推动巨头股及“最被做空”股票飙升,“加密周”胜利提升以太坊价格

The week was dominated by rising tariff/trade uncertainty...offset by improving domestic macro and micro situation, and a drop in geopolitical uncertainty...

本周以关税/贸易不确定性上升为主导……但被国内宏观和微观形势改善以及地缘政治不确定性下降所抵消……

Source: Bloomberg 来源:彭博社

But it was an odd week:

但这是一个奇怪的一周:

Nasdaq rallied for the 3rd of the last 4 weeks but The Dow ended red for the second week in a row.

纳斯达克在过去四周中上涨了三周,但道琼斯连续第二周收跌。MegaCap Tech was higher for the 4th week in a row

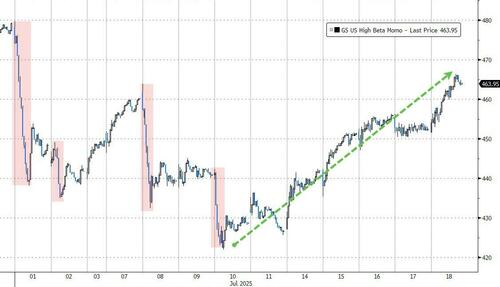

大型科技股连续第四周上涨'Most Shorted' Stocks ripped higher for the 8th straight week to its highest since Aug 2022

“最被做空”股票连续第八周大幅上涨,达到自 2022 年 8 月以来的最高点Long-Bond yields were higher for the 3rd straight week while the short-end saw yields decline.

长期债券收益率连续第三周上升,而短期收益率则下降。Dollar rallied for the second week in a row

美元连续第二周上涨Gold managed modest gains for the second week in a row

黄金连续第二周实现小幅上涨Palladium rose to its highest since June 2023, up for the 5th week in a row

钯金升至 2023 年 6 月以来的最高点,连续第五周上涨Platinum returned to gains (after last week's drop), to its highest since 2014 (up 6 of the last 7 weeks)

铂金回升至涨幅(继上周下跌后),达到自 2014 年以来的最高点(过去 7 周中上涨了 6 周)Bitcoin ended down on the week (after testing new record highs)

比特币本周收跌(此前测试了新的历史高点)Ethereum soared over 20% on the week (its 4th straight week of gains)

以太坊本周飙升超过 20%(连续第 4 周上涨)

However, in many ways, 2025 is shaping up now to be a continuation of the post-pandemic echo-boom era.

然而,在许多方面,2025 年现在正呈现出疫情后回声繁荣时代的延续趋势。

One characterized by stubborn, but not too-high inflation, surprisingly steady growth, full employment, oscillating business sentiment, a steady positive impulse from technology advances, and upward pressure on corporate earnings. And, as Goldman Sachs' Chris Hussey details below, we saw elements of many of these characteristics this week.

一个特点是通胀顽固但不过高,增长出人意料地稳健,充分就业,商业情绪波动,技术进步带来持续的正面推动,以及企业盈利的上行压力。正如高盛的 Chris Hussey 在下文详细说明的那样,本周我们看到了许多这些特征的体现。

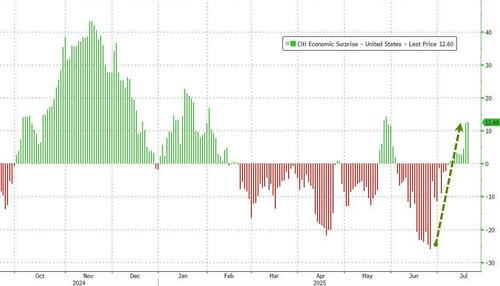

Inflation. Both June CPI and PPI came in anemically low this week with little signs that tariffs are pressuring prices higher.

通胀。本周 6 月 CPI 和 PPI 均表现疲软,几乎没有迹象显示关税正在推高价格。Retail and Industrial Production. Core Retail Sales rose 0.5% mom in June, albeit off of a revised lower base, and Industrial Production was up 0.3% - highlighting the resilience of the US consumer and manufacturing base amidst so much policy uncertainty.

零售和工业生产。6 月核心零售销售环比增长 0.5%,尽管基数经过下调修正,工业生产增长 0.3%——这凸显了在如此多政策不确定性下,美国消费者和制造业基础的韧性。Business sentiment. The Philly Fed index jumped to +15.9 from -4.0 a month ago, reflecting a sharp shift in how industry is viewing activity and growth prospects in the wake of everything that has taken place lately.

商业情绪。费城联储指数从一个月前的-4.0 跃升至+15.9,反映出在近期发生的一切之后,行业对活动和增长前景的看法发生了显著转变。

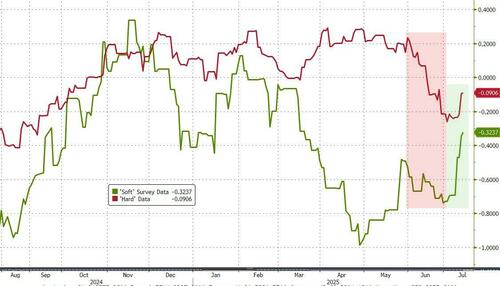

All of which leaves 'soft' data catching up rapidly to 'hard' data's relative strength after an initially weak July...

所有这些都使得“软”数据在经历了 7 月初的疲软后,迅速赶上了“硬”数据的相对强势...

Source: Bloomberg 来源:彭博社

In addition to the better activity data, we are also seeing sustained technology advances taking place even in an environment that in some ways has taken on a more skeptical tone around science. For the week, NVDA shares have gained ~5%, helped by news that it may resume shipments of its sought after GPU's to China as US trade policy evolves (dramatically more bubbly than the CSCO dotcom bubble)...

除了更好的活动数据外,我们还看到即使在某些方面对科学持更怀疑态度的环境中,技术进步依然持续进行。本周,NVDA 股价上涨约 5%,受益于美国贸易政策演变的消息,可能恢复向中国出口其备受追捧的 GPU(远比 CSCO 互联网泡沫时期更为火爆)...

Source: Bloomberg 来源:彭博社

Finally, earnings season heated up a bit this week with the Big Banks reporting results as well as a slew of companies across the economy's spectrum. The big banks faced a high bar into earnings having gained 20%-40% over the past 3 months, and many found that bar difficult to exceed. Half of the big bank stocks traded down on the week while half traded up. The stock with the best performance for the week: Citi -- up ~8% on the back of results that set it on a path to better returns. Beyond the Banks, we had strong results from GE and JNJ with a more negative reaction to results from NFLX and UAL.

最后,本周财报季有所升温,大型银行公布了业绩,还有一大批涵盖经济各领域的公司也发布了财报。大型银行在过去三个月股价上涨了 20%-40%,因此业绩门槛较高,许多银行难以超越这一标准。大型银行股票本周半数下跌,半数上涨。本周表现最佳的股票是花旗银行——因业绩表现良好,股价上涨约 8%,为其带来更好的回报路径。除银行外,GE 和 JNJ 业绩强劲,而 NFLX 和 UAL 的业绩则引发了较为负面的市场反应。

Overall, evidence that the policy uncertainty that characterized 2Q25 is having a major impact on economic or corporate activity in the US remains scarce... at least for now...

总体而言,表明 2025 年第二季度政策不确定性对美国经济或企业活动产生重大影响的证据仍然稀缺……至少目前如此……

Source: Bloomberg 来源:彭博社

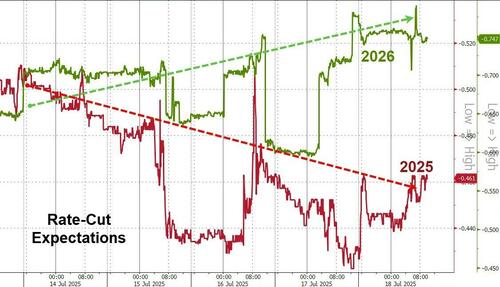

The 'good news' was 'bad news' for rate-cut hopers as 2025 expectations slipped lower (but 2026's expectations rose modestly)...

“好消息”对期待降息的人来说是“坏消息”,因为 2025 年的预期下降了(但 2026 年的预期则略有上升)……

Source: Bloomberg 来源:彭博社

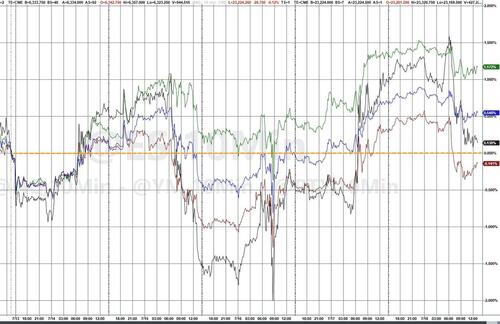

Stocks ended the week on a down-note as 'good news was bad news'. Stocks legged down again to the lows of the day after headlines on Trump's EU tariff plans hit: "*TRUMP PUSHES FOR 15%-20% MINIMUM TARIFF ON ALL EU GOODS: FT". Stocks then trod water at the lows of the day leaving The Dow red on the week while Nasdaq outperformed...

股票本周以下跌收盘,因“好消息反成坏消息”。在有关特朗普欧盟关税计划的头条新闻发布后,股市再次下跌至当日低点:“*特朗普推动对所有欧盟商品征收 15%-20%的最低关税:金融时报*”。随后,股市在当日低点徘徊,道琼斯指数本周收跌,而纳斯达克表现较好……

Goldman notes that despite the positive sentiment and lower inflation expectations today, there’s a lot of 'wrong way' action today: Shorts > Longs .. Small > Big .. SW > Semis .. Value > Growth

高盛指出,尽管今天市场情绪积极且通胀预期下降,但今天存在大量“逆势”操作:空头多于多头……小盘股优于大盘股……西南部优于半导体……价值股优于成长股。

Mag7 stocks dramatically outperformed the S&P 493 this week...

本周,Mag7 股票的表现远远超过了标普 493 指数……

Source: Bloomberg 来源:彭博社

'Most Shorted' stocks soared this week

本周“最被做空”股票飙升

Source: Bloomberg 来源:彭博社

Momo stocks rebounded strongly this week...

Momo 股票本周强劲反弹...

Source: Bloomberg 来源:彭博社

But hedge funds suffered bigly, with returns dragged down to the lows of the year...

但对冲基金遭受重创,回报率被拖累至今年低点...

Source: Bloomberg 来源:彭博社

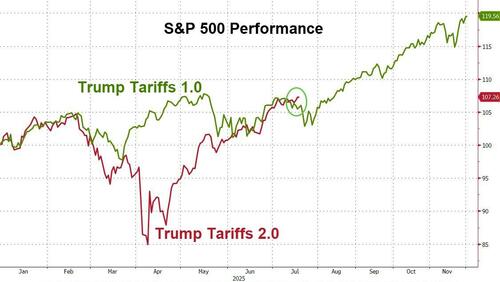

Before we leave equity-land, one more chart for fun... Trump 2.0 is now outperforming Trump 1.0...

在离开股票领域之前,再来一张有趣的图表……特朗普 2.0 现在的表现超过了特朗普 1.0……

Source: Bloomberg 来源:彭博社

Treasuries were mixed on the week with the long-end underperforming...

国债本周表现不一,长期债券表现较差……

Source: Bloomberg 来源:彭博社

... as the curve (2s30s) steepened further on the week...

... 随着本周曲线(2 年期与 30 年期)进一步陡峭化...

Source: Bloomberg 来源:彭博社

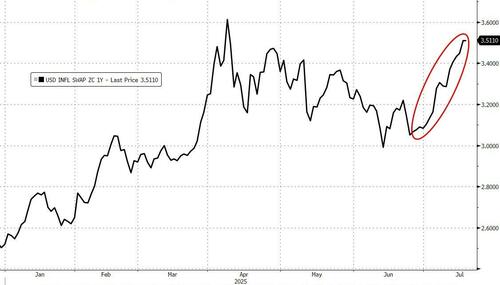

Interestingly, given the decline in inflation expectations and CPI/PPI coming in cooler than expected, inflation swaps (expectations) rose notably on the week...

有趣的是,鉴于通胀预期下降且 CPI/PPI 低于预期,通胀互换(预期)本周显著上升……

Source: Bloomberg 来源:彭博社

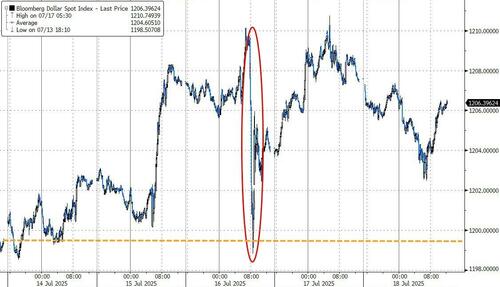

The dollar ended higher amid a wild week of swings amid CPI/PPI and Trump/Powell comments...

美元在经历了 CPI/PPI 数据发布及特朗普/鲍威尔言论引发的剧烈波动一周后收盘走高...

Source: Bloomberg 来源:彭博社

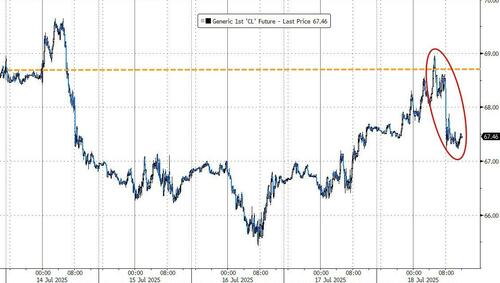

Oil gave up earlier gains to end the week lower as traders calmed over geopolitical risks and reassessed future supply-demand balances.

油价放弃了早前的涨幅,因交易员对地缘政治风险趋于冷静,并重新评估未来的供需平衡,最终本周收低。

Source: Bloomberg 来源:彭博社

Bitcoin ended the week unchanged - after hitting new record highs on Monday...

比特币本周收盘持平——此前周一曾创下新高纪录...

Source: Bloomberg 来源:彭博社

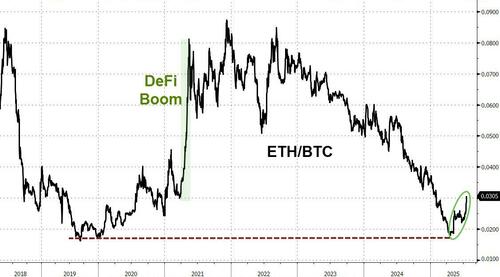

But Ethereum was the week's biggest gainer, breaking out to new cycle highs above $3600 late in the week...

但以太坊是本周涨幅最大的,周末时突破至 3600 美元以上的新周期高点……

Source: Bloomberg 来源:彭博社

Finally, with the success of 'Crypto Week', it appears the digital currencies have finally crossed the Rubicon. As Bloomberg's Brendan Fagan reports, after years of speculative booms and existential regulatory uncertainty, Washington has delivered the crypto space its long-sought legitimacy, and Ethereum, in particular, is reaping the benefits.

最后,随着“加密周”的成功,数字货币似乎终于跨过了卢比孔河。正如彭博社的 Brendan Fagan 报道,多年来经历了投机性繁荣和存在性监管不确定性后,华盛顿终于赋予了加密领域长期以来渴望的合法性,尤其是以太坊正在收获这一成果。

Ethereum outperformed Bitcoin for the 4th straight week...

以太坊连续第四周表现优于比特币...

Source: Bloomberg 来源:彭博社

And for all those who claim Bitcoin is just 'too volatile' - the 3-month realized vol of the crytpocurrency is now at its lowest relative to the DXY Dollar Index in over 8 years...

对于所有声称比特币“波动性太大”的人来说——该加密货币的 3 个月实现波动率现已达到相对于 DXY 美元指数 8 年来的最低水平……

Source: Bloomberg 来源:彭博社

Crypto is no longer a fringe experiment; it’s a maturing asset being welcomed into the financial mainstream.

加密货币不再是边缘实验;它是一种正在成熟的资产,正被金融主流所接受。

用 JM Bullion 保护您的财富免受通胀影响。

More market-recaps stories on ZeroHedge

更多 ZeroHedge 市场回顾报道

Futures Flat With $2.8 Trillion In Options Set To Expire

期货持平,2.8 万亿美元期权即将到期

Futures Drop After US-China Trade Talks Fall Flat, CPI Looms

美中贸易谈判破裂后期货下跌,CPI 数据临近