'Liquidity Is Taking Over From Fundamentals' But Goldman Trader Says 'Macro Noise' Is About To Bite Again

“流动性正在取代基本面”,但高盛交易员称“宏观噪音”即将再次发力

"Markets are moving through a transitional phase," according to top Goldman Sachs macro trader Paolo Schiavine and not just in price action, but in macro function.

高盛顶级宏观交易员 Paolo Schiavine 表示:“市场正处于一个过渡阶段,”不仅体现在价格走势上,也体现在宏观功能上。

The Fed is still the shock absorber, and while inflation data might remain elevated , that alone may not stop the start of easing.

美联储仍然是冲击的缓冲器,尽管通胀数据可能仍然偏高,但仅凭这一点可能无法阻止宽松政策的启动。

We are likely moving into a Fed that needs to elongate the cycle, not just a Fed that monitors CPI prints. The NFP might be the catalyst. GS 85K vs mkt 113K.

我们很可能正进入一个需要延长经济周期的美联储,而不仅仅是一个监控 CPI 数据的美联储。非农就业数据可能成为催化剂。高盛预测 85K,市场预期 113K。

Again, as we approach a key NFP print and I look at markets , liquidity is taking over from fundamentals.

同样,随着我们接近关键的非农就业数据发布,我观察市场,流动性正在取代基本面。

Markets are a policy tool, and policymakers know that liquidity transmission drives asset prices.

市场是政策工具,政策制定者知道流动性传导推动资产价格。

This isn’t a story about inflation or growth — it’s about what regime we’re in and how liquidity and volatility are behaving.

这不是关于通胀或增长的故事——而是关于我们处于何种体制,以及流动性和波动性如何表现。

Most of the clients I speak to don’t see value in chasing equities here. For three main reasons.

我交谈的大多数客户认为此时追逐股票没有价值,主要有三个原因。

Weakening corporate profit outlooks

企业利润前景走弱No Fed “put” 没有美联储“保护”

Bond market instability 债券市场不稳定

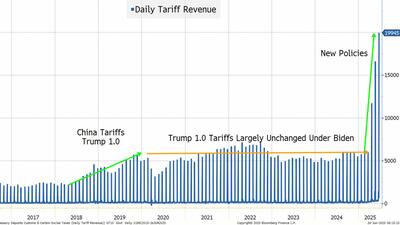

Tariffs and High relative valuations are the other most trending concerns. For me those aren’t strong enough reasons to short.

关税和高相对估值是其他最热门的担忧。对我来说,这些还不足以成为做空的强有力理由。

As a trend follower, I acknowledge the signals, but I don’t anchor to them unless price confirms.

作为一个趋势跟随者,我会注意这些信号,但除非价格确认,否则我不会依赖它们。

If I think about finding bull markets,

如果我要寻找牛市,

This is shaping up to be a liquidity-driven cycle in the US and a fiscal-led one in Europe.

这正在形成一个由流动性驱动的美国周期和一个由财政主导的欧洲周期。I’d always rather be long excess liquidity than long government balance sheets. That’s why US over Europe.

我总是更愿意持有过剩流动性,而不是持有政府资产负债表。这就是为什么选择美国而非欧洲。Eventually, the ECB and BOE will follow the Fed and ease further — terminal rates don’t matter here.

最终,欧洲央行和英格兰银行将跟随美联储进一步宽松——终端利率在这里并不重要。

Thematically in the US, own cyclicals (industrials, materials) over banks.

在美国的主题上,持有周期性行业(工业、材料)优于银行股。

Banks won’t benefit until steeper curves and real growth show up.

银行只有在收益率曲线变陡和实际增长出现时才会受益。

I have learned that market trade financial conditions. Looser financial conditions are offsetting the drag from policy lags.

我了解到市场交易的是金融状况。宽松的金融状况正在抵消政策滞后的拖累。Given that, we are still in the “ beautiful deleveraging ” , The key question is are we at the start of a new cycle.

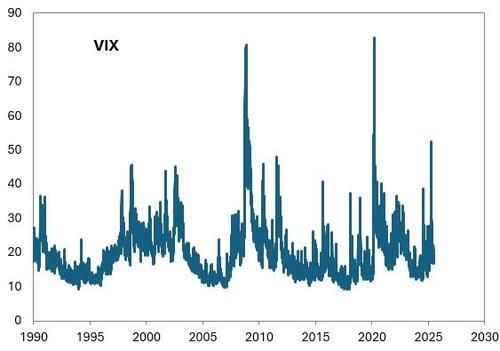

鉴于此,我们仍处于“美丽的去杠杆”阶段,关键问题是我们是否处于新周期的开始。If I look at the VIX chart below, a trend might be starting.

如果我看下面的 VIX 图表,可能一个趋势正在开始。

In recent history I focus on:

我最近关注的是:

Dec 2018: Market correction.

2018 年 12 月:市场调整。Aug 2024: End of low-vol regime.

2024 年 8 月:低波动率阶段结束。Mar 2025: Latest correction

2025 年 3 月:最新调整

The sequencing matters. 顺序很重要。

In low-volatility environments, multiples expand.

在低波动率环境中,估值倍数会上升。

But, coming out of low-vol doesn’t trigger immediate sell-offs - instead, you typically get a vol spike, then a transition to a higher vol regime, and only 6–12 months later, a real correction.

但是,从低波动率环境中走出并不会立即引发抛售——相反,通常会先出现波动率飙升,然后过渡到更高的波动率阶段,真正的调整通常要在 6 到 12 个月后才会出现。

So, the question is: Are we at the start of something new or the end of something old? A few points would suggest VIX might be trending lower.

所以,问题是:我们是在某个新阶段的开始,还是旧阶段的结束?有几点迹象表明 VIX 可能正处于下行趋势。

A healthy IPO pipeline and performance

健康的首次公开募股(IPO)管道和表现Broader participation (Russell up, not just megacaps)

更广泛的参与(罗素指数上涨,不仅仅是大型股)Lower rates expectations feeding into cyclicals

较低的利率预期推动周期股

Something that helps to showcase the low subscription level into the “ new cycle “ narrative is the Equity / Interest rates correlation.

有助于展示“新周期”叙事中认购水平较低的一个指标是股票与利率的相关性。

“it is a very interesting dynamic as i can argue both scenarios of +50 corr and -50 corr, but implieds are near the middle.”

“这是一个非常有趣的动态,因为我可以为+50 相关和-50 相关这两种情景辩护,但隐含相关接近中间值。”

Currently Correlation between Eq & yield level is realising positive.

目前股票与收益率水平之间的相关性正在实现正相关。

Implied levels are still trading small positive in say SPX vs US10y, like +5-15%.

隐含相关水平仍在小幅正相关区间交易,比如 SPX 与美国 10 年期国债之间约为+5-15%。We have seen mostly trades relating to yields wider & equities down (so selling this correl), due to the deficit/inflation narrative

我们主要看到的交易是收益率走阔且股票下跌(因此卖出这种相关性),这主要是由于赤字/通胀的叙事。Alternatively, SPX down Yields tighter which would be the recession type scenario. Very low subscription in yield higher / Eq higher.

或者,SPX 下跌,收益率走紧,这将是衰退类型的情景。收益率较高/股票较高时认购量非常低。

Moreover, 此外,

If we look at TLT skew it has repriced with "put over", meaning there is higher vol on the TLT put, so on yields wider

如果我们观察 TLT 的偏斜度,它已经重新定价为“看跌期权占优”,意味着 TLT 看跌期权的波动率更高,因此收益率波动更大。So indeed, there has been demand for the “risk off" scenario, which would support market down vs yields wider correlation (i.e. -ve correl)

所以确实存在对“风险规避”情景的需求,这将支持市场下跌与收益率走宽的相关性(即负相关)。What is surprising to me is that there is high conviction in the negative correlation narrative: equities down, yields up.

令我惊讶的是,市场对负相关叙事的信心很高:股市下跌,收益率上升。

My conviction is that equity is an inflation asset class. So, I tend to like higher SPX vs Higher US10y.

我的信念是股票是一种通胀资产类别。因此,我倾向于看好标普 500 指数上涨而美国 10 年期国债收益率上升。

If I take another step back and look at realizes vs implied correlation cross asset, this year has been rare one : long vol strategies made money.

如果我再退一步,观察今年跨资产的实现相关性与隐含相关性,今年是罕见的一年:多波动率策略获利。

In details, the P&L of strategies which go long a straddle across some asset classes and have performed relatively well this year.

具体来说,那些在多个资产类别上做多跨式期权策略的盈亏表现相对较好。

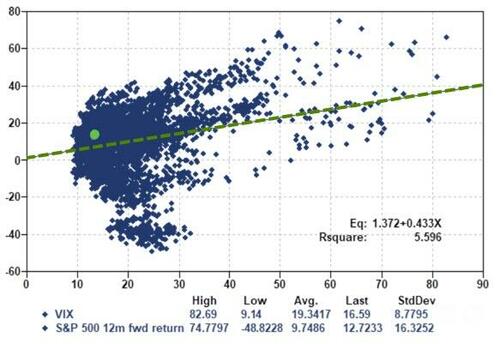

There’s a mildly positive relationship between realized > implied and SPX forward returns, especially over longer horizons.

实现收益率高于隐含收益率与 SPX 远期回报之间存在轻微的正相关关系,尤其是在较长的时间范围内。This is subtle, but meaningful — it tells us something about future asymmetry.

这很微妙,但意义重大——它告诉我们未来的不对称性。Historically, when the VIX spikes, 12-month forward returns improve. Because fear creates dislocations and better entry points.

历史上,当 VIX 飙升时,12 个月的远期回报会有所改善。因为恐惧会造成市场错位,带来更好的入场点。

You can see this in the scatterplot below vol spikes are usually forward bullish, not bearish.

你可以在下面的散点图中看到,波动率飙升通常预示着未来看涨,而非看跌。

To conclude, for years across asset classes macro didn’t matter much. For a few reasons.

总之,多年来在各类资产中,宏观因素并不重要。原因有几点。

US geopolitical dominance / Declining global interest rates

美国地缘政治主导地位 / 全球利率下降Stable reserve currency status / Innovation concentration in Silicon Valley

稳定的储备货币地位 / 硅谷的创新集中度Coordinated fiscal and monetary expansion

协调的财政和货币扩张

That combination insulated markets — macro noise didn’t bite. Now, as macro returns, volatility must rise but doesn’t mean asset prices go up or down.

这种组合使市场免受影响——宏观噪音未能产生冲击。现在,随着宏观因素的回归,波动性必然上升,但这并不意味着资产价格一定上涨或下跌。

For equity, the trend is higher but most importantly this is an asset class with positive drift. .

对于股票而言,趋势是向上的,但最重要的是这是一个具有正漂移的资产类别。

Higher yields / Higher equity as my base case.

我的基本假设是收益率上升 / 股市上涨。

More from the rest of Goldman Sachs research team here available to pro subs.

更多内容来自高盛研究团队的其他成员,现已向专业订阅者开放。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

How Canada's Digital Tax Exposes Brussels' Globalist Playbook: A Trump Retaliation

加拿大数字税如何揭露布鲁塞尔的全球主义剧本:特朗普的报复

1 In 3 Americans Are Cutting Insurance Costs Just To Afford Food

三分之一的美国人正在削减保险费用以支付食物开销