Hartnett: Stocks, Crypto Loving Trump Policy Flipflop From "Detox" To "Gorge"

Hartnett:股票和加密货币喜爱特朗普政策从“排毒”到“暴食”的反复无常

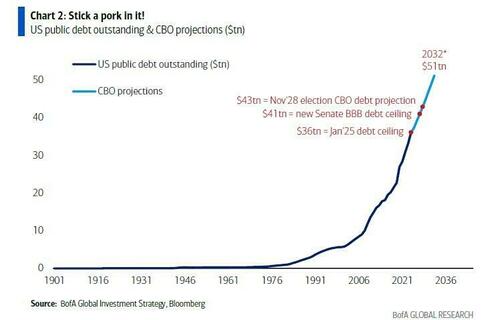

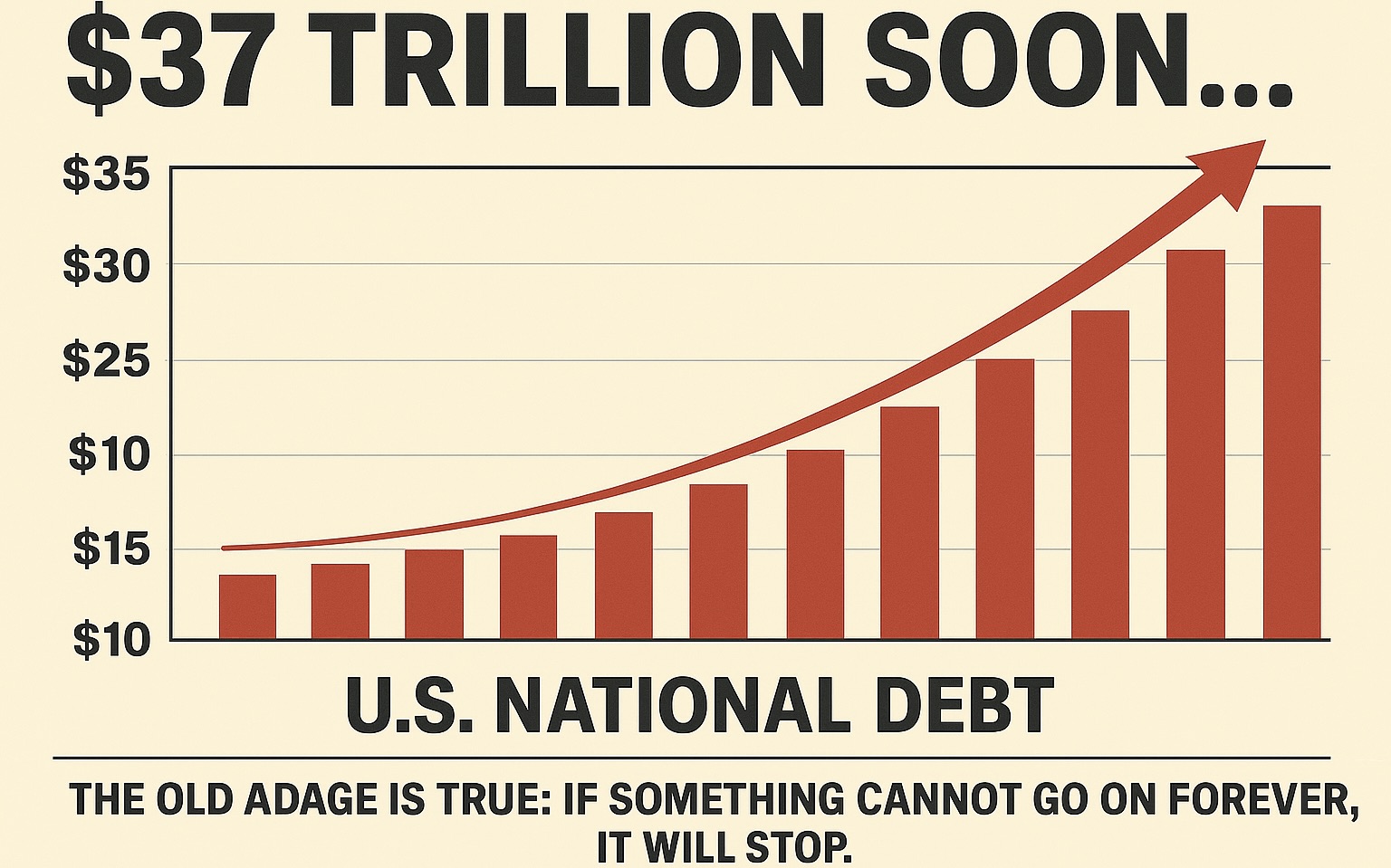

After being decidedly bullish on bonds for much of the first half, the last few notes have seen BofA chief investment strategist Michael Hartnett turn increasingly downbeat on prospects for fixed income, and especially long duration, dedicating much of his last note, one dissecting the "Big, Beautiful Bubble", on the exponential surge in US (and global) debt issuance which will push total US debt above the insane high water mark of $50 trillion by 2032, if not sooner.

在上半年大部分时间里对债券持明确看涨态度后,BofA 首席投资策略师 Michael Hartnett 在最近几份报告中对固定收益,尤其是长期债券的前景变得越来越悲观,他在最新一份分析“巨大、美丽泡沫”的报告中,详细剖析了美国(及全球)债务发行的指数级激增,这将推动美国总债务在 2032 年之前(甚至更早)超过惊人的 50 万亿美元高点。

With a ton of new issuance on deck, demand for said paper will continue to decline until rates rise enough to make said paper attractive enough. And one can be absolutely certain the US will now unleash an epic deficit-funding debt barrage because as Hartnett put it, since Trump “can’t cut spending, can’t cut defense, can’t cut debt, go big with tariffs, so only way they can pay for One Big Beautiful Bill is with One Big Beautiful Bubble.”

随着大量新债发行即将到来,对这些债券的需求将持续下降,直到利率上升到足以使这些债券具有吸引力为止。可以完全确定的是,美国现在将释放一场史诗级的赤字融资债务攻势,正如 Hartnett 所说,由于特朗普“无法削减开支,无法削减国防,无法削减债务,只能大规模征收关税,因此他们支付‘一项巨大美丽法案’的唯一方式就是‘一场巨大美丽泡沫’。”

Translation: not just more of the same, but much more of the same. And stock, which are now melting up faster and faster, definitely got the message.

不仅仅是更多的同样内容,而是更多的同样内容。而且股票现在上涨速度越来越快,显然已经接收到这个信号。

So fast forwarding to today, Hartnett picks up where he left off and writes that the current zeitgeist can be best summarized as follows:

快进到今天,Hartnett 继续他之前的观点,写道当前的时代精神可以最好地总结如下:

“Bought the election, sold the Inauguration, bought Liberation Day, thought about selling Big Beautiful Bill, but price action just telling me to rotate not retreat.”

“买入选举,卖出就职典礼,买入解放日,考虑卖出大漂亮法案,但价格走势只是告诉我轮换而非撤退。”

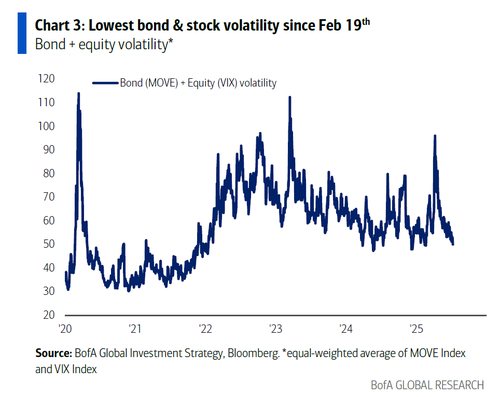

But what price action is the BofA strategist looking at? As he explains in his latest Flow Show note titled "No Pain... No Pain' (available to pro subscribers), the MOVE and VIX indexes are the best TACO index, and the good news for the bulls is that and they are showing the lowest bond & stock volatility since Feb 19th...

但这位 BofA 策略师在看什么价格走势?正如他在最新的《Flow Show》笔记《No Pain... No Pain》(仅限专业订阅者)中解释的那样,MOVE 和 VIX 指数是最好的 TACO 指数,好消息是它们显示自 2 月 19 日以来债券和股票的波动率最低……

... which means no policy fear, and stocks and crypto are liking Trump policy flip from “detox” to “gorge” (see ARKK vs BRK). Here, Hartnett's reco is simple: go all-in until 30-year bond yield “jailbreak” levels (UK 5.6%, US 5.1%, Japan 3.2%) are breached.

…这意味着没有政策恐惧,股票和加密货币都喜欢特朗普政策从“排毒”转向“暴饮暴食”的转变(参见 ARKK 与 BRK)。在这里,Hartnett 的建议很简单:全力以赴,直到 30 年期国债收益率突破“越狱”水平(英国 5.6%,美国 5.1%,日本 3.2%)。

And yet, cracks are starting to form, and not just in the ominous plunge in high beta momentum names during this relentless highly concentrated meltup we discussed last week: while the global leadership of US/China tech, and EU/UK banks is still intact, though HY bonds and Japan banks are stalling. That said, anything is still possible in this "summer of rotation" and Hartnett notes that a clean US bank index breakout above the Jan’22 highs (i.e. BKX >150) would be a trigger for laggard catch-up vs leaders (note value vs growth, small vs large, all ended H1 at multi-year relative lows, read more in "The Price Of An Asset Has Become Meaningless. What Matters Are Relative Prices.").

然而,裂痕开始显现,不仅仅是在我们上周讨论的这场无情且高度集中的上涨中,高贝塔动量股的 ominous 暴跌:尽管美中科技和欧盟/英国银行的全球领导地位仍然稳固,但高收益债券和日本银行正在停滞。不过,在这个“轮动之夏”中,一切皆有可能,Hartnett 指出,美国银行指数若能干净利落地突破 2022 年 1 月的高点(即 BKX >150),将触发落后者对领先者的追赶(注意价值股对成长股,小盘股对大盘股,均在上半年结束时处于多年相对低点,详见《资产价格已变得毫无意义,重要的是相对价格》)。

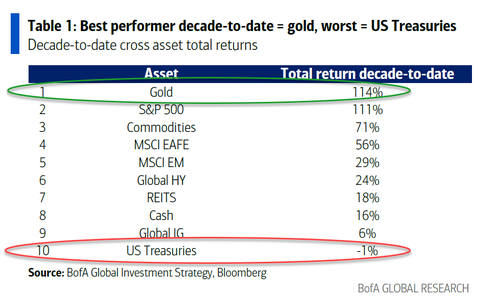

Turning to the biggest picture - and going back to our point up top - Hartnett notes that while the best performer (in his universe of assets) decade-to-date is gold (114%), the worst is US Treasuries (-1%)...

回到更大的格局——回到我们开头的观点——Hartnett 指出,迄今为止(在他关注的资产范围内)表现最好的资产是黄金(114%),表现最差的是美国国债(-1%)…

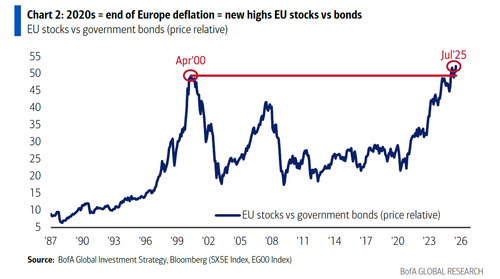

... because the 2020s have been decade of inflation, a mirror image of the NIRP/ZIRP ridding decade prior, which is good news for the EU and Japan as secular deflation is now over. In response, EU stocks vs bonds is now above the 2000 high...

……因为 2020 年代是通胀的十年,是之前实行负利率政策(NIRP)和零利率政策(ZIRP)十年的镜像,这对欧盟和日本来说是好消息,因为长期通缩现已结束。作为回应,欧盟股票相对于债券的比率现已超过 2000 年的高点……

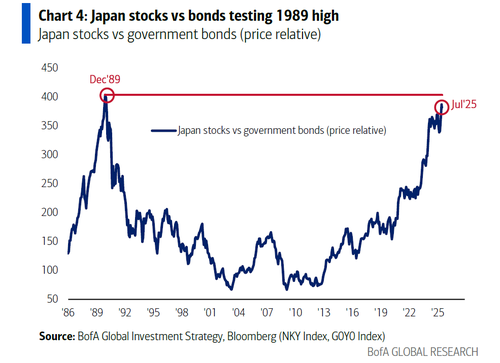

... Japan stocks vs bonds testing 1989 highs...

……日本股票相对于债券的比率正在测试 1989 年的高点……

... as Anything but Bonds (US and everywhere else) trade goes global; meanwhile Hartnett believes that the secular US dollar bear is just getting started, which is why he is calling for higher allocation to commodities, crypto, International & EM in second half of 2020s (but not bonds, which recall was the B in the BIG trade, so now it's just IG).

……随着除债券(美国及其他地区)之外的所有资产交易走向全球;与此同时,Hartnett 认为美元的长期熊市才刚刚开始,这也是他呼吁在 2020 年代下半年增加对大宗商品、加密货币、国际市场和新兴市场的配置的原因(但不包括债券,回想一下债券曾是“大交易”中的 B,所以现在只剩下投资级债券)。

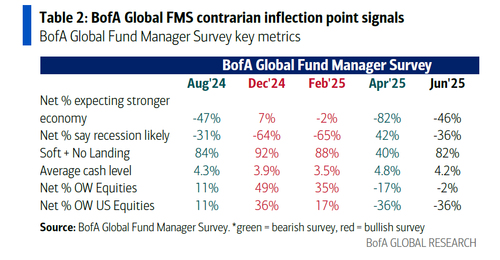

Hartnett then previews the monthly contrarian joke that is the Bank of America Fund Manager survey (which regular readers know we view as nothing more than the confused chatter of schizophrenic "professional" traders, meant to be faded) whose July survey will be released this Tuesday; Here even Hartnett notes that the FMS has become a great contrarian signal, marking the key inflection points in the past 12 months, e.g. bearish Aug’24, Apr’25 surveys, bullish Dec’25, Feb’25 surveys...

Hartnett 随后预览了每月的逆向笑话——美国银行基金经理调查(常读者知道我们认为这不过是精神分裂“专业”交易者的混乱喋喋不休,应该被反向操作),其 7 月调查将于本周二发布;即使是 Hartnett 也指出,FMS 已成为一个极佳的逆向信号,标志着过去 12 个月的关键转折点,例如 2024 年 8 月和 2025 年 4 月的看跌调查,2025 年 12 月和 2025 年 2 月的看涨调查……

... and bullish sentiment in the July FMS metrics would be consistent with profit-taking/summer pull-back. Some other bubble indicators: FMS cash level <4.0%, expectations of soft or no landing >90%, net equity allocation >20% OW. Also worth noting that nothing says “it’s a bubble” more than price action ignoring normally reliable trading rules, or as Hartnett puts it, "greed always harder to reverse than fear."

……七月 FMS 指标中的看涨情绪与获利了结/夏季回调相符。其他一些泡沫指标包括:FMS 现金水平低于 4.0%,对软着陆或无着陆的预期超过 90%,净股票配置超配超过 20%。同样值得注意的是,没有什么比价格走势无视通常可靠的交易规则更能说明“这是泡沫”,正如 Hartnett 所说,“贪婪总比恐惧更难逆转。”

It's not just the upcoming FMS that will be closely watched for bubble euphoria: we already have to courtesy of Hartnett's summer client feedback, where we find that:

不仅即将到来的 FMS 会因泡沫狂热而备受关注:我们已经通过 Hartnett 的夏季客户反馈看到了这一点,其中发现:

- no-one is worried about economy

没人担心经济 - no-one talking valuation 没人谈论估值

- no-one asking about China...

没人问及中国... - but all asking about bonds & deficits and avoiding long bonds (“there be dragons”)

但所有人都在问债券和赤字,并避免长期债券(“那里有龙”)

The take home here according to the BofA strategist is that the macro community thinks "government bonds on cusp of disorderly sell-off and stock/credit clients asleep at wheel; but stock/credit clients say “long TACO.” Why? Because Trump needs a boom into midterms so follow the bitcoin breakout; meanwhile Europe/Asia clients are enthusiastic about Big Beautiful Bill and less desperate to hedge US dollar exposure; majority expect Q2 earnings to surprise to upside, AI capex forecasts to rise, less sure AI EPS boost across corporate sector shows up Q2. The best way to trade it is via equity barbell of US growth stocks & RoW value core position... but active managers are increasingly lamenting concentration of performance (which is manifesting in momentum blowups like the one seen last week).

根据 BofA 策略师的观点,这里的要点是宏观社区认为“政府债券正处于无序抛售的边缘,而股票/信用客户却像睡着了一样;但股票/信用客户却表示‘看多 TACO’。为什么?因为特朗普需要在中期选举前实现经济繁荣,所以跟随比特币的突破;与此同时,欧洲/亚洲客户对《大而美的法案》充满热情,对对冲美元风险的需求减少;大多数人预计第二季度盈利将超预期,AI 资本支出预测将上升,但不确定 AI 对企业部门第二季度每股收益的提振是否显现。交易的最佳方式是通过美国成长股和全球其他地区价值核心头寸的股票杠铃策略……但主动管理者越来越抱怨业绩集中度(这在上周出现的动量爆炸中表现得尤为明显)。

Finally, the trading consensus is more S&P500 upside/catch-up into Aug Fed Jackson Hole meeting, then healthy back’n’fill correction.

最后,交易共识是标普 500 指数在 8 月美联储杰克逊霍尔会议前将进一步上涨/追赶,然后进行健康的回调修正。

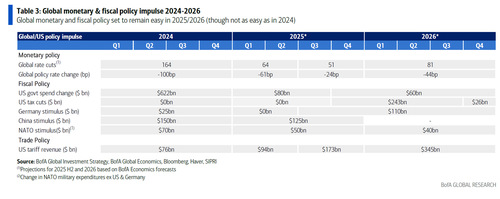

Hartnett concludes on a bullish note, writing that there are still "No Policy Dragons" - and yes, global policy remains easy, but not as easy as in 2024...

Hartnett 以乐观的语调总结道,目前仍然“没有政策巨龙”——是的,全球政策依然宽松,但没有 2024 年那么宽松……

... even as central banks are still cutting rates (164 cuts in ’24, 95 in ’25, 81 in “26); In the US, tax cuts of $243bn in FY2026 will partially offset end of US big government fiscal stimulus, which added $622bn in 2024 but will only add $140bn in 2025-2026; Meanwhile, China/EU/NATO fiscal stimulus on the rise; and all know the negative impact of US tariff tax increase (from $76bn in ’24, to $161bn in ’25, $345bn in ’26) can and will be quickly adjusted lower if macro needs help.

……即使各国央行仍在降息(2024 年降息 164 次,2025 年 95 次,2026 年 81 次);在美国,2026 财年将实施 2430 亿美元的减税,部分抵消美国大政府财政刺激的结束,后者在 2024 年增加了 6220 亿美元,但在 2025-2026 年仅增加 1400 亿美元;与此同时,中国、欧盟和北约的财政刺激正在上升;众所周知,美国关税税收的增加(从 2024 年的 760 亿美元,升至 2025 年的 1610 亿美元,2026 年的 3450 亿美元)会产生负面影响,但如果宏观经济需要帮助,这些关税将会并且能够迅速下调。

More in the full Hartnett note available to pro subscribers.

更多内容请参阅提供给专业订阅者的完整 Hartnett 报告。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

EU Won't Retaliate To Trump's 30% Tariff, Countermeasures On Hold Until August

欧盟不会对特朗普 30%的关税进行报复,反制措施将推迟到八月实施

Hedge Fund CIO: "Three Top Investment Ideas For The Next Decade"

对冲基金首席投资官:“未来十年的三大顶级投资理念”