CTAs 'Flip' To Global Equity Sellers As Retail Sentiment Dips, Buyback Blackout Builds

随着散户情绪下滑和回购禁令加剧,CTA 转为全球股票卖方

After making another attempt at breaking above 6,000 points amidst Iran/Israel/US headlines and the hopes of a negotiation off-ramp earlier in the week, the S&P500 gradually gave up all gains to end last week's shortened week down 15bps.

在伊朗/以色列/美国相关头条新闻以及本周早些时候对谈判出路的希望推动下,标普 500 指数再次尝试突破 6000 点,但最终逐渐回吐所有涨幅,上周这个缩短交易周以下跌 15 个基点收盘。

The early gains today have all been erased now as fears of retaliation by Iran grow more imminent...

今天早盘的涨幅现已全部抹去,因对伊朗报复的担忧日益迫近……

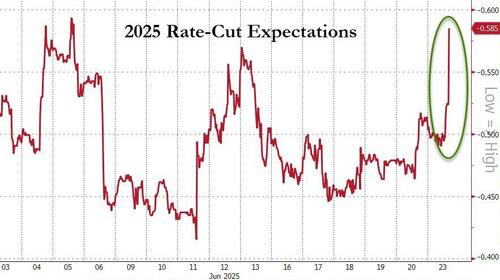

Aside from the intense focus on Middle East tension and left tail scenarios, investors had a flurry of Central Bank meetings to digest – with the Fed leaning hawkish at the margin on FOMC day, before Waller reintroduced some dovishness on Friday (“FED'S WALLER: COULD CUT RATES AS EARLY AS JULY MEETING”) and Fed's Bowman joined the dovish crowd this morning: "BOWMAN: SUPPORTED JUNE RATE HOLD, LABOR MARKET SOLID".

除了对中东紧张局势和极端尾部风险的高度关注外,投资者还需消化一系列央行会议——在 FOMC 会议当天,美联储边际上偏鹰派,随后 Waller 于周五重新释放鸽派信号(“美联储 WALLER:最早可能在 7 月会议降息”),而 Fed 的 Bowman 今晨也加入了鸽派阵营:“BOWMAN:支持 6 月维持利率,劳动力市场稳健”。

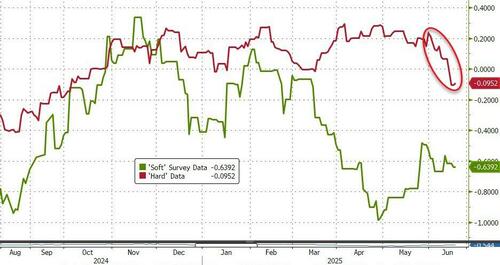

Additionally, some softening US hard data, with Retail sales and Industrial production both coming below expectations.

此外,美国部分硬数据有所走软,零售销售和工业产出均低于预期。

Fueling the narrative that the tariff/uncertainty impact on the US economy is only starting to feed through to the data, with a final magnitude difficult to assess.

这进一步支持了关税/不确定性对美国经济影响刚开始反映在数据中的观点,且最终影响的规模难以评估。

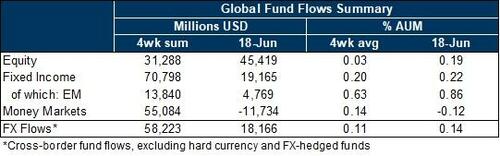

Goldman Sachs' Pierre Saboureault points out flows on the week were mixed:

高盛的 Pierre Saboureault 指出,本周资金流动表现混合:

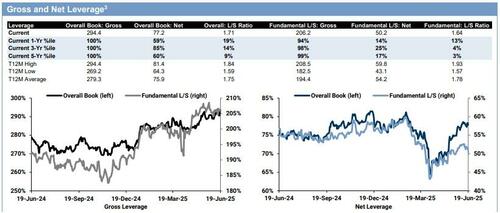

On one hand Hedge Funds net selling Global Equities for the time in 7 weeks, while increasing their gross leverage to its highest level in 5 years ; Long Onlys finishing slightly net sellers on our floor every day of the week ; and CTAs flipping to (very modest) Equity sellers.

一方面,对冲基金净卖出全球股票,为 7 周以来首次,同时将其总杠杆率提升至 5 年来的最高水平;纯多头基金在我们交易大厅的每一天均略微净卖出;而 CTA 则转为(非常温和的)股票卖方。On the other hand, Equity Mutual Funds registered significant demand for Equities (+$45bn on the week), driven almost entirely by US investors’ demand for US equity funds.

另一方面,股票共同基金录得显著的股票需求(本周净流入 450 亿美元),几乎完全由美国投资者对美国股票基金的需求推动。

HEDGE FUNDS 对冲基金

Global equities were modestly net sold for the first time in 7 weeks (-0.1 SDs 1-year) while gross trading activity increased at the fastest pace in 11 weeks, driven by short sales slightly outpacing long buys.

全球股票首次在 7 周内出现小幅净卖出(1 年期标准差-0.1),同时总交易活动以 11 周来的最快速度增长,主要由卖空略微超过买多推动。

ASSET MANAGERS 资产管理者

Institutions were small US equity buyers on the week ending June 10th. Overall non-dealer position edged lower.

截至 6 月 10 日当周,机构为美国股票的小幅买家。整体非做市商头寸略有下降。

MUTUAL FUNDS 共同基金

Net flows into global equity funds increased substantially in the week ending June 18 (+$45bn vs -$10bn in the previous week). The inflows were led by strong demand for US equity funds, driven almost entirely by US investors. Western Europe ex. UK equity funds continued to see firm demand, while Japanese equity funds saw additional outflows. In EM, flows into mainland China funds turned positive; Brazil continued to attract robust inflows. At the sector level, technology funds saw the strongest net inflows, while financials saw the largest net outflows.

截至 6 月 18 日当周,全球股票基金的净流入大幅增加(+450 亿美元,前一周为-100 亿美元)。资金流入主要由美国股票基金的强劲需求推动,几乎完全由美国投资者驱动。除英国外的西欧股票基金继续保持稳定需求,而日本股票基金则出现额外的资金流出。在新兴市场方面,流入中国大陆基金的资金转为正值;巴西继续吸引强劲的资金流入。在行业层面,科技基金的净流入最为强劲,而金融板块则出现最大净流出。

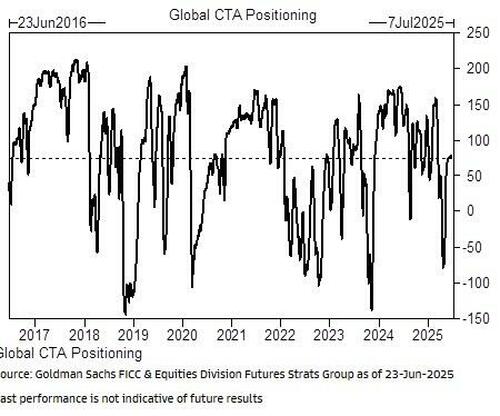

SYSTEMATIC (CTAs) 系统化交易(CTAs)

In our latest update on Friday pre-US open, our models estimated CTAs had sold $1bn of Global Equities on the week, lowering their overall exposure to +$76.2bn (65th percentile over a year).

在我们周五美国开盘前的最新更新中,我们的模型估计 CTAs 本周已卖出 10 亿美元的全球股票,整体敞口降至+762 亿美元(过去一年处于第 65 百分位)。

Trigger levels across global equity markets:

全球股票市场的触发水平:

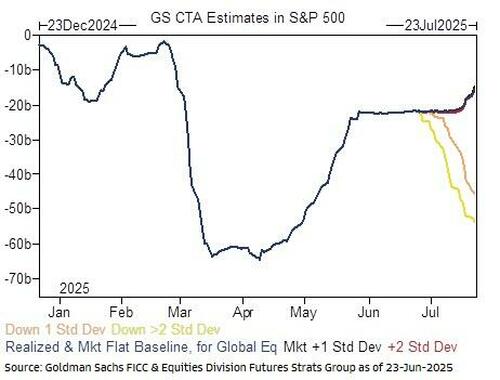

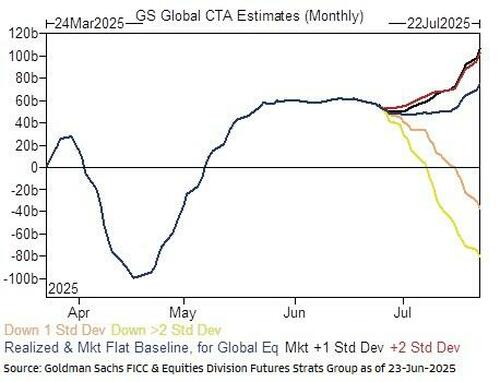

This cohort has flipped to selling and our models anticipate c.$10bn of selling over a one-week-horizon in a flat market scenario, and selling regardless of the market scenario.

这一群体已转为卖出,我们的模型预计在一周时间内,在市场持平的情况下将卖出约 100 亿美元,并且无论市场情况如何都会卖出。

Over the next 1 week…

未来一周…

Flat tape: Sellers $10.03B ($1.06B out the US)

持平盘:卖出额 100.3 亿美元(美国境外 10.6 亿美元)Up tape: Sellers $4.87B ($0.09B out the US)

上涨盘:卖出额 48.7 亿美元(美国境外 0.9 亿美元)Down tape: b$32.13B ($9.29B out the US)

下跌盘:卖出额 321.3 亿美元(美国境外 92.9 亿美元)

Over the next 1 month…

在接下来的 1 个月内……

Flat tape: Buyers $15.80B ($7.32B into the US)

平盘:买入额 158 亿美元(其中 73.2 亿美元流入美国)Up tape: Buyers $44.40B ($11.47B into the US)

上涨:买入额 444 亿美元(其中 114.7 亿美元流入美国)Down tape: Sellers $137.65B ($43.05B out the US)

下跌走势:卖出额 1376.5 亿美元(其中美国市场 430.5 亿美元)

Key pivot levels for SPX:

SPX 的关键转折点:

Short term: 5867 短期:5867

Med term: 5826 中期:5826

Long term: 5596 长期:5596

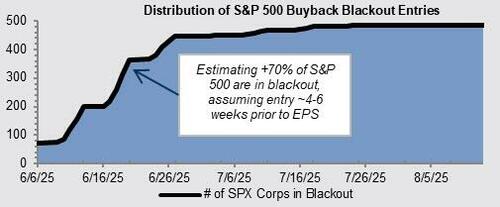

CORPORATES (BUYBACKS) 企业(回购)

Additionally, Goldman currently estimates over 70% are in blackout window today with +85% in blackout by the end of the week...

此外,高盛目前估计今天有超过 70%处于禁售期,预计到本周末禁售期将超过 85%……

RETAIL 零售

AAII SENTIMENT SURVEY: Lower.

AAII 情绪调查:下降。

On the week ending June 18th, Bulls were down 3.5 points to 33.2%, Bears up 7.8 points to 41.4%, while Neutrals were down 4.3 points to 25.4%. To compare to historical averages of Bulls 37.5% / Bears 31% / Neutral 31.5%.

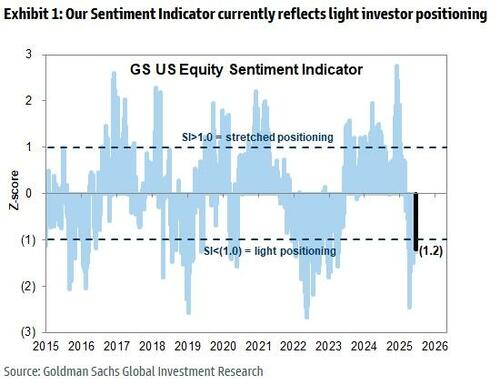

GS Sentiment Indicator

Our Sentiment Indicator (SI) registers -1.2 this week, remaining in negative territory despite a 21% rally in the S&P 500 from its April trough.

Although the SI has recovered from a reading of -2.5 in early April, mutual fund and ETF flow data have remained weak.

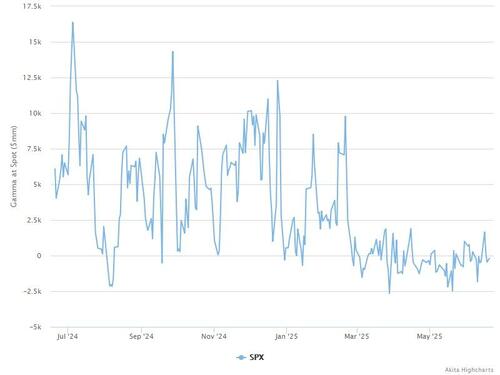

GAMMA

One quick glance at today's market action (and inability to extend intraday trends) gives a clear indication that the market's gamma never pushed notably negative after Friday's big Options Expiration. In fact, as Goldman's Cullen Morgan notes, market gamma is actually almost perfectly neutral here...

Vol Panic

But Goldman's Vol Panic index remains near highs...

Looking ahead, that markets will remain wired to the geopolitical situation (oil price) and the form that any Iran’s response could take (Hormuz strait disruption? US bases?), or whether any further action by the US takes place, while also having to digest a new round of flash PMIs, in Europe a growing focus on the French pension reform, and some important micro data points with Micron, Fedex, Nike, Jefferies.

More in this Goldman Positioning note available to professional subs.

More markets stories on ZeroHedge

Trump Has Already Pivoted To Mulling Regime Change In Iran With Latest Post

Hims & Hers Health Crashes After Novo Nukes GLP-1 Partnership Over "Illegal Mass Compounding" Scheme