Changes in zoning laws, tax policies, or land acquisition regulations may delay projects or increase costs.

Revoking implemented policies without approvals from lenders.| Changes in zoning laws, tax policies, or land acquisition regulations may delay projects or increase costs. |

| :--- |

| Revoking implemented policies without approvals from lenders. |

Conduct thorough due diligence, engage with regulatory bodies early, and ensure legal compliance.

Attract a wider range of potential investors/ buyers with focus on both local and overseas investors.| Conduct thorough due diligence, engage with regulatory bodies early, and ensure legal compliance. |

| :--- |

| Attract a wider range of potential investors/ buyers with focus on both local and overseas investors. |

确保高效的项目管理,按时完成项目,以最大限度减少政治动荡对项目的影响。

政治不稳定

政治不稳定或治安问题可能会吓退投资者,减缓开发进程。

创建占用期,即单位的提前交付,并通过租赁管理公司进行出租,直到土地所有权证书办理完成

避免完全依赖销售。制定情景/应急计划。持有库存并通过租赁管理公司出租

Risks Mitigation Strategies

Economic Fluctuating exchange rates, high inflation, and economic downturns can increase construction costs and reduce investor confidence. Use fixed-price contracts, hedge against currency fluctuations, and diversify funding sources.

Government Policies "Changes in zoning laws, tax policies, or land acquisition regulations may delay projects or increase costs.

Revoking implemented policies without approvals from lenders." "Conduct thorough due diligence, engage with regulatory bodies early, and ensure legal compliance.

Attract a wider range of potential investors/ buyers with focus on both local and overseas investors."

Ensure efficient project management and complete the project on time to minimize the impact of political turmoil on the project

Political Instability Political instability or law and order concerns may deter investors and slow down development. Create occupancy period i.e. early hand over of units and renting through rent management companies until land titles are created

Avoid being completely reliant on sales. Have scenario / contingency planning. Hold inventory and rent through rent management companies| Risks | | Mitigation Strategies |

| :--- | :--- | :--- |

| Economic | Fluctuating exchange rates, high inflation, and economic downturns can increase construction costs and reduce investor confidence. | Use fixed-price contracts, hedge against currency fluctuations, and diversify funding sources. |

| Government Policies | Changes in zoning laws, tax policies, or land acquisition regulations may delay projects or increase costs. <br> Revoking implemented policies without approvals from lenders. | Conduct thorough due diligence, engage with regulatory bodies early, and ensure legal compliance. <br> Attract a wider range of potential investors/ buyers with focus on both local and overseas investors. |

| | | Ensure efficient project management and complete the project on time to minimize the impact of political turmoil on the project |

| Political Instability | Political instability or law and order concerns may deter investors and slow down development. | Create occupancy period i.e. early hand over of units and renting through rent management companies until land titles are created |

| | | Avoid being completely reliant on sales. Have scenario / contingency planning. Hold inventory and rent through rent management companies |

Secure long-term financing at favorable rates and offer flexible payment plans for buyers.

Find an exclusive financial partner for the development that provides mortgage financing to the clients as well| Secure long-term financing at favorable rates and offer flexible payment plans for buyers. |

| :--- |

| Find an exclusive financial partner for the development that provides mortgage financing to the clients as well |

供需不匹配

价格过高的开发项目可能限制买家需求,而供应过剩则可能导致市场饱和。

避免在供应和定价上过于激进,采用有效的营销策略吸引投资者

Risks Mitigation Strategies

Interest Rates Rising interest rates may reduce affordability for buyers and increase project financing costs. "Secure long-term financing at favorable rates and offer flexible payment plans for buyers.

Find an exclusive financial partner for the development that provides mortgage financing to the clients as well"

Mismatch in Supply and Demand Overpriced developments may limit buyer demand, while excessive supply can lead to market saturation. Avoid being over ambitious in supply and price setting and use effective marketing strategies to engage investors| Risks | | Mitigation Strategies |

| :--- | :--- | :--- |

| Interest Rates | Rising interest rates may reduce affordability for buyers and increase project financing costs. | Secure long-term financing at favorable rates and offer flexible payment plans for buyers. <br> Find an exclusive financial partner for the development that provides mortgage financing to the clients as well |

| Mismatch in Supply and Demand | Overpriced developments may limit buyer demand, while excessive supply can lead to market saturation. | Avoid being over ambitious in supply and price setting and use effective marketing strategies to engage investors |

拉合尔的人口统计和地理环境

人口统计 - 拉合尔区

拉合尔区人口统计数据*

拉合尔区

人口

2017

2023

增长率(%)

2035 年(预测)

卡苏尔区

3,454,881

4,084,286

2.83%

5,707,977

拉合尔区

11,119,985

13,004,135

2.64%

17,784,268

南卡纳萨希布区

1,354,986

1,634,871

3.18%

2,380,021

谢赫普拉区

3,460,004

4,049,418

2.66%

5,546,572

总计(拉合尔区)

19,389,856

22,772,710

2.72%

31,418,839

Lahore Division Population

2017 2023 Growth Rate (%) 2035 (Projected)

Kasur District 3,454,881 4,084,286 2.83% 5,707,977

Lahore District 11,119,985 13,004,135 2.64% 17,784,268

Nankana Sahib District 1,354,986 1,634,871 3.18% 2,380,021

Sheikhupura District 3,460,004 4,049,418 2.66% 5,546,572

Total (Lahore Division) 19,389,856 22,772,710 2.72% 31,418,839| Lahore Division | Population | | | |

| :--- | :--- | :--- | :--- | :--- |

| | 2017 | 2023 | Growth Rate (%) | 2035 (Projected) |

| Kasur District | 3,454,881 | 4,084,286 | 2.83% | 5,707,977 |

| Lahore District | 11,119,985 | 13,004,135 | 2.64% | 17,784,268 |

| Nankana Sahib District | 1,354,986 | 1,634,871 | 3.18% | 2,380,021 |

| Sheikhupura District | 3,460,004 | 4,049,418 | 2.66% | 5,546,572 |

| Total (Lahore Division) | 19,389,856 | 22,772,710 | 2.72% | 31,418,839 |

农村人口 - 2023年

城市人口 - 2023年(百万)

Urban Pop -2023

(Million)| Urban Pop -2023 |

| :---: |

| (Million) |

Pakistan's Middle Class as a Percentage of Total Population

2013-14*** 2018-19*** 2019 Onwards

42% 36% Specific data is not available but a further decline is expected due to covid, high inflation and taxes

UNDP's definition of middle class: people whose per capita expenditure is in the range of 25 percent more or less than the median per capita expenditure. | Pakistan's Middle Class as a Percentage of Total Population | | |

| :--- | :--- | :--- |

| 2013-14*** | 2018-19*** | 2019 Onwards |

| 42% | 36% | Specific data is not available but a further decline is expected due to covid, high inflation and taxes |

| UNDP's definition of middle class: people whose per capita expenditure is in the range of 25 percent more or less than the median per capita expenditure. | | |

CBD Punjab is equipped with three dedicated grid stations, for electricity supply for residents and businesses.

The location is expected to use solar photovoltaic (PV) technology.| CBD Punjab is equipped with three dedicated grid stations, for electricity supply for residents and businesses. |

| :--- |

| The location is expected to use solar photovoltaic (PV) technology. |

燃气

天然气供应网络已覆盖。

电信

该地区拥有先进的电信基础设施,配备高速互联网,实现无缝连接和数字访问。

供水

清洁且连续的供水系统满足多样化需求,支持健康的环境。

排水系统

计划建设一个现代化且高效的地下排污系统,以管理废弃物处理并促进清洁。

雨水排水系统

已建立完善的雨水排放网络,以高效管理强降雨。

Electricity "CBD Punjab is equipped with three dedicated grid stations, for electricity supply for residents and businesses.

The location is expected to use solar photovoltaic (PV) technology."

Gas Gas network is available for supply of natural gas.

Telecom The district boasts advanced telecom infrastructure with high-speed internet for seamless connectivity and digital access.

Water Supply A clean, uninterrupted water supply system meets diverse needs, supporting a healthy environment.

Sewerage System A modern and efficient underground sewerage system is planned to manage disposal and promoting cleanliness.

Storm Water Drainage A comprehensive stormwater network is in place to manage heavy rainfall efficiently.| Electricity | CBD Punjab is equipped with three dedicated grid stations, for electricity supply for residents and businesses. <br> The location is expected to use solar photovoltaic (PV) technology. |

| :--- | :--- |

| Gas | Gas network is available for supply of natural gas. |

| Telecom | The district boasts advanced telecom infrastructure with high-speed internet for seamless connectivity and digital access. |

| Water Supply | A clean, uninterrupted water supply system meets diverse needs, supporting a healthy environment. |

| Sewerage System | A modern and efficient underground sewerage system is planned to manage disposal and promoting cleanliness. |

| Storm Water Drainage | A comprehensive stormwater network is in place to manage heavy rainfall efficiently. |

Road Density Only 0.6 meters per capita compared to regional standards of 1.5+ meters.

Vehicle Growth Over 6 million registered vehicles in Lahore as of 2025 with a 51% surge in private vehicles during last 10 years.

Public Transport Access Only 31% of residents have access to transit within 500 meters.

Congestion Average traffic speeds are projected to drop to 13km//h by 2030, reducing labor productivity by an estimated Rs. 150 billion annually.| Road Density | Only 0.6 meters per capita compared to regional standards of 1.5+ meters. |

| :--- | :--- |

| Vehicle Growth | Over 6 million registered vehicles in Lahore as of 2025 with a 51% surge in private vehicles during last 10 years. |

| Public Transport Access | Only 31% of residents have access to transit within 500 meters. |

| Congestion | Average traffic speeds are projected to drop to $13 \mathrm{~km} / \mathrm{h}$ by 2030, reducing labor productivity by an estimated Rs. 150 billion annually. |

Metrobus (Red Line) Covers 27 km, carries 180,000+ passengers daily

Orange Line Metro Train Launched in 2020, spans 27.1km,26 stations, ridership around 250,000/day.

Akbar Chowk Flyover Features 2 flyovers, 10 U-turns, easing congestion for 0.5 million daily commuters

Shahdara Flyover Expected to serve 700,000 vehicles daily, nearing completion in just 7.5 months

Bedian Road Underpass Completed in 2.5 months, improving flow on a corridor used by 200,000+ commuters/day.

Metro Bus Green Line (Extension to Kasur) Under feasibility review to cover over 30 km, connecting 2.5 million people.| Metrobus (Red Line) | Covers 27 km, carries 180,000+ passengers daily |

| :--- | :--- |

| Orange Line Metro Train | Launched in 2020, spans $27.1 \mathrm{~km}, 26$ stations, ridership around 250,000/day. |

| Akbar Chowk Flyover | Features 2 flyovers, 10 U-turns, easing congestion for 0.5 million daily commuters |

| Shahdara Flyover | Expected to serve 700,000 vehicles daily, nearing completion in just 7.5 months |

| Bedian Road Underpass | Completed in 2.5 months, improving flow on a corridor used by 200,000+ commuters/day. |

| Metro Bus Green Line (Extension to Kasur) | Under feasibility review to cover over 30 km, connecting 2.5 million people. |

Overall Impact:

- Infrastructure projects in Lahore (Ring Road, Metro, CPEC) have driven real estate growth, with price hikes of 15-30% in key areas. Suburban developments and transit-oriented properties are seeing the highest demand and price appreciation. New developments have seen the highest growth, with 5-10% annual appreciation.| Overall Impact: |

| :--- |

| - Infrastructure projects in Lahore (Ring Road, Metro, CPEC) have driven real estate growth, with price hikes of 15-30% in key areas. Suburban developments and transit-oriented properties are seeing the highest demand and price appreciation. New developments have seen the highest growth, with $5-10 \%$ annual appreciation. |

Lahore Ring Road Lahore Metro Other Planned Developments (CPEC, New Housing Schemes):

Impact on Expansion Increased demand in areas near the Ring Road like DHA, Bahria Town, and Ferozepur Road. Metro stations, especially along the Orange Line, have spurred commercial and residential developments. CPEC's proximity is attracting investments in industrial zones and suburbs.

Price Growth Property prices near key interchanges (e.g., Babu Sabu, Saggian) have seen increases of 20-30% over the past 5 years. Properties near metro stations like Anarkali, LHC, and G.T. Road see price hikes of 15-25%. Prices in newly developing areas have increased by 10-15% as infrastructure improves.

Real Estate Development Suburban growth in areas like DHA Phase 9 and 10 due to better connectivity. Increased mixed-use developments near stations. Significant real estate activity in areas like DHA Phase 10 and residential schemes along Ring Road.

"Overall Impact:

- Infrastructure projects in Lahore (Ring Road, Metro, CPEC) have driven real estate growth, with price hikes of 15-30% in key areas. Suburban developments and transit-oriented properties are seeing the highest demand and price appreciation. New developments have seen the highest growth, with 5-10% annual appreciation." | | Lahore Ring Road | Lahore Metro | Other Planned Developments (CPEC, New Housing Schemes): |

| :--- | :--- | :--- | :--- |

| Impact on Expansion | Increased demand in areas near the Ring Road like DHA, Bahria Town, and Ferozepur Road. | Metro stations, especially along the Orange Line, have spurred commercial and residential developments. | CPEC's proximity is attracting investments in industrial zones and suburbs. |

| Price Growth | Property prices near key interchanges (e.g., Babu Sabu, Saggian) have seen increases of $20-30 \%$ over the past 5 years. | Properties near metro stations like Anarkali, LHC, and G.T. Road see price hikes of 15-25%. | Prices in newly developing areas have increased by $10-15 \%$ as infrastructure improves. |

| Real Estate Development | Suburban growth in areas like DHA Phase 9 and 10 due to better connectivity. | Increased mixed-use developments near stations. | Significant real estate activity in areas like DHA Phase 10 and residential schemes along Ring Road. |

| Overall Impact: <br> - Infrastructure projects in Lahore (Ring Road, Metro, CPEC) have driven real estate growth, with price hikes of 15-30% in key areas. Suburban developments and transit-oriented properties are seeing the highest demand and price appreciation. New developments have seen the highest growth, with $5-10 \%$ annual appreciation. | | | |

环路周边的新开发项目

巴基斯坦新兴房地产科技

巴基斯坦的房地产科技

概述

巴基斯坦的房地产科技仍处于初级阶段,与全球标准相比,渗透率有限。

房地产行业仍然严重依赖传统的纸质流程,缺乏信任、透明度和数字素养,持续阻碍了技术的普及。

最近,一波新的初创企业和技术驱动的房地产公司开始引入创新的房地产科技解决方案。

这些先行者正在利用数据、自动化和数字平台,逐步改善房地产的搜索、交易和投资机会,推动行业转型。

目前大多数平台专注于房产列表,部分平台正向虚拟导览、数据分析和数字投资模型等更高级服务发展。

精选房地产科技公司

公司名称

解决方案

土地跟踪

人工智能营销与销售

DAO 房地产科技

数字房地产投资

HD360

虚拟导览

Select Prop-Tech Companies

Company Name Solutions

Land Track Al Marketing and Sales

DAO Proptech Digital real estate investment

HD360 Virtual Tours| Select Prop-Tech Companies | |

| :--- | :--- |

| Company Name | Solutions |

| Land Track | Al Marketing and Sales |

| DAO Proptech | Digital real estate investment |

| HD360 | Virtual Tours |

Site Overview

Site Fact Box*

Plot Size: 46,059 Sq. Ft. (10.23 Kanal) Front Road width: ~40 ft.

Frontage: ~176 ft. Permitted use: Commercial

FAR: 1:21 Max Floors: 42

Max Height: 499 Ft. Max BUA: 967,066 Sq. Ft.| Site Overview | |

| :--- | :--- |

| Site Fact Box* | |

| Plot Size: 46,059 Sq. Ft. (10.23 Kanal) | Front Road width: ~40 ft. |

| Frontage: ~176 ft. | Permitted use: Commercial |

| FAR: 1:21 | Max Floors: 42 |

| Max Height: 499 Ft. | Max BUA: 967,066 Sq. Ft. |

当前使用情况

目前是一块空地,边界开放。

无障碍性:

该地点可通过主大道路从北、 west 和 east 方向进入,南侧则通过主 CBD 路和苗圃路进入。地块前的主路有一个潜在的出入口。

B 级购物中心如新华购物中心、堡垒购物中心、大广场购物中心、购物中心 1 号和加勒利亚购物中心距离较近

餐饮店

附近有独立的餐饮店,如麦当劳、肯德基、Pie in the Sky、Lal Qila 和 Salt n Pepper。最近的购物中心餐饮店位于 Mall 1(2 公里)和 Galleria(3.5 公里)

银行

附近有所有主要银行分行,如 HBL、Punjab Tower 银行和 Faysal 银行

企业大厦

Askari 企业大厦(A 级)、Naveena 大厦(A 级)和 Grand Square 购物中心(B 级)均在附近

附近即将开发的项目

CBD 即将有多个项目开发,如 Sirius、Prime、Zameen Arx(综合用途)、Grand Souk(零售)、Regalia(住宅)和 IT City(综合用途)。其他值得关注的即将开发项目包括 AI Fatah E Mall 和 High Q Mall & Office Tower。

Feature Comments

Road Infrastructure Road infrastructure of two-way Main Boulevard Road and Main CBD Road is of premium quality. Nursery Road is a narrower road of adequate quality.

Streetlights Adequate streetlighting with well-lit roads

Hospitals Multiple hospitals present in proximity such as United Christian Hospital, Masood Hospital, and Hameed Latif Hospital

Educational Institutions Multiple educational institutes located within 5 km radius such as Superior Law College, International School, Qarshi University, Lahore Grammer School, and Universal College Lahore

Malls Grade B malls such as Xinhua Mall, Fortress Mall, Grand Square Mall, Mall 1, and Galleria are in close proximity

Eateries Isolated food joints are available in proximity such as McDonalds, KFC, Pie in the Sky, Lal Qila, and Salt n Pepper. Closest F&B outlets in malls is in Mall 1 ( 2 km ) and in Galleria ( 3.5 km )

Banks All major banks branches in proximity such as HBL, Bank of Punjab Tower, and Faysal Bank

Corporate Towers Askari Corporate Tower (Grade A), Naveena Tower (Grade A), and Grand Square Mall (Grade B) are in proximity

Upcoming Developments Nearby Multiple developments are upcoming in CBD such as Sirius, Prime, Zameen Arx as mixed use, Grand Souk (retail), Regalia (residential), and IT City (mixed use). Other notable upcoming developments include AI Fatah E Mall and High Q Mall & Office Tower.| Feature | Comments |

| :--- | :--- |

| Road Infrastructure | Road infrastructure of two-way Main Boulevard Road and Main CBD Road is of premium quality. Nursery Road is a narrower road of adequate quality. |

| Streetlights | Adequate streetlighting with well-lit roads |

| Hospitals | Multiple hospitals present in proximity such as United Christian Hospital, Masood Hospital, and Hameed Latif Hospital |

| Educational Institutions | Multiple educational institutes located within 5 km radius such as Superior Law College, International School, Qarshi University, Lahore Grammer School, and Universal College Lahore |

| Malls | Grade B malls such as Xinhua Mall, Fortress Mall, Grand Square Mall, Mall 1, and Galleria are in close proximity |

| Eateries | Isolated food joints are available in proximity such as McDonalds, KFC, Pie in the Sky, Lal Qila, and Salt n Pepper. Closest F&B outlets in malls is in Mall 1 ( 2 km ) and in Galleria ( 3.5 km ) |

| Banks | All major banks branches in proximity such as HBL, Bank of Punjab Tower, and Faysal Bank |

| Corporate Towers | Askari Corporate Tower (Grade A), Naveena Tower (Grade A), and Grand Square Mall (Grade B) are in proximity |

| Upcoming Developments Nearby | Multiple developments are upcoming in CBD such as Sirius, Prime, Zameen Arx as mixed use, Grand Souk (retail), Regalia (residential), and IT City (mixed use). Other notable upcoming developments include AI Fatah E Mall and High Q Mall & Office Tower. |

AA 级和 BB 级现有办公供应为 ∼2.3\sim 2.3 百万平方英尺,其中大部分集中在古尔伯格地区。

现有办公类型

租赁价格范围(巴基斯坦卢比/平方英尺净价)

平均公共区域维护费(每平方英尺巴基斯坦卢比)

A 级

200-300

45-65

B 级

120-210

35-40

Existing Office Type Lease Rate Range (PKR per sq. ft. net) Average CAM Charges (PKR per sq. ft.)

Grade A 200-300 45-65

Grade B 120-210 35-40| Existing Office Type | Lease Rate Range (PKR per sq. ft. net) | Average CAM Charges (PKR per sq. ft.) |

| :--- | :--- | :--- |

| Grade A | 200-300 | 45-65 |

| Grade B | 120-210 | 35-40 |

办公市场 - 供应

现有及未来供应 - A 级写字楼市场

主要结论

目前拉合尔有四栋 A 级写字楼,其中三栋位于古尔伯格,总计提供 ∼966,000sq\sim 966,000 \mathrm{sq} 平方英尺的净可租赁面积。

鉴于标的地块的位置,我们认为 A 级和 B 级开发更适合该地块。因此,A 级和 B 级的需求已被估算。

A 级写字楼需求计算方法

在进行拉合尔 A 级和 B 级写字楼需求分析时,我们采用了结构化的方法,以确保预测基于可用数据并与巴基斯坦特定市场动态相关。鉴于用于计算写字楼需求的可靠数据存在局限性,且数据未更新至 2024 财年,我们不得不依赖基于假设的预测,这些假设被认为最能准确反映写字楼的真实需求。

虽然人口增长、外国直接投资、空置率、租金趋势、吸纳率、商业增长和政府政策等变量能提供未来写字楼需求的基本判断,但鉴于该地块规模庞大,具备混合开发和多栋建筑的潜力,这些变量无法直接应用于该项目。因此,我们基于假设进行了需求估算,以“白领岗位数量”作为 A 级和 B 级写字楼需求的核心决定因素,因为这些写字楼主要面向企业租户、跨国公司和专业服务公司,这些行业主要雇佣白领员工。

使用了两个独立的数据集来估算拉合尔白领工作的总数,从而推断当前及未来对 A 级和 B 级办公空间的需求。

* Population Census 2023

** Population Data for Punjab Urban, Pakistan Bureau of Statistics (2023)| * Population Census 2023 |

| :--- |

| ** Population Data for Punjab Urban, Pakistan Bureau of Statistics (2023) |

Lahore District's Population - FY23 * 13,004,135

Urban Average Population growth rate 2.64%

Lahore District's Population (FY25) - (Y) 13,699,817

Punjab Urban's Population that would makeup the workforce (15-60 years of age) - (Z)** 38.62%

Lahore's Working Population (Y x Z) 15,290,869

"* Population Census 2023

** Population Data for Punjab Urban, Pakistan Bureau of Statistics (2023)" | Lahore District's Population - FY23 * | 13,004,135 |

| :--- | :--- |

| Urban Average Population growth rate | 2.64% |

| Lahore District's Population (FY25) - (Y) | 13,699,817 |

| Punjab Urban's Population that would makeup the workforce (15-60 years of age) - (Z)** | 38.62% |

| Lahore's Working Population (Y x Z) | 15,290,869 |

| * Population Census 2023 <br> ** Population Data for Punjab Urban, Pakistan Bureau of Statistics (2023) | |

办公市场需求计算

A 级和 B 级办公需求计算方法(续)

D) 需要 A 级和 B 级办公空间的拉合尔工作人口

基于行业知识,城市中总白领劳动力的 5%-10%5 \%-10 \% 需要 A 级和 B 级办公空间。该假设得到了拉合尔目前 A 级和 B 级办公空间极度稀缺且入住率极高的事实的支持。

在本研究中,我们使用了 7.5%7.5 \% (中点)作为假设来计算需要 A 级和 B 级办公空间的工作人口。

FY24

拉合尔总白领工作人口 - (D)

984,174

需要 A 级和 B 级办公空间的劳动人口(占 D 的 7%)

FY24

Lahore's Total White-Collar Working Population - (D) 984,174

Working population requiring Grade A and B Office Space (7% of D) https://cdn.mathpix.com/cropped/2025_08_04_97dc7ee61878588e6167g-044.jpg?height=101&width=249&top_left_y=1276&top_left_x=1427| | FY24 |

| :--- | :--- |

| Lahore's Total White-Collar Working Population - (D) | 984,174 |

| Working population requiring Grade A and B Office Space (7% of D) |  |

(D) - 通过将步骤 A 中计算的“巴基斯坦白领工作占总就业比例”即 18.6%18.6 \% ,乘以步骤 C 中计算的“拉合尔工作人口”即 5,544,454 来估算

(E)拉合尔 A 级和 B 级办公空间需求

拉合尔 A 级和 B 级办公楼的设施设计支持每人 100 平方英尺(毛面积)/ ∼^(∼)90sq\stackrel{\sim}{\sim} 90 \mathrm{sq} 平方英尺(净面积)

拉合尔 A 级和 B 级写字楼的现有可出租总面积显示,目前 A 级和 B 级写字楼的供应远低于潜在需求。

FY24

拉合尔工作人口对 A 级和 B 级办公空间的需求(平方英尺) - ( 72,194 xx9072,194 \times 90 )

16,643,177

FY24

Grade A and B Office Space Demand for Lahore's Working Population (sq. ft.) - ( 72,194 xx90 ) 16,643,177| | FY24 |

| :--- | :--- |

| Grade A and B Office Space Demand for Lahore's Working Population (sq. ft.) - ( $72,194 \times 90$ ) | 16,643,177 |

办公市场需求计算

计算 A 级写字楼需求的方法(续)

F) 预计拉合尔在 FY3O 财年需要 A 级和 B 级办公空间的工作人口

步骤 D 中计算的工作人口已使用步骤 B 中计算的 2.82%的复合年增长率外推至 FY3O 财年。

为了预测 2030 财年所需的办公空间,将拉合尔需要 A 级和 B 级办公空间的工作人口乘以每人 90 平方英尺。

FY24

FY25

FY26

FY27

FY28

FY29

FY30

拉合尔 A 级和 B 级办公空间需求(平方英尺)

6,643,1776,643,177

6,830,4496,830,449

7,023,0007,023,000

7,220,9797,220,979

7,424,5397,424,539

7,633,8377,633,837

7,849,0357,849,035

FY24 FY25 FY26 FY27 FY28 FY29 FY30

Grade A and B Office Space Demand in Lahore's (sq. ft.) 6,643,177 6,830,449 7,023,000 7,220,979 7,424,539 7,633,837 7,849,035| | FY24 | FY25 | FY26 | FY27 | FY28 | FY29 | FY30 |

| :---: | :---: | :---: | :---: | :---: | :---: | :---: | :---: |

| Grade A and B Office Space Demand in Lahore's (sq. ft.) | $6,643,177$ | $6,830,449$ | $7,023,000$ | $7,220,979$ | $7,424,539$ | $7,633,837$ | $7,849,035$ |

供应

可出租净面积(平方英尺)

现有 A 级和 B 级

2,303,0002,303,000

即将到来(已公布)

1,090,0001,090,000

即将到来(未公布)

2,183,7502,183,750

总供应量(十亿)

5,576,7505,576,750

Supply Net Leasable area (Sq. Ft.)

Existing Grade A and B 2,303,000

Upcoming (Announced) 1,090,000

Upcoming (Unannounced) 2,183,750

Total supply (B) 5,576,750| Supply | Net Leasable area (Sq. Ft.) |

| :---: | :---: |

| Existing Grade A and B | $2,303,000$ |

| Upcoming (Announced) | $1,090,000$ |

| Upcoming (Unannounced) | $2,183,750$ |

| Total supply (B) | $5,576,750$ |

需求

可出租净面积(平方英尺)

预计到 2030 财年的需求(A)

7,849,0357,849,035

过剩需求(平方英尺)-(A-B)

2,272,2852,272,285

我们开发项目可满足的需求(平方英尺)

Demand which can be catered by

our development (Sq. Ft.)| Demand which can be catered by |

| :---: |

| our development (Sq. Ft.) |

227,229(超额需求的10%)

227,229

(10% of the excess demand)| 227,229 |

| :---: |

| (10% of the excess demand) |

Demand Net Leasable area (Sq. Ft.)

Estimated Demand by FY'30 (A) 7,849,035

Excess Demand (Sq. Ft.) - (A-B) 2,272,285

"Demand which can be catered by

our development (Sq. Ft.)" "227,229

(10% of the excess demand)"| Demand | Net Leasable area (Sq. Ft.) |

| :---: | :---: |

| Estimated Demand by FY'30 (A) | $7,849,035$ |

| Excess Demand (Sq. Ft.) - (A-B) | $2,272,285$ |

| Demand which can be catered by <br> our development (Sq. Ft.) | 227,229 <br> (10% of the excess demand) |

- Helipad and solar energy - Parking Management

- Gym and fitness facility

- High Speed Elevators - Separate Cargo lift

- Fire/Life Safety System - Earthquake resistant

Major Tenants | - Helipad and solar energy | - Parking Management |

| :--- | :--- |

| - Gym and fitness facility | |

| - High Speed Elevators | - Separate Cargo lift |

| - Fire/Life Safety System | - Earthquake resistant |

| Major Tenants | |

Contour Software

Sendoso

Askari 银行

Servier 制药

预计租户组合

平均入住趋势

关键数据

租赁交易率(净)*

有效租金增长率(复合年增长率)**

资本化率

公共区域维护费(CAM 费用)

销售交易率(净值)*

销售价格增长率(复合年增长率)***

接受率

每平方英尺 300 巴基斯坦卢比

14%

8%

每平方英尺 45.5 巴基斯坦卢比 每平方英尺 35,000 巴基斯坦卢比

9%

不适用

Key Data

Lease Transaction Rate (Net)* Effective Rental Growth (CAGR)** Capitalization Rate CAM Charges Sale Transaction Rate (Net)* Sale Rate Escalation (CAGR)*** Take-Up

PKR 300 per Sq. ft. 14% 8% PKR 45.5 per sq. ft. PKR 35,000 per sq. ft. 9% N/A| Key Data | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Lease Transaction Rate (Net)* | Effective Rental Growth (CAGR)** | Capitalization Rate | CAM Charges | Sale Transaction Rate (Net)* | Sale Rate Escalation (CAGR)*** | Take-Up |

| PKR 300 per Sq. ft. | 14% | 8% | | PKR 45.5 per sq. ft. PKR 35,000 per sq. ft. | 9% | N/A |

案例研究 Naveena N31

于 2022 年底投入运营,当时客户因可用性和良好业绩记录而坚持选择 Tricon 和 Askari。入口位于 MM Alam 路的背面,塔楼之间没有互联。平均楼层面积为 10,000 平方英尺。EY 承租了大约 70%70 \% 的建筑面积,这使他们能够要求较低的租金。

Key Data

Transaction Lease Rate (Net)* Effective Rental Growth (CAGR) Capitalization Rate Cam Charges Sale Transaction Rate (Net)* Sale Rate Escalation (CAGR)** Take-Up

PKR 130 per Sq ft N/A 5% PKR 45 per Sq Ft. PKR 30,000 per Sq. Ft. 14% N/A| Key Data | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Transaction Lease Rate (Net)* | Effective Rental Growth (CAGR) | Capitalization Rate | Cam Charges | Sale Transaction Rate (Net)* | Sale Rate Escalation (CAGR)** | Take-Up |

| PKR 130 per Sq ft | N/A | 5% | PKR 45 per Sq Ft. | PKR 30,000 per Sq. Ft. | 14% | N/A |

即将推出的可比办公项目

项目名称

位置

启动年份

运营年份

评级

(交易)平均销售价格(净价)(巴基斯坦卢比/平方英尺)*

(交易)平均租赁率(净)(巴基斯坦卢比/平方英尺)*

净可租赁面积(平方英尺)

接受 **

一级

帝国企业大厦 1 H

古尔伯格

2020

2025

A

50,000***

300***

~139,952

不适用

Zameen ARX

古尔伯格

2025

不适用

A

46,450

销售模式

~80,000

不适用

101 Tower

古尔伯格

2024

2027

A

48,000*

销售模式

~294,960

11.5%

总计

-

-

514,912

-

平均

~48,150

300

171,637

11.5%

其他可比项

V2 商务中心

松树大道

2022

2025

B

27,000

销售模式

~71,250

55%

Q 高街

松树大道

2024

2028

B

27,000

销售模式

~146,430

25%

Project Name Location Launch Year Operational Year Grading (Transaction) Avg. Sale Rate (Net) (PKR per sq. ft.)* (Transaction) Avg. Lease Rate (Net) (PKR per sq. ft.)* Net Leasable Area (sq. ft) Take Up **

Tier 1

Imperium Corporate Tower 1 H Gulberg 2020 2025 A 50,000*** 300*** ~139,952 N/A

Zameen ARX Gulberg 2025 N/A A 46,450 Sale Model ~80,000 N/A

101 Tower Gulberg 2024 2027 A 48,000* Sale Model ~294,960 11.5%

Total - - 514,912 -

Average ~48,150 300 171,637 11.5%

Other Comparable

V2 Business Centre Pine Avenue 2022 2025 B 27,000 Sale Model ~71,250 55%

Q High Street Pine Avenue 2024 2028 B 27,000 Sale Model ~146,430 25%| Project Name | Location | Launch Year | Operational Year | Grading | (Transaction) Avg. Sale Rate (Net) (PKR per sq. ft.)* | (Transaction) Avg. Lease Rate (Net) (PKR per sq. ft.)* | Net Leasable Area (sq. ft) | Take Up ** |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Tier 1 | | | | | | | | |

| Imperium Corporate Tower 1 H | Gulberg | 2020 | 2025 | A | 50,000*** | 300*** | ~139,952 | N/A |

| Zameen ARX | Gulberg | 2025 | N/A | A | 46,450 | Sale Model | ~80,000 | N/A |

| 101 Tower | Gulberg | 2024 | 2027 | A | 48,000* | Sale Model | ~294,960 | 11.5% |

| Total | | | | | - | - | 514,912 | - |

| Average | | | | | ~48,150 | 300 | 171,637 | 11.5% |

| Other Comparable | | | | | | | | |

| V2 Business Centre | Pine Avenue | 2022 | 2025 | B | 27,000 | Sale Model | ~71,250 | 55% |

| Q High Street | Pine Avenue | 2024 | 2028 | B | 27,000 | Sale Model | ~146,430 | 25% |

即将推出的办公项目

编号

开发名称

距目标地点距离(公里)

1

Zameen Arx

0.5

2

Imperium 企业大厦 1H

4

3

101 Tower

4

4

V3 商务中心

19

4

V3 商务中心

19

5

V2 商务中心

20

6

Q 高街办公大楼

21

No. Name of Development Distance from Subject Site (Km)

1 Zameen Arx 0.5

2 Imperium Corporate Tower 1H 4

3 101 Tower 4

4 V3 Business Center 19

4 V3 Business Center 19

5 V2 Business Center 20

6 Q High Street Office Tower 21| No. | Name of Development | Distance from Subject Site (Km) |

| :--- | :--- | :--- |

| 1 | Zameen Arx | 0.5 |

| 2 | Imperium Corporate Tower 1H | 4 |

| 3 | 101 Tower | 4 |

| 4 | V3 Business Center | 19 |

| 4 | V3 Business Center | 19 |

| 5 | V2 Business Center | 20 |

| 6 | Q High Street Office Tower | 21 |

Key Data

Demand Lease Rate (Net) Effective Rental Growth (CAGR) Capitalization Rate CAM Charges Sale Demand Rate (Net)* Sale Rate Escalation (CAGR) Take-Up

Sale Model Sale Model Sale Model Sale Model PKR 48,000 per sq. ft. N/A 11.5%| Key Data | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Demand Lease Rate (Net) | Effective Rental Growth (CAGR) | Capitalization Rate | CAM Charges | Sale Demand Rate (Net)* | Sale Rate Escalation (CAGR) | Take-Up |

| Sale Model | Sale Model | Sale Model | Sale Model | PKR 48,000 per sq. ft. | N/A | 11.5% |

案例研究 V2 商务中心

毗邻 94 号商务中心,可从主松树大道进入。该建筑设有两层地下停车场和地面停车场。

开发信息

建筑名称

V2 商务中心

等级

B

位置

松树大道

结构

2楼至9楼

可出租净面积

71,250 平方英尺

运营年份

2025

完成百分比

75%

停车配备

每 1000 平方英尺配 1 个停车位

单元面积

450-500 平方英尺

设施和特点

安全和闭路电视监控

高速电梯

消防/生命安全系统

暖通空调

停车管理系统/祈祷区

独立货梯

备用发电

关键数据

需求租赁率(净)

有效租金增长率(复合年增长率)

资本化率

公共区域维护费(CAM 费用)

销售交易率(净值)*

销售率上升**

接受率

销售模式

销售模式

销售模式

销售模式

每平方英尺 27,000 巴基斯坦卢比

17%

55%

Key Data

Demand Lease Rate (Net) Effective Rental Growth (CAGR) Capitalization Rate CAM Charges Sale Transaction Rate (Net)* Sale Rate Escalation** Take-Up

Sale Model Sale Model Sale Model Sale Model 27,000 PKR per sq. ft. 17% 55%| Key Data | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Demand Lease Rate (Net) | Effective Rental Growth (CAGR) | Capitalization Rate | CAM Charges | Sale Transaction Rate (Net)* | Sale Rate Escalation** | Take-Up |

| Sale Model | Sale Model | Sale Model | Sale Model | 27,000 PKR per sq. ft. | 17% | 55% |

Key Data

Demand Lease Rate (Net) Effective Rental Growth (CAGR) Capitalization Rate CAM Charges Sale Transaction Rate (Net)* Sale Rate Escalation Take-Up

Sale Model Sale Model Sale Model Sale Model 27,000 PKR per sq. ft. N/A 25%| Key Data | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Demand Lease Rate (Net) | Effective Rental Growth (CAGR) | Capitalization Rate | CAM Charges | Sale Transaction Rate (Net)* | Sale Rate Escalation | Take-Up |

| Sale Model | Sale Model | Sale Model | Sale Model | 27,000 PKR per sq. ft. | N/A | 25% |

未来供应的大部分将被希望在巴基斯坦为其远程员工开发办公室的国际 IT 公司、多国公司(MNCs)寻求扩展并创建更多区域办公室,以及希望吸引中小企业和自由职业者的联合办公空间所占据。

销售/租赁条款

市场普遍偏好租赁办公空间。然而,开发商在早期阶段倾向于出售办公库存以产生现金流。

不建议理想地出售办公空间,因为这可能影响整体开发质量,但通过良好的设施管理可以减轻这一影响。

销售周期往往比租赁租户入驻时间更长。

租赁期限通常为3到5年,历史年租金增长率在12 14%14 \% 之间。

办公市场 - 分级、质量、设施与特点

办公分级与质量

写字楼资产 - 质量等级

A 级

B+级

B 级

项目内的高质量装饰

高

高

中等

技术解决方案

配备最先进的技术

先进的技术配置

基础技术配置

办公室布局和空间

开放且高效的平面布局

开放且高效的平面布局

至少一半建筑总租赁面积的开放且高效布局

物业管理团队

当然

当然

通常

ESG 标准与可持续性

节能高效与智能建筑管理解决方案,最高评级

视开发情况和地点而定

否

安全服务

优秀

好

平均

公共设施

广泛的

好

平均

服务与设施

宽敞,设计合理,高品质装修

宽敞,设计和装修质量参差不齐

空间充足,设计和装修质量一般至较差

停车服务

员工和访客

员工和访客

高管层

高速电梯

是

是

是

入口大堂

宽敞且设计合理

宽敞且设计合理

好

Office Asset - Quality Scale Grade A Grade B+ Grade B

Quality Finishings within the Project High High Moderate

Technology Solutions Equipped with State-of-the-Art Technology Advanced Technology Setup Basic Technology Setup

Office Layout and space Open and Efficient Floor Plan Open and Efficient Floor Plan Open and Efficient Layout for At Least Half of the Building's GLA

Property Management Team Certainly Certainly Usually

ESG Criteria and Sustainability Energy Efficient and Smart Building Management Solutions, Highest Ratings Possible, depending on the development and location No

Security Services Excellent Good Average

Common facilities Extensive Good Average

Service and Amenities Spacious, well-designed, highquality finishes Spacious, variable quality of design and finishes Adequate space, average to below average design and quality of finishes

Parking Service Employees and Visitors Employees and Visitors C-Level Executives

High Speed Elevators Yes Yes Yes

Entrance Lobby Spacious and Well Designed Spacious and Well Designed Good| Office Asset - Quality Scale | Grade A | Grade B+ | Grade B |

| :--- | :--- | :--- | :--- |

| Quality Finishings within the Project | High | High | Moderate |

| Technology Solutions | Equipped with State-of-the-Art Technology | Advanced Technology Setup | Basic Technology Setup |

| Office Layout and space | Open and Efficient Floor Plan | Open and Efficient Floor Plan | Open and Efficient Layout for At Least Half of the Building's GLA |

| Property Management Team | Certainly | Certainly | Usually |

| ESG Criteria and Sustainability | Energy Efficient and Smart Building Management Solutions, Highest Ratings | Possible, depending on the development and location | No |

| Security Services | Excellent | Good | Average |

| Common facilities | Extensive | Good | Average |

| Service and Amenities | Spacious, well-designed, highquality finishes | Spacious, variable quality of design and finishes | Adequate space, average to below average design and quality of finishes |

| Parking Service | Employees and Visitors | Employees and Visitors | C-Level Executives |

| High Speed Elevators | Yes | Yes | Yes |

| Entrance Lobby | Spacious and Well Designed | Spacious and Well Designed | Good |

推荐设施和特点

零售 商店

健身设施

环境认证(BREEAM/LEED 认证)

24 小时安保

接待休息区

物业管理支持

停车

专属办公区访问

代客泊车

闭路电视系统

办公市场 - 可比分析

销售和租赁价格

销售成交价-净值(巴基斯坦卢比/平方英尺) -A 级

租赁成交率-净(每平方英尺巴基斯坦卢比)-A 级

销售成交价-净值(巴基斯坦卢比/平方英尺) -B 级

租赁成交价-净值(巴基斯坦卢比/平方英尺)-B 级

价格上涨

销售增长复合年增长率(CAGR)百分比 - B 级

公共区域维护费及资本化率

公共区域维护费(每平方英尺巴基斯坦卢比)- A 级

资本化率(%)- A 级

公共区域维护费(每平方英尺巴基斯坦卢比)- B 级

资本化率(%)- B 级

租户组合

租户组合 - 现有 A 级写字楼

租户组合 - 现有 B 级写字楼

零售市场 - 概述

零售市场概览

概述

过去几年,拉合尔的零售市场经历了发展,消费者偏好从传统的零售广场转向大型、国际标准的购物中心。高端零售市场也逐渐发展起来。Dolmen 新增了近约 200 万平方英尺的零售面积,且已有约 90%90 \% 的库存被租出,进一步巩固了拉合尔的零售格局。随着混合开发模式的成功引入,随后是零售带模式的兴起,市场正在进一步演变,这其中包括 Raya Fairways Commercial 和 Lake City Downtown,以及即将推出的零售项目如 Q High Street。其中一些项目还包含办公部分,形成了固定的客户群,进一步增加了人流量。

历史上,拉合尔的零售市场由不同区域的零售街区组成,然而,随着国际品牌进入市场以及零售区优质空间的短缺,过去十年中购物中心的供应量有所增加。Johar Town、Gulberg 和 DHA 被认为是该市的主要零售市场,同时城市不同区域的新开发项目也在进行中。拉合尔目前拥有 Packages、Dolmen Mall 和 Emporium 作为主要的零售开发项目。DHA Raya Fairways 推出的零售空间为传统购物中心引入了一种替代概念,且这一模式正被其他开发项目如 Q High street 所复制。

Average Lease Rate

(PKR per sq. ft.)| Average Lease Rate |

| :---: |

| (PKR per sq. ft.) |

街边零售店

200-500200-500

购物中心(B 级)

200-600200-600

购物中心(A 级)

800-1,200800-1,200

Retail Type "Average Lease Rate

(PKR per sq. ft.)"

Strip Retail Shops 200-500

Shopping Mall (Grade B) 200-600

Shopping Mall (Grade A) 800-1,200| Retail Type | Average Lease Rate <br> (PKR per sq. ft.) |

| :---: | :---: |

| Strip Retail Shops | $200-500$ |

| Shopping Mall (Grade B) | $200-600$ |

| Shopping Mall (Grade A) | $800-1,200$ |

总供应量 - 概要

供应

可出租净面积 (" Sq. Ft. ")^(**)(\text { Sq. Ft. })^{*}

Net Leasable area

(" Sq. Ft. ")^(**)| Net Leasable area |

| :---: |

| $(\text { Sq. Ft. })^{*}$ |

现有 A 级和 B 级

∼4,968,000\sim 4,968,000

即将到来的 A 级和 B 级

∼966,000\sim 966,000

Supply "Net Leasable area

(" Sq. Ft. ")^(**)"

Existing Grade A and B ∼4,968,000

Upcoming Grade A and B ∼966,000| Supply | Net Leasable area <br> $(\text { Sq. Ft. })^{*}$ |

| :---: | :---: |

| Existing Grade A and B | $\sim 4,968,000$ |

| Upcoming Grade A and B | $\sim 966,000$ |

*我们使用了条形商场的估算可出租净面积

零售市场 - 需求

零售市场需求评估

本幻灯片概述了与目标地点相关的指标以及与我们地点相关的零售需求

主题地点周边指标

非常强劲

强劲

中等

低

非常低

目标地点周边的人口密度

目标地点周边的消费能力

附近缺乏竞争

附近的 A 级和 B 级零售品牌

目标地点的可见性

目标地点的可达性

预期目标地点客流量

Indicators around Subject Site Very Strong Strong Moderate Low Very Low

Population Density around Subject Site

Spending Power around Subject Site

Lack of competition nearby

Grade A & B Retail Brands Nearby

Visibility of Subject Site

Accessibility of Subject Site

Expected Footfall at Subject Site | Indicators around Subject Site | Very Strong | Strong | Moderate | Low | Very Low |

| :--- | :--- | :--- | :--- | :--- | :--- |

| Population Density around Subject Site | | | | | |

| Spending Power around Subject Site | | | | | |

| Lack of competition nearby | | | | | |

| Grade A & B Retail Brands Nearby | | | | | |

| Visibility of Subject Site | | | | | |

| Accessibility of Subject Site | | | | | |

| Expected Footfall at Subject Site | | | | | |

世邦魏理仕对目标地点最大零售需求的研究

通常,零售需求估算方法是基于周边人口制定的

然而,基于人口的方法不可行,因为地块的大小和形状不允许大规模零售开发。

然而,超过一百万人居住在该地块5公里半径范围内,这为该地块的零售需求提供了有力支撑。

鉴于中央商务区附近缺乏高质量的零售选择,该地区零售开发成功的可能性很大。

零售市场 - 供应

现有可比零售开发项目

项目名称

位置

启动年份

运营年份

评级

需求销售价格(巴基斯坦卢比/平方英尺)(净价)

需求租赁价格(巴基斯坦卢比/平方英尺)(净价)

总建筑面积(平方英尺)

净可租赁面积(平方英尺)

入住率(%)

Emporium 购物中心

乔哈尔镇

2013

2016

A

仅租赁

800-1,000

~1,820,000

~1,183,000

95%

包裹广场

沃尔顿军营

2012

2017

A

仅租赁

800-1,000

~1,200,000

~601,000

95%

Dolmen 购物中心

DHA 第六期

2022

2024

A

仅租赁

900

~2,000,000

~1,100,000

90%

新华商城

Gulberg III

2006

2010

B

100,000 到 115,000

600

~116,450

~98,983

95%

堡垒广场商城

军区

2008

2014

B

46,000 到 97,000

350-600

~304,710

~152,355

90%

古尔伯格购物中心

古尔伯格

2006

2010

B

仅租赁

200-480

~100,00

~ 70,000

90%

商城 1

古尔伯格

2009

2011

A

仅租赁

550-750

~ 50,000

~ 41,000

80%

大广场购物中心

古尔伯格

2015

2024

B

35,000 到 100,000

300-500

~ 70,000

~ 49,500

5%

彭塔广场

DHA 第二期

2017

2025

B

仅租赁

350

~350,000

~179,516

不适用

总计

-

-

5,911,160

3,475,354

-

平均

-

-

738,895

386,150

80%

Project Name Location Launch Year Operational Year Grading Demand Sale Rate (PKR per sq. ft.) (Net) Demand Lease Rate (PKR per sq. ft.) (Net) Total BUA (sq. ft.) Net Leasable Area (Sq. Ft.) Occupancy (%)

Emporium Mall Johar Town 2013 2016 A Lease Only 800-1,000 ~1,820,000 ~1,183,000 95%

Packages Mall Walton Cantonment 2012 2017 A Lease Only 800-1,000 ~1,200,000 ~601,000 95%

Dolmen Mall DHA phase VI 2022 2024 A Lease Only 900 ~2,000,000 ~1,100,000 90%

Xinhua Mall Gulberg III 2006 2010 B 100,000 to 115,000 600 ~116,450 ~98,983 95%

Fortress Square Mall Cantt 2008 2014 B 46,000 to 97,000 350-600 ~304,710 ~152,355 90%

Gulberg Galleria Gulberg 2006 2010 B Lease Only 200-480 ~100,00 ~ 70,000 90%

Mall 1 Gulberg 2009 2011 A Lease Only 550-750 ~ 50,000 ~ 41,000 80%

Grand Square Mall Gulberg 2015 2024 B 35,000 to 100,000 300-500 ~ 70,000 ~ 49,500 5%

Penta Square DHA phase II 2017 2025 B Lease Only 350 ~350,000 ~179,516 N/A

Total - - 5,911,160 3,475,354 -

Average - - 738,895 386,150 80%| Project Name | Location | Launch Year | Operational Year | Grading | Demand Sale Rate (PKR per sq. ft.) (Net) | Demand Lease Rate (PKR per sq. ft.) (Net) | Total BUA (sq. ft.) | Net Leasable Area (Sq. Ft.) | Occupancy (%) |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Emporium Mall | Johar Town | 2013 | 2016 | A | Lease Only | 800-1,000 | ~1,820,000 | ~1,183,000 | 95% |

| Packages Mall | Walton Cantonment | 2012 | 2017 | A | Lease Only | 800-1,000 | ~1,200,000 | ~601,000 | 95% |

| Dolmen Mall | DHA phase VI | 2022 | 2024 | A | Lease Only | 900 | ~2,000,000 | ~1,100,000 | 90% |

| Xinhua Mall | Gulberg III | 2006 | 2010 | B | 100,000 to 115,000 | 600 | ~116,450 | ~98,983 | 95% |

| Fortress Square Mall | Cantt | 2008 | 2014 | B | 46,000 to 97,000 | 350-600 | ~304,710 | ~152,355 | 90% |

| Gulberg Galleria | Gulberg | 2006 | 2010 | B | Lease Only | 200-480 | ~100,00 | ~ 70,000 | 90% |

| Mall 1 | Gulberg | 2009 | 2011 | A | Lease Only | 550-750 | ~ 50,000 | ~ 41,000 | 80% |

| Grand Square Mall | Gulberg | 2015 | 2024 | B | 35,000 to 100,000 | 300-500 | ~ 70,000 | ~ 49,500 | 5% |

| Penta Square | DHA phase II | 2017 | 2025 | B | Lease Only | 350 | ~350,000 | ~179,516 | N/A |

| Total | | | | | - | - | 5,911,160 | 3,475,354 | - |

| Average | | | | | - | - | 738,895 | 386,150 | 80% |

现有零售开发项目

否

开发名称

距目标地点距离(公里)

1

大广场购物中心

2

2

商城 1

4

3

新华商城

4

4

古尔伯格购物中心

4.5

5

包裹广场

8

6

堡垒广场商城

8

7

Emporium 购物中心

10

8

Penta Square

15

9

Dolmen 购物中心

19

No Name of Development Distance from Subject Site (Km)

1 Grand Square Mall 2

2 Mall 1 4

3 Xinhua Mall 4

4 Gulberg Galleria 4.5

5 Packages Mall 8

6 Fortress Square Mall 8

7 Emporium Mall 10

8 Penta Square 15

9 Dolmen Mall 19| No | Name of Development | Distance from Subject Site (Km) |

| :--- | :--- | :--- |

| 1 | Grand Square Mall | 2 |

| 2 | Mall 1 | 4 |

| 3 | Xinhua Mall | 4 |

| 4 | Gulberg Galleria | 4.5 |

| 5 | Packages Mall | 8 |

| 6 | Fortress Square Mall | 8 |

| 7 | Emporium Mall | 10 |

| 8 | Penta Square | 15 |

| 9 | Dolmen Mall | 19 |

案例研究:Emporium 商场

项目名称

Emporium 购物中心

等级

A

位置

乔哈尔镇

建筑面积

1,820,000 平方英尺

可出租净面积

1,183,000sqft1,183,000 \mathrm{sq} \mathrm{ft}

预计客流量

35,000

启动年份

2013

运营年份

2016

入住率

95%

Project Name Emporium Mall

Grade A

Location Johar Town

Built Up Area 1,820,000 sq ft

Net Leasable Area 1,183,000sqft

Estimated Footfall 35,000

Launch Year 2013

Operational Year 2016

Occupancy 95%| Project Name | Emporium Mall |

| :--- | :--- |

| Grade | A |

| Location | Johar Town |

| Built Up Area | 1,820,000 sq ft |

| Net Leasable Area | $1,183,000 \mathrm{sq} \mathrm{ft}$ |

| Estimated Footfall | 35,000 |

| Launch Year | 2013 |

| Operational Year | 2016 |

| Occupancy | 95% |

租户组合

商场特色

成功因素

- 现场 / 管理办公室

- 便捷的地理位置

- 高速

- 毗邻 Nishat

- 中央空调

- 高效的商场管理

- 独立的游乐区

- 靠近博览中心——有利的客源范围

- 全天候24小时待命维护

- 国际品牌入驻

- 备用发电机

- 娱乐和儿童区

Mall Features Success Factors

- Site / Management Office - Easy access location

- High Speed - Adjacent to Nishat

- Centrally Air Conditioned - Effective mall management

- Separate play zone - Near Expo Centre - favorable catchment

- 24/7 on-call maintenance - International brand presence

- Standby Power Generation - Entertainment and Kids Zone| Mall Features | Success Factors |

| :--- | :--- |

| - Site / Management Office | - Easy access location |

| - High Speed | - Adjacent to Nishat |

| - Centrally Air Conditioned | - Effective mall management |

| - Separate play zone | - Near Expo Centre - favorable catchment |

| - 24/7 on-call maintenance | - International brand presence |

| - Standby Power Generation | - Entertainment and Kids Zone |

案例研究套餐商场

项目名称

包裹广场

等级

A

位置

拉合尔沃尔顿

建筑面积

1,200,000 平方英尺

可出租净面积

601,000sqft601,000 \mathrm{sq} \mathrm{ft}

预计客流量

16,500

启动年份

2012

运营年份

2017

入住率

95%

Project Name Packages Mall

Grade A

Location Lahore Walton

Built Up Area 1,200,000 sq ft

Net Leasable Area 601,000sqft

Estimated Footfall 16,500

Launch Year 2012

Operational Year 2017

Occupancy 95%| Project Name | Packages Mall |

| :--- | :--- |

| Grade | A |

| Location | Lahore Walton |

| Built Up Area | 1,200,000 sq ft |

| Net Leasable Area | $601,000 \mathrm{sq} \mathrm{ft}$ |

| Estimated Footfall | 16,500 |

| Launch Year | 2012 |

| Operational Year | 2017 |

| Occupancy | 95% |

租户组合

零售单元 - 主要租户 - 美食广场 - 游乐区 - 影院

Retail Units

- Anchor Tenants

- Food Court

- Play Area

- Cinema| Retail Units |

| :--- |

| - Anchor Tenants |

| - Food Court |

| - Play Area |

| - Cinema |

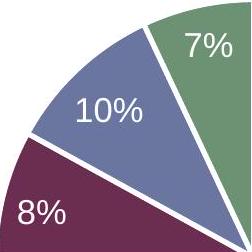

20%

55%

Tenancy Mix

https://cdn.mathpix.com/cropped/2025_08_04_97dc7ee61878588e6167g-080.jpg?height=252&width=252&top_left_y=439&top_left_x=1307 "Retail Units

- Anchor Tenants

- Food Court

- Play Area

- Cinema"

20% 55% | Tenancy Mix | | |

| :--- | :--- | :--- |

|  | | Retail Units <br> - Anchor Tenants <br> - Food Court <br> - Play Area <br> - Cinema |

| 20% | 55% | |

Unit Type Unit Size (sq. ft.) "Lease Rate (PKR/sq

ft/month)"

"Anchor

Stores" 5,000-15,000 300-400

Shops 450-5,000 600-1,000| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq <br> ft/month) |

| :---: | :---: | :---: |

| Anchor <br> Stores | $5,000-15,000$ | $300-400$ |

| Shops | $450-5,000$ | $600-1,000$ |

(需求)每平方英尺租赁价格(净价)

(Demand) Lease Rate Per sq. ft.

(Net)| (Demand) Lease Rate Per sq. ft. |

| :---: |

| (Net) |

巴基斯坦卢比 800-1000

每平方英尺平均 CAM 费用

巴基斯坦卢比200

平均单元面积

2,500平方英尺

"(Demand) Lease Rate Per sq. ft.

(Net)" PKR 800-1000

Average CAM Charges Per sq. ft. PKR 200

Average Unit Size 2,500 sq. ft| (Demand) Lease Rate Per sq. ft. <br> (Net) | PKR 800-1000 |

| :---: | :---: |

| Average CAM Charges Per sq. ft. | PKR 200 |

| Average Unit Size | 2,500 sq. ft |

充足的停车位

高速电梯

中央空调

24 小时不间断电力备用

内部广播系统

受过培训的客户服务

成功因素

从 DHA 和 Model Town 轻松到达

增加办公楼开发,提供折扣价以支持白天的餐饮业

多样的食品选择,餐饮区座位充足

娱乐区和儿童区

有效管理

主要租户

阿迪达斯 Borgan

添柏岚

香奈儿

charcoal edenrobe GulAhmed

Khaadi

CINNABON.

CINNABON.

BODY 商店

junaid

Ja

AMSHED

案例研究 多尔门购物中心

项目名称

Dolmen 购物中心

等级

A

位置

DHA 第 6 期

建筑面积

2,000,000sqft2,000,000 \mathrm{sq} \mathrm{ft}

可出租净面积

1,100,000 平方英尺

启动年份

2022

运营年份

2024年12月

入住率

90%

Project Name Dolmen Mall

Grade A

Location DHA Phase 6

Built Up Area 2,000,000sqft

Net Leasable Area 1,100,000 sq. ft.

Launch Year 2022

Operational Year December 2024

Occupancy 90%| Project Name | Dolmen Mall |

| :--- | :--- |

| Grade | A |

| Location | DHA Phase 6 |

| Built Up Area | $2,000,000 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | 1,100,000 sq. ft. |

| Launch Year | 2022 |

| Operational Year | December 2024 |

| Occupancy | 90% |

Unit Type Unit Size (sq. ft.) "Lease Rate

(PKR/sq ft/month)"

"Anchor

Stores" 20,000-25,000 PKR 600-1,200

Shops 3,000-5,000 | Unit Type | Unit Size (sq. ft.) | Lease Rate <br> (PKR/sq ft/month) |

| :---: | :---: | :---: |

| Anchor <br> Stores | $20,000-25,000$ | PKR $600-1,200$ |

| Shops | $3,000-5,000$ | |

(需求)每平方英尺平均租赁费率(净)

(Demand) Average Lease Rate

per Sq. Ft. (Net)| (Demand) Average Lease Rate |

| :--- |

| per Sq. Ft. (Net) |

巴基斯坦卢比 900

每平方英尺平均公共区域维护费(CAM)

Average CAM Charges per Sq.

Ft.| Average CAM Charges per Sq. |

| :--- |

| Ft. |

TBD

平均单元面积(最小-最大)

4,000 平方英尺

"(Demand) Average Lease Rate

per Sq. Ft. (Net)" PKR 900

"Average CAM Charges per Sq.

Ft." TBD

Average Unit Size (min-max) 4,000 sq. ft.| (Demand) Average Lease Rate <br> per Sq. Ft. (Net) | PKR 900 |

| :--- | :--- |

| Average CAM Charges per Sq. <br> Ft. | TBD |

| Average Unit Size (min-max) | 4,000 sq. ft. |

商场特色

成功因素

地点 / 管理

与 Gulberg 商场相比,办公区竞争较少

充足的停车位

国际停车品牌存在

高速

拉合尔最大的电梯商场

中央空调

在巴基斯坦市场建立了良好的声誉

全天候供电

多样的快餐选择

内部

公告美食广场区域有充足的座位

训练有素的客户

提供娱乐服务区

主要租户

户外装备商

J. Khaadi

IWC

沙夫豪森

KIKO

米兰

新华商城案例研究

项目名称

新华商城

等级

B

位置

Gulberg III

建筑面积 - 零售

116,450sqft116,450 \mathrm{sq} \mathrm{ft}

可出租净面积

98,983 平方英尺

预计客流量

3,000

启动年份

2006

运营年份

2010

入住率

95%

Project Name Xinhua Mall

Grade B

Location Gulberg III

Built Up Area - Retail 116,450sqft

Net Leasable Area 98,983 sq. ft.

Estimated Footfall 3,000

Launch Year 2006

Operational Year 2010

Occupancy 95%| Project Name | Xinhua Mall |

| :--- | :--- |

| Grade | B |

| Location | Gulberg III |

| Built Up Area - Retail | $116,450 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | 98,983 sq. ft. |

| Estimated Footfall | 3,000 |

| Launch Year | 2006 |

| Operational Year | 2010 |

| Occupancy | 95% |

单位类型

单位面积(平方英尺)

Unit Size (sq.

ft.)| Unit Size (sq. |

| :---: |

| ft.) |

PKR 100,000 to

115,000| PKR 100,000 to |

| :--- |

| 115,000 |

(需求)每平方英尺租赁价格(净价)

(Demand) Lease Rate Per sq. ft.

(Net)| (Demand) Lease Rate Per sq. ft. |

| :--- |

| (Net) |

巴基斯坦卢比 600

每平方英尺平均 CAM 费用

巴基斯坦卢比 88

平均单元面积

1,000 平方英尺

(Demand) Sale Rate Per sq. ft. (Net) "PKR 100,000 to

115,000"

"(Demand) Lease Rate Per sq. ft.

(Net)" PKR 600

Average CAM Charges Per sq. ft. PKR 88

Average Unit Size 1,000 sq. ft| (Demand) Sale Rate Per sq. ft. (Net) | PKR 100,000 to <br> 115,000 |

| :--- | :--- |

| (Demand) Lease Rate Per sq. ft. <br> (Net) | PKR 600 |

| Average CAM Charges Per sq. ft. | PKR 88 |

| Average Unit Size | 1,000 sq. ft |

案例研究 堡垒广场购物中心

项目名称

堡垒广场商城

等级

B

位置

军区

建筑面积

304,710sqft304,710 \mathrm{sq} \mathrm{ft}

可出租净面积

152,355 平方英尺

预期客流量

9,000

启动年份

2008

运营年份

2014

入住率

90%

Project Name Fortress Square Mall

Grade B

Location Cantt

Built Up Area 304,710sqft

Net Leasable Area 152,355 sq. ft.

Expected Footfall 9,000

Launch Year 2008

Operational Year 2014

Occupancy 90%| Project Name | Fortress Square Mall |

| :--- | :--- |

| Grade | B |

| Location | Cantt |

| Built Up Area | $304,710 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | 152,355 sq. ft. |

| Expected Footfall | 9,000 |

| Launch Year | 2008 |

| Operational Year | 2014 |

| Occupancy | 90% |

单位类型

单位面积(平方英尺)

租赁价格(巴基斯坦卢比/平方英尺/月)

主力店

2,000-8,000

400-500

商铺

300-1,600

450-600

(需求)每平方英尺销售率(净额)

巴基斯坦卢比46,000至97,000

(需求)每平方英尺租赁率(净额)

PKR 350-600

平均 CAM 费用

每平方英尺 PKR 225

平均单元面积

750 平方英尺

Unit Type Unit Size (sq. ft.) Lease Rate (PKR/sq ft/month)

Anchor Stores 2,000-8,000 400-500

Shops 300-1,600 450-600

(Demand) Sale Rate Per sq. ft. (Net) PKR 46,000 to 97,000

(Demand) Lease Rate Per sq. ft. (Net) PKR 350-600

Average CAM Charges PKR 225 Per sq. ft.

Average Unit Size 750 sq. ft| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq ft/month) |

| :--- | :--- | :--- |

| Anchor Stores | 2,000-8,000 | 400-500 |

| Shops | 300-1,600 | 450-600 |

| (Demand) Sale Rate Per sq. ft. (Net) | | PKR 46,000 to 97,000 |

| (Demand) Lease Rate Per sq. ft. (Net) | | PKR 350-600 |

| Average CAM Charges | | PKR 225 Per sq. ft. |

| Average Unit Size | | 750 sq. ft |

Project Name Galleria

Grade B

Location Gulberg

Built Up Area ∼100,000sqft

Net Leasable Area ~70,000 sq. ft.

Launch Year 2006

Operational Year 2010

Occupancy 90%

Unit Type Unit Size (sq. ft.) Lease Rate (PKR/sq ft/month)

Anchor Stores 1,500-2,000 400-480

Shops 500-600 200-250

(Demand) Average Sale Rate Per sq. ft. (Net) N/A

(Demand) Lease Rate Per sq. ft. (Net) PKR 200-480

Average CAM Charges PKR 90 Per sq. ft.

Average Unit Size 500 sq. ft| Project Name | | Galleria |

| :--- | :--- | :--- |

| Grade | | B |

| Location | | Gulberg |

| Built Up Area | | $\sim 100,000 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | | ~70,000 sq. ft. |

| Launch Year | | 2006 |

| Operational Year | | 2010 |

| Occupancy | | 90% |

| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq ft/month) |

| Anchor Stores | 1,500-2,000 | 400-480 |

| Shops | 500-600 | 200-250 |

| (Demand) Average Sale Rate Per sq. ft. (Net) | | N/A |

| (Demand) Lease Rate Per sq. ft. (Net) | | PKR 200-480 |

| Average CAM Charges | | PKR 90 Per sq. ft. |

| Average Unit Size | | 500 sq. ft |

商场特色

地点 /

管理办公室

充足的停车位

高速电梯

独立的游乐区

全天候 24 小时维修服务

备用发电

成功因素

从骑兵路和监狱路轻松到达的位置

有效的商场管理

国际品牌影响力

现代且美观的设计

SANA SAFINAZ Lawrencepur

SHELBY’S 高端男士沙龙

SAFWA

[Y19]=[V]

KHADIJAH SHAH

案例研究 商场 1

项目名称

商城 1

等级

A

位置

古尔伯格

建筑面积

50,000sqft50,000 \mathrm{sq} \mathrm{ft}

可出租净面积

41,000 平方英尺

启动年份

2009

运营年份

2011

入住率

80%

单位类型

单位面积(平方英尺)

租赁价格(巴基斯坦卢比/平方英尺/月)

主力店

2,200

650-750(估计)

商铺

1,000-1,400

550-650(估计)

(需求)每平方英尺平均销售价格(净价)

租赁模式

(需求)每平方英尺租赁率(净额)

估计为 PKR 550-750

平均 CAM 费用

不适用

平均单元面积

1,200 平方英尺

Project Name Mall 1

Grade A

Location Gulberg

Built Up Area 50,000sqft

Net Leasable Area 41,000 sq. ft.

Launch Year 2009

Operational Year 2011

Occupancy 80%

Unit Type Unit Size (sq. ft.) Lease Rate (PKR/sq ft/month)

Anchor Stores 2,200 650-750 (estimated)

Shops 1,000-1,400 550-650 (estimated)

(Demand) Average Sale Rate Per sq. ft. (Net) Lease model

(Demand) Lease Rate Per sq. ft. (Net) PKR 550-750 (estimated)

Average CAM Charges N/A

Average Unit Size 1,200 Sq. ft.| Project Name | | Mall 1 |

| :--- | :--- | :--- |

| Grade | | A |

| Location | | Gulberg |

| Built Up Area | | $50,000 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | | 41,000 sq. ft. |

| Launch Year | | 2009 |

| Operational Year | | 2011 |

| Occupancy | | 80% |

| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq ft/month) |

| Anchor Stores | 2,200 | 650-750 (estimated) |

| Shops | 1,000-1,400 | 550-650 (estimated) |

| (Demand) Average Sale Rate Per sq. ft. (Net) | | Lease model |

| (Demand) Lease Rate Per sq. ft. (Net) | | PKR 550-750 (estimated) |

| Average CAM Charges | | N/A |

| Average Unit Size | | 1,200 Sq. ft. |

案例研究 大广场购物中心

项目名称

大广场购物中心

等级

B

位置

古尔伯格

建筑面积

70,000sqft70,000 \mathrm{sq} \mathrm{ft}

可出租净面积

49,500 平方英尺

启动年份

2015

运营年份

2024

入住率

5%

单位类型

单位面积(平方英尺)

租赁价格(巴基斯坦卢比/平方英尺/月)

商铺

300-900

300-500

每平方英尺销售率(净额)

巴基斯坦卢比 35,000 至 100,000

(需求)每平方英尺租赁率(净额)

巴基斯坦卢比 300 至 500

平均 CAM 费用

每平方英尺巴基斯坦卢比 57

平均单元面积

600 平方英尺

Project Name Grand Square Mall

Grade B

Location Gulberg

Built Up Area 70,000sqft

Net Leasable Area 49,500 sq. ft.

Launch Year 2015

Operational Year 2024

Occupancy 5%

Unit Type Unit Size (sq. ft.) Lease Rate (PKR/sq ft/month)

Shops 300-900 300-500

Sale Rate Per sq. ft. (Net) PKR 35,000 to 100,000

(Demand) Lease Rate Per sq. ft. (Net) PKR 300 to 500

Average CAM Charges PKR 57 Per sq. ft.

Average Unit Size 600 sq. ft| Project Name | | Grand Square Mall |

| :--- | :--- | :--- |

| Grade | | B |

| Location | | Gulberg |

| Built Up Area | | $70,000 \mathrm{sq} \mathrm{ft}$ |

| Net Leasable Area | | 49,500 sq. ft. |

| Launch Year | | 2015 |

| Operational Year | | 2024 |

| Occupancy | | 5% |

| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq ft/month) |

| Shops | 300-900 | 300-500 |

| Sale Rate Per sq. ft. (Net) | | PKR 35,000 to 100,000 |

| (Demand) Lease Rate Per sq. ft. (Net) | | PKR 300 to 500 |

| Average CAM Charges | | PKR 57 Per sq. ft. |

| Average Unit Size | | 600 sq. ft |

租户组合

目前只有 5%5 \% 的零售空间被 Habib 银行有限公司占用

其余空间未被占用

商场特色

-

地点 /

管理

办公楼

-

充足的停车位

停车

-

高速

电梯

-

待机功率

世代

Mall Features

- Site /

Management

Office

- Ample Car

Parking

- High Speed

Elevators

- Standby Power

Generation

| Mall Features | |

| :--- | :--- |

| - | Site / |

| | Management |

| | Office |

| - | Ample Car |

| | Parking |

| - | High Speed |

| | Elevators |

| - | Standby Power |

| | Generation |

| | |

成功因素

便捷的地理位置

极佳的可见度

主要租户

HBL

HABIB BANK

sum_(n=0)^(n)\sum_{n=0}^{n}

案例研究 Penta Square

项目名称

五角广场

等级

B

位置

DHA 第二期

建筑面积

350,000平方英尺

可出租净面积

179,516平方英尺

启动年份

2017

运营年份

2025年第一季度

入住率

不适用,仅 Imtiaz 运营

单位类型

单位面积(平方英尺)

租赁价格(巴基斯坦卢比/平方英尺/月)

主力店

2,500-7,000

巴基斯坦卢比350

商铺

1,500-2,000

(需求)每平方英尺平均租赁价格(净价)

巴基斯坦卢比350

每平方英尺平均 CAM 费用

65

预计平均单位规模

1500sq.ft1500 \mathrm{sq} . \mathrm{ft}

Project Name Penta Square

Grade B

Location DHA Phase 2

Built Up Area 350,000 sq ft

Net Leasable Area 179,516 sq. ft.

Launch Year 2017

Operational Year Q1 2025

Occupancy N/A Only Imtiaz Operational

Unit Type Unit Size (sq. ft.) Lease Rate (PKR/sq ft/month)

Anchor Stores 2,500-7,000 PKR 350

Shops 1,500-2,000

(Demand) Average Lease Rate Per sq. ft. (Net) PKR 350

Average CAM Charges Per sq. ft. 65

Estimated Average Unit Size 1500sq.ft| Project Name | | Penta Square |

| :--- | :--- | :--- |

| Grade | | B |

| Location | | DHA Phase 2 |

| Built Up Area | | 350,000 sq ft |

| Net Leasable Area | | 179,516 sq. ft. |

| Launch Year | | 2017 |

| Operational Year | | Q1 2025 |

| Occupancy | | N/A Only Imtiaz Operational |

| Unit Type | Unit Size (sq. ft.) | Lease Rate (PKR/sq ft/month) |

| Anchor Stores | 2,500-7,000 | PKR 350 |

| Shops | 1,500-2,000 | |

| (Demand) Average Lease Rate Per sq. ft. (Net) | | PKR 350 |

| | Average CAM Charges Per sq. ft. | 65 |

| Estimated Average Unit Size | | $1500 \mathrm{sq} . \mathrm{ft}$ |

租户组合

目前只有 Imtiaz 和 Loafology 在运营

已与几家品牌签署谅解备忘录,可能很快投入运营

商场特色

场地 / 管理办公室

充足的停车位

高速电梯

中央空调

独立的游乐区

全天候 24 小时维修服务

备用发电

成功因素

吸引富裕的 DHA 居民

超级/大型超市

美食广场

儿童游乐区

主要租户

已签署的谅解备忘录

即将到来的同类零售开发项目

项目名称

位置

启动年份

运营年份

评级

需求平均销售率(巴基斯坦卢比每平方英尺)(净值)

需求 平均租金率(巴基斯坦卢比/平方英尺)(净价)

总建筑面积(平方英尺)

净可租赁面积(平方英尺)

% 已售出

古尔伯格市中心

古尔伯格

2021

不适用

B

仅租赁模式

不适用

~ 148,076

~ 148,076

不适用

Swiss Mall

古尔伯格

2022

不适用

B

51,000

不适用

~ 110,000

~ 75,000

不适用

麦迪逊广场

古尔伯格

2021

不适用

B

110,000

不适用

~ 130,000

~ 90,000

不适用

总计

-

-

388,076

313,076

-

平均

80,500

-

129,359

104,359

-

Project Name Location Launch Year Operational Year Grading Demand Avg. Sale Rate (PKR per sq. ft.) (Net) Demand Avg. Lease Rate (PKR per sq. ft.) (Net) Total BUA (sq. ft.) Net Leasable Area (Sq. Ft.) % Sold

Gulberg City Center Gulberg 2021 N/A B Lease Model Only N/A ~ 148,076 ~ 148,076 N/A

Swiss Mall Gulberg 2022 N/A B 51,000 N/A ~ 110,000 ~ 75,000 N/A

Madisson Square Gulberg 2021 N/A B 110,000 N/A ~ 130,000 ~ 90,000 N/A

Total - - 388,076 313,076 -

Average 80,500 - 129,359 104,359 -| Project Name | Location | Launch Year | Operational Year | Grading | Demand Avg. Sale Rate (PKR per sq. ft.) (Net) | Demand Avg. Lease Rate (PKR per sq. ft.) (Net) | Total BUA (sq. ft.) | Net Leasable Area (Sq. Ft.) | % Sold |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| Gulberg City Center | Gulberg | 2021 | N/A | B | Lease Model Only | N/A | ~ 148,076 | ~ 148,076 | N/A |

| Swiss Mall | Gulberg | 2022 | N/A | B | 51,000 | N/A | ~ 110,000 | ~ 75,000 | N/A |

| Madisson Square | Gulberg | 2021 | N/A | B | 110,000 | N/A | ~ 130,000 | ~ 90,000 | N/A |

| Total | | | | | - | - | 388,076 | 313,076 | - |

| Average | | | | | 80,500 | - | 129,359 | 104,359 | - |

即将到来的零售开发项目

否

开发名称

距目标地点距离(公里)

1

Swiss Mall

2.5

2

麦迪逊广场

3

3

古尔伯格市中心

3.5

No Name of Development Distance from Subject Site (Km)

1 Swiss Mall 2.5

2 Madison Square 3

3 Gulberg City Centre 3.5| No | Name of Development | Distance from Subject Site (Km) |

| :--- | :--- | :--- |

| 1 | Swiss Mall | 2.5 |

| 2 | Madison Square | 3 |

| 3 | Gulberg City Centre | 3.5 |

古尔伯格市中心案例研究

项目名称

古尔伯格市中心

等级

B

位置

古尔伯格

建筑面积

∼\sim 148,076 平方英尺

可出租净面积

~118,461

启动年份

2021

运营年份

不适用

入住率

不适用

Project Name Gulberg City Centre

Grade B

Location Gulberg

Built Up Area ∼ 148,076 sq ft

Net Leasable Area ~118,461

Launch Year 2021

Operational Year N/A

Occupancy N/A| Project Name | Gulberg City Centre |

| :--- | :--- |

| Grade | B |

| Location | Gulberg |

| Built Up Area | $\sim$ 148,076 sq ft |

| Net Leasable Area | ~118,461 |

| Launch Year | 2021 |

| Operational Year | N/A |

| Occupancy | N/A |

(需求)每平方英尺平均销售价格(净价)

PKR 145,000

(需求)每平方英尺平均租赁价格(净价)

不适用

平均 CAM 费用

TBD

平均单元面积

800 平方英尺

(Demand) Average Sale Rate Per sq. ft. (Net) PKR 145,000

(Demand) Average Lease Rate Per sq. ft. (Net) N/A

Average CAM Charges TBD

Average Unit Size 800 sq. ft.| (Demand) Average Sale Rate Per sq. ft. (Net) | PKR 145,000 |

| :--- | :--- |

| (Demand) Average Lease Rate Per sq. ft. (Net) | N/A |

| Average CAM Charges | TBD |

| Average Unit Size | 800 sq. ft. |

市场推广的购物中心特色

地点 /

管理办公室

充足的停车位

高速电梯

中央空调

全天候 24 小时维修服务

备用发电

游泳池、健身房、水疗中心

未来成功因素

从主大道 Gulberg 轻松到达的位置

连接至酒店开发项目(Radisson)

单位类型

单位面积(平方英尺)

Unit Size (sq.

ft.)| Unit Size (sq. |

| :---: |

| ft.) |

Project Name Swiss Mall

Grade B

Location Gulberg

Built Up Area 110,000 sq. ft.

Net Leasable Area 75,000 sq. ft.

Launch Year 2022

Operational Year N/A

Occupancy N/A| Project Name | Swiss Mall |

| :--- | :--- |

| Grade | B |

| Location | Gulberg |

| Built Up Area | 110,000 sq. ft. |

| Net Leasable Area | 75,000 sq. ft. |

| Launch Year | 2022 |

| Operational Year | N/A |

| Occupancy | N/A |

(需求)每平方英尺平均销售价格(净价)

51,000 巴基斯坦卢比

(需求)每平方英尺平均租赁价格(净价)

不适用

平均 CAM 费用

TBD

平均单元面积

435 平方英尺

(Demand) Average Sale Rate Per sq. ft. (Net) PKR 51,000

(Demand) Average Lease Rate Per sq. ft. (Net) N/A

Average CAM Charges TBD

Average Unit Size 435 sq. ft| (Demand) Average Sale Rate Per sq. ft. (Net) | PKR 51,000 |

| :--- | :--- |

| (Demand) Average Lease Rate Per sq. ft. (Net) | N/A |

| Average CAM Charges | TBD |

| Average Unit Size | 435 sq. ft |

- Site / Management Office

- Ample Car Parking

- High Speed Elevators

- Centrally Air Conditioned

- 24/7 on-call maintenance

- Standby Power Generation

- Swimming pool, gym, spa| - Site / Management Office |

| :--- |

| - Ample Car Parking |

| - High Speed Elevators |

| - Centrally Air Conditioned |

| - 24/7 on-call maintenance |

| - Standby Power Generation |

| - Swimming pool, gym, spa |

- 位置便利,位于 M.M. Alam 路,Gulberg 区,能见度高 - 与酒店开发项目(瑞士国际酒店)相连

- Easy access location and great visibility at M.M. Alam Road, Gulberg

- Connected to hotel development (Swiss International)| - Easy access location and great visibility at M.M. Alam Road, Gulberg |

| :--- |

| - Connected to hotel development (Swiss International) |

Marketed Mall Features Future Success Factors

"- Site / Management Office

- Ample Car Parking

- High Speed Elevators

- Centrally Air Conditioned

- 24/7 on-call maintenance

- Standby Power Generation

- Swimming pool, gym, spa" "- Easy access location and great visibility at M.M. Alam Road, Gulberg

- Connected to hotel development (Swiss International)"| Marketed Mall Features | Future Success Factors |

| :--- | :--- |

| - Site / Management Office <br> - Ample Car Parking <br> - High Speed Elevators <br> - Centrally Air Conditioned <br> - 24/7 on-call maintenance <br> - Standby Power Generation <br> - Swimming pool, gym, spa | - Easy access location and great visibility at M.M. Alam Road, Gulberg <br> - Connected to hotel development (Swiss International) |

单位类型

单位面积(平方英尺)

Unit Size (sq.

ft.)| Unit Size (sq. |

| :---: |

| ft.) |

Unit Type "Unit Size (sq.

ft.)" "Lease Rate (PKR/sq

ft/month)"

Shops 250-620 N/A| Unit Type | Unit Size (sq. <br> ft.) | Lease Rate (PKR/sq <br> ft/month) |

| :---: | :---: | :---: |

| Shops | $250-620$ | N/A |

麦迪逊广场案例研究

项目名称

麦迪逊广场购物中心

等级

B

位置

古尔伯格

建筑面积

130,000 平方英尺

可出租净面积

90,000 平方英尺

启动年份

2021

运营年份

不适用

入住率

不适用

Project Name Madison Square Mall

Grade B

Location Gulberg

Built Up Area 130,000 sq. ft.

Net Leasable Area 90,000 sq. ft.

Launch Year 2021

Operational Year N/A

Occupancy N/A| Project Name | Madison Square Mall |

| :--- | :--- |

| Grade | B |

| Location | Gulberg |

| Built Up Area | 130,000 sq. ft. |

| Net Leasable Area | 90,000 sq. ft. |

| Launch Year | 2021 |

| Operational Year | N/A |

| Occupancy | N/A |

单位类型

单位面积(平方英尺)

Unit Size (sq.

ft.)| Unit Size (sq. |

| :---: |

| ft.) |

Unit Type "Unit Size (sq.

ft.)" "Lease Rate (PKR/sq

ft/month)"

Shops 350-450 N/A| Unit Type | Unit Size (sq. <br> ft.) | Lease Rate (PKR/sq <br> ft/month) |

| :---: | :---: | :---: |

| Shops | $350-450$ | N/A |

(需求)每平方英尺平均销售价格(净价)

巴基斯坦卢比 110,000

(需求)每平方英尺平均租赁价格(净价)

不适用

平均 CAM 费用

TBD

平均单元面积

400 平方英尺

(Demand) Average Sale Rate Per sq. ft. (Net) PKR 110,000

(Demand) Average Lease Rate Per sq. ft. (Net) N/A

Average CAM Charges TBD

Average Unit Size 400 sq. ft| (Demand) Average Sale Rate Per sq. ft. (Net) | PKR 110,000 |

| :--- | :--- |

| (Demand) Average Lease Rate Per sq. ft. (Net) | N/A |

| Average CAM Charges | TBD |

| Average Unit Size | 400 sq. ft |

市场推广的购物中心特色

地点 /

管理办公室

高速电梯

中央空调

独立的游乐区

全天候 24 小时维修服务

备用发电

未来成功因素

位于 Gulberg 的 Mahmud Kasuri 路,交通便利,视野开阔

与酒店开发(Swiss)相连 国际)

奢侈服装品牌入驻

零售市场主要收获

成功因素

消费者偏好已从传统零售广场转向大型国际标准购物中心

国际品牌进入市场以及零售区域优质空间的短缺。

该地区缺乏零售商场,加上人口密度高,表明优质开发项目将吸引可观的人流。

应提供充足的停车位,以确保良好的客户体验和项目的成功。

库存

现有的 AA 级和 BB 级零售提供 ∼4.96Mn\sim 4.96 \mathrm{Mn} 平方英尺的净可租赁面积。

Developers' Margin*

20%-25%

Rental Escalation

10%

Apartment Construction Cost Grade A

Core and Shell: PKR 8,000-10,000 Finishing and MEP: PKR 6,000-8,000

Apartment Construction Cost Grade B

Core and Shell: PKR 6,000-8,000 Finishing and MEP: PKR 4,000-6,000

Average Inventory Take Up

20% per Annum| Developers' Margin* |

| :--- |

| 20%-25% |

| Rental Escalation |

| 10% |

| Apartment Construction Cost Grade A |

| Core and Shell: PKR 8,000-10,000 Finishing and MEP: PKR 6,000-8,000 |

| Apartment Construction Cost Grade B |

| Core and Shell: PKR 6,000-8,000 Finishing and MEP: PKR 4,000-6,000 |

| Average Inventory Take Up |

| 20% per Annum |

Key Data

Average Gross Sale Rate Sale Rate Escalation (CAGR) Occupancy (%) Inventory Sold (%) Take-Up

PKR 30,000/Sq. Ft. 5% 85 % 100% Sold out| Key Data | | | | |

| :--- | :--- | :--- | :--- | :--- |

| Average Gross Sale Rate | Sale Rate Escalation (CAGR) | Occupancy (%) | Inventory Sold (%) | Take-Up |

| PKR 30,000/Sq. Ft. | 5% | 85 % | 100% | Sold out |

案例研究 牡蛎苑

物业详情

牡蛎庭位于 MM Alam 路附近,靠近连接学院路和监狱路的 Guru Mangat 路。通道仅有 20 英尺宽。

- Gym - 24/7 CCTV

- Swimming Pool Surveillance

- Standby Power - Earthquake Resistant

Generation - Garden / Play Area

- Community

mosque | - Gym | - 24/7 CCTV |

| :--- | :--- |

| - Swimming Pool | Surveillance |

| - Standby Power | - Earthquake Resistant |

| Generation | - Garden / Play Area |

| - Community | |

| mosque | |

单元类型

Unit

Type| Unit |

| :---: |

| Type |

单元面积(平方英尺)

Unit Size

(sq. ft.)| Unit Size |

| :---: |

| (sq. ft.) |

单元数量(#)

No. of

Units (#)| No. of |

| :---: |

| Units (#) |

销售单位(数量)

Units

Sold (#)| Units |

| :---: |

| Sold (#) |

占总单位类型的百分比

% of Total

Unit Types| % of Total |

| :---: |

| Unit Types |

一居室

1,136-1,3691,136-1,369

35

35

100%100 \%

2 卧室

1,764-2,2901,764-2,290

49

49

100%100 \%

3 卧室

3,240-3,2503,240-3,250

14

14

100%100 \%

"Unit

Type" "Unit Size

(sq. ft.)" "No. of

Units (#)" "Units

Sold (#)" "% of Total

Unit Types"

1-Bed 1,136-1,369 35 35 100%

2-Bed 1,764-2,290 49 49 100%

3-Bed 3,240-3,250 14 14 100%| Unit <br> Type | Unit Size <br> (sq. ft.) | No. of <br> Units (#) | Units <br> Sold (#) | % of Total <br> Unit Types |

| :---: | :---: | :---: | :---: | :---: |

| 1-Bed | $1,136-1,369$ | 35 | 35 | $100 \%$ |

| 2-Bed | $1,764-2,290$ | 49 | 49 | $100 \%$ |

| 3-Bed | $3,240-3,250$ | 14 | 14 | $100 \%$ |

关键数据

分期付款计划(不适用)

平均毛销售价格

销售增长率(复合年增长率)

入住率(%)

库存销售率(%)

接受率

- 100% 售罄 - 仅在转售市场有售

- 100% Sold Out

- Only available in resale| - 100% Sold Out |

| :--- |

| - Only available in resale |

每平方英尺 35,000 巴基斯坦卢比

5%

100 %

100%(98 套中的 98 套)

已售罄

Key Data Installment Plan (N/A)

Average Gross Sale Rate Sale Rate Escalation (CAGR) Occupancy (%) Inventory Sold (%) Take-Up "- 100% Sold Out

- Only available in resale"

PKR 35,000/Sq. Ft. 5% 100 % 100% (98 of 98 Units) Sold out | Key Data | | | | | Installment Plan (N/A) |

| :--- | :--- | :--- | :--- | :--- | :--- |

| Average Gross Sale Rate | Sale Rate Escalation (CAGR) | Occupancy (%) | Inventory Sold (%) | Take-Up | - 100% Sold Out <br> - Only available in resale |

| PKR 35,000/Sq. Ft. | 5% | 100 % | 100% (98 of 98 Units) | Sold out | |

- Gym - 24/7 CCTV

- Standby Power Surveillance

Generation - Centrally air

- Separate service conditioned

elevators | - Gym | - 24/7 CCTV |

| :--- | :--- |

| - Standby Power | Surveillance |

| Generation | - Centrally air |

| - Separate service | conditioned |

| elevators | |

单元类型

Unit

Type| Unit |

| :---: |

| Type |

单元面积(平方英尺)

Unit Size

(sq. ft.)| Unit Size |

| :---: |

| (sq. ft.) |

单元数量(个)

No. of

Units (#)| No. of |

| :---: |

| Units (#) |

销售单位(数量)

Units

Sold (#)| Units |

| :---: |

| Sold (#) |

占总单位类型的百分比

% of Total

Unit Types| % of Total |

| :---: |

| Unit Types |

一居室

918-1,260918-1,260

20

100%100 \%

35%35 \%

2 卧室

1,700-2,1101,700-2,110

28

100%100 \%

50%50 \%

3 卧室

2,160-3,3352,160-3,335

8

100%100 \%

15%15 \%

"Unit

Type" "Unit Size