Treasury Refunding Outbids The Fed For Importance Today

国债再融资今日重要性超越美联储

Authored by Simon White, Bloomberg macro strategist,

作者:彭博宏观策略师 Simon White

Today’s Treasury refunding announcement may have more import for the bond market in the medium and longer term than the Federal Reserve meeting.

今天的国债再融资公告,可能对中长期债券市场的影响超过美联储会议。

No rate move is expected at today’s Fed meeting, but the elephant in the room is the bank’s fiscal overseers.

预计今天的美联储会议不会调整利率,但会议中不可忽视的问题是该行的财政监管者。

President Trump has heaped the pressure on Fed Chair Powell to cut rates. He’s unlikely to relent at this meeting, but we could see some dovish dissent, with voters Christopher Waller and perhaps Michelle Bowman looking the most likely candidates.

特朗普总统对美联储主席鲍威尔施加了降息压力。他在本次会议上不太可能让步,但我们可能会看到一些鸽派异议,投票者克里斯托弗·沃勒和或许米歇尔·鲍曼看起来是最有可能的候选人。

Either way, the Fed’s political independence is clearly being infringed, but it is the erosion of its operational independence that is more insidious, and potentially more consequential.

无论如何,美联储的政治独立性显然受到了侵犯,但其操作独立性的侵蚀更为隐蔽,且可能带来更严重的后果。

In that vein, we’ll also get the second part of the Treasury’s refunding announcement today, where it details the maturity of the debt it plans to issue to meet its borrowing requirements.

在这方面,我们今天还将看到财政部再融资公告的第二部分,详细说明其计划发行以满足借款需求的债务期限。

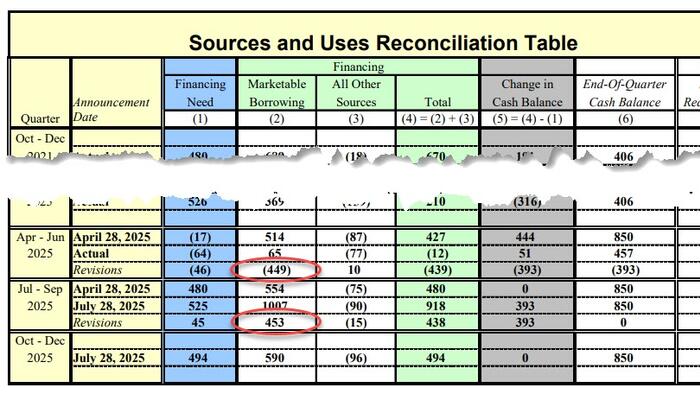

For the coming quarter that’s over $1 trillion, in part due the refilling of the Treasury’s cash account, the TGA, at the Fed.

未来一个季度的发行规模超过 1 万亿美元,部分原因是财政部在美联储补充现金账户(TGA)。

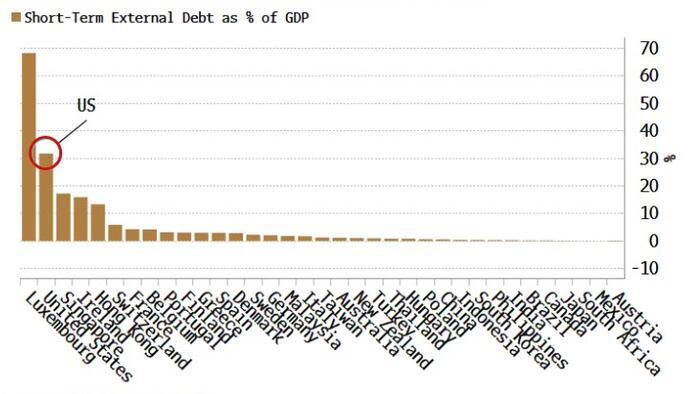

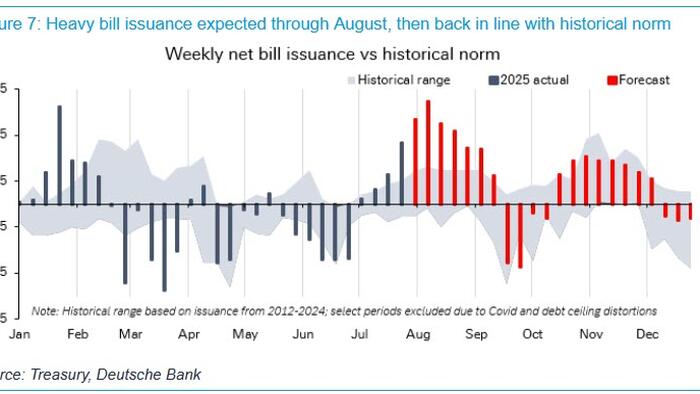

If the Treasury reduces its auction sizes of longer-term debt, it will need to increase issuance of short-term bills.

如果财政部减少长期债务的拍卖规模,就需要增加短期国库券的发行。

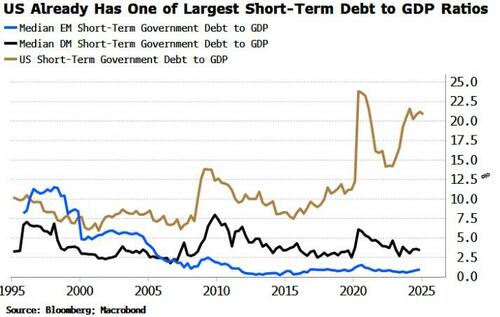

As we can see, though, the US government already has an abnormally high dependence on short-term funding.

不过,正如我们所见,美国政府已经异常依赖短期融资。

There may be some increase in bill issuance anyway, again due to the refilling of the TGA. But even if we don’t see a rise over and above this at today’s refunding announcement, the direction of travel is clear, with Treasury Secretary Scott Bessent indicating he is less keen borrowing longer term at the moment.

无论如何,国库券的发行可能会有所增加,这也是由于财政部账户余额(TGA)的补充。但即使在今天的再融资公告中我们没有看到超出这一水平的增长,发展方向依然明确,财政部长 Scott Bessent 表示他目前不太愿意进行长期借款。

Such a heavy load of short-term debt, ie more money-like liabilities, can interfere with the central bank being able to set monetary policy freely.

如此大量的短期债务,即更多类似货币的负债,可能会干扰央行自由制定货币政策的能力。

Thus even though the Fed still sets rates, markets may soon have to apply equal or more attention to what the government and the Treasury say and do.

因此,尽管美联储仍然设定利率,市场可能很快就必须同样甚至更多地关注政府和财政部的言行。

Want to know more? 想了解更多?

Treasury Refunding Highlights US Debt Short-Termism

国债再融资凸显美国债务短期主义

Refunding Preview: Rising Risk Of Treasury Sell-Off On Spike In US Funding Needs

再融资预览:美国融资需求激增引发国债抛售风险上升