MTC Education - Elliott Impulses [English]

MTC 教育 - 艾略特脉冲理论 [英文版]

As Elliott Wave theory is often quite abstract for the beginner, we have decided to work a lot with pictures rather than writing huge novels, which there are more than enough of already. By following this principle, your understanding of the subject will be much better. You will soon realize that only the visualization of the theory will give you the lasting "aha-effect".

由于艾略特波浪理论对初学者来说往往相当抽象,我们决定采用大量图示而非撰写冗长文字——市面上此类文字著作已足够丰富。遵循这一原则,您对课题的理解将更为透彻。很快您就会发现,只有通过理论的可视化呈现,才能获得持久的"顿悟效应"。

Before we start with the structure of the Elliott Wave Theory (EW) and take a closer look at the internal structures / formations, a few brief words on the background.

在我们开始探讨艾略特波浪理论(EW)的结构并深入研究其内部结构/形态之前,先简要介绍一下背景知识。

The EW theory is based on observations of recurring market sequences that can be traced back to the psychological behavior of investors. Two emotions are of particular importance here - fear and greed. Driven by external factors and influences, these emotions are decisive for the majority of all buy and sell decisions.

艾略特波浪理论基于对市场重复出现序列的观察,这些序列可追溯至投资者的心理行为。其中两种情绪尤为关键——恐惧与贪婪。在外部因素和影响的驱动下,这些情绪对绝大多数买卖决策起着决定性作用。

This is why we like to refer to it as the "action-reaction" principle of market participants. It is responsible for the resulting price movements, which can be summarized in a comprehensible development pattern.

这就是我们喜欢将其称为市场参与者"作用-反作用"原理的原因。它决定了最终的价格走势,这些走势可以概括为一种易于理解的发展模式。

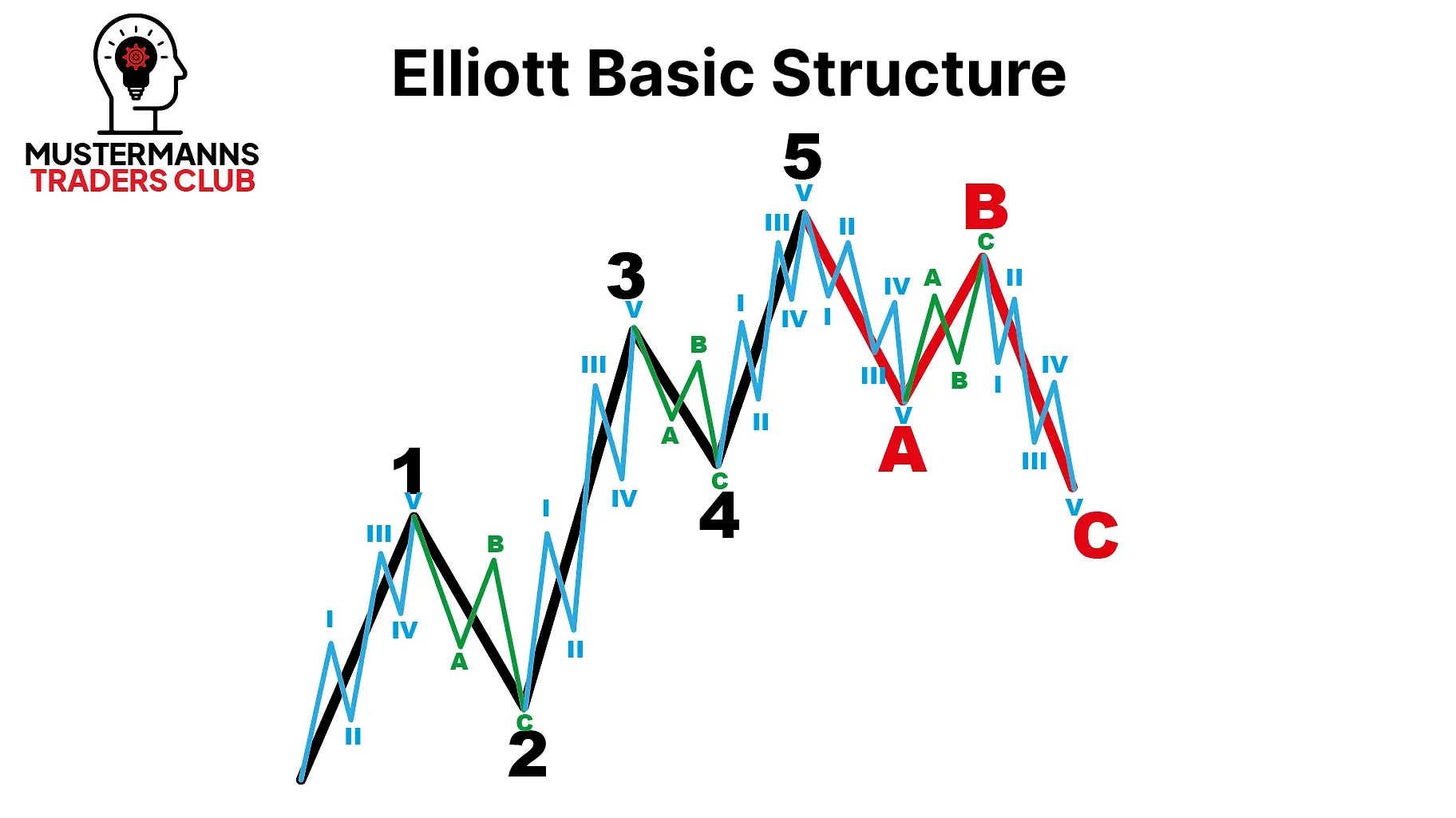

In this lesson, you will learn the basis of Elliott Wave Theory. It forms the basic structure of all movements in the chart.

本节课你将学习艾略特波浪理论的基础知识。该理论构成了图表中所有走势的基本结构。

As already mentioned, in the introduction, price movements are based on the "action-reaction" principle. This means that an action or build-up is always required first in order to trigger a subsequent impulse (reaction).

正如引言中所述,价格波动遵循"作用力-反作用力"原理。这意味着必须先有作用力或能量积累,才能触发后续的脉冲式波动(反作用力)。

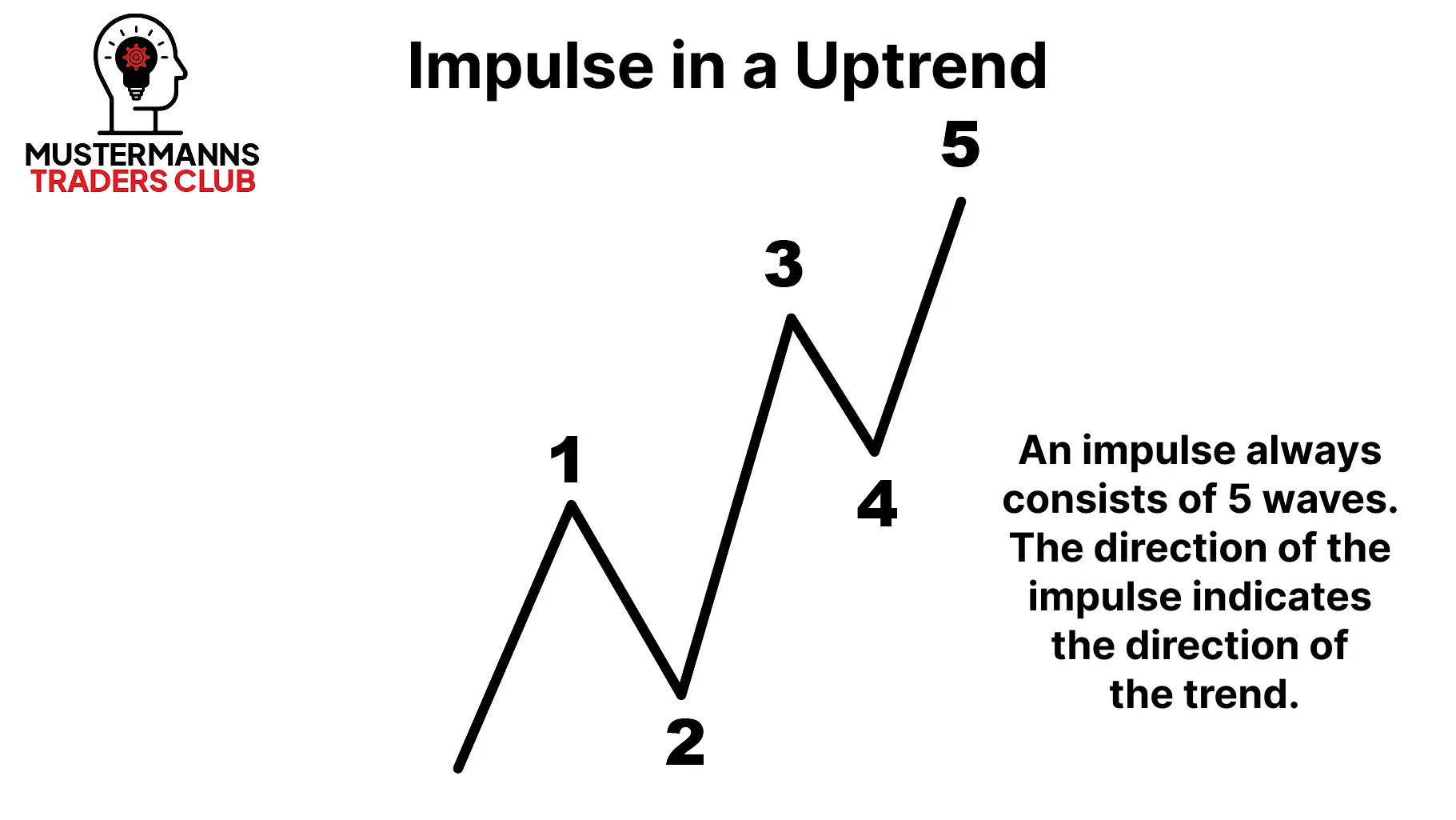

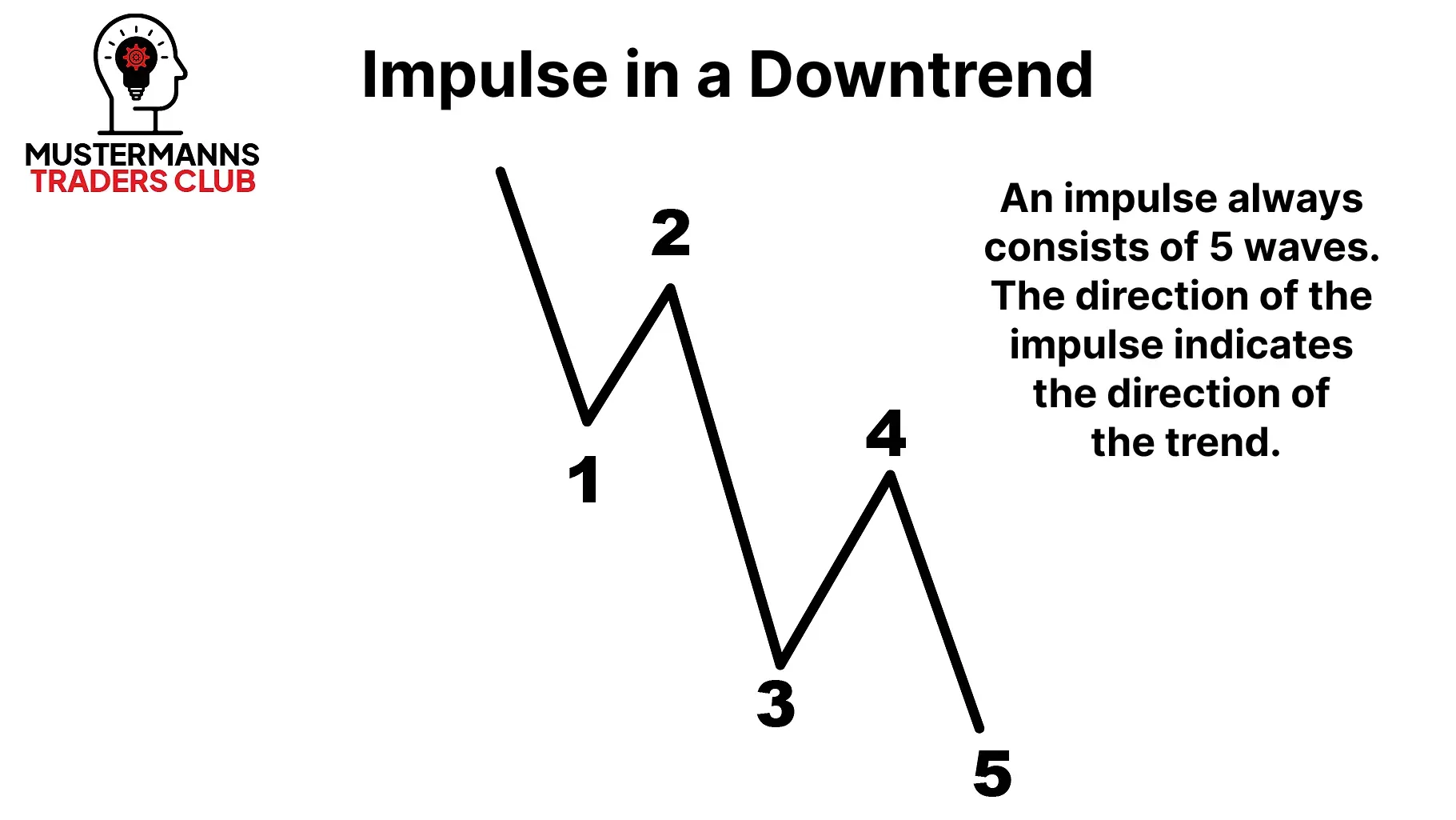

The whole thing can be compared to a bow and arrow. First, the bow must be drawn so that the arrow can then be shot. In this case, drawing back the bow is the action and firing the arrow is the reaction. The impulse movement is therefore the drive of a trend movement and consists of a total of five movements. In Elliott wave theory, these movements are also known as waves.

整个过程可以比作弓箭。首先必须拉弓,箭才能射出。在这里,拉弓是主动动作,射箭则是反作用力。因此,推动浪是趋势运动的驱动力,总共由五个运动阶段构成。在艾略特波浪理论中,这些运动阶段也被称为波浪。

脉冲波的方向表明了市场当前的运行趋势。

Waves 1, 3 and 5 define the basic direction of the trend movement (impulse), while waves 2 and 4 are the so-called corrective movements. In other words, the impulse waves are the arrows that reach their target depending on the correction (tension of the bow).

第1、3、5浪决定了趋势运动(推动浪)的基本方向,而第2、4浪则是所谓的调整浪。换言之,推动浪如同射向目标的箭矢,其射程取决于调整浪(弓弦的张力)。

同一波浪级别中的推动与调整。三个推动浪之间呈斐波那契比例关系。

However, for an impulse to occur at all, an action is required first. In the case of the Elliot wave theory, we are talking about corrective waves 2 and 4.

然而,要形成完整的推动浪,首先需要出现调整动作。在艾略特波浪理论中,这指的就是第2浪和第4浪的调整波。

In contrast to the impulse waves, these are usually more corrective and consist of different formations. More on this in detail later. In the following section, we will first look at the basic rules of the basic structure.

与推动浪不同,这些通常更具修正性,且由不同形态构成。后续章节将对此进行详细阐述。在接下来的部分中,我们将首先了解基本结构的基础规则。

通常而言,调整浪会跟随推动浪出现。但此处存在一个例外情况。在继续阅读下文前,请尝试自行识别这个例外:

What is different here? 这里有什么不同?

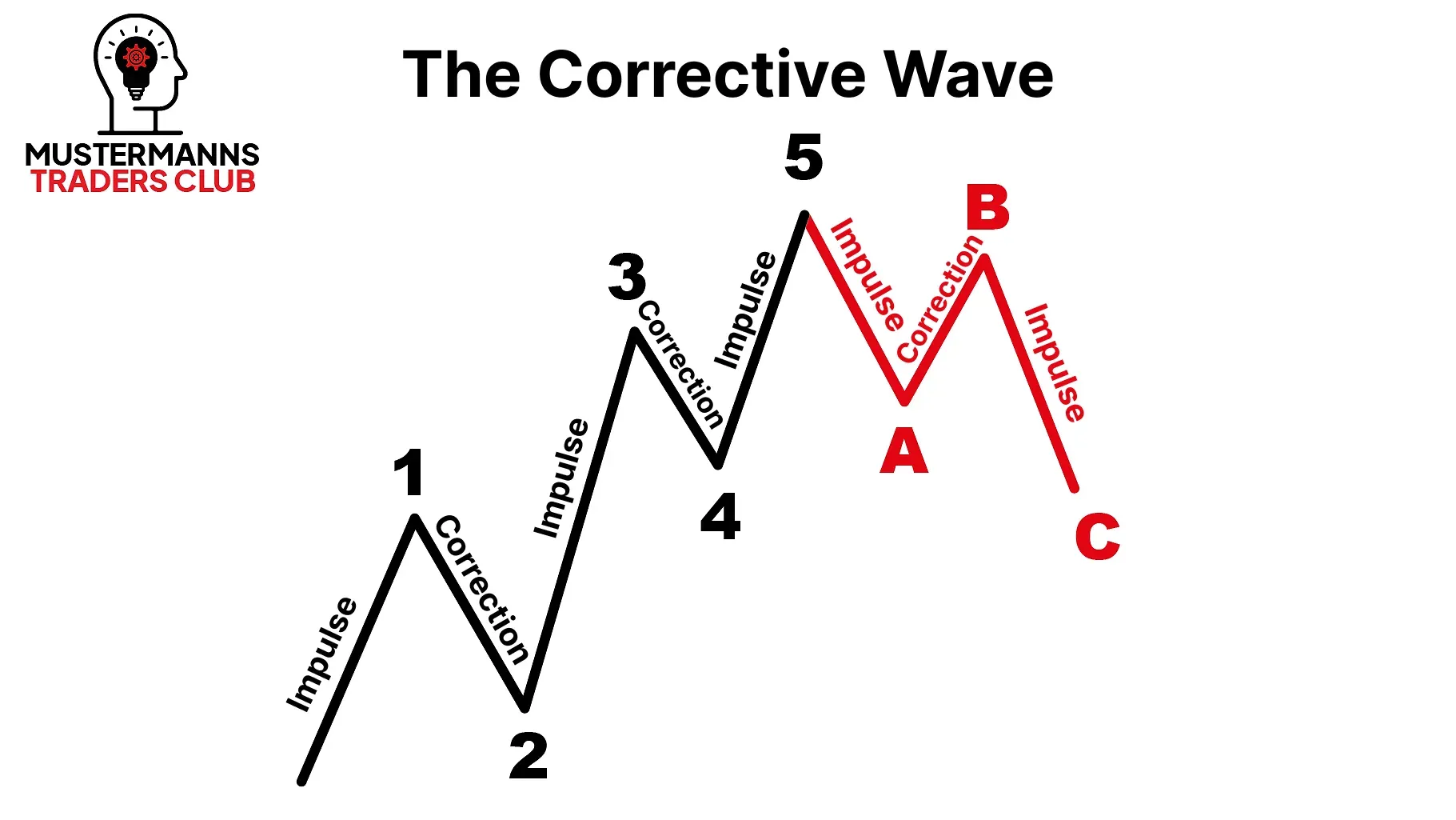

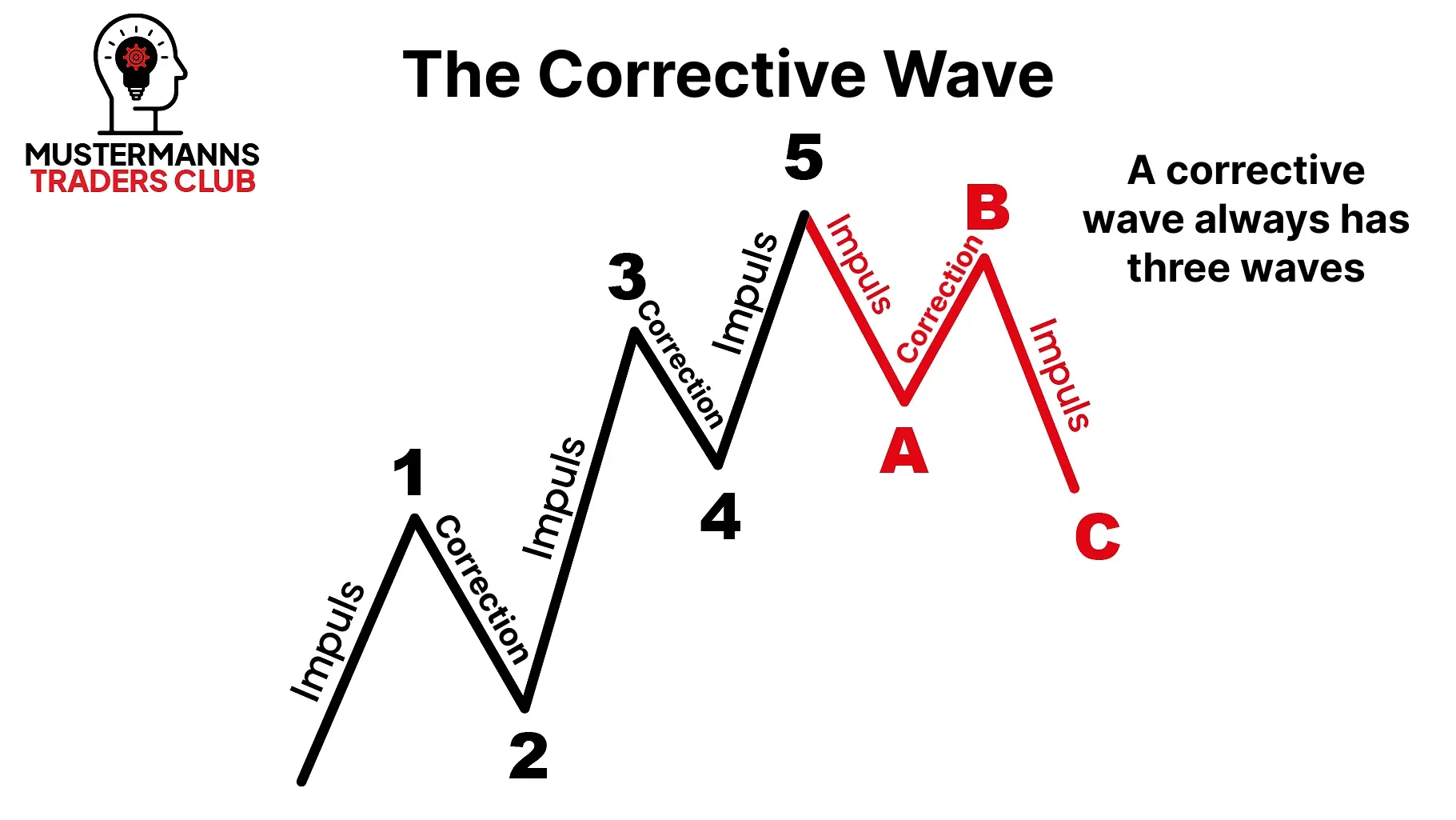

As you can see from the picture, the A-B-C correction wave also consists of impulses and corrections. The impulse waves can be found in waves A and C. A corrective movement can be found in wave B.

如图所示,A-B-C 调整浪同样由推动浪和调整浪构成。推动浪出现在 A 浪和 C 浪中,而 B 浪则呈现调整走势。

You can also see here that a wave 5 (impulse), unlike the impulses of waves 1 and 3, is not followed by a corrective wave. The corrective movement (wave A) also has five waves and is therefore also a subordinate impulse.

此处可见,与第 1 浪和第 3 浪的推动浪不同,第 5 浪(推动浪)之后并未跟随调整浪。该调整运动(A 浪)同样由五浪构成,因此也属于次级推动浪。

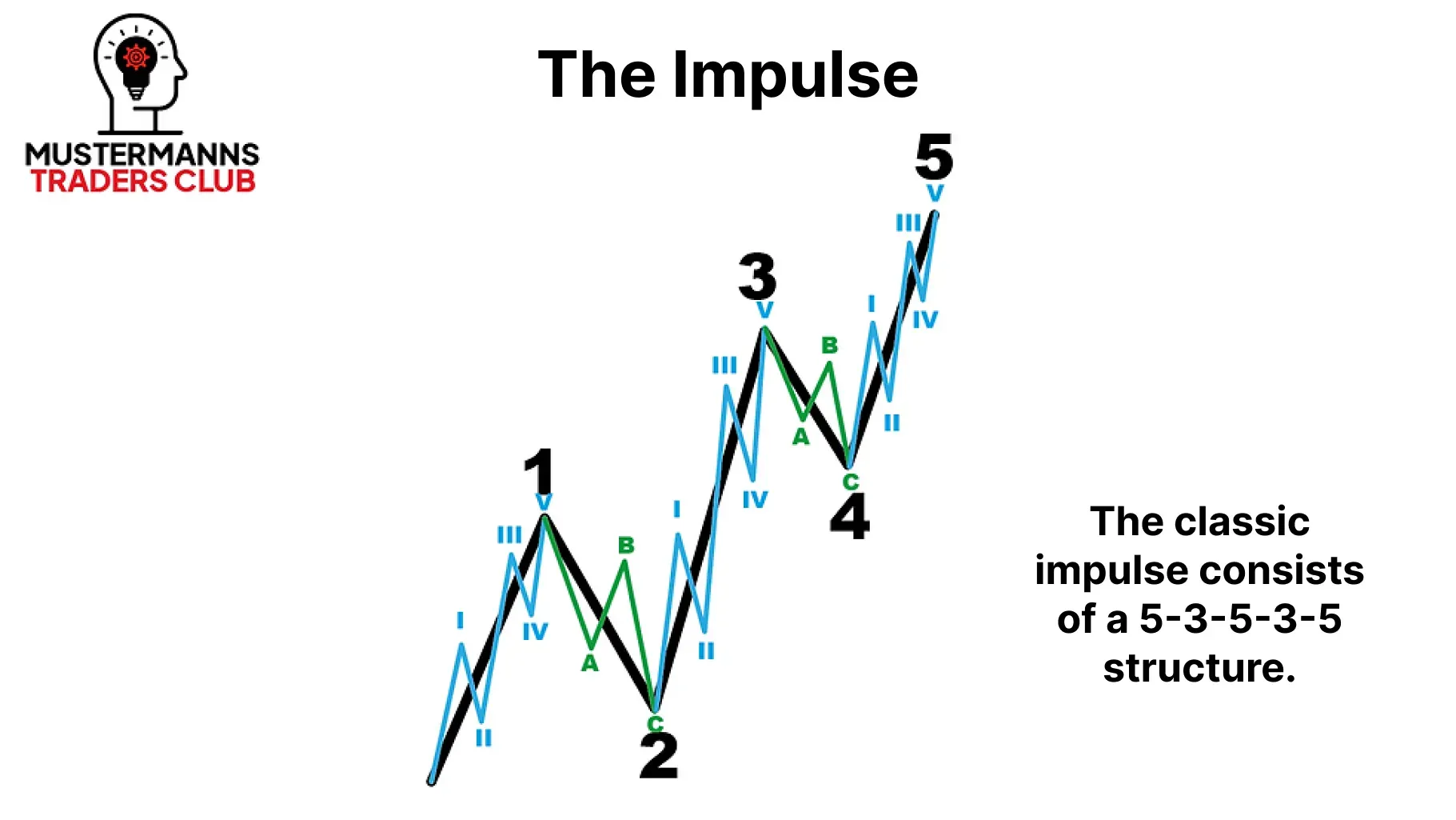

As you have probably already noticed above, impulse and corrective movements can always be broken down into smaller movements. Impulse movements always consist of a 5-wave movement, while corrective movements are made up of 3-wave movements. At Mustermann's Traders Club, we also like to talk about the "innards" of the larger, superordinate movement. Similar to an onion, a chart can be broken down to the smallest detail (<M1).

正如你可能已经注意到的,推动浪和调整浪总是可以分解为更小的波浪结构。推动浪始终由 5 浪构成,而调整浪则由 3 浪组成。在 Mustermann 交易者俱乐部,我们也喜欢探讨更大级别波浪的"内部构造"。就像剥洋葱一样,图表可以被分解到最细微的级别(<1分钟图)。

推动浪始终用数字计数,调整浪始终用字母计数。

Elliott basic structure: The fractals of waves 1 and 2 consist of even smaller waves. Since you can also divide the yellow waves into even smaller waves, you can analyze the chart down to the smallest detail and define precise entry zones for your trading.

艾略特基本结构:第1浪和第2浪的分形由更小的波浪组成。由于黄色波浪也能被分解为更细微的波浪,因此您可以对图表进行最精细的分析,并为交易确定精确的入场区域。

In this lesson, you have learned the basic structure of every chart according to Elliott. You now know that a chart is made up of impulses and corrections, and that these in turn are also made up of impulses and corrections.

在本课程中,您已掌握了艾略特理论下所有图表的基本结构。现在您了解到,图表由推动浪和调整浪组成,而这些浪型本身又由更小层级的推动浪和调整浪构成。

We will build on this knowledge in the next lesson, which will deal with important rules that need to be respected when counting each chart.

我们将在下一课中以此为基础,讲解分析图表时需要遵守的重要规则。

An overview 概述

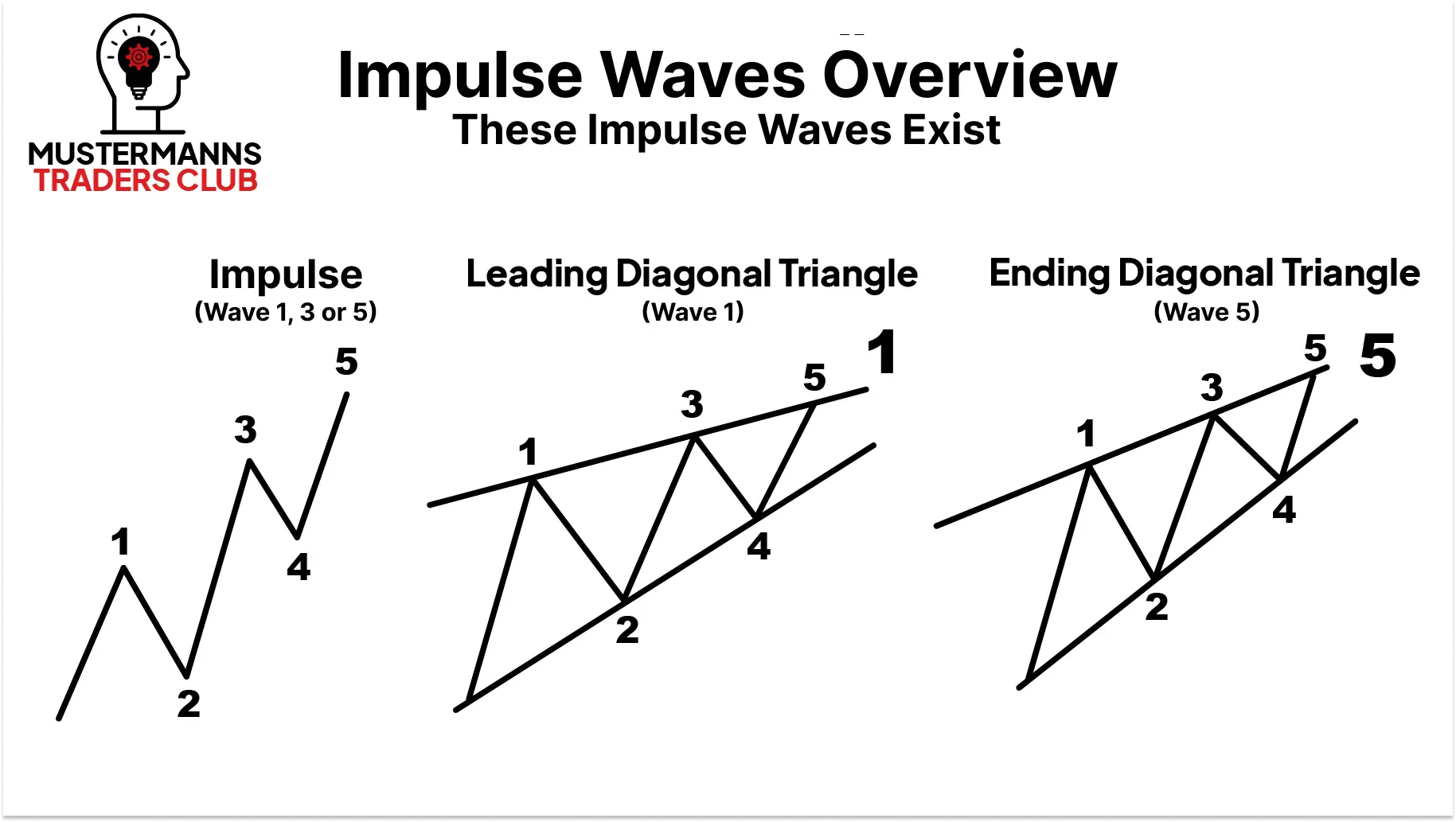

在图表中,脉冲可以以三种不同的方式出现。

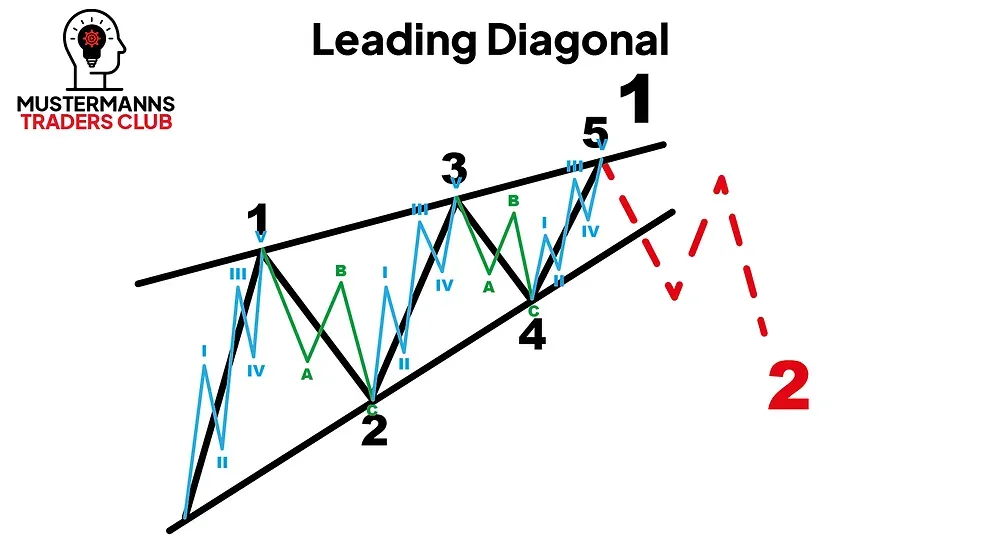

While the normal impulse is the most common of all three in the chart, the Leading Diagonal Triangle (referred to as LDT in the following) and the Ending Diagonal Triangle (EDT) can only be found in the chart in certain situations. They are therefore rarely found on the chart and are thus special cases of wave 1 or wave 5.

虽然标准推动浪是图表中最常见的三种形态,但引导倾斜三角形(下文简称 LDT)和终结倾斜三角形(EDT)仅会在特定情况下出现在图表中。因此它们在图表中较为罕见,属于第 1 浪或第 5 浪的特殊形态。

Unlike the impulse, the LDT can only form at the beginning of an impulse and therefore cannot be found in the third and fifth waves. In turn, the EDT can only be observed at the end of the impulse movement.

与推动浪不同,LDT 只能在推动浪初期形成,因此不会出现在第三浪和第五浪中。而 EDT 则只能在推动浪运动末期观察到。

Basic rules 基本规则

Even if every impulse wave has its own rules, there are basic rules that apply to every variant. Every Tradebuddy should be familiar with them.

即便每个推动浪都有其独特规律,但仍存在适用于所有变体的基本法则。每位交易伙伴都应当熟稔于心。

If these rules are violated, you can be sure that the chart in question is not an impulse wave.

如果违反了这些规则,可以确定所讨论的图表并非推动浪。

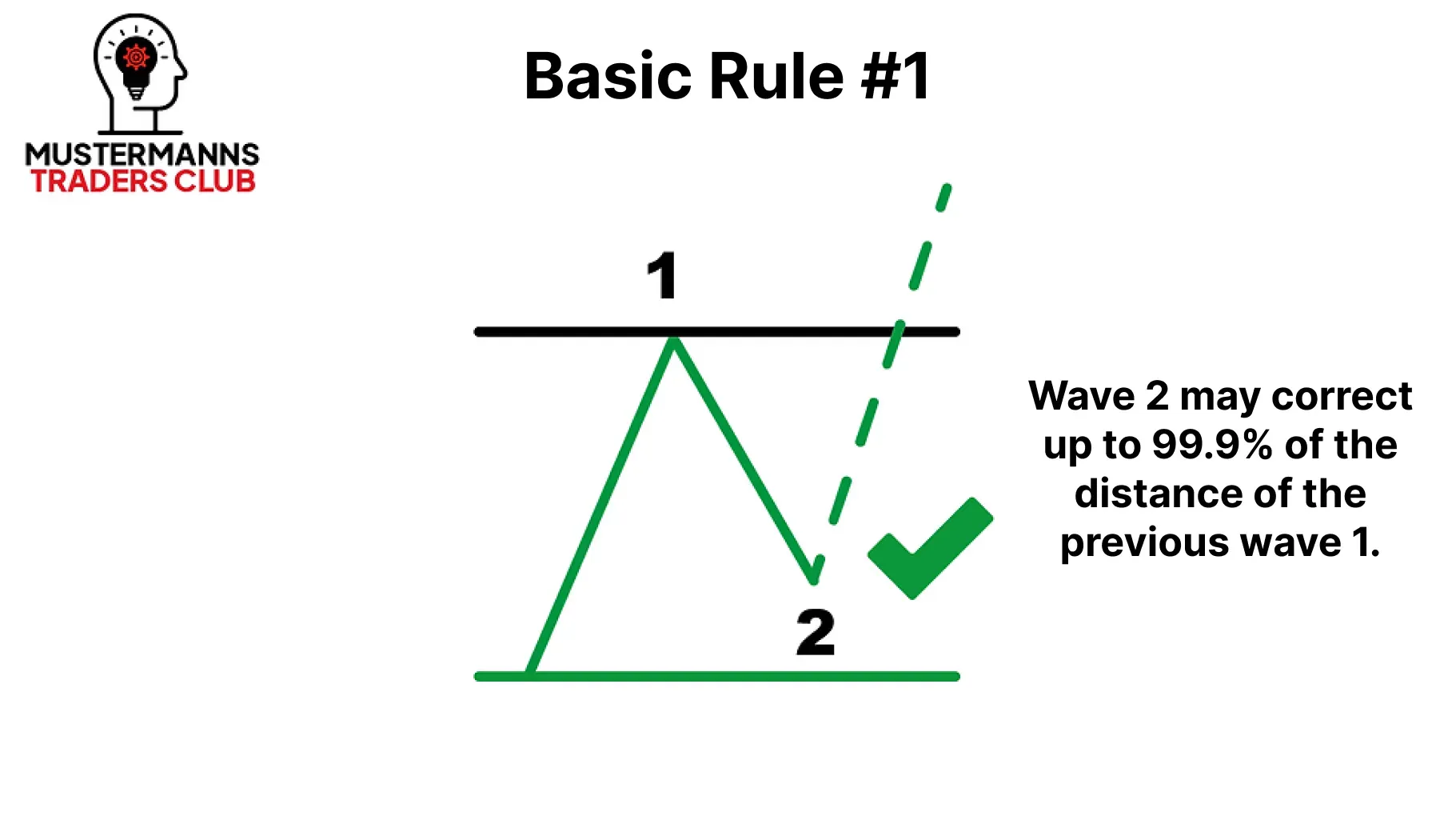

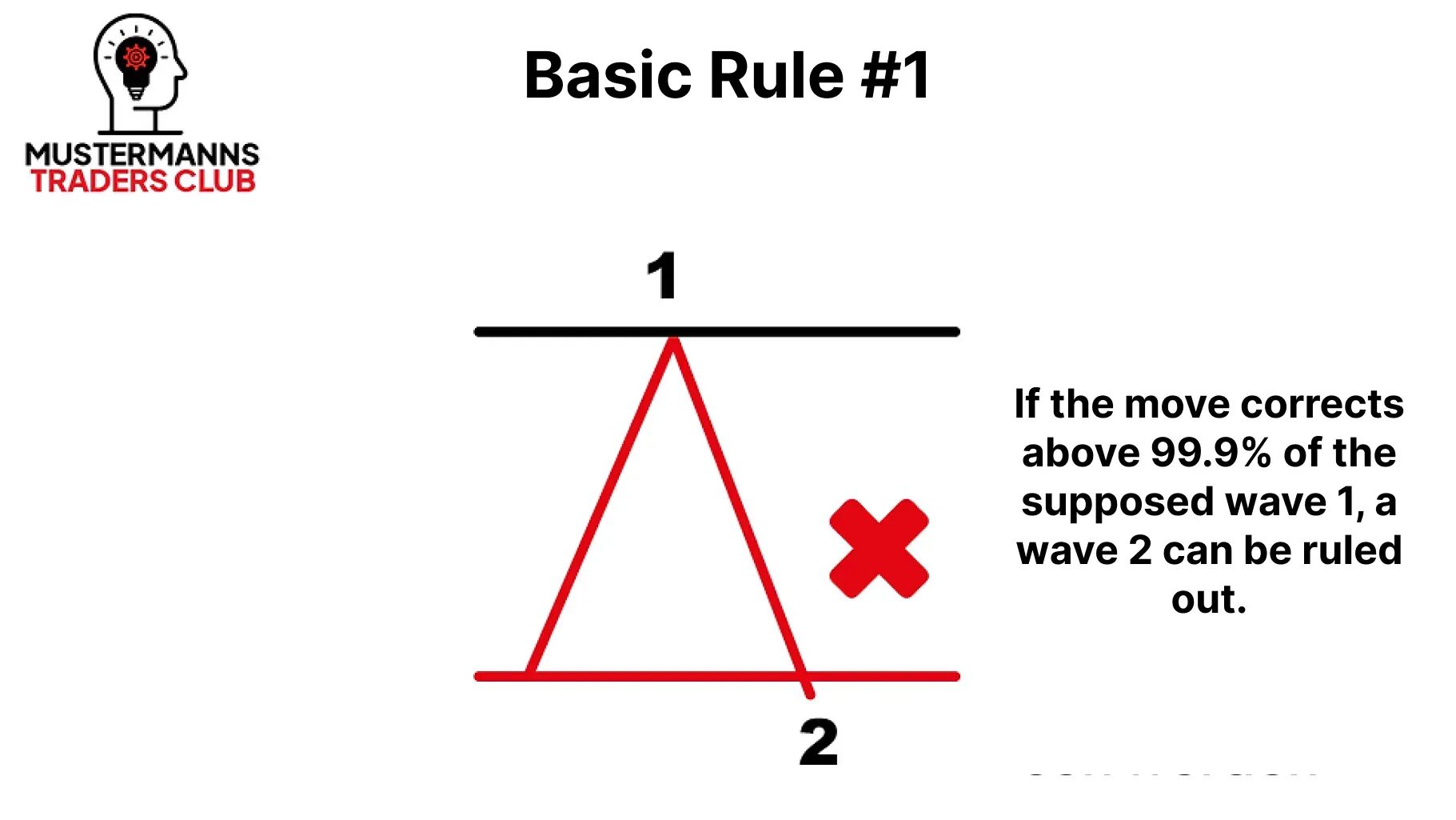

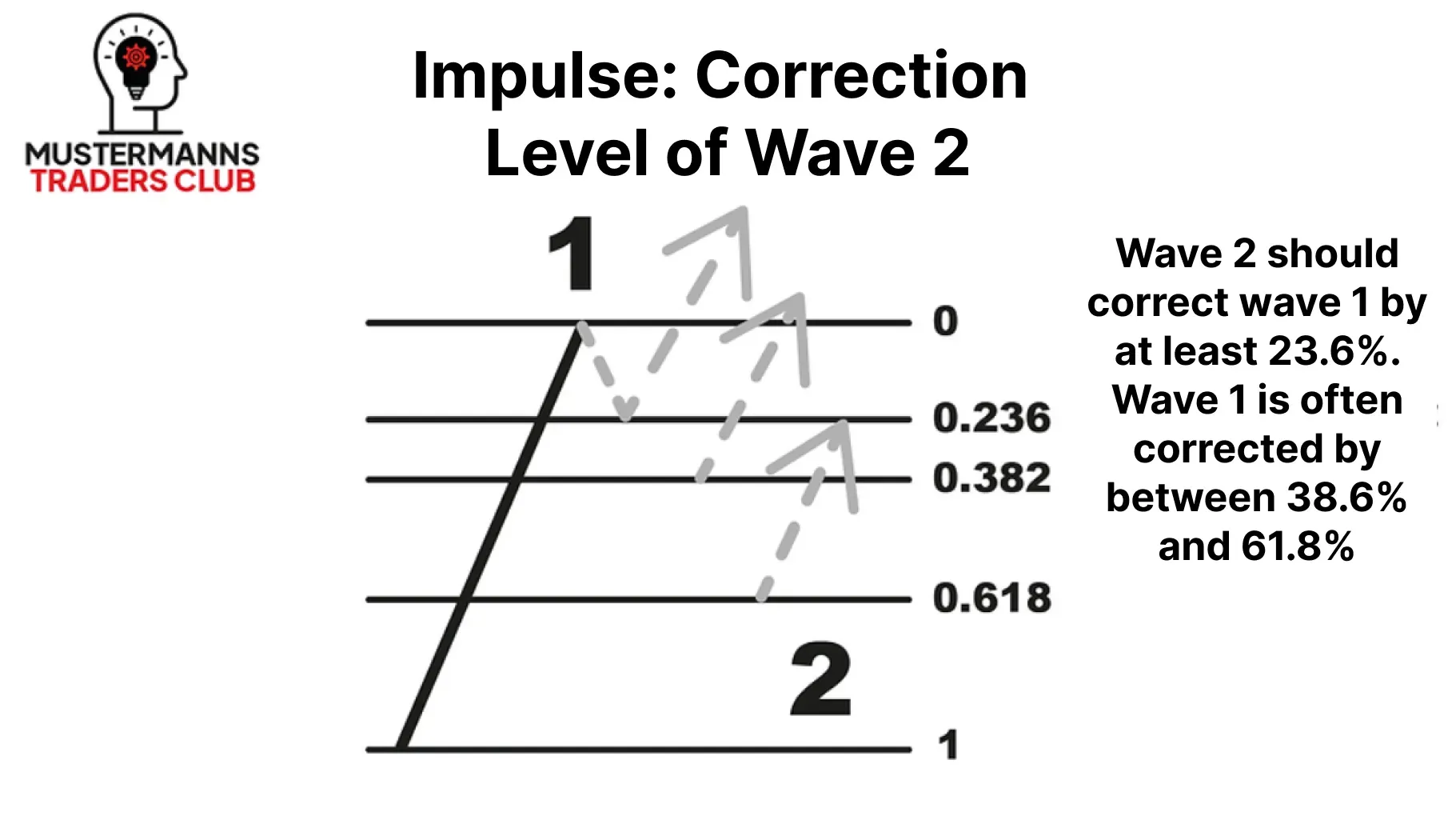

One of the most important rules for the impulse wave is the permitted correction level of the second wave. Wave 2 may only correct the first wave by a maximum of 99.9%. In other words, it may not intersect the origin of the impulse movement.

关于推动浪最重要的规则之一,是第二浪允许的回调幅度。第二浪最多只能回调第一浪的99.9%。换句话说,它不能跌破整个推动浪的起点。

You can use these rules to narrow down the possible reversal points in the chart.

你可以运用这些规则来缩小图表中潜在反转点的范围。

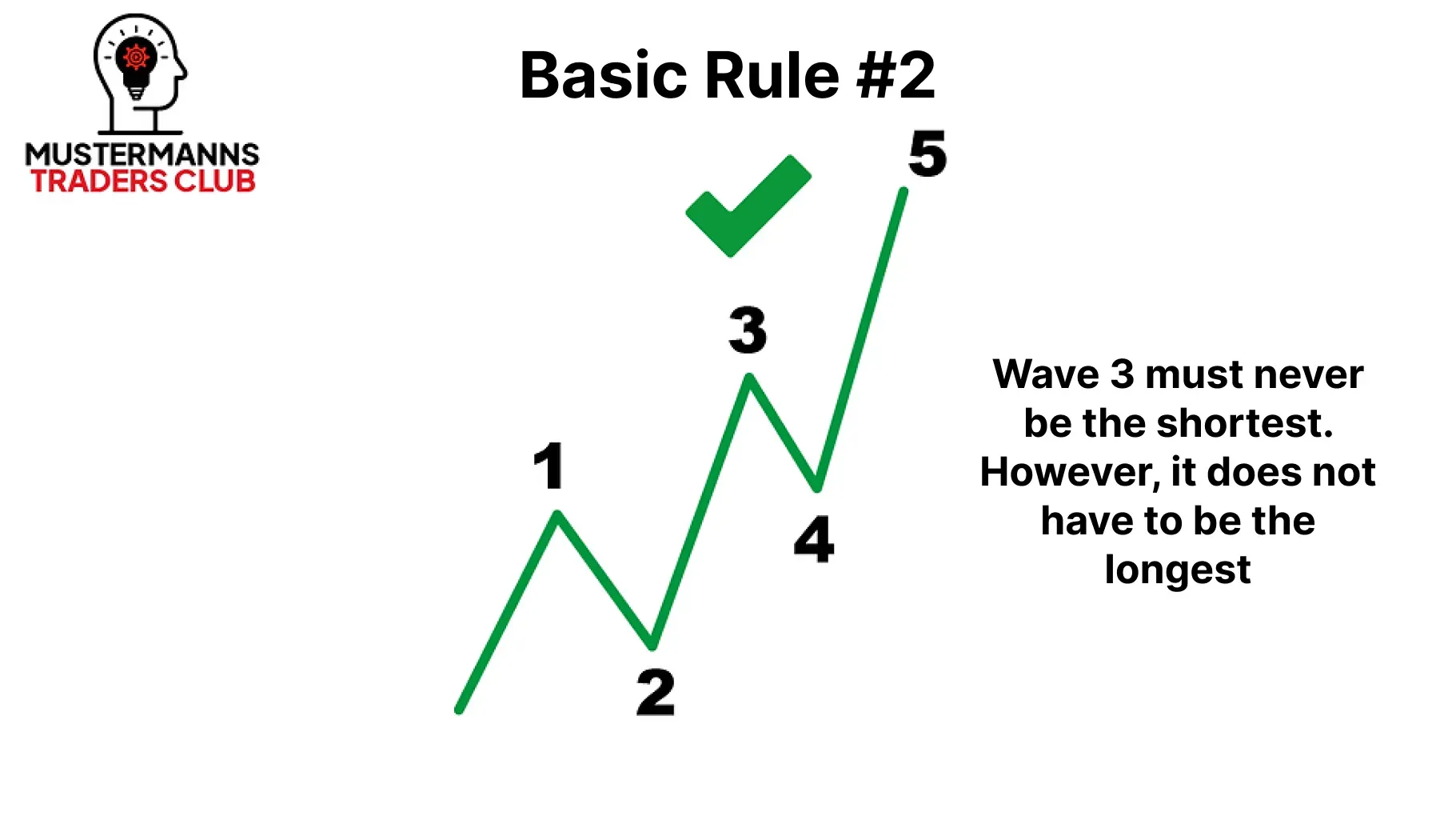

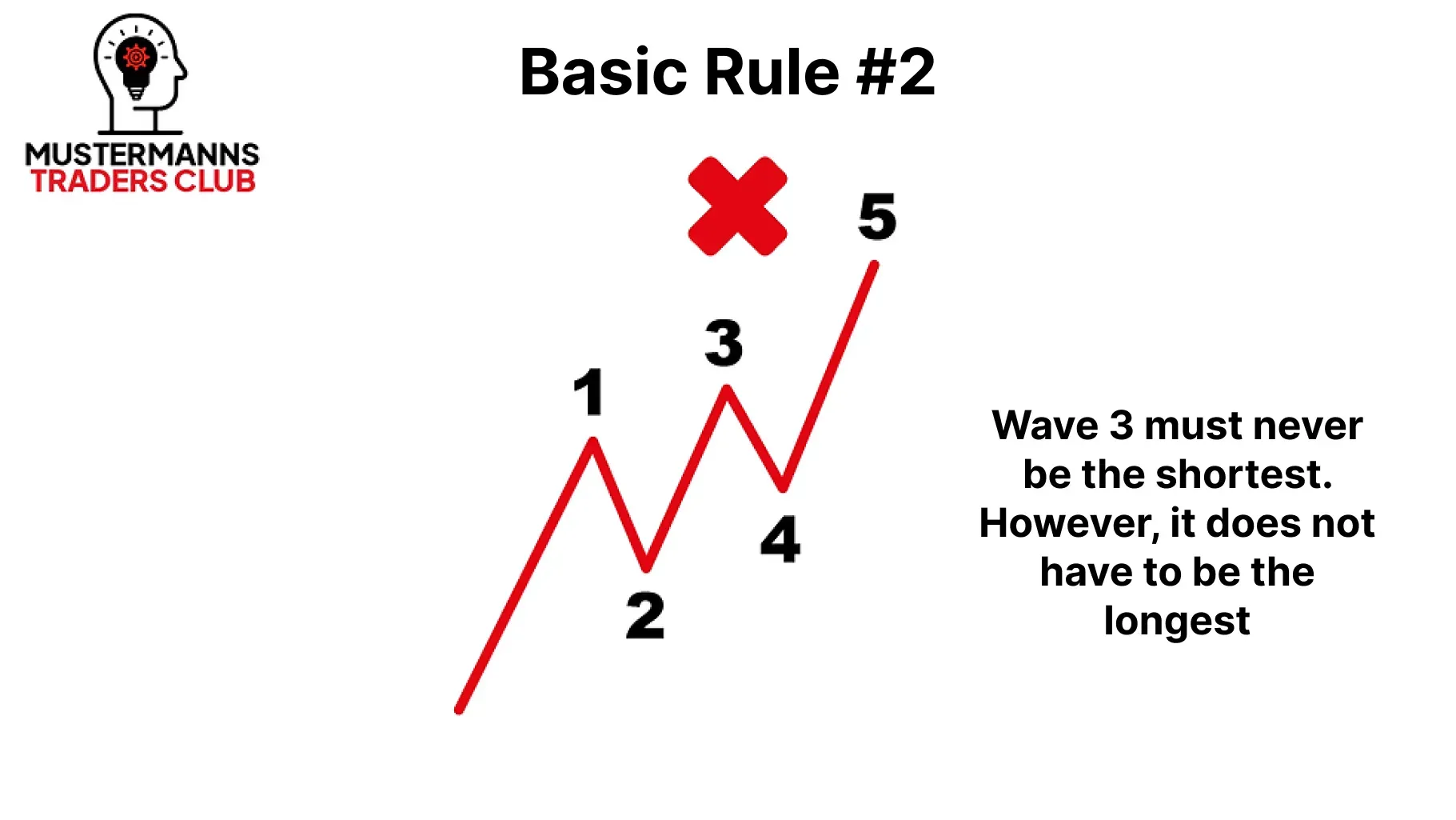

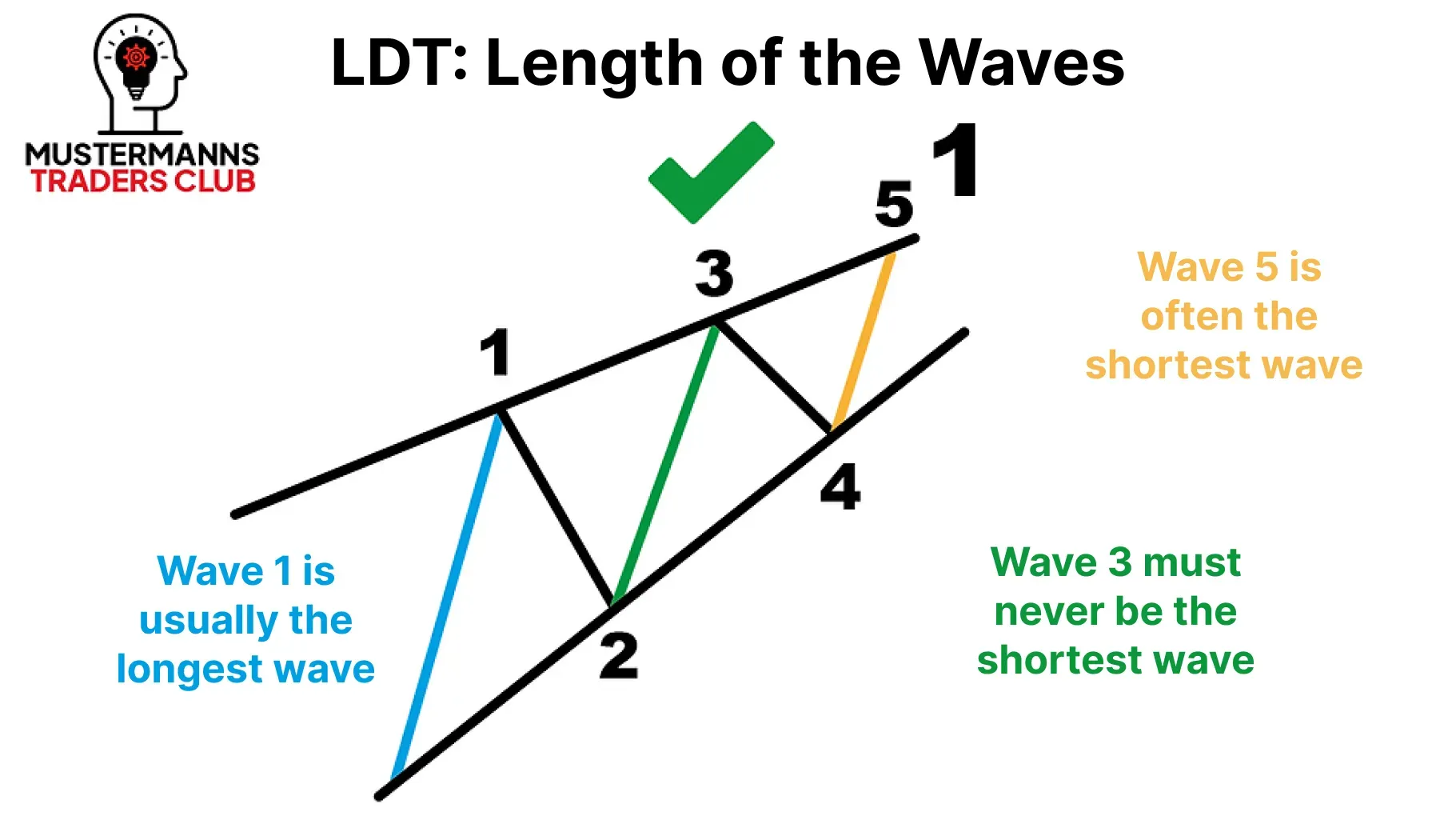

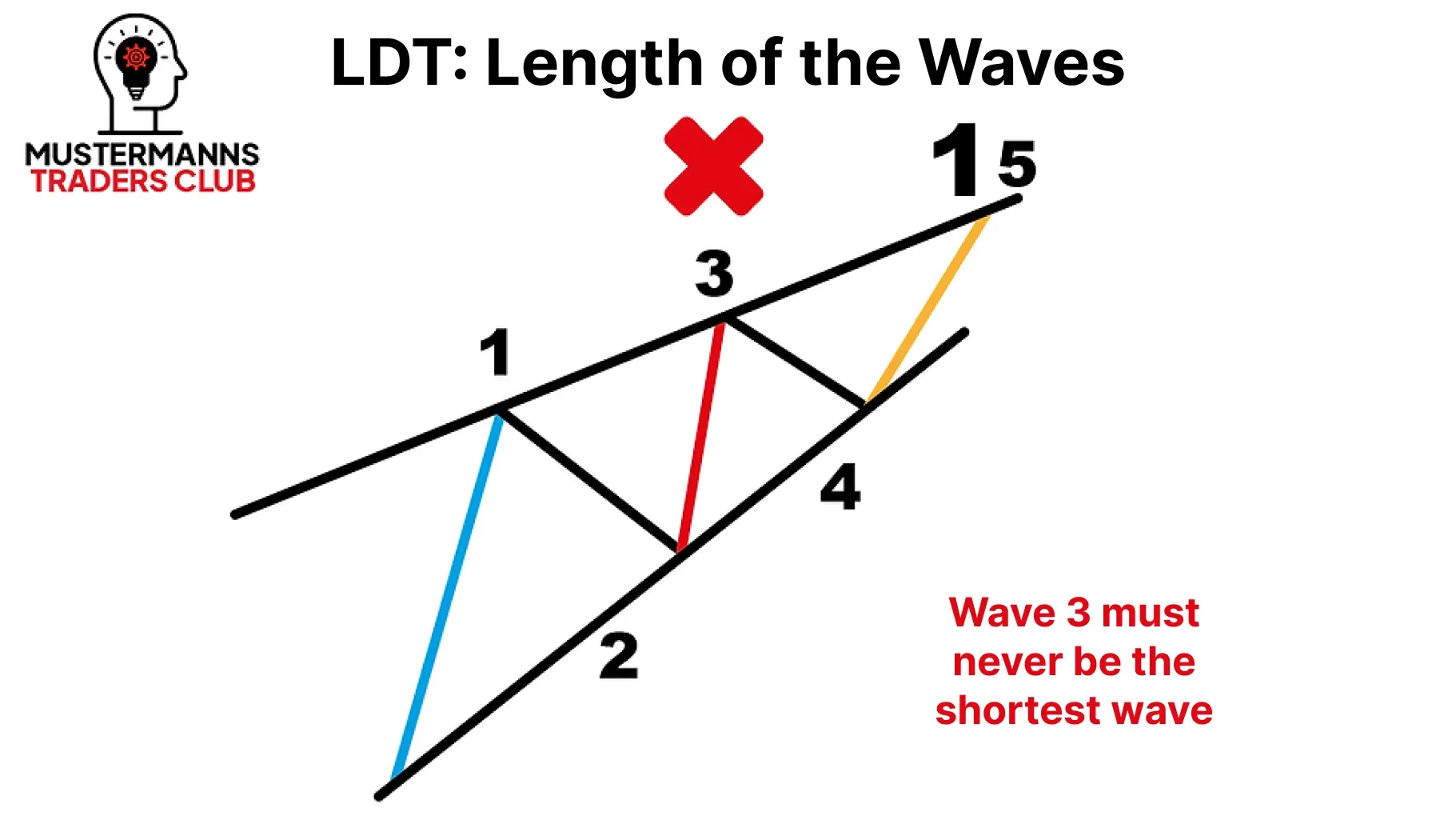

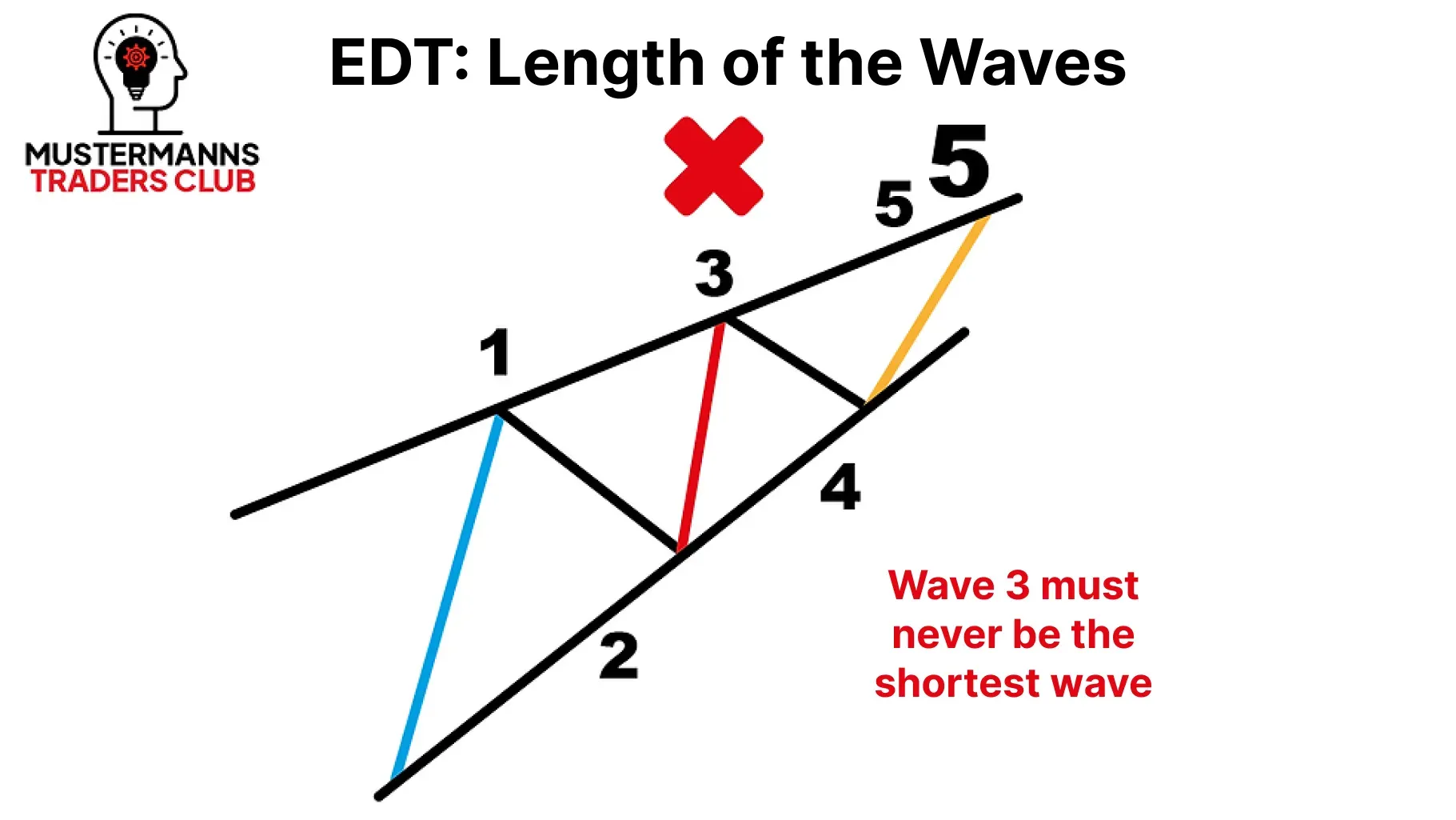

Wave 3 must never be the shortest wave. There is no exception to this rule. In your count, always make sure that wave 3 is of a certain size. Measurement tools from TakeProfit help you to precisely measure the price extension of the waves.

第三浪绝不能是最短的一浪。这条规则没有例外。在数浪时,务必确保第三浪达到特定规模。TakeProfit 的测量工具可帮助您精确测量各浪的价格延伸幅度。

Impulse 冲动

Let's first have a look at the normal impulse. Even if you have already dealt with the basic structure of Elliott waves in the basics, we want to repeat the structure at this point.

让我们先来看看正常的推动浪。即便您已在基础知识中接触过艾略特波浪的基本结构,我们仍想在此重申其构成。

The impulse consists of a total of three impulse waves and two correction waves. This is where the term 5-3-5-3-5 comes from, with 5 standing for a five-wave impulse movement and 3 for a correction wave, which is usually three waves.

该脉冲由总共三个脉冲波和两个修正波组成。这就是5-3-5-3-5这一术语的由来,其中5代表五浪推动运动,3代表通常由三浪构成的修正波。

But how is momentum structured in detail? Which impulse waves and different correction waves can be found in it?

但动量在细节上是如何构建的?其中可以找到哪些推动浪和不同的调整浪?

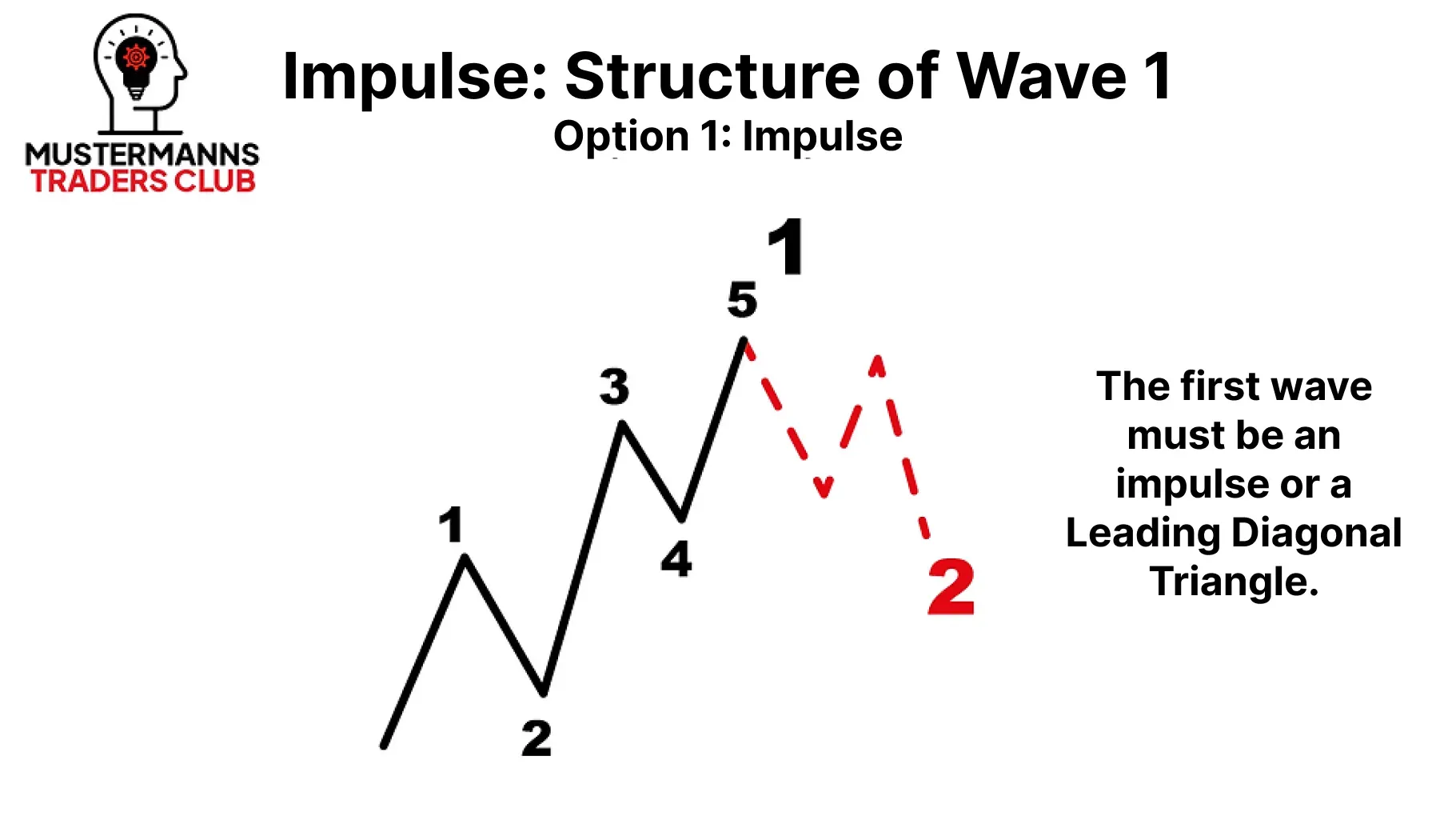

The Beginning - Wave 1

开端 - 第一浪

The first movement in an impulse is itself a five-wave impulse movement. You can find another impulse or a Leading Diagonal Triangle in wave 1 itself.

冲动浪的第一浪本身就是一个五浪推动结构。在第一浪内部,你可能会发现另一个推动浪或引导楔形形态。

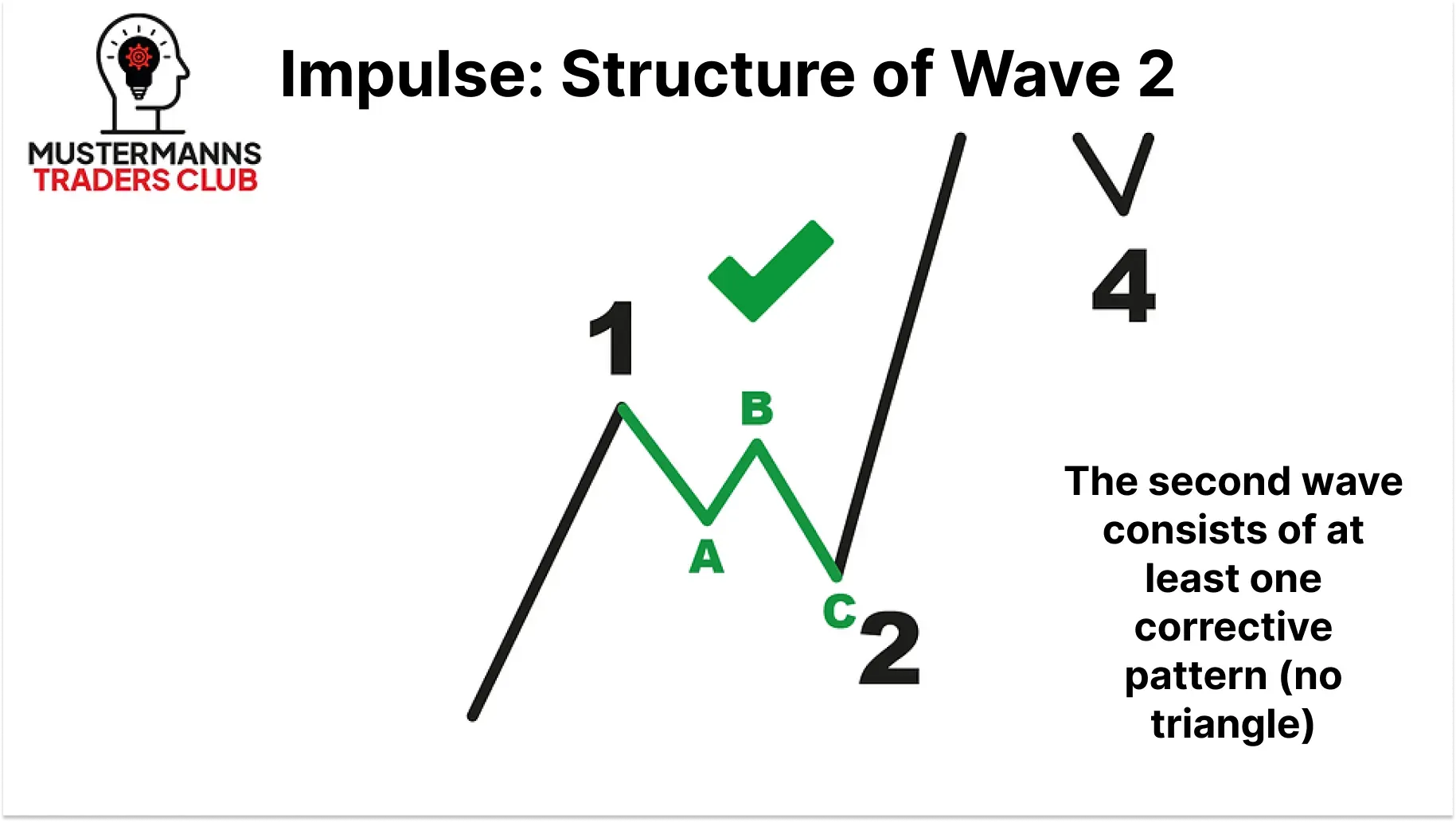

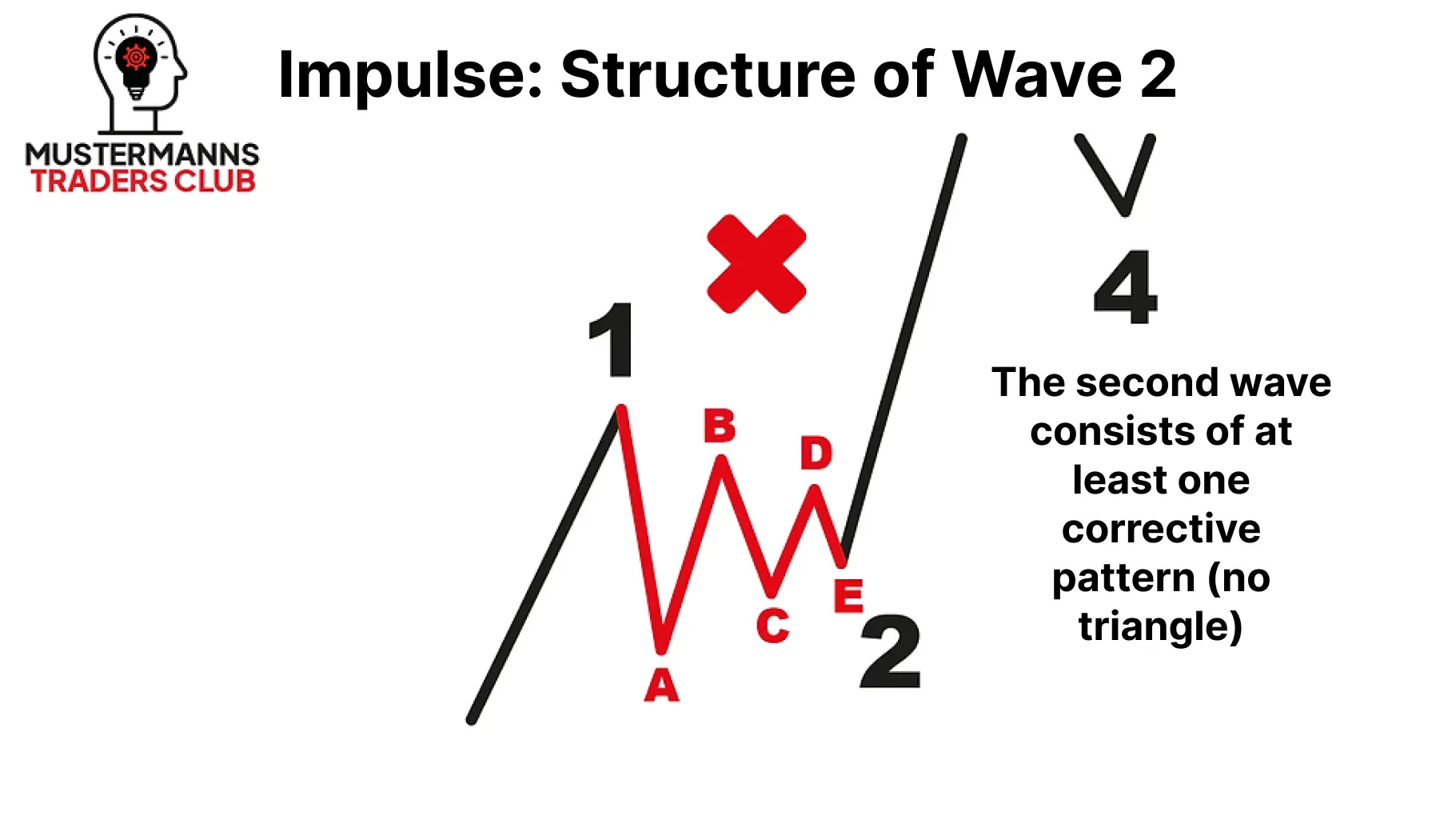

The Reaction - Wave 2

反应阶段——第二浪

The first wave is followed by a breather in the form of a correction wave. As already mentioned, this is usually three waves in the form of a ZigZag. However, the first wave can also consist of more complex corrections, which do not always have to have a three-wave structure. However, a triangle correction is excluded and not possible.

第一波之后会以调整浪的形式出现一个喘息期。如前所述,这通常是以锯齿形三浪形式出现。不过第一浪也可能由更复杂的调整构成,这些调整并不总是必须呈现三浪结构。但三角形调整是被排除且不可能出现的。

In addition to the structure of wave 2, the possible correction levels also play an important role. As already mentioned, in the basic rules for impulse waves, wave 2 must not intersect the origin of wave 1. Therefore, when analyzing, pay particular attention to the fact that the maximum correction is 99.9%.

除了第二浪的结构外,可能的修正水平也起着重要作用。正如之前提到的,在推动浪的基本规则中,第二浪绝不能与第一浪的起点相交。因此,在分析时要特别注意,最大修正幅度为99.9%。

A Rocket - Wave 3

火箭式上涨 - 第3浪

Wave 3 is probably the most attractive wave to place a trade on an impulse. In most cases, it brings a strong movement to the market, which is often referred to as a "flagpole".

第三浪很可能是推动浪中最具交易吸引力的波段。在多数情况下,它会为市场带来强劲的走势,这种走势常被称为"旗杆行情"。

Fundamentally, wave 3 is typically accompanied by important news, such as quarterly figures, central bank meetings, labor market data, etc.

从本质上讲,第三浪通常伴随着重要消息,如季度数据、央行会议、劳动力市场数据等。

As a favorable entry into a wave 3 often promises an attractive risk/reward ratio, many buddies in the Mustermanns Traders Club attach great importance to analyzing the third wave in the chart.

由于第三浪通常能提供极具吸引力的风险回报比,作为理想的入场时机,穆斯特曼交易俱乐部的许多伙伴都非常重视图表中第三浪的分析。

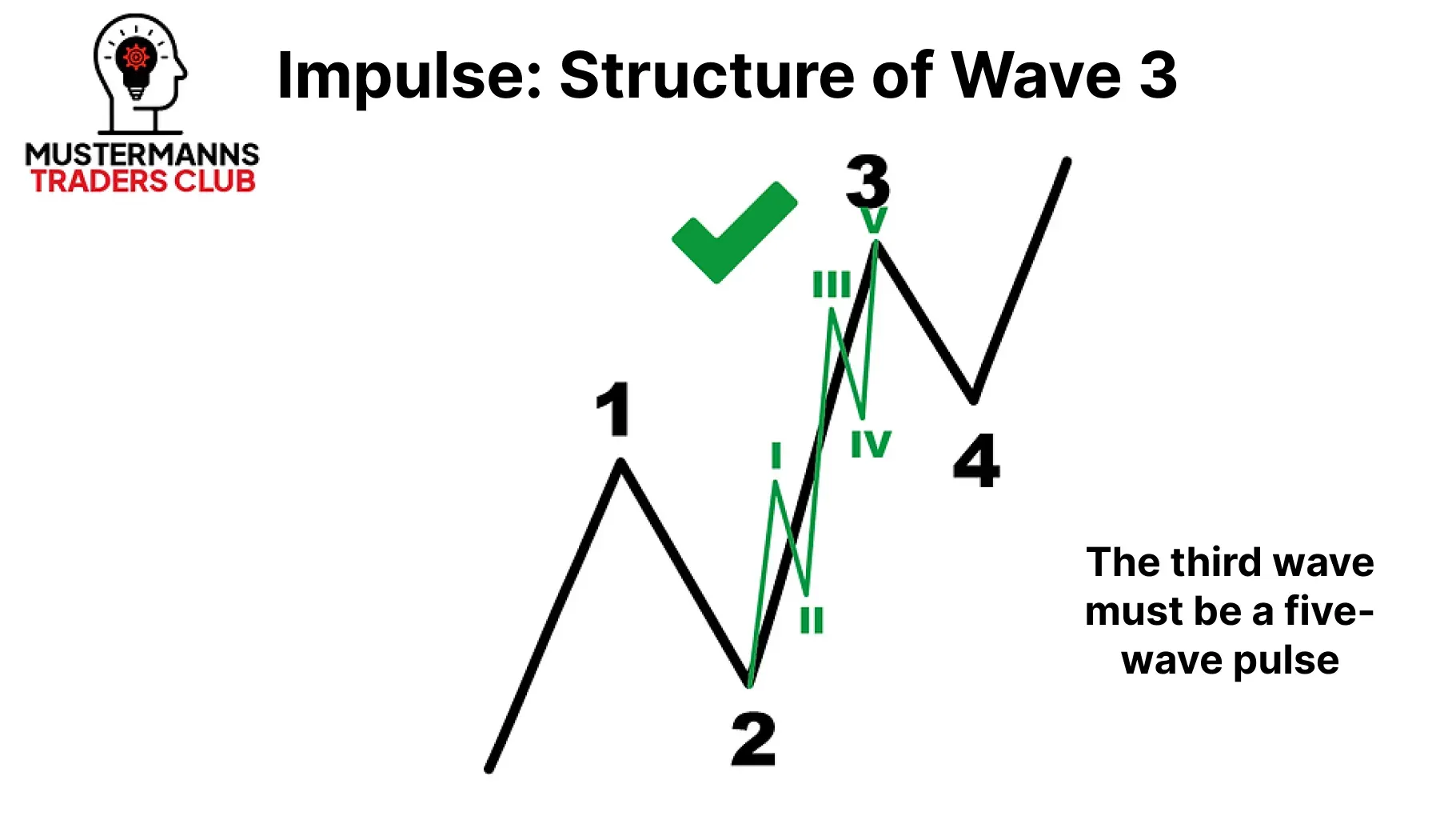

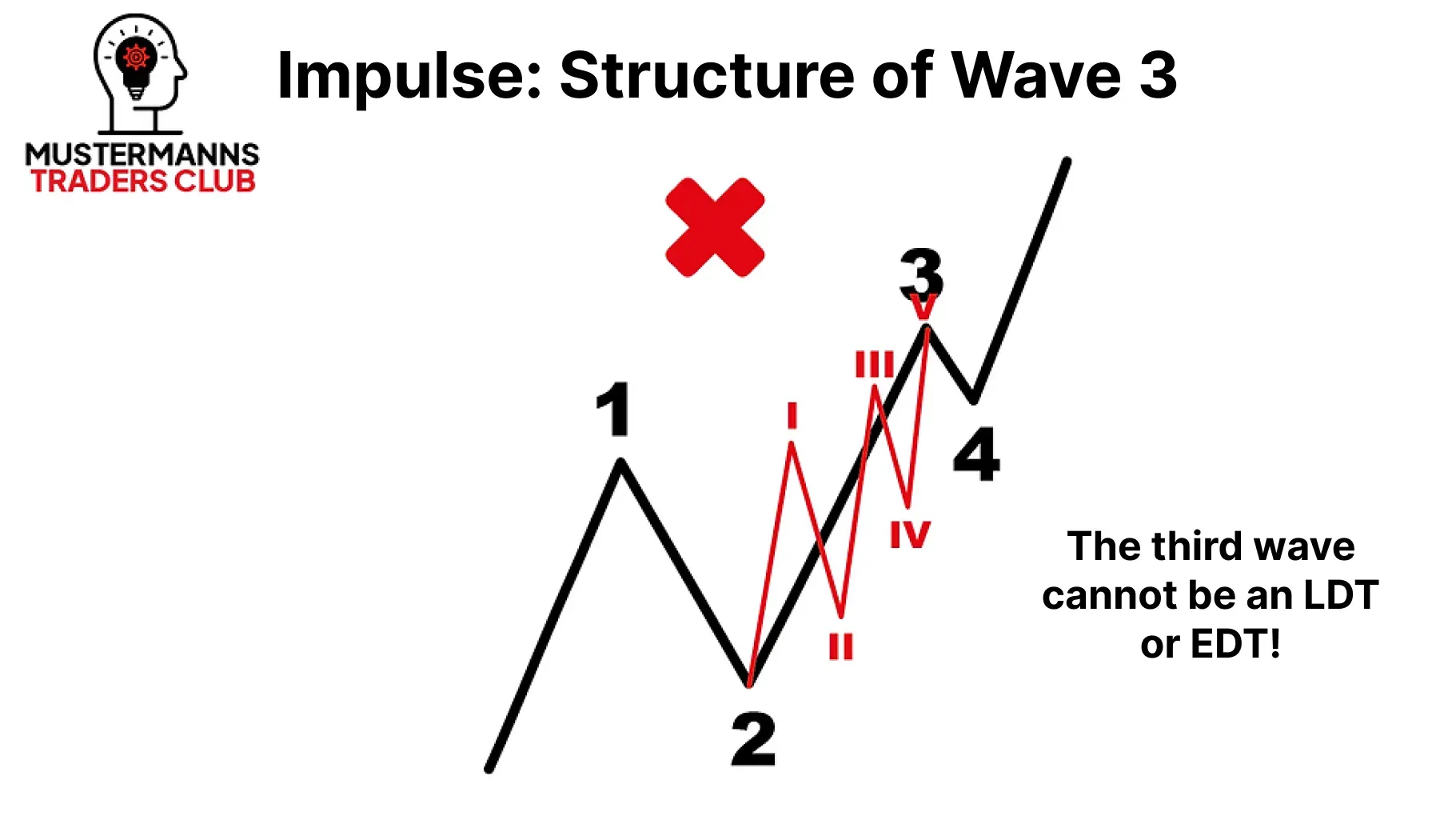

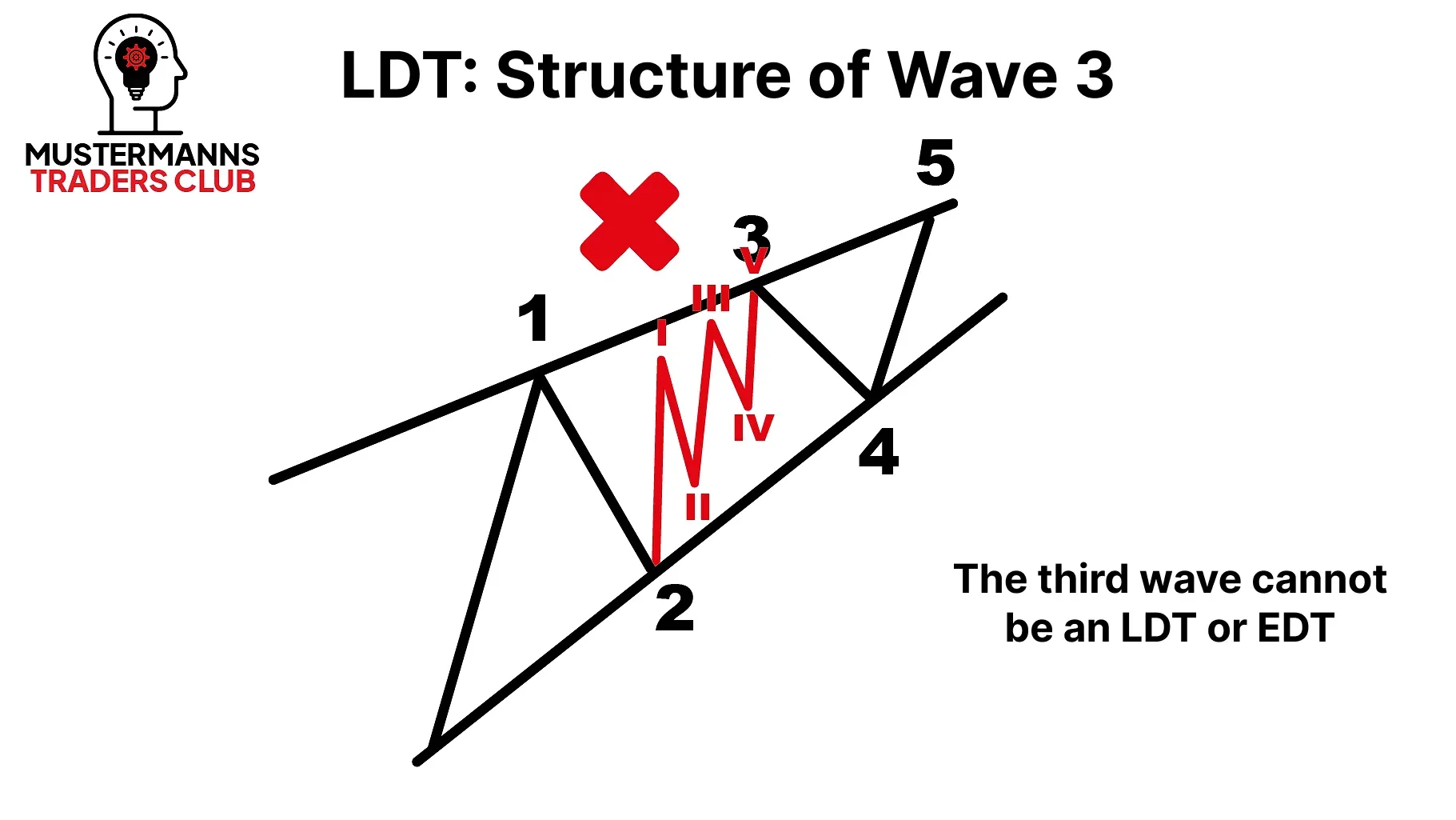

The third wave in an impulse can also consist of just one impulse. You can rule out an LDT or EDT here.

在推动浪中,第三浪也可能仅由一个推动浪构成。此时可以排除 LDT 或 EDT 的可能性。

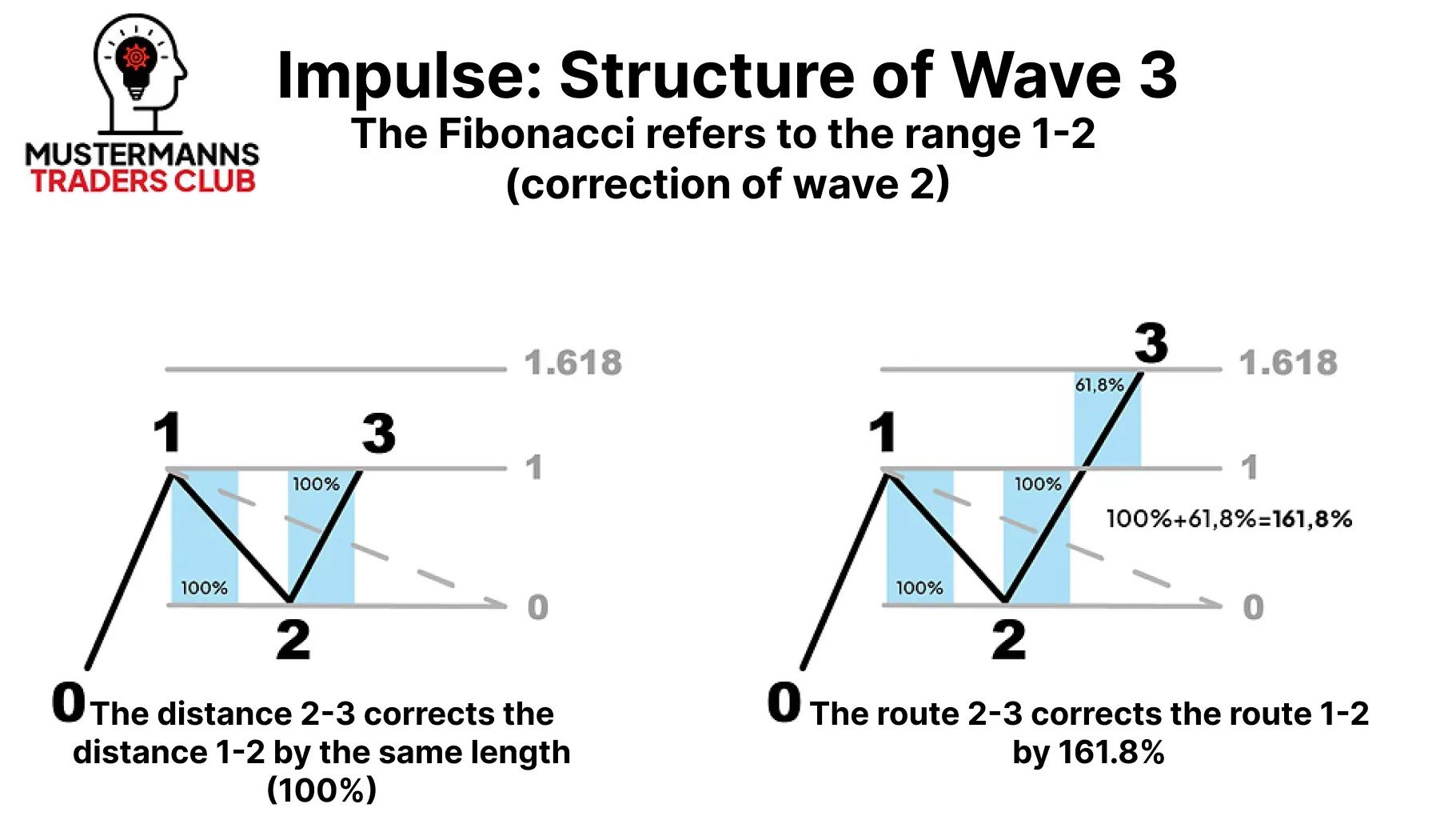

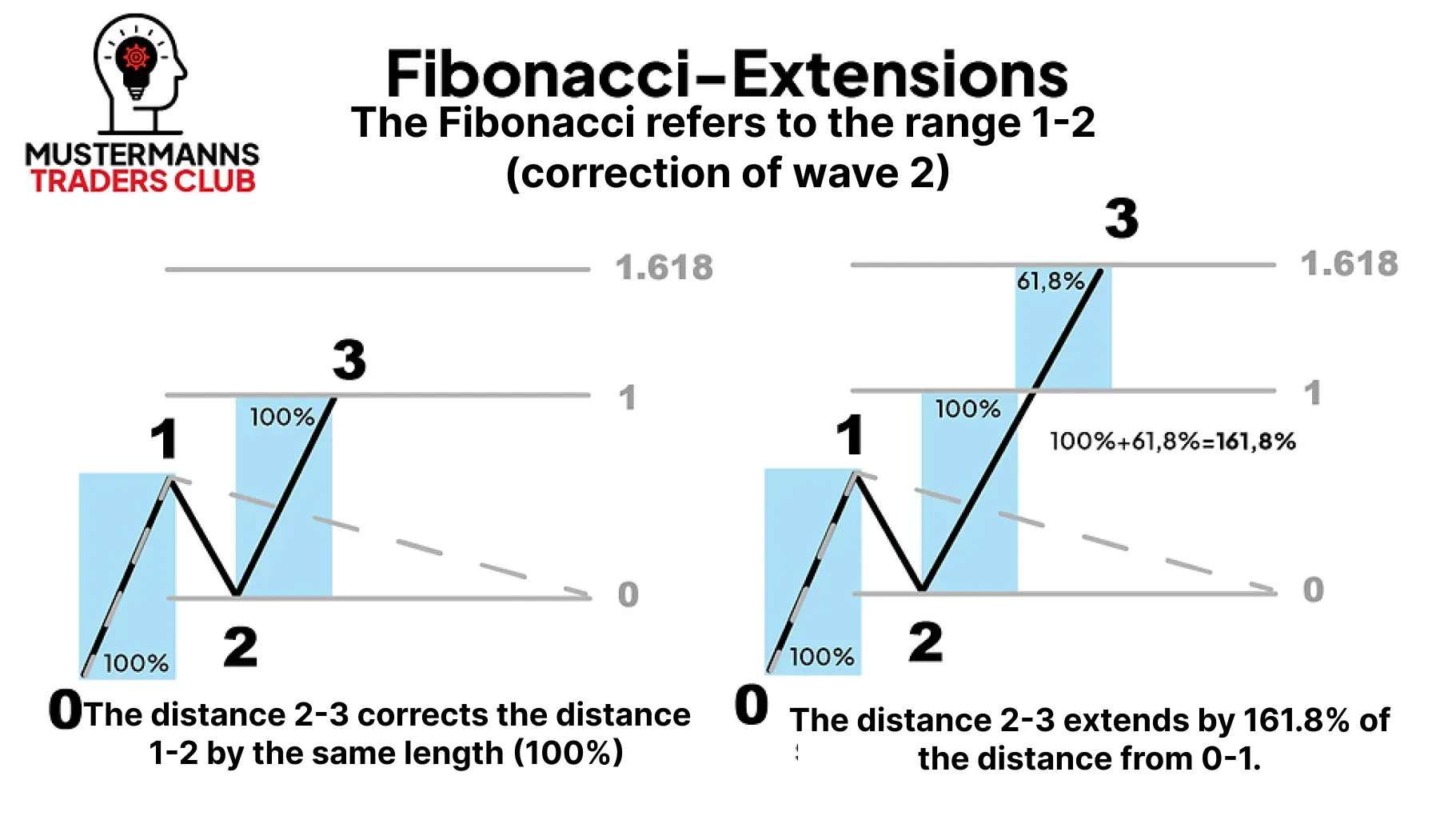

If you were able to realize your entry at the beginning of wave 3, you can use Fibonacci extensions to plan the targets for your trade. Fibonacci extensions should not be confused with Fibonacci retracements, which are usually used in harmonic analysis.

若能在第三浪初期把握入场时机,便可运用斐波那契扩展位规划交易目标。需注意斐波那契扩展位不同于常用于谐波分析的斐波那契回调位。

As you can see in the illustration, extension and retracement differ in the type of movement they compare with each other.

如图所示,延伸和回撤的区别在于它们相互比较的运动类型不同。

In the case of an extension, the first movement - wave 1 in Elliott wave theory terms - is decisive, where the extension levels for wave 3 can be found.

在延伸行情中,第一浪——即艾略特波浪理论中的1浪——具有决定性意义,从中可推演出第3浪的延伸幅度。

Retracements, on the other hand, do not take into account the first movement, but the subsequent correction. In the case of the Elliott wave theory, this is correction wave 2.

另一方面,回撤不考虑最初的走势,而是关注随后的修正。在艾略特波浪理论中,这对应的是修正浪2。

Which tool you use to determine the target of your wave 3 therefore has a major influence on the price regions in which the targets can be found. When analyzing Elliott waves, always remember to use the "Trend-based Fib Extension" tool.

因此,您用来确定第三浪目标的工具会极大影响潜在目标价位区域的判定范围。在进行艾略特波浪分析时,请始终牢记使用"基于趋势的斐波那契扩展"工具。

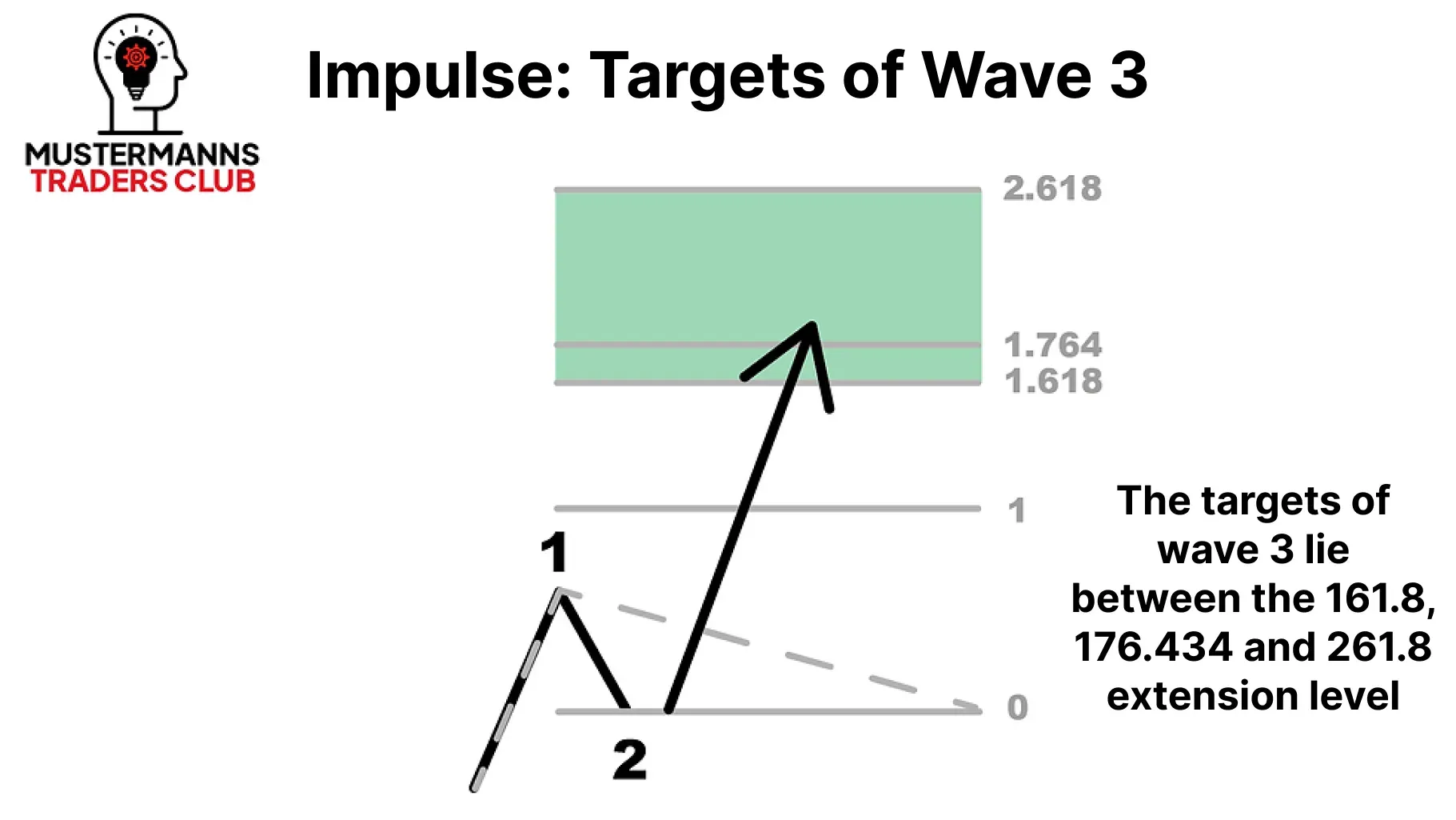

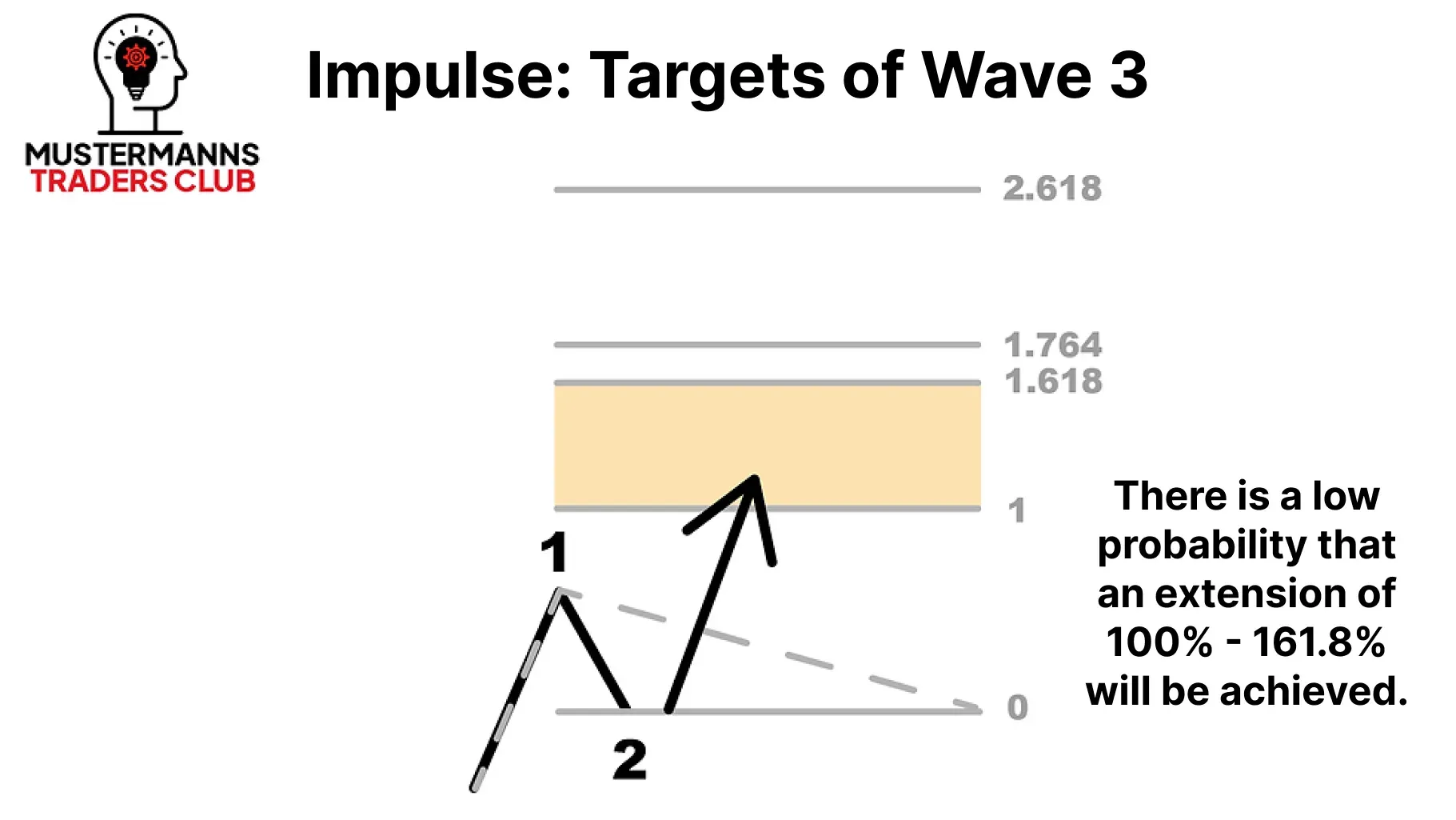

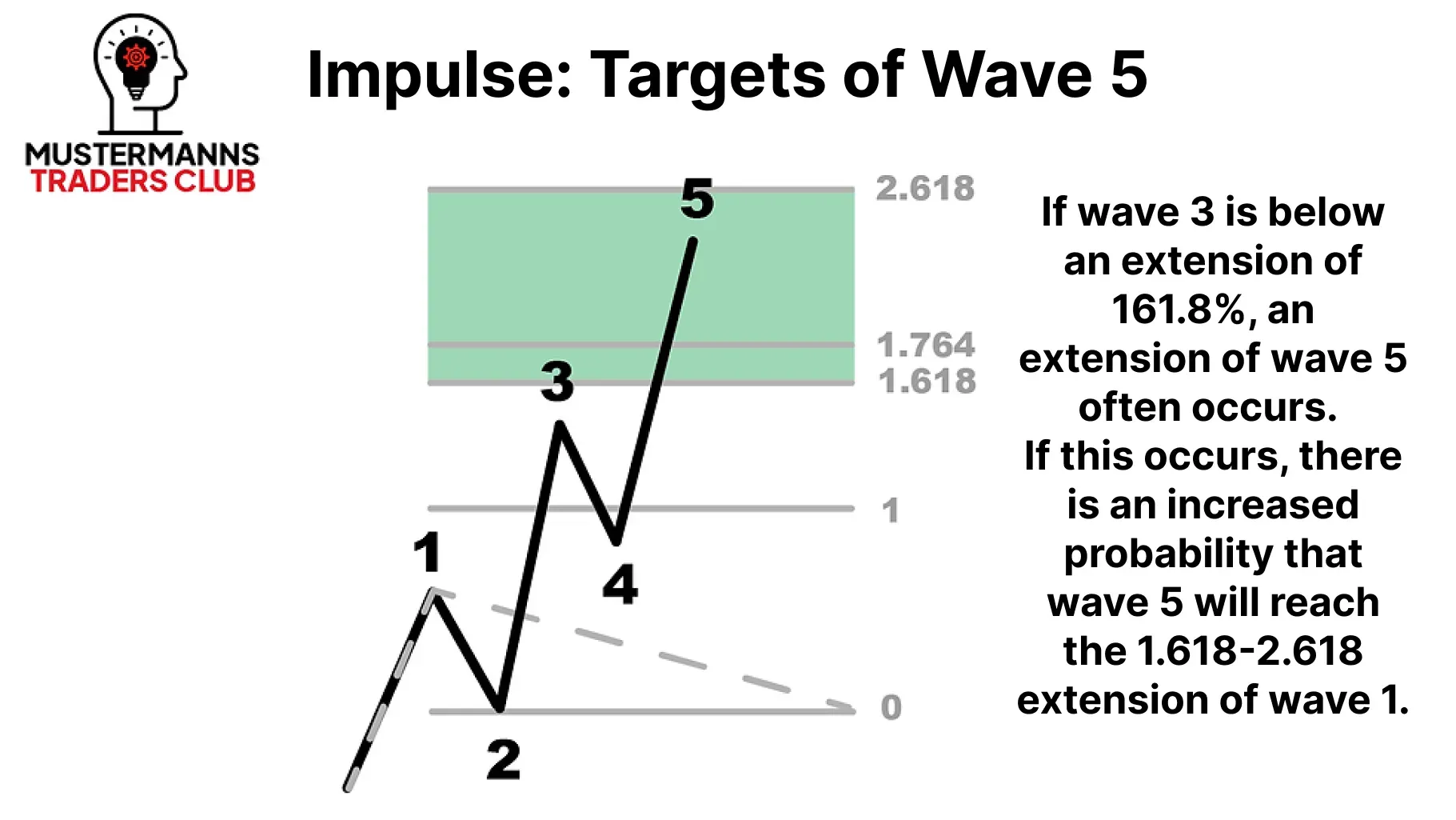

In most cases, wave 3 reaches at least the 161.8 extension level. This can also be derived from the fact that the third wave is predominantly impulsive. If the movement lacks suitable momentum, a wave 3 can also extend below 1.618. If this occurs, certain forecasts can be made for the last impulse wave, wave 5, which will be discussed in more detail below. Note, however, that the supposed wave 3 does not extend below 1, as in this case another option, such as a correction wave, is more likely.

在大多数情况下,第三浪至少会触及161.8%的延伸位。这也可以从第三浪主要呈现推动浪特性的事实中推导得出。若走势缺乏足够动能,第三浪也可能延伸至1.618倍以下。若出现这种情况,可对最后的推动浪——第五浪作出特定预测,下文将对此进行详细讨论。但需注意,假设的第三浪不应延伸至1倍以下,因为此时更可能出现其他走势选项,例如调整浪。

Note, however, that wave 3 must necessarily extend above the high of wave 1.

但需注意,第三浪必须突破第一浪的高点。

Wave 4 第四浪

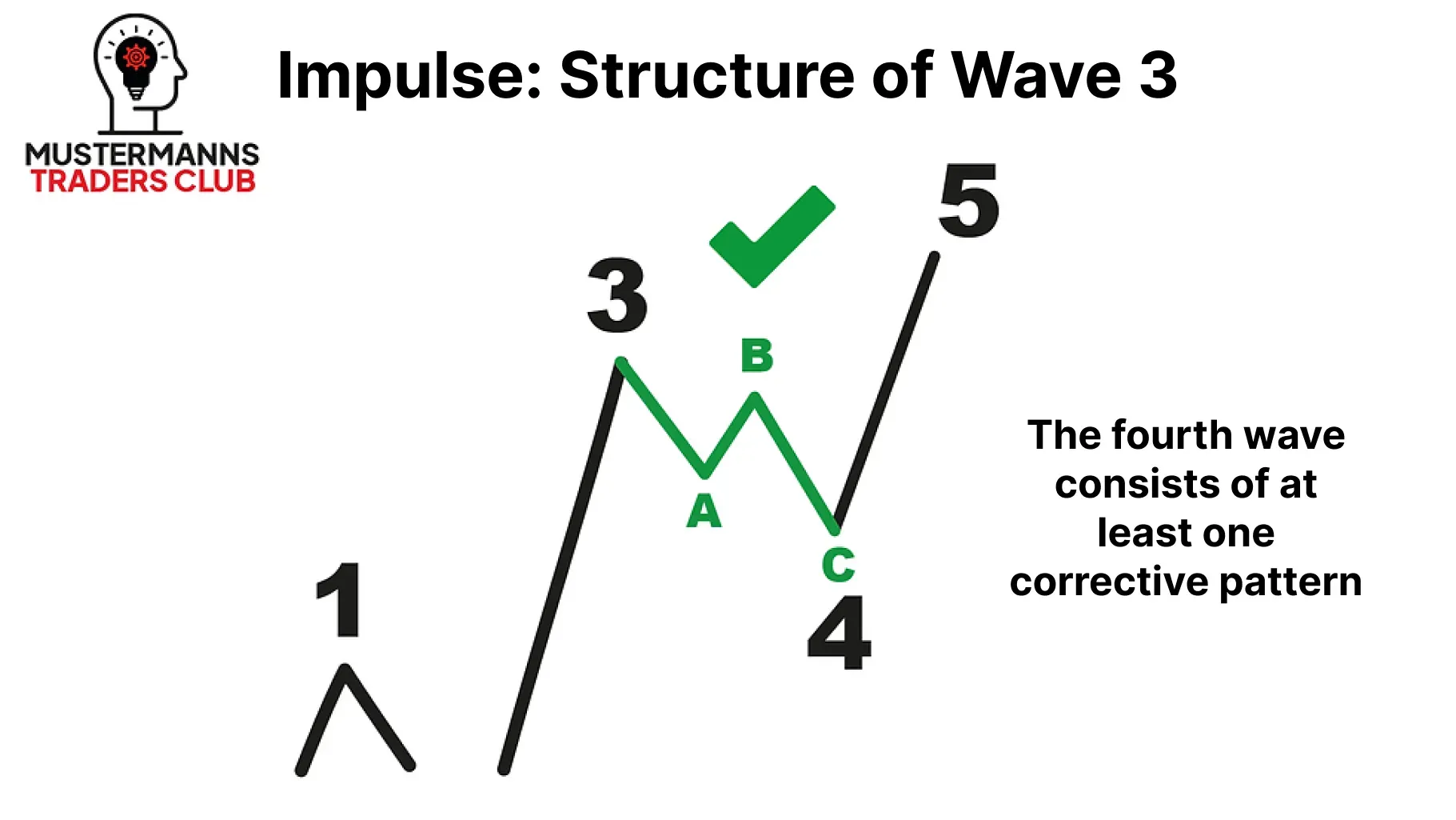

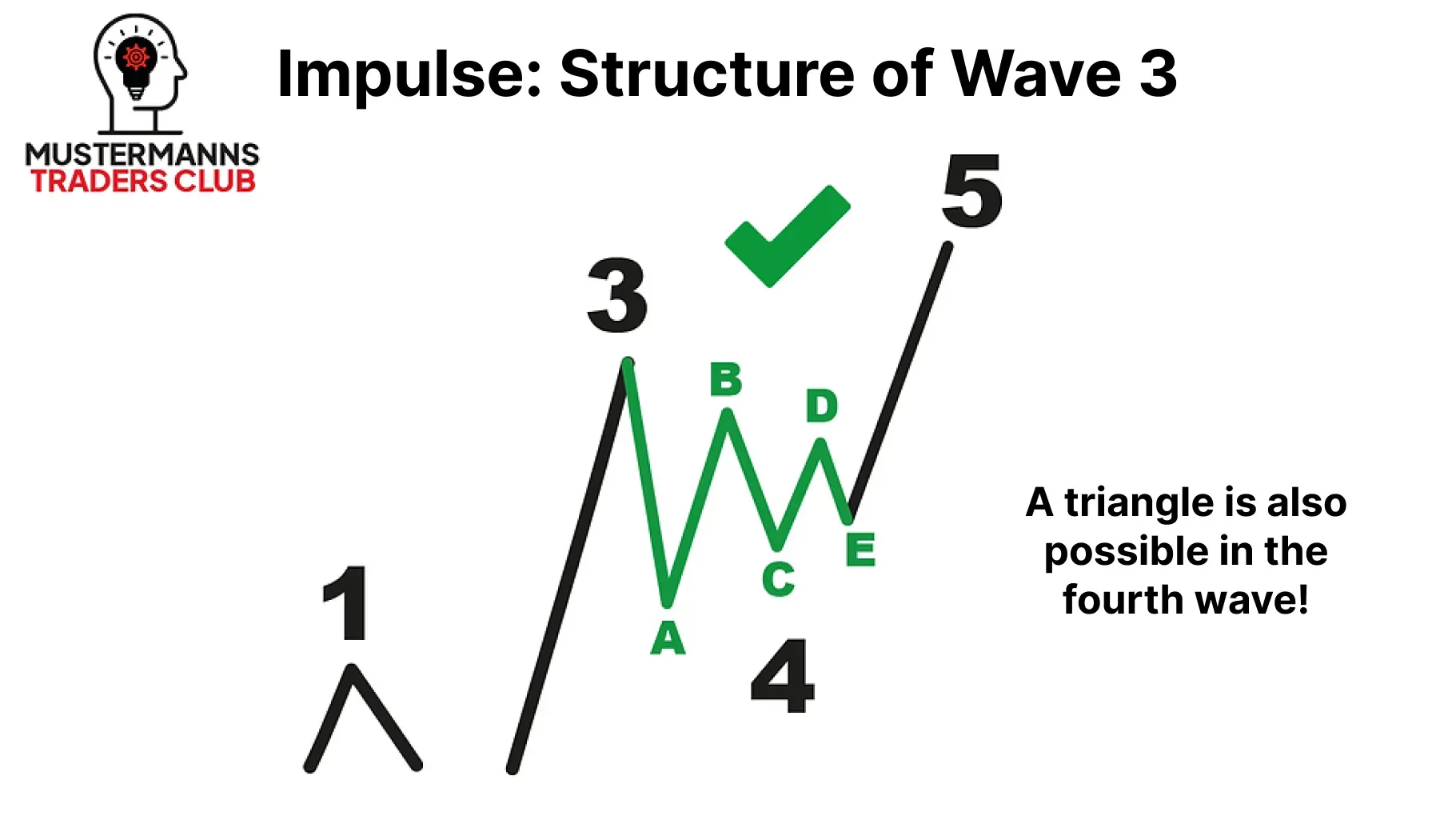

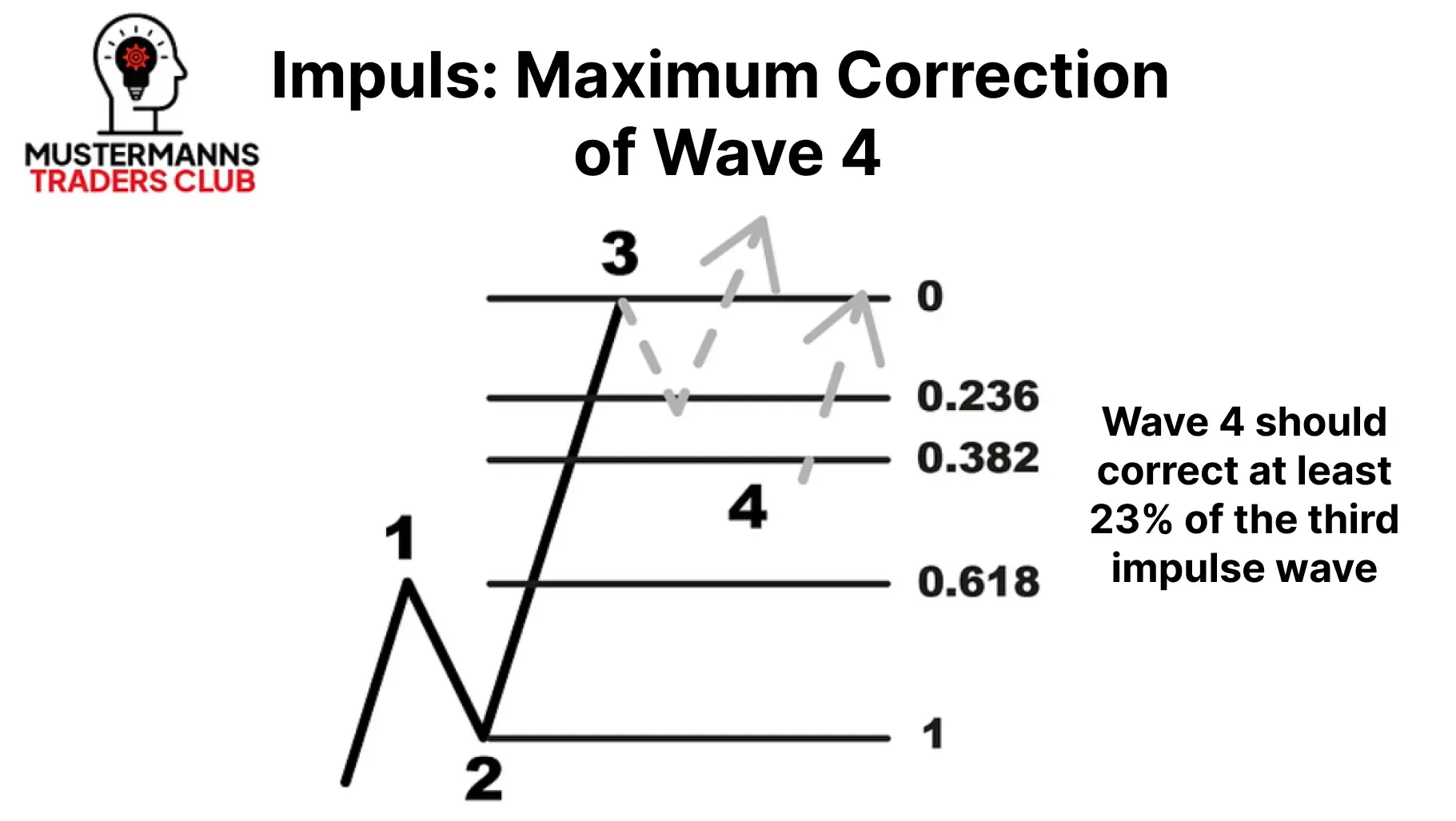

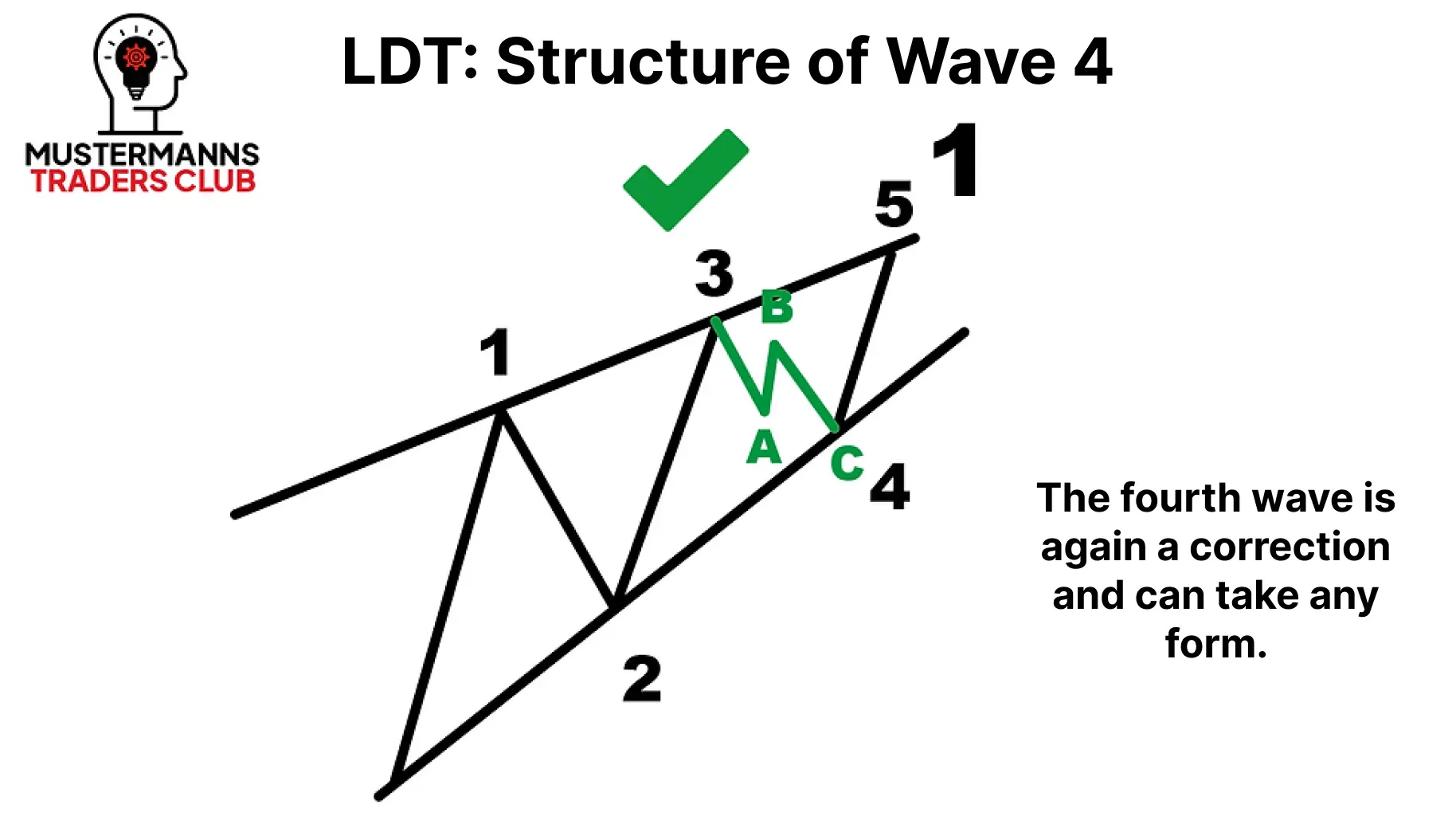

Before the impulse ends with the fifth wave, a second corrective wave follows in wave 4, which, unlike wave 2, may consist of all possible corrections.

在第五浪结束推动浪之前,第四浪会出现第二次调整浪,与第二浪不同,它可能包含所有可能的调整形态。

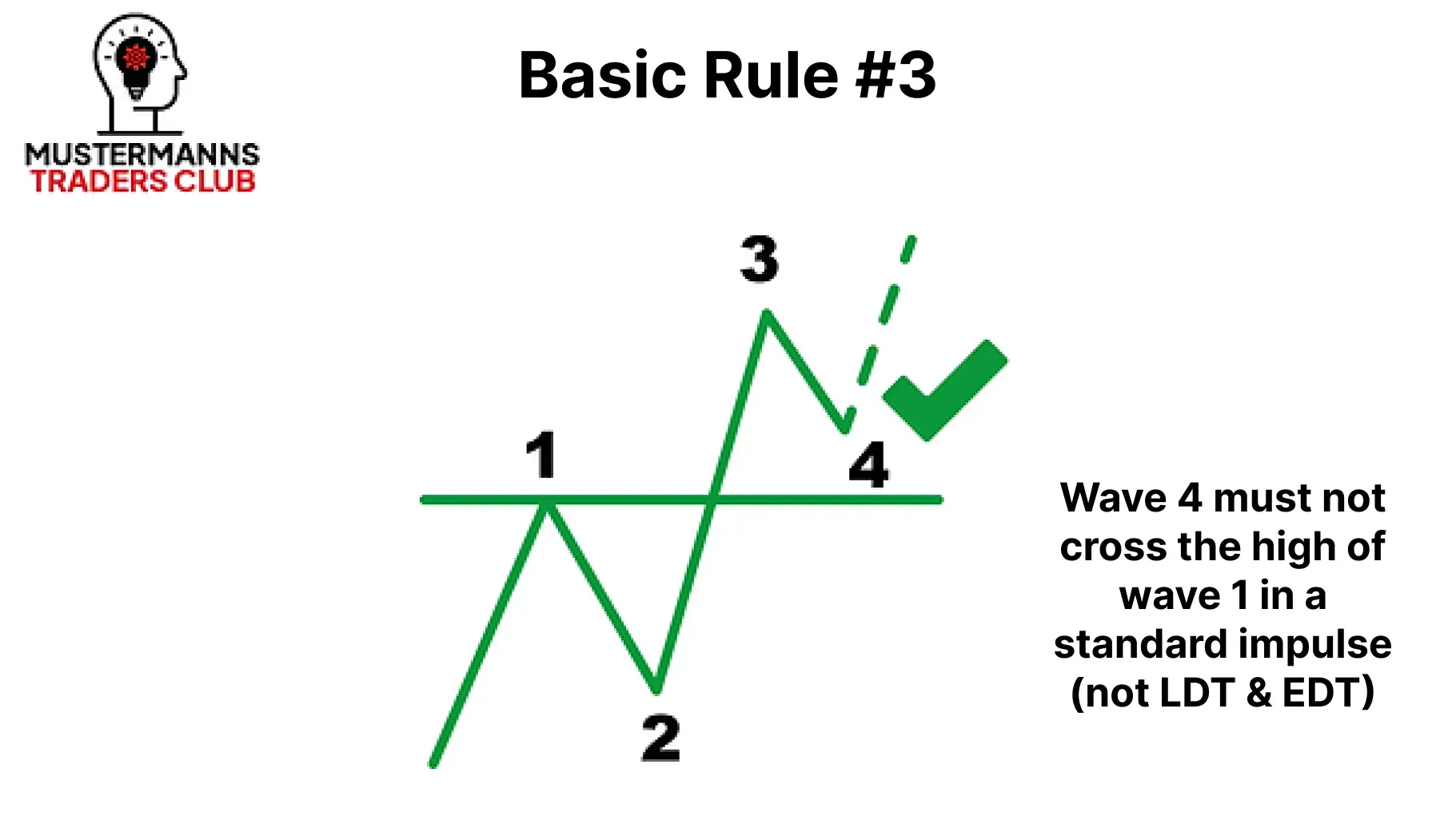

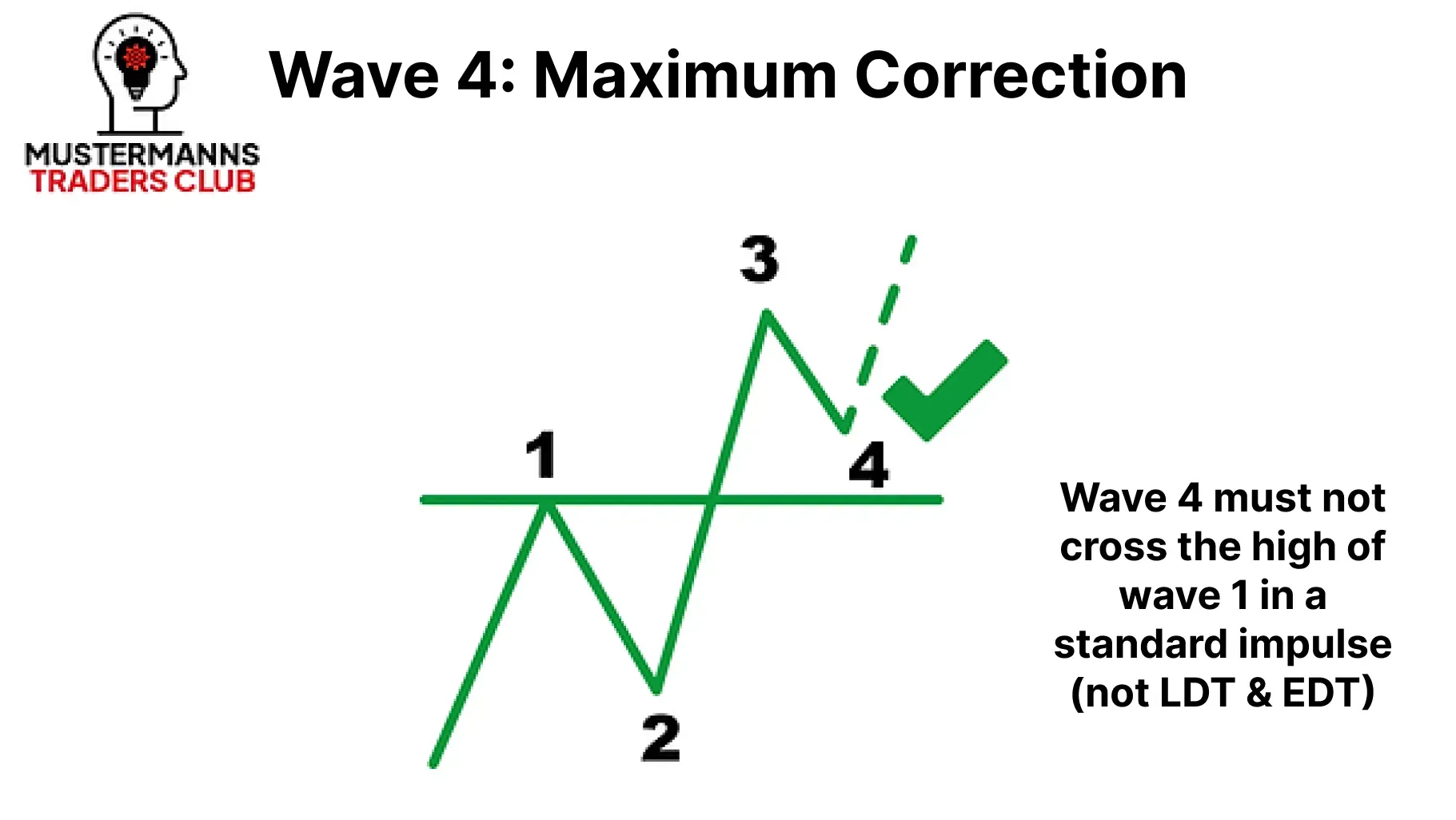

One of the most important rules in an impulse is that wave 4 must not intersect the high of the first wave. This rule always applies in an impulse!

在推动浪中最重要的规则之一是第4浪绝不能与第1浪的高点相交。这条规则在推动浪中永远适用!

You can also use this rule to refine your risk management. If you are planning to enter wave 4 in order to trade in the direction of wave 5, the rule can be a basis for you to define a stop loss. But more on this later...

你也可以运用这一法则来优化风险管理。若计划在第四浪入场以顺第五浪方向交易,该法则可作为你设定止损位的依据。不过关于这点我们稍后再详谈...

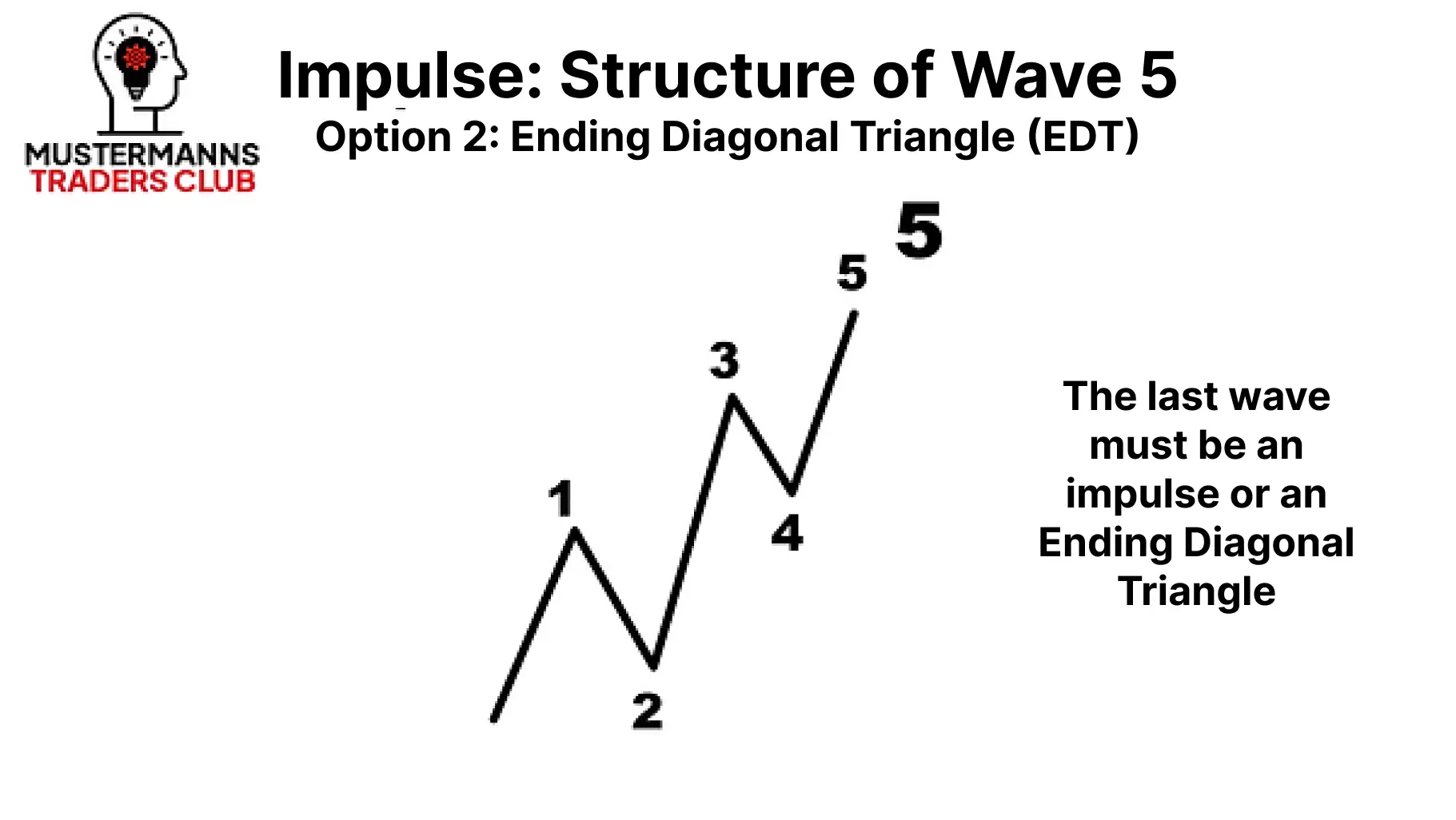

The End - Wave 5

终结浪 - 第5浪

The impulse ends with wave 5. It marks the end of the movement and the beginning of the subsequent corrective movement. For this reason, falling volume can often be seen in the chart. Compared to the third wave, the fifth wave is generally less impulsive.

推动浪在第5浪结束。它标志着该趋势的终结和后续调整浪的开始。因此,图表中常可见成交量下降。与第3浪相比,第5浪通常推动力较弱。

It is often the peak of large movements in the chart and can therefore be observed shortly before a trend reversal.

它通常是图表中大幅波动的峰值,因此可以在趋势反转前观察到。

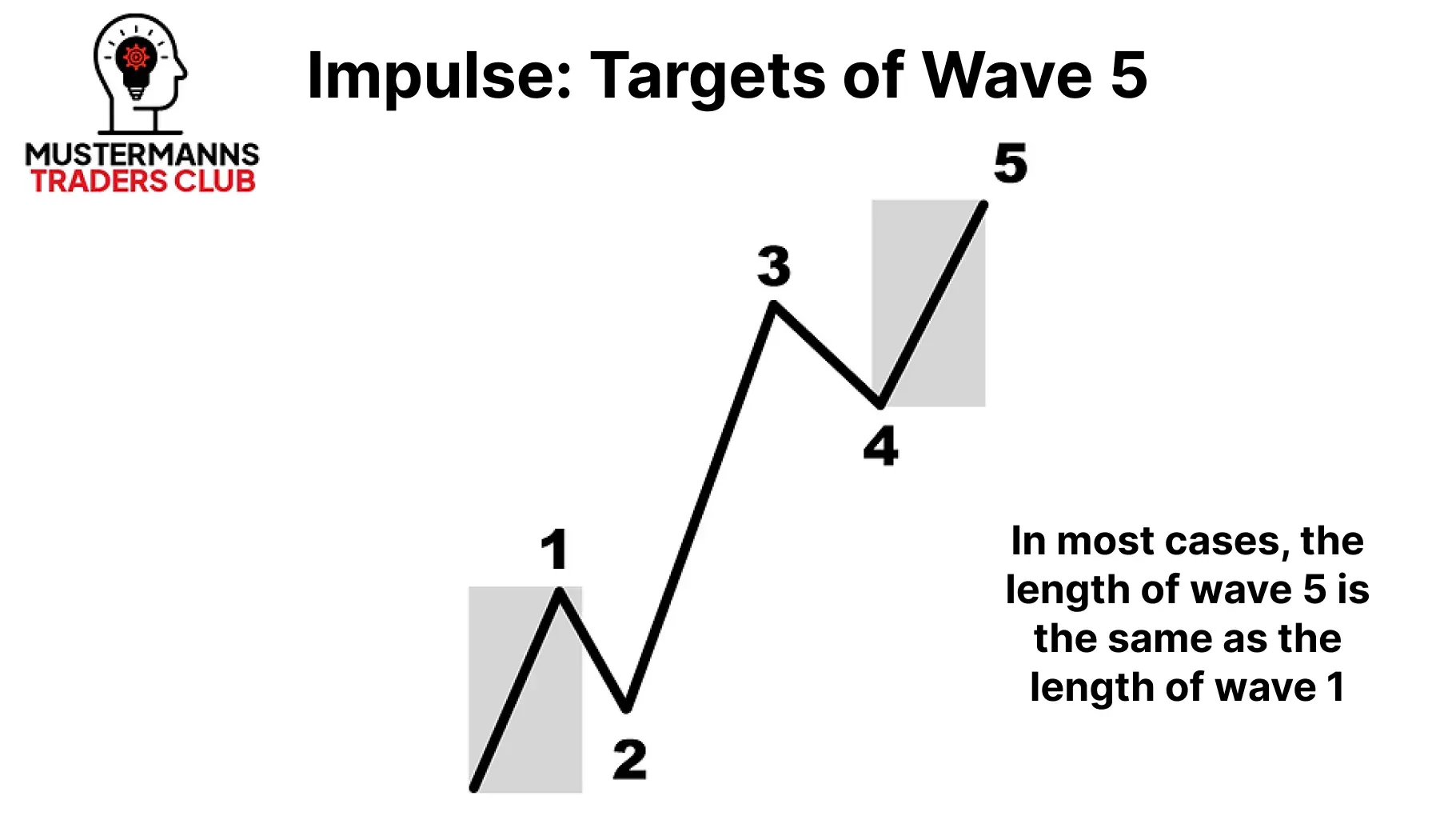

The extension of the fifth wave in the impulse can often be equated with the length of wave 1. However, this rule of thumb can often only be applied to situations in the chart where the impulse of wave 3 reaches at least the 1.618 extension. If the third wave was unusually short, the probability that the fifth wave will extend strongly is increased. Among "Elliott wavers", the term "extended five" is commonly used for this phenomenon.

在推动浪中,第五浪的延伸往往与第一浪的长度相当。不过这一经验法则通常仅适用于图表中第三浪推动至少达到1.618倍延伸的情况。若第三浪异常短小,则第五浪强势延伸的概率将增大。在"艾略特波浪理论实践者"群体中,这种现象常被称为"延伸五浪"。

This characteristic of wave 5 shows how important it is to measure the impulse using the Fibonacci extension.

第5浪的这一特性展示了使用斐波那契扩展来衡量推动浪的重要性。

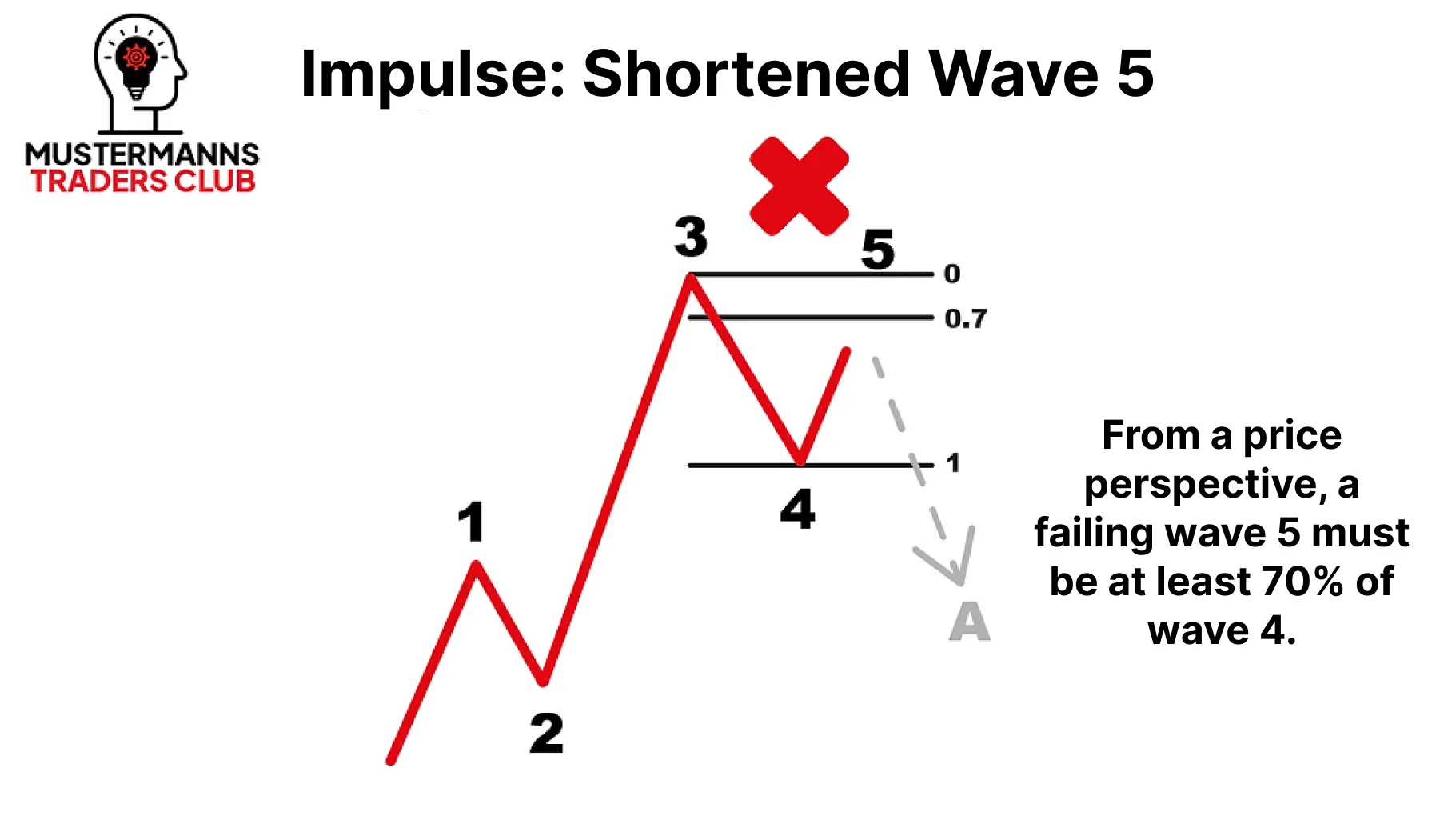

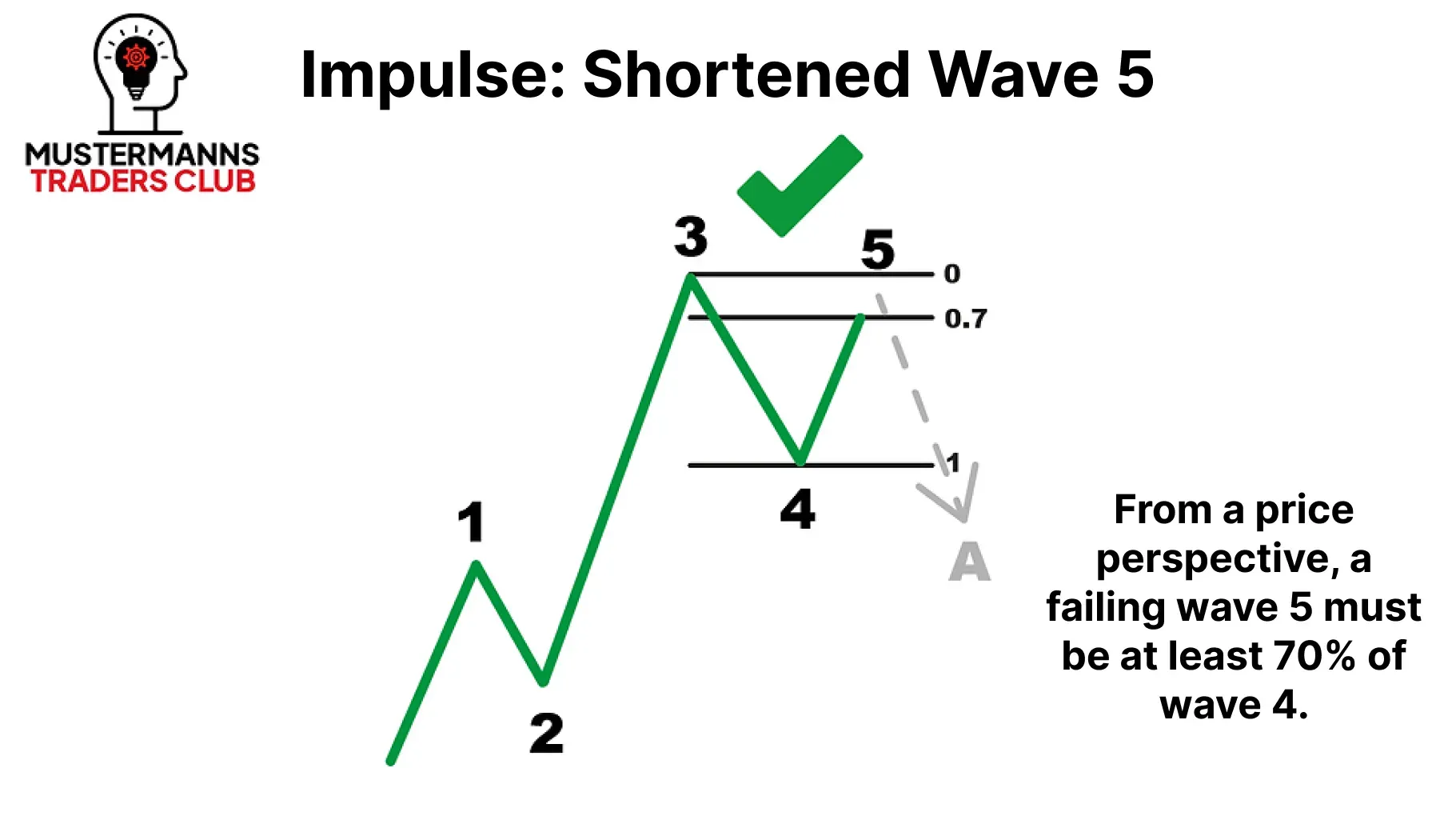

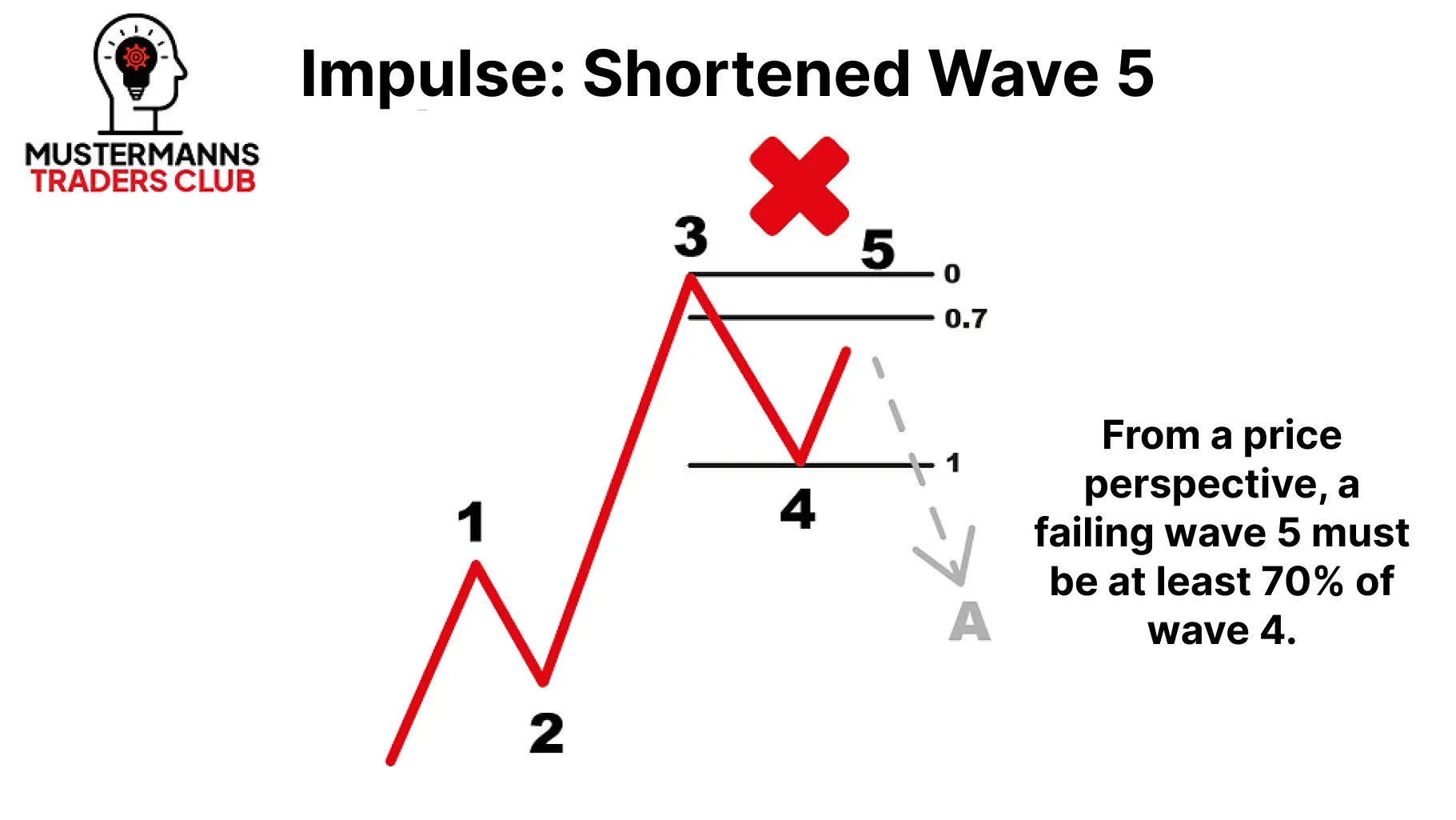

Although wave 5 does not necessarily have to surpass the high of wave 4, it must correct the previous correction in the fourth wave by at least 70%. If it fails to do so, it is often a wave B.

尽管第五浪不一定要超越第四浪的高点,但它必须至少修正第四浪前一波调整的 70%。若未能达成这一条件,则通常属于 B 浪。

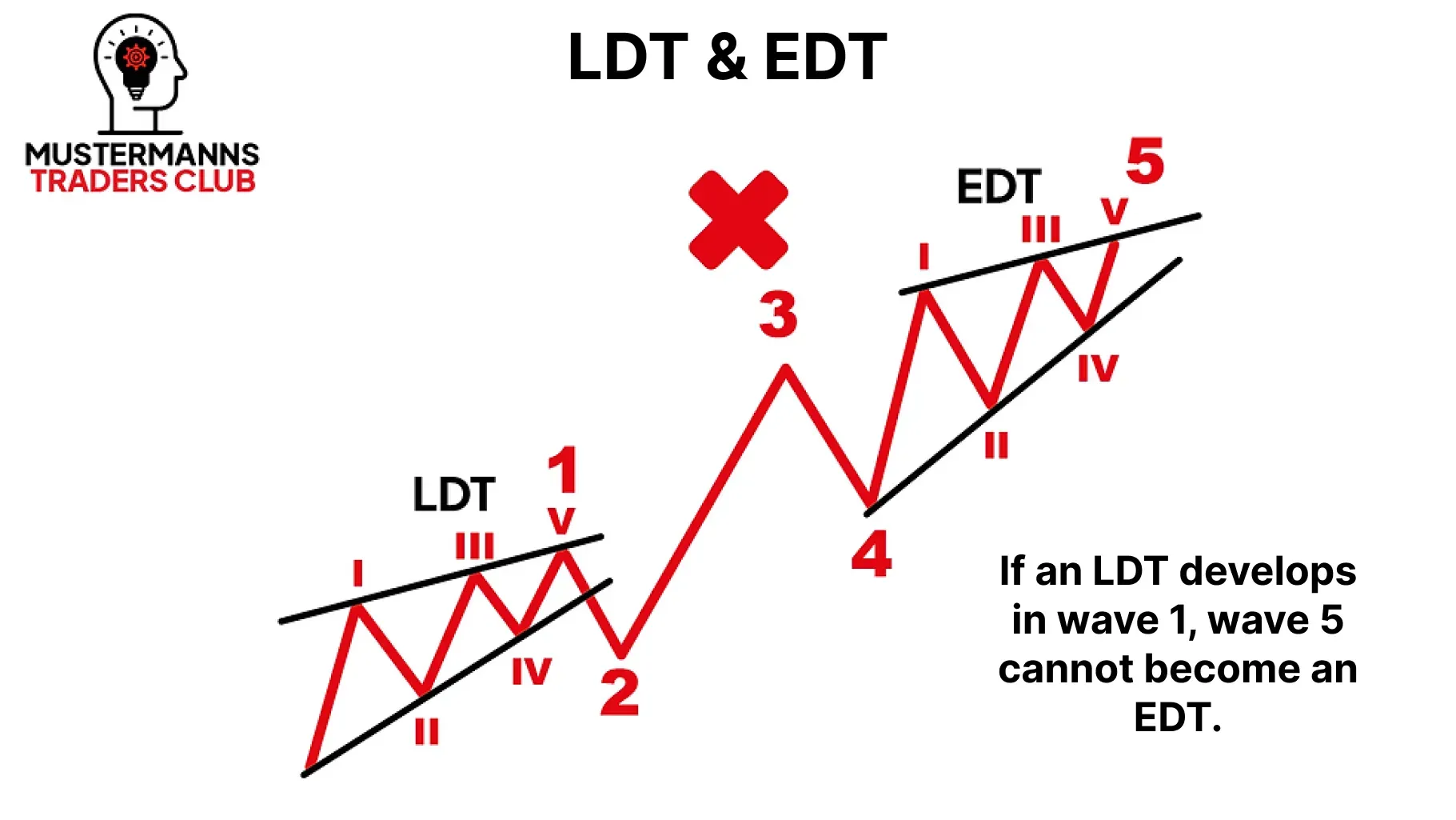

As you learned in this lesson, waves 1 and 5 can also form an LDT or an EDT in addition to the impulse itself. However, it is important to know that they are not both present in the chart at the same time. If you find an LDT in the first wave, you can rule out an EDT in the last wave.

正如本课所学,除了完整的推动浪形态外,第 1 浪和第 5 浪也可能形成 LDT 或 EDT 结构。但需注意这两种形态不会同时出现在图表中。若发现第一浪呈现 LDT 形态,则可排除最后一浪出现 EDT 的可能性。

Impulse wave ≠ Impulse?

脉冲波 ≠ 脉冲?

As you probably already learned in the last lesson on impulses, there are different impulse waves. Just because there is an impulse wave in the chart does not mean, for example, that wave 4 must not intersect. This rule only applies to normal impulses, as is often the case on the internet. In the LDT and in the later EDT, the crossing is even a prerequisite for the wave count to be valid. This example makes it clear to you why it is so relevant to classify impulse waves into their three variants.

正如你可能在上节关于推动波的课程中已了解到的,推动波存在不同类型。图表中出现推动波并不意味着第四浪绝对不能重叠——这条规则仅适用于常规推动波,正如网络上常见的情况。而在引导倾斜三角形(LDT)和后续的终结倾斜三角形(EDT)中,浪型重叠恰恰是有效波浪计数的前提条件。这个例子清楚地说明了为何将推动波划分为三种变体具有如此重要的意义。

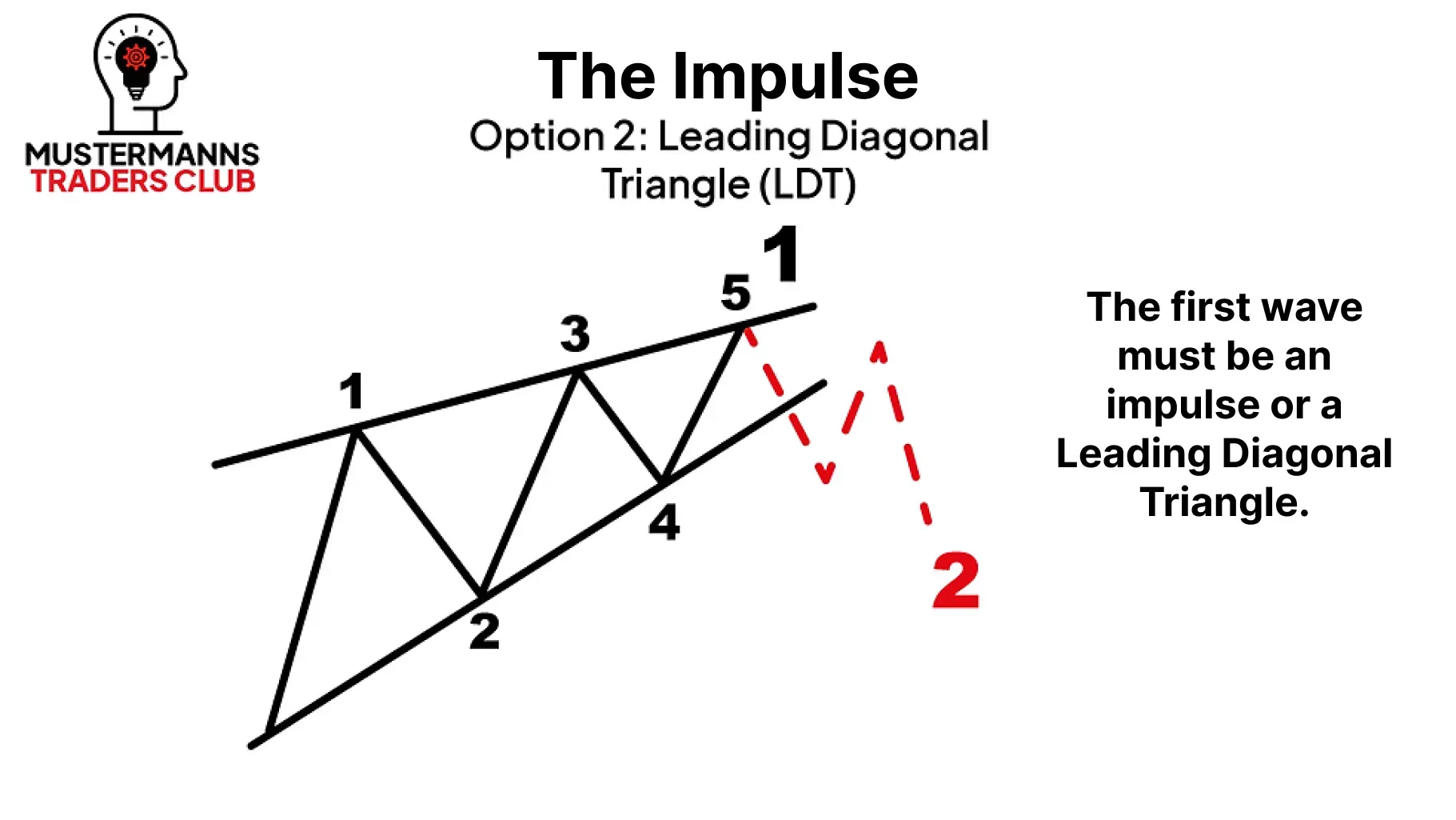

Now that we have an overview, let's take a closer look at the specific structure of the Leading Diagonal Triangle.

既然我们已经有了整体认识,接下来让我们更详细地观察引导对角线三角形的具体结构。

Leading Diagonal Triangle

引导对角线三角形

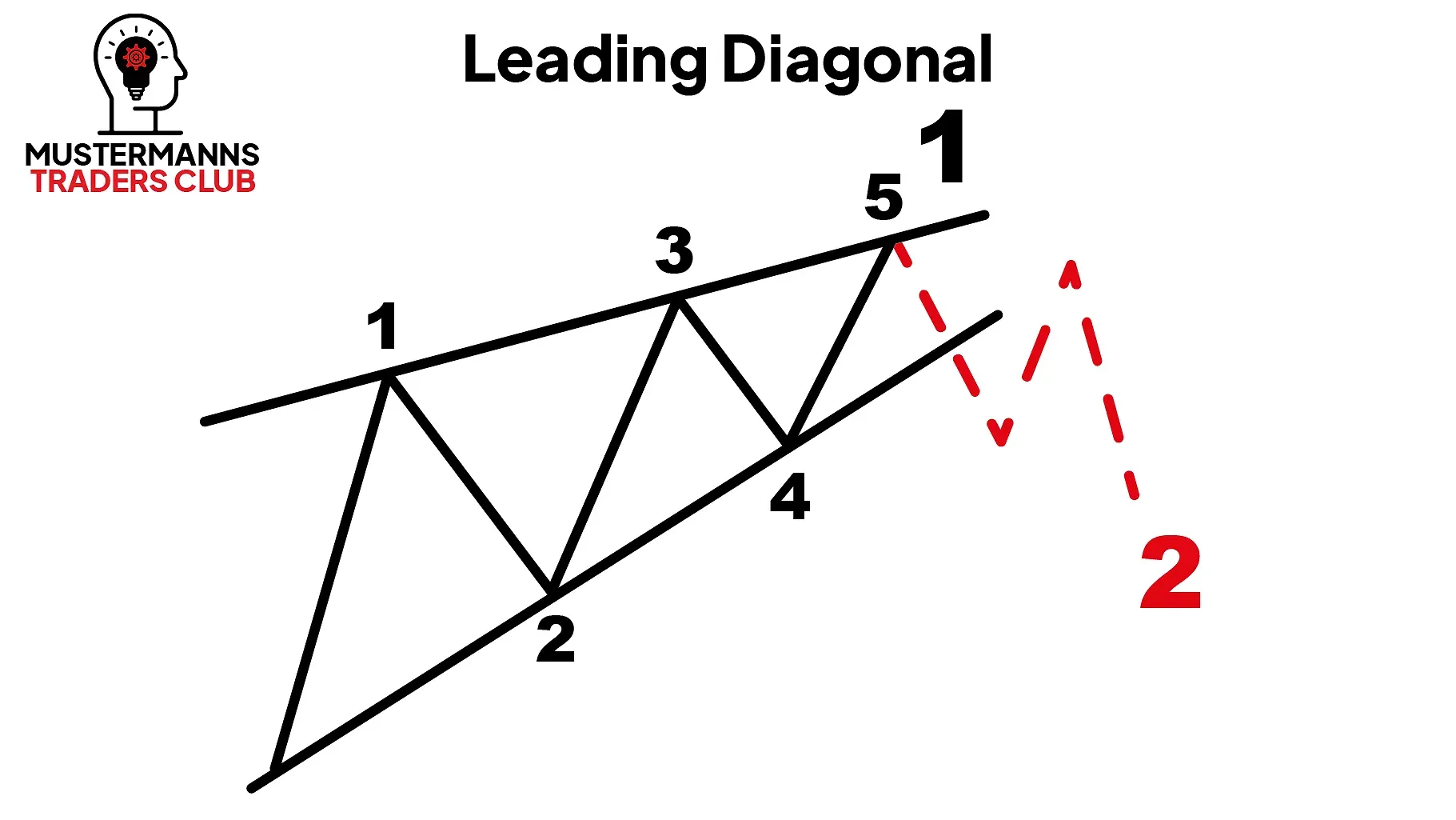

Like the normal impulse, the LDT is an impulse wave with a 5-3-5-3-5 structure. There are therefore three impulse waves and two correction waves in the wave formation. Unlike the impulse, the LDT is more reminiscent of a flat wedge, which makes it easier to analyze in the chart. Your chances of success on an LDT are highest on small charts (<15 minutes). Since the LDT can only form in wave 1 of an impulse wave (impulse or a superordinate LDT itself), wave 5 in the LDT is followed by a correction wave in the superordinate wave 2. The

与常规推动浪类似,LDT(领先对角线形态)是一种具有 5-3-5-3-5 结构的推动浪。因此在波浪形态中包含三组推动浪和两组调整浪。不同于标准推动浪的是,LDT 更类似于平坦楔形,这使得其在图表中更易于分析。在小周期图表(15 分钟以下)中交易 LDT 的成功率最高。由于 LDT 仅可能出现在上级推动浪(标准推动浪或更高级别的 LDT 本身)的第 1 浪中,因此 LDT 的第 5 浪结束后将迎来上级第 2 浪的调整。

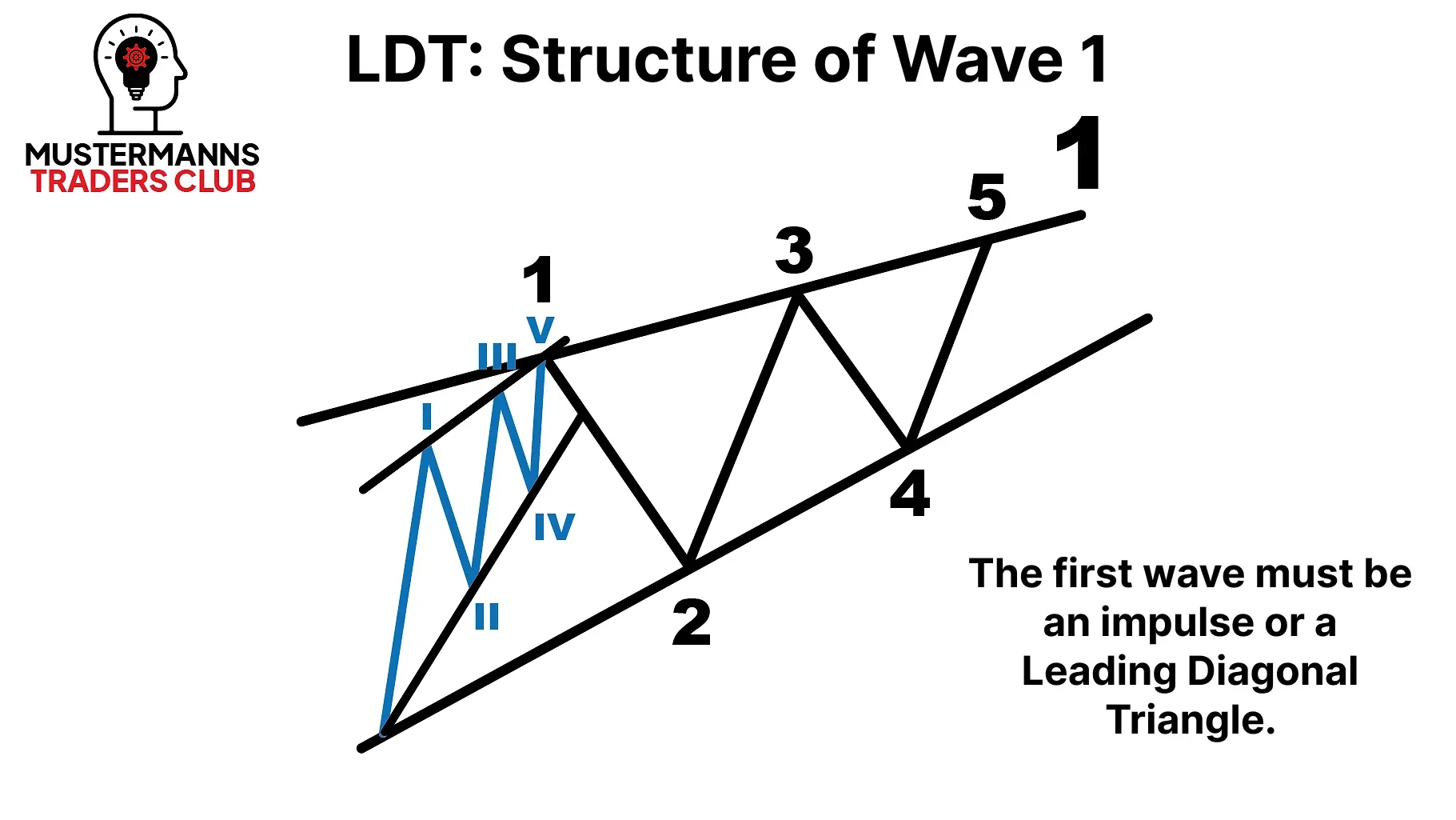

The Beginning - Wave 1

初始阶段 - 第一浪

The first movement in an LDT can be a five-wave impulse or an LDT itself. Tip: Also analyze the structure of the subordinate impulse wave! There are correction waves, which are also five-wave waves. You can distinguish these from a real impulse wave by making sure that the first, third and fifth waves themselves have a five-wave structure, i.e. that they are impulse waves.

LDT 中的第一段走势可以是五浪推动浪,也可以是 LDT 本身。提示:还需分析次级推动浪的结构!存在一些修正浪同样呈现五浪形态。要将其与真正的推动浪区分开,需确认第一、第三和第五浪本身具有五浪结构,即它们必须是推动浪。

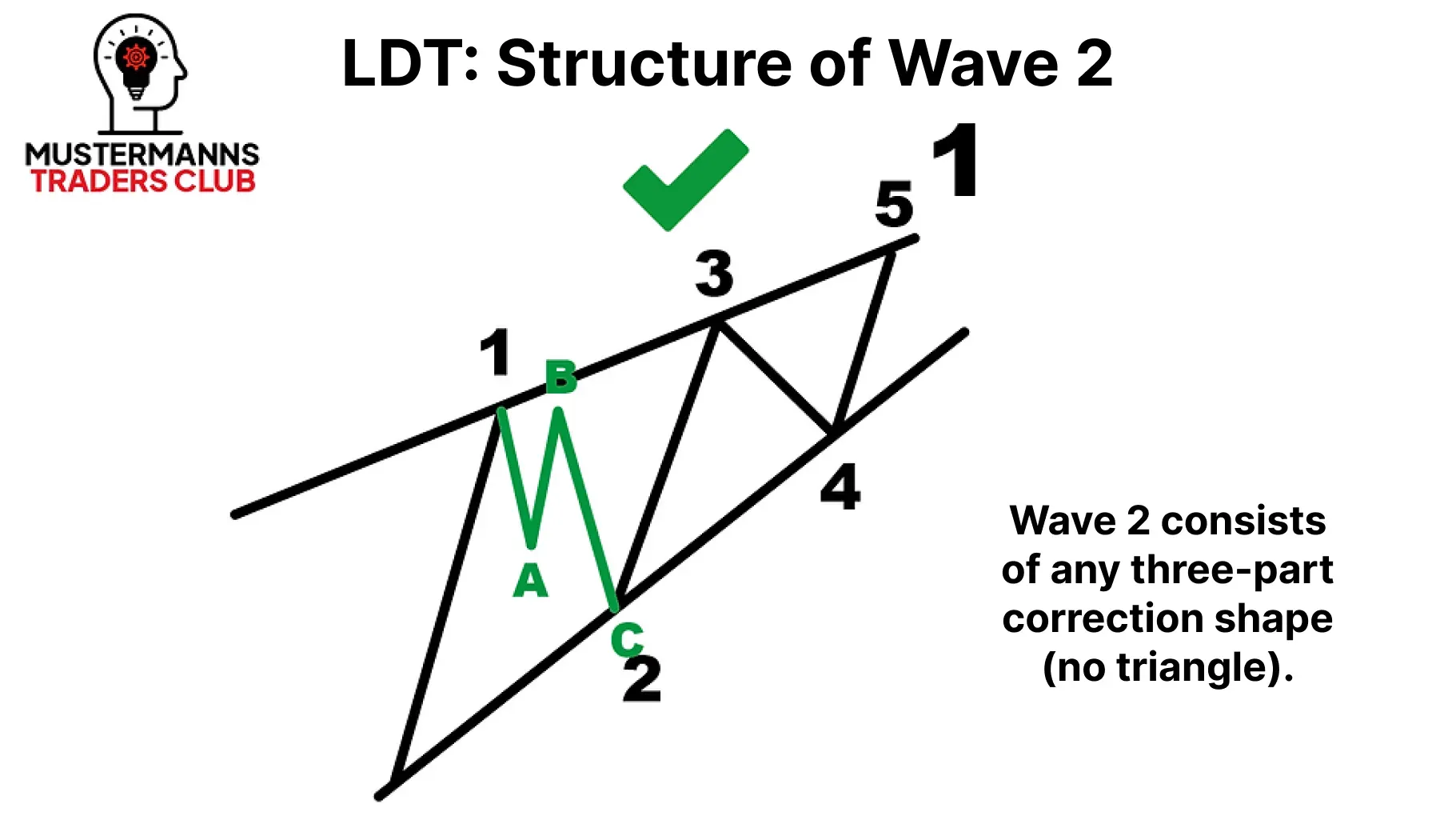

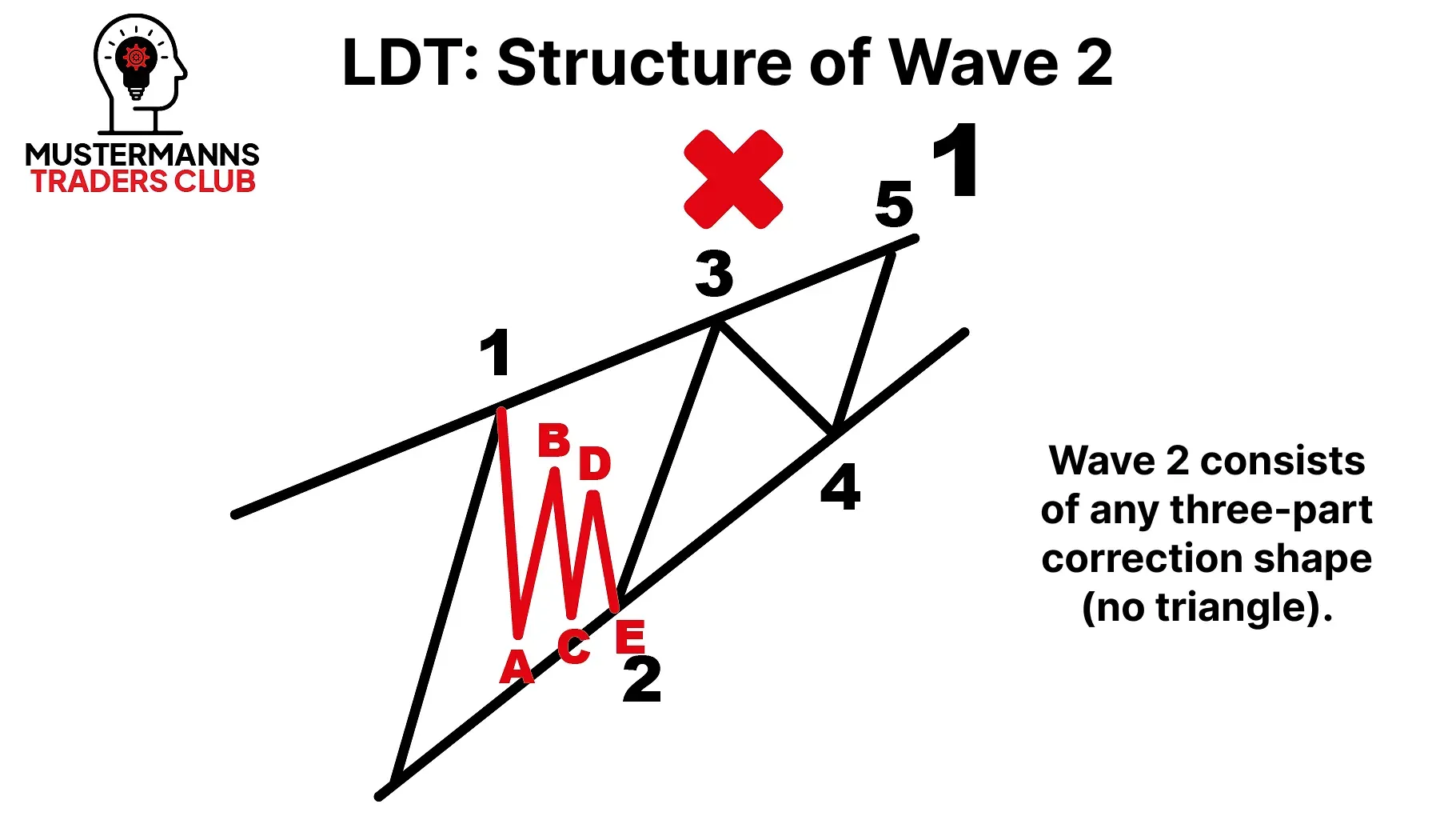

The Reaction - Wave 2

反应阶段——第二浪

Just like the normal impulse, wave 2 can consist of all possible corrective waves except triangles. If you find a triangle in the second wave of your LDT, your count is wrong.

与常规推动浪相同,浪2可以包含除三角形之外的所有调整浪形态。如果在你的引导倾斜三角形第二浪中发现三角形结构,说明你的浪型划分存在错误。

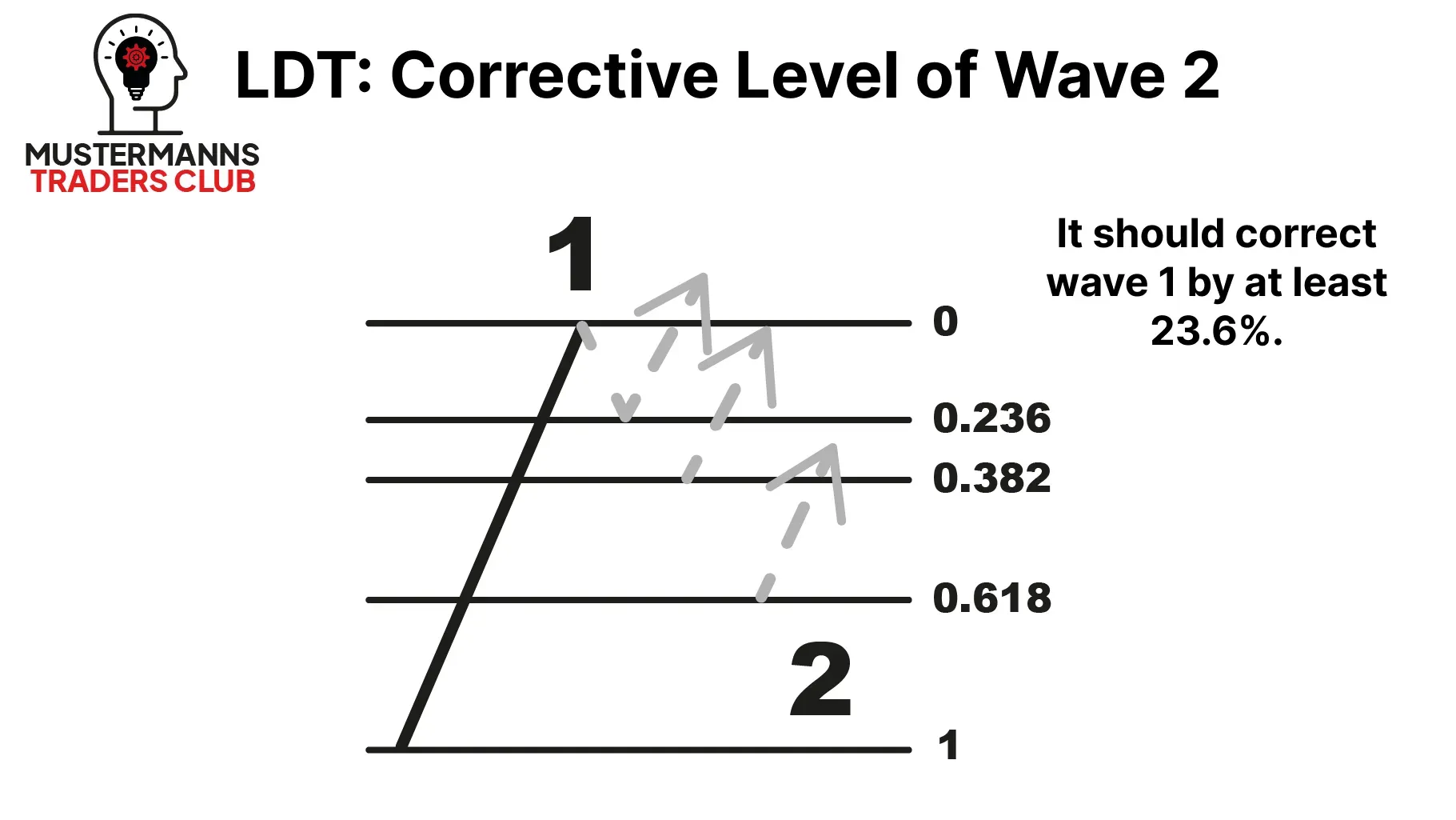

As you can see, the relevant correction levels of wave 2 are the same as for the impulse. Wave 2 should correct wave 1 by at least 23.6%. The 38.2% and 61.8% Fibonacci retracement are also important starting points for the correction. Since the LDT is an impulse wave, you must always take into account that the correction in wave 2 does not intersect the origin (i.e. the low) of wave 1.

如图所示,浪 2 的相关修正级别与推动浪相同。浪 2 对浪 1 的修正幅度至少应达到 23.6%。38.2%和 61.8%的斐波那契回撤位同样是修正阶段的重要起始点。由于 LDT 属于推动浪,必须始终注意浪 2 的修正不会跌破浪 1 的起点(即浪 1 的低点)。

No rocket? - Wave 3

没有火箭?- 第3浪

There are also similarities in wave 3 to wave 3 in the impulse. Here, wave 3 must also consist of an impulse and be higher in price than the high of wave 1. The biggest visual difference between the impulse and the LDT is probably the extent of wave 3. While it is common for it to be the largest wave in the impulse, it is usually smaller than wave 1 in the LDT. However, it should not be forgotten that it must never be the smallest.

在推动浪中,第三浪与第三浪之间也存在相似性。此处第三浪同样必须由推动浪构成,且价格需高于第一浪的高点。推动浪与延长浪最显著的视觉差异或许在于第三浪的幅度——虽然在推动浪中它常是最大的一浪,但在延长浪中通常小于第一浪。不过必须牢记:它绝不能成为最小的一浪。

The Trademark - Wave 4

商标标识 - 第4浪

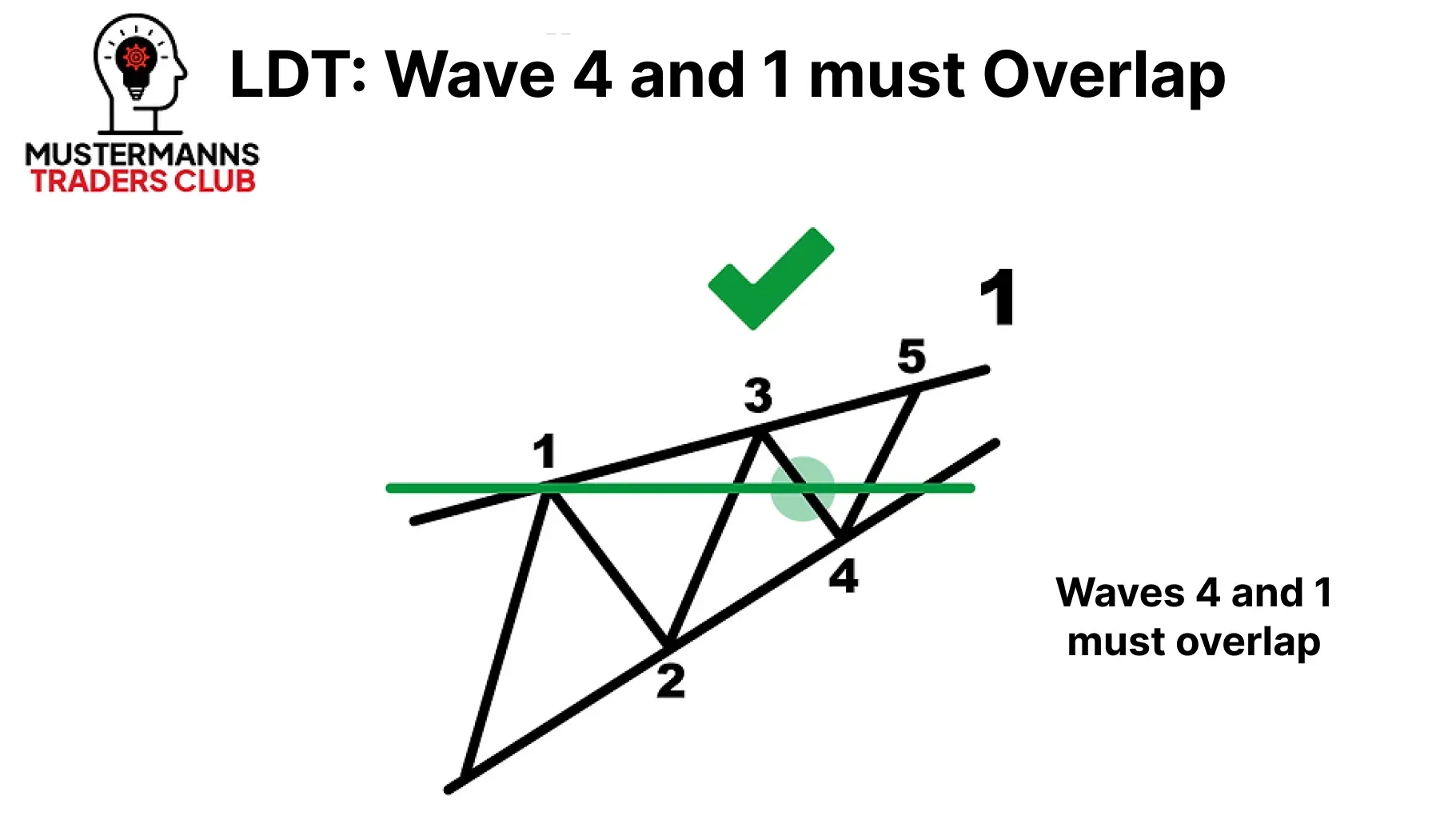

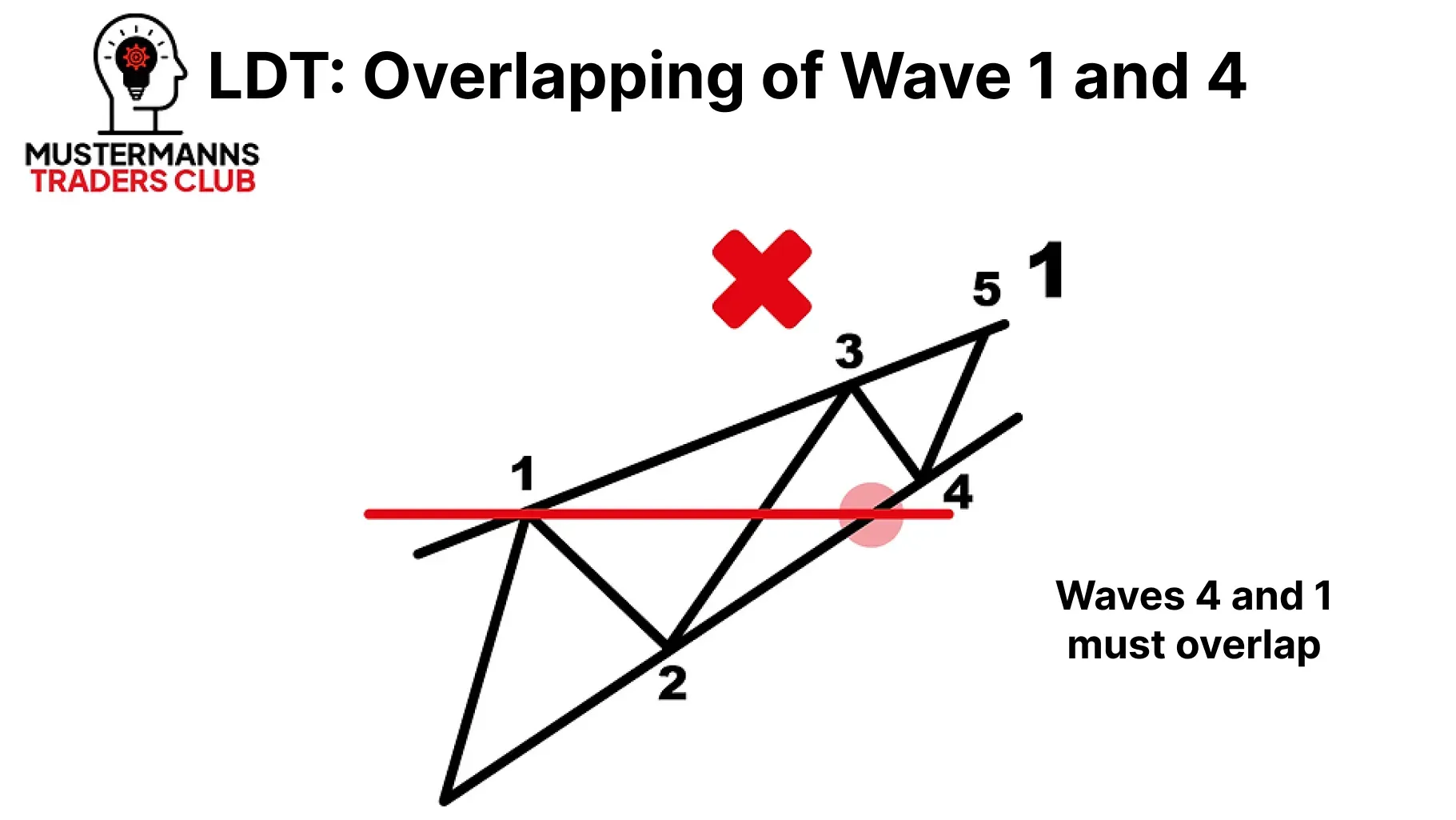

The correction that follows wave 3, wave 4, makes the LDT special. In contrast to the impulse, wave 4 must intersect the high of wave1. This characteristic is the prerequisite for identifying an impulse wave(in wave 1) as an LDT. If waves 1 and 4 do not overlap, a normal impulse is present in most cases.

第三浪之后的调整浪——第四浪,使得引导倾斜三角形(LDT)具有特殊性。与推动浪不同,第四浪必须与第一浪的高点相交。这一特征是判断第一浪是否为引导倾斜三角形(LDT)的前提条件。若第一浪与第四浪未出现重叠,多数情况下呈现的是普通推动浪。

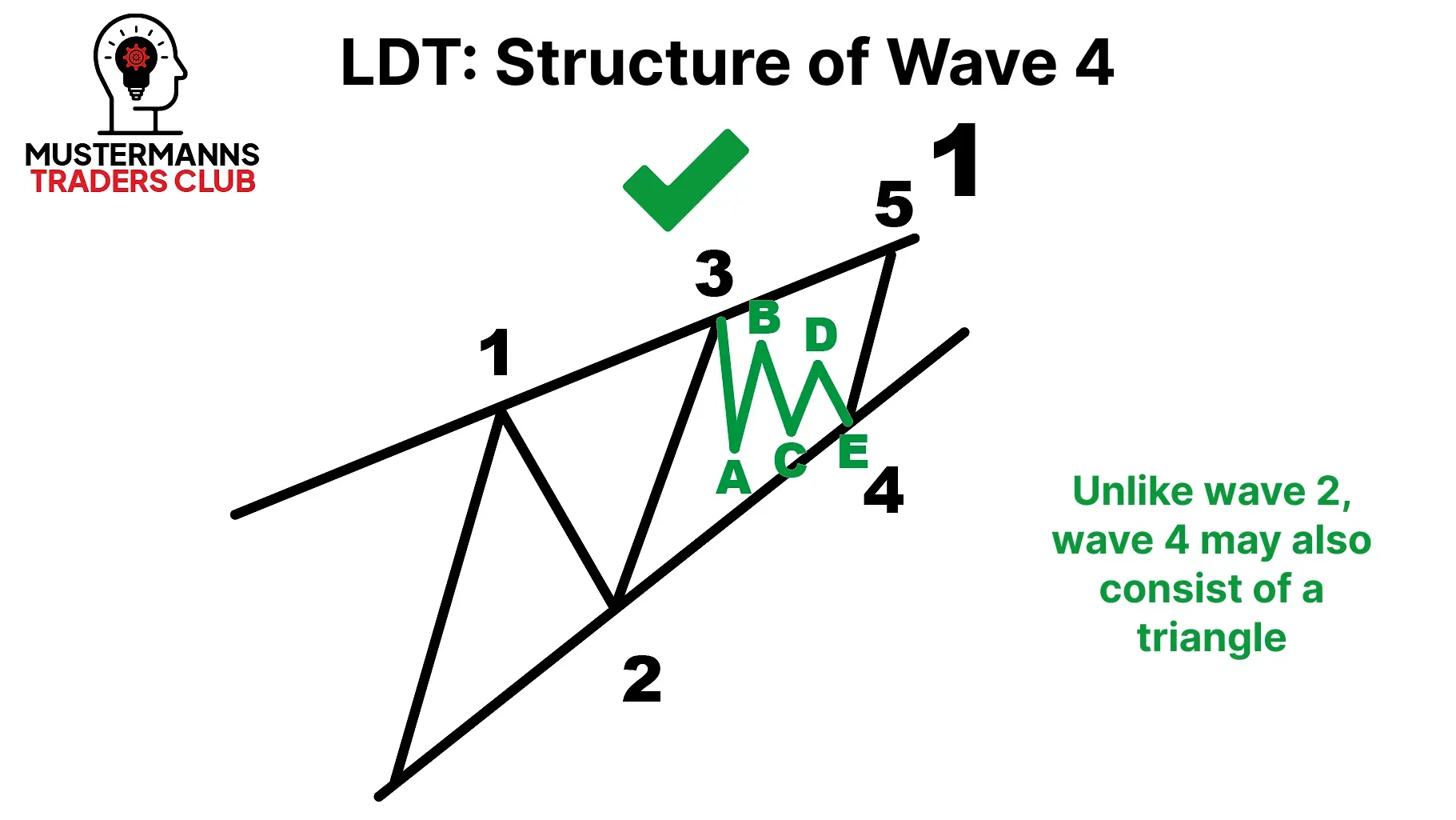

Wave 4 can consist of any correction. A triangular formation is also possible.

第四浪可能由任何调整形态构成,三角形整理形态亦有可能出现。

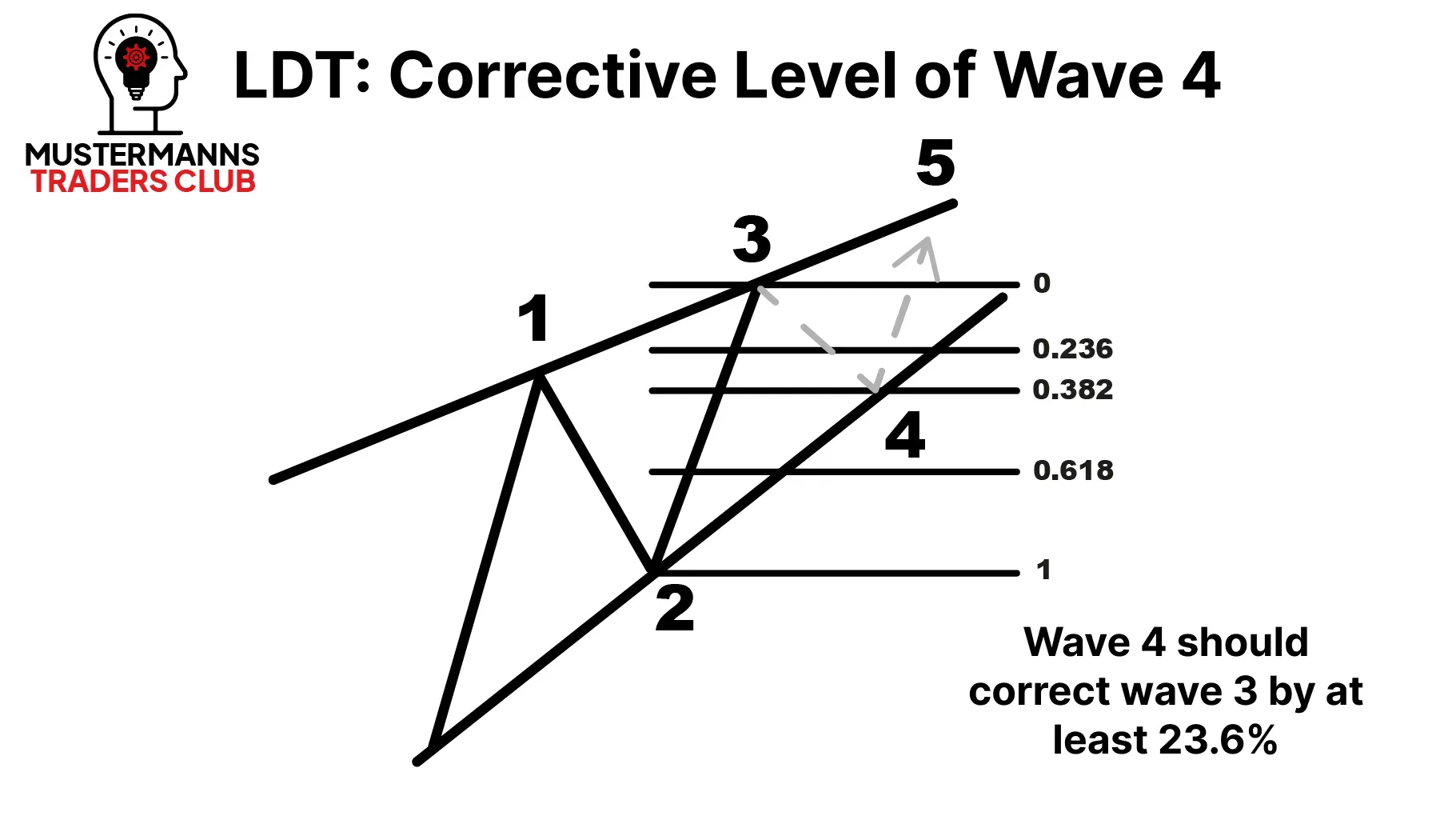

Wave 4 should at least correct wave 3 by23.6%. The lower trend line, which you were able to draw with the help of the lows of waves 1 and 2, helps you to narrow down the possible reversal points from wave 4 to wave 5.

第4浪至少应回调第3浪的23.6%。通过第1浪和第2浪低点绘制的下方趋势线,有助于缩小从第4浪到第5浪的潜在反转点位范围。

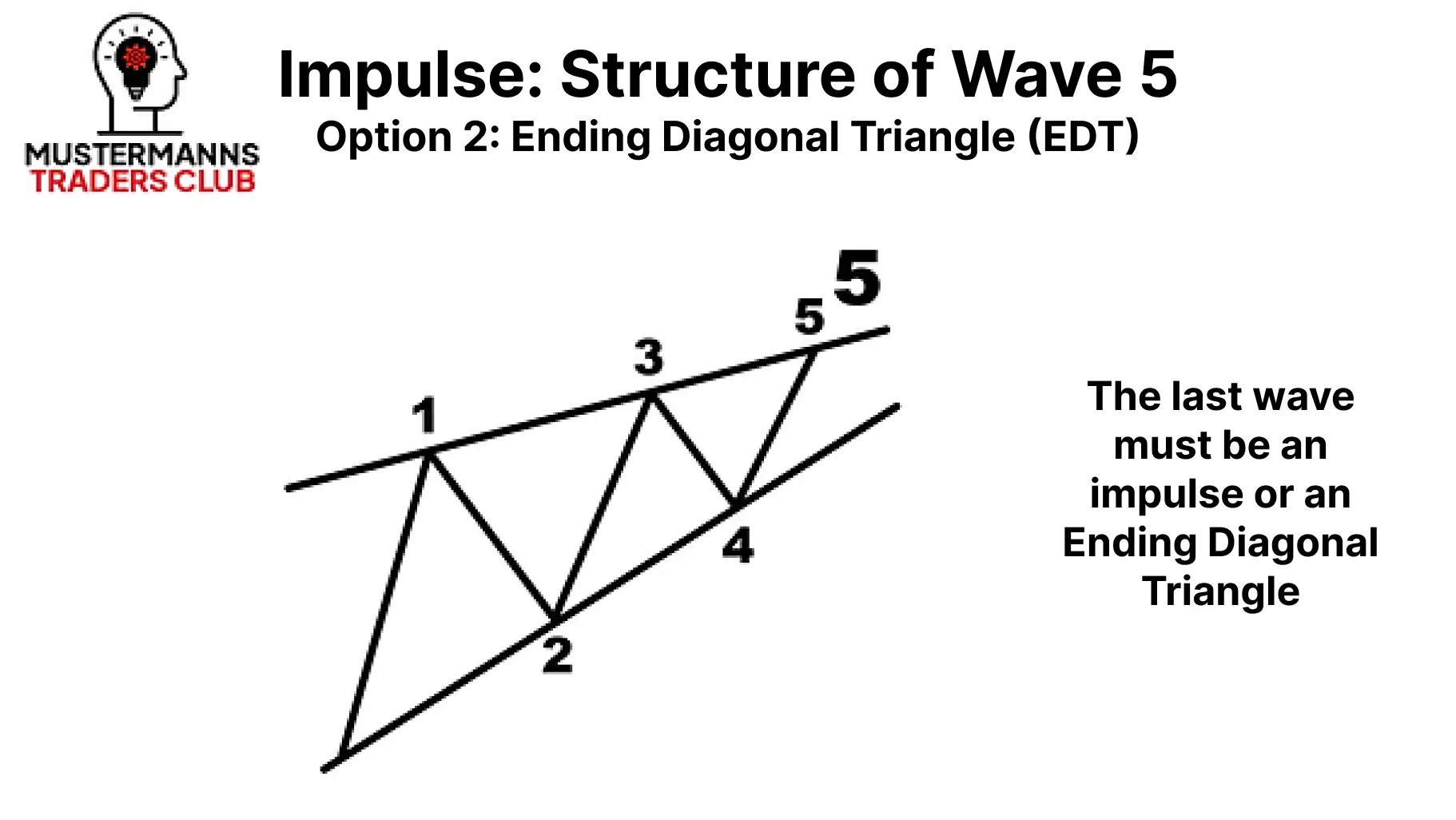

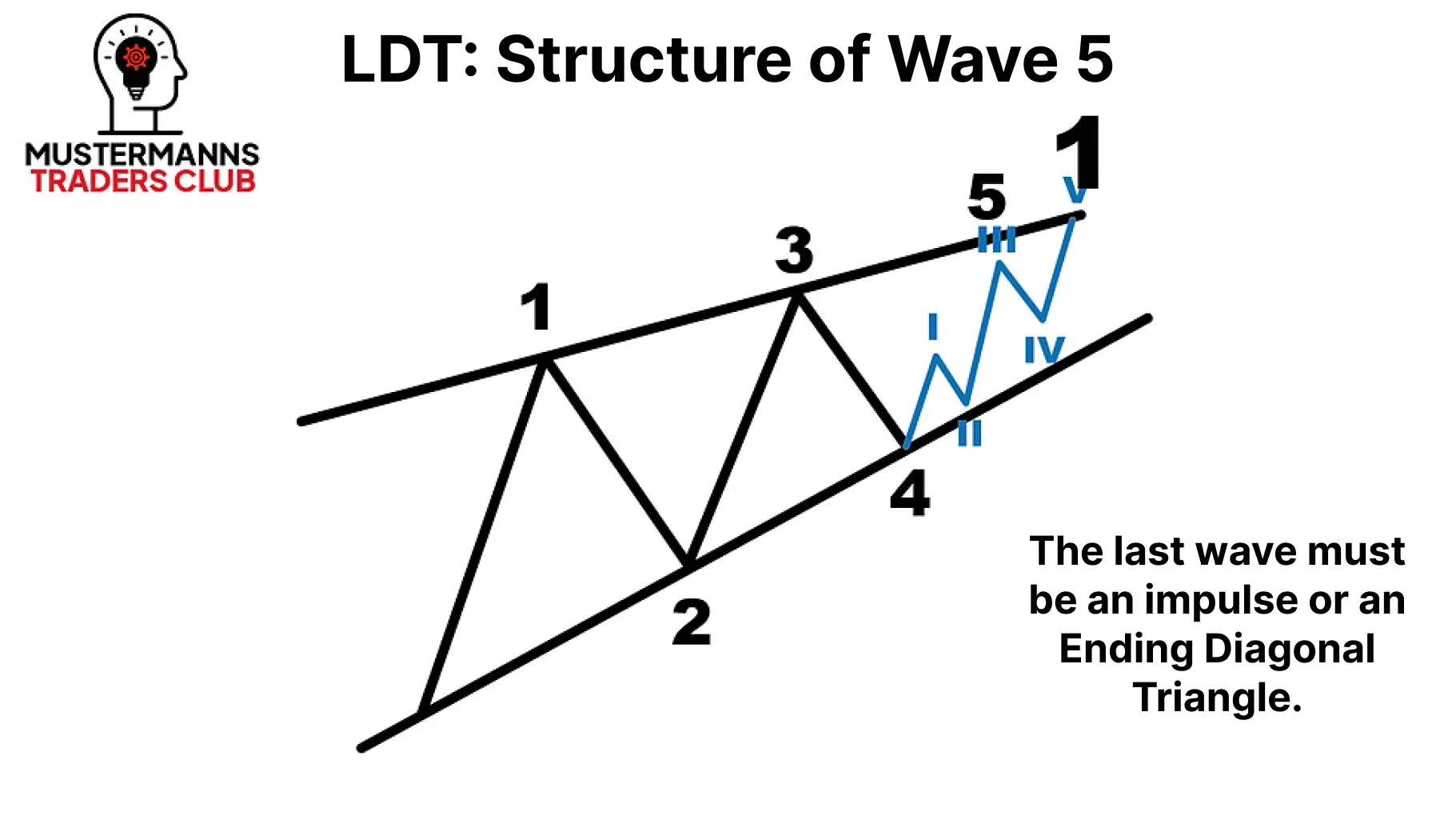

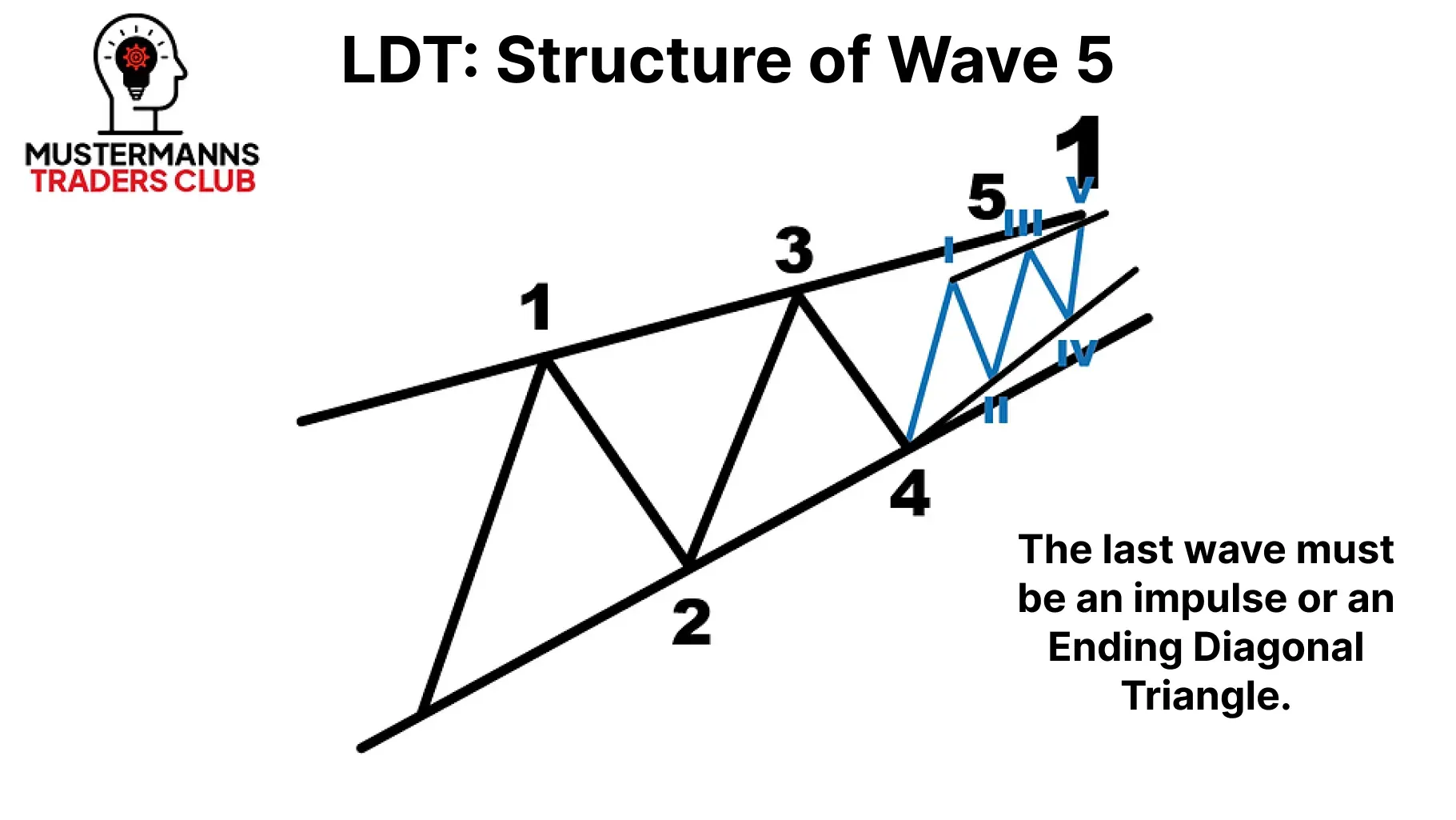

Similar to wave 1, wave 5 can occur in two different variants in the chart. While the normal impulse can be found in all waves, wave 5 is characterized by the fact that it can also consist of an EDT. Bear in mind, however, that an LDT cannot be built up from an LDT and EDT at the same time.

与第一浪类似,第五浪在图表中也可能呈现两种不同形态。虽然所有浪型中都能出现标准推动浪,但第五浪的独特之处在于它也可能由终结倾斜三角形(EDT)构成。需注意的是,一个引导倾斜三角形(LDT)不能同时由 LDT 和 EDT 组合形成。

The trend lines, which are defined by the lows and highs, are important reaction markers for the subsequent price movements. If the LDT continues into wave 2, for example, it can often be observed that the corrective wave B represents a retest of the previously broken trend line.

由低点和高点定义的趋势线,是后续价格走势的重要反应标记。例如,当 LDT 延续至第二浪时,常可观察到调整浪 B 会对先前突破的趋势线进行回测。

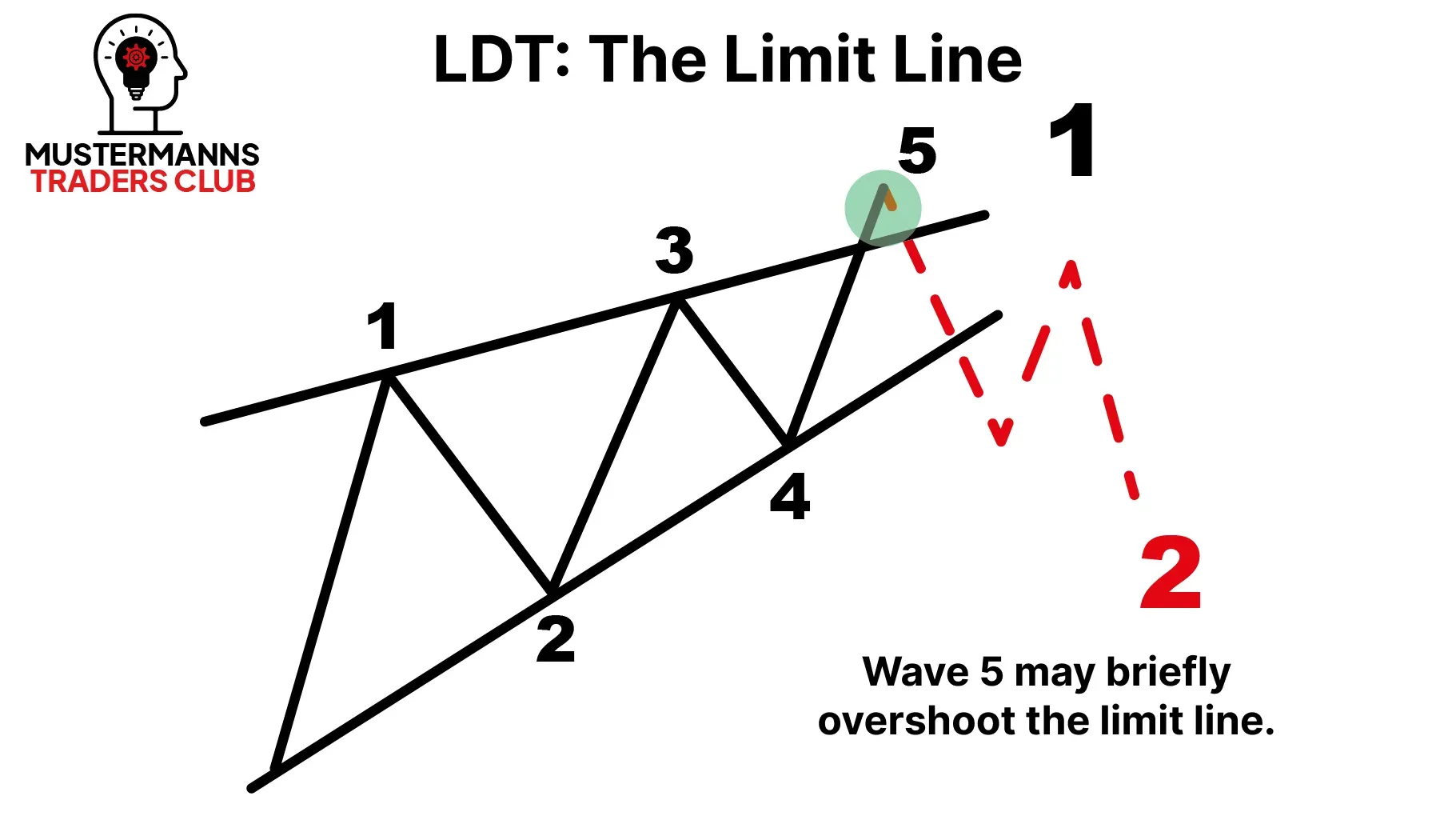

Furthermore, it can often be observed in the chart that the high of wave 5 is formed outside the upper trend line. This phenomenon is also known as a"fake-out" in the break-out strategy. While many market participants see this supposed breakout from the trend line as a buy signal, you should be aware that an LDT could possibly also form, which would then lead to the above-mentioned"fake-out".

此外,在图表中经常可以观察到第 5 浪的高点形成于上方趋势线之外。这种现象在突破策略中也被称为"假突破"。虽然许多市场参与者将这种看似突破趋势线的情况视为买入信号,但您应该意识到也可能形成 LDT(末浪延长),从而导致上述的"假突破"现象。

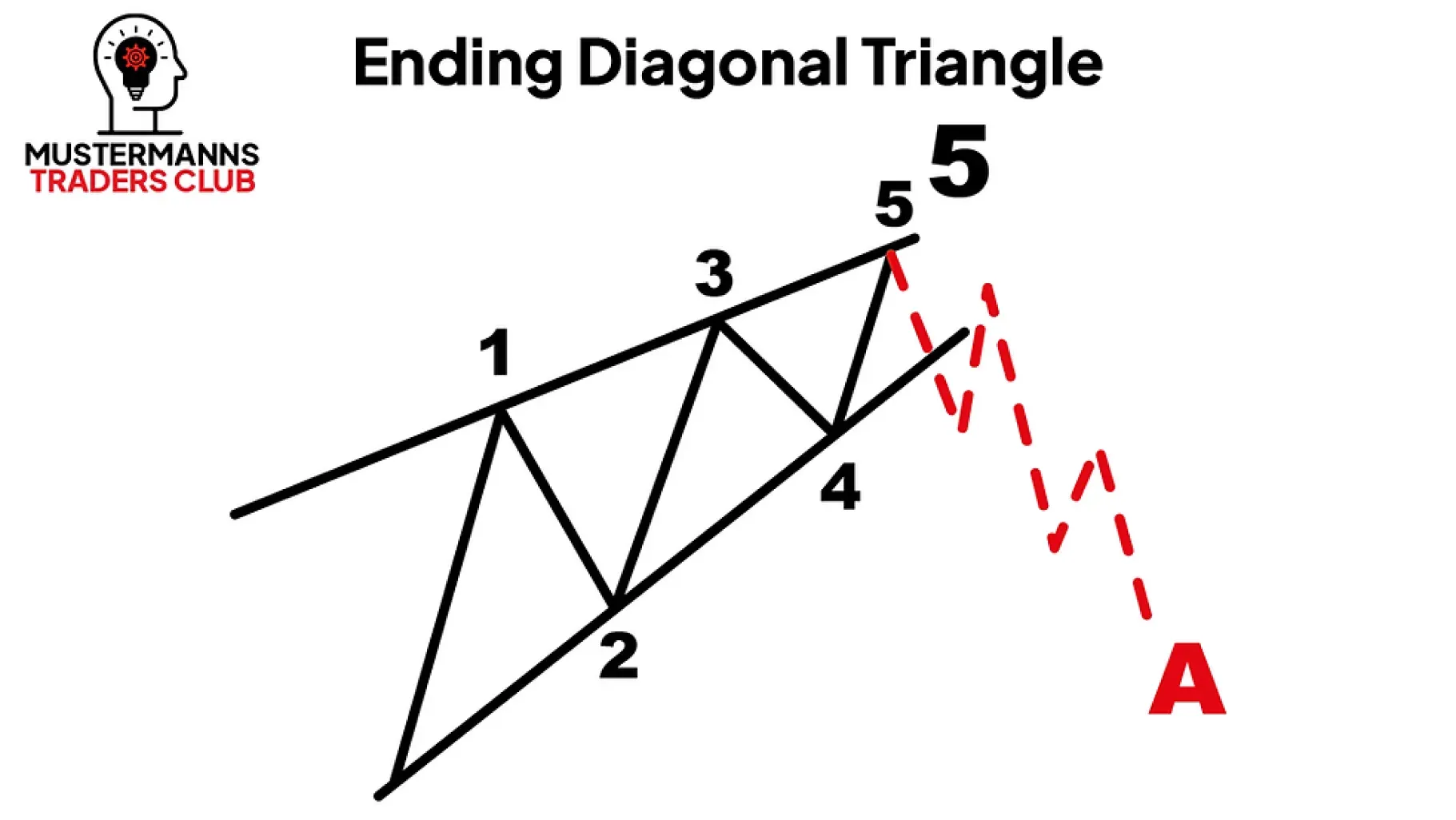

Ending Diagonal Triangle (EDT)

终结倾斜三角形(EDT)

EDT - correction or impulse wave?

EDT - 修正浪还是推动浪?

In the last lesson on the LDT, you already learned that not every impulse wave has the same rules. However, you were able to see that the LDT is very similar to the normal impulse, as both have a 5-3-5-3-5 structure.

在上节课关于 LDT 的内容中,你已经了解到并非每个推动浪都具有相同的规则。不过你可以发现,LDT 与常规推动浪非常相似,两者都具有 5-3-5-3-5 的结构。

The EDT, which we will discuss in more detail here, is different. Although it looks quite similar to the LDT, it has a different internal structure.

我们将在下文详细讨论的 EDT 则有所不同。虽然它看起来与 LDT 非常相似,但其内部结构却截然不同。

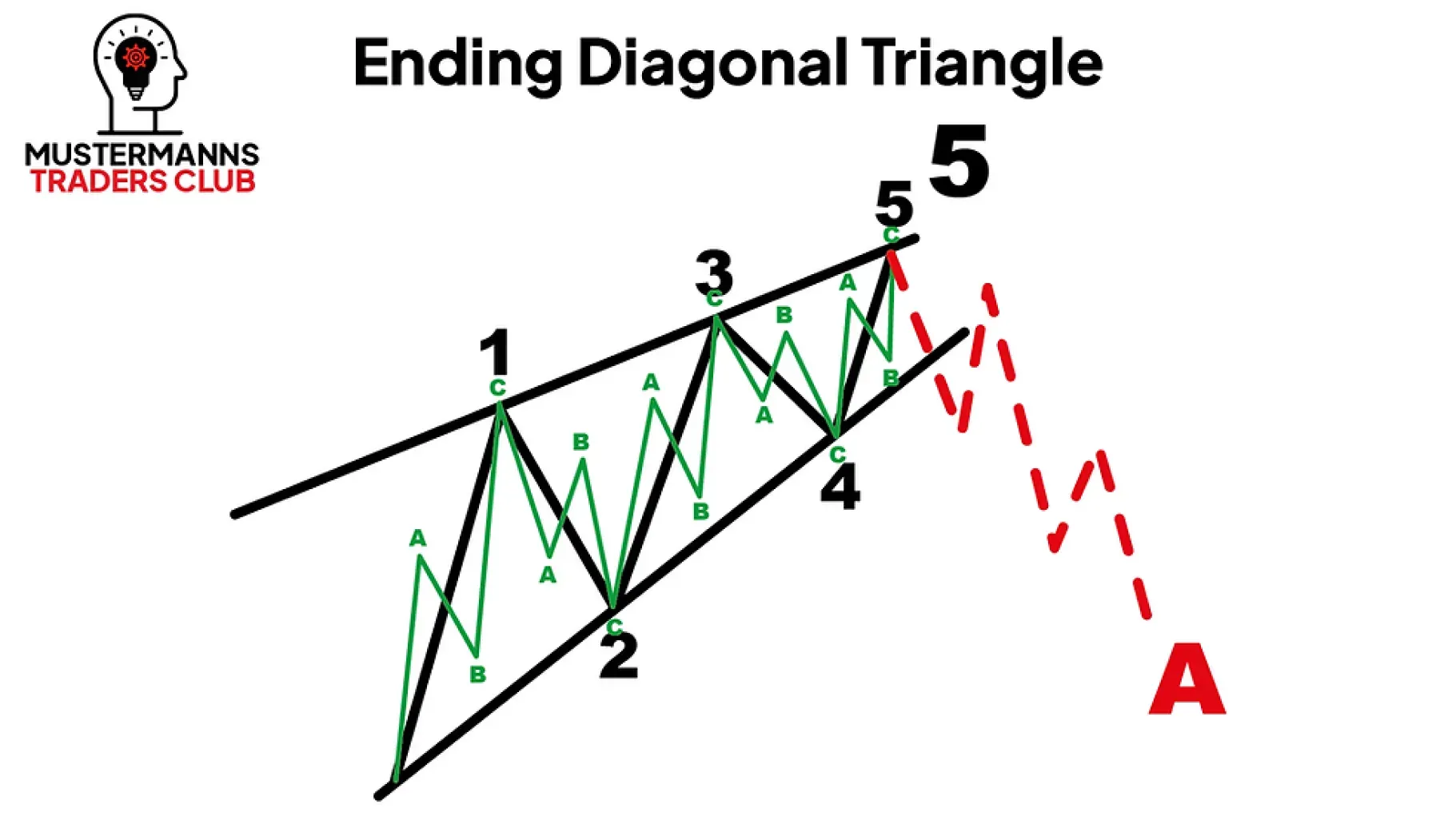

Ending Diagonal Triangle 终结楔形

Only corrections - this is what characterizes the EDT. It therefore has a 3-3-3-3-3 structure. Below you can find out which corrective waves are possible in an EDT. Don't be confused if you are not yet familiar with some of the corrective waves. Your knowledge of the basics is sufficient to understand this impulse wave.

仅修正——这是 EDT 的特征。因此它具有 3-3-3-3-3 结构。以下你将了解 EDT 中可能出现的修正浪型。若对某些修正浪型尚不熟悉也无需困惑,掌握基础知识就足以理解这个驱动浪。

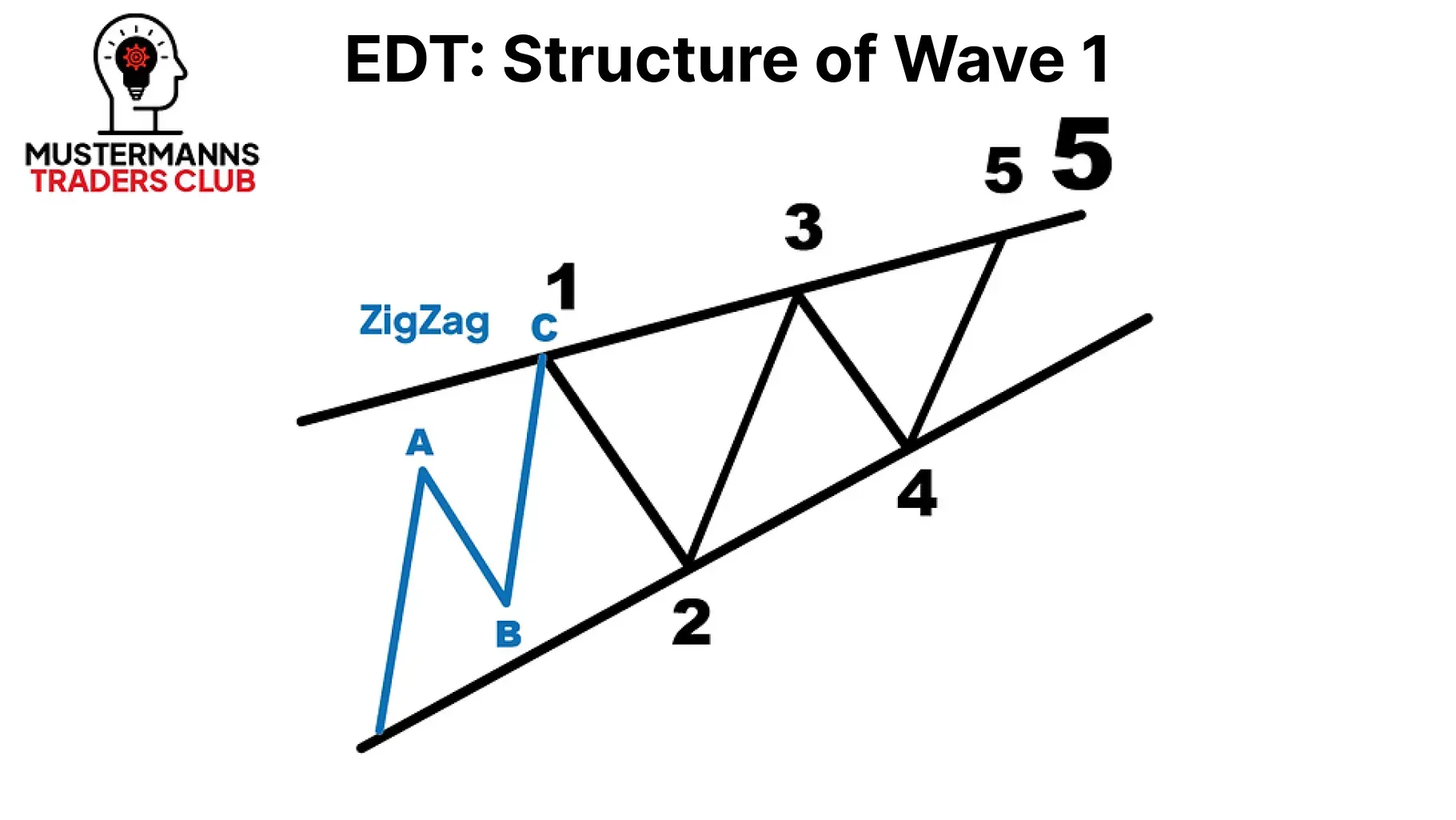

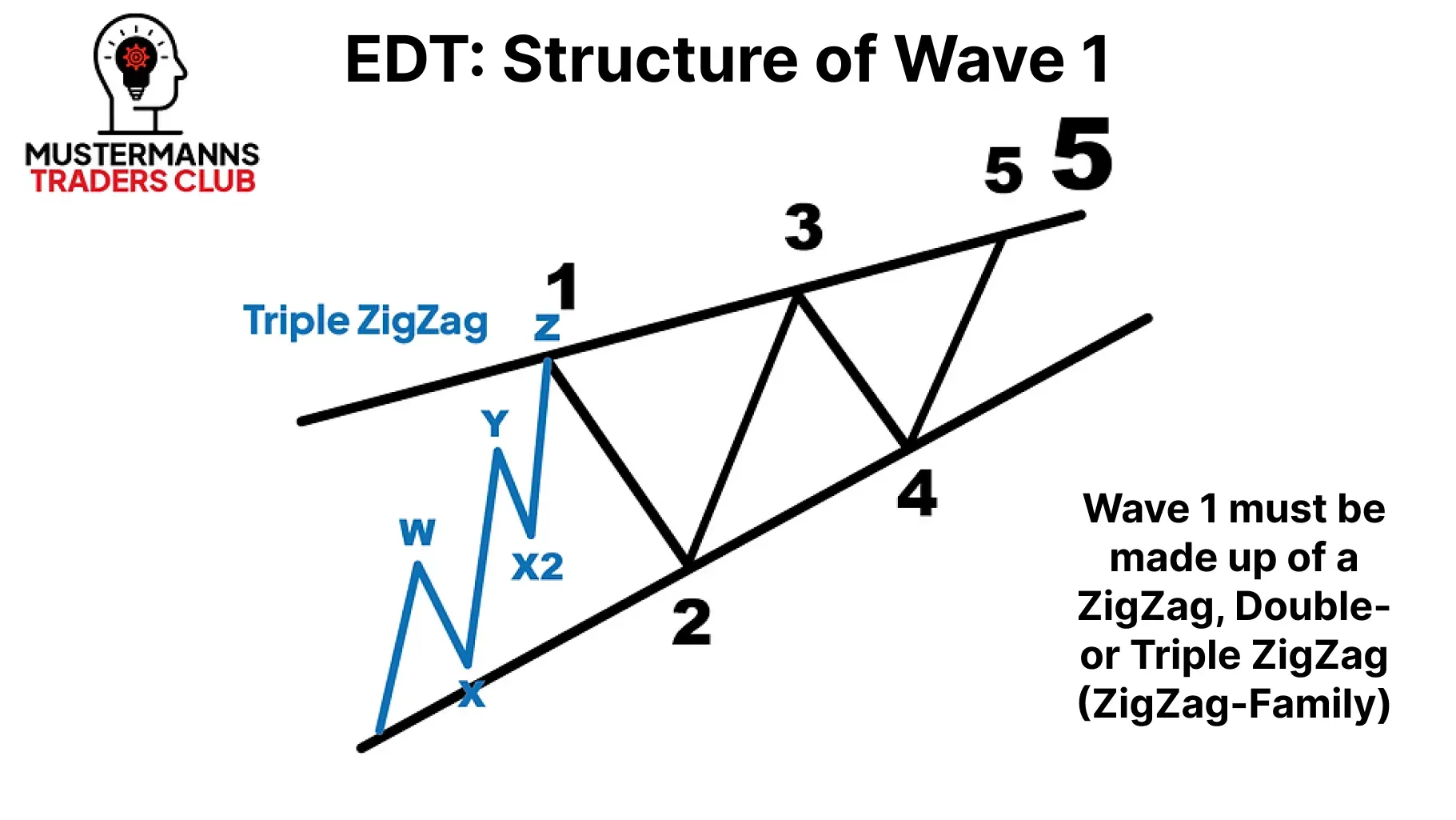

The Beginning - Wave 1

开端 - 第一浪

The first move in an EDT must be a corrective wave of the ZigZag family. In other words, a ZigZag, Double-ZigZag or Triple-ZigZag. Unlike the LDT, wave 1 cannot consist of an LDT. Because remember: wave 1 is not an impulse wave, but a corrective wave, which means that the LDT cannot be considered an impulse wave.

在 EDT 中,第一浪必须是锯齿形家族的调整浪。换句话说,可以是单锯齿、双锯齿或三锯齿。与 LDT 不同,第 1 浪不能由 LDT 构成。因为请记住:第 1 浪不是推动浪,而是调整浪,这意味着 LDT 不能被视作推动浪。

From Correction to Correction - Wave 2

从调整到调整——第二浪

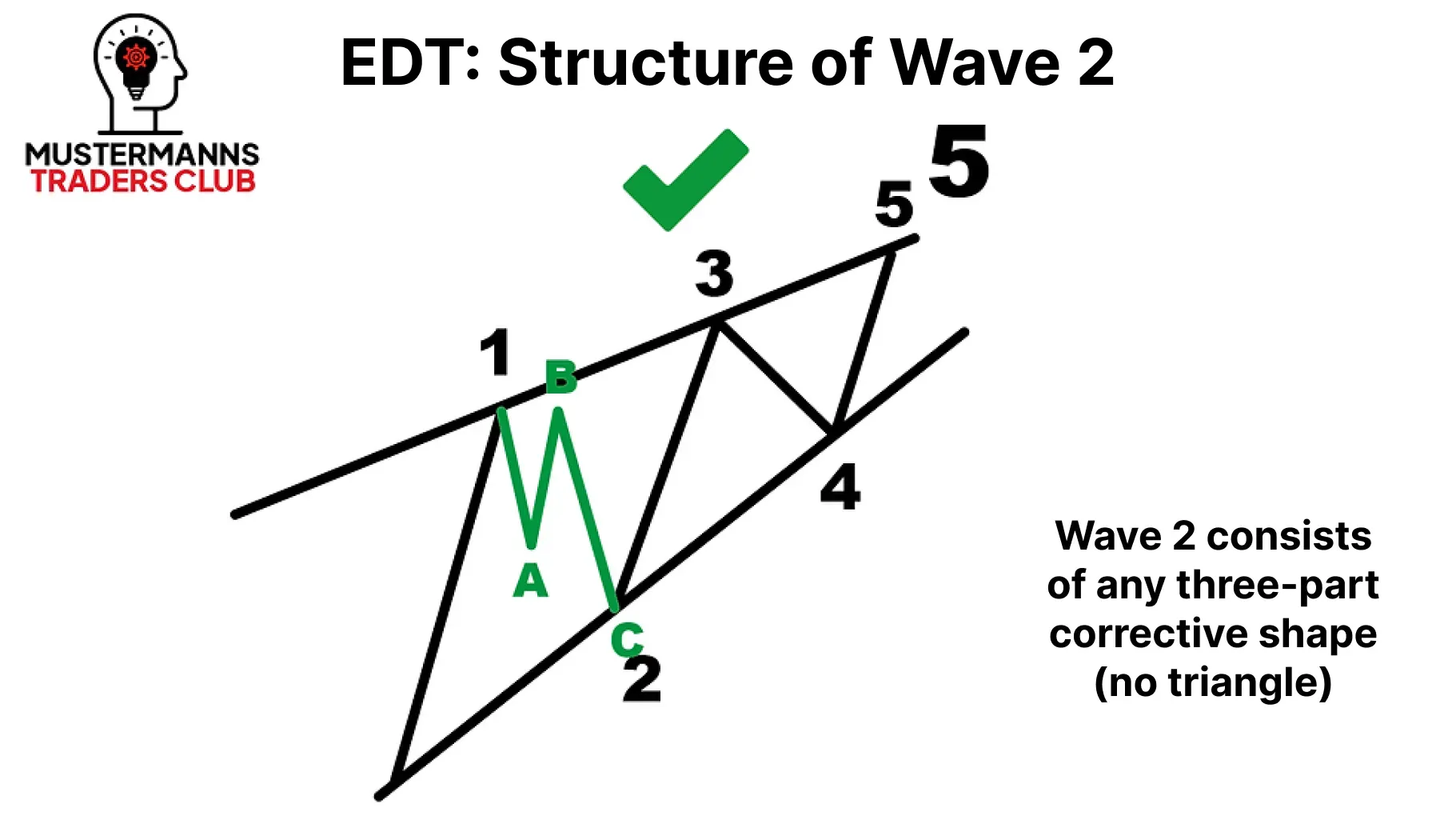

Wave 2 in the EDT will remind you of wave 2 in the impulse and LDT. Here too, all corrective waves are permitted. With the exception of triangles.

在 EDT 中的第 2 浪会让人联想到推动浪和 LDT 中的第 2 浪。同样地,这里也允许所有调整浪形态出现——除了三角形之外。

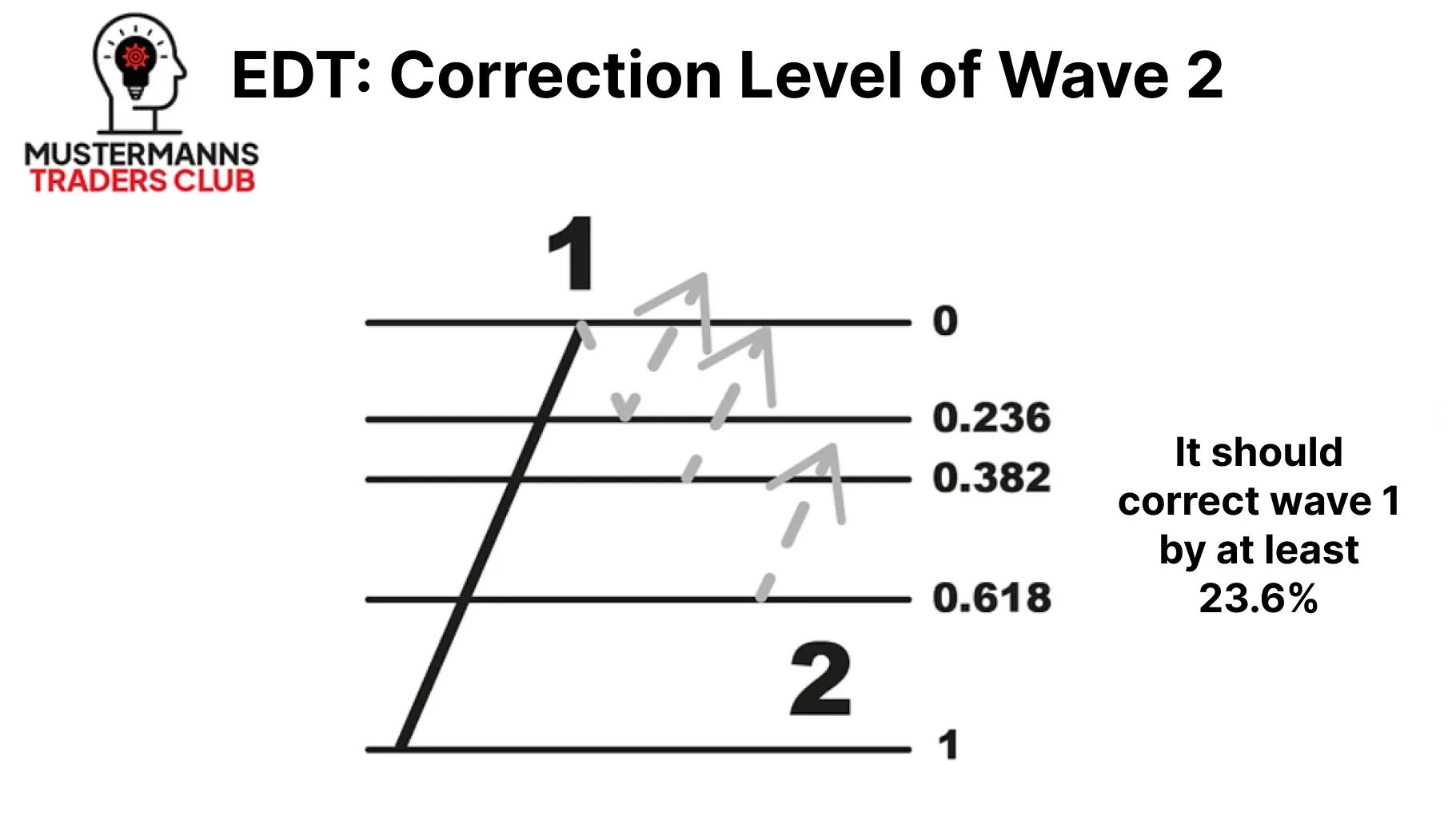

The EDT is no different: the correction in wave 2 should at least correct wave 1 by 23.6%. The subsequent Fibonacci levels represent potential reversal zones.

EDT 也不例外:第二浪的回调至少应达到第一浪的 23.6%。后续的斐波那契水平代表着潜在的反转区域。

ZigZag on ZigZag - Wave 3

锯齿上的锯齿 - 第3浪

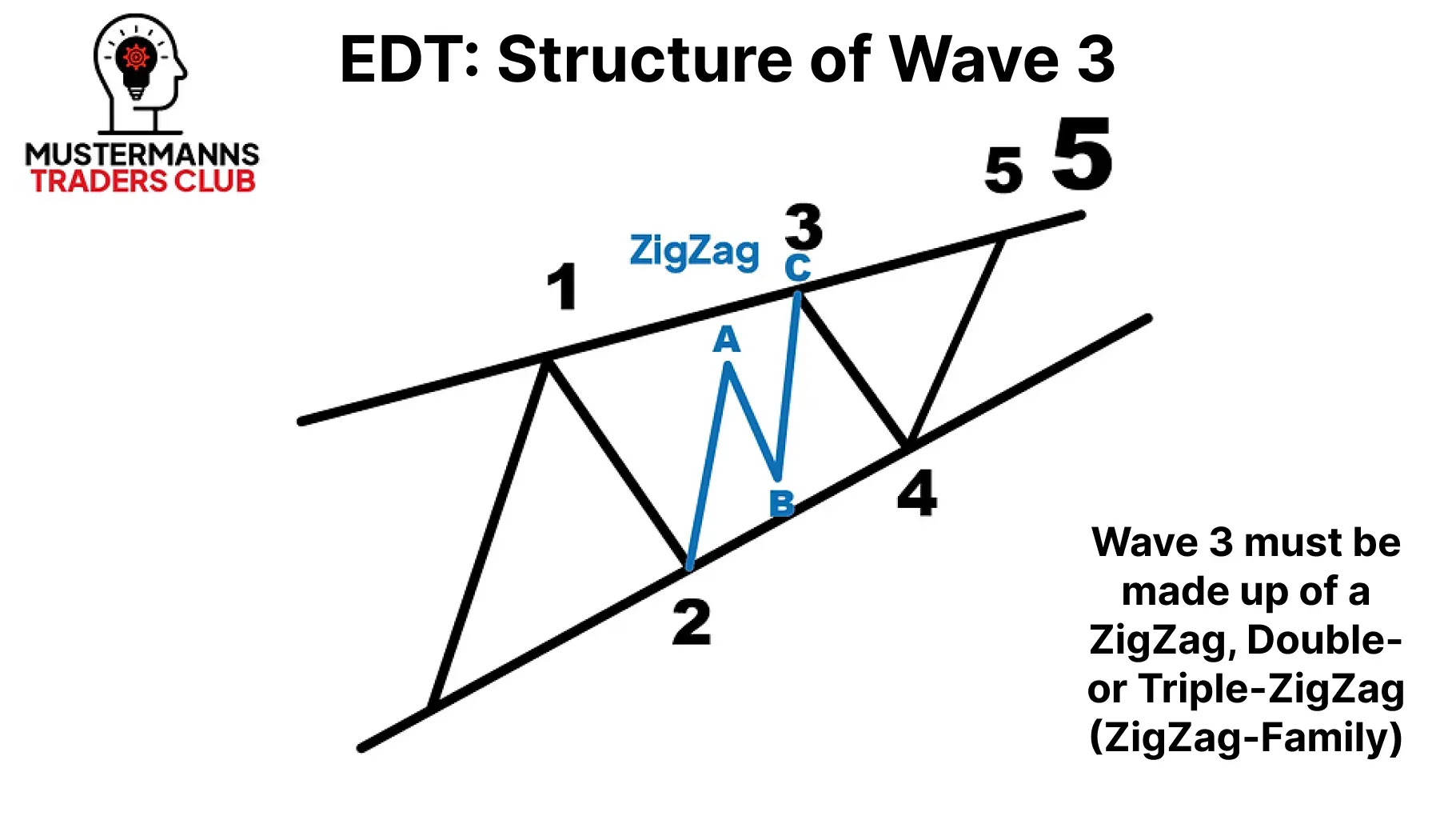

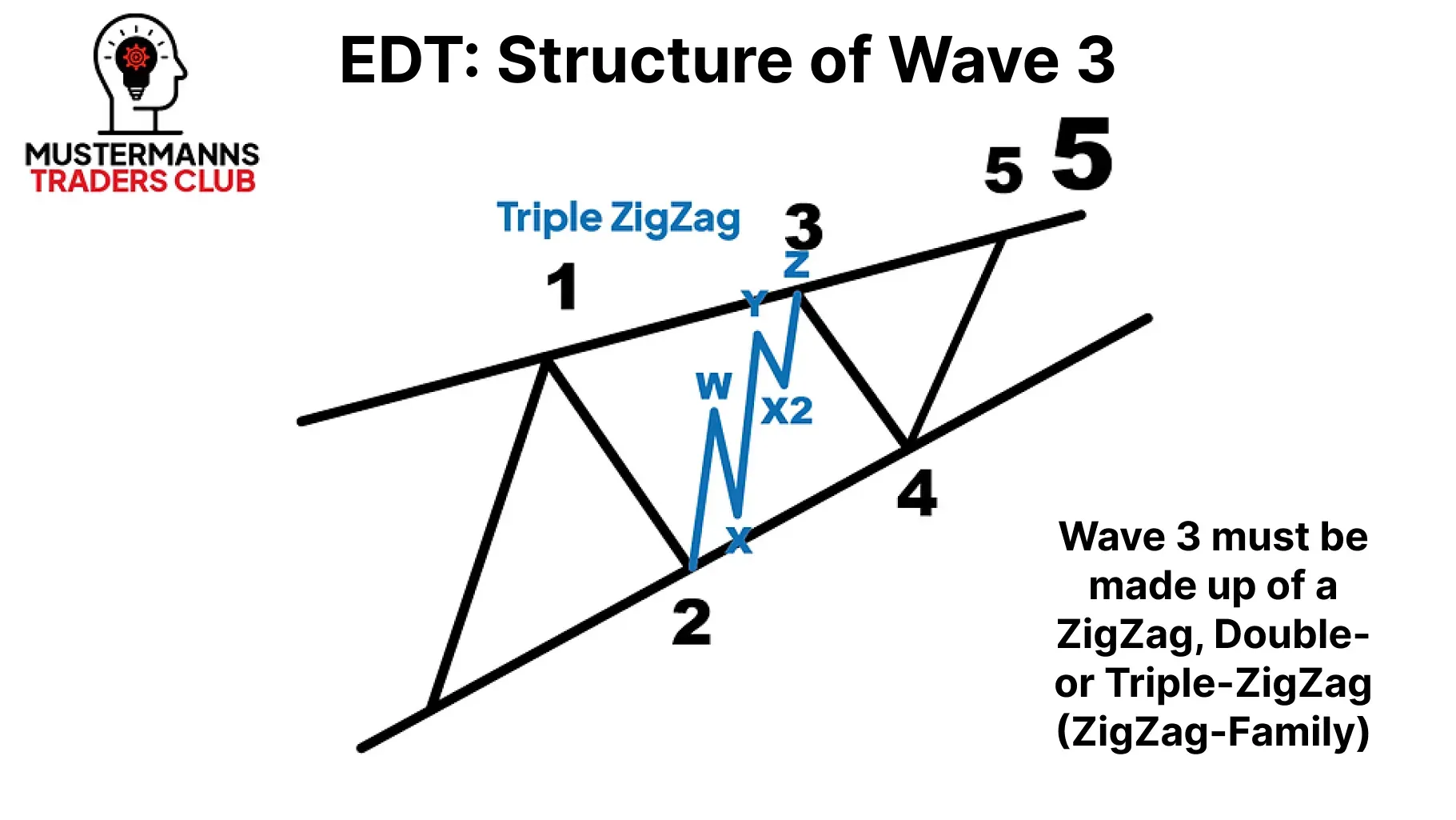

Wave 3 may also only consist of a ZigZag of the ZigZag family. Other corrective waves such as combos, flats or triangles are not permitted.

第三浪也可能仅由锯齿形家族的锯齿形态构成。其他修正浪形态如联合型、平台型或三角形均不被允许。

Due to the wedge shape, wave 3 is not the longest wave in most cases, even in an EDT.

由于楔形结构的存在,在大多数情况下第三浪并非最长浪,即便在终结倾斜三角形中亦是如此。

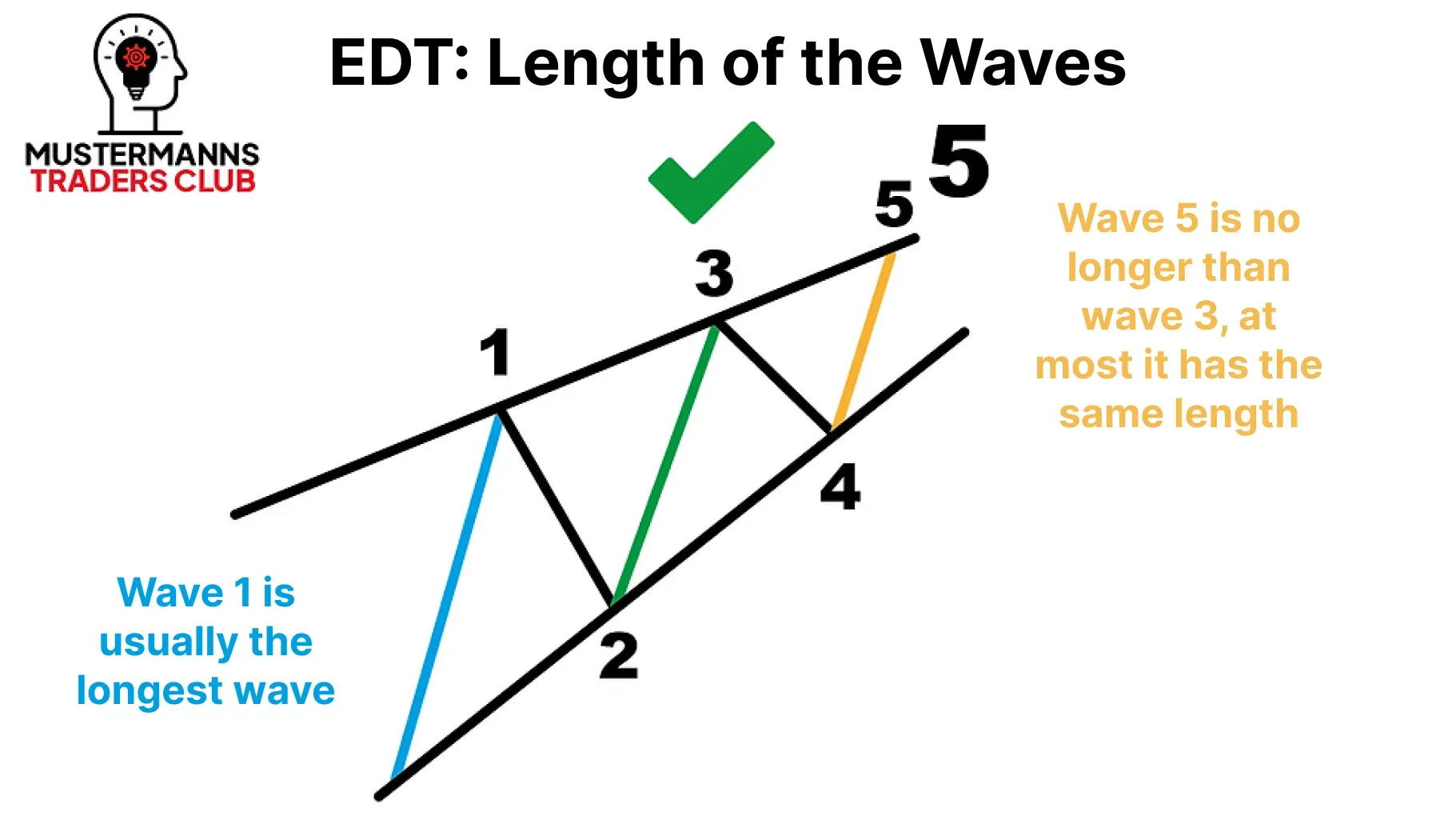

If the third wave is shorter than the first wave, you can better define the last movement in the EDT. In this case, it must not be longer than wave 3, as wave 3 can never be the shortest wave.

若第三浪短于第一浪,则可更精准界定 EDT 中的末段走势。此时末浪长度不得超过第三浪,因为第三浪永远不能是最短的一浪。

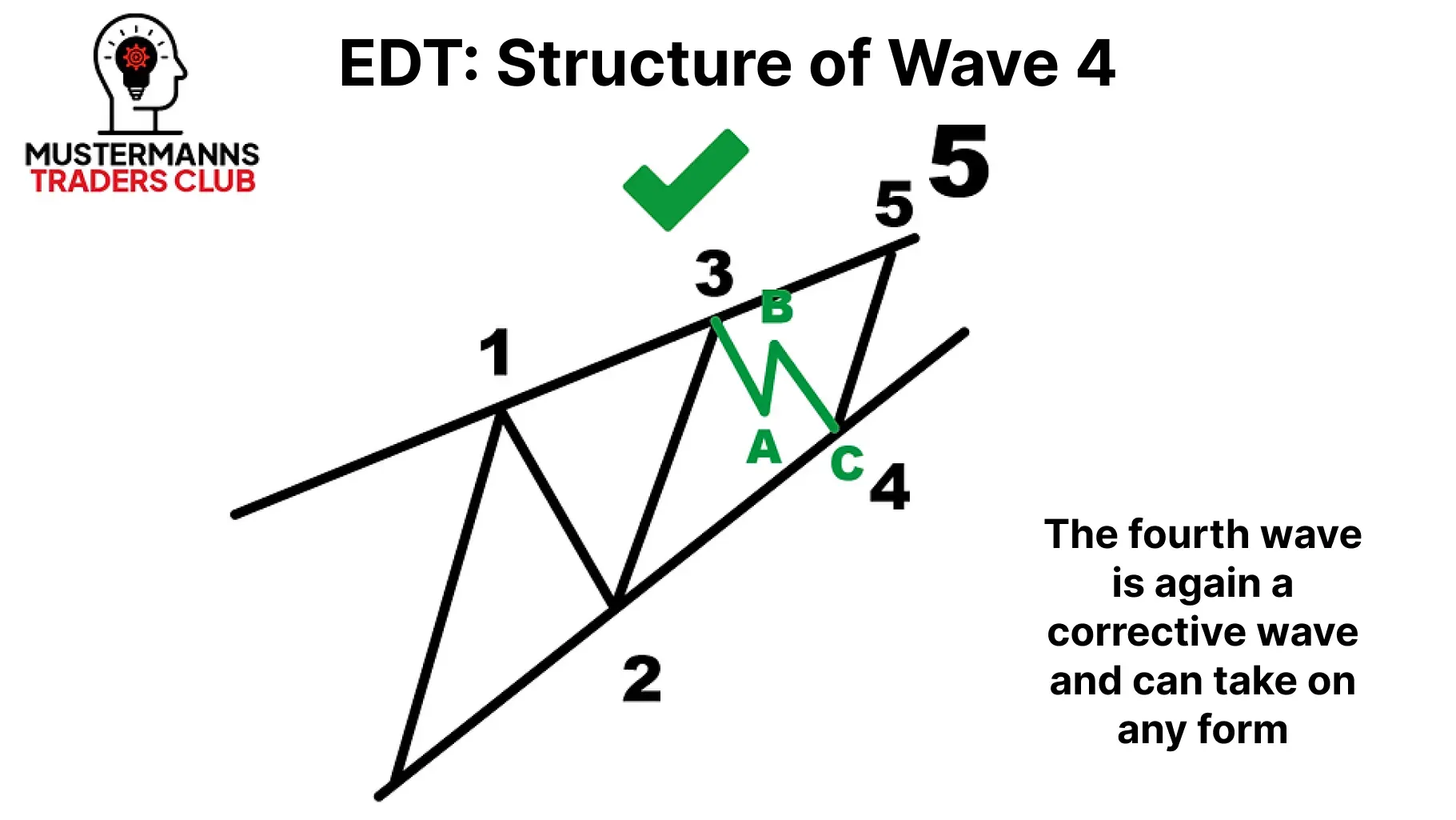

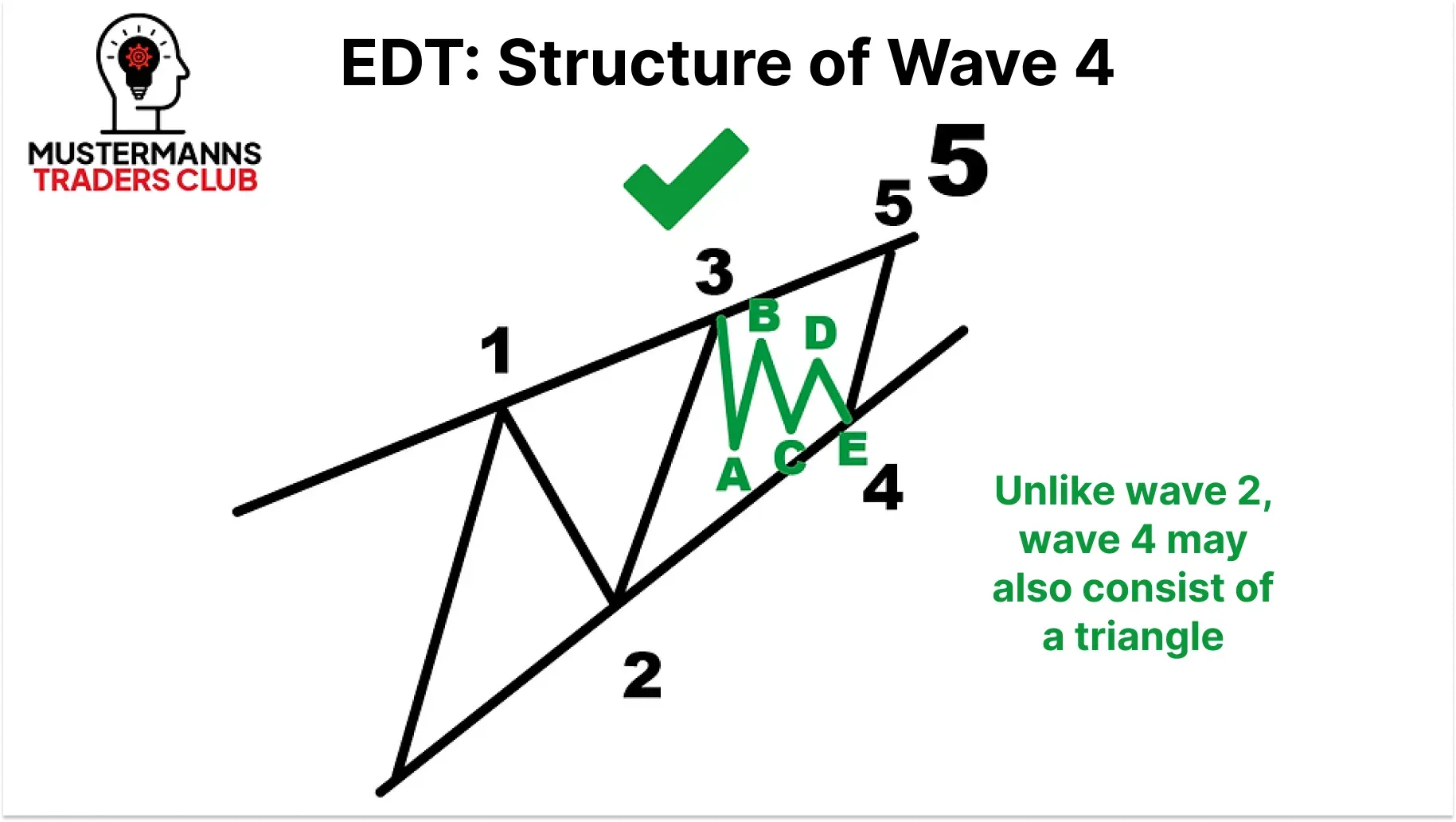

The Trademark - Wave 4

商标标识 - 第4浪

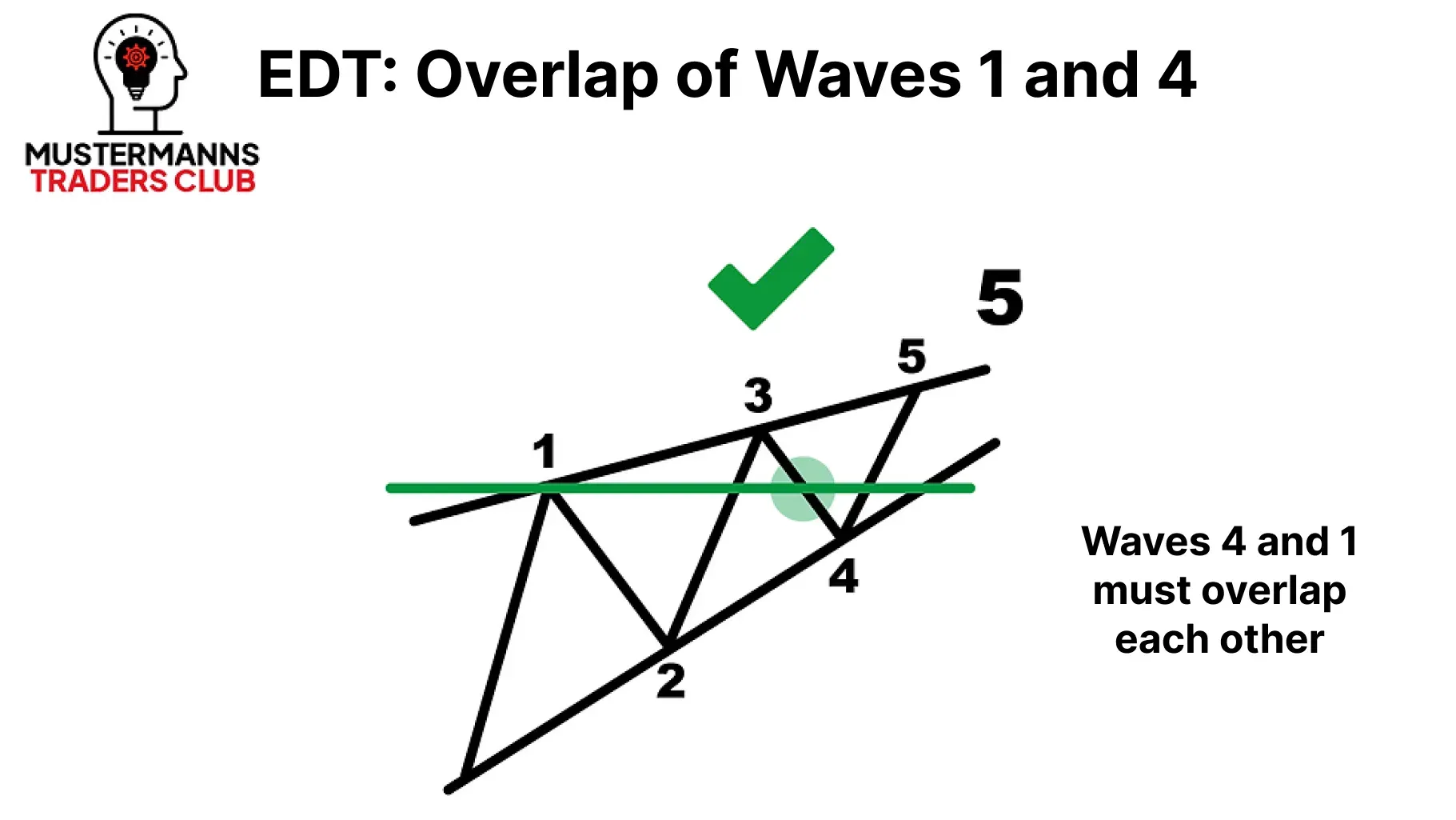

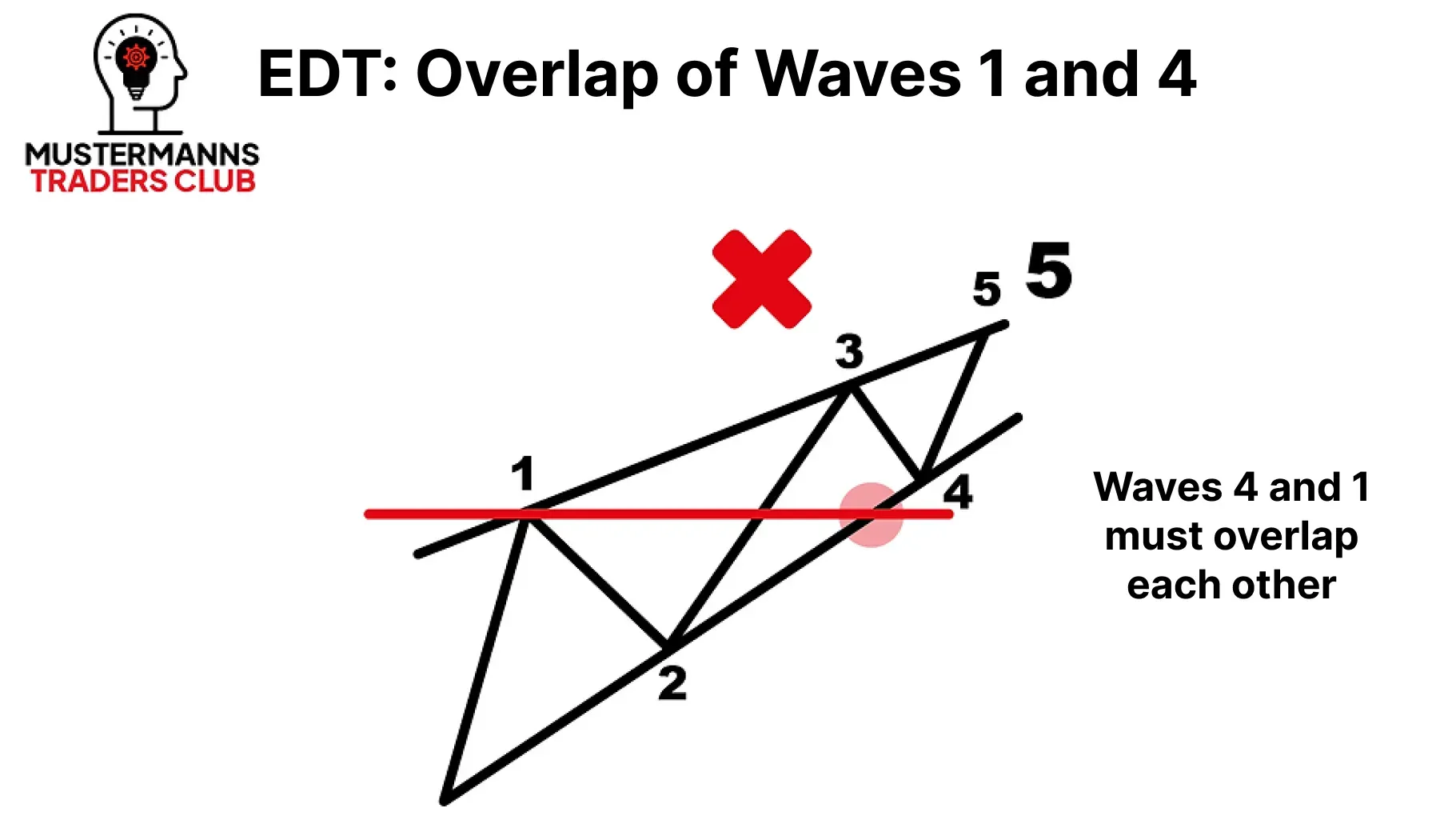

Wave 4 in the EDT corresponds to the same waves in the LDT. As a result, waves 1 and 4 must also overlap here in order to be considered an EDT.

在 EDT 中,第 4 浪与 LDT 中的对应浪型一致。因此,若要被认定为 EDT 结构,此处第 1 浪与第 4 浪也必须出现重叠。

The only possibility that a triangle can be found in an EDT is in wave 4. As with the other impulse waves, all possible corrective waves can be found here.

在终结倾斜三角形(EDT)中,唯一可能出现三角形调整浪的位置是第 4 浪。与其他推动浪相同,所有可能的调整浪形态都可能在此出现。

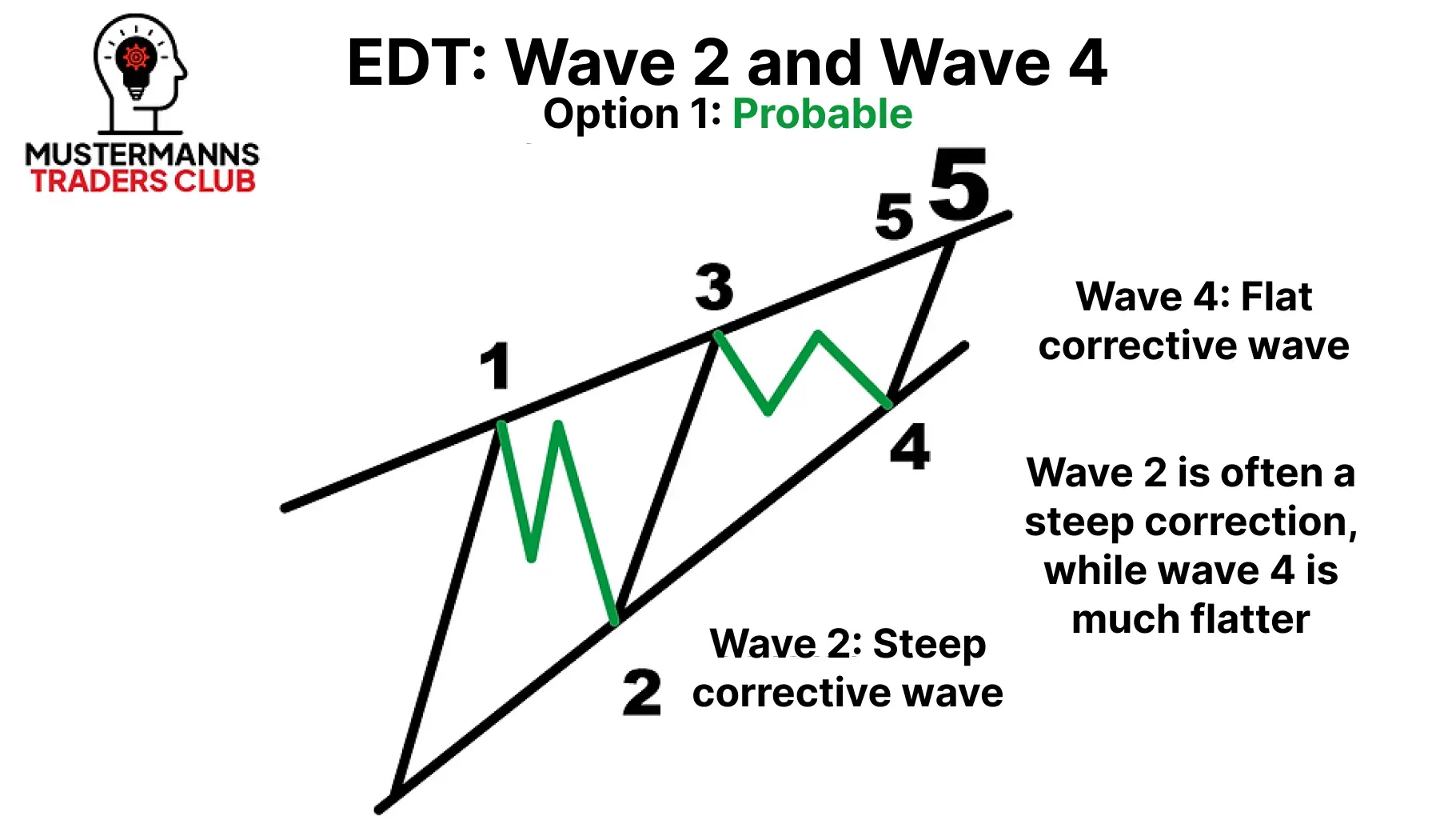

In an EDT, it is more likely that a steep correction will form in wave 2 and that the fourth wave will be flat. Although a flat wave 2 and a steep wave 4 is not a violation of the rules in an EDT, this occurrence can be observed less often.

在终结倾斜三角形(EDT)中,第二浪更可能形成陡直调整,而第四浪往往呈现平坦形态。虽然平坦的第二浪和陡直的第四浪并不违反 EDT 的规则,但这种情况较为少见。

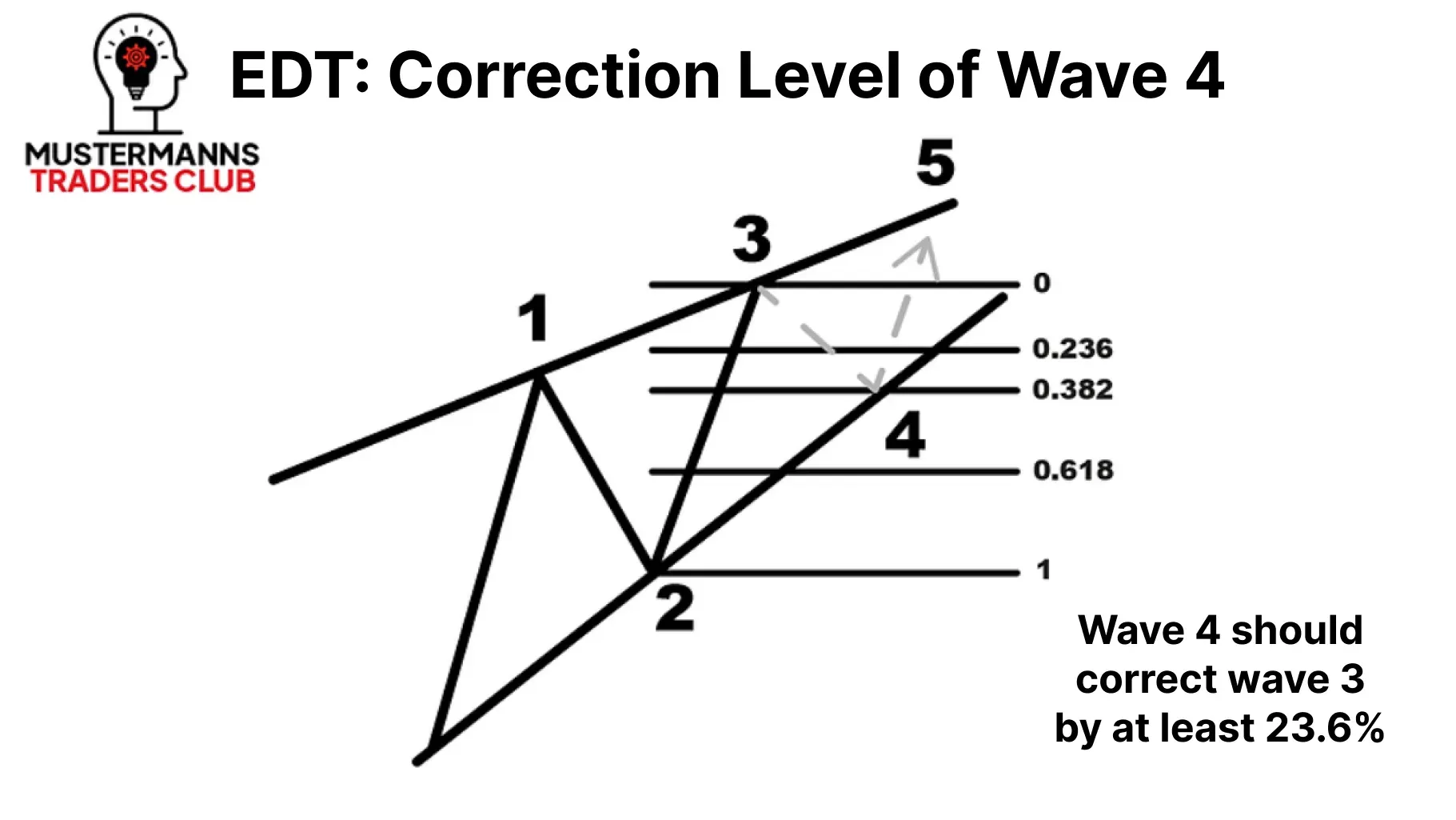

Wave 4 should correct wave 3 by at least 23.6%. The lower trend line, which you were able to draw with the help of the lows of waves 1 and 2, helps you to narrow down the possible reversal points from wave 4 into wave 5.

第4浪应当至少回调第3浪的23.6%。通过连接第1浪和第2浪低点绘制的下方趋势线,有助于缩小从第4浪转向第5浪的可能反转区域。

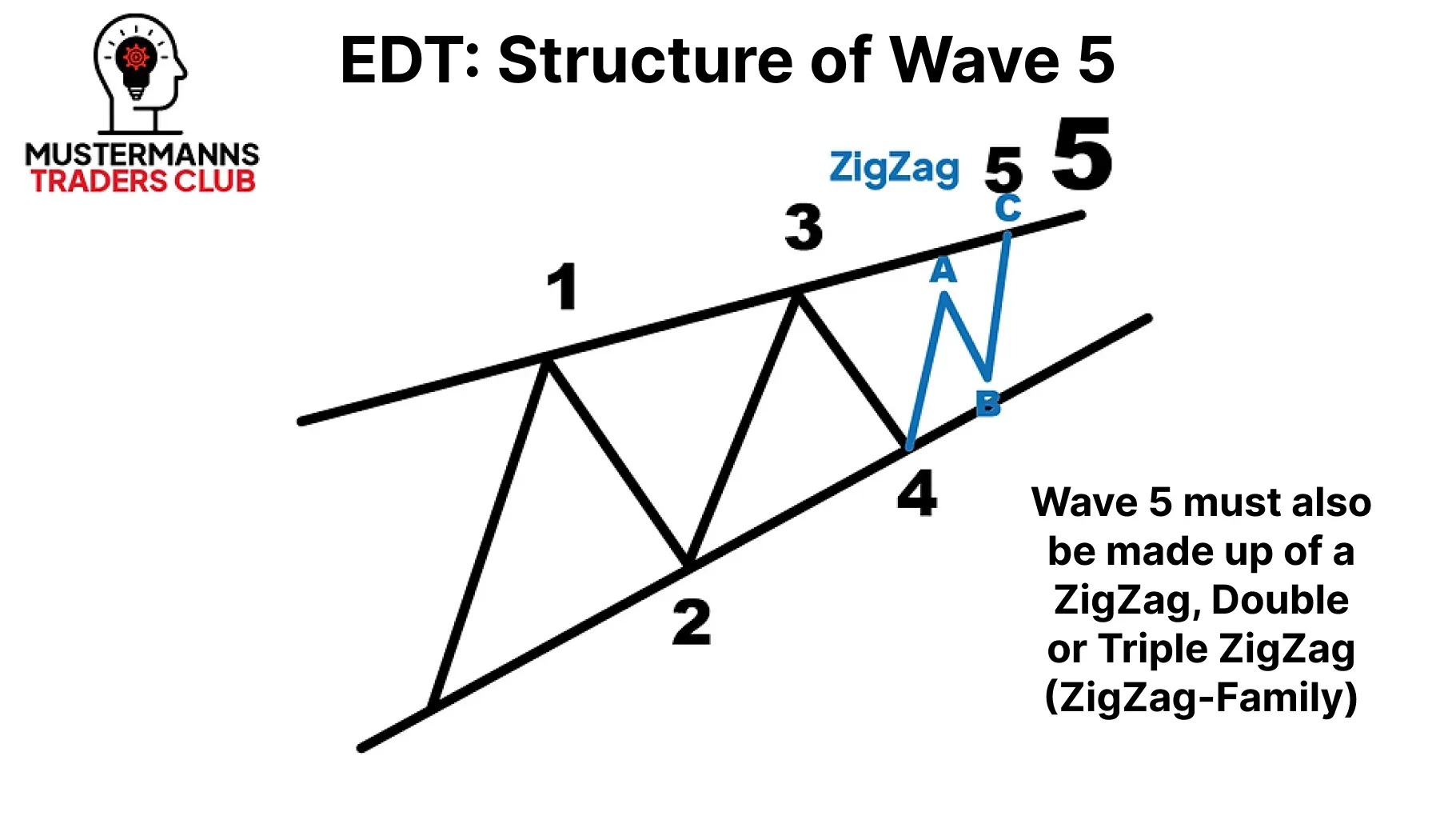

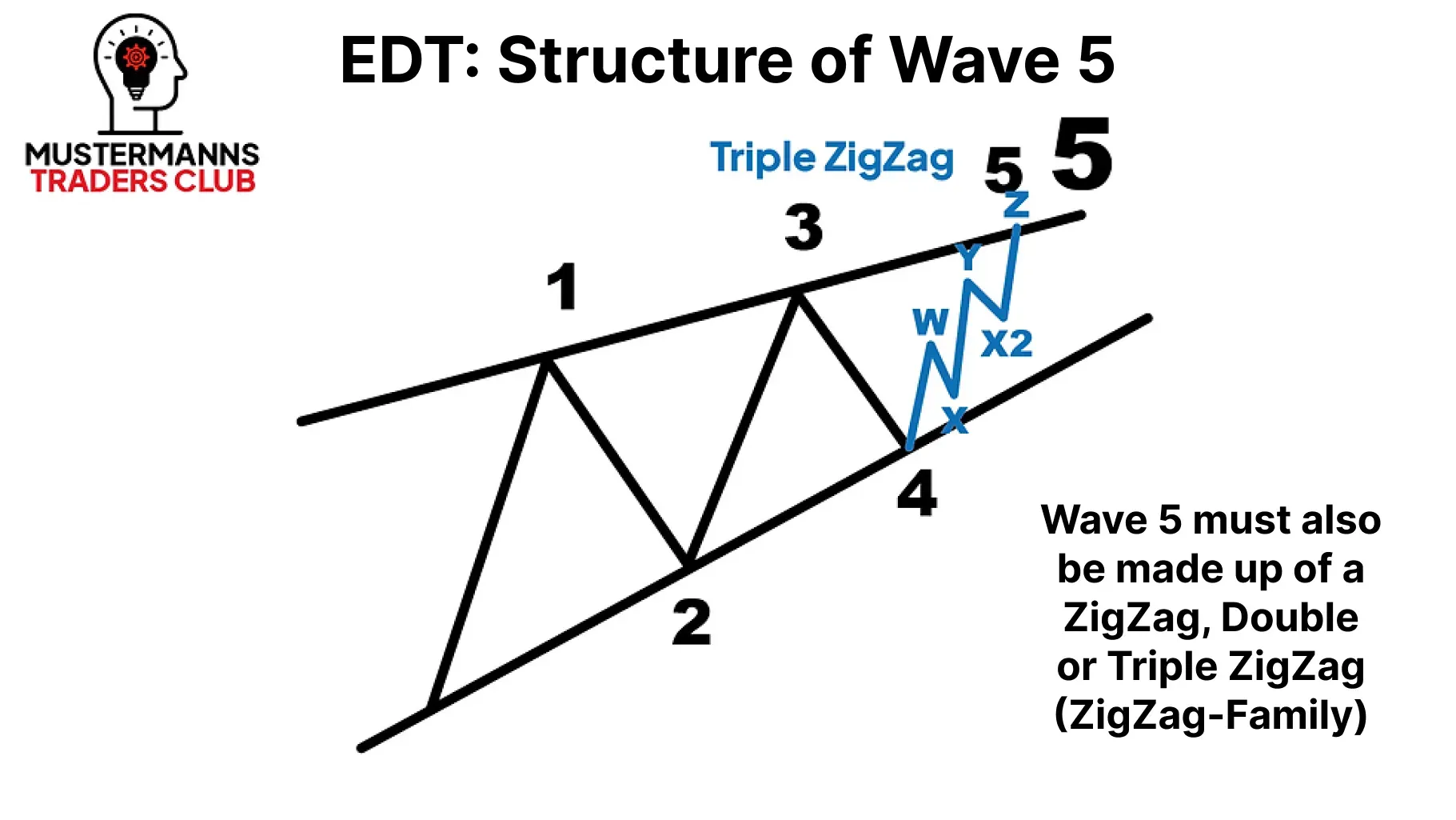

The End - Wave 5

终结浪 - 第5浪

The last wave must also consist of a correction wave of the ZigZag family.

最后一波也必须由锯齿形家族的修正波组成。

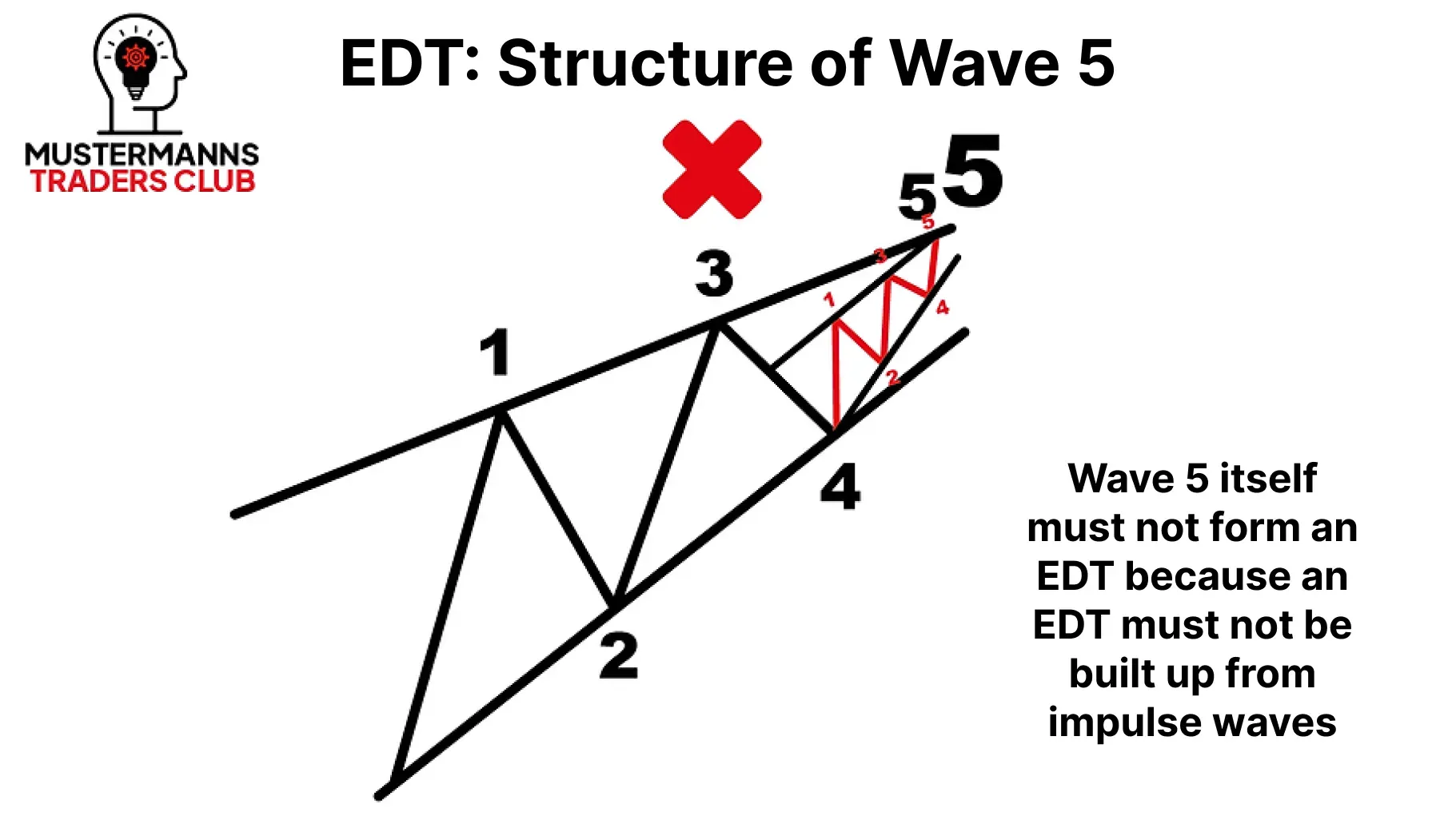

The EDT itself cannot consist of an EDT. Never forget that the EDT consists of corrective waves, which means that an EDT itself, as an impulse wave, is out of the question.

EDT 本身不能由 EDT 构成。永远记住,EDT 由调整浪组成,这意味着 EDT 本身作为推动浪是绝不可能的。

关于艾略特脉冲波的讲解简直精彩绝伦。这是我迄今为止见过最棒的解析。感谢您创作出这样的精品!

哇,太感谢了!我刚开启交易之旅,您的内容真的帮了大忙!

thank you buddie! 谢谢兄弟!

For EDT I could add, that wave 2 and 4 must not retrace wave 1 / wave 3 61.8% or even more.

关于 EDT,我可以补充一点:浪 2 和浪 4 的回撤幅度不能超过浪 1/浪 3 的 61.8%或更多。