Tsunami of Buying Pushes Wall Street to the Edge

买盘海啸将华尔街推向边缘

The real tsunami 真正的海啸

A tsunami of buying has pushed risk sentiment and positioning to extremes—from vol-control flows to record retail leverage. But warning lights are flashing: stretched sentiment, 100th percentile CTA longs, seasonality risk, and a market running out of hedges. Be careful out there.

一波买入海啸将风险情绪和仓位推向极端——从波动率控制资金流到创纪录的散户杠杆。但警示信号正在闪烁:情绪过度、CTA 多头达到第 100 百分位、季节性风险以及市场对冲工具耗尽。外面要小心。

Stretched 过度

When the French quant gurus at BNP speak, we listen.

当法国量化大师 BNP 发声时,我们都会倾听。

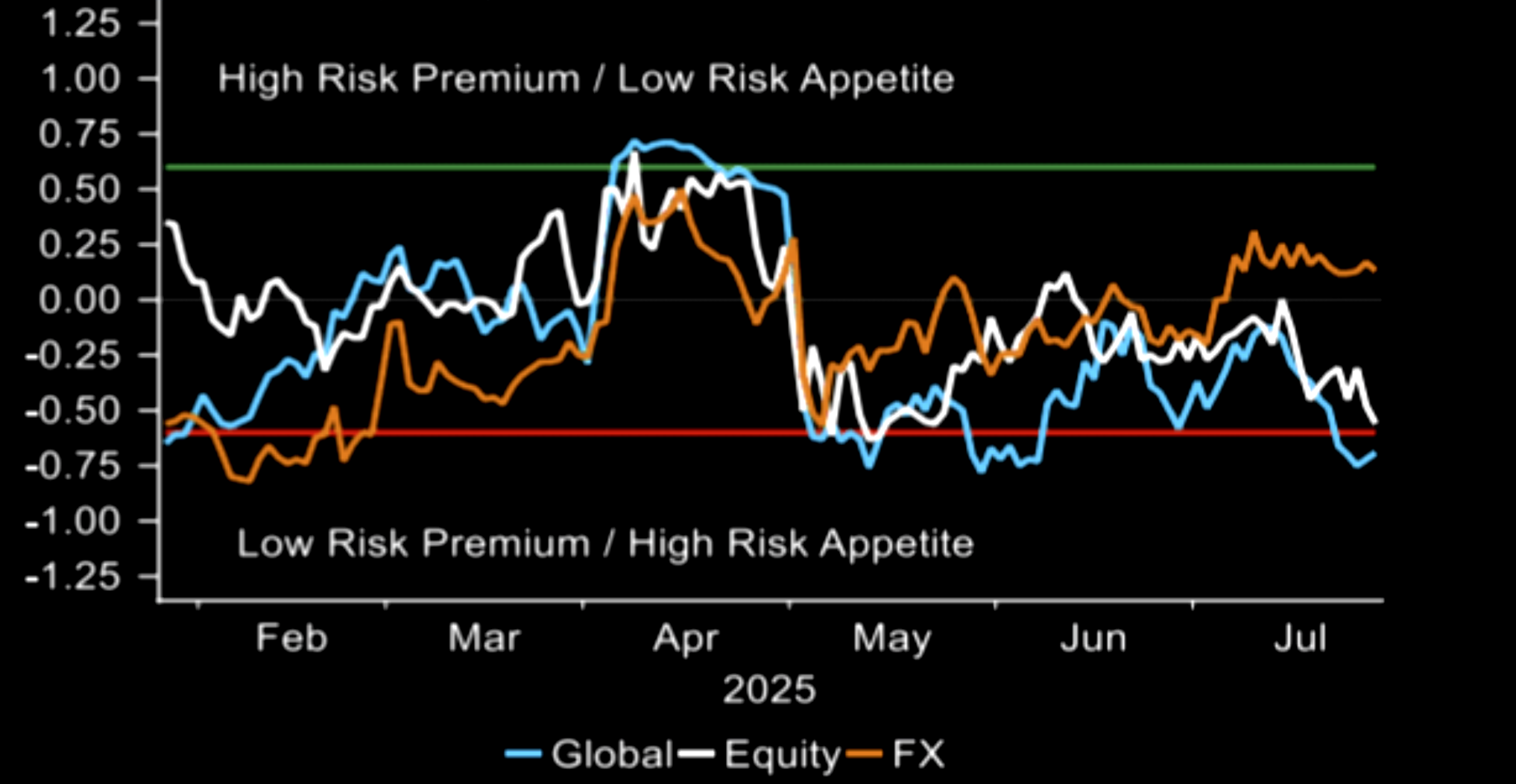

"Risk sentiment looks stretched from a cross-asset and equities perspective."

“从跨资产和股票的角度来看,风险情绪显得过度紧张。”

Source: BNP 来源:BNP

Vol control controlled the market

波动率控制主导了市场走势

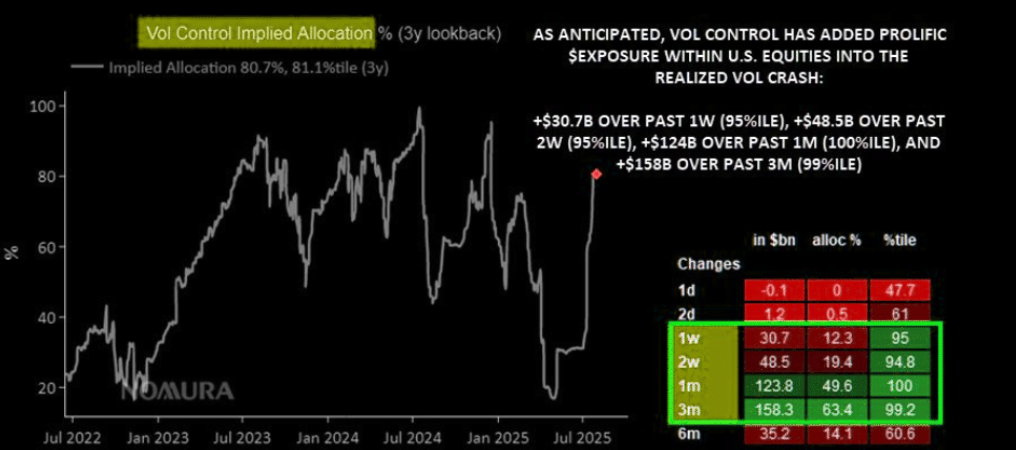

Vol control bought >$100bn in the last month. That's massive! This chart shows equities LONG -positioning extremes which have been rebuilt from “vol-scaling” Systematics thanks to the Realized Vol smash.

波动率控制在过去一个月内买入超过 1000 亿美元。那是巨大的!这张图显示了股票多头头寸的极端情况,这些头寸是通过“波动率缩放”系统策略在实现波动率暴跌的情况下重建的。

Source: Nomura vol 来源:野村波动率

100th percentile 第 100 百分位

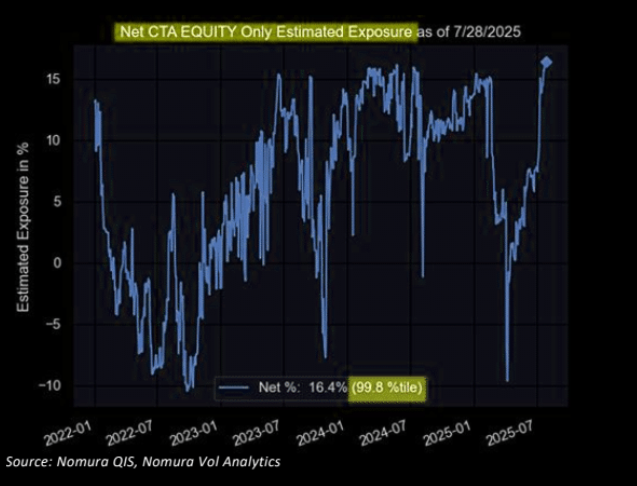

Nomura estimate of global CTA positioning.

野村对全球 CTA 头寸的估计。

Source: Nomura vol 来源:野村波动率

Another 100th percentile 又一个第 100 百分位

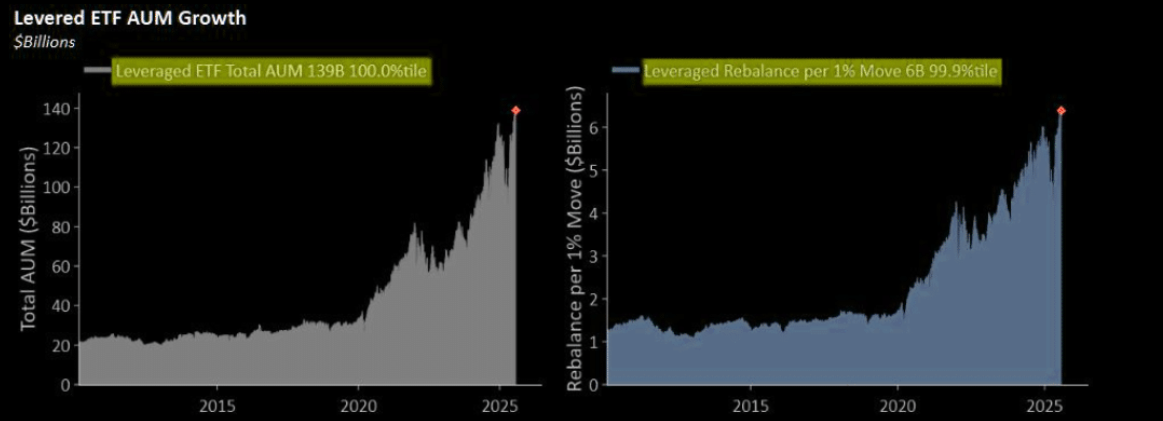

"And look at the Retail -cohort demand for Leveraged ETFs taking their AUM—and thus, EOD rebalancing needs—to 100%ile ATHs...."

“看看零售群体对杠杆 ETF 的需求,将其资产管理规模——从而每日收盘时的再平衡需求——推至 100 百分位的历史最高点……”

Their mechanical balancing impact has meant late day buying almost every day.

他们的机械性再平衡影响意味着几乎每天都会在收盘时买入。

Source: Nomura vol 来源:野村波动率

Highest bull reading ever

最高的多头读数

It's the Schwab client survey. 57% bullish is the highest reading ever going back to 2017.

这是施瓦布客户调查。57%的多头比例是自 2017 年以来的最高读数。

Source: Helene Meisler 来源:Helene Meisler

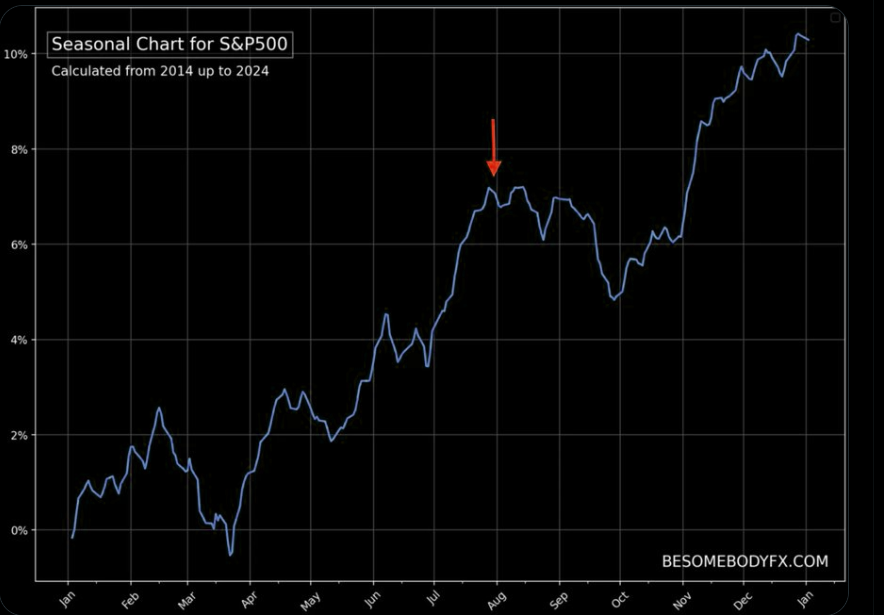

Seasonality 季节性

SPX has tracked seasonality almost perfectly in '25. Risk of Q3 turbulence ahead. Odds of a pullback are elevated.

2025 年,SPX 几乎完美地跟踪了季节性走势。第三季度可能出现波动的风险增加。回调的概率较高。

Source: Puru Saxena 来源:Puru Saxena

Tapping-out of hedges and buying into daily ATH’s

清仓对冲并买入每日历史新高

When McElligot speaks we listen and now he likes VIX calls outright.

当 McElligot 发声时,我们都会倾听,现在他直接看好 VIX 看涨期权。

"Traders / funds are indeed nearing extreme “Long” underlying in Equities again, and thus have needed to rent some S&P Downside Hedges...but those things keep bleeding you to death as there simply are no pullbacks, and owning Gamma kills you...so I think a fair number of people are sick of this frustration, and are tapping-out of said SPX Hedges into daily ATH’s.

“交易员/基金确实再次接近极端‘多头’股票头寸,因此需要租用一些标普下行对冲……但这些对冲不断让你亏损,因为根本没有回调,持有 Gamma 会让你损失惨重……所以我认为相当多的人已经厌倦了这种挫败感,正在清仓上述标普对冲,转而买入每日历史新高。

That’s why from an Equities perspective, the message continues to be “Hedge When You Can, Not When You Have To,” as with VVIX back in the 80sand iVol back in the teens, I like VIX Calls outright as a convex hedge, or from a value perspective for the Vol savvy, with 1m VIX Call Skew 85%ile / 2m93%ile, Call Spreads set-up nicely too"

这就是为什么从股票角度来看,信息依然是‘能对冲时就对冲,而不是非对冲不可’,正如 VVIX 曾在 80 年代高企,iVol 曾在十几的水平,我直接看好 VIX 看涨期权,作为一种凸性对冲,或者从价值角度对波动率敏感者来说,1 个月 VIX 看涨期权偏度处于 85 百分位,2 个月处于 93 百分位,看涨价差也设置得很好。”

Want to know more? 想了解更多?

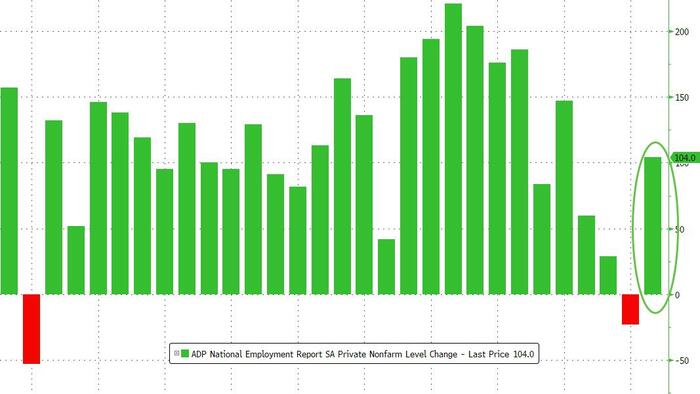

"Employers More Optimistic Than Consumers" As ADP Reports Big Rebound In Jobs In July

“雇主比消费者更乐观” ADP 报告 7 月就业大幅反弹

Treasury Refunding Outbids The Fed For Importance Today

国债再融资今日重要性超越美联储