Parabolic Panic: Japanese 30Y Yield Is a Bigger Threat Than Markets Admit

抛物线式恐慌:日本 30 年期收益率比市场承认的威胁更大

Parabolic 抛物线形

Japan 30 year yield chart looking more and more like a classical parabolic chart...

日本 30 年期收益率图表看起来越来越像经典的抛物线图表……

Source: LSEG Workspace 来源:LSEG Workspace

Bigger 更大

The latest move higher in Japanese long end is "substantially" bigger than what made people nervous back in mid May...

日本长期债券收益率的最新上涨幅度“实质上”比五月中旬让人紧张的情况还要大……

Source: LSEG Workspace 来源:LSEG Workspace

To follow? 会跟随吗?

Will US 30 year follow the Japanese version?

美国 30 年期国债会跟随日本版吗?

Source: LSEG Workspace 来源:LSEG Workspace

JGB driving western yields

日本国债推动西方收益率

"The simple fact is that super loose BoJ policies, both Zero Interest Rate Policy (ZIRP)…and outsized BoJ QE, had long helped anchor western bond yields far below where they would have been otherwise as various forms of the yen carry trade suppressed western yields". (Albert Edwards)

“简单的事实是,日本央行超宽松政策,包括零利率政策(ZIRP)……以及大规模的日本央行量化宽松,长期以来帮助将西方债券收益率锚定在远低于本应水平的位置,因为各种形式的日元套利交易抑制了西方收益率。”(Albert Edwards)

Source: Soc Gen 来源:Soc Gen

Underestimated risk 被低估的风险

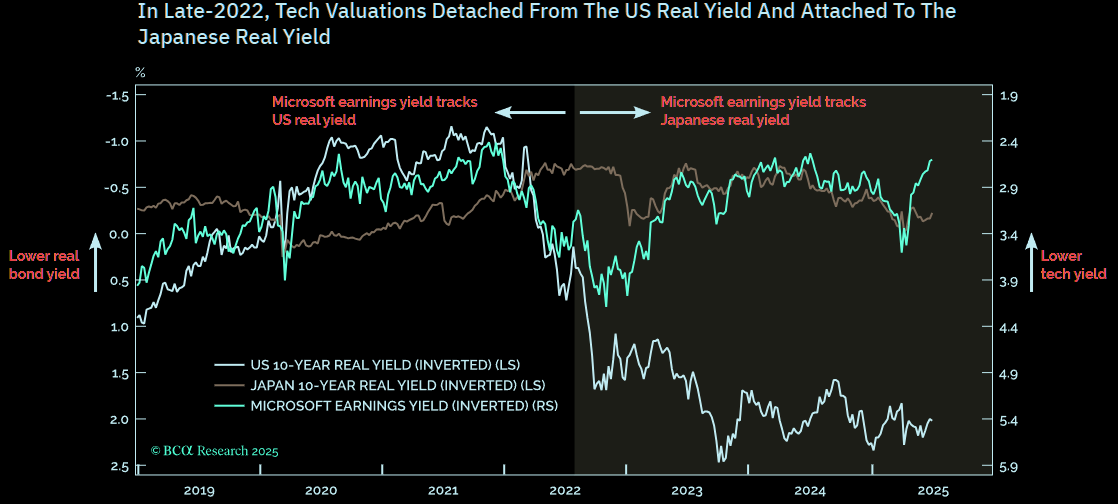

On the tech connection. "...our hypothesis that valuations are vulnerable to a normalisation of the Japanese real bond yield will only be tested if/when the Japanese real bond yield rises meaningfully. On a medium-term horizon, this is a significant and underestimated risk...." (BCA, Dhaval Joshi)

关于科技关联。“……我们假设估值对日本实际债券收益率正常化的脆弱性,只有在日本实际债券收益率显著上升时才会被验证。从中期来看,这是一个重大且被低估的风险……”(BCA,Dhaval Joshi)

Source: BCA 来源:BCA

Pay attention 请注意

You probably don't trade Japanese bonds, but moves like these should be observed, irrespective if you "only" trade the SPX. Chart shows SPX vs the Japanese 30 year (inverted).

你可能不交易日本债券,但无论你是否“只”交易 SPX,这样的走势都应该被关注。图表显示了 SPX 与日本 30 年期债券(倒置)的对比。

Source: LSEG Workspace 来源:LSEG Workspace

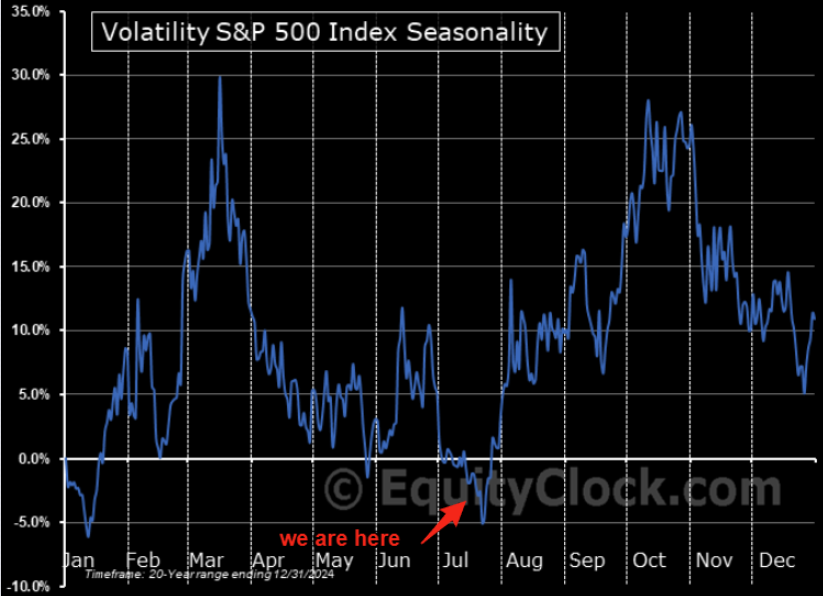

VIX to revive? VIX 会复苏吗?

Bigger moves in the Japanese 30 year have spilled over to VIX catching strong bids. Is this time different, or will VIX "nail" the seasonality chart again?

日本 30 年期国债的更大波动已溢出至 VIX,吸引了强劲买盘。这次情况是否不同,还是 VIX 将再次“钉住”季节性图表?

Source: LSEG Workspace 来源:LSEG Workspace

Source: Equity Clock 来源:Equity Clock

Precious connection 珍贵的联系

Japanese 30 year vs. gold and silver moving in pretty much perfect tandem.

日本 30 年期国债收益率与黄金和白银几乎完美同步变动。

Source: LSEG Workspace 来源:LSEG Workspace

Source: LSEG Workspace 来源:LSEG Workspace

Loving it 喜欢极了

BTC loving bond vigilantes in action...

热爱比特币的债券警戒者正在行动……

Source: LSEG Workspace 来源:LSEG Workspace

Trending on ZeroHedge ZeroHedge 热门趋势

'The View' Host Declares Violence Against ICE Agents Is Part Of A Justified "Reckoning"

《The View》主持人宣称对 ICE 特工的暴力是正当的“清算”行为

Rapper's Scheme To Create A Real Life Wakanda In Africa Ends In Failure

说唱歌手在非洲打造现实版瓦坎达的计划以失败告终

Military Aircraft's Mysterious Crash Sparks UFO Speculation In U.S. Airspace

军用飞机神秘坠毁引发美国领空不明飞行物猜测

NEVER MISS THE NEWS THAT MATTERS MOST

永远不错过最重要的新闻

ZEROHEDGE DIRECTLY TO YOUR INBOX

ZEROHEDGE 直达您的收件箱

Receive a daily recap featuring a curated list of must-read stories.

每日接收一份精选必读故事的摘要。