"A Legitimate Banger!" - Goldman Hedge Fund Honcho Reflects On "One Of The Most Consequential Weeks Of The Year"

“真正的重磅消息!”——高盛对冲基金负责人回顾“今年最具影响力的一周之一”

This week was "a legitimate banger," according to Goldman Sachs head of hedge fund coverage, Tony Pasquariello with the S&P taking out new highs and the Nasdaq 100 rallying from wire-to-wire.

高盛对冲基金覆盖主管 Tony Pasquariello 表示,本周是“一场真正的盛事”,标普创下新高,纳斯达克 100 指数从开盘一路上涨。

Said more formally, Pasquariello believes it was one of the most consequential weeks of the year.

更正式地说,Pasquariello 认为这是今年最具影响力的周之一。

From a geopolitical perspective, both Operation Midnight Hammer and the NATO pledge of 5% should be remembered as watersheds.

从地缘政治角度来看,“午夜铁锤行动”和北约承诺的 5%目标都应被视为分水岭。

In the words of Mark Rutte, NATO is now on a path to be “stronger, fairer, more lethal.” to say we’re living through “consequential” times is, perhaps, an understatement

用 Mark Rutte 的话说,北约现在正走在“更强大、更公平、更致命”的道路上,说我们正经历“关键”时期,或许还言过其实。

US federal politics broke favorably, as section 899 looks to be scrapped, and a series of trade deals are reportedly on the come.

美国联邦政治形势向好,第 899 条款有望被废除,据报道一系列贸易协议即将达成。

Alongside all of this, the prevailing market trends extended, and with notable force in certain spots.

与此同时,主流市场趋势得以延续,且在某些领域表现尤为强劲。

Which is to say: 换句话说:

crude oil was hit hard...

原油遭受重创……the dollar melted lower...

美元大幅下跌...the US interest rate curve bull steepened...

美国利率曲线呈牛市陡峭化...industrial metals pounded higher, and

工业金属大幅上涨,S&P printed a new ATH (thanks to a 6% rip in mega cap tech).

标普创下新历史高点(得益于大型科技股暴涨 6%)。

I’ll mention here that I saw another large set of clients this week, and while those positions are broadly popular, I’d argue that none of them are fully subscribed.

我在这里提一下,本周我见了另一批大客户,虽然这些头寸普遍受欢迎,但我认为没有一个是完全认购的。

So, with another interesting week ahead of us - payrolls, quarter end and the budget debate, with an eye towards the July 9th tariff deadline - you can call it like you see it.

所以,随着另一个有趣的一周即将到来——包括就业数据、季度末和预算辩论,同时关注 7 月 9 日的关税截止日期——你可以按自己的判断来解读。

What follows from here is a check-down of the core building blocks, some odd lot thoughts, and a handful of charts.

接下来是对核心构建模块的逐一检查,一些零散的想法,以及几张图表。

I’ll preface it with a quote, one that could currently be applied to the craft of money management:

我先用一句话作开场,这句话目前可以用来形容资金管理的艺术:

“you have to believe that anything can happen. you never know how things are going to change. you’ve got to be ready when they change. and you have to be prepared to get lucky.”

“你必须相信任何事情都有可能发生。你永远不知道事情会如何变化。你必须在变化时做好准备。你还必须准备好抓住好运。”

source: Scott Bessent, The Capital Allocators podcast

来源:Scott Bessent,《The Capital Allocators》播客

1. the market view.

1. 市场观点。

To level set, our US economics team expects that GDP will grow 1.25% in 2025, and the better part of 2% in 2026. which is to say: after a year that will shoulder the bulk of tariff uncertainty and friction, next year will mark a return towards trend growth.

为了统一认识,我们的美国经济团队预计 2025 年 GDP 将增长 1.25%,2026 年将增长接近 2%。也就是说:在经历了将承担大部分关税不确定性和摩擦的一年后,明年将标志着回归趋势增长。

In turn, S&P earnings should grow 7% this year, and then 7% again next year.

反过来,标普收益今年应增长 7%,明年也将增长 7%。

To say it again: as earnings go, so goes the stock market.

再说一遍:收益如何,股市就如何。

Where this all leads is a forecast of 6500 on S&P out 12 months from now.

这一切的结果是,预计 12 个月后标普指数将达到 6500 点。

I think that’s a very reasonable base case; if anything, my instinct is most all of these figures are a touch low.

我认为这是一个非常合理的基本预期;如果说有什么的话,我的直觉是这些数字大多偏低了一点。

At the same time, what we see is what we get, and I expect more of the same: the path of least resistance is higher, but it comes with a lot of noise, and not a lot of breadth.

与此同时,眼见为实,我预计情况将继续如此:阻力最小的路径是向上,但伴随着大量噪音,且市场广度不大。

Said another way: it’s a bull market, and the primary trend is still higher, but I reckon the trading environment will remain choppy for a while longer.

换句话说:这是一个牛市,主要趋势仍然向上,但我认为交易环境还会持续一段时间的震荡。

2. flow-of-funds / positioning.

2. 资金流动/仓位。

On a scale of -10 to +10, I’d put current length at +5. how do I get there? for discretionary funds, GS PB net exposure measures in the 44th percentile (on a 3-year lookback window). on the systematic side, Paul Leyzerovich estimates current length as a 5-of-10 (with a return to buy mode). most broadly, our GOAL matrix -- which pulls together 16 distinct indicators -- currently measures around the 50th percentile. locally, this week did not bring the kind of chase I’d normally expect at new highs.

在-10 到+10 的尺度上,我会将当前多头仓位定为+5。我是如何得出这个结论的?对于主动管理基金,高盛 PB 净敞口处于 44 百分位(基于三年回顾窗口)。在系统化方面,Paul Leyzerovich 估计当前多头仓位为 5 分(满分 10 分,处于买入模式回归)。更广泛地说,我们的 GOAL 矩阵——汇集了 16 个不同指标——目前处于大约 50 百分位。本地来看,本周并未出现我通常在新高时预期的追涨行情。

Here’s where I’m going with this: the trading community is NOT as long today as it was at various breakouts in recent history (e.g. last July, year-end, this February).

我的意思是:目前交易社区的多头仓位并不像近期历史上的多次突破时那样高(例如去年七月、年末、今年二月)。

One more note: the near-term should bring a chop of quarter-end supply that’s followed by an upswing in systematic demand ... that leaves me thinking weakness at the end of next week is, all else equal, a tactical buy.

还有一点:短期内应会出现一波季度末的供应震荡,随后系统性需求将上升……这让我认为,如果其他条件不变,下周末的回调是一个战术性买入机会。

3. US tech. 3. 美国科技股。

Again, NDX went 5-for-5 this week.

同样,NDX 本周五战全胜。

While not without significant challenges and a serious drawdowns this year, one thing is very clear to me: the cyclical impulse for companies to spend -- on all things technology -- remains exceedingly strong right now. while it’s old news at this point, Q1 earnings were a remarkable show-of-force. what we heard in recent weeks from AVGO, ORCL and now MU suggests that momentum continued.

虽然今年面临重大挑战和严重回撤,但有一点我非常清楚:企业在所有技术领域的周期性支出动力目前依然非常强劲。虽然这已经不是新鲜事,但第一季度的财报表现堪称强势展示。我们最近几周从 AVGO、ORCL 以及现在的 MU 听到的信息表明,这种势头仍在持续。

So, while the bar is MUCH higher for Q2, when considering the very big picture, I’m still drawn to this basic pattern of fact: the biggest companies in the world are generating, returning and reinvesting huge amounts of capital.

因此,尽管第二季度的门槛高得多,但从更宏观的角度来看,我仍然被这个基本事实所吸引:全球最大的公司正在创造、回报并再投资巨额资本。

In the end, I’m certainly not willing to step in front of that freight train, and would look to buy any meaningful dip during the reporting period.

最终,我当然不愿意站在这列货运列车前面,并会在报告期内寻找任何有意义的回调买入机会。

4. the US economy.

4. 美国经济。

US growth has slowed this year. Recently, this has been noticeable (if most worrisome) in the labor market. I summarized our forecast for GDP in point #1 above, but it’s worth spending a minute on the sequence. this comes with admission that it’s difficult to calibrate, with any real precision, the trajectory of growth given the immense distortions around trade (witness Q1 GDP -0.5%, followed by a Q2 estimate of +3.9%; those both feel like throwaways).

今年美国经济增长放缓。最近,这一点在劳动力市场上尤为明显(尽管令人担忧)。我在上文第 1 点中总结了我们的 GDP 预测,但值得花点时间谈谈其发展顺序。需要承认的是,由于贸易带来的巨大扭曲,很难精确校准增长轨迹(例如第一季度 GDP 为-0.5%,随后第二季度预估为+3.9%;这两个数据都感觉不太可靠)。

As the second half plays out, it’s reasonable to expect a bit more of a slowdown -- particularly in the hard data -- as the effects of front-loading bleed out (thus we forecast a 4.4% unemployment rate come year-end).

随着下半年进展,合理预期经济会进一步放缓——尤其是硬数据方面——因为前期集中释放的影响逐渐消退(因此我们预测年底失业率将达到 4.4%)。

I wouldn’t go too far with that, however, as fiscal policy is still supportive of GDP, the reconciliation bill should provide a boost and a tremendous amount of capital is flowing into the AI buildout.

不过,我不会对此过于悲观,因为财政政策仍然支持 GDP,调和法案应会带来提振,且大量资金正流入人工智能建设。

Conclusion: the stock market is looking through all of these oddities to a return of trend growth next year.

结论:股市正在透过所有这些异常现象,期待明年趋势性增长的回归。

5. the Fed. 5. 美联储。

While certain members of his committee are flirting with a July cut -- and the strip heavily discounts a move by September -- it seemed very clear from this week’s testimony that Chair Powell remains in wait-and-see mode.

尽管他的委员会中某些成员正在试探性地考虑 7 月降息——市场普遍预计 9 月会有动作——但从本周的证词来看,鲍威尔主席显然仍处于观望状态。

Note we’re about five weeks out from July FOMC and two months from Jackson Hole -- I suspect that Powell is buying time to assess where the growth/inflation tradeoff truly stands.

请注意,距离 7 月的 FOMC 会议还有大约五周,距离杰克逊霍尔会议还有两个月——我怀疑鲍威尔正在争取时间,以评估增长与通胀的权衡究竟处于何种状态。

For the moment, GIR has a different profile than both the Fed and the market: just one cut in December, followed by two next year, taking us to 3-5/8.

目前,GIR 的利率路径与美联储和市场都有所不同:12 月仅降息一次,明年再降两次,利率将降至 3-5/8。

One more point: in my recent client travels, the Fed really wasn’t coming up -- until the second half of this week.

还有一点:在我最近与客户的交流中,美联储几乎没有被提及——直到本周下半周才开始讨论。

While the move in the strip added some air to the equity trade, I still don’t believe the Fed is the main arbiter of stocks right now.

尽管利率曲线的变动为股票交易带来了一些空间,但我仍然不认为美联储是当前股票市场的主要决定因素。

Odd Lots

To put a line under an earlier comment, I’ve been on the road a good bit recently, and this seems clear: the speculative community has kept risk on a short leash, and I don’t know anyone who is fully deployed.

为了回应之前的评论,我最近出差较多,情况似乎很明确:投机社区一直对风险保持紧绷的控制,我不认识有谁是完全满仓的。

Although hedge funds haven’t been carrying max length, their sector selection has included some clear winners (for example, GS PB data shows that financials have been net bought for 10 straight weeks).

尽管对冲基金没有持有最大仓位,但它们的行业选择中包含了一些明显的赢家(例如,GS PB 数据显示金融板块已连续 10 周被净买入)。

Subject to your interpretation: I’d put the ratio of recent client questions on AI vs tariffs at 5:1; if anything, that’s too low.

根据你的解读:我会将近期客户关于人工智能与关税的提问比例定为 5:1;如果说有偏差,可能这个比例还偏低。

Another year, another dose of small cap disappointment - if it couldn’t outperform when growth was 3% and the Fed was cutting 100 bps, I don’t see why it should outperform now.

又是一年,小盘股再次令人失望——如果在增长率为 3%且美联储降息 100 个基点时都无法跑赢大盘,我看不出它现在为什么能跑赢。

One caveat to the prior point: small cap is the hedge for a lot of different things, so I’d bet that it’ll have a few indiscriminate, short-cycle rips as H2’25 plays out.

对前一点的一个警告:小盘股是对许多不同因素的对冲工具,所以我敢打赌,在 2025 年下半年展开时,它会有几次不加区分的短周期暴涨。

If you squint at various measures of hedge fund flow -- both discretionary and systematic -- it looks like some capital that moved into Europe for a trade is now returning to the US (in this context, it’s worth keeping an eye on the SX5E / SPX ratio).

如果你仔细观察各种对冲基金资金流动的指标——包括主动型和系统型——似乎一些流入欧洲进行交易的资金现在正回流美国(在这种情况下,值得关注 SX5E / SPX 比率)。

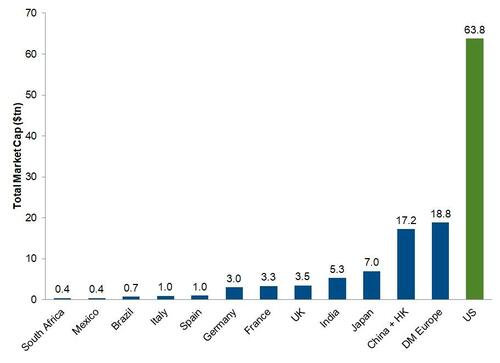

This is a simple plot of equity market cap by country (credit to Brett Nelson). In the context of liquidity and risk transfer, it’s incredibly hard to compete with the US:

这是一个按国家划分的股票市值简单图表(感谢 Brett Nelson)。在流动性和风险转移的背景下,与美国竞争极其困难:

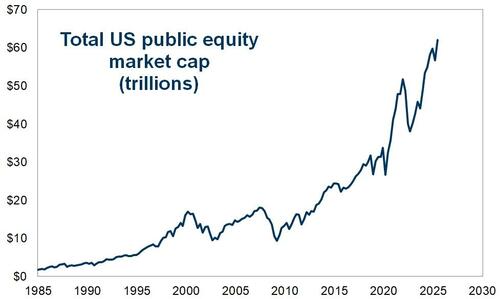

That last chart inspired this one (thanks Ben Snider). As a veteran client noted, US equity market cap has tripled in the last decade alone:

最后一张图启发了这张图(感谢 Ben Snider)。正如一位资深客户所指出的,美国股市市值在过去十年里已经增长了三倍:

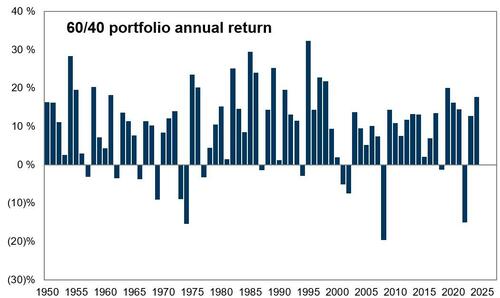

Last week I mentioned how the returns from a very basic 60/40 stock/bond portfolio have flatlined since 2022. as a follow up point, with credit to Jenny Ma, I think this does a nice job of illustrating recent history (again, the linear combination of that asset mix went 14-for-16 post-GFC). While the future is not yet written, I suspect the getting will not be nearly as good as it had been:

上周我提到,自 2022 年以来,一个非常基础的 60/40 股票/债券组合的回报已经趋于平稳。作为补充,并感谢 Jenny Ma,我认为这很好地说明了近期的历史(同样,这种资产组合的线性组合在全球金融危机后 16 次中有 14 次表现良好)。虽然未来尚未确定,但我怀疑收益不会像过去那样丰厚:

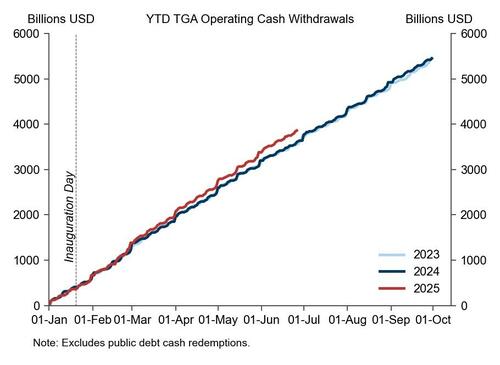

Subject to your interpretation, this plots total US federal government spending, using operating cash withdrawals from the TGA as proxy (credit to Sarah Dong):

根据您的理解,这张图绘制了美国联邦政府的总支出,使用来自 TGA 的运营现金提取作为代理(感谢 Sarah Dong):

Again, for all the oddities of the first half, US financial conditions are now at YTD lows. The logic is admittedly circular, but this is not a bad thing for risky assets:

同样,尽管上半年出现了各种奇怪现象,但美国金融状况目前处于年内最低点。逻辑虽然有些循环,但这对风险资产来说并非坏事:

By now you’ve seen our AI leaders-vs-laggard pair trade several times. As you can see in the bottom half of this chart, it has been melting higher of late. What’s also very notable is what’s taking place beneath the hood, which you can see in the top half ... you can guess which leg is which:

到现在为止,你已经多次看到我们关于 AI 领先者与落后者的配对交易。正如你在这张图的下半部分所见,近期该交易一直在持续上涨。更值得注意的是图表上半部分所显示的内部情况……你可以猜出哪一边代表哪一方:

Following on from there, this is a basket that encompasses the favorite multi-year themes of our custom basket desk. Right now, it’s a blend of AI ... power / nuclear ... the banks ... quantum computing ... and robotics. this is just the outright plot, but it has also significantly outperformed the broader market:

接下来,这是一个涵盖我们定制篮子交易台多年最受欢迎主题的篮子。目前,它是人工智能……电力/核能……银行……量子计算……和机器人技术的混合。这不仅是整体布局,而且其表现也显著优于大盘:

Finally, Pasquariello concludes, again with a nod to one of the greats: for all the adventures in any given week in 2025, this core mosaic is still performing well: short dollars, curve steepeners, long stores-of-value, long stocks.

最后,Pasquariello 再次致敬一位伟人总结道:尽管 2025 年任何一周都会有各种冒险,这个核心组合依然表现良好:做空美元、曲线陡峭交易、长期持有价值储存资产、长期持有股票。

As the world tries to figure out what to do with a record high allocations to US equities and record low currency hedge ratios, I think the dollar will do most all of the heavy lifting.

随着全球试图应对创纪录的美国股票配置和创纪录的低货币对冲比例,我认为美元将承担大部分重任。

More from the rest of Goldman Sachs Sales & Trading team here available to pro subs.

更多来自高盛销售与交易团队的内容,专业订阅者可在此获取。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

The End Of Bank Branches: How Europe's Digital Euro And Stablecoins Are Reshaping Finance

银行分支的终结:欧洲数字欧元和稳定币如何重塑金融

Hartnett: These Are The Best Trades For The Second Half Of 2025

Hartnett:2025 年下半年最佳交易策略