Mesut Dogan

There's a common saying that "what is old becomes new again" - but while this saying can often be applied in the world of fashion and trends, it's not often that we can say the same about the tech industry. And yet Oracle Corporation (NYSE:ORCL) is enjoying a substantial resurgence this year. One of the best-performing large-cap tech stocks this year isn't NVIDIA Corporation (NVDA) or Microsoft Corporation (MSFT) - but indeed Oracle, a company that many tech investors consider to be a laggard in the cloud.

儘管許多投資者認為 Oracle 在雲端領域落後,但它今年卻經歷了顯著的復甦,成為表現最好的大型科技股之一。

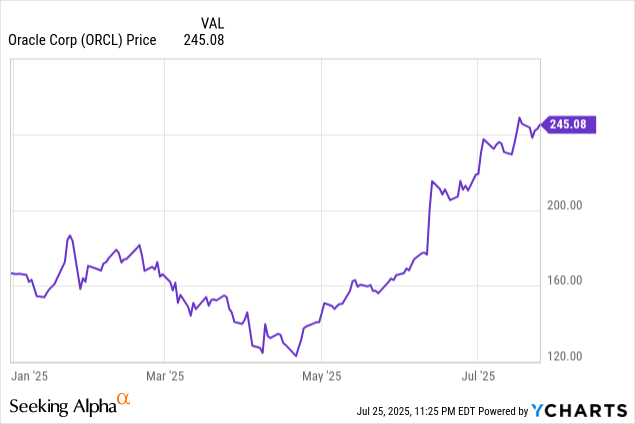

Shares of Oracle are up >40% this year, proving many bears wrong. Oracle has benefited from investing heavily into its Oracle Cloud Infrastructure (OCI) product, which has given the company a compelling cloud offering to rival Amazon AWS and Microsoft Azure while supporting cross-sales into the company's deep portfolio of application software. The key question for investors now is: after Oracle's rally, can we expect the stock to surge further?

Oracle 股價今年上漲超過 40%,其成功歸功於對雲端基礎設施 (OCI) 的大量投資,這使其能與 AWS 和 Azure 競爭,並帶動其他軟體的交叉銷售。現在的關鍵問題是:股價能否持續上漲?

I last wrote a bullish opinion on Oracle in early April, when the stock was trading near $140 just after the broader stock market had crashed in the wake of President Trump's initial tariff announcement in the Rose Garden. Since then, shares of Oracle have skyrocketed about ~80%, making Oracle one of the best-performing stocks in my portfolio this year.

我先前在四月初看好 Oracle,此後其股價飆升了約 80%,成為我今年投資組合中表現最好的股票之一。

Originally, I purchased Oracle as a value investment. It had long sailed below the valuations of peers like Microsoft and SAP SE (SAP), and I argued that much of the appeal in Oracle was in its potential to re-rate upward. Now, with Oracle's growth rates markedly improving, it has largely closed that gap. The key now is for us to consider Oracle as a growth stock, which is quite appropriate when the company is expecting revenue growth to continue accelerating at least through FY27 (the year for Oracle ending in May 2027). All in all, I remain at a buy rating here.

我最初將 Oracle 視為價值投資,因其估值低於同業。如今,隨著成長率顯著提升,估值差距已縮小,應將其視為成長股。考量到其營收預計將加速成長至 27 財年,我維持買入評級。

To me, there are a slew of reasons to remain long on Oracle, which include:

我認為,持續看好 Oracle 的理由包括:

- Multi-year, non-cancelable deals are leading to a surge in RPO. Safra Catz, Oracle's CEO, is expecting RPO (remaining performance obligations) to double in FY26, which is nearly unheard of for a large-cap tech company. Though Oracle was long considered behind in transitioning to cloud products, clearly the company has invested in the quality of its cloud offerings (particularly OCI) to drive a significant competitive advantage and take a surge of new bookings.

多年期、不可取消的合約正帶動剩餘履約義務 (RPO) 激增。執行長預期 RPO 將在 26 財年翻倍,這對大型科技公司而言幾乎前所未見。這顯示公司對雲端產品(特別是 OCI)的投資已成功建立競爭優勢並贏得大量新訂單。 - Expectation of revenue acceleration through FY27. Backed by enormous RPO/backlog growth, Oracle expects revenue growth to accelerate to 16% y/y in FY26, with further (unspecified) acceleration in FY27. We've already seen sequential improvements throughout FY25. Today, Oracle is unrecognizable from the laggard that grew only in the mid single digits during the post-pandemic period (when every other tech stock was rallying).

預期營收將加速成長至 27 財年。在龐大 RPO 的支持下,Oracle 預計 26 財年營收將加速至年增 16%,並在 27 財年進一步提升。相較於過去僅有個位數成長的落後者形象,如今的 Oracle 已截然不同。 - Massive portfolio of enterprise software products. Oracle is best known for its database software that forms the backbone of modern enterprise IT infrastructures, but it also boasts a large portfolio of cloud applications ranging from sales to finance, a combination of apps both developed in-house and acquired. The company is now leading with its infrastructure deals, but is also well-positioned to cross-sell its apps to gain customer wallet share.

Oracle 擁有龐大的企業軟體組合,其核心產品是作為企業 IT 骨幹的資料庫軟體,同時也提供大量自主開發及收購的雲端應用(涵蓋銷售、財務等)。公司現以基礎設施業務為主導,並具備交叉銷售應用程式以提升客戶價值的優勢。 - AI advantages. Oracle is also leading in agentic AI innovation, having released over 100 types of AI agents to help automate work. The company's infrastructure products (OCI) are being pitched as the central repository to house AI data and run large language models. The company is also offering AI integrations into its suite of operational tools, ranging from its core ERP solutions to its front-end applications.

甲骨文引領代理型 AI 創新,已發布逾百種 AI 代理以協助工作自動化。其基礎設施產品 (OCI) 可作為儲存 AI 資料與運行大型語言模型的核心平台。公司亦將 AI 整合至其營運工具套件,範圍涵蓋核心的 ERP 解決方案到前端應用。

Valuation checkup

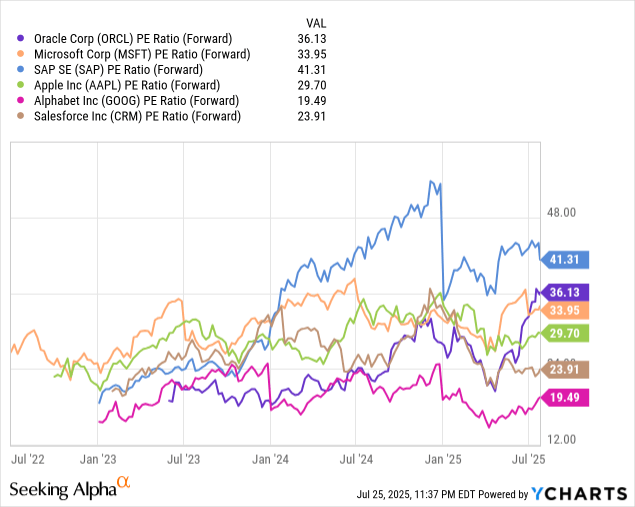

Where we are less than enthusiastic about Oracle, however, is the fact that its cheap valuation advantage has been consumed by its recent rally. In a very short space of time, Oracle has gone from being one of the cheapest large-cap tech stocks to becoming one of the most expensive, topped only by SAP SE (SAP), the German software rival to Oracle which is enjoying its own cloud resurgence.

然而,我們對 Oracle 較不樂觀的是,其近期漲勢已使其估值優勢消失。短時間內,Oracle 已從最便宜的大型科技股之一,轉變為最昂貴的個股之一,僅次於德國軟體競爭對手 SAP。

As we mentioned upfront, however, we have to shift our thinking now on Oracle as a growth stock. In FY26 and FY27, consensus is currently calling for Oracle to generate 16% y/y and 19% y/y revenue growth respectively, and 12% and 21% y/y EPS growth. Compare that with Microsoft, where FY26 EPS growth is expected at "only" 13% y/y. Note that Oracle's FY27 (ending May 2027) is roughly aligned to Microsoft's FY26. Oracle should now enjoy a growth premium versus its peers.

我們需將甲骨文重新定位為成長股。市場預期其 2026 和 2027 財年,營收將分別年增 16%與 19%,EPS 則年增 12%與 21%。此 EPS 成長率已超越微軟同期預估的 13%。因此,甲骨文應比同業享有更高的成長溢價。

It's clear as well now that Oracle is taking market share from its longtime rival, Salesforce, Inc. (CRM), whose top-line growth has stalled to the high single digits. Oracle's investment in its infrastructure capabilities (whereas Salesforce boasts only SaaS applications) has built a competitive moat for the company, justifying a premium.

甲骨文正從其宿敵 Salesforce 手中奪取市占,後者的營收成長已停滯。與只提供 SaaS 應用的 Salesforce 不同,甲骨文投資基礎設施以建立競爭護城河,使其享有溢價合情合理。

Note that I don't expect any further upward multiples re-rating for Oracle. Investors should take care to monitor this stock closely, and I'd sell Oracle if its valuation overtakes SAP. That being said, I continue to believe that Oracle's accelerating growth trajectory through FY27 should help to justify and counterbalance its enriched valuation multiples.

預期甲骨文的估值不會再進一步上修,投資人應密切關注,並在其估值超越 SAP 時賣出。不過,甲骨文至 2027 財年的加速增長,應能為其偏高的估值提供支撐。

Q4 download

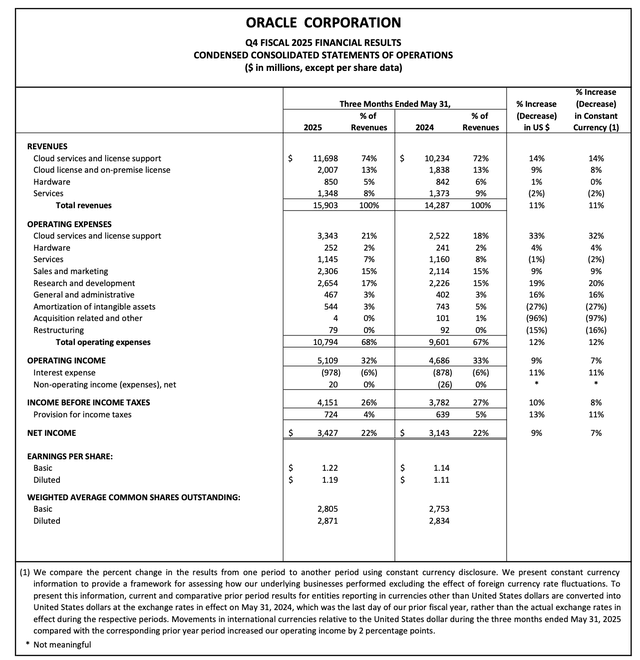

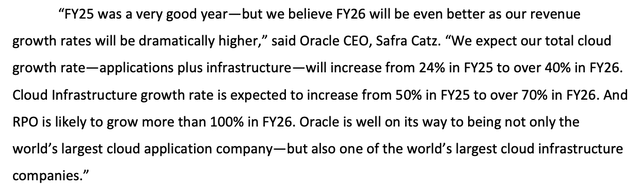

In June, Oracle released incredible fiscal Q4 (May quarter) results that decimated expectations and affirmed the company's accelerating growth profile. Take a look at the Q4 earnings summary below:

甲骨文六月公布的第四財季(截至五月)財報遠超預期,證實了公司的加速成長。下方為第四財季的財報摘要:

Oracle Q4 results (Oracle Q4 earnings release)

Oracle's revenue grew 11% y/y to $15.90 billion, beating Wall Street's expectations of $15.58 billion (9% y/y) by a two-point margin. Oracle's growth also vastly accelerated versus just 6% y/y growth in Q3.

甲骨文營收年增 11% 至 159 億美元,高於華爾街預期的 9%,且成長率較第三季的 6% 大幅加速。

The company's growth was driven by the strength of Oracle Cloud Infrastructure. The company's backlog has given management confidence that OCI will grow at over a 70% y/y pace in FY26. Per CEO Safra Catz's remarks on the Q4 earnings call:

公司的成長動能來自 Oracle Cloud Infrastructure (OCI)。執行長 Safra Catz 在第四季財報會議上表示,積壓訂單使管理層有信心,OCI 在 26 財年的年增率將超過 70%。

Our infrastructure business was the next area to move to the cloud. We made engineering decisions that were much different from the other hyperscalers and that were better suited to the needs of enterprise customers, resulting in lower costs to them and giving them deployment flexibility. OCI has seen exceptional demand for infrastructure services, and those contracted noncancelable bookings in RPO give us confidence that OCI revenue will grow over 70% this current year. Included in that is the Oracle Autonomous Database and the AI data platform. Enterprises know that their AI needs demand the most capable database to manage a company's full data set. Further, with our AI and autonomous features, our customers can bring all their data together, make it available for LLMs and yet have the best security built in. In addition, our customers have the flexibility to run their Oracle databases in OCI, in private clouds or in partner clouds with our multi-cloud offering. But what is clear is that more customers will use the Oracle database to leverage AI."

我們的基礎設施業務接著轉移至雲端。我們做出與其他超大規模雲端供應商不同的工程決策,更適合企業客戶,為他們降低成本並提供部署彈性。OCI 的基礎設施服務需求強勁,其不可取消的合約訂單讓我們相信 OCI 今年營收將成長超過 70%。 這其中包括 Oracle 自治資料庫和 AI 資料平台。企業了解其 AI 需求需要最強大的資料庫來管理公司的完整資料集。此外,透過我們的 AI 和自治功能,客戶可以整合所有資料,在內建最佳安全性的情況下,提供給 LLMs 使用。 此外,我們的多雲產品讓客戶能彈性地在 OCI、私有雲或合作夥伴雲端中運行其 Oracle 資料庫。顯然,更多客戶將使用 Oracle 資料庫來利用 AI。

There are clearly a number of tailwinds at hand here. First, it's clear that OCI is taking market share. AWS grew at only a 17% y/y pace in the most recent quarter. Oracle appears to be winning customers over with its promise of lower total cost of ownership, as well as its ability to integrate with AI applications.

顯然有多項利好因素。首先,OCI 正擴大市佔率,其成長速度已超越 AWS。Oracle 憑藉更低的總持有成本及整合 AI 應用的能力來贏得客戶。

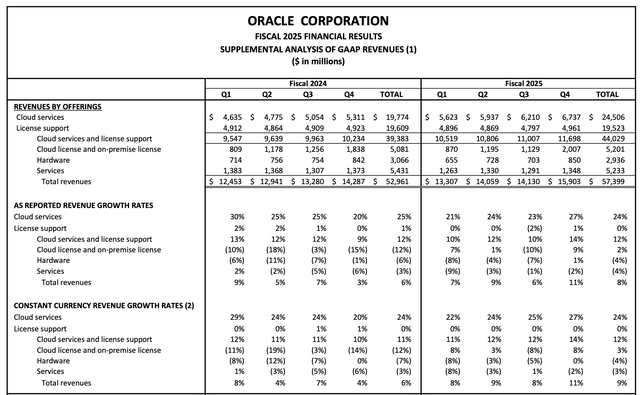

The chart below showcases Oracle's trended growth over the past few quarters. After growing at just a 6% total pace in FY24, Oracle's total growth improved to 8% y/y in FY25, with growth peaking in the last quarter of the year, which is unusual in a macro environment in which most software companies have reported decelerating growth. It's clear here that AI demand has helped Oracle to defy macro headwinds and to take market share from its competition.

甲骨文的增長率從 FY24 的 6% 加速至 FY25 的 8%,並在該年末季達到高峰。在多數軟體公司因宏觀環境而放緩之際,此趨勢相當罕見。顯然 AI 需求幫助甲骨文抵禦了經濟逆風,並從競爭對手中奪取市佔率。

Oracle growth trends (Oracle Q4 earnings release)

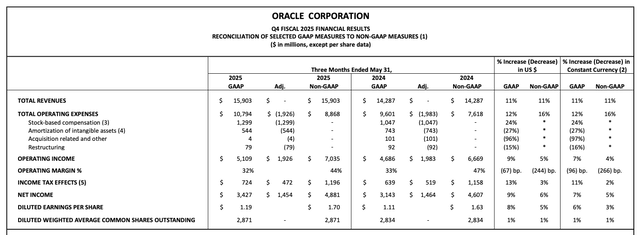

The guidance statement below, meanwhile, showcases Oracle's expectations that cloud revenue growth will be "over 40%" in FY26, versus 24% y/y growth in FY25 and 26% y/y growth in FY24, while RPO is expected to grow "more than 100% y/y".

甲骨文預期 2026 財年雲端營收年增率將超過 40%,高於 2025 財年的 24%與 2024 財年的 26%;同時,剩餘履約價值(RPO)年增率預計將超過 100%。

Oracle FY26 expectations (Oracle Q4 earnings release)

We are watchful of one factor, however. Oracle has capitalized on its incredible demand strength by investing in both sales and R&D. Opex grew at 12% y/y, a slightly faster pace than revenue. As shown in the chart below, operating margins actually pulled back -67bps.

然而,有一點值得注意。為因應強勁需求,甲骨文擴大投資銷售與研發,導致營運支出年增 12%,增速略高於營收,使營運利潤率下滑 67 個基點。

Oracle operating margins (Oracle Q4 earnings release)

The company has been guided to accelerate revenue growth in FY26, but has given little indication of where it expects margins to trend. Thankfully, consensus is currently quite constructive, expecting 12% EPS growth versus 16% revenue growth (implying further margin decay) - so there's room for Oracle to surprise to the upside.

公司指引 2026 財年營收將加速成長,但未說明利潤率走向。市場共識預期營收與每股盈餘將分別成長 16%和 12%,這隱含了利潤率下滑,因此也為甲骨文保留了優於預期的空間。

Risks and key takeaways

For me, the major risks to Oracle are its much richer valuation—the stock's P/E multiples, typically sitting in the high teens, have approximately doubled in a very short amount of time. Added on top of this is the risk that earnings growth trends slower than revenue growth, given current rates of margin pullback.

甲骨文的主要風險在於估值過高,其本益比在短時間內已翻倍。此外,利潤率下滑可能導致獲利成長慢於營收。

At the same time, however, it's difficult to ignore Oracle's expectations for accelerating revenue growth through FY27, backed by an expectation for >100% backlog growth. Stay long here and keep riding Oracle's recent momentum higher.

然而,甲骨文預期營收將加速成長至 2027 財年,並有超過 100% 的積壓訂單增長支撐。建議續抱以順應其上漲動能。

Comments (1)

幾年前在甲骨文股價跌至 80 幾塊時,一時興起用太太的退休帳戶買進,此後一直是主力持股。