I was involved in this rally from the start:

我从一开始就参与了这次集会:

Aggressively bullish on the market since April.

自四月份以来,市场一直积极看涨。

At every opportunity, I wrote the edge was “higher”.

每当有机会,我就会写下优势“更高”。

Pundits waited for a retest (didn’t happen), then a correction (nope), then a pullback (not even).

专家们等待重新测试 (没有发生),然后是修正 (没有),然后是回调 (甚至没有)。

Every day on Twitter/X, all I heard was pessimism and disbelief.

每天在 Twitter/X 上,我听到的都是悲观和怀疑。

Still — I shared my ideas here on Substack, and worked harder.

尽管如此,我还是在 Substack 上分享了我的想法,并且更加努力。

Nearly the whole way up, I said this could go further.

几乎在整个上行过程中,我都在说这还能走得更远。

Three months later, nearly every name in our watchlist has been among the top-performing stocks in the market.

三个月后,我们关注名单上的几乎每只股票都已成为市场上表现最好的股票。

I’m now at +60% YTD (vs. a max drawdown of -10%, one of my best 1H returns ever).

我现在年初至今的回报率为 +60%(而最大跌幅为 -10%,这是我有史以来最好的 1H 回报率之一)。

As an independent investor, I get to share my thoughts on this platform — with no agenda or sugar-coating.

作为一名独立投资者,我可以在平台上分享我的想法——没有任何议程或粉饰。

So I’ll say what I think here, and what I’m doing about it.

因此,我将在这里说出我的想法以及我对此采取的措施。

I think we’re approaching a moment where experience and discipline can really pay off…

我认为我们即将迎来一个经验和纪律真正发挥作用的时刻……

I'm Bearish. Here's why: 我看跌。原因如下:

SETTING THE TABLE 摆好餐桌

*First and foremost, a disclaimer:

*首先,免责声明:

For those who know our work, this is a Bull Market.

对于那些了解我们工作的人来说,这是一个牛市。

There’s no need to do anything extreme.

没必要做任何极端的事情。

This report is about understanding the BALANCE of risks, and making SMART decisions to potentially be in an *even stronger* position later on.

本报告旨在了解风险的平衡,并做出明智的决策,以便日后有可能处于*更强大*的地位。

There’s a difference between taking down exposure in a SMART, METHODICAL way, versus a blanket “Sell everything”.

以聪明、有条理的方式降低曝光度与一刀切的“卖掉一切”是有区别的。There was a time in this rally to play every opportunity — this is not the time anymore.

在这次集会中,我们曾经抓住每一个机会——但现在不再是时候了。I’m not adding new money to stocks here.

我不会在这里向股票注入新的资金。I’m gradually AND carefully taking money OUT of the market (raising cash).

我正在逐步且谨慎地从市场中撤出资金(筹集现金)。On balance, I’m CONCENTRATING exposure in higher quality stocks (more on this later).

总的来说,我集中投资于质量较高的股票(稍后会详细介绍)。If you’re in the business of allocating capital (like I am), I think we may see better prices into later Q3.

如果您从事资本配置业务(就像我一样),我认为我们可能会在第三季度后期看到更好的价格。

How we got here: 我们是如何走到这一步的:

This has been a high hit-rate rally with more than 90%+ of positions working for an extended period of time.

这是一次高命中率的反弹,超过 90% 的仓位在较长时间内有效。Stocks got in rally position, and buyers immediately pushed them higher.

股票进入上涨状态,买家立即推高价格。Now, some stocks are taking longer to respond.

现在,一些股票的反应时间更长。Now, the same names are looking played-out, and a lot of eyeballs are on them — chasing mindlessly. I’ve seen this movie before.

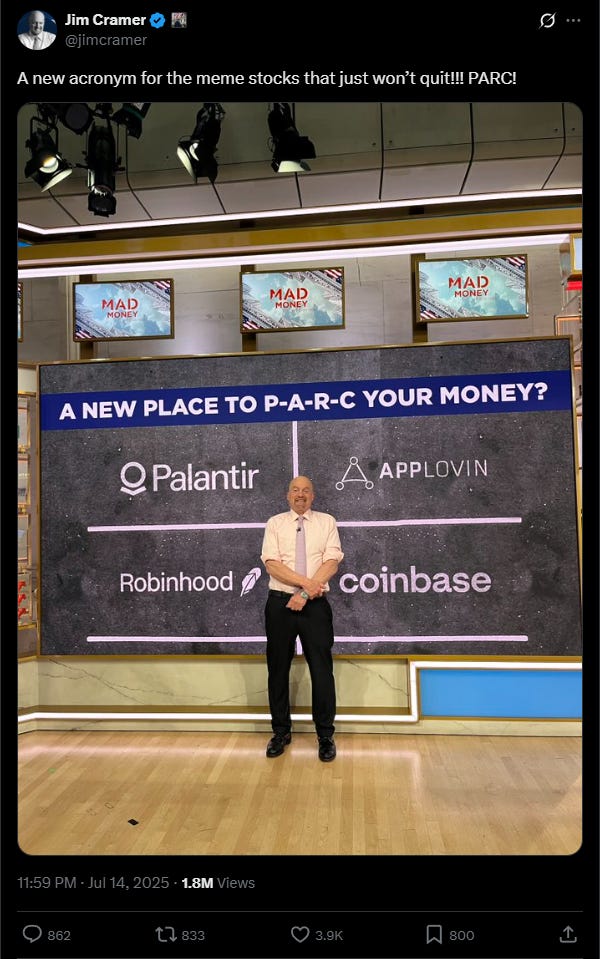

如今,那些名字看起来已经过时了,许多人的目光都集中在他们身上——盲目地追逐。我以前看过这部电影。Now, AFTER the leaders are up 50-200%, we’re hearing about the “exciting time” for innovation stocks and future technology.

现在,在领先者股价上涨 50-200% 之后,我们听到了有关创新股和未来技术的“激动人心的时刻”。

Additionally: 此外:

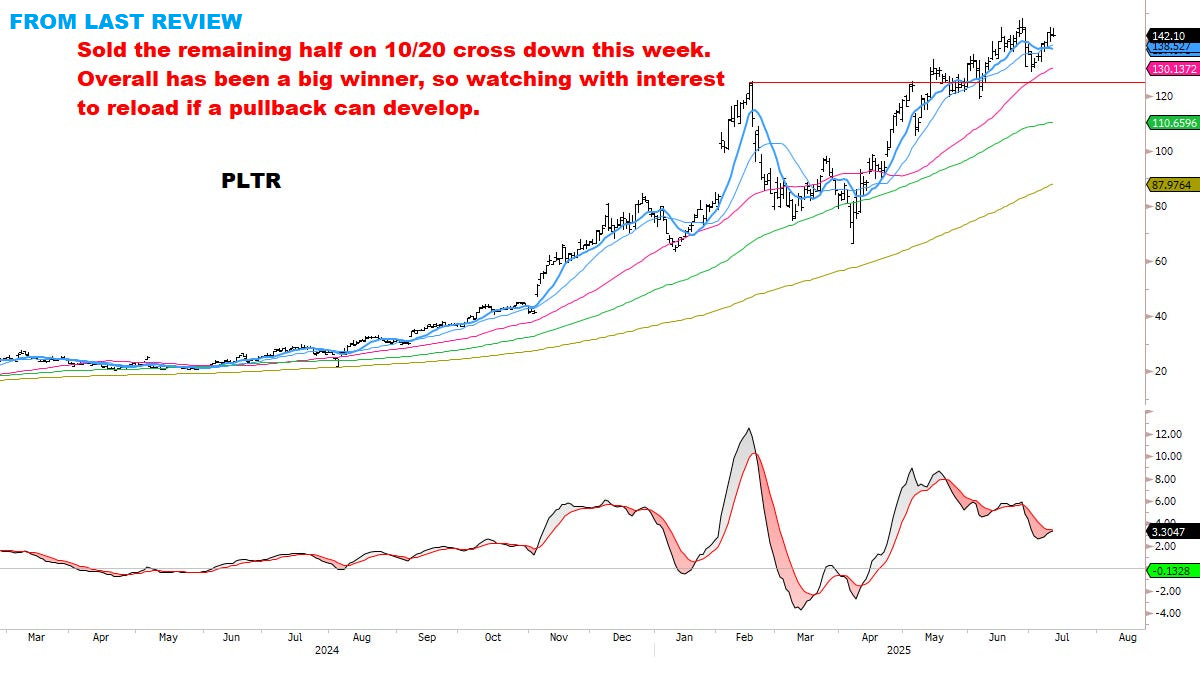

In the recent Weekend Review, I noted that

在最近的《周末评论》中,我指出

Some stocks are extremely extended and it’s finally time to begin thinking about the exits on a case-by-case basis — whether or not Sells are triggered.

有些股票的价格已经非常高了,现在终于到了需要根据具体情况考虑退出的时候了——无论是否触发卖出。Some stocks are beginning to trigger trailing sell crosses, and I’m moving out of those names methodically.

一些股票开始触发尾随卖出交叉,我正在有条不紊地卖出这些股票。Many of these stocks have been huge gainers since April (up 50-200%) — and every step of the way, we highlighted them as big opportunities. But now, some are starting to look tired.

自4月份以来,这些股票中有很多都大幅上涨(涨幅达50-200%)——我们一路走来,都强调它们蕴藏着巨大的机遇。但现在,有些股票开始显得疲软。

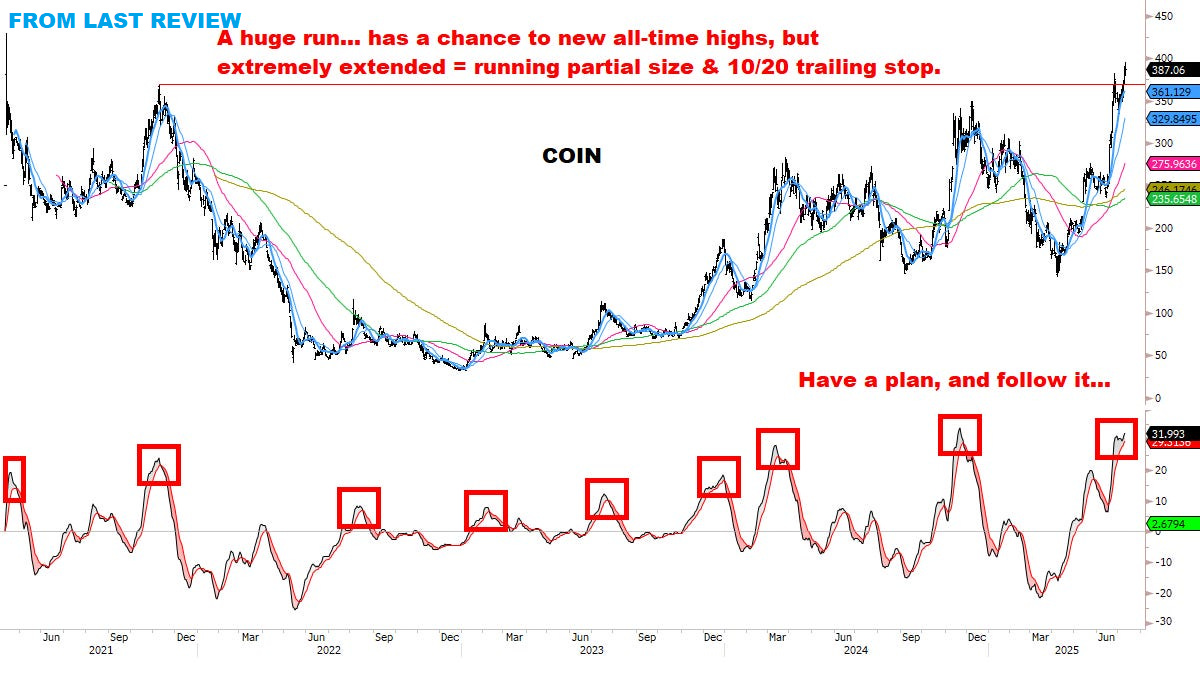

So I’m saying: “have a plan and follow it”.

所以我说:“制定计划并遵循它”。

Some examples from our recent report:

我们最近的报告中的一些例子:

Meanwhile, this happened on Monday…

与此同时,这件事发生在周一……

On April 30 I wrote:

4月30日我写道:

Inevitably, at some point in every rally, the wall of worry finally crumbles and even the garbage gets bought.

不可避免的是,在每次上涨的某个时刻,担忧之墙最终会崩塌,甚至垃圾也会被买走。This extreme risk-seeking behavior is fueled by two forces: performance-chasing, and general FOMO taking over.

这种极端的冒险行为受到两种力量的推动:追逐业绩和普遍的 FOMO 情绪。Looking around today, quantitatively and qualitatively I don’t think we’re quite there yet. I also think it will be a much different market picture in a few weeks’ time.

放眼目前的情况,无论从数量还是质量来看,我认为我们还没有完全达到目标。我还认为几周后市场形势将会大不相同。

That was three months ago.

那是三个月前的事了。

Now the world is indeed starting to look different…

现在世界确实开始变得不一样了……

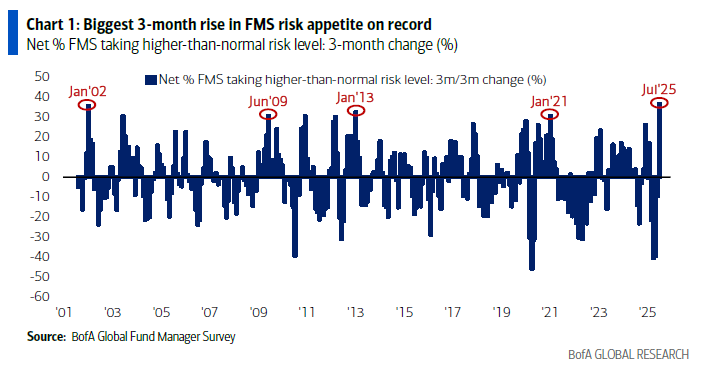

From BofA: “Investor sentiment most bullish since February 2025 on biggest surge in profit optimism since July 2020 and record surge in risk appetite past 3 months; Cash levels fall to 3.9% triggering “sell signal”; Sentiment getting “toppy” but with equity overweight not yet extreme, Bond Volatility still low, greed always much harder to reverse than fear, investors more likely to stick to summer of hedging & rotation rather than big shorts & retreat.”

美国银行称:“投资者情绪自 2025 年 2 月以来最为乐观,原因是盈利乐观情绪出现自 2020 年 7 月以来的最大涨幅,风险偏好在过去三个月创下纪录;现金水平降至 3.9%,触发“卖出信号”; 市场情绪正在“触顶”,但股票增持尚未达到极端水平,债券波动率仍然较低,贪婪总是比恐惧更难逆转,投资者更有可能坚持夏季的对冲和轮动,而不是大规模做空和撤退 。”

My notes: 我的笔记:

Previous spikes in the survey were led by funds getting back IN the market after dumping stocks.

调查中之前的飙升是由于资金在抛售股票后重返市场所致。With the exception of January 2002 (during a Bear Market), other spikes did not lead to a significant top. Again, I don’t think this is a major sell signal.

除了2002年1月(熊市期间)之外,其他峰值均未达到显著的峰值。同样,我不认为这是一个重要的卖出信号。But it DO think it means: TIME TO BE MORE SELECTIVE.

但它确实认为这意味着:是时候更加有选择性了。

I wrote recently: “Feels like a change coming in markets”.

我最近写道:“感觉市场即将发生变化”。

Let’s build on this. 让我们在此基础上继续努力。

To me now, the most important question is:

对我来说,现在最重要的问题是:

WHAT do you own? 你拥有什么?

BONDS 债券

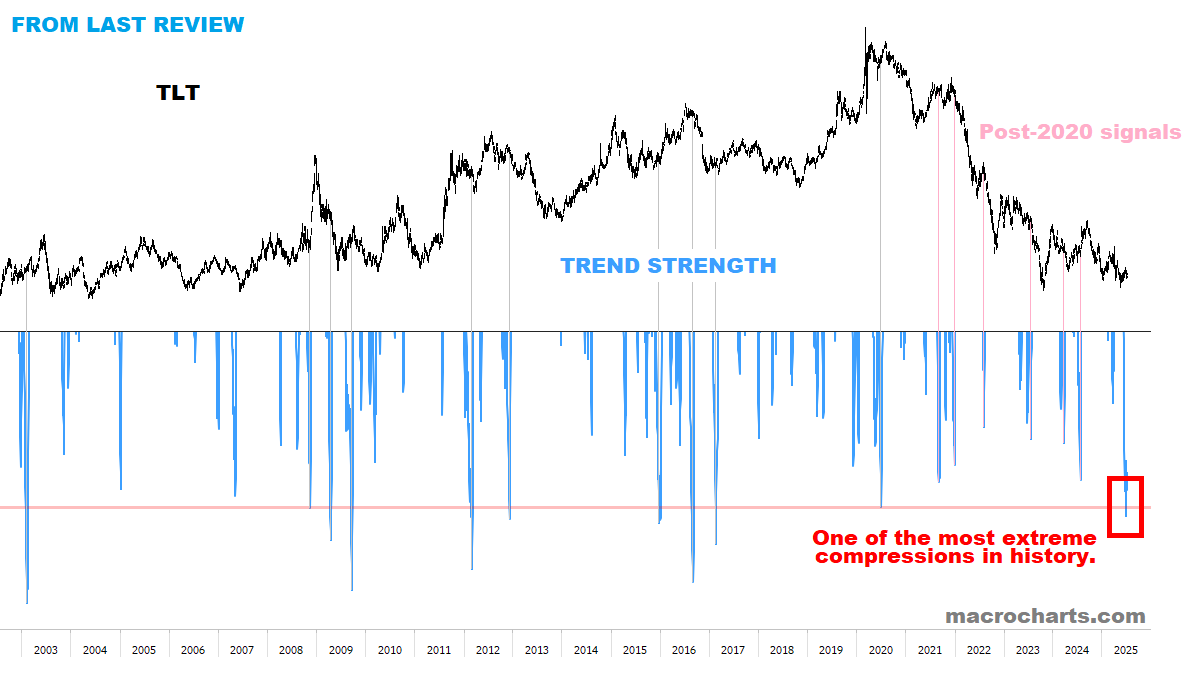

From our last Review: “Bonds are coiled for a big move — have to stay flexible. Feels like a shift coming…”

摘自我们上一篇评论:“债券市场即将迎来大波动——必须保持灵活性。感觉转变即将到来……”

This week, the risk/reward has gotten worse:

本周,风险/回报变得更糟:

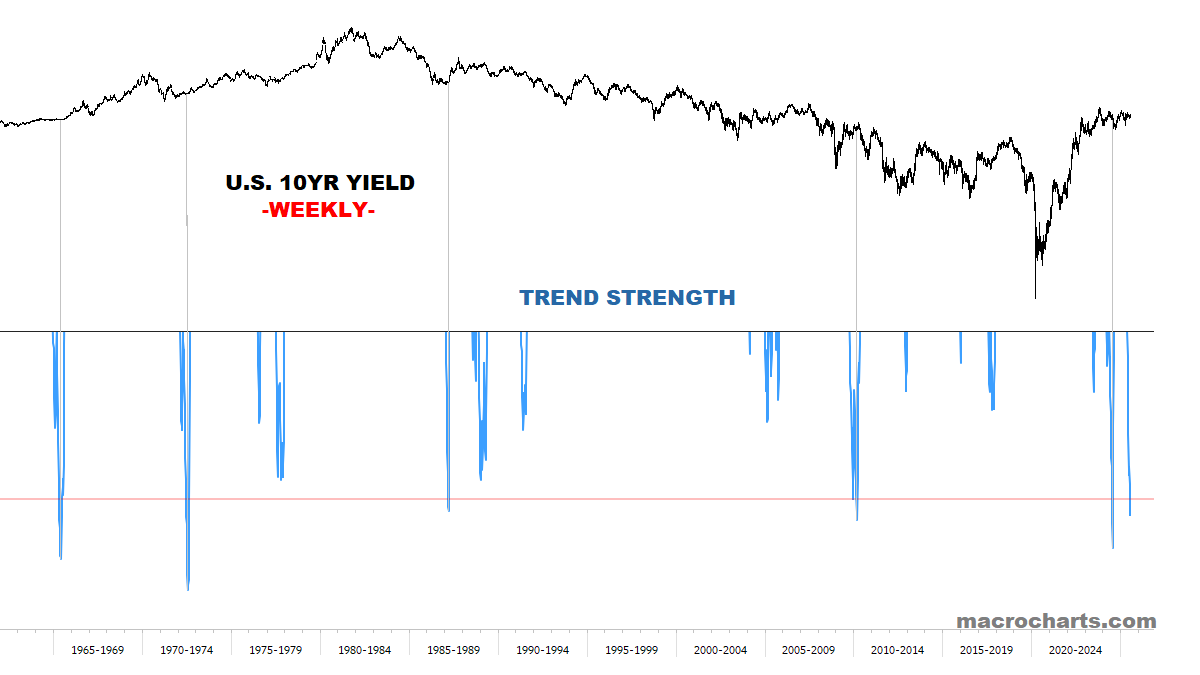

The Weekly chart of the 10YR is near the most compressed in six DECADES…

10 年期国债收益率的周线图接近 60 年来最压缩的水平……

And the long end is starting to move:

长端开始移动:

Meanwhile the 30YR looks to be confirming “UP & OUT”:

与此同时,30年期债券收益率曲线似乎正在确认“上升和下降”:

Bond Volatility is rolling up from its floor over the last few years:

过去几年,债券波动率不断上升:

Would I short Bonds here?

我会在这里做空债券吗?

Not outright, but Vol is relatively cheap, so Puts could be interesting for August/September expiration.

虽然不是直接的,但 Vol 相对便宜,因此对于 8 月/9 月到期的看跌期权来说可能会很有趣。Again, I don’t think Yields go to 1970s levels here… but the 10YR at ~5.20%+ and 30YR at ~5.50%+ seems achievable.

再说一次,我不认为收益率会达到 1970 年代的水平……但 10 年期债券收益率达到 ~5.20%+ 和 30 年期债券收益率达到 ~5.50%+ 似乎是可以实现的。One thing to note: there’s more economic data to finish off the week, but the key here is the Weekly trend may already be starting. The price action suggests something has materially changed. Let’s see how they close the week…

需要注意的是:本周最后会有更多经济数据公布,但关键在于周线趋势可能已经开始。价格走势表明情况已经发生了重大变化。让我们拭目以待本周收官……

DOLLAR 美元

A rising Dollar would be liquidity-negative for markets — and is looking correlated with higher Bond Yields:

美元上涨将对市场产生流动性负面影响,并且与债券收益率上升相关:

*I’ll be updating USDJPY, USDCHF, EURUSD, GBPUSD as I get involved in the coming weeks. I don’t think the Dollar train has left the station — markets almost always provide multiple entry points along a trend.

*未来几周,我将持续更新美元/日元、美元/瑞郎、欧元/美元和英镑/美元的走势。我认为美元这趟列车尚未驶离车站——市场几乎总是会沿着趋势提供多个切入点。

Stay tuned. 敬请关注。

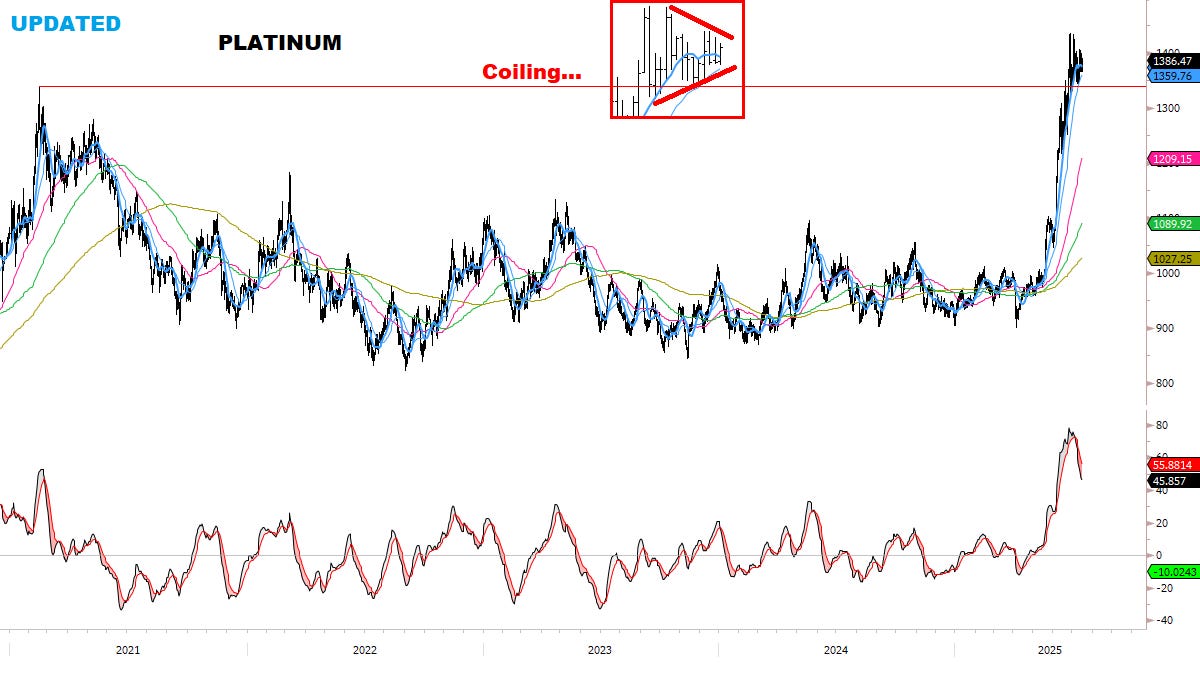

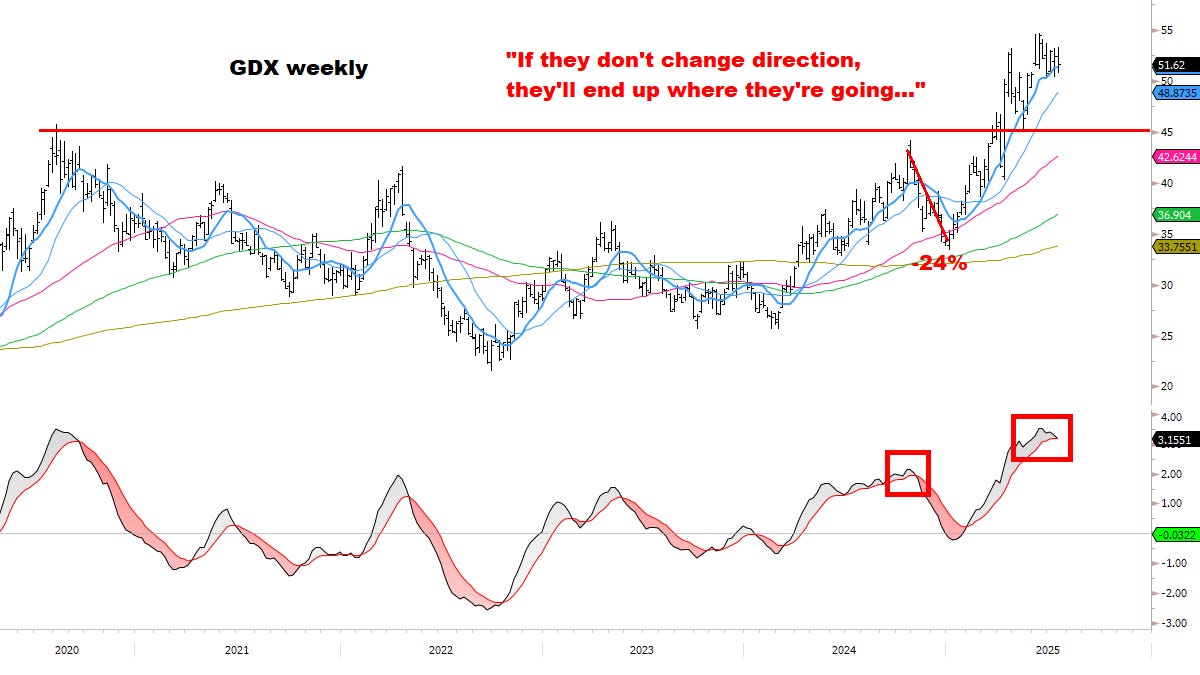

METALS 金属

Here too, the risk reward may be getting worse:

在这方面,风险回报可能也会变得更糟:

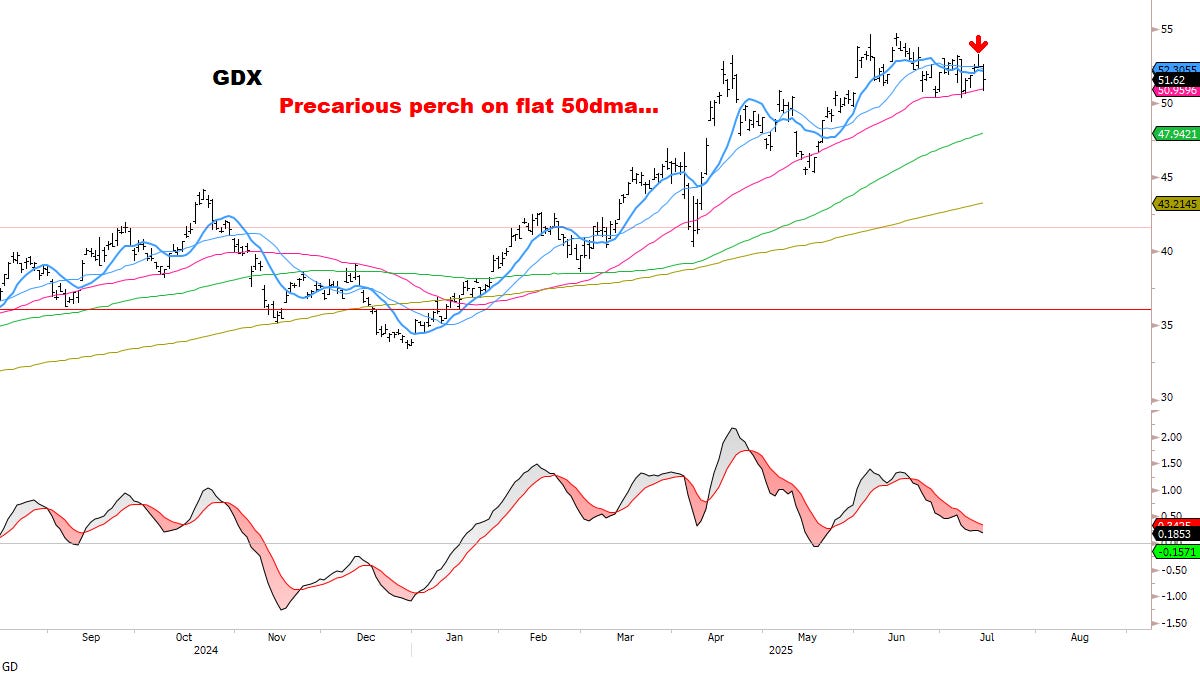

Stop remains $37— 停止仍为 37 美元—

Meanwhile: 同时:

Gold Miners are at a critical juncture — any decline here would risk targets 15-20% lower — Bulls need to hold *right here, right now*:

黄金矿商正处于关键时刻——任何下跌都可能导致目标价下跌 15-20%——多头需要*在此时此刻*坚守阵地:

OIL 油

Concerns building: 关注建筑:

More concerns: 更多担忧:

STOCKS 股票

Rule 1: Have a plan and follow it.

规则 1:制定计划并遵循计划。

Rule 2: Time to be more selective.

规则 2:需要更加有选择性。

More evidence of stocks leaving the rally, at the margin:

有更多证据表明股市已经脱离涨势,具体如下:

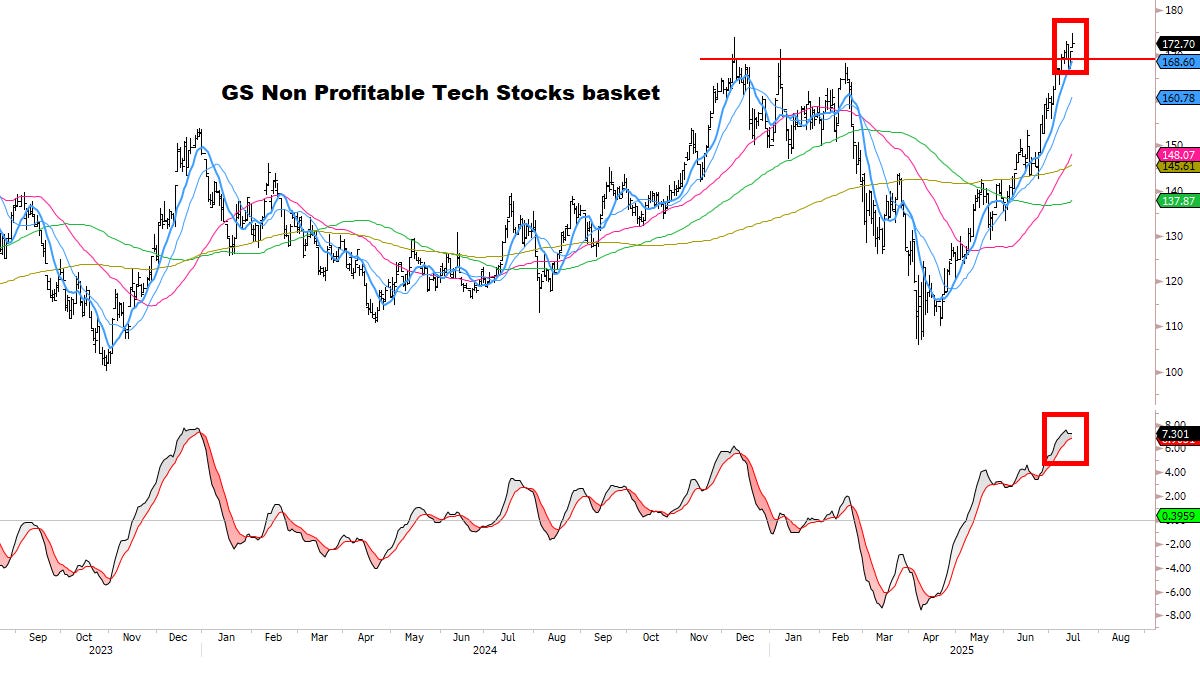

1. There’s a case to be made that lower-quality / higher-beta names are topping — and *Animal Spirits* topped alongside them.

1. 有理由相信,质量较低/贝塔值较高的股票名列前茅 — — 而 *Animal Spirits* 也与它们并列前茅。

2. We’ll be evaluating this on a daily basis and updating subscribers.

2. 我们将每天评估此事并向订阅者更新。

3. Again, the high-risk names just look played-out. Nothing wrong with staying Long until the market hits trailing stops, but dialing down exposure on extremely extended / high-beta names is ok too.

3. 再次强调,高风险股票看起来已经过时了。持有多头仓位直到市场触及追踪止损点并没有错,但降低持有极长/高贝塔值股票的风险敞口也是可以的。

4. Garbage stocks may have PEAKED also:

4. 垃圾库存可能也已达到峰值:

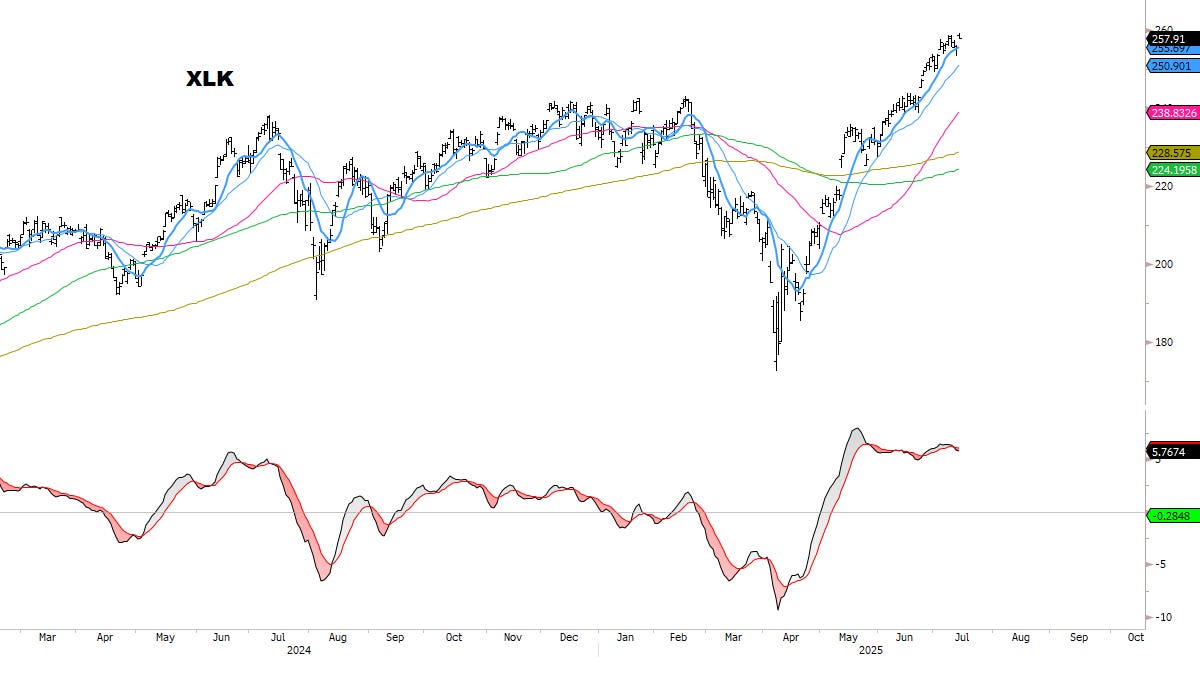

5. I *remain* focused on Quality names, and if history is a guide, think the core market leaders can continue advancing a bit more:

5. 我*仍然*关注优质品牌,如果历史可以作为借鉴,我认为核心市场领导者可以继续前进:

How much more upside? 还有多少上涨空间?

My BEST ESTIMATE at this time (*subject to change*): S&P may be 2-3 weeks and 2-3% away from an intermediate top, potentially in the 6300-6400 range.

我目前的最佳估计(*可能会发生变化*):标准普尔指数可能还需要 2-3 周的时间,并且距离中期顶部还有 2-3%,可能在 6300-6400 范围内。If a top is made, history suggests a 10-15% correction in core Indexes could be seen in Q3. NOT a forecast, but a historical pattern (as discussed throughout this rally).

如果触顶,历史表明核心指数可能在第三季度出现10-15%的回调。这并非预测,而是一种历史模式(正如本次反弹期间所讨论的那样)。I’ll be updating conditions in real-time — as the next weeks will be critical.

我将实时更新情况——因为接下来的几周至关重要。If more stocks peel off the rally, I may raise as much as 40-50% cash, then fully hedge the rest of the book with Puts (“cost of doing business”).

如果更多股票开始上涨,我可能会筹集高达 40-50% 的现金,然后用看跌期权(“经营成本”)完全对冲剩余部分。I’ll be updating my hedging plan with priority as we go.

我将优先更新我的对冲计划。For now, I’m raising cash by 20% this week, for the first time in this rally.

目前,本周我将增加 20% 的现金,这是此次反弹中的第一次。Cash is being raised from high-beta names which are rolling over / triggering trailing stops / extended. (As discussed, no need for “Carolina Reaper” heat in the equity book at this point.)

高贝塔值股票正在筹集资金,这些股票正在展期/触发追踪止损/延长。(正如之前讨论的,目前股票账簿上不需要“卡罗莱纳死神”的火热气氛。)

What does “The Top” look like?

“The Top” 是什么样子的?

It’s one of those things that “we’ll know it when we see it”, and I’ll get vocal about it.

这是那些“当我们看到它时我们就会知道它”的事情之一,我会大声说出它。For now, I propose it doesn’t really matter — only HOW we get there matters:

目前,我认为这并不重要——重要的是我们如何实现目标:Remain focused on quality Tech, still holding MAG7 and Large-cap names.

继续关注优质科技,仍持有 MAG7 和大型股。Over time, think the rally NARROWS to these names which are still working and have some potential upside.

随着时间的推移,认为涨势将缩小到这些仍在发挥作用并具有潜在上涨潜力的股票。Pundits will say Stocks are narrowing “and it’s bearish” — but it won't matter (until it does).

专家们会说股市正在收窄“并且是看跌的”——但这并不重要(直到它真的出现)。Pundits will say Stocks are ignoring Rates, Dollar, Tariffs — but it won't matter (until it does).

专家们会说股票不受利率、美元、关税的影响——但这并不重要(直到它真的重要)。Remember: Equities are the “last to get the memo”. S&P and NDX almost always top LATER than everyone expects — this is key to remember.

记住:股票是“最后收到备忘录”的。标普 500 指数和 NDX 指数的触顶时间几乎总是比所有人预期的要晚——这是关键。

When will MC switch to “full bear” on Stocks (and fully hedge the book)?

MC 何时会转向对股票进行“全面看跌”(并完全对冲账簿)?

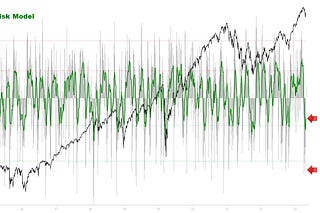

Most of our models are still in position to reach a Sell signal, and are NOT quite there yet.

我们的大多数模型仍处于发出卖出信号的位置,但尚未完全到达。BUT they are getting close…

但他们已经接近了……We’ll update signals in real-time with priority as they get there.

一旦信号到达,我们将实时更新并优先处理。

Lol Cramer. He never disappoints

What about crypto?