Audit Training Workshop for Audit Accountants Lesson 1 审计会计师审计培训工作坊 第一课

Disclaimer免責聲明

-The materials of this event are intended to provide general information and guidance on the subject concerned.Examples and other materials in this event are only for illustrative purposes and should not be relied upon for technical answers.HLB Hodgson Impey Cheng Limited(HLB),the speaker(s)and the firm(s)that the speaker(s)is representing take no responsibility for any errors or omissions in,or for the loss incurred by individuals or companies due to the use of,the materials of this event. - 本活动资料旨在提供有关相关主题的一般信息和指导。本活动中的例子和其他资料仅用于说明目的,不应作为技术答案的依据。豐隆银行国卫会计师事务所有限公司(HLB)、讲者及其代表的公司对本活动资料的任何错误或遗漏,或个人或公司因使用本活动资料而造成的损失概不负责。

-No claims,action or legal proceedings in connection with this event brought by any individuals or companies having reference to the materials on this event will be entertained by HLB,the speaker(s)and the firm(s)that the speaker(s)is representing. - 豐隆银行、演讲者及其代表的公司不会受理任何个人或公司在参考本活动资料后提起的与本活动有关的索赔、诉讼或法律程序。

-All rights reserved.No part of this publication may be reproduced,stored in a retrieval system or transmitted,in any form of by any means,electronic, mechanical,photocopying,recording or otherwise,without the prior written permission of HLB. - 未经豐隆银行事先书面许可,reserved.No 任何形式,均可复制、储存在检索系统或传播本出版物的所有权利,包括电子、机械、影印、录制或其他方式。

Agenda议程

-Basic of an audit-审计的基本

-True and fair view - 真实公正的观点

-Professional framework of auditing -专业的审计框架

-Three stages of an audit - 审计的三个阶段

-Audit risk-审计风险

-Knowledge of client's business -了解客户的业务

-Controls and walkthrough testing -控制和演练测试

Definition of an audit 审计的定义

In conducting an audit of financial statements,the overall objectives of the auditor are 在进行财务报表审计时,审计师的总体目标是

a)To obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement,whether due to fraud or error,thereby enabling the auditor to express an opinion on whether the financial statements are prepared,in all material respects, in accordance with an applicable financial reporting framework;and a)就财务报表整体上是否不存在重大错报(无论是由于欺诈还是错误)获得合理保证,从而使审计师能够就财务报表是否在所有重大方面按照适用的财务报告框架编制发表意见;

b)To report on the financial statements,and communicate as required by the HKSAs,in accordance with the auditor's findings. b) 根据核数师的调查结果,报告财务报表,并按照香港自营协会的要求进行沟通。

Paragraph 11 of HKSA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Hong Kong Standards on Auditing HKSA 200 独立核数师的整体目标及根据香港审计准则进行审计的第 11 段

Why have an audit? 为什么要进行审计?

Intender usersIntender 用户

Shareholders,individual or organization who use the assurance report 使用鉴证报告的股东、个人或组织

Practitioner医生

Provide assurance to intended users about a subject matter(e.g. the financial statements) 向目标用户提供有关主题(例如财务报表)的保证

Responsible party责任方

Board of Directors,management etc. responsible for the subject matter (e.g.the financial statements)of the assurance engagement 负责鉴证业务的主题(财务报表等)的董事会、管理层等

Companies Ordinance(Cap.622) 《公司条例》(第622章)

405.Auditor's duty to report 405.审计师的报告义务

A company's auditor must prepare a report for the members on any financial statements prepared by the directors,a copy of which is laid before the company in general meeting under section 429,or is sent to a member under section 430 or otherwise circulated,published or issued by the company,during the auditor's term of office. 公司的核数师必须就董事编制的任何财务报表向成员准备一份报告,该报告的副本根据第 429 条在股东大会上提交给公司,或根据第 430 条发送给成员,或由公司在审计师任期内以其他方式传阅、发布或发布。

Companies Ordinance(Cap.622) 《公司条例》(第622章)

406.An auditor's report must state,in the auditor's opinion 406.审计师报告必须说明审计师认为

(1)An auditor's report must state,in the auditor's opinion (1)审计报告必须说明审计师认为

a)whether the financial statements have been properly prepared in compliance with this Ordinance;and a)财务报表是否已按照本条例妥善编制;及

b)in particular,whether the financial statements b)特别是,财务报表是否

i.In the case of annual financial statements of a company that does not fall within the reporting exemption for the financial year;give a true and fair view of the financial position and financial performance of the company as required by section 380 i.In 公司的年度财务报表不属于该财政年度的报告豁免范围;按照第 380 条的要求,真实、公平地了解公司的财务状况和财务业绩

ii.In the case of annual consolidated financial statements of a company does not fall within the reporting exemption for the financial year,give a true and fair view of the financial position and financial performance of the company and all the subsidiary undertakings as required by section 380 ii.In 公司的年度合并财务报表不属于该财政年度的报告豁免范围,请按照第 380 条的要求真实、公平地了解公司和所有附属企业的财务状况和财务业绩

Companies Ordinance(Cap.622) 《公司条例》(第622章)

407.Auditor's opinion on other matters 407.审计师对其他事项的意见

(1)In preparing an auditor's report,the auditor must carry out an investigation that will enable the auditor to form an opinion as to (1)在编写审计报告时,审计师必须进行调查,使审计师能够形成以下方面的意见

a)whether adequate accounting records have been kept by the company; and a)该公司是否备存了足够的会计记录;及

b)whether the financial statements are in agreement with the accounting records. b)财务报表是否与会计记录一致。

Prepared,in all material respects 在所有物质方面都做好了准备

Have the financial statements been prepared in accordance with the relevant financial reporting framework? 财务报表是否按照相关的财务报告框架编制?

Paragraph 15 of HKAS 1 (Revised) 香港认可处第1号(修订版)第15段

"True and fair view requires the faithful representation of the effects of transactions,other events and conditions in accordance with the definitions and recognition criteria for assets,liabilities,income and expenses set out in the Conceptual Framework.The application of HKFRSs,with additional disclosure hen necessary,is presumed to result in financial statements that achieve a true and fair view. “真实和公平的观点需要根据概念框架中规定的资产、负债、收入和支出的定义和确认标准,忠实地陈述交易、其他事件和条件的影响。适用香港财务报告准则,加上必要的额外披露,可以推定导致财务报表达到真实和公平的观点。

True and fair view 真实公正的观点

Section 380(1)of the Companies Ordinance stipulates that the annual financial statements for a financial year: 《公司条例》第380(1)条规定,一个财政年度的年度财务报表:

a)must give a true and fair view of the financial position of the company as at the end of the financial year;and a)必须真实和公平地反映公司于财政年度结束时的财务状况;及

b)must give a true and fair view of the financial performance of the company for the financial year. b)必须真实、公正地看待公司财政年度的财务业绩。

True and fair view 真实公正的观点

When the financial statements are prepared in accordance with a fair presentation framework,the description of responsibilities for the financial statements in the auditor's report shall refer to"the preparation and fair presentation of these financial statements"or "the preparation of financial statements that give a true and fair view,"as appropriate in the circumstances. 财务报表按照公允列报框架编制时,审计报告中对财务报表职责的描述应视情况酌情提及“编制和公允列报这些财务报表”或“编制真实、公允的财务报表”。

Paragraph 36,HKSA 700 (Revised),Forming an Opinion and Reporting on Financial Statements HKSA 700(修订)第 36 段,就财务报表形成意见及报告

Faithful representation忠实的代表

-Financial reports represent economic phenomena in words and numbers.To be useful,financial information must not only represent relevant phenomena,but it must also faithfully represent the substance of the phenomena that it purports to represent. -财务报告用文字代表经济现象,numbers.To 有用,财务信息不仅要代表相关现象,还必须忠实地代表它所声称代表的现象的实质。

(Paragraph 2.12 of HKICPA Conceptual Reporting Framework for Financial Reporting) (香港会计师公会财务报告概念报告框架第2.12段)

-To be a perfectly faithful representation,a depiction would have three characteristics.It would be complete,neutral and free from error.Of course,perfection is seldom,if ever,achievable.Our objective is to maximise those qualities to the extent possible. -为了成为一个完全忠实的表现,一个描绘应该有三个 characteristics.It 是完整的、中立的和没有错误的。当然,完美很少(如果有的话)是可以实现的。我们的目标是尽可能地最大化这些品质。

(Paragraph 2.13 of HKICPA Conceptual Reporting Framework for Financial Reporting) (香港会计师公会财务报告概念报告框架第2.13段)

Three Depictions for "Faithful Representation" “忠实的代表”的三种描述

Complete完成Includes all information necessary for a user to understand the phenomenon being depicted,including all necessary descriptions and explanations. 包括用户理解所描述的现象所需的所有信息,包括所有必要的描述和解释。

Neutral中性

Without bias in the selection or presentation of financial information. 在选择或呈现财务信息时没有偏见。

Free from error没有错误

There are no errors or omissions in the description of the phenomenon,and the process used to produce the reported information has been selected and applied with no errors in the process. 对现象的描述没有错误或遗漏,并且选择并应用了用于生成报告信息的过程,过程中没有错误。

True and fair view 真实公正的观点

-HKAS 1 (Revised),Presentation of Financial Statements -香港会计准则第1号(修订版),财务报表列报

Paragraph 15:"The application of HKFRSs,with additional disclosure when necessary,is presumed to result in financial statements that achieve a true and fair view." 第15段:「适用香港财务报告准则,并在有需要时作出额外披露,可推定财务报表的财务报表具有真实和公认的观点。」

Paragraph 19:"In the extremely rare circumstances in which management concludes that compliance with a requirement in a HKFRS would be so misleading that it would conflict with the objective of financial statements set out in the Framework,the entity shall depart from that requirement in the manner set out in paragraph 20 if the relevant regulatory framework requires,or otherwise does not prohibit, such a departure." 第19段:“在极少数情况下,管理层得出结论认为遵守香港财务报告准则的规定会具有如此大的误导性,以致与框架中规定的财务报表的目标相冲突,如果相关监管框架要求或不禁止,则实体应按照第20段规定的方式偏离该要求。”

True and fair view 真实公正的观点

-HKFRS for Private Entities -私人实体的香港财务报告准则

Paragraph 3.2:"the application of the HKFRS for Private Entities,with additional disclosure when necessary,is presumed to result in financial statements that achieve a true and fair view of the financial position, financial performance and cash flows of Private Entities." 第3.2段:「适用于私人实体的香港财务报告准则,并在有需要时作出额外披露,可推定其财务报表能够真实及公平地反映私人实体的财务状况、财务表现及现金流量。」

Paragraph 3.4:"In the extremely rare circumstances when management concludes that compliance with this Standard would be so misleading that it would conflict with the objective of financial statements of Private Entities set out in Section 2,the entity shall depart from that requirement in the manner set out in paragraph 3.5 unless the relevant regulatory framework prohibits such a departure." 第3.4段:“在极少数情况下,当管理层得出结论认为遵守本标准将具有如此大的误导性,以致与第2节所列的私营实体财务报表的目标相冲突时,该实体应按照第3.5段所规定的方式偏离该要求,除非相关监管框架禁止这种偏离。

-Checking accounts for material errors -检查账目中的重大错误

-Responsible to shareholders -对股东负责

-Adjusts/interested in material errors -调整/对材料误差感兴趣

-Audit file must contain evidence of work done - 审计文件必须包含已完成工作的证据

Accountant会计

-Preparing accounts- 准备账目

-Responsible to directors -对董事负责

-Adjusts for all errors -针对所有错误进行调整

-Accounts file shows how figures made up -账目文件显示数字是如何构成的

Materiality重要性

-Auditors check for material misstatements -审计师检查重大错报

>Maximum error before accounts are"wrong" >账户“错误”之前的最大误差

>In the opinion of a user of the accounts >账户用户认为

-Can be qualitative or quantitative -可以是定性的或定量的

-Consider the following example:Which error would you judge to be material - 考虑以下示例:您认为哪个错误是重大的

Company AA 公司

Company BB 公司

Turnover营业额

HK\$10,000港币10,000元

HK\$10 Million1,000万港元

Error错误

HK1,000港币1,000元

HK5,000港币5,000元

Company A Company B

Turnover HK\$10,000 HK\$10 Million

Error HK1,000 HK5,000| | Company A | Company B |

| :--- | :---: | :---: |

| Turnover | HK\$10,000 | HK\$10 Million |

| Error | HK1,000 | HK5,000 |

The"expectation gap"“期望差距”

-Gap between-差距

>What the public think an auditor does,and what they would like us to do >公众认为审计师是做什么的,以及他们希望我们做什么

-What users expect from the auditor and how the auditor actually performs -用户对审核员的期望以及审核员的实际表现

-What the public believe an audit is,and what it actually is -公众认为审计是什么,以及它实际上是什么

-Fraud detection-欺诈检测

-Delivery gap-what an auditor is supposed to do and what they actually do -交付差距——审计师应该做什么以及他们实际做什么

Quick test快速测试

-Which of the following statements are correct? -以下哪项说法正确?

A."An auditor certifies that the financial statements are correct" A.“审计师证明财务报表正确无误”

B."Entities applying the SME-FRF \&SME-FRS have an exemption from audit" B.“适用 SME-FRF \&SME-FRS 的实体可免于审计”

C."Limited company financial statements must be prepared in accordance with accounting standards and the Companies Ordinance" C.“有限公司财务报表必须按照会计准则和《公司条例》编制”

Professional framework of auditing 专业的审计框架

Auditing standards审计标准

-Hong Kong Standards on Auditing(HKSAs). -香港审计准则(HKSA)。

-Effectively same as International Standards on Auditing. -实际上与国际审计标准相同。

-Audits MUST be carried out in accordance with auditing standards. - 必须按照审计标准进行审计。

Assurance engagements other than audit or review 审计或审查以外的鉴证业务

-Types of assurance engagement can include: -鉴证业务的类型可以包括:

-A statement about the effectiveness of internal control resulting from an evaluation of the effectiveness of an entity's internal control process. -通过评估实体内部控制流程的有效性而产生的关于内部控制有效性的声明。

-Reporting on a company's performance measures by applying relevant measurement methodologies. - 通过应用相关衡量方法报告公司的绩效衡量标准。

-Reporting on a greenhouse gas emissions statement measuring the company's greenhouse emissions by applying recognition,measurement and presentation protocols. -报告温室气体排放报表,通过应用识别、测量和列报协议来衡量公司的温室气体排放量。

-A statement about a company's compliance results from evaluating the compliance of an entity with a specific law and regulation. -关于公司合规性的声明是通过评估实体对特定法律法规的遵守情况而产生的。

-These are not audit engagements and have their own reporting standards(Hong Kong Standards on Assurance Engagements or HKSAEs) -这些不是审计业务,并有自己的报告标准(香港鉴证业务准则或 HKSAE)

Auditing and Assurance standards 审计和鉴证标准

-Available at HKICPA Members'Handbook:Volume III Auditing and Assurance Standards -可参阅香港会计师公会会员手册:第三卷审计及鉴证准则

Content page of Volume III Auditing and Assurance Standards 第三卷审计和鉴证标准的内容页面

Financial reporting frameworks 财务报告框架

-"Full"Hong Kong Financial Reporting Standards(HKFRS) -“完整”香港财务报告准则(HKFRS)

-HKFRS for Private Entities(HKFRS for PE) -香港私人实体财务报告准则(HKFRS for PE)

-Small and Medium-sized Entity Financial Reporting Framework and Financial Reporting Standard(SME-FRF \&FRS) -中小型实体财务报告框架和财务报告准则(SME-FRF \&FRS)

Financial reporting frameworks 财务报告框架

-All Hong Kong incorporated companies may choose to prepare their financial statements in accordance with HKFRS. -所有在香港注册成立的公司都可以选择根据香港财务报告准则编制财务报表。

-Companies wishing to apply HKFRS for PE and SME-FRF \& FRS should fulfil certain criteria. -希望将香港财务报告准则应用于常设机构和中小企业-财务报告准则的公司应满足某些标准。

Financial reporting frameworks 财务报告框架

The following companies can never apply HKFRS for PE 以下公司永远不能申请香港财务报告准则进行私募股权

-Debt or equity instruments are traded in a public market(i.e.listed entities) -债务或股权工具在公开市场交易(即上市实体)

-In the process of IPO/listing -IPO/上市过程中

-Holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses(most banks,credit unions,insurance companies,securities brokers/dealers, mutual funds and investment banks would meet this criterion). -以受托身份为广大外部人士持有资产,作为其主要业务之一(大多数银行、信用合作社、保险公司、证券经纪人/交易商、共同基金和投资银行都符合此标准)。

The following companies can never apply SME-FRF \&FRS 以下公司永远不能申请 SME-FRF \&FRS

-Listed company-上市公司

-Banking company-银行公司

-Company making loans at interest as a business -将有息贷款的公司作为业务

-Insurance business-保险业务

-Company carrying on any regulated activity under Part V of the Securities and Futures Ordinance(Cap.571) -根据《证券及期货条例》(第 571 章)第 V 部进行任何受规管活动的公司

Financial Reporting Options in Hong Kong 香港的财务报告选项

Full HKFRS完整的香港财务报告准则

Must be applied by publicly listed entities;can be applied by all types of companies 必须由上市公司申请;所有类型的公司都可以申请

Based on IASB's IFRS Comprises 基于国际会计准则理事会的国际财务报告准则,包括

-Hong Kong Financial Reporting Standards; -香港财务报告准则;

-Hong Kong Accounting Standards;and -香港会计准则;及

-Interpretations-解释

A fair presentation framework 公平的演示框架

HKFRS for PE香港财务报告准则

May be applied by entities which: 可由以下实体申请:

-Have no public accountability -没有公共责任

-Prepare general purpose financial statements -编制通用财务报表

Not applicable to specified entities 不适用于指定实体

A self-contained standard 独立的标准

Based on the IASB's IFRS for SMEs 基于国际会计准则理事会的《中小企业国际财务报告准则》

A fair presentation framework 公平的演示框架

SME-FRF \&FRS中小企业-FRF \&FRS

May be applied by private entities which meet the set criteria in section 359 of Companies Ordinance(Cap.622) 符合《公司条例》(第622章)第359条所订定准则的私人实体可申请

Not applicable to specified entities 不适用于指定实体

A self-contained standard Developed by HKICPA 由香港会计师公会制定的独立标准

Acknowledges that to achieve fair presentation of the financial statements,it may be necessary for management to provide disclosures beyond those required by the framework,or to depart . from a requirement of the framework.

A fair presentation framework

Acknowledges that to achieve fair presentation of the financial statements,it may be necessary for management to provide disclosures beyond those required by the framework,or to depart . from a requirement of the framework.| A fair presentation framework |

| :--- |

| Acknowledges that to achieve fair presentation of the financial statements,it may be necessary for management to provide disclosures beyond those required by the framework,or to depart . from a requirement of the framework. |

合规框架不包含“完整的香港财务报告准则”和“香港财务报告准则(常设机构)”中的确认

A compliance framework

Does not contain the acknowledgement in the"Full HKFRS"and "HKFRS for PE"

A compliance framework

Does not contain the acknowledgement in the"Full HKFRS"and "HKFRS for PE"| A compliance framework |

| :--- |

| Does not contain the acknowledgement in the"Full HKFRS"and "HKFRS for PE" |

Full HKFRS SME-FRF \&FRS

Financial reporting framework "A fair presentation framework

Acknowledges that to achieve fair presentation of the financial statements,it may be necessary for management to provide disclosures beyond those required by the framework,or to depart . from a requirement of the framework." "A compliance framework

Does not contain the acknowledgement in the"Full HKFRS"and "HKFRS for PE""| | Full HKFRS | SME-FRF \&FRS |

| :--- | :--- | :--- |

| Financial reporting framework | A fair presentation framework <br> Acknowledges that to achieve fair presentation of the financial statements,it may be necessary for management to provide disclosures beyond those required by the framework,or to depart . from a requirement of the framework. | A compliance framework <br> Does not contain the acknowledgement in the"Full HKFRS"and "HKFRS for PE" |

The auditor's opinion states that the financial statements give a true and fair view of the matters that the financial statements are designed to present. 审计师的意见指出,财务报表真实、公正地展示了财务报表旨在呈现的事项。

The auditor expresses an opinion as to whether the financial statements are prepared,in all material respects,in accordance with the revised SME-FRS(i.e. not a"true and fair view"opinion"). 核数师就财务报表在所有重大方面是否按照经修订的中小企业财务报告准则编制发表意见(即不是“真实和公平的观点”意见“)。

Full HKFRS SME-FRF \&FRS

Financial reporting framework The auditor's opinion states that the financial statements give a true and fair view of the matters that the financial statements are designed to present. The auditor expresses an opinion as to whether the financial statements are prepared,in all material respects,in accordance with the revised SME-FRS(i.e. not a"true and fair view"opinion").

HLB國衛倉計師事務所有限公司HODGSON IMPEY CHENG LIMITED | | Full HKFRS | SME-FRF \&FRS |

| :--- | :--- | :--- |

| Financial reporting framework | The auditor's opinion states that the financial statements give a true and fair view of the matters that the financial statements are designed to present. | The auditor expresses an opinion as to whether the financial statements are prepared,in all material respects,in accordance with the revised SME-FRS(i.e. not a"true and fair view"opinion"). |

| HLB國衛倉計師事務所有限公司HODGSON IMPEY CHENG LIMITED | | |

Illustrative auditor's opinion 说明性审计师意见

-Available at Technical reference page -可在技术参考页面获得

General A\&A Report Templates 常规 A\&A 报告模板

Links to:链接到:

-Technical Reference Page -技术参考页面

General A\&A Report Templates 常规 A\&A 报告模板

(current page).(当前页面)。

General A\&A Standard通用 A\&A 标准

Document Templates文档模板

-RFI Engagements Report and Letter Templates -RFI 参与报告和信函模板

RFI Engagements Standard Document Templates RFI Engagements 标准文档模板

Report reference报告参考

Description描述

View/ Download查看/下载

Audit Renarts-Standard审核 Renarts-Standard

W ^("W "){ }^{\text {W }}

RT10.1RT10.1

在香港注册成立的私人公司 - 不需要 KAM

Private company incorporated in Hong Kong

-KAM not required

Private company incorporated in Hong Kong

-KAM not required| Private company incorporated in Hong Kong |

| :--- |

| -KAM not required |

RT10.2RT10.2 系列

在香港注册成立的私人公司 - 合并财务报表 - 不需要 KAM

Private company incorporated in Hong Kong

-Consolidated financial statements

-KAM not required

Private company incorporated in Hong Kong

-Consolidated financial statements

-KAM not required| Private company incorporated in Hong Kong |

| :--- |

| -Consolidated financial statements |

| -KAM not required |

w

RT10.3RT10.3 系列

在香港交易所上市的外国公司 -合并财务报表 -KAM 通讯

Foreign company listed in the HKEx

-Consolidated financial statements

-KAM communicated

Foreign company listed in the HKEx

-Consolidated financial statements

-KAM communicated| Foreign company listed in the HKEx |

| :--- |

| -Consolidated financial statements |

| -KAM communicated |

RT10.4RT10.4

在香港注册成立的私人公司 -SME-FRS -PN 900 (2016 年修订) -不需要 KAM

Private company incorporated in Hong Kong

-SME-FRS

-PN 900 (Revised 2016)

-KAM not required

Private company incorporated in Hong Kong

-SME-FRS

-PN 900 (Revised 2016)

-KAM not required| Private company incorporated in Hong Kong |

| :--- |

| -SME-FRS |

| -PN 900 (Revised 2016) |

| -KAM not required |

RT10.5RT10.5

在香港注册成立的私人公司 -HKFRS-PE -综合财务报表 -不需要 KAM

Private company incorporated in Hong Kong

-HKFRS-PE

-Consolidated financial statements

-KAM not required

Private company incorporated in Hong Kong

-HKFRS-PE

-Consolidated financial statements

-KAM not required| Private company incorporated in Hong Kong |

| :--- |

| -HKFRS-PE |

| -Consolidated financial statements |

| -KAM not required |

w

Report reference Description View/ Download

Audit Renarts-Standard W ^("W ")

RT10.1 "Private company incorporated in Hong Kong

-KAM not required" https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-17.jpg?height=34&width=37&top_left_y=833&top_left_x=1793

RT10.2 "Private company incorporated in Hong Kong

-Consolidated financial statements

-KAM not required" w

RT10.3 "Foreign company listed in the HKEx

-Consolidated financial statements

-KAM communicated" https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-17.jpg?height=31&width=37&top_left_y=963&top_left_x=1793

RT10.4 "Private company incorporated in Hong Kong

-SME-FRS

-PN 900 (Revised 2016)

-KAM not required" https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-17.jpg?height=33&width=38&top_left_y=1042&top_left_x=1795

RT10.5 "Private company incorporated in Hong Kong

-HKFRS-PE

-Consolidated financial statements

-KAM not required" w| Report reference | Description | View/ Download |

| :--- | :--- | :--- |

| | Audit Renarts-Standard | W ${ }^{\text {W }}$ |

| RT10.1 | Private company incorporated in Hong Kong <br> -KAM not required |  |

| RT10.2 | Private company incorporated in Hong Kong <br> -Consolidated financial statements <br> -KAM not required | w |

| RT10.3 | Foreign company listed in the HKEx <br> -Consolidated financial statements <br> -KAM communicated |  |

| RT10.4 | Private company incorporated in Hong Kong <br> -SME-FRS <br> -PN 900 (Revised 2016) <br> -KAM not required |  |

| RT10.5 | Private company incorporated in Hong Kong <br> -HKFRS-PE <br> -Consolidated financial statements <br> -KAM not required | w |

Full HKFRS完整的香港财务报告准则

HKFRS for Private Entities 私人实体的香港财务报告准则

INDEPENDENT AUDITORS'REPORT 独立核数师报告

To the Members of ABC Company 致 ABC 公司成员

(Incorporated in Hong Kong with limited liability) (在香港注册成立的有限公司)

Opinion意见

We have audited the consolidated financial statements of ABC Company and its subsidiaries(the"Group")set out on pages[•] to[•],which comprise the consolidated statement of financial position as at 31 December 20X2,and the[consolidated income statement and the]consolidated statement of comprehensive income,the consolidated statement of changes in equity,and the consolidated statement of cash flows for the year then ended,and notes to the consolidated financial statements,including material accounting policy information and other explanatory information. 我们已审计了 ABC 公司及其附属公司(“集团”)的合并财务报表,载于[•]至[•]页,包括截至 20X2 年 12 月 31 日的合并财务状况表、[合并损益表]和综合综合收益表、合并权益变动表和截至该年度的合并现金流量表,以及合并财务报表的附注,包括重大内容会计政策信息和其他解释性信息。

In our opinion,the consolidated financial statements give a true and fair view of the consolid ated financial position of the Group as at 31 December 20X2,and of its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with Hong Kong Financial Reporting Standard for Private Entities("HKFRS for Private Entities")issued by the Hong Kong Institute of Certified Public Accountants("HKICPA")and have been properly prepared in compliance with the Companies Ordinance. 我们认为,综合财务报表根据香港会计师公会(HKICPA)发出的《香港私人实体财务报告准则》(「香港私人实体财务报告准则」),真实及公允地反映本集团于 20X2 年 12 月 31 日的综合财务状况,以及截至该年度截至该年度的综合财务表现及综合现金流量,并已根据《香港会计师公会》(HKICPA)的规定妥善编制。《公司条例》。

Basis for opinion意见依据

We conducted our audit in accordance with Hong Kong Standards on Auditing("HKSAs")issued by the HKICPA.Our responsibilities under those standards are further described in the Auditors'responsibilities for the audit of the consolidated financial statements section of our report.We are independent of the Group in accord ance with the HKICPA's Code of Ethics for Professional Accountants(the"Code"),and we have fulfilled our other ethical responsibilities in accordance with the Code.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. 我们根据香港会计师公会颁布的《香港审计准则》(「香港会计准则」)进行审计,我们在该等准则下的责任详见我们报告的核数师对综合财务报表的审计责任部分。我们根据香港会计师公会的《专业会计师道德守则》(「守则」)独立于本集团,并且我们已根据该守则履行了我们的其他道德责任。我们获得的审计证据充分且适当,可以为我们的意见提供依据。

SME-FRS中小企业-FRS

INDEPENDENT AUDITORS'REPORT 独立核数师报告

To the Members of SME Company 致中小企业成员

(Incorporated in Hong Kong with limited liability) (在香港注册成立的有限公司)

Opinion意见

We have audited the financial statements of SME Company(the"Company")set out on pages[•]to[•],which comprise the statement of financial position as at 31 December 20X1,and the income statement[and cash flow statement]for the year then ended,and notes to the financial statements,including material accounting policy information and other explan atory information. 我们已审计中小企业公司(「本公司」)的财务报表,包括截至 20X1 年 12 月 31 日的财务状况表、截至该年度的损益表[及现金流量表],以及财务报表附注,包括重大会计政策资料及其他解释性资料。

In our opinion,the financial statements of the Company are prepared,in all material respects,in accord ance with the Hong Kong Small and Medium-Sized Entity Financial Reporting Standard("SME-FRS")issued by the Hong Kong Institute of Certified Public Accountants("HKICPA")and have been property prepared in compliance with the Companies Ordinance. 我们认为,本公司的财务报表在所有重大方面均按照香港会计师公会(「香港会计师公会」)发出的香港中小型实体财务报告准则(「中小企财务报告准则」)编制,并已按照《公司条例》编制。

Basis for opinion意见依据

We conducted our audit in accordance with Hong Kong Standards on Auditing("HKSAs")and with reference to Practice Note 900 (Revised)"Audit of Financial Statements Prepared in Accordance with the Small and Medium-Sized Entity Financial Reporting Standard'issued by the HKICPA.Our responsibilities under those standards are further described in the Auditors responsibilities for the audit of the financial statements section of our report.We are independent of the Company in accord ance with the HKICPA's Code of Ethics for Professional Accountants(the"Code"),and we have fulfilled our other ethical responsibilities in accord ance with the Code.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. 我们根据香港审计准则(「香港会计准则」)及香港会计师公会发出的第900号应用指引(经修订)「根据中小型实体财务报告准则编制财务报表的审计」进行审计。我们根据该等准则承担的责任详见我们报告的审计师审计财务报表的责任部分。根据香港会计师公会的《专业会计师道德守则》(“守则”),我们已根据该守则履行了其他道德责任。我们相信我们所获得的审计证据是充分和适当的,可以为我们的意见提供依据。

Hong Kong Financial Reporting Standards 香港财务报告准则

-Available at HKICPA Members'Handbook:Volume II Financial Reporting Standards -可参阅香港会计师公会会员手册:第二卷财务报告准则

Content page of Volume II Financial Reporting Standards 第二卷财务报告准则的内容页面

HONG KONG ACCOUNTING STANDARDS(HKAS) 香港会计准则

HKAS 1香港认可处 1

Presentation of Financial Statements. 财务报表的列报。

HKAS 2香港认可处 2

Inventories库存

HKAS 7香港认可处 7

Statement of Cash Flows 现金流量表

HKAS 8香港会计师事务所 8

Accounting Policies,Changes in Accounting Estimates and Errors 会计政策,会计估计的变化和错误

HKAS 10香港认可准则第10号

Events after the Reporting Period 报告期后发生的事件

HKAS 12香港认可处 12

Income Taxes所得税

Risk assessment风险评估

Notes:笔记:

1.Refer to ISA 230 for a more complete list of documentation required. 1.请参阅 ISA 230 以获取更完整的所需文件列表。

2.Planning(ISA 300)is a continual and iterative process throughout the audit. 2.规划(ISA 300)是整个审计过程中持续迭代的过程。

3.RMM=Risks of material misstatement. 3.RMM=重大错报风险。

Risk response风险应对

Reporting报告

Notes:笔记:

1.Refer to ISA 230 for a more complete list of required documentation. 1.请参阅 ISA 230 以获取更完整的所需文件列表。

2.Planning(ISA 300)is a continual and iterative process throughout the audit. 2.规划(ISA 300)是整个审计过程中持续迭代的过程。

Audit risk model审计风险模型

Audit risk审计风险

The risk that the auditor expresses an inappropriate audit opinion when the financial are materially misstated.Audit risk is a function of the risks of material statements misstatement and detection risk. 审计师在财务信息严重错报时表达不适当的审计意见的风险。审计风险是重大陈述、错报和检测风险的函数。

(Paragraph A35 of HKSA 200,Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Hong Kong Standards on Auditing) (《香港会计准则第 200 号》第 A35 段《独立核数师的总体目标及根据香港审计准则进行审计)

The risk of giving an inappropriate opinion: 给出不当意见的风险:

-An audit report being qualified when it should not have been;or -审计报告在不应该被鉴定的情况下被鉴定;或

-An unqualified audit opinion being issued when a qualification was appropriate -在资格适当时出具无保留意见

When planning and undertaking an audit assignment,the auditor needs to be aware of this issue and undertake sufficient audit work to reduce this risk to an acceptably ow level,although it can never be eliminated entirely. 在规划和承担审计任务时,审计师需要意识到这个问题并进行足够的审计工作,以将这种风险降低到可接受的水平,尽管它永远无法完全消除。

Risk of material misstatement ("RMM") 重大错报风险

The risk that the financial statements of an entity contain material misstatements due to error or fraud that may not be detected or prevented by the entity’s internal control system. 实体的财务报表包含由于错误或欺诈而导致的重大错报的风险,而该实体的内部控制系统可能无法检测或防止这些错误陈述。

The RMM may exist at two levels: RMM 可能存在于两个级别:

The overall financial statement level; and 财务报表总体层面;和

The assertion level for classes of transactions, account balances, and disclosures. 交易类别、账户余额和披露的断言级别。

For RMM at the assertion level, it consists of two components: inherent risk and control risk. 对于断言级别的 RMM,它由两个部分组成:固有风险和控制风险。

Perform risk assessment procedures 执行风险评估程序

Inherent risk固有风险

-The susceptibility of an account balance or class of transactions to material misstatement,either individually or when aggregated with misstatements in other balances or classes,irrespective of related internal controls. -账户余额或交易类别对重大错报的敏感性,无论是单独的还是与其他余额或类别的错报合并时,无论相关的内部控制如何。

-Inherent risk needs to be considered at two levels: -固有风险需要从两个层面考虑:

-At the level of the engagement itself(the higher the risk of the engagement,the lower the audit risk the auditor should be willing to accept);and -在聘用本身的层面(聘用的风险越高,核数师应愿意接受的审计风险越低);及

-At the level of a particular balance,or class of transactions. -在特定余额或交易类别的级别。

Control risk控制风险

-The risk that a misstatement that could occur in an assertion about a class of transaction,account balance or disclosure and that could be material,either individually or when aggregated with other misstatements,will not be prevented,or detected and corrected,on a timely basis by the entity's controls. -在关于某类交易、账户余额或披露的断言中可能发生的错误陈述,并且可能是重大的,无论是单独的还是与其他的错误陈述合并时,都无法被实体控制及时预防或检测和纠正的风险。

Detection risk检测风险

-The risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material,either individually or when aggregated with other misstatements. -审计师为将审计风险降低到可接受的低水平而执行的程序不会发现存在的错误陈述,并且可能是重大的,无论是单独还是与其他错误陈述合并时。

Identifying risks识别风险

Financial Risks that relate pervasively to the financial statements as a statement whole,and potentially affect many assertions. level risks 财务风险 与整个报表普遍相关的财务风险,并可能影响许多断言。级别风险

Risks of this nature are not necessarily risks identifiable with specific assertions at the class of transactions,account balance or disclosure level(e.g .,risk of management override of controls). 这种性质的风险不一定是交易类别、账户余额或披露层面的特定断言(例如,管理层控制权凌驾的风险)可识别的风险。

Rather,they represent circumstances that may pervasively increase the risks of material misstatement at the assertion level. 相反,它们代表的情况可能普遍增加断言层面重大错报的风险。

Assertion level Risks of material misstatements that do not relate pervasively risks to the financial statements are risks of material misstatement at the assertion level. 断言层面与财务报表无关的重大错报风险是断言层面的重大错报风险。

Examples:completeness of payables,valuation of trade receivables,etc. 例如:应付账款的完整性、应收账款的估值等。

Identification of inherent risks 识别固有风险

Identification of risks involves 风险识别涉及

-Performing risk assessment procedures to understand the entity and identify possible sources(causes)of business risk and fraud risk,especially performing the specific risk assessment procedures on fraud,significant accounting estimates,related parties and on going concern; - 执行风险评估程序,了解实体并确定业务风险和欺诈风险的可能来源(原因),特别是对欺诈、重大会计估计、关联方和持续经营执行具体风险评估程序;

-Documenting the risks identified.A common form of documentation is to list and assess all risks are listed in one place;and -记录已识别的风险。一种常见的文档形式是列出和评估所有风险,并列在一个地方;以及

-For each risk source that is identified,consider what sort of misstatements(error and fraud)could occur(the'effect'of each risk)in the financial statements as a result. -对于确定的每个风险源,考虑财务报表中可能出现什么样的错报(错误和欺诈)(每种风险的“影响”)。

Identification of inherent risks 识别固有风险

-Significant risks require special audit consideration by the auditor,including obtaining an understanding of the entity's related controls relevant to such risks. -重大风险需要审计师进行特别审计考虑,包括了解实体与此类风险相关的相关控制措施。

-As a guide,risk factors with a combined risk assessment score of 20 or more should be considered as"significant"risks -作为指导,综合风险评估评分为20分或以上的风险因素应被视为“显着”风险

Likelihood to occur on a scale 1-5 发生的可能性为 1-5 级

Impact in relation to materiality on a scale 1-5 与重要性相关的影响(按1-5级计算)

1=1= Remote 1=1= 远程

1=1= Immaterial 1=1= 非物质的

2=2= Unlikely 2=2= 不可能

2=2= Minor 2=2= 次要

3=3= Likely 3=3= 可能

3=3= Moderate 3=3= 温和

4=4= Most likely 4=4= 最有可能的

4=4= Major 4=4= 主要

5=5= Almost certain 5=5= 几乎可以肯定

5=5= Material 5=5= 材料

Likelihood to occur on a scale 1-5 Impact in relation to materiality on a scale 1-5

1= Remote 1= Immaterial

2= Unlikely 2= Minor

3= Likely 3= Moderate

4= Most likely 4= Major

5= Almost certain 5= Material| Likelihood to occur on a scale 1-5 | Impact in relation to materiality on a scale 1-5 |

| :--- | :--- |

| $1=$ Remote | $1=$ Immaterial |

| $2=$ Unlikely | $2=$ Minor |

| $3=$ Likely | $3=$ Moderate |

| $4=$ Most likely | $4=$ Major |

| $5=$ Almost certain | $5=$ Material |

Presumed fraud risk-Fraud risk in revenue recognition 假定欺诈风险-收入确认中的欺诈风险

Y

Revenue收入

N

C,E,A,U

5

5

25

Y

Complexity:复杂性:

H

x

The major souvce of revenue recognition is the point in time which is straightforward.Revenue is recognised under HFKRS 15, which has already been adopted since 2018,the reporting framework on revenue has no further updates cluring the year.The risk related to subjectivity is low. 收入确认的主要来源是时间点,这是直截了当的。收入根据 HFKRS 15 确认,该标准自 2018 年以来已采用,收入报告框架没有进一步更新。与主观性相关的风险较低。

Susceptibility to misstatement clue to management bias or other fraud risk factors insofar as they affect inherent risk: The nature is complex and risk may be high due to insufficient gridelines for discount arrangements,say authorization and record.The revenue recognition often results from an overstatement of revenues through,for example,premature revenue recognition or recording fictitious revenues.Besides,it may result also from an understatement of revenues through,for example,improperly shifting revenues to a later period 易受错报线索影响内在风险的管理偏见或其他欺诈风险因素的影响:性质复杂,由于折扣安排(例如授权和记录)的网格线不足,风险可能很高。收入确认通常是由于过早确认收入或记录虚构收入等方式多报收入造成的。此外,也可能是由于不当地少报收入造成的将收入转移到后期

变化:收入确认政策与去年相比无重大变化。

Change:

No material change in revenue recognition policies compared to last year.

Change:

No material change in revenue recognition policies compared to last year.| Change: |

| :--- |

| No material change in revenue recognition policies compared to last year. |

不确定性:假设它们可以被验证,则几乎没有不确定性。

Uncertaintr:

There is little uncertainty assuming they can be verified.

Uncertaintr:

There is little uncertainty assuming they can be verified.| Uncertaintr: |

| :--- |

| There is little uncertainty assuming they can be verified. |

发生的可能性:请注意,在收入统计中发生欺诈的可能性被假定为很高。因此,选择了 5 分。

Likeliood to occur:

Note that the likelihood to occur a fraud in revenue recongition is presumed to be high.Thus, 5 points are selected.

Likeliood to occur:

Note that the likelihood to occur a fraud in revenue recongition is presumed to be high.Thus, 5 points are selected.| Likeliood to occur: |

| :--- |

| Note that the likelihood to occur a fraud in revenue recongition is presumed to be high.Thus, 5 points are selected. |

Identified risks Inherent risk Control risk Planned audit approach (select approach(es)with an"N"

SCOT \# Inherent risks idertified Is this a risk of fraud; Class of transactions, account balance and disclosure Is this an accounting estimate? Assertions "Likeli- hood to occur

(A)" Impact Com-bined accore "Signi- ficant risk:

(Y/N)" Rationale for the inherent risk assessments or other comments (H/M/L) Test of controls Substantive

(Y/N) (Y/N) C.E.A.U,O,P (B) (A)xx(B) -Anabatical Test of actails

SCOTL Presumed fraud risk-Fraud risk in revenue recognition Y Revenue N C,E,A,U 5 5 25 Y Complexity: H x

The major souvce of revenue recognition is the point in time which is straightforward.Revenue is recognised under HFKRS 15, which has already been adopted since 2018,the reporting framework on revenue has no further updates cluring the year.The risk related to subjectivity is low.

Susceptibility to misstatement clue to management bias or other fraud risk factors insofar as they affect inherent risk: The nature is complex and risk may be high due to insufficient gridelines for discount arrangements,say authorization and record.The revenue recognition often results from an overstatement of revenues through,for example,premature revenue recognition or recording fictitious revenues.Besides,it may result also from an understatement of revenues through,for example,improperly shifting revenues to a later period

"Change:

No material change in revenue recognition policies compared to last year."

"Uncertaintr:

There is little uncertainty assuming they can be verified."

"Likeliood to occur:

Note that the likelihood to occur a fraud in revenue recongition is presumed to be high.Thus, 5 points are selected."

| Identified risks | | | | | | Inherent risk | | | | | Control risk | Planned audit approach (select approach(es)with an"N" | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| SCOT \# | Inherent risks idertified | Is this a risk of fraud; | Class of transactions, account balance and disclosure | Is this an accounting estimate? | Assertions | Likeli- hood to occur <br> (A) | Impact | Com-bined accore | Signi- ficant risk: <br> (Y/N) | Rationale for the inherent risk assessments or other comments | (H/M/L) | Test of controls | Substantive | |

| | | (Y/N) | | (Y/N) | C.E.A.U,O,P | | (B) | (A)$\times(\mathrm{B})$ | | | | | -Anabatical | Test of actails |

| SCOTL | Presumed fraud risk-Fraud risk in revenue recognition | Y | Revenue | N | C,E,A,U | 5 | 5 | 25 | Y | Complexity: | H | | | x |

| | | | | | | | | | | The major souvce of revenue recognition is the point in time which is straightforward.Revenue is recognised under HFKRS 15, which has already been adopted since 2018,the reporting framework on revenue has no further updates cluring the year.The risk related to subjectivity is low. | | | | |

| | | | | | | | | | | Susceptibility to misstatement clue to management bias or other fraud risk factors insofar as they affect inherent risk: The nature is complex and risk may be high due to insufficient gridelines for discount arrangements,say authorization and record.The revenue recognition often results from an overstatement of revenues through,for example,premature revenue recognition or recording fictitious revenues.Besides,it may result also from an understatement of revenues through,for example,improperly shifting revenues to a later period | | | | |

| | | | | | | | | | | Change: <br> No material change in revenue recognition policies compared to last year. | | | | |

| | | | | | | | | | | Uncertaintr: <br> There is little uncertainty assuming they can be verified. | | | | |

| | | | | | | | | | | Likeliood to occur: <br> Note that the likelihood to occur a fraud in revenue recongition is presumed to be high.Thus, 5 points are selected. | | | | |

| | | | | | | | | | | | | | | |

Knowledge of client's business 了解客户业务

HKAS 315 (Revised 2019)

-HKSA 315 (Revised 2019)sets out two areas that are fundamental to the audit planning process. -HKSA 315(2019 年修订)规定了审计规划过程的两个基础领域。

-The first is the information you need to demonstrate that you have understood the entity and its environment and the applicable financial reporting framework - 第一个是您需要证明您了解实体及其环境以及适用的财务报告框架的信息

-The second is your assessment of the risk of a material misstatement arising -第二个是您对产生重大错报的风险的评估

Practice Aid-Audit Planning

Refer to Practice Aid-Audit Planning(PA-PLA)for examples of the matters that we may consider in understanding the entity: 请参阅实践援助审计计划 (PA-PLA),了解我们在了解实体时可能考虑的事项示例:

-Understanding the Entity's Business Model -了解实体的商业模式

-Activities of the entity -实体的活动

-The entity's objectives and strategies and related business risks -实体的目标和战略以及相关业务风险

-Industry,Regulatory and Other External Factors -行业、监管和其他外部因素

-Industry factors

-Regulatory factors

-Other external factors

-Potential instances of non-compliance with laws and regulations -不遵守法律法规的潜在情况

-Measures Used to Assess the Entity's Financial Performance -用于评估实体财务业绩的指标

-Key indicators

-Publicly available information -公开信息

-Understanding the Applicable Financial Reporting Framework and the Entity's Accounting Policies - 了解适用的财务报告框架和实体的会计政策

-The entity's financial reporting practices -实体的财务报告惯例

-Going concern-持续经营

Practice Aid-Audit Planning

Schedule 5 Audit Planning

Document our understanding of the entity in Section D Contents 在 D 部分内容中记录我们对实体的理解

A.PRELIMINARY ENGAGEMENT ACTIVITIES AND GENERAL PLANNING PROCEDURES A.初步参与活动和总体规划程序

B.ASSIGNMENT OF ROLESB.角色分配

C.ENGAGEMENT TIMETABLEC.参与时间表

D.UNDERSTANDING THE ENTITY D.了解实体

1.Structure,ownership and governance of the entity 1.实体的结构、所有权和治理

2.Business model

3.Industry,regulatory and other external factors 3.行业、监管等外部因素

4.Measures used to assess the entity's financial performance 4.用于评估实体财务绩效的指标

5.The applicable financial reporting framework and the entity's accounting policies 5.适用的财务报告框架和实体的会计政策

6.The consolidation process 6.合并过程

E.IDEN1IFICD KSNS,KSNS OF MLA IEKINL MISS IAIEMEN I AVD PLANENED RESPUNSES E. IDEN1IFICD KSNS,KSNS OF MLA IEKINL MISS IAIEMEN I AVD PLANENED RESPUNSES

1.Risks at the financial statement level 1.财务报表层面的风险

2.Risks at the assertion level 2.断言层面的风险

3.Fraud risk in revenue recognition 3.收入确认中的欺诈风险

4.Management override of controls 4.管理控制的覆盖

Knowledge of the client's 了解客户的

business can include:业务可以包括:

External factors外部因素

-行业性质 -监管环境 -财务报告框架

-Nature of industry

-Regulatory environment

-Financial reporting framework

-Nature of industry

-Regulatory environment

-Financial reporting framework| -Nature of industry |

| :--- |

| -Regulatory environment |

| -Financial reporting framework |

Nature of the entity 实体的性质

-运营和关键人员 -所有权和治理 -投资、结构和融资

-Operations and key personnel

-Ownership and governance

-Investment,structure and financing

-Operations and key personnel

-Ownership and governance

-Investment,structure and financing| -Operations and key personnel |

| :--- |

| -Ownership and governance |

| -Investment,structure and financing |

Accounting policies会计政策

-选择和应用 -变更原因 -对实体的适当性

-Selection and application

-Reason for changes

-Appropriateness to entity

-Selection and application

-Reason for changes

-Appropriateness to entity| -Selection and application |

| :--- |

| -Reason for changes |

| -Appropriateness to entity |

Entity objective and strategies 实体目标和战略

-业务计划和战略-财务影响和承担的风险

-Business plans and strategies

-Financial implication and risks undertaken

-Business plans and strategies

-Financial implication and risks undertaken| -Business plans and strategies |

| :--- |

| -Financial implication and risks undertaken |

Measurement/ review of financial performance 衡量/审查财务业绩

-衡量什么-谁审查财务业绩

-What is measured

-Who reviews financial results

-What is measured

-Who reviews financial results| -What is measured |

| :--- |

| -Who reviews financial results |

External factors "-Nature of industry

-Regulatory environment

-Financial reporting framework"

Nature of the entity "-Operations and key personnel

-Ownership and governance

-Investment,structure and financing"

Accounting policies "-Selection and application

-Reason for changes

-Appropriateness to entity"

Entity objective and strategies "-Business plans and strategies

-Financial implication and risks undertaken"

Measurement/ review of financial performance "-What is measured

-Who reviews financial results"| External factors | -Nature of industry <br> -Regulatory environment <br> -Financial reporting framework |

| :--- | :--- |

| Nature of the entity | -Operations and key personnel <br> -Ownership and governance <br> -Investment,structure and financing |

| Accounting policies | -Selection and application <br> -Reason for changes <br> -Appropriateness to entity |

| Entity objective and strategies | -Business plans and strategies <br> -Financial implication and risks undertaken |

| Measurement/ review of financial performance | -What is measured <br> -Who reviews financial results |

Industry factors行业因素

-What does the clients do? -客户是做什么的?

-How will this affect the financial statements: -这将如何影响财务报表:

>Food retail>食品零售

House builder房屋建筑商

Think about groups/large companies which involve in many industries 想想涉及许多行业的团体/大公司

Industry factors行业因素

Other factors其他因素

-The economy-经济

-Global-全球

-Local-当地

-Political and regulatory situation -政治和监管形势

-Products-产品

-What does the company sell/produces? -公司销售/生产什么?

-Is it established,outdated,cutting edge? -它是成熟的、过时的、前沿的吗?

Measurement/review of financial performance 财务执行情况的衡量/审查

-Have generally accepted accounting principles been complied with in the past years? -过去几年是否遵守了公认会计原则?

-Are the accounting policies for significant matters appropriate to the circumstances of the entity? -重大事项的会计政策是否适合实体的情况?

-Could the treatment of any areas in the accounts be disputed by the tax authorities? -税务机关是否会对账目中任何区域的处理提出异议?

-Consideration the degree of estimation uncertainty associated with accounting estimates? -考虑与会计估计相关的估计不确定性程度?

(HLB)

Controls and walkthrough testings 控制和演练测试

Understanding internal controls 了解内部控制

3.RMM=Risks of material misstatement. 3.RMM=重大错报风险。

Two levels of risk assessment 两个级别的风险评估

-Assess the risk of material misstatements at -评估重大错报的风险

-The financial statement level -财务报表层面

-The assertion level for class of transactions, account balances,and disclosures -交易类别、账户余额和披露的断言级别

Assessment of Risks at the Two Required Levels 在两个所需级别评估风险

Interrelationship between risk and control 风险与控制之间的相互关系

Entity's Objective实体目标

-The inherent risk bar contains all the business and fraud risk factors that could result in the financial statements being materially misstated(before any consideration of internal control). -固有风险栏包含可能导致财务报表严重错报的所有业务和欺诈风险因素(在考虑任何内部控制之前)。

-The control risk bars reflect the pervasive and transactional control procedures put into effect by management to mitigate the risk that the financial statements are misstated. -控制风险条反映了管理层为降低财务报表错报风险而实施的普遍和交易控制程序。

-The extent to which the control risk bars do not completely mitigate the inherent risks is often called management's residual risk,risk appetite or risk tolerance. -控制风险条不能完全减轻固有风险的程度通常称为管理层的残余风险、风险偏好或风险承受能力。

Note:The length of the bars in the exhibit would vary based on the particular circumstances and risk profile of the entity,and the nature of the auditor's response. 注:附件中条形图的长度会根据实体的具体情况和风险状况以及审计师回应的性质而有所不同。

-This chart outlines the auditor's role in assessing the risks of material misstatement in the financial statements and then performing responsive audit procedures designed to reduce the audit risk to an appropriately low level. -该图表概述了审计师在评估财务报表中重大错报风险,然后执行旨在将审计风险降低到适当低水平的响应性审计程序方面的作用。

Audit report审计报告

The audit report includes the auditor's responsibilities to "obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control" 审计报告包括审计师的职责,即“了解与审计相关的内部控制,以便设计适合情况的审计程序,但不是为了对实体内部控制的有效性发表意见”

Paragraph 39(b)(ii),HKSA 700 (Revised),Forming an Opinion and Reporting on Financial Statements HKSA 700 (修订版)第 39(b)(ii) 段,就财务报表形成意见和报告

Components of internal control 内部控制的组成部分

-Control environment-控制环境

-Entity's risk assessment process -实体的风险评估流程

-Information system and communication -信息系统和通信

-Control activities-控制活动

-Monitoring of controls-监控控制

Objective:To document our understanding and evaluation of the entity's system of intermal control. 目的:记录我们对实体内部控制系统的理解和评估。 qquad\qquad

1.Control environment;1.控制环境;

2.The entiry's nask assessm 2.整体鼻垫评估

The entify's risk assessment process; 实体的风险评估流程;

The entity's process to monitor the sys 实体监视系统的进程

The entity's process to monitor the system of internal control; 实体监控内部控制系统的流程;

The intormation 3535 号

Control accivities控制辅助功能

Document our understanding and eyaluation of the y. tion of financial statements.Whare necessary,use PF41-PF4.4 to document the understanding and evaluation. In evaluating each of the components,if we identify one or more control deficencies,determine whether,ind- 记录我们对财务报表的理解和评估。必要时,使用 PF41-PF4.4 记录理解和评估。在评估每个组成部分时,如果我们发现一个或多个控制缺陷,请确定是否,ind-

vidually or in combination,the deficiences constitute a significant deficiency.HK/ISA 265 contains require- vidually or in combination,the deficiences constitute 2 significant deficiency.HK/ISA 265 contains require- cating internal control deficiencies. 这些缺陷构成了重大 deficiency.HK/ISA 265 包含需要的或组合的,缺陷构成 2 个显著的 deficiency.HK/ISA 265 包含需要的内部控制缺陷。

Recording systems notes记录系统注意事项

-Start with permanent file - 从永久文件开始

-Existing clients-update existing notes -现有客户-更新现有笔记

-New clients-document from scratch -新客户-从头开始记录

-Number of possible methods -可能的方法数量

-Questionnaires, flowcharts and narrative notes -问卷、流程图和叙述性笔记

-Usually document each transaction cycle separately -通常单独记录每个交易周期

SUBJECT

FINANCIAL REPORTING SYSTEM DOCUMENTATION 财务报告系统文档

Sch ref

Significart audit areas and transartinn classan to the eativy's operationas 重要的审计领域和 transartinn classan 对 eativy 的运营

How and by vhom rranactionsars initiated and authorized 如何以及由 vhom rranactionsars 发起和授权

How and by whom informarion ahour transactions,eveats and conditiona are idantified,exptured. and entered in the accouning system 如何以及由谁对每小时的 informarion 交易、eveats 和条件进行识别、验证。并输入到收款系统中

General ledger screanisensod 总账 screanisensod

How and by whom tresnsacrians sre. processed from original eatry to inclusion in the genaral ledger 如何以及由谁处理 tresnsacrians sre.从原始 eatry 到包含在 genaral 分类账中

Accounthy records, flum orbal remorr)or supporting inforwation generated for internal usa 账户记录、flum orbal remorr)或为美国国内生成的支持信息

How and by ubom infarmarian ke rapterred for iaclasion in the financial atatements, including significant accounting estimates and dischosures 如何以及通过 ubom infarmarian ke raptered 在财务状况中出现 iaclasion,包括重要的会计估计和分类

CASH Receipts现金收据

Paymant支付

SALES/ACCOUNTS RECETVABLES 销售/应收账款

Orders and shimments订单和条件

Provision for obubiffildehts obubiffildehts 的经费

COST OF SALES/销售成本/

Purchasecudes购买程序

Shock receiving冲击接收

nuvantoric)

Overlead costing超额成本核算

Provieion and netrealizable Provieion 和 netrealizable

FLXED ASSETSFLXED 资产

Additions增加

Disposl tatriamant

Dempacition邓帕西西翁

Impziment影响

INVESTMENTS

Parchases/mitiation项目/缓解

Sales/setliement销售/设置

Impamant/valuation估价/估价

OTHER ASSETS其他资产

Additions增加

https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-35.jpg?height=54&width=223&top_left_y=1788&top_left_x=975

SUBJECT FINANCIAL REPORTING SYSTEM DOCUMENTATION Sch ref

Significart audit areas and transartinn classan to the eativy's operationas How and by vhom rranactionsars initiated and authorized How and by whom informarion ahour transactions,eveats and conditiona are idantified,exptured. and entered in the accouning system General ledger screanisensod How and by whom tresnsacrians sre. processed from original eatry to inclusion in the genaral ledger Expected type,number and shan officurnal eatrits affecting thls account Accounthy records, flum orbal remorr)or supporting inforwation generated for internal usa How and by ubom infarmarian ke rapterred for iaclasion in the financial atatements, including significant accounting estimates and dischosures

CASH Receipts

Paymant

SALES/ACCOUNTS RECETVABLES

Orders and shimments

Provision for obubiffildehts

COST OF SALES/

Purchasecudes

Shock receiving

nuvantoric)

Overlead costing

Provieion and netrealizable

FLXED ASSETS

Additions

Disposl tatriamant

Dempacition

Impziment

INVESTMENTS

Parchases/mitiation

Sales/setliement

Impamant/valuation

OTHER ASSETS

Additions |  | | | | | | | |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| SUBJECT | FINANCIAL REPORTING SYSTEM DOCUMENTATION | | | | | | Sch ref |

| Significart audit areas and transartinn classan to the eativy's operationas | How and by vhom rranactionsars initiated and authorized | How and by whom informarion ahour transactions,eveats and conditiona are idantified,exptured. and entered in the accouning system | General ledger screanisensod | How and by whom tresnsacrians sre. processed from original eatry to inclusion in the genaral ledger | Expected type,number and shan officurnal eatrits affecting thls account | Accounthy records, flum orbal remorr)or supporting inforwation generated for internal usa | How and by ubom infarmarian ke rapterred for iaclasion in the financial atatements, including significant accounting estimates and dischosures |

| CASH Receipts | | | | | | | |

| Paymant | | | | | | | |

| SALES/ACCOUNTS RECETVABLES | | | | | | | |

| Orders and shimments | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Provision for obubiffildehts | | | | | | | |

| COST OF SALES/ | | | | | | | |

| Purchasecudes | | | | | | | |

| Shock receiving | | | | | | | |

| nuvantoric) | | | | | | | |

| | | | | | | | |

| Overlead costing | | | | | | | |

| Provieion and netrealizable | | | | | | | |

| FLXED ASSETS | | | | | | | |

| Additions | | | | | | | |

| Disposl tatriamant | | | | | | | |

| Dempacition | | | | | | | |

| Impziment | | | | | | | |

| INVESTMENTS | | | | | | | |

| Parchases/mitiation | | | | | | | |

| Sales/setliement | | | | | | | |

| Impamant/valuation | | | | | | | |

| OTHER ASSETS | | | | | | | |

| Additions | | | | | | | |

Further understanding of control activities 进一步了解控制活动

Should only complete if(a)you need a further understanding of control activities to plan the audit,or (b)you plan to test controls,but have not identified the control activities you plan to test. 仅当 (a) 您需要进一步了解控制活动以计划审计,或 (b) 您计划测试控制,但尚未确定计划测试的控制活动时,才应完成。

Most useful in conjunction with flowcharts and narrative notes 与流程图和叙述性注释结合使用最有用

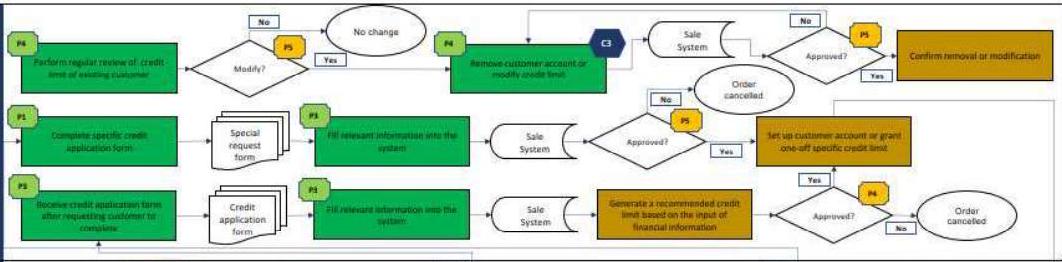

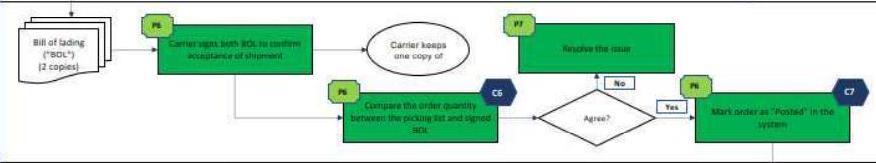

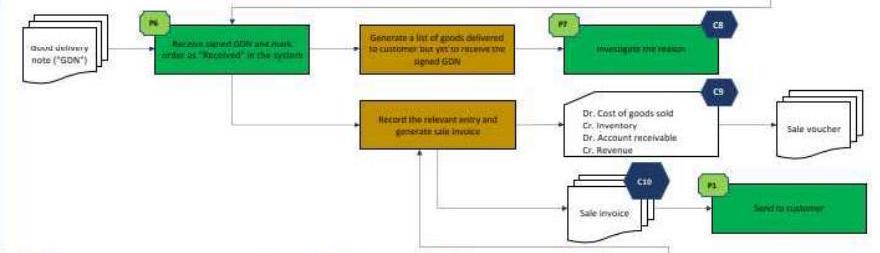

Flowcharts流程图

-More visual depiction can be helpful - 更多的视觉描述可能会有所帮助

-Useful for large complicated clients -适用于大型复杂客户

-Can be time consuming to prepare -准备工作可能很耗时

-Combine with narrative notes -结合叙述性笔记

Access to enter sales order is restricted to appropriate personnel or electronic data interface from third party.

Contral 2

The system is configured to anily process orders to approved customers and orders that are within approved credit limits:

Control 3

Access to set up/remove customers, modity approved credit limits and grant special approval is restricted to approgriate persannel.

Control 4

The system is configured to generate a complete and

Control 1

Access to enter sales order is restricted to appropriate personnel or electronic data interface from third party.

Contral 2

The system is configured to anily process orders to approved customers and orders that are within approved credit limits:

Control 3

Access to set up/remove customers, modity approved credit limits and grant special approval is restricted to approgriate persannel.

Control 4

The system is configured to generate a complete and| Control 1 |

| :--- |

| Access to enter sales order is restricted to appropriate personnel or electronic data interface from third party. |

| Contral 2 |

| The system is configured to anily process orders to approved customers and orders that are within approved credit limits: |

| Control 3 |

| Access to set up/remove customers, modity approved credit limits and grant special approval is restricted to approgriate persannel. |

| Control 4 |

| The system is configured to generate a complete and |

Order Processing订单处理

人事 1 Amy Chan,saie afficer 人事 2 Billy Chen,经理

Personnal 1

Amy Chan, saie afficer

Personnal 2

Billy Chen, cale manager

Personnal 1

Amy Chan, saie afficer

Personnal 2

Billy Chen, cale manager| Personnal 1 |

| :--- |

| Amy Chan, saie afficer |

| Personnal 2 |

| Billy Chen, cale manager |

accurate picking int when a valid sales order has been ontered into the system and the itom is an hand.

Contral 5

The system is configered to unily allow completely and acturately picked orders to be marked as "Complets".

accurate picking int when a valid sales order has been ontered into the system and the itom is an hand.

Contral 5

The system is configered to unily allow completely and acturately picked orders to be marked as "Complets".| accurate picking int when a valid sales order has been ontered into the system and the itom is an hand. |

| :--- |

| Contral 5 |

| The system is configered to unily allow completely and acturately picked orders to be marked as "Complets". |

venty the snoments are compsete and accurate prior to nitiating the "Posted" in the system. Excaptions are routed to the warehouse manager for resolution.

Control 6

venty the snoments are compsete and accurate prior to nitiating the "Posted" in the system. Excaptions are routed to the warehouse manager for resolution.| Control 6 |

| :--- |

| venty the snoments are compsete and accurate prior to nitiating the "Posted" in the system. Excaptions are routed to the warehouse manager for resolution. |

Access to modify goods usue status is rastrictod to appropriate personnel.

Control 8

The system is configured to compare the goods distributed and goods confirmed and followed up to investigate the reason.

Control 9

The system is configured to completaly and accurately record accounts recelvable and trade sales only after geineration of the invoice.

Contral 7

Access to modify goods usue status is rastrictod to appropriate personnel.

Control 8

The system is configured to compare the goods distributed and goods confirmed and followed up to investigate the reason.

Control 9

The system is configured to completaly and accurately record accounts recelvable and trade sales only after geineration of the invoice.| Contral 7 |

| :--- |

| Access to modify goods usue status is rastrictod to appropriate personnel. |

| Control 8 |

| The system is configured to compare the goods distributed and goods confirmed and followed up to investigate the reason. |

| Control 9 |

| The system is configured to completaly and accurately record accounts recelvable and trade sales only after geineration of the invoice. |

Sale allining销售 allining

Salp PricingSalp 定价

Credit Approval https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=262&width=1062&top_left_y=247&top_left_x=338 https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=261&width=244&top_left_y=249&top_left_x=1396 "Control 1

Access to enter sales order is restricted to appropriate personnel or electronic data interface from third party.

Contral 2

The system is configured to anily process orders to approved customers and orders that are within approved credit limits:

Control 3

Access to set up/remove customers, modity approved credit limits and grant special approval is restricted to approgriate persannel.

Control 4

The system is configured to generate a complete and"

Order Processing https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=93&width=1053&top_left_y=505&top_left_x=344 "Personnal 1

Amy Chan, saie afficer

Personnal 2

Billy Chen, cale manager" "accurate picking int when a valid sales order has been ontered into the system and the itom is an hand.

Contral 5

The system is configered to unily allow completely and acturately picked orders to be marked as "Complets"."

Order Picking https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=96&width=834&top_left_y=602&top_left_x=360 "Personnel 3 Candy Chan, urdit analyst

Personnel 4

Dors Chen, credit manager" "Control 6

venty the snoments are compsete and accurate prior to nitiating the "Posted" in the system. Excaptions are routed to the warehouse manager for resolution."

Drder Dellivery https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=163&width=876&top_left_y=697&top_left_x=342 "Personnel6

Frank Chan, warehouse officer:

Personnel7

Gigi Chen, warehouse manager

Personnel 8

Honson Chat head of sale deportment" "Contral 7

Access to modify goods usue status is rastrictod to appropriate personnel.

Control 8

The system is configured to compare the goods distributed and goods confirmed and followed up to investigate the reason.

Control 9

The system is configured to completaly and accurately record accounts recelvable and trade sales only after geineration of the invoice."

Sale allining https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=253&width=880&top_left_y=861&top_left_x=344

Salp Pricing https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-37.jpg?height=98&width=728&top_left_y=1116&top_left_x=346 | Credit Approval |  |  | Control 1 <br> Access to enter sales order is restricted to appropriate personnel or electronic data interface from third party. <br> Contral 2 <br> The system is configured to anily process orders to approved customers and orders that are within approved credit limits: <br> Control 3 <br> Access to set up/remove customers, modity approved credit limits and grant special approval is restricted to approgriate persannel. <br> Control 4 <br> The system is configured to generate a complete and |

| :--- | :--- | :--- | :--- |

| Order Processing |  | Personnal 1 <br> Amy Chan, saie afficer <br> Personnal 2 <br> Billy Chen, cale manager | accurate picking int when a valid sales order has been ontered into the system and the itom is an hand. <br> Contral 5 <br> The system is configered to unily allow completely and acturately picked orders to be marked as "Complets". |

| Order Picking |  | Personnel 3 Candy Chan, urdit analyst <br> Personnel 4 <br> Dors Chen, credit manager | Control 6 <br> venty the snoments are compsete and accurate prior to nitiating the "Posted" in the system. Excaptions are routed to the warehouse manager for resolution. |

| Drder Dellivery |  | Personnel6 <br> Frank Chan, warehouse officer: <br> Personnel7 <br> Gigi Chen, warehouse manager <br> Personnel 8 <br> Honson Chat head of sale deportment | Contral 7 <br> Access to modify goods usue status is rastrictod to appropriate personnel. <br> Control 8 <br> The system is configured to compare the goods distributed and goods confirmed and followed up to investigate the reason. <br> Control 9 <br> The system is configured to completaly and accurately record accounts recelvable and trade sales only after geineration of the invoice. |

| | | | |

| Sale allining |  | | |

| Salp Pricing |  | | |

Key points to mark into Flowchart 流程图中要标记的要点

Key points to mark into Flowchart 流程图中要标记的要点

Key points to mark into Flowchart 流程图中要标记的要点

Narrative notes叙述笔记

Updating systems notes更新系统说明

Discuss changes with the client 与客户讨论变更

-Accounting software package used -使用的会计软件包

-Account department staff and their responsibilities -会计部门员工及其职责

-Outsourcing-外包

-Changes in procedures and/or controls -程序和/或控制的变更

-New areas of business i.e.systems not previously documented -新的业务领域,即以前未记录的系统

Review the D\&I controls 查看 D\&I 控件

-Must test controls for design and implementation every year -必须每年测试设计和实施的控制措施

!!!Even if not intending to rely on them !!即使不打算依赖他们

-What is the control designed to do? -控件的设计目的是什么?

-Assertions-断言

-Should it be effective if it works as documented? -如果它按照记录工作,它应该有效吗?

-Enough information to tell? -足够的信息可以告诉?

Assessing design-Example 评估设计示例

The systems notes of a particular client noted that the accounts assistant performed a bank reconciliation at the end of each month. On the face of it,this might appear to be a well-designed control. However,when actually performing the bank reconciliation,the accounts assistant only reviewed the entries in the cash book and ticked them off in the accounting software package when she spotted them on the bank statement.She did not work down the bank statement looking for any transactions which had gone through the bank account but had not been recorded in the cash book.So although a bank reconciliation was being performed(and hence implemented),it was clearly a poorly designed control. 某个客户的系统注释指出,会计助理在每个月底执行银行对账。从表面上看,这似乎是一个精心设计的控制。然而,在实际执行银行对账时,会计助理只是在银行对账单上发现这些条目时,才查看现金簿中的条目,并在会计软件包中勾选它们。她没有记录银行对账单寻找任何通过银行账户但尽管正在执行银行对账(并因此实施)但尚未记录在现金 book.So 的交易,这显然是一个设计不当的控制。

HLBHLB 的

Validating implementation 验证实现

-Asking the client is not sufficient -询问客户是不够的

-Testing controls individually -单独测试控制

-Observation,inspection etc.of each relevant control -各相关控制的观察、检查等

-Documented in a grid in audit file - 记录在审计文件的网格中

Internal Control Evaluation 内部控制评估

Sch 5.6 -Understanding the Entity's System of Internal Control 附表5.6 - 了解实体的内部监控系统

5.Control Activities5.控制活动

The control activities component includes controls that are designed to ensure the proper application of policies in all the other components of the entity's system of internal control,and includes both direct and indirect con- trols. 控制活动部分包括旨在确保在实体内部控制系统的所有其他组成部分中正确应用政策的控制,并包括直接和间接控制。

Controls in the control activities component are required to be identified when such controls meet one or more of the following criteria: 当控制活动组件中的控制满足以下一个或多个条件时,需要识别此类控制:

(1)Controls that address a significant risk; (1)应对重大风险的控制措施;

(2)Controls over journal entries (JE_(s))\left(J E_{s}\right) ; (2)日记账分录的控制 (JE_(s))\left(J E_{s}\right) ;

(3)Controls for which we plan to test operating effectiveness;and (3)我们计划测试作有效性的控制措施;以及

(4)Other controls that we consider appropriate. (4)其他我们认为适当的控制措施。

For controls identified based on the above criteria,we identify the IT applications and the other aspects of the entity's IT environment that are subject to risks arising from the use of IT.For such IT applications and other aspects of the IT environment,we identify the related risks arising from the use of IT and the entity's general IT controls(GITC)that address such risks.We evaluate the design and implementation of these identified controls (D\&I test).Refer to Practice Aid-Audit Planning for examples of consideration.[PA-PLA 5 \&6] 对于根据上述标准确定的控制措施,我们确定了 IT 应用程序和实体 IT 环境中因使用 IT 而产生风险的其他方面。对于此类 IT 应用程序和 IT 环境的其他方面,我们确定了因使用 IT 而产生的相关风险以及实体解决此类风险的一般 IT 控制措施 (GITC)。我们评估这些已识别的控制措施的设计和实施(D\&I 测试)。有关考虑的示例,请参阅实践援助审计计划。[PA-PLA 5 \&6]

5.3 Controls over significant risks and other appropriate controls 5.3 对重大风险的控制和其他适当的控制

If we have identified a significant risk in Part E2 in Sch.5,or there are other RMMs for which it is necessary for us to evaluate the design of controls and determine that they have been implemented[PA-PLA 4.5.1],we are required to identify and evaluate the design,and determine the implementation of the controls that address these risks. 如果我们在附表 5 的 E2 部分中发现了重大风险,或者有其他 RM,我们有必要评估控制措施的设计并确定它们已经实施[PA-PLA 4.5.1],我们需要确定和评估设计,并确定解决这些风险的控制措施的实施情况。

5.3

Accounts(include x-ref to of Part E2 in Sch.5) 账目(包括附表 5 中 E2 部的 x-ref)

Significant risk?(Y/N)重大风险?(是/否)

Controls(a)

IT applications and the other aspects of the IT envi- ronment IT 应用程序和 IT 环境的其他方面

Related IT risks and GITC that address these risks 相关 IT 风险和应对这些风险的 GITC

D\&I test of(a)and(b)(in- clude x-ref to WP where ap- propriate)

5.3.1

◻\square

[Y/N] ◻\square

◻\square

IT 应用程序: ◻\square IT 环境的其他方面:

IT applications: ◻\square

Other aspects of the IT environment:

IT applications: ◻

Other aspects of the IT environment:| IT applications: $\square$ |

| :--- |

| Other aspects of the IT environment: |

Related IT'risks:

I

GITC(b):

Related IT'risks:

I

GITC(b):| Related IT'risks: |

| :--- |

| I |

| GITC(b): |

◻\square

5.3.2

◻\square

P/N

◻

P/N| $\square$ |

| :--- |

| P/N |

◻\square

阳离子:IT 环境的其他方面:

cations:

Other aspects of the IT environment:

cations:

Other aspects of the IT environment:| cations: |

| :--- |

| Other aspects of the IT environment: |

Related IT risks:

GITC(b):

Related IT risks:

GITC(b):| Related IT risks: |

| :--- |

| GITC(b): |

5.3.3

[Y/N][是/否]

atton IT 环境的其他方面: ◻\square

atton

Other aspects of the IT environment: ◻\square

atton

Other aspects of the IT environment: ◻| atton |

| :--- |

| Other aspects of the IT environment: $\square$ |

Ralated IT siake:GITC(b): ◻\square

Ralated IT siake:

GITC(b): ◻\square

Ralated IT siake:

GITC(b): ◻| Ralated IT siake: |

| :--- |

| GITC(b): $\square$ |

◻\square

5.3.4

[Y/N][是/否]

◻\square

IT 应用程序:IT 环境的其他方面:

IT applications:

Other aspects of the IT environment:

IT applications:

Other aspects of the IT environment:| IT applications: |

| :--- |

| Other aspects of the IT environment: |

相关资讯科技风险:全球资讯科技(b ◻\square ):

Related IT risks:

GITC(b): ◻\square

Related IT risks:

GITC(b): ◻| Related IT risks: |

| :--- |

| GITC(b): $\square$ |

5.3 .5

[Al]

◻\square

IT 应用程序:IT 环境的其他方面:

IT applications:

Other aspects of the IT environment:

IT applications:

Other aspects of the IT environment:| IT applications: |

| :--- |

| Other aspects of the IT environment: |

相关 IT 风险:GITC(b): ◻\square

Related IT'risks:

GITC(b): ◻\square

Related IT'risks:

GITC(b): ◻| Related IT'risks: |

| :--- |

| GITC(b): $\square$ |

5.3 Accounts(include x-ref to of Part E2 in Sch.5) Significant risk?(Y/N) Controls(a) IT applications and the other aspects of the IT envi- ronment Related IT risks and GITC that address these risks D\&I test of(a)and(b)(in- clude x-ref to WP where ap- propriate)

5.3.1 ◻ [Y/N] ◻ ◻ "IT applications: ◻

Other aspects of the IT environment:" "Related IT'risks:

I

GITC(b):" ◻

5.3.2 https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-42.jpg?height=26&width=59&top_left_y=1888&top_left_x=310 "◻

P/N" ◻ "cations:

Other aspects of the IT environment:" "Related IT risks:

GITC(b):"

5.3.3 [Y/N] "atton

Other aspects of the IT environment: ◻" "Ralated IT siake:

GITC(b): ◻" ◻

5.3.4 https://cdn.mathpix.com/cropped/2025_07_23_61ad319929f5bdaece20g-42.jpg?height=29&width=59&top_left_y=2146&top_left_x=310 [Y/N] ◻ "IT applications:

Other aspects of the IT environment:" "Related IT risks:

GITC(b): ◻"

5.3 .5 [Al] ◻ "IT applications:

Other aspects of the IT environment:" "Related IT'risks:

GITC(b): ◻" | 5.3 | Accounts(include x-ref to of Part E2 in Sch.5) | Significant risk?(Y/N) | Controls(a) | IT applications and the other aspects of the IT envi- ronment | Related IT risks and GITC that address these risks | D\&I test of(a)and(b)(in- clude x-ref to WP where ap- propriate) |

| :--- | :--- | :--- | :--- | :--- | :--- | :--- |

| 5.3.1 | $\square$ | [Y/N] $\square$ | $\square$ | IT applications: $\square$ <br> Other aspects of the IT environment: | Related IT'risks: <br> I <br> GITC(b): | $\square$ |

| 5.3.2 |  | $\square$ <br> P/N | $\square$ | cations: <br> Other aspects of the IT environment: | Related IT risks: <br> GITC(b): | |

| 5.3.3 | | [Y/N] | | atton <br> Other aspects of the IT environment: $\square$ | Ralated IT siake: <br> GITC(b): $\square$ | $\square$ |

| 5.3.4 |  | [Y/N] | $\square$ | IT applications: <br> Other aspects of the IT environment: | Related IT risks: <br> GITC(b): $\square$ | |

| 5.3 .5 | | <smiles>[Al]</smiles> | $\square$ | IT applications: <br> Other aspects of the IT environment: | Related IT'risks: <br> GITC(b): $\square$ | |

Walkthrough tests-watch out! 演练测试 - 小心!

-Key is to check the operation of controls and not to just match bits of paper -关键是检查控件的作,而不仅仅是匹配纸片

-Can be time-consuming,so check which method to use with your manager or senior - 可能很耗时,因此请与您的经理或高级人员一起检查使用哪种方法

-Also prone to over-auditing -也容易过度审计

-Need to see records or visit client's premises - 需要查看记录或访问客户场所

-Ideally test at the planning stage -理想情况下,在规划阶段进行测试

Timing of the work 工作时间

-Need to see records or visit client's premises - 需要查看记录或访问客户场所

-Ideally test at the planning stage -理想情况下,在规划阶段进行测试

-If testing at the fieldwork stage,do on the first day -如果在实地考察阶段进行测试,请在第一天进行

Control deficiencies控制缺陷

-Flag immediately to your manager or senior - 立即向您的经理或上级举报

-Add to the draft letter of comment - 添加到评论信草案中

-May need to change the audit plan -可能需要更改审核计划

CASE STUDY个案研究

Test and document the implementation of controls 测试并记录控制措施的实现

-You are assisting your supervisor plan the audit of Meridian Air Limited,a manufacturer of air conditioning units with a year-end of 31 December 20X9.It is mid-December 20X9,and you and your supervisor are doing some pre year-end planning work on-site at the client's premises. -您正在协助您的主管计划对 Meridian Air Limited 的审计,Meridian Air Limited 是一家空调机组制造商,年终为 12 月 31 日 20X9.It 20X9 年 12 月中旬,您和您的主管正在客户场所现场进行一些年终前计划工作。

-Your supervisor asks you to check the implementation of controls by performing walkthrough tests.You refer to last year's planning section with a view to performing the test and documenting this year's work in the same way. - 您的主管要求您通过执行演练测试来检查控制措施的实施情况。您参考了去年的计划部分,以期以同样的方式执行测试并记录今年的工作。