In today’s post:

✅ Starting a list to document what’s going on in markets (again…)

✅ By the looks of it, we’ll have a lot more to add in coming days.

(Remember at the April lows, we published a Market Bottom Checklist?)

WHAT TOPS LOOK LIKE — A CHECKLIST:

a.k.a. “Things you don’t see at a Bottom…”

You’re not going to believe this…

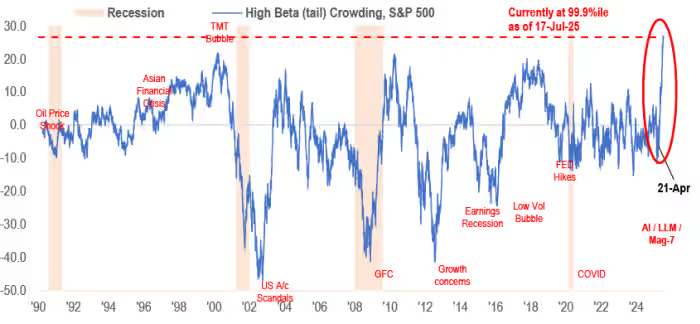

✅ From JPM: “Long High Beta Stocks is now the most crowded trade it has ever been in history” (link to article)

In a JPM note published Monday, strategists observe that there have been three episodes already this year where investing style factors have seen “extreme crowding episodes”.

In January, investors piled into quality growth, large-size companies reflecting a desire to own the AI-linked mega caps. (Our notes: ended badly)

Then, as concerns about AI overspend infected sentiment and tariff policy raised recession fears, April saw a rush into stocks deemed low volatility, safer. (Our notes: ended badly)

The latest bout of extreme crowding — currently in the 100th percentile — is in high-beta stocks. And this spans both riskier low value alongside speculative growth plays, according to JPM.

The overcrowding is particularly unsustainable because it has occurred at such speed. The move in positioning from the 25th percentile to the 100th percentile took place in just three months, which is the fastest in 30 years, says the JPM team. In addition, short interest in high-beta names has crumbled, they observe, meaning investors are inadequately hedged for any selloff.

Here is a three-decade chart of what the current High Beta Crowding looks like:

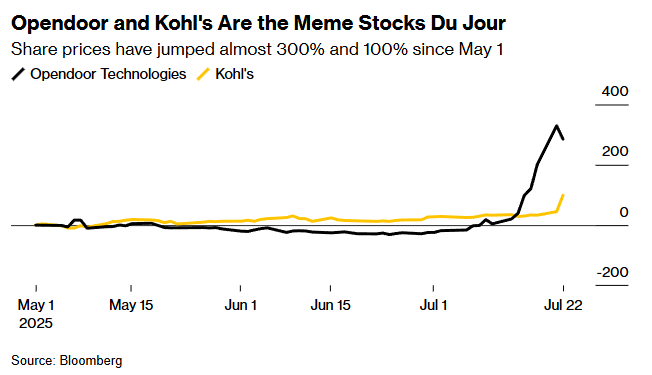

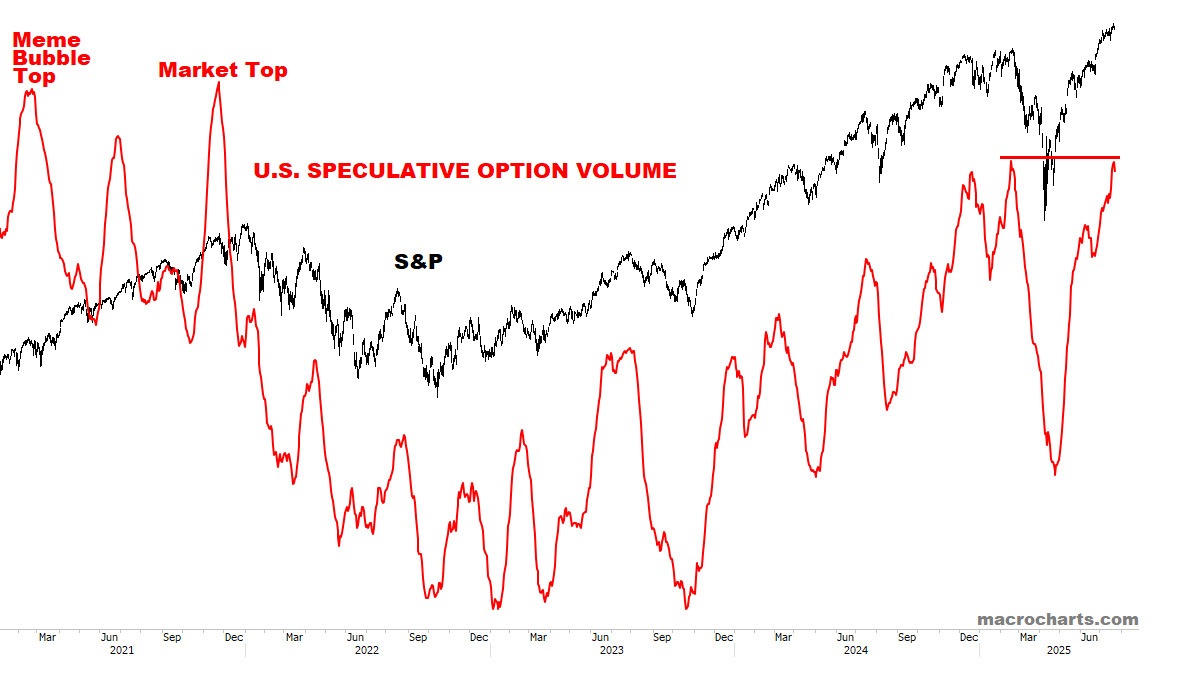

✅ “Meme Stock Fever Is Spreading Like It’s 2021 With Kohl’s Soaring” (link to article)

Stocks are at all-time highs and retail traders are flooding into low-priced shares, with companies like Opendoor and Kohl’s being the current “meme stock” favorites.

According to Steve Sosnick, chief strategist at Interactive Brokers, there is a “flight to crap” as individual investors are emboldened to engage in more risky types of investing.

“The recent rally, which was largely powered in its initial phase by individual investors buying large cap stocks and major indices, has emboldened many to engage in more risky types of investing.”

Sounds like what we wrote back in April…

Quality names tend to lead the initial rally, while investors continue to doubt how far the rally can go. (There are many strong setups currently as discussed — and evidence continues to build in this direction.)

But inevitably, at some point in every rally, the wall of worry finally crumbles and even the garbage gets bought.

This extreme risk-seeking behavior is fueled by two forces: performance-chasing, and general FOMO taking over.

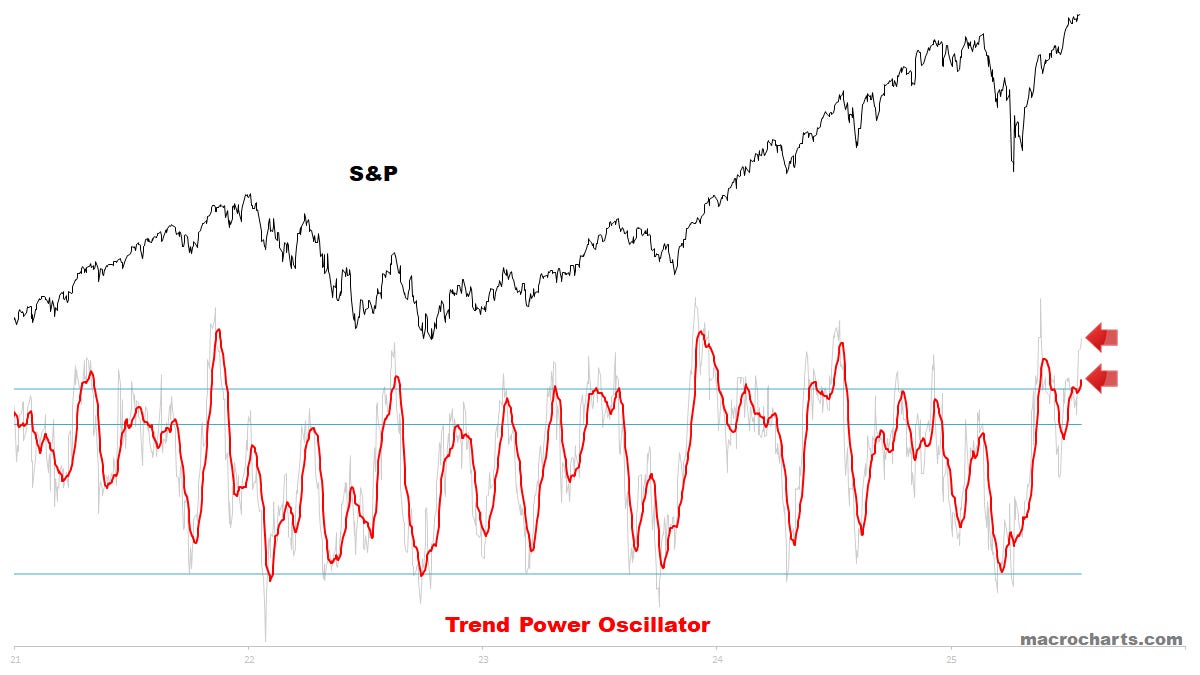

Below is a perfect illustration of a POPCORN MARKET:

(*For those who missed, this is a term I first used years ago to describe a prior bubbling rally…)

✅ From the same article: “Retail traders are now a key component of the US stock market, comprising 20.5% of total volume.”

✅ From the same article: “Trading activity in names priced below $5 makes up more than 26% of the overall trading volume, according to Jefferies.” (This is a new record in penny stock volume by the way.)

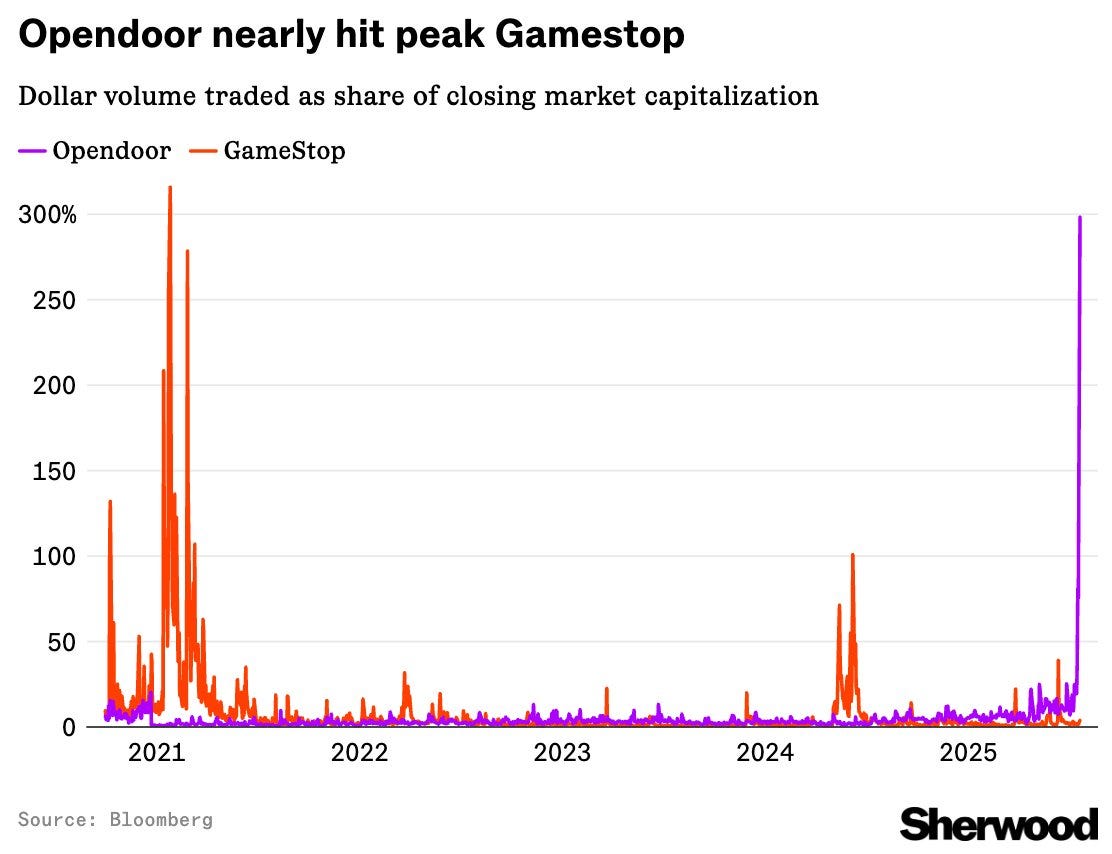

✅ History doesn’t repeat, but often rhymes — here is a chart with commentary from Luke Kawa (follow him on Twitter/X): “OPEN traded 298% of its closing market cap Monday. That is very close to peak GME, which moved 316% of its market value on January 25, 2021. GME closing peak came two sessions after that.”

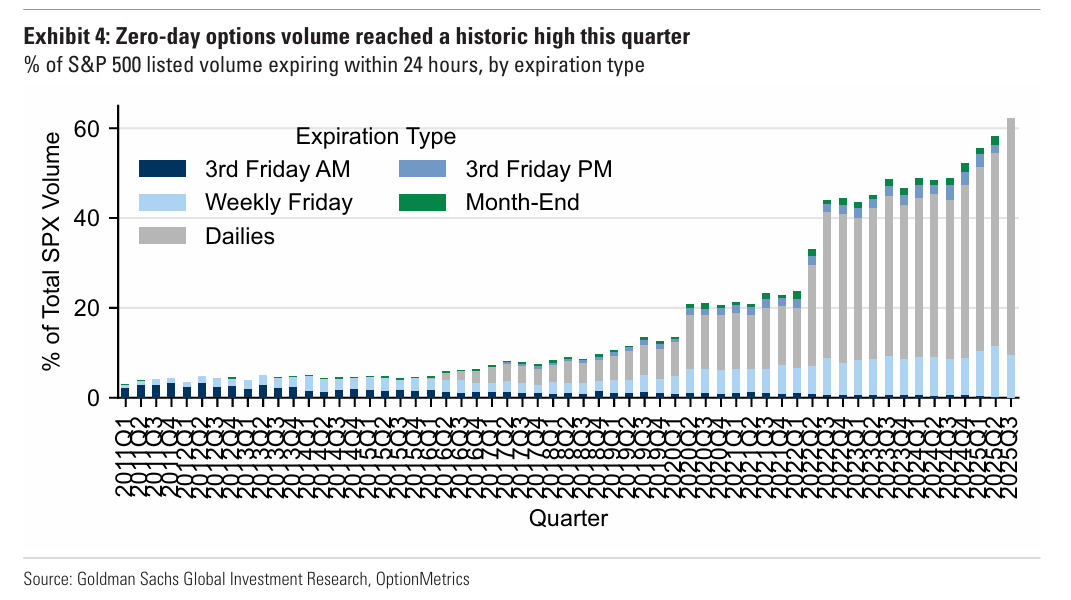

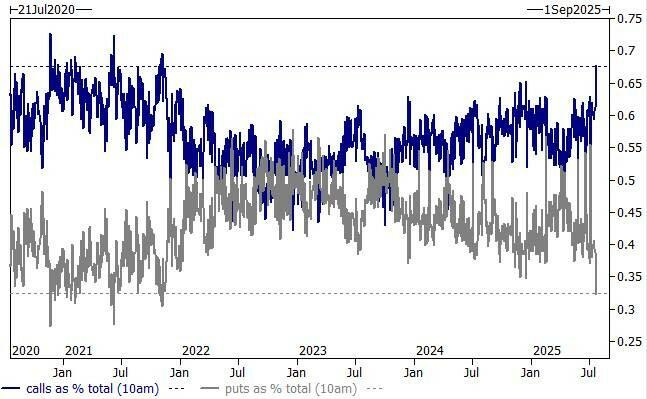

✅ Below, from GS: “Retail 0DTE option trading is now nearly 2/3 of all option volumes”:

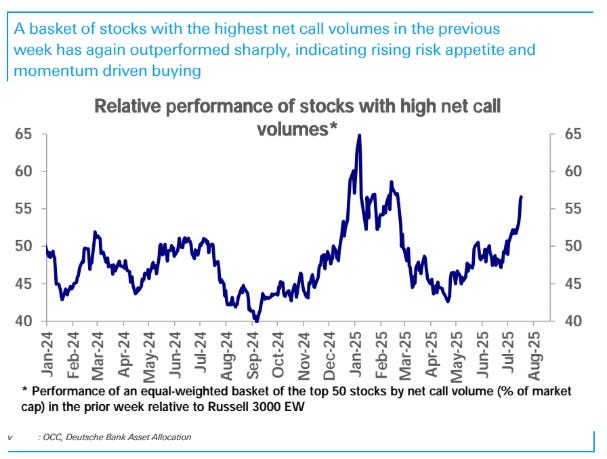

✅ Below, from DB: “A basket of stocks with the highest net call volumes in the previous week has again outperformed sharply, indicating rising risk appetite and momentum driven buying” (Note the last time at these levels was near the Jan-Feb 2025 peak.)

✅ Below, from GS: “Calls are almost 70% of the total market volume — hasn’t been this high since 2021 meme days”

✅ July 21, 2025: Schwab Announces Further Expansion of Overnight Trading: “clients can now trade more than 1,100 securities 24-hours a day, five days a week.”

✅ Day-Trading Restraints to Be Loosened Under Proposed Rule Change (link to article):

US regulators are finalizing plans to replace the “pattern day trading” rule, which limits investors with less than $25,000 in their margin account from borrowing to trade four or more times in a five-day period.

A proposal being prepared would lower the threshold to $2,000, and individual brokerages would make their own margin calculation and decisions as to the minimum balance that customers need to day trade.

The existing rule was put in place to protect investors from massive losses and borrowing more than they can cover, but industry executives say that markets have evolved since its adoption in 2001