100+ Charts & Commentary on all major Markets — for your weekend reading.

“Don’t start the week without it”

“Higher For Longer” continues:

New all-time highs in Stocks and Bitcoin — just like experts predicted months ago.

Price > opinions:

KEY TOPICS COVERED

In today’s report:

READY FOR THE NEXT SHIFT: Feels like a change coming in markets…

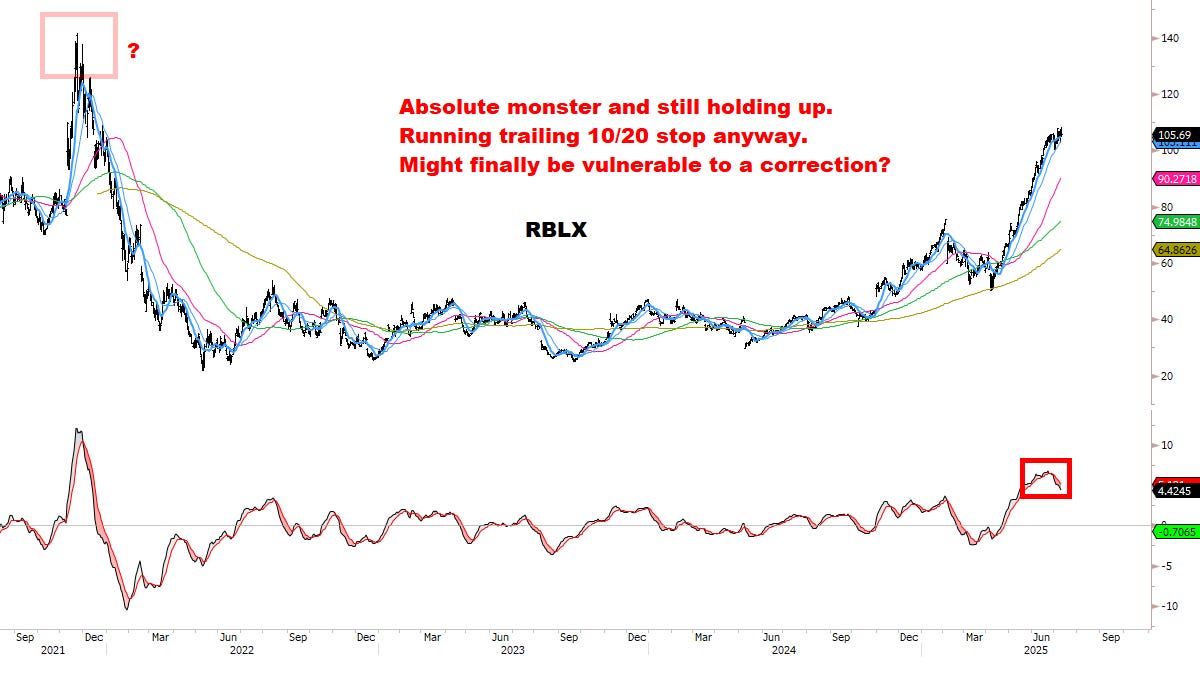

STOCKS: Big names melting up… no turning back now?

Core Watchlist names up nearly +50% on average.

Buyers coming for what they can: This has been a feature the entire way up. Meanwhile every narrative was left in the dust.

Special Update continued: Watching Topping Signals (Subscribers only).

Updated scans & targets: assessing (1) model signals, (2) market behavior, (3) individual stocks.

Lastly: working on a NEW Thematic Report with a compelling idea I’m studying — which is still under the radar. I think this theme could be extremely timely, and from many angles. Coming soon — you won’t want to miss this.

METALS: Tight as a drum — ready for expansion.

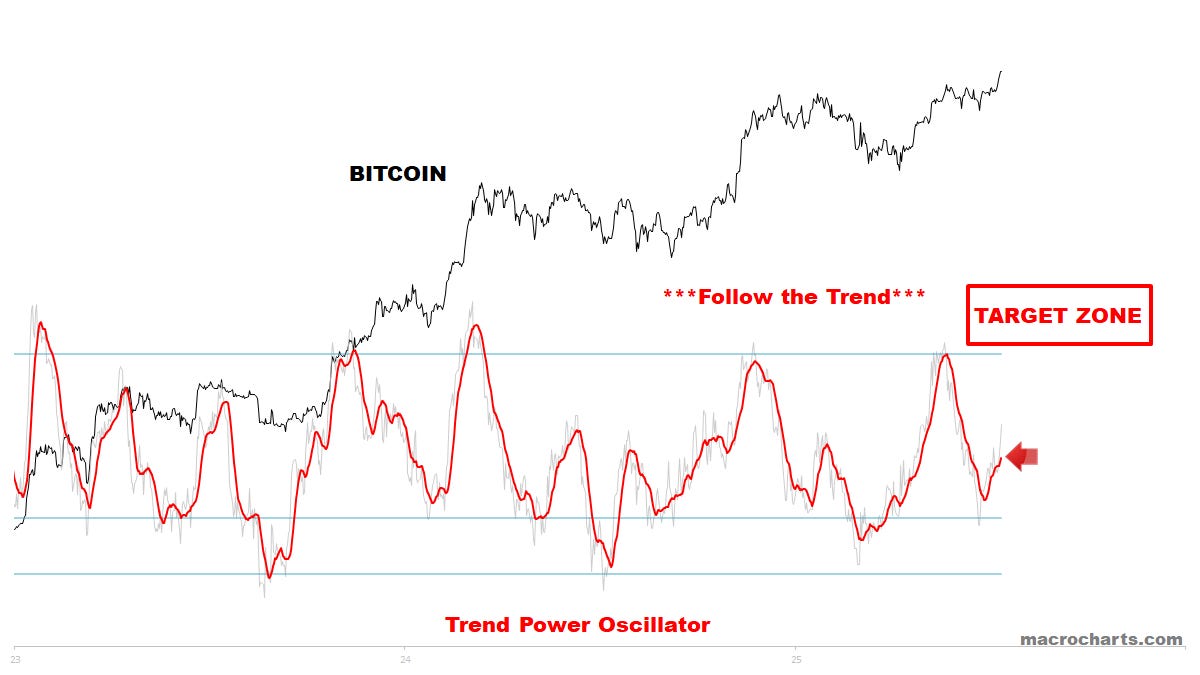

BITCOIN: Big Beautiful Week.

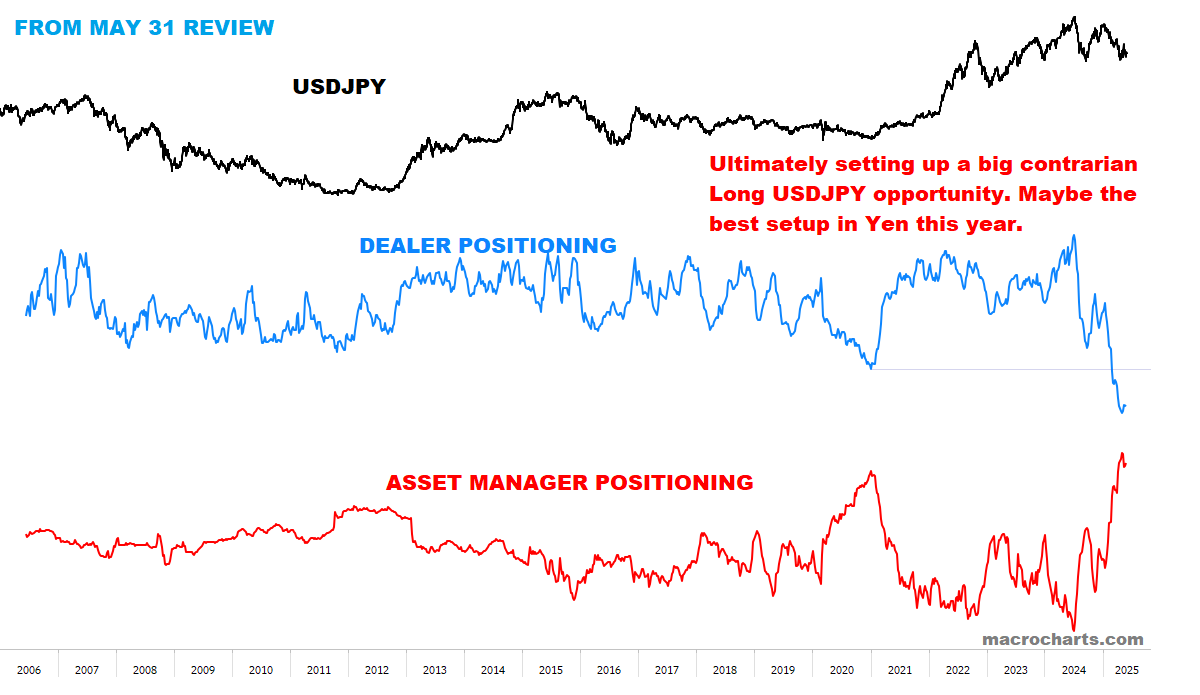

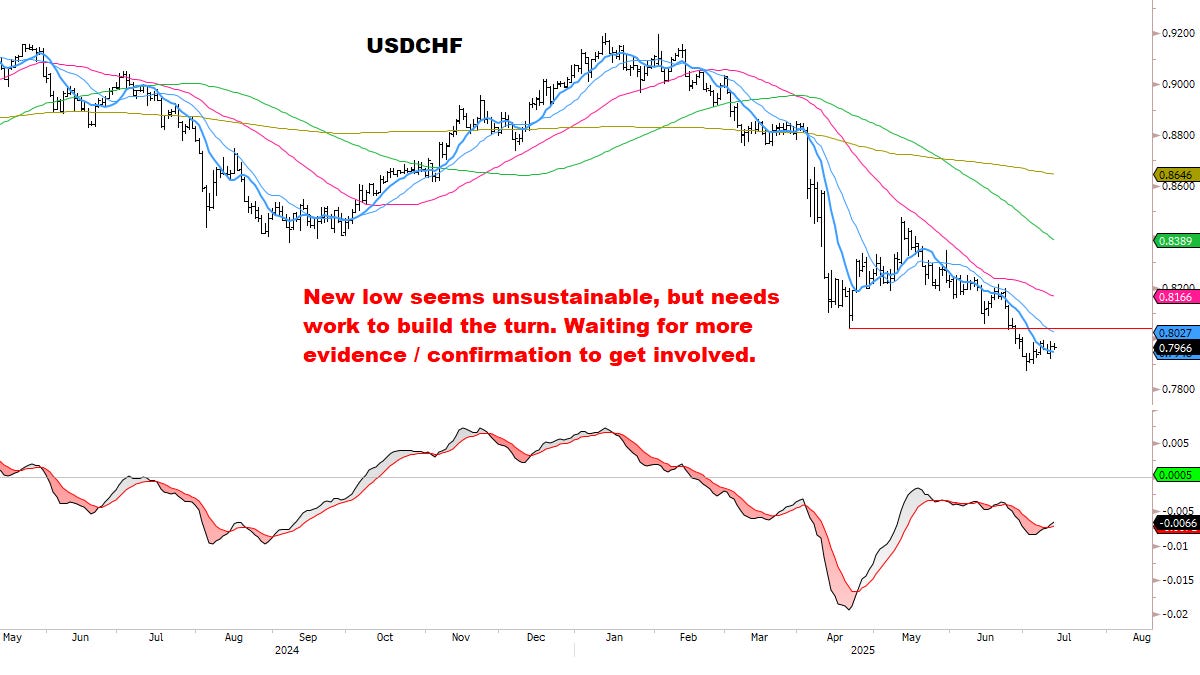

FX: The Buck stops here…?

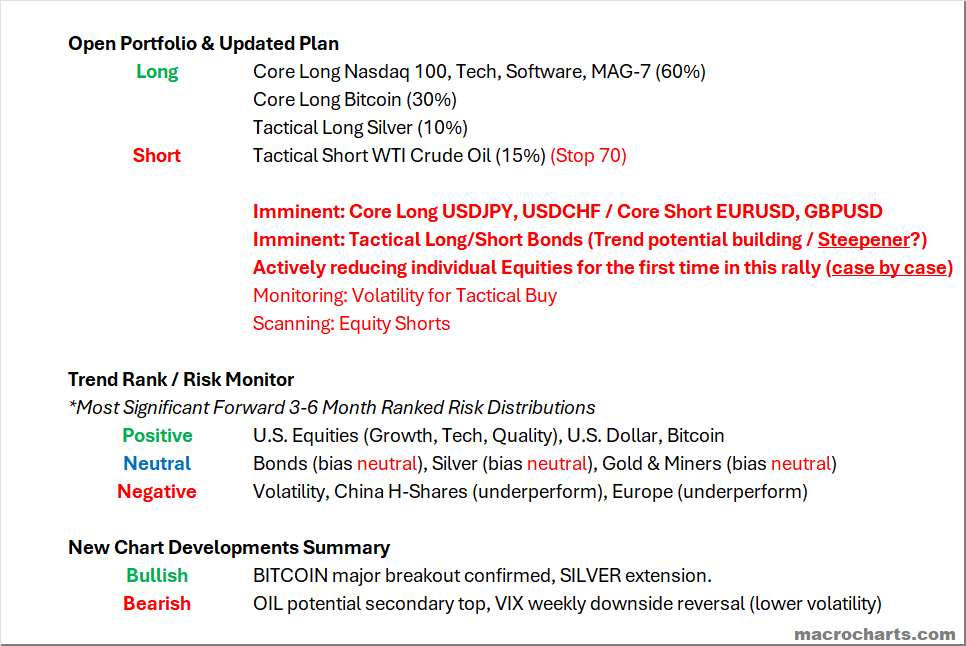

Open Portfolio & Updated Plan

Emphasizing: keeping an open mind could be the difference between a great summer and an average one. It’s a strong year and I intend to keep pushing — eyes on the next big move (*now underway*).

Positions moving well together — “make hay while the sun shines”:

*Monitoring the Dollar AND Bonds closely for a big play soon:

CORE MODELS & DATA

STOCKS

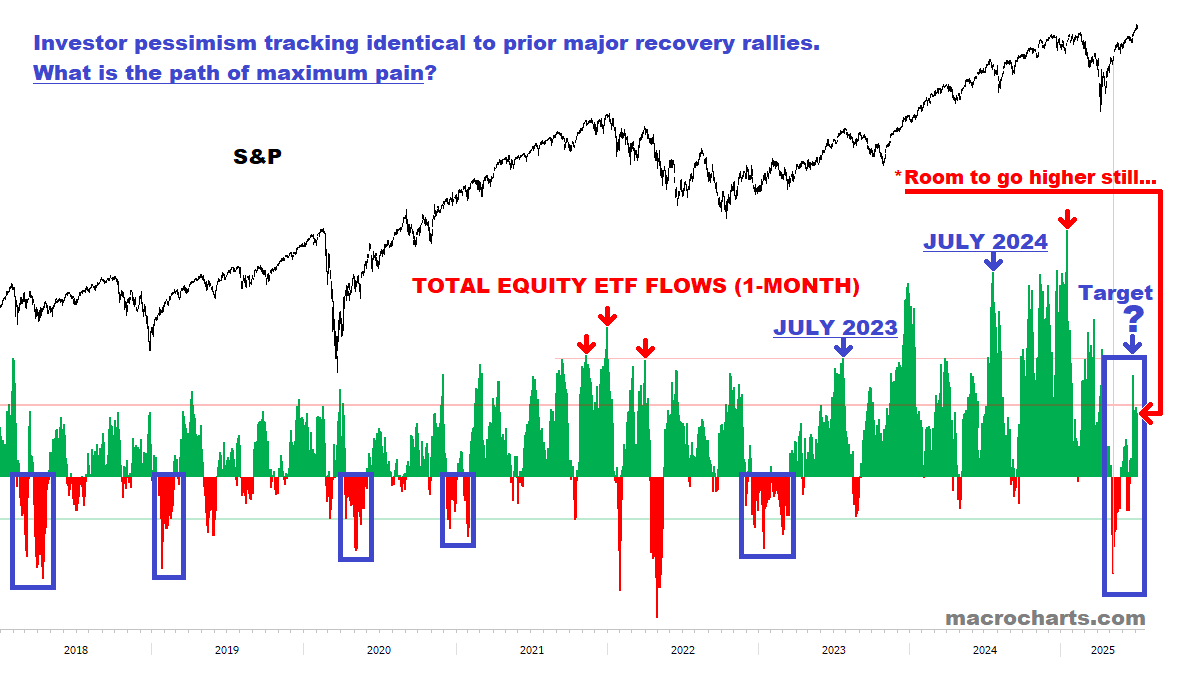

Investors continue to follow the historical script.

Base case: flows should accelerate.

From May 24: If history is a guide, the path of maximum pain is for the market to grind higher over time, leaving sellers behind. Pullbacks could be limited in scope. (*This framework continues to be validated by the indexes.)

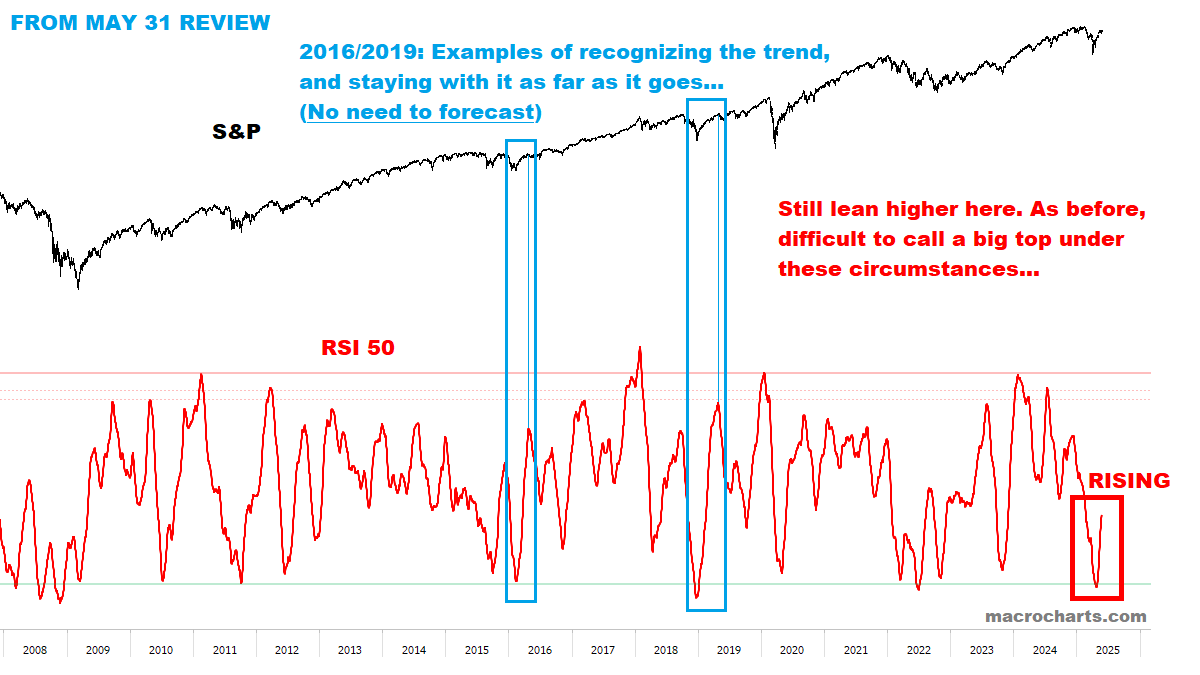

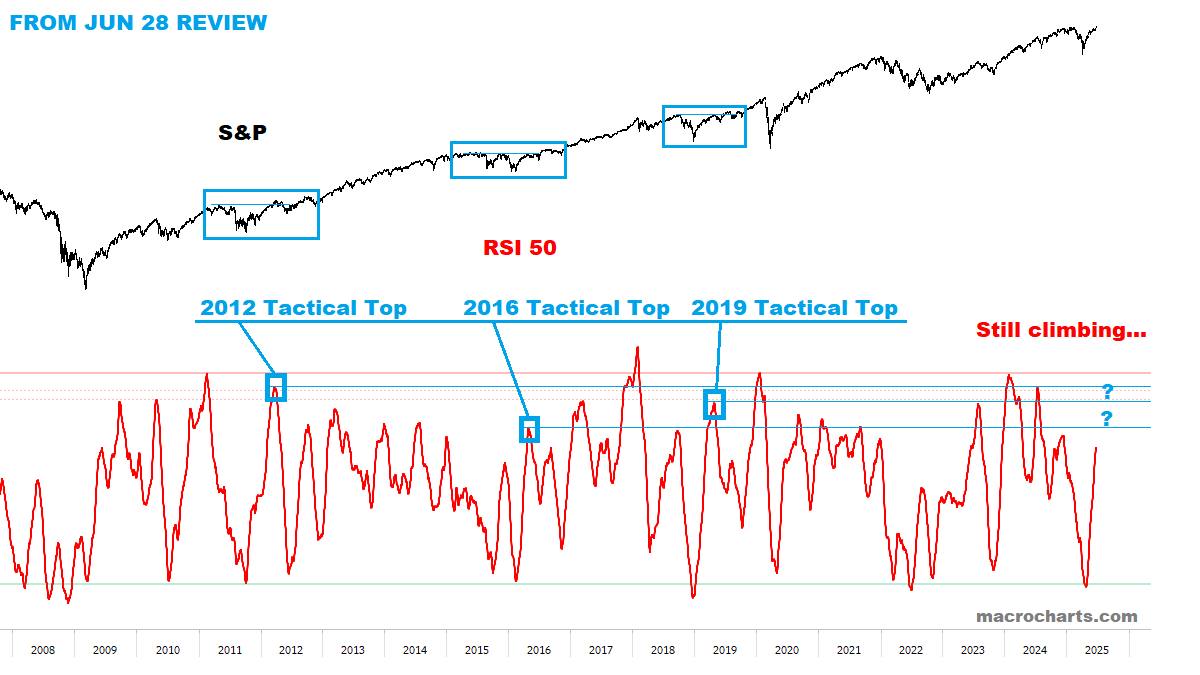

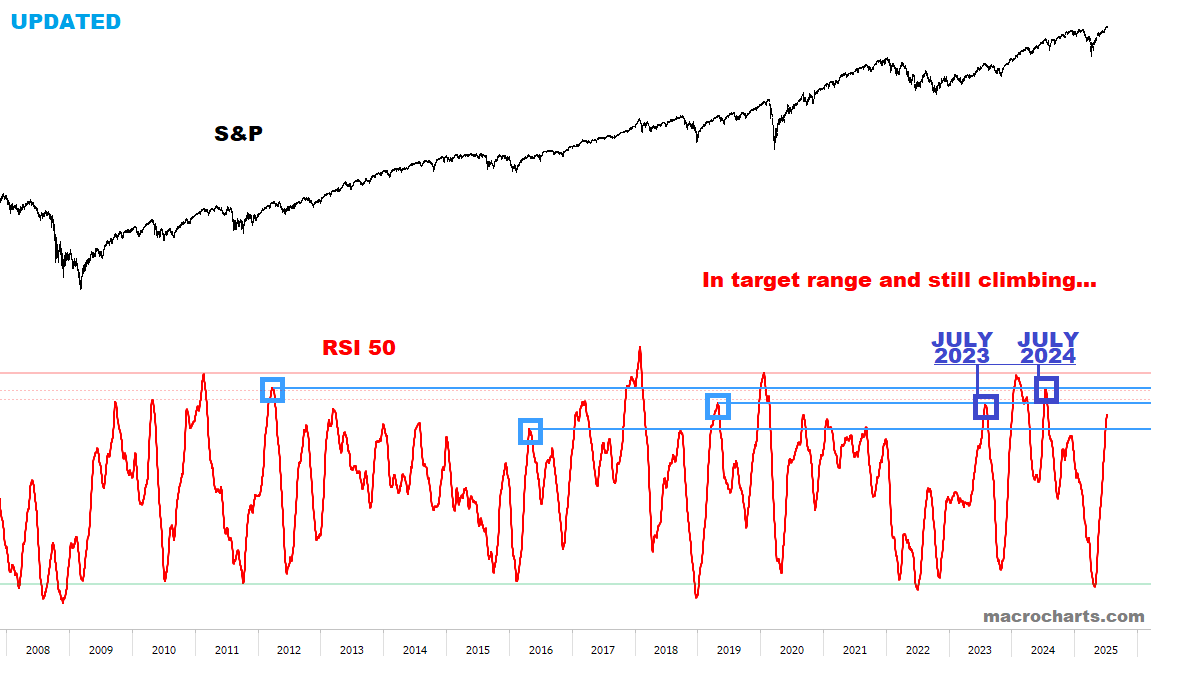

*Below: look at the pattern of buying spikes into JULY 2023 and JULY 2024, right before the market corrected = room to go higher still?

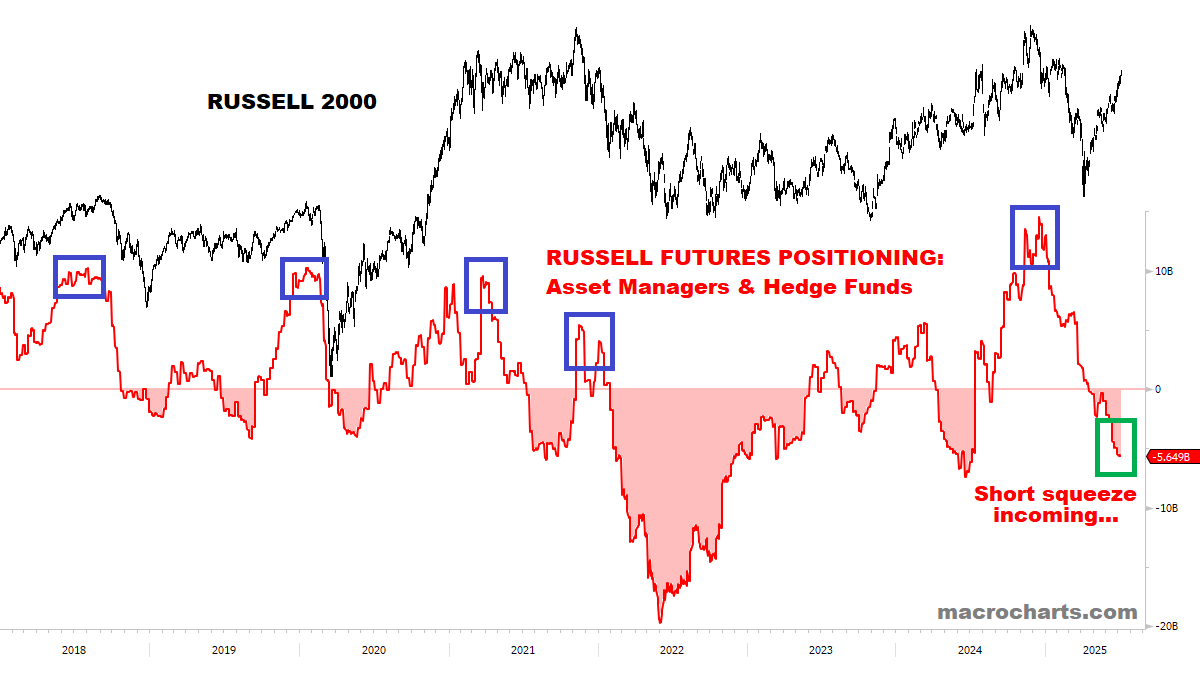

Institutions remain massively underinvested:

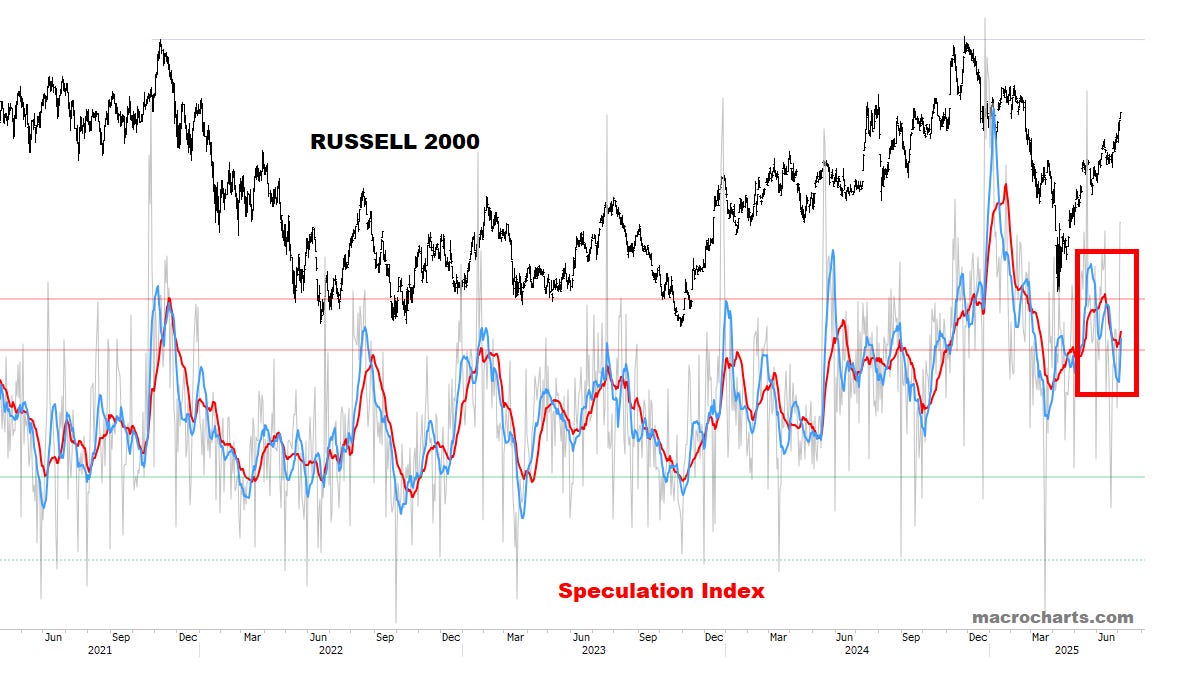

…and still SHORT Russell:

*There has never been a major Top with this level of Short positioning…

A Melt-Up developing (continued):

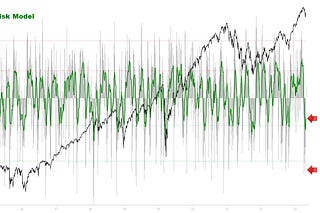

Core Risk Models made ZERO progress this week.

Room to get more overbought — especially if a melt-up is underway.

When this reaches topping range and turns down, I’ll raise cash / look to put on Tactical hedges. Not before.

When the time comes, we’ll be sharing this and other signals with Subscribers only. No public sites or social media.

We continue to track this closely for an ideal top into late summer — note “Golden cross” in line with prior rallies:

As discussed May 24:

“If the sequence continues, dips should remain shallow for the next few weeks, with the market in a slight upward bias. Overall, a *perfect environment* for stock-picking. *Also: not yet an optimal setup to Short Indexes or buy Volatility.”

*This framework continues to be validated by the market.

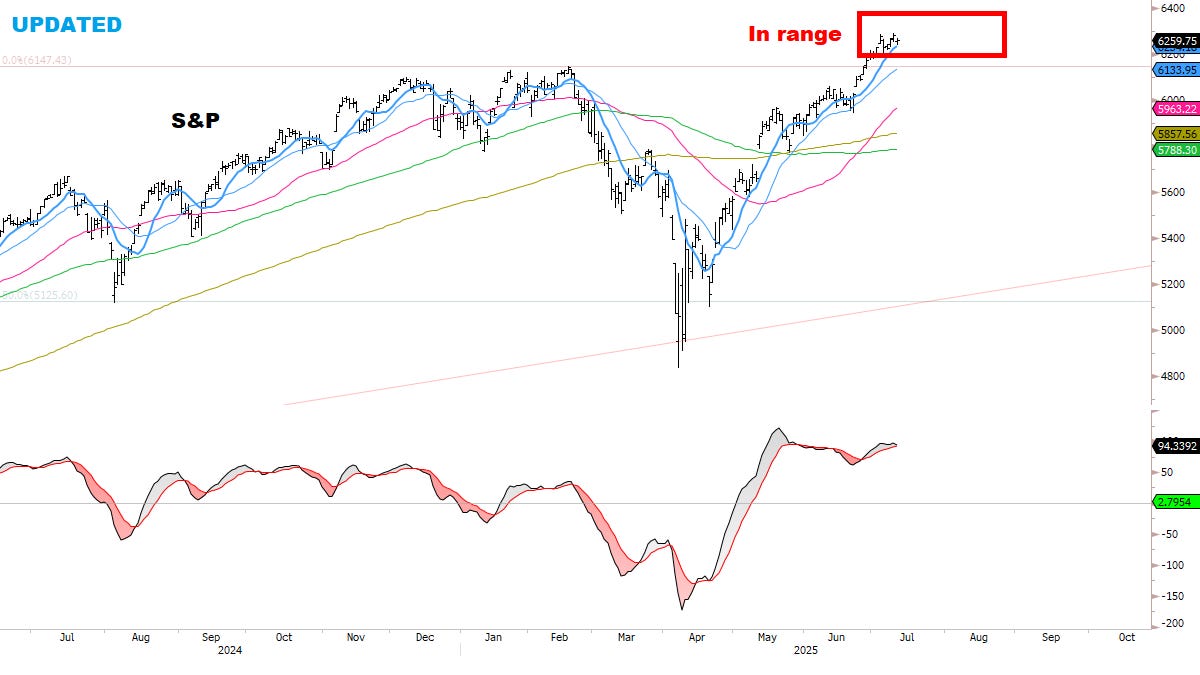

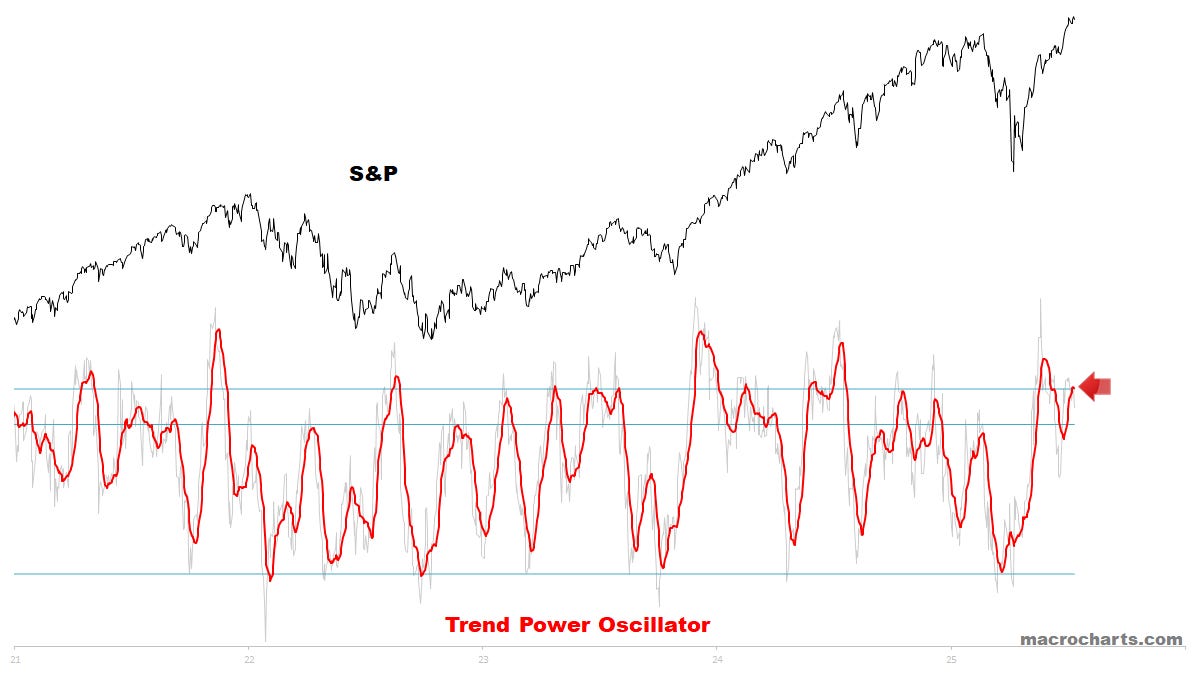

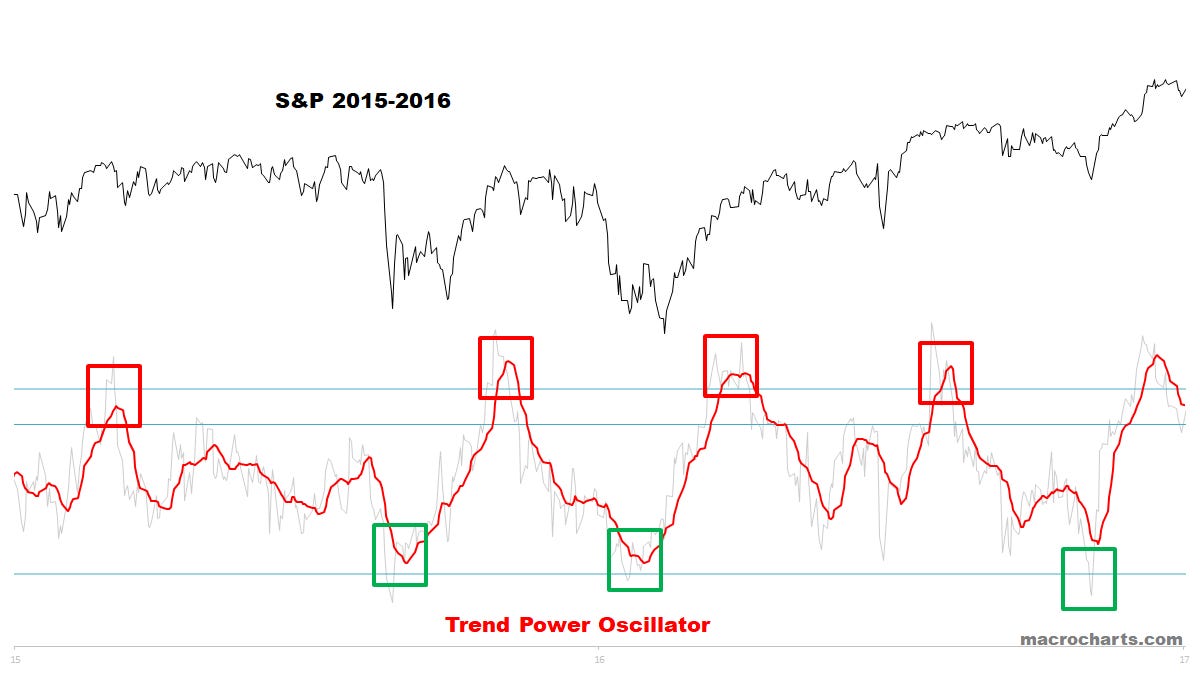

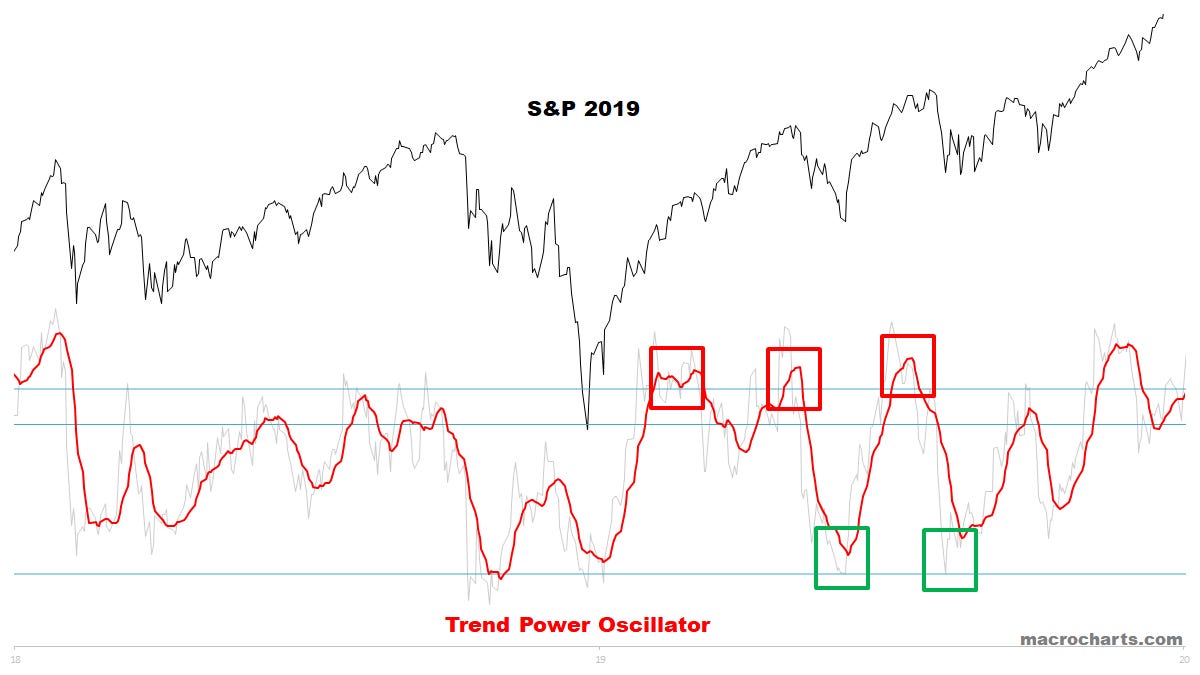

Trend Power Oscillator is moving to overbought — still tracking the 2016/2019 scenario:

When this reaches extreme overbought and turns down, I’ll raise cash / look to put on Tactical hedges. Not before that, and for Subscribers only.

Remember:

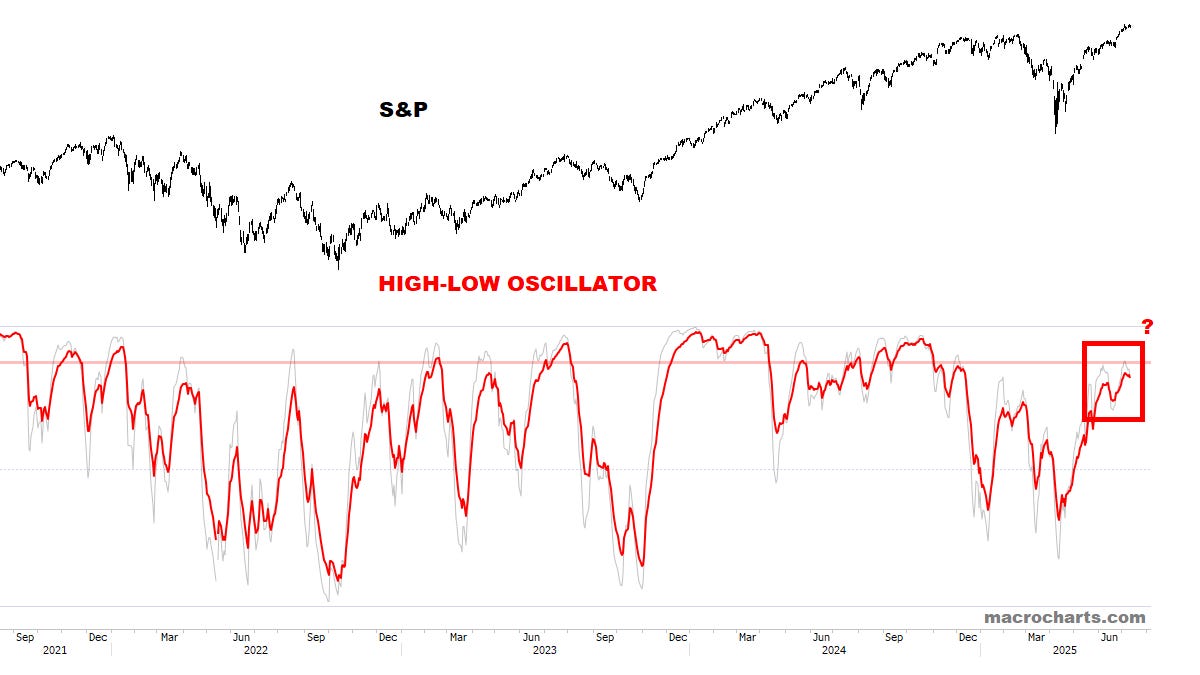

High-Low Oscillator has room to push a bit higher:

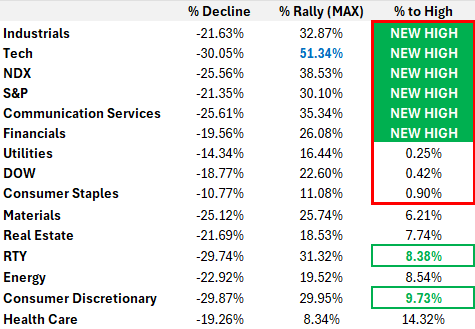

Still on track for new highs in key areas, before a bigger correction:

Tech now up more than +50% from the April lows…

Note the DOW still below its prior high — and could try to push through.

Russell & Consumer Discretionary remain in green, with potential to recover further (see Technical Charts section):

Base case: speculation & flows should ramp up as the summer melt-up continues.

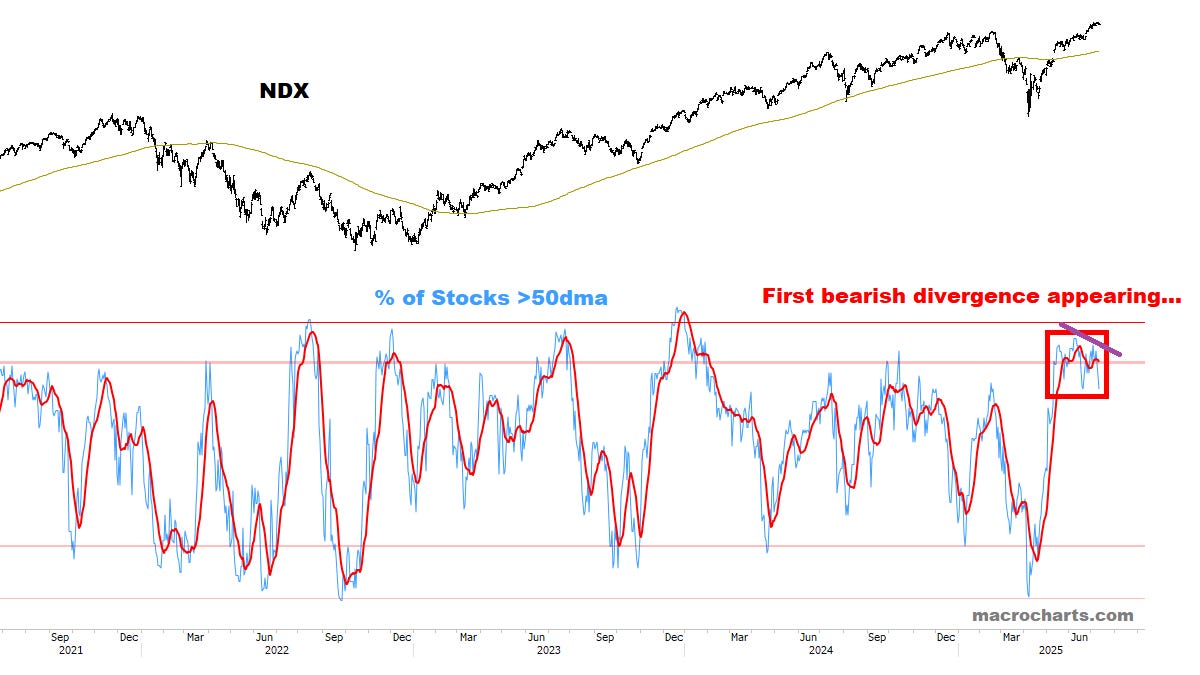

NDX is still showing good strength — an important bullish sign:

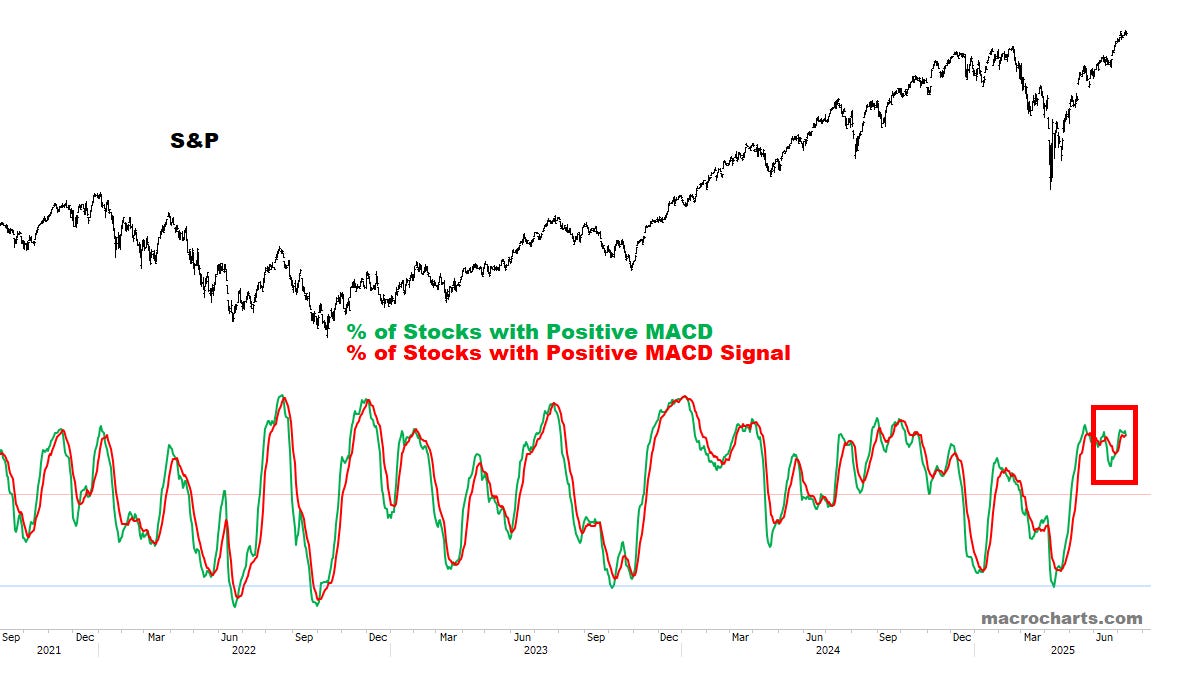

Sell Signals are picking up, but remain low — watching this evolve:

MACD Profiles remain constructive:

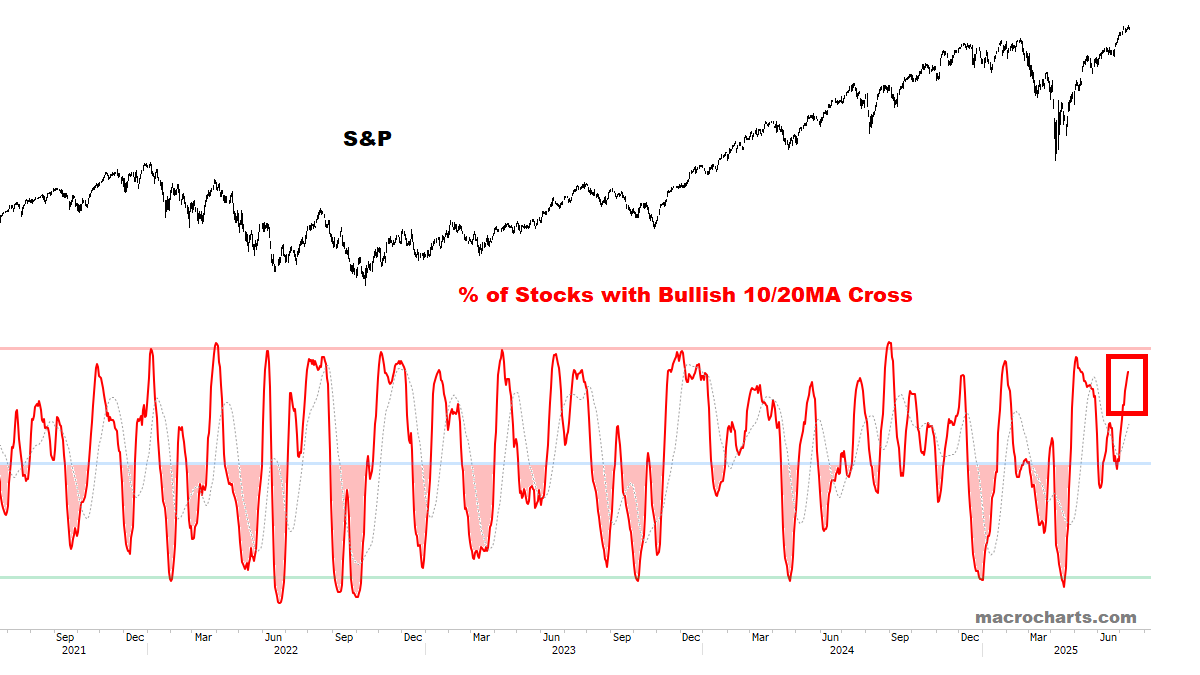

Stocks with a Bullish Cross are still expanding — *but soon could approach the topping range. Monitoring for a turn:

Long-term Breadth still looks healthy — particularly NDX:

Intermediate Breadth is showing *early signs* of weakness:

*Above, this breadth divergence looks to be primarily from Software weakness (which we’ll cover in the next section).

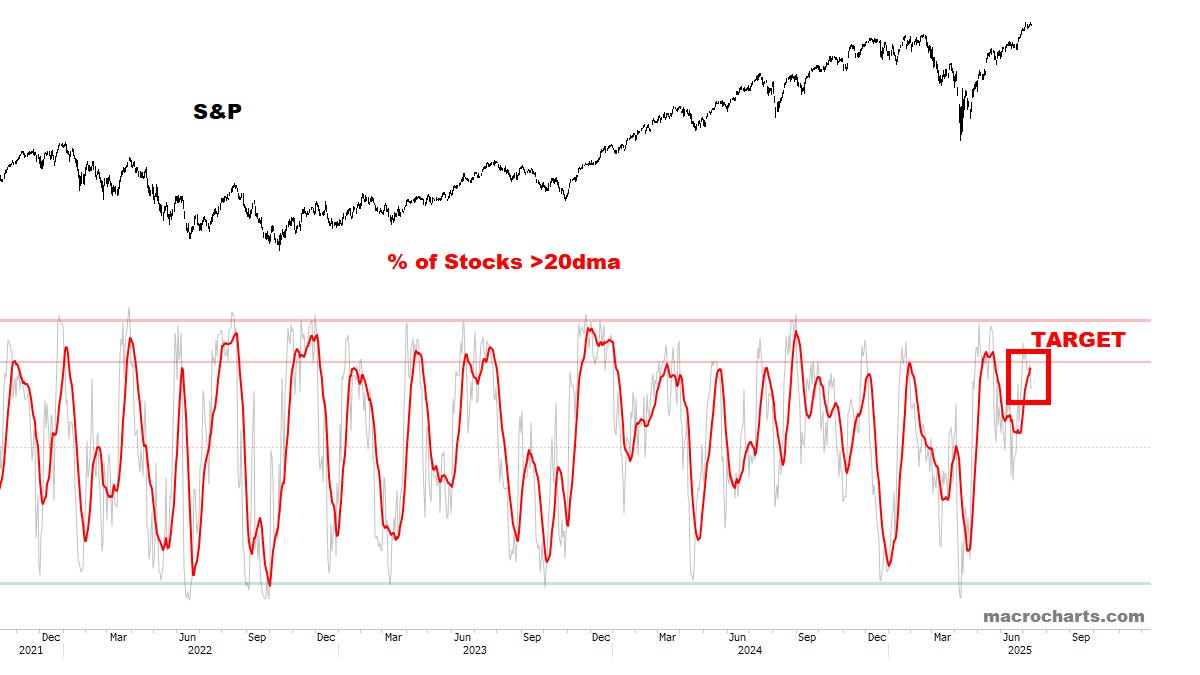

Short-Term Breadth has room to push to target range:

Summation Index remains constructive:

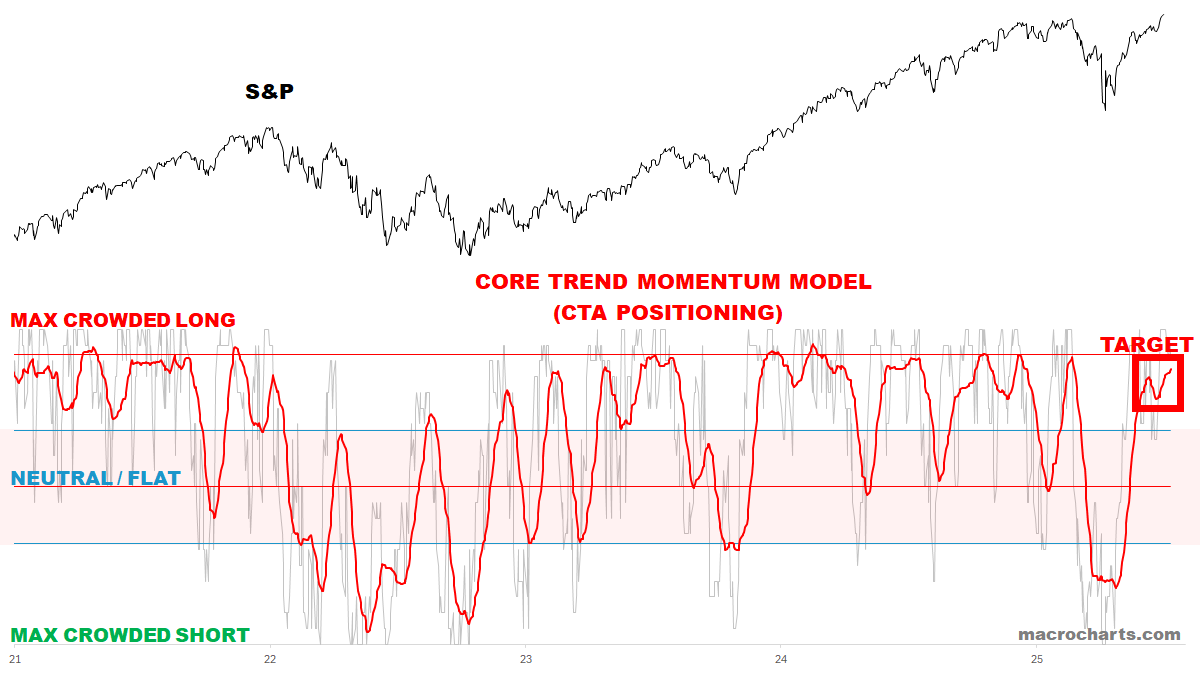

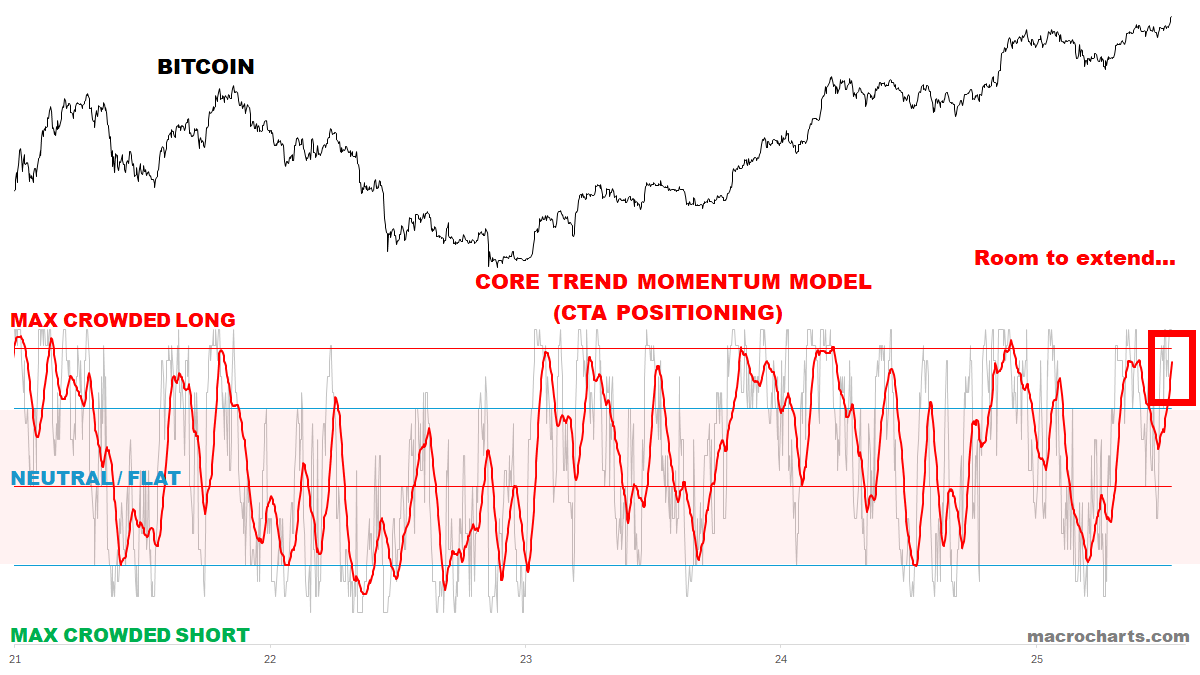

CTA Equity Trend positioning has room to get more extended:

Option Skews have room to get more extended:

Speculation Index remains a medium-term concern — but Russell momentum is still ok and Shorts are at risk of a squeeze (shown earlier):

Equity Sentiment can still go a bit higher — particularly NDX:

(*Below, compare NDX now vs. JULY 2023 / JULY 2024 for reference…)

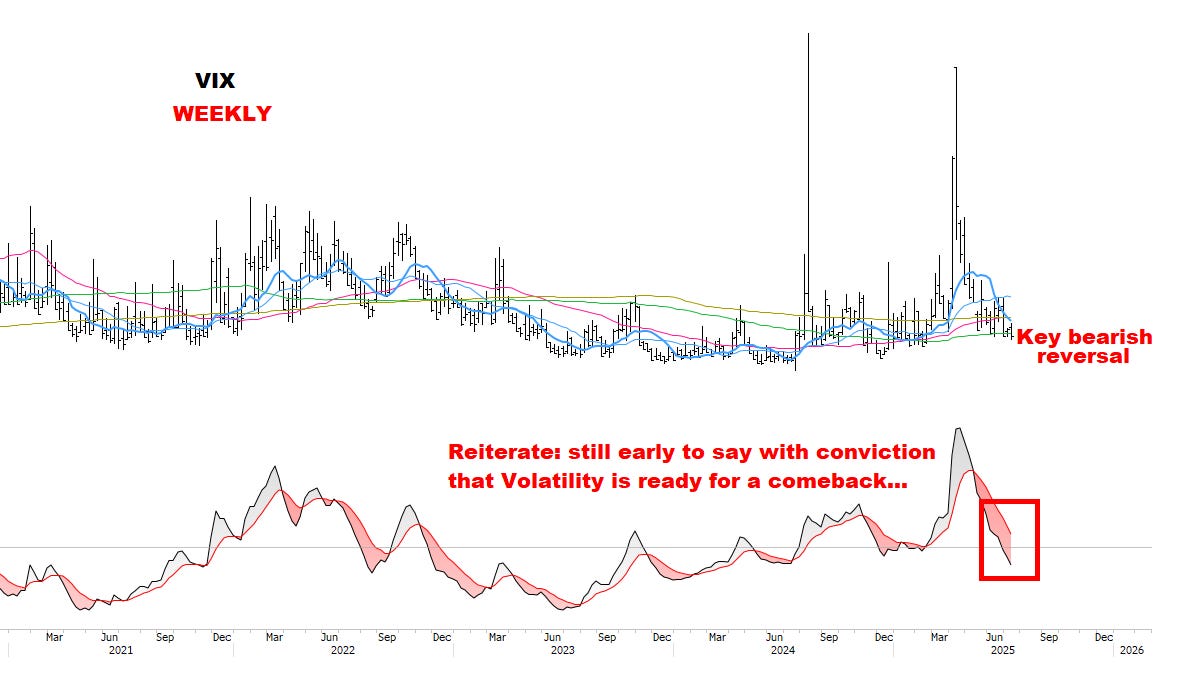

VIX Sentiment still has room down to our ideal targets — *note JULY 2023 and JULY 2024 for reference:

VIX has room to test the lower target range:

DOLLAR

The Buck stops here…?

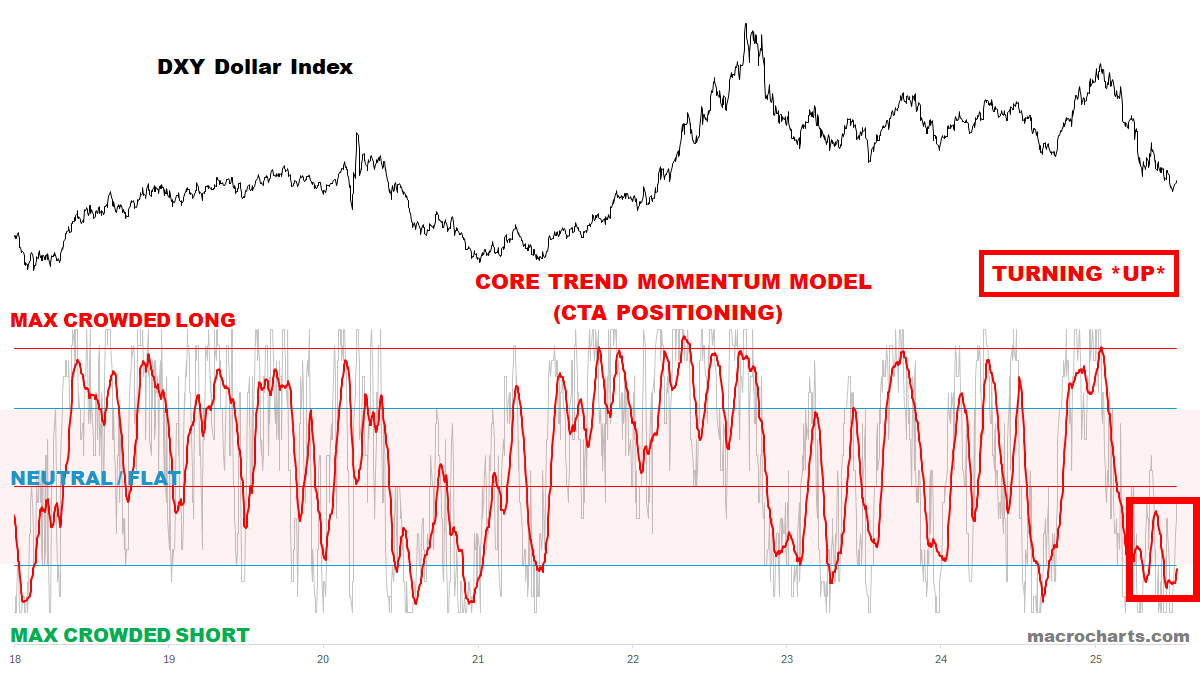

CTA Dollar Trend positioning is turning UP from bottoming range — it’s time?

Dollar Sentiment turned UP on Friday’s close — the bottom may be in:

Dollar Net Short Positioning is tied with the JULY 2023 bottom:

Momentum is slowly beginning to recover:

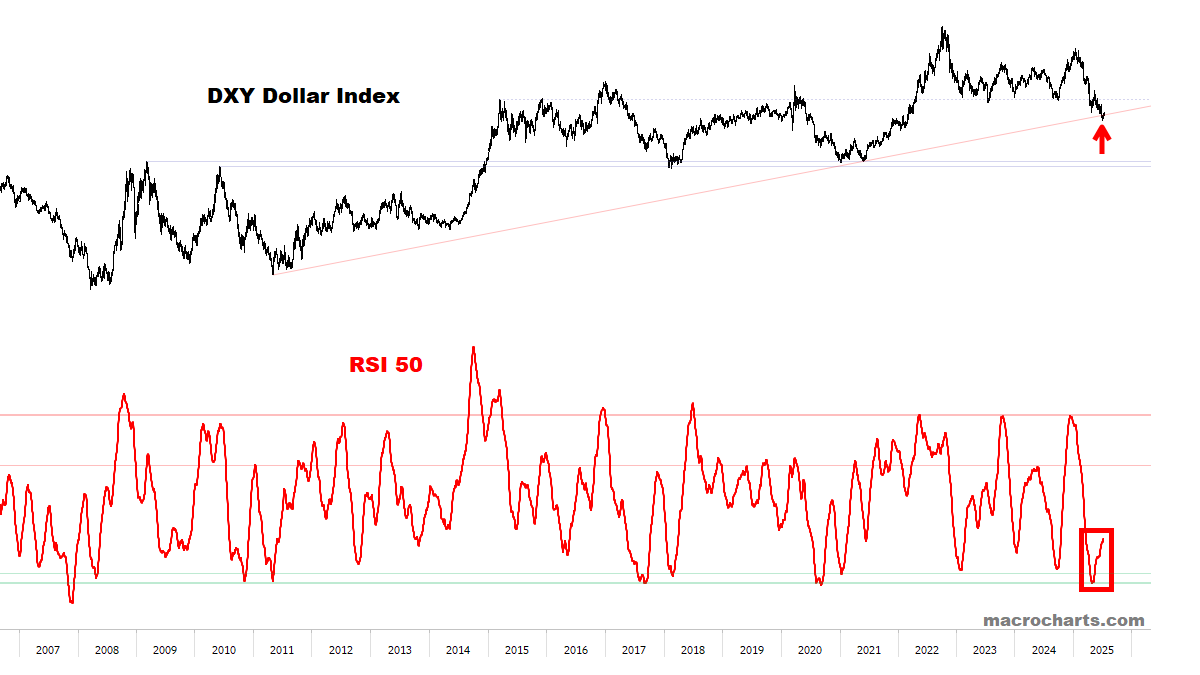

Trying to establish support at long-term channel bottom.

Starting to look like a turn but need to see a break >98 to get more conviction.

Then needs to build momentum back up, including moving averages.

Potential for a big turn here…

BONDS

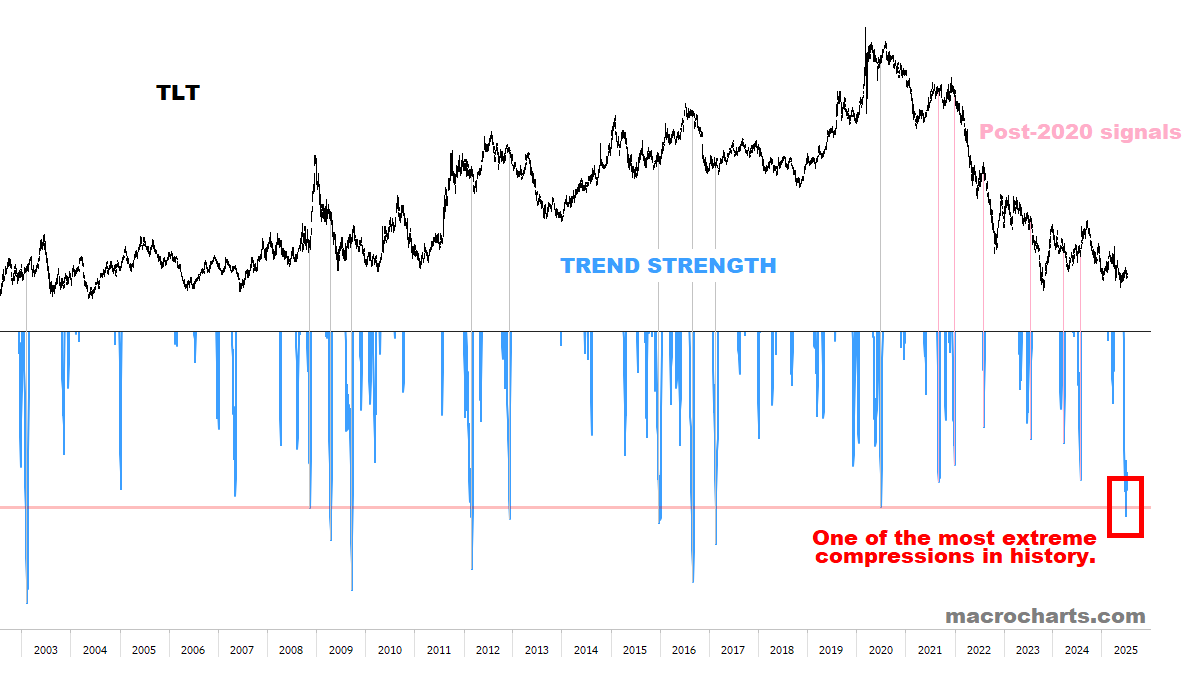

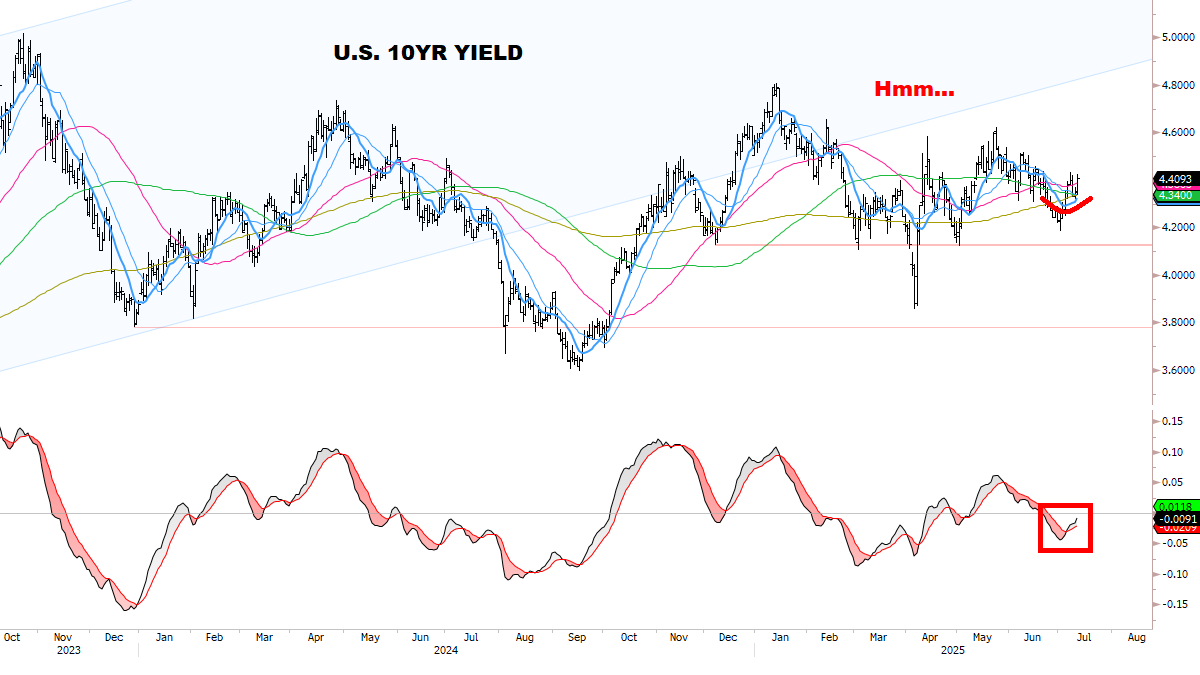

Bonds are coiled for a big move — have to stay flexible.

Feels like a shift coming… ready for the next phase:

CTA Rates Trend positioning is turning up from a mild oversold level:

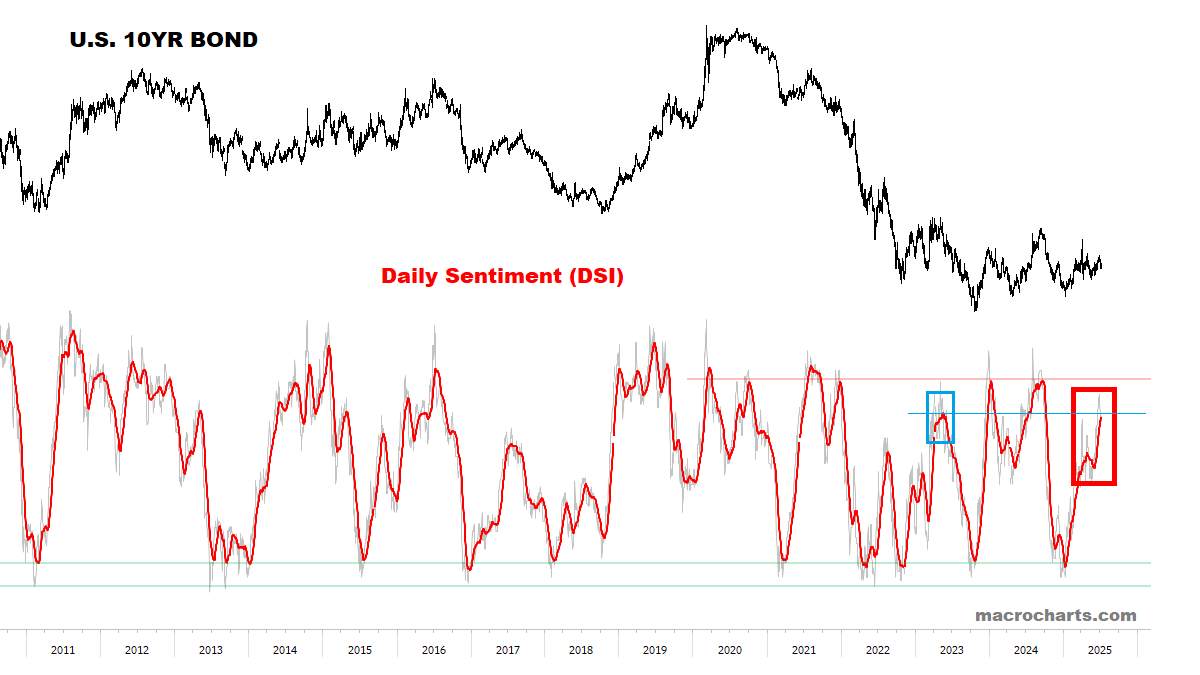

Bond Sentiment is in a tricky spot — IF it turns down here, could be similar to MAY 2023 (blue box). *Watching / will update if this triggers:

Coiled for a big move:

Last but certainly not least: maybe time to look at Steepeners again?

*Goldilocks steepening scenario: 2YR Yield “relatively anchored” by stable inflation + incoming Fed cuts, while 10YR Yield widens on higher growth expectations?

*How likely is this? We may soon find out: next week is data-heavy with CPI, PPI, Retail Sales — no pressure.

*Maybe it’s all tied to the Dollar finding a bottom? What happens to Bonds if the Dollar rallies?

PRECIOUS METALS

Tight as a drum — ready for expansion.

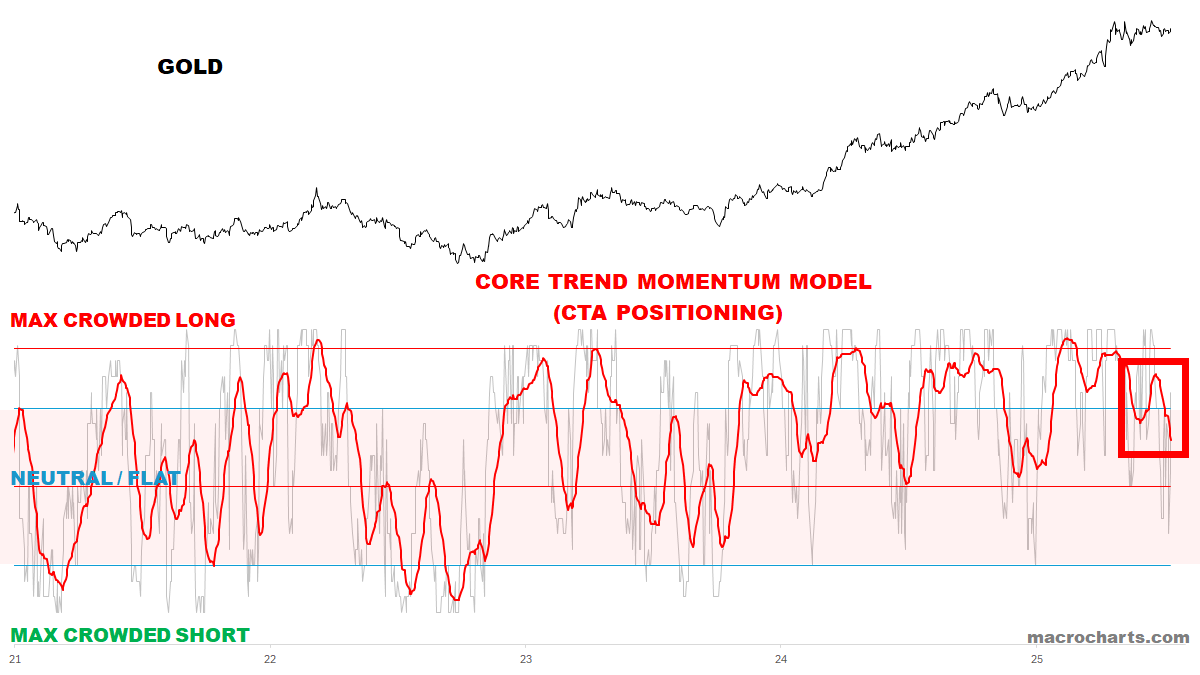

CTA Gold Trend positioning continues to lose altitude and is not oversold yet:

Gold remains on a Weekly Sell — *but Gold’s daily chart (below) may be rolling UP for another extension, AND Silver broke out again this week, so Gold Bulls have their best chance in MONTHS to step up. A failure to do so would be very bad news…

Gold Sentiment has rolled off a bit, while Silver sentiment is spiking but could go higher:

KEY TECHNICAL CHARTS 关键技术图表

A QUALITATIVE ASSESSMENT (CONTINUED)

定性评估(续)

On April 30 in “What’s Next For Stocks?”, I wrote:

4 月 30 日,在《股票的下一步是什么?》一文中,我写道:

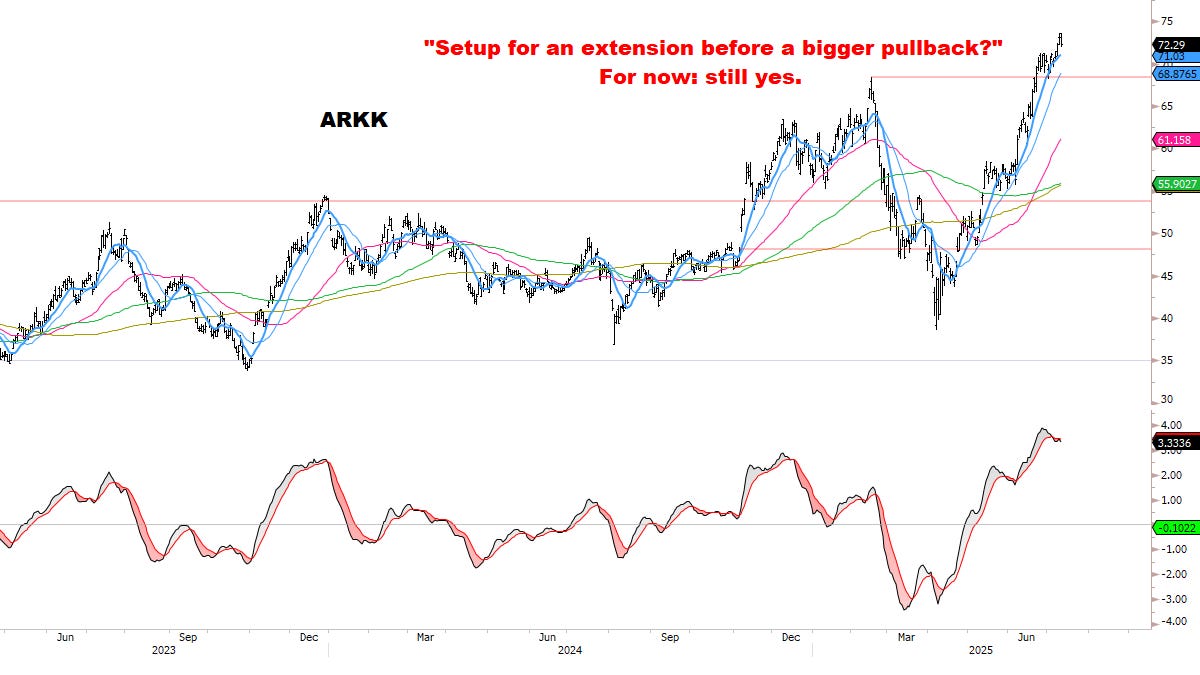

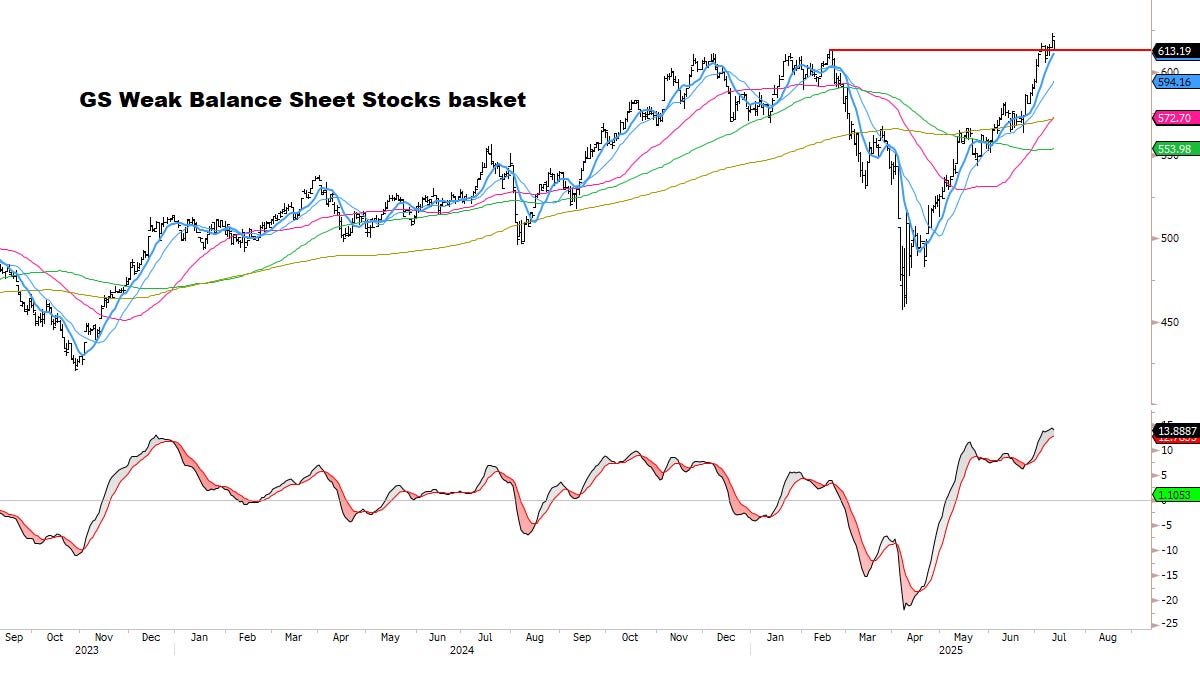

Inevitably, at some point in every rally, the wall of worry finally crumbles and even the garbage gets bought.

不可避免地,在每一次反弹的某个时刻,担忧之墙最终会崩溃,甚至连垃圾股也会被买入。This extreme risk-seeking behavior is fueled by two forces: performance-chasing, and general FOMO taking over.

这种极端的风险偏好行为由两股力量推动:追逐业绩和普遍的害怕错过(FOMO)。Looking around today, quantitatively and qualitatively I don’t think we’re quite there yet. I also think it will be a much different market picture in a few weeks’ time.

从今天的定量和定性角度来看,我认为我们还没到那个地步。我也认为几周后市场的情况会大不相同。

Things could still get extreme:

情况仍可能变得极端:

Let the rally run its course:

让反弹顺其自然:

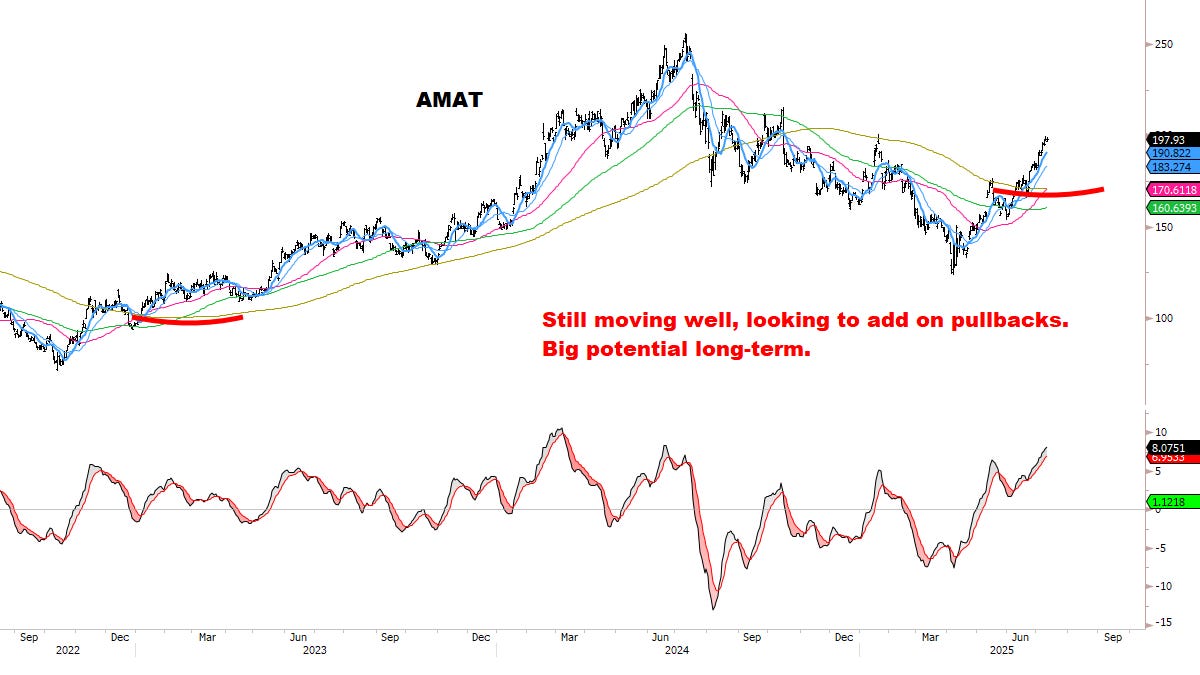

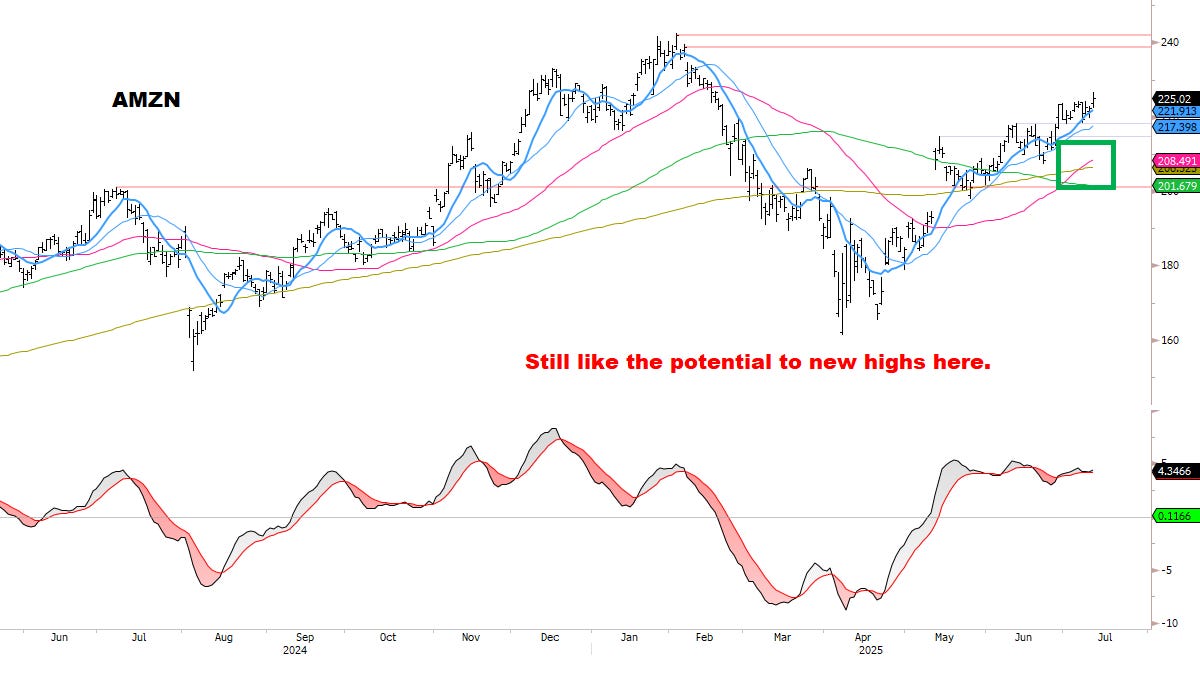

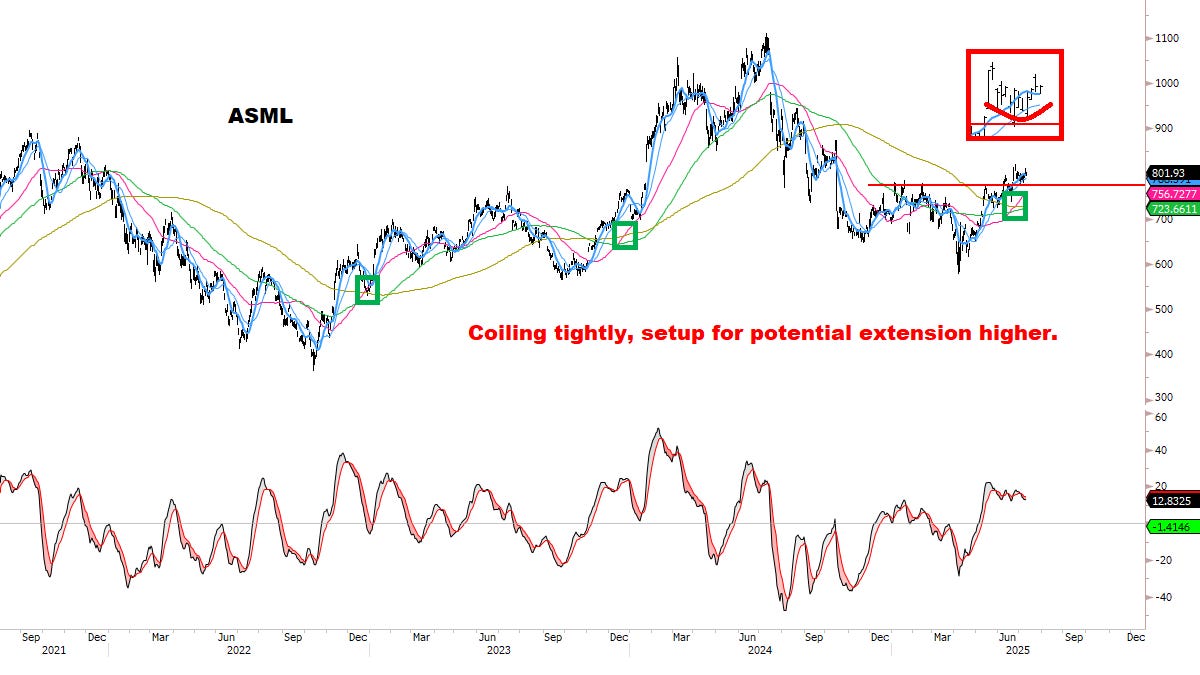

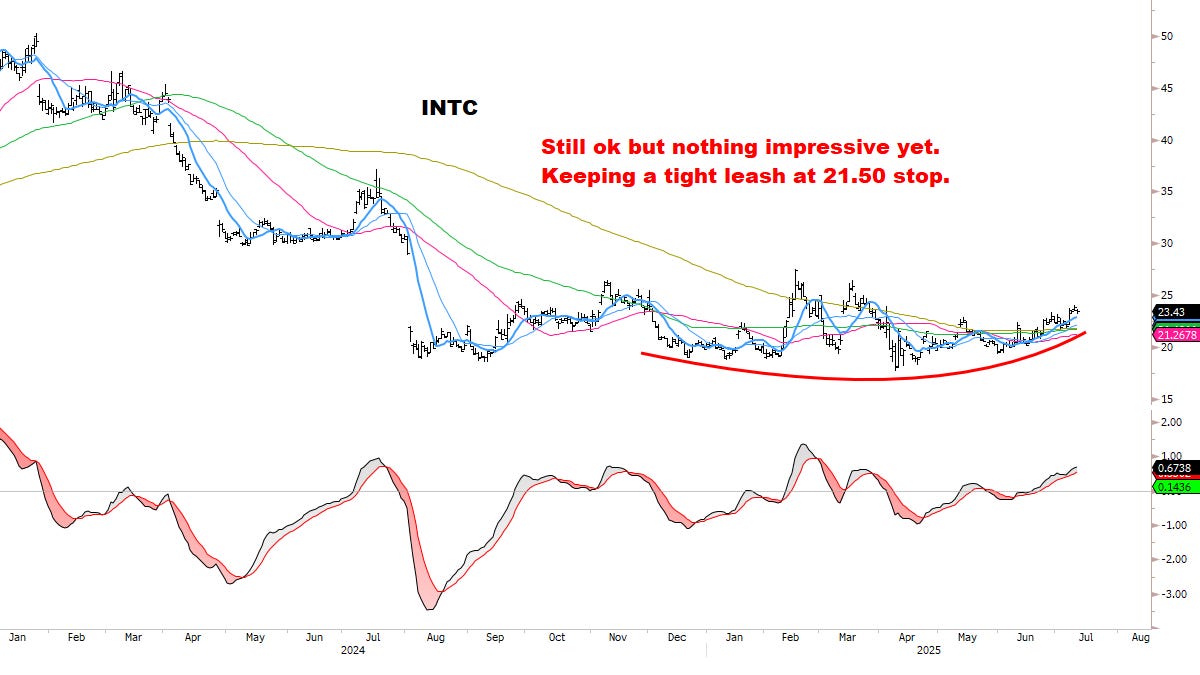

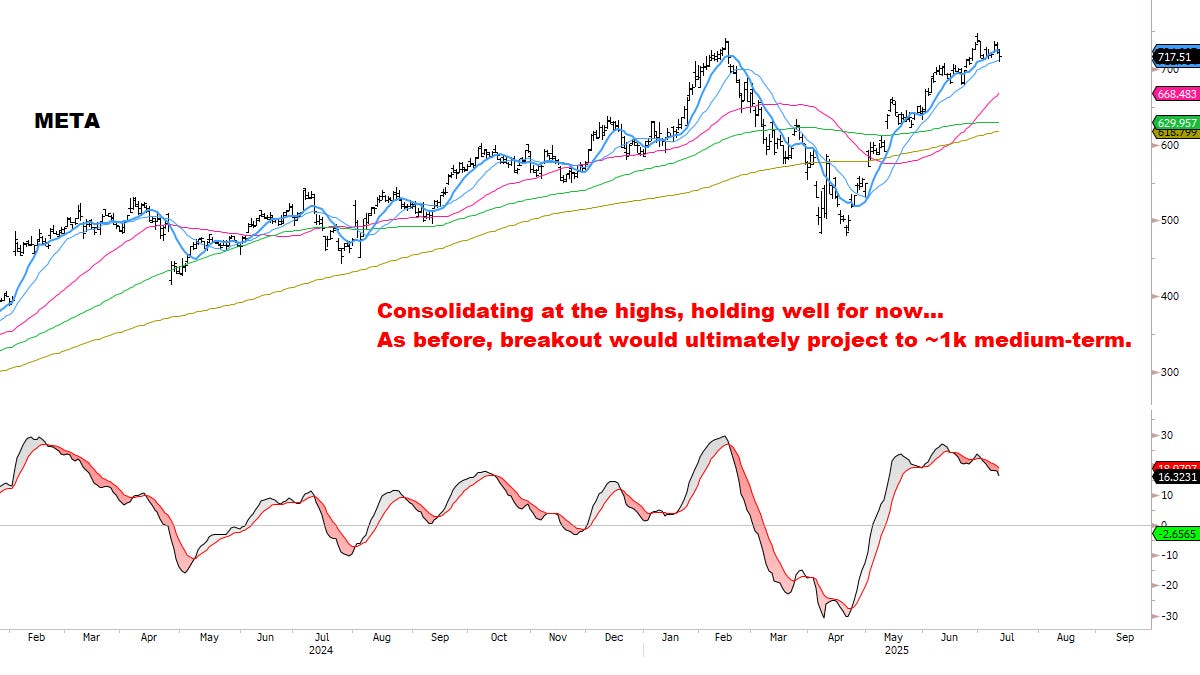

All key Sectors & Groups remain in good chart position: especially the leaders in Semis, Tech, Communication Services, and Software.

所有主要行业和板块的图表位置依然良好:尤其是半导体、科技、通信服务和软件领域的领头羊。Difficult to build a top while these leading areas continue to carry the market AND are moving in synch.

当这些领先领域继续支撑市场并同步移动时,顶部难以形成。Uptrends remain intact, with no bearish reversals in any major Index.

上涨趋势保持完好,所有主要指数均未出现看跌反转。VIX and Credit Spreads continue trending DOWN.

VIX 和信用利差持续下行。Max pain scenario remains: low-volatility grind (now in full force).

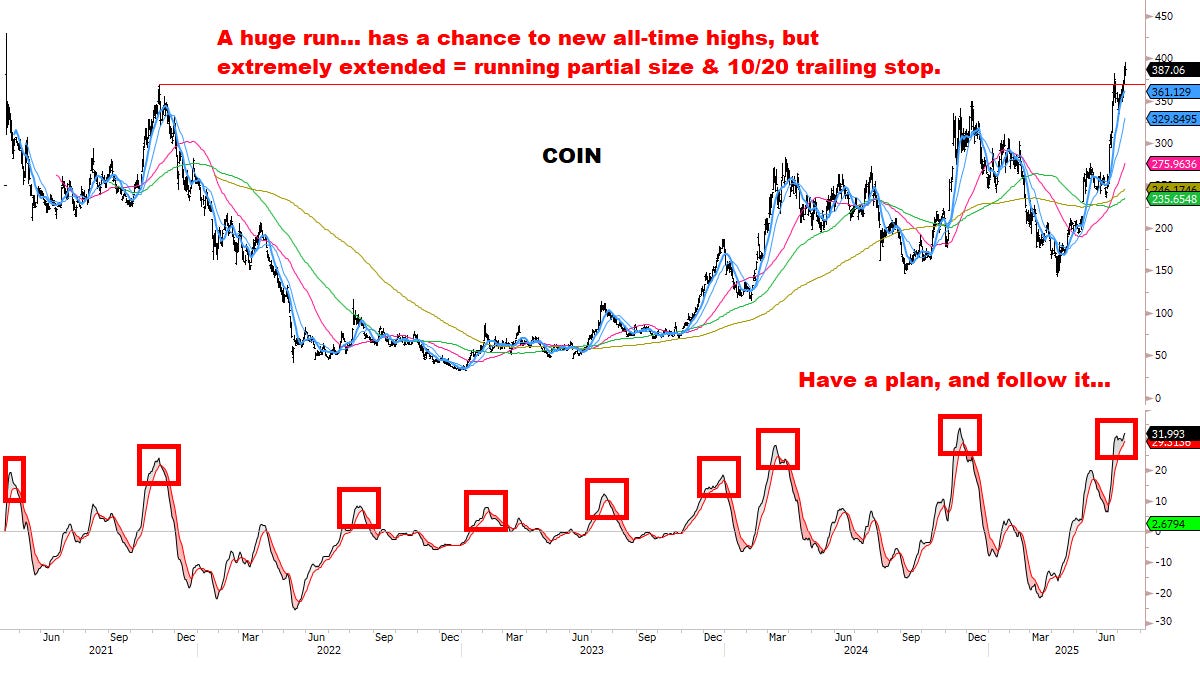

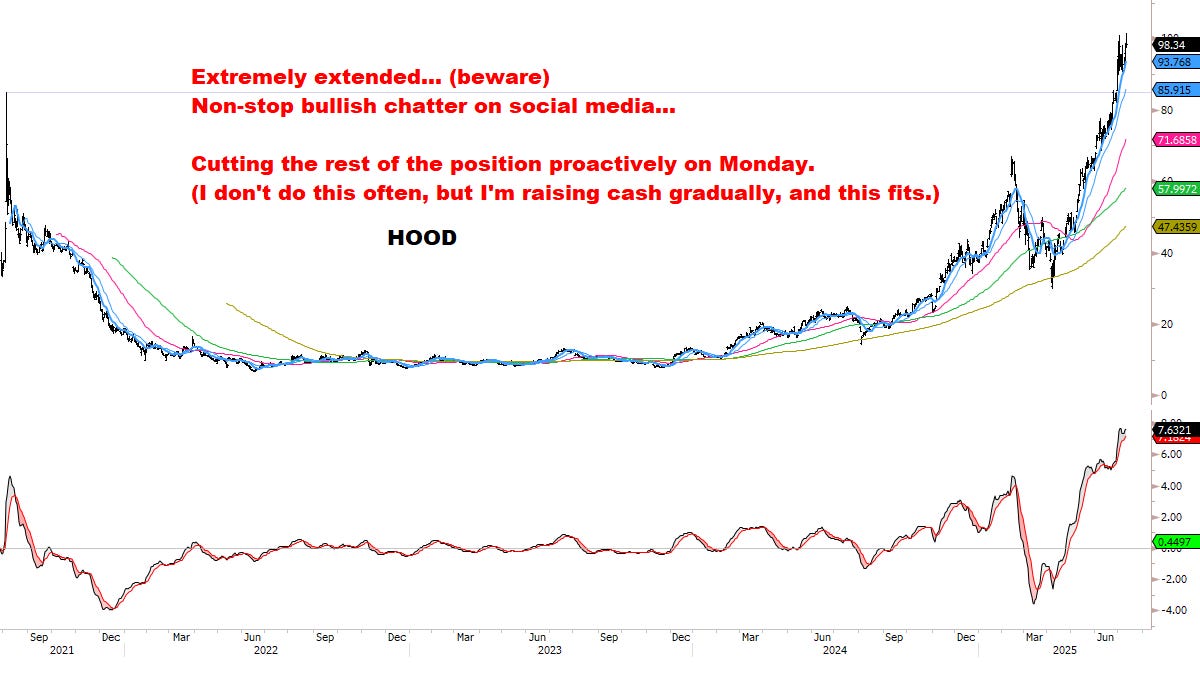

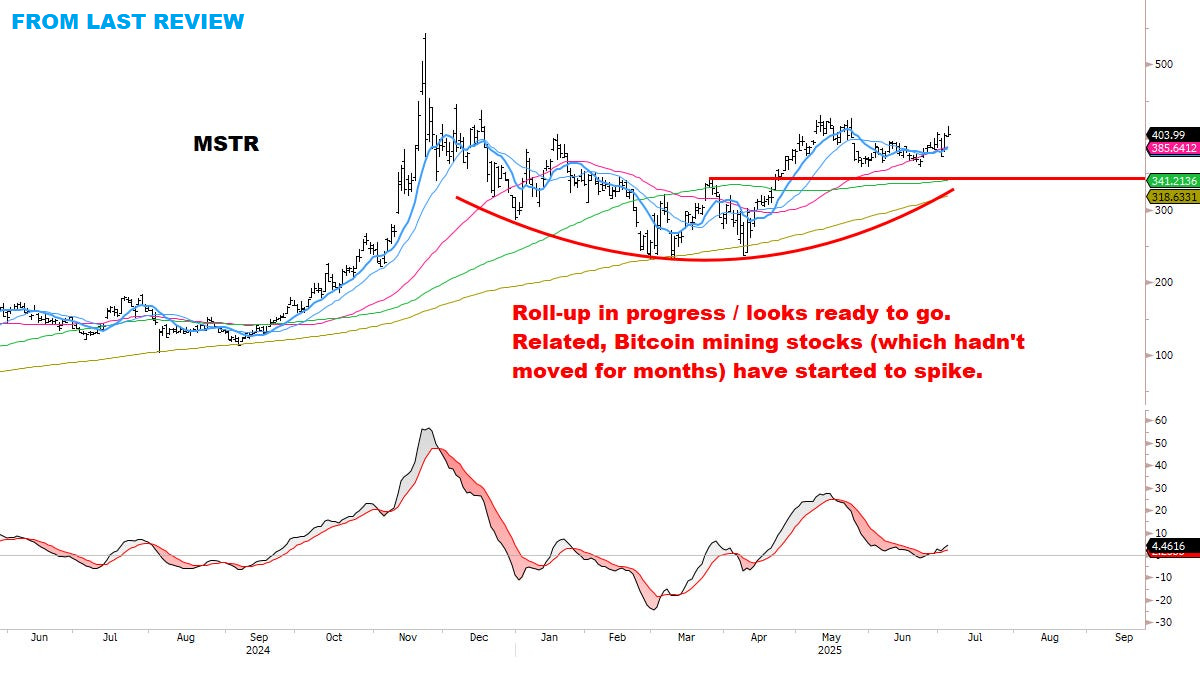

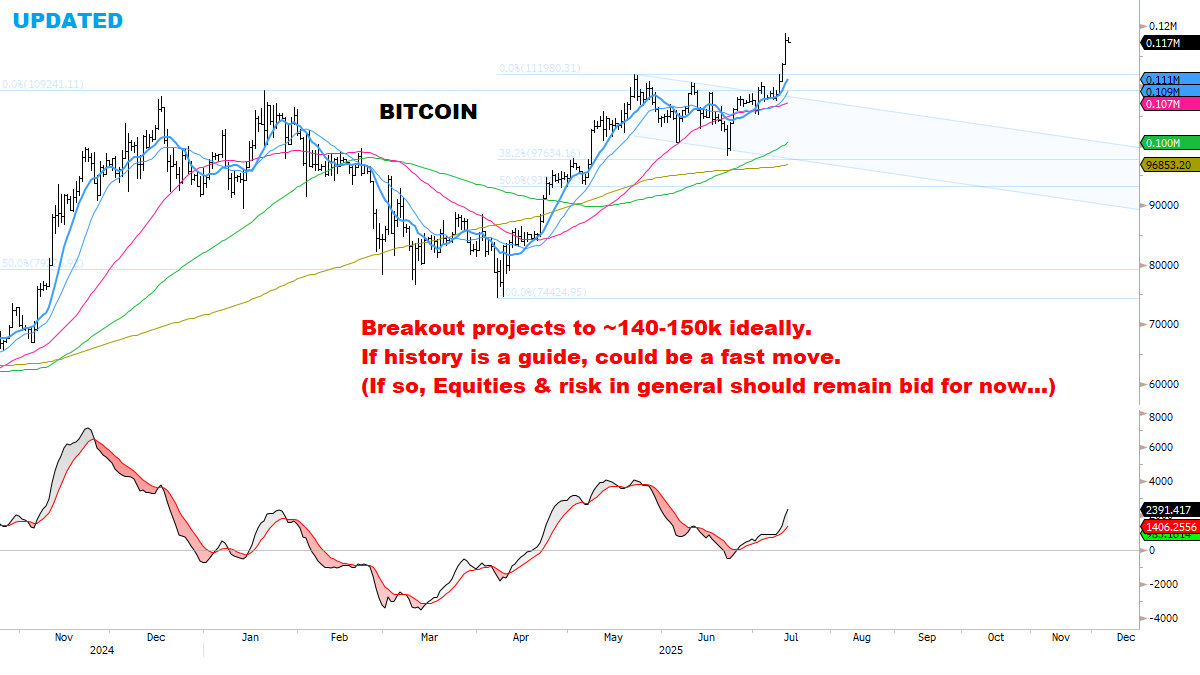

最大痛点情景依然存在:低波动率的缓慢上涨(现已全面展开)。NEW: Bitcoin and related high-beta stocks are moving well. From July 5 Review: “Crypto Stocks / Miners are starting to show strength again — perhaps anticipating Bitcoin’s breakout. We may soon find out.” (*Bitcoin broke out July 9… and the stocks correctly anticipated it.)

最新动态:比特币及相关高贝塔股票表现良好。7 月 5 日回顾:“加密货币股票/矿工开始再次显示出强劲走势——或许预示着比特币的突破。我们可能很快就会知道答案。”(*比特币于 7 月 9 日突破……股票正确地预见了这一点。)

✅ Big names still working well… NVDA now almost a 2x since April, and the first company to reach $4T.

✅ 大牌股依然表现良好……NVDA 自四月以来几乎翻倍,成为首家市值达到 4 万亿美元的公司。

✅ Last summer when we tracked a major top in Semis, we noted weakness spreading while sentiment was to the moon. Today is the complete opposite... leaders still strong, and sentiment still borderline skeptical. Stunning to behold.

✅ 去年夏天,当我们追踪半导体行业的一个重要顶点时,我们注意到尽管情绪高涨,但市场开始出现疲软。今天则完全相反……龙头股依然强劲,情绪仍然处于边缘怀疑状态。令人震惊。

Updated Stocks Scan: 更新股票扫描:

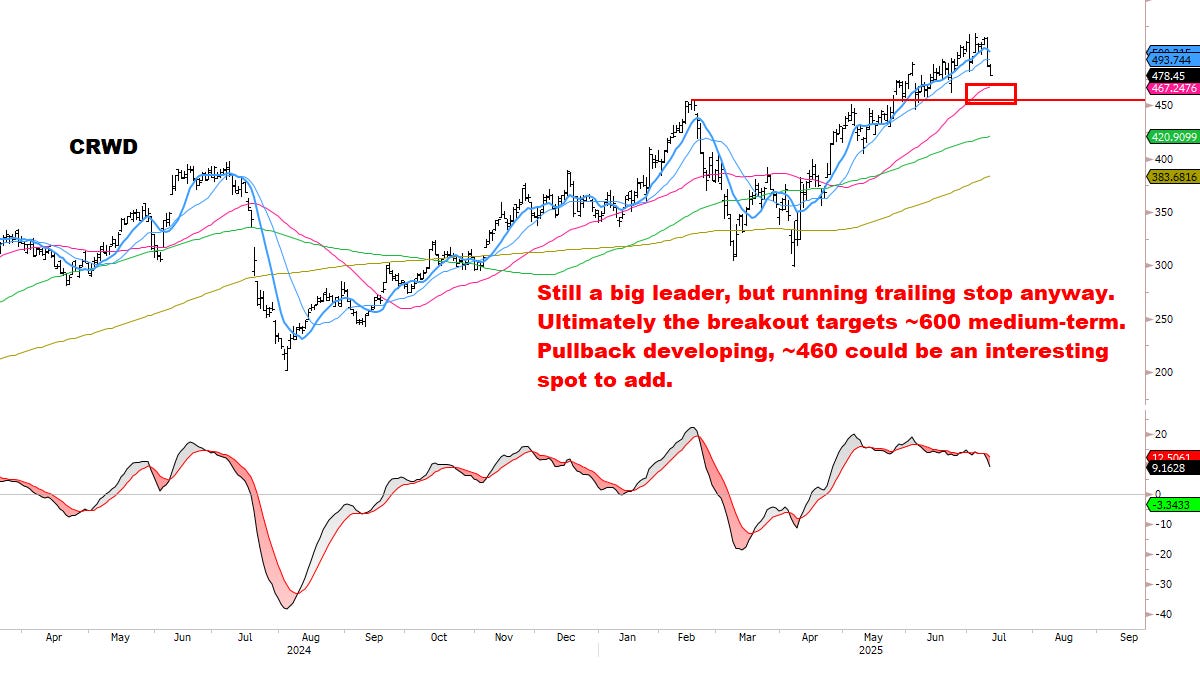

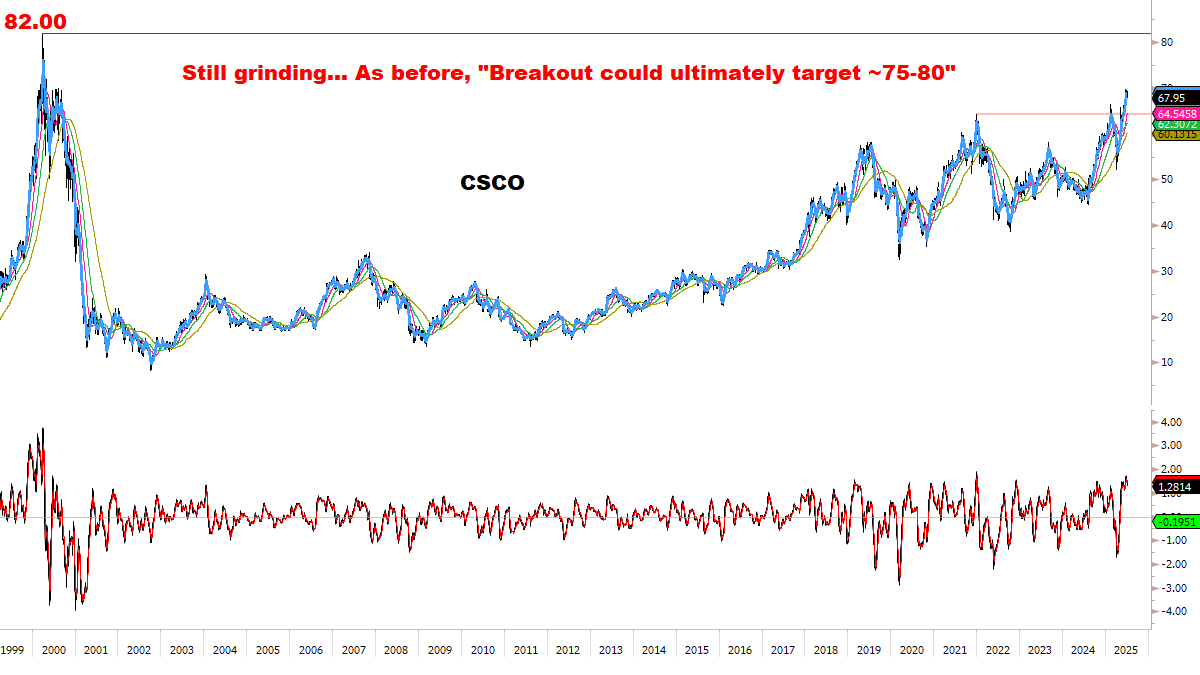

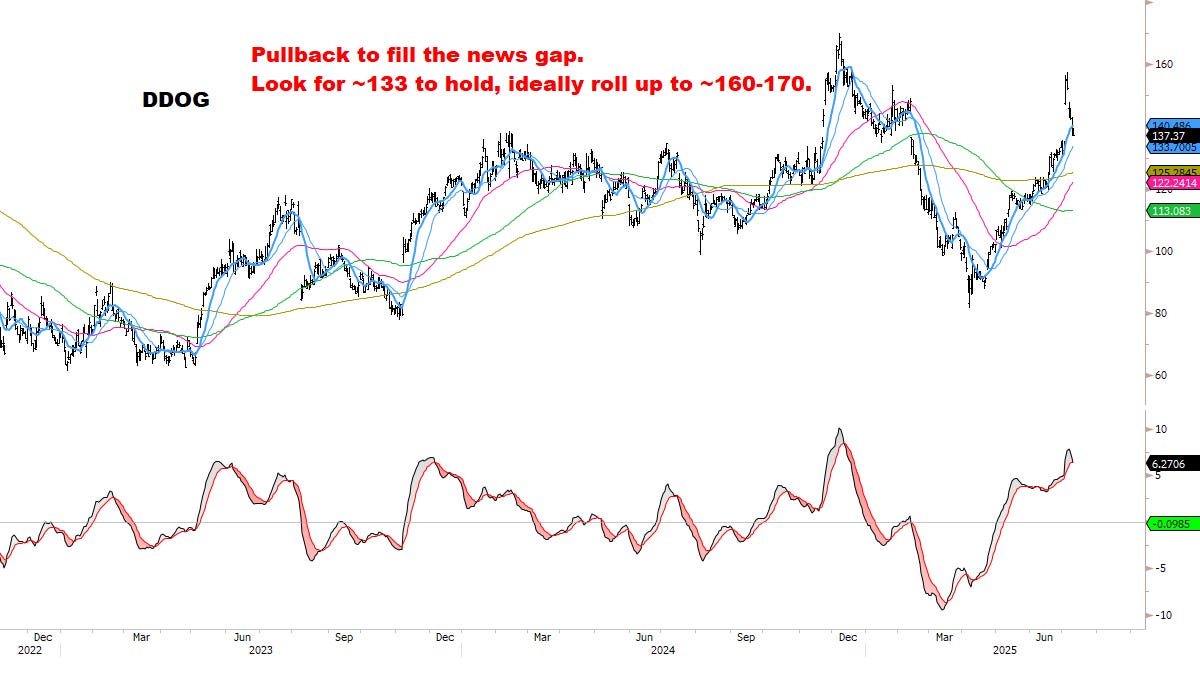

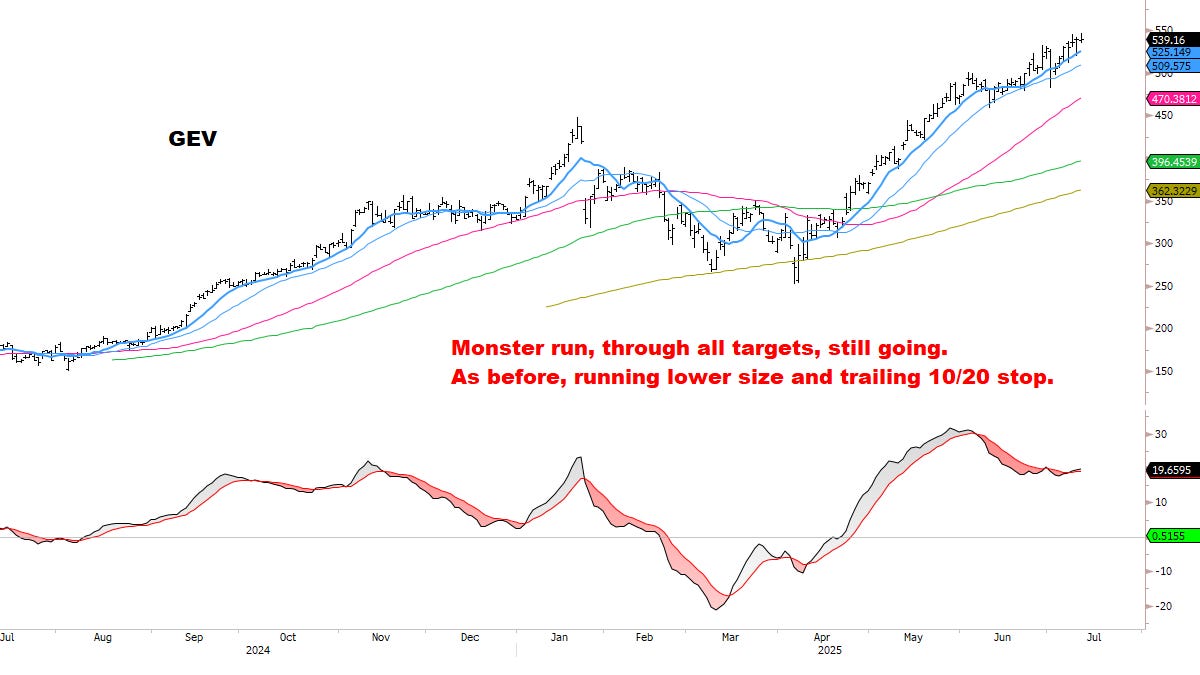

Through the end of June 2025, the average stock in our Core Watchlist was up +45%, with several names near/over 2x — a strong outperformance relative to the market.

截至 2025 年 6 月底,我们核心观察名单中的平均股票上涨了 45%,其中多只股票接近或超过翻倍——相较于市场表现出强劲的超额收益。

As before, focused on: Stocks meeting strict criteria for (1) relative strength, (2) improving momentum, (3) defined risk. Building on this list as signals develop.

一如既往,重点关注符合以下严格标准的股票:(1)相对强势,(2)动能改善,(3)风险明确。随着信号的发展,持续完善该名单。

SCAN: S&P, NDX, Tech, Semiconductors, Software, Consumer Discretionary, Speculative/High-Beta.

扫描范围:S&P、NDX、科技、半导体、软件、非必需消费品、投机性/高贝塔。

✅ Most Core names remain in leading position.

✅ 大多数核心股票仍处于领先地位。

✅ HOWEVER: it’s time to begin cutting names which aren’t keeping up, overall get more selective / hold only what's still working well.

✅ 然而:现在是开始剔除表现不佳股票的时候,总体上要更加精选/只持有仍表现良好的股票。

✅ This marks an IMPORTANT shift in strategy for the first time in this entire rally.

✅ 这标志着在整个反弹过程中,策略首次发生了重要转变。

Momentum picking up in Solar stocks:

太阳能股票动能回升:

The group was decimated, but may be waking up? Evaluating for initial size position / then build from there. (*Warning label: not for everyone…)

该集团遭受重创,但可能正在苏醒?正在评估初始仓位规模,然后从那里逐步建立。(*警告标签:并非适合所有人…)

CURRENCIES 货币

The Buck stops here…? 美元止步于此…?

Remain focused on the Big Four and looking to get involved:

继续关注四大巨头,并寻求参与机会:

OIL & ENERGY 石油与能源

From Thursday’s update: “Stalling for three days at ideal topping range ~68.50, which contains the key downtrend resistance. If looking to add/enter Shorts, this is a clean setup with a tight stop at 70. Focused on Equities lately and adding to BTC, plus leaving room to buy USD if there’s an opening. Otherwise I’d be doubling my Short WTI right here, no question.”

来自周四的更新:“在理想的顶部区间约 68.50 处停滞了三天,该区间包含关键的下跌趋势阻力位。如果打算加仓/入场做空,这是一个干净的布局,止损设在 70 点位。最近专注于股票市场并增加了 BTC 的持仓,同时留有空间在有机会时买入美元。否则,我肯定会在这里加倍做空 WTI,毫无疑问。”

BITCOIN

“Big Beautiful” — remains a core focus area:

Trend Power Oscillator: *Follow the Trend — this could be a big one*

Tracking the perfect sequence:

From Thursday’s update: “The breakout is beginning. A lot of eyes on it but also a lot of second-guessing ‘is this it’. Meanwhile all trend signals remain up, the job here is to follow and let the market tell you what this is. Here we are, QQQ and BTC at all-time highs, and maybe a lot more to come this summer.”

Great update, MC.

New subscriber, love the analysis. Where can we find the complete list of stocks on Core Watchlist?