Daniel Grizelj

Today's theme is sector rotation! Sector rotation is a strategy where investors move portfolio positions between different sectors based on the stage of the economic lifecycle. The idea is that some sectors tend to outperform while others underperform with a degree of regularity. By rotating their investments into underperforming sectors expected to rise and out of outperforming sectors expected to fall, you can spin a wheel of constant appreciation…in theory.

產業輪動是一種投資策略,投資者依經濟週期將資金在不同產業間轉移,理論上可透過賣出強勢產業、買入弱勢產業來持續獲利。

This strategy applies broadly across the market to a variety of asset classes. In fact, it's been a tried and true investment strategy for generations, proving to serve investors a fortuitous cycle. Over time, sector rotation has become less effective as transparent and market efficiency improve over years and years. Despite challenges, the strategy remains broadly successful, especially in niche asset classes, such as real estate.

此策略適用於多種資產類別,雖因市場效率提升使其效果減弱,但在房地產等特定領域依然有效。

It's no secret that REITs sit at the core of REITer's Digest. After all, it's the lion's share of my professional experience, so it's to be expected that REITs will come up frequently in my publications. Today will be no different as we explore sector rotation in commercial real estate.

REITs 是我專業經驗的核心,今天我們將探討商業房地產的產業輪動。

Setting The Stage

Sector rotation as a broad strategy involves capitalizing on market exuberance and upswings as well as downturns. Asset classes go in and out of style in commercial real estate, but by and large, their staying power has remained through generations.

產業輪動策略旨在利用市場的起伏獲利。商業地產的資產類別各有興衰,但長期價值依然存在。

What do I mean?

Look at the big three: office, multifamily, and industrial. Each has had its peaks and valleys over long time horizons. Investors who were willing to sell at the peaks and confidently buy in the valleys have historically been rewarded. This strategy is effective. Even better, the trends are often relatively easy to identify.

以辦公、住宅和工業地產為例,它們都經歷過景氣循環。在高峰賣出、低谷買入的投資者通常能獲利,且趨勢相對容易辨識。

In today's discussion, I will present an opportunity for sector rotation in real estate. We will take in incisive look into two of the top REITs in their respective sectors. While one company is currently trading at all-time highs, riding the momentum of key tailwinds, the other offers new value as renewed interest returns to net lease. I float the idea of selling one to buy the other based on valuation discrepancies in a thematic play as sectors begin to rotate.

本文將提出一個房地產產業輪動的機會,分析兩個頂尖的 REITs。一家公司股價處於歷史高點,另一家則價值浮現。我建議基於估值差異,在產業輪動之際賣出前者、買入後者。

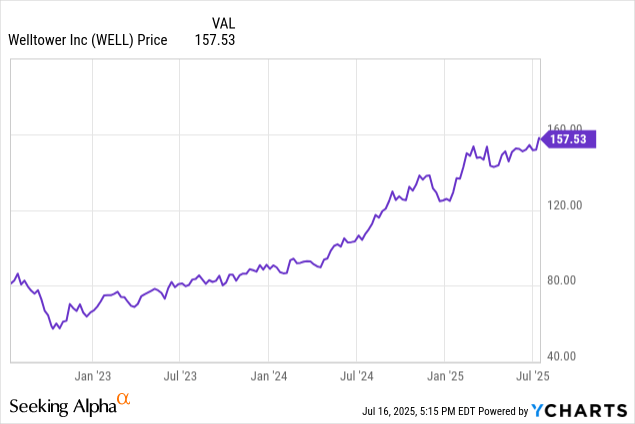

Welltower (NYSE:WELL), the world's largest publicly traded senior living REIT, has surged over the past twelve months to all-time highs on account of market confidence and emerging demand drivers.

全球最大的上市養老房地產 REIT Welltower (WELL),因市場信心與需求驅動,過去一年股價飆升至歷史新高。

In contrast, Realty Income (NYSE:O), the blue chip of the net lease sector, remains in the doldrums following several punishing years that have dramatically impacted the company from the standpoint of operating challenges and opportunity cost.

相對地,淨租賃領域的績優股 Realty Income (O),在經歷數年營運挑戰與機會成本的衝擊後,股價依然低迷。

While investors hold the status quo, I see emerging market dynamics that could suggest getting ahead of the game could be a wise decision.

當多數投資者維持現狀時,我看到新興的市場動態,暗示提前佈局可能是明智之舉。

The Sell: Welltower

Over the past several years, senior living demand has expanded significantly. The pandemic uncovered flaws and issues within senior living that cause market upheaval. Following several years of aging demographics and limited new deliveries coming online, there is once again a supply-demand mismatch in the marketplace. For WELL, the world's largest senior living REIT, this has materialized into revenue growth and increased demand.

近年來養老住宅需求顯著擴大。在人口老化和新建案有限的情況下,市場出現供需失衡,這為全球最大的養老房地產 REIT WELL 帶來營收增長。

According to Cushman & Wakefield, senior living fundamentals are strong and getting stronger.

根據高緯環球的數據,養老住宅的基本面強勁且持續增強。

- U.S. senior living property market fundamentals continue to strengthen. Stabilized occupancy trended upward for the seventeenth consecutive quarter, surpassing 89% overall, with secondary markets reaching 90% occupancy, a level not obtained since 2017.

美國養老住宅市場基本面持續走強,穩定入住率連續十七季上升,總體超過 89%,次級市場更達到 90%,創下 2017 年以來新高。- The number of occupied units reached a new all-time-high in Q1 2025 with net absorption outpacing supply growth by 2.5 to 1, as inventory growth remains near historic lows.

2025 年第一季入住單位數創下歷史新高,淨吸納量為供給增長的 2.5 倍,庫存增長則維持在歷史低點。- Annual rent growth, though tapered from prior quarters, has remained intact, averaging 3.9% in Q1 2025, a dip that is likely seasonal as the sector emerges from winter months. This outsized occupancy and rent growth has helped counterbalance short-term turbulence in the broader capital markets.

2025 年第一季租金年增率為 3.9%,雖較前期放緩,但可能受季節性因素影響。強勁的入住率與租金增長,有助於抵銷資本市場的短期動盪。

The market has taken note, and the company is currently trading at an extraordinary valuation from both an earnings multiple and share yield perspective. What was once a high yielding REIT is now considered a growth powerhouse by Mr. Market. Shares of WELL have more than doubled over the past three years as the company's earnings multiple balloon past 30x.

市場已注意到該公司極高的估值。這家曾是高股息的 REIT,現已被市場視為成長型巨頭。過去三年,WELL 股價翻漲一倍以上,本益比也飆升超過 30 倍。

The question becomes if the company is able to deliver on the lofty expectations. Often in a slow-moving game like real estate, the answer is no.

問題是公司能否達成高度期望。在房地產這種變化緩慢的市場,答案往往是否定的。

In fact, it appears as though trouble is brewing in senior living. Just recently, one of WELL's tenants declared bankruptcy as mounting expenses in the industry overtook their revenue generating abilities. Historically, WELL has been able to navigate tenant issues including limiting ties with Genesis Healthcare ahead of their bankruptcy.

長照產業正醞釀危機,近期 WELL 便有租戶因成本攀升、壓垮營收而宣告破產。然而,WELL 過去曾成功應對租戶問題,例如在 Genesis Healthcare 破產前即已減少往來。

In 2021, Welltower announced it was cutting most of its ties with Genesis in a massive $880 million deal, which included terminating leases with the nursing home giant on 51 of its properties.

2021 年,Welltower 宣布一項 8.8 億美元的交易,終止與護理巨頭 Genesis 的 51 處物業租約,從而切斷雙方大部分的合作關係。

Even still, according to Bisnow, Genesis owes WELL a significant amount of money.

根據 Bisnow,Genesis 仍欠 WELL 大筆款項。

Genesis owes roughly $700M to secured creditors, including Welltower, a REIT with a $100B market cap, and Omega Healthcare Investors, another REIT it leases properties from, according to the WSJ.

華爾街日報指出,Genesis 欠下 Welltower 等有擔保債權人約 7 億美元。

Interestingly enough, this was identified as a key consideration in Hindenburg Research's short report on WELL published several years ago.

Hindenburg Research 幾年前的放空報告中,就已點出此問題。

- Red flags indicate that another of Welltower's distressed deals, a 2021 restructuring with its troubled 4th largest operator, Genesis Healthcare, mirrored the latest 'miracle' deal.

警訊顯示,Welltower 在 2021 年與其第四大營運商 Genesis Healthcare 的重組案,與近期一筆交易如出一轍。- In late 2021, evidence suggests that Welltower quietly disposed of 21 of its distressed Genesis assets to a Gefner-affiliated firm, once again handing skilled nursing facilities over to an inexperienced manager and clearing its books of the mess.

2021 年底,Welltower 為清理帳目,將 21 項不良 Genesis 資產低調出售給 Gefner 的關聯公司,並再次將專業護理機構交由無經驗的管理者經營。

The issue with WELL lies in the company's current valuation. While tailwinds continue to power the company ahead, trading at more than 30x FFO tells a cautionary tale for a senior living REIT which has historically been a high yielder. While WELL is priced to perfection, I am beginning to doubt the feasibility or likelihood that the market will deliver a senior living renaissance over the next couple of years. Considering shares of WELL are up around 50% over the past twelve months, taking profits looks appealing.

WELL 的問題在於估值。儘管前景有利,但其營運現金流(FFO)本益比超過 30 倍,對於一個歷史上的高收益安養宅 REIT 而言是個警訊。WELL 的股價已反映完美預期,但我懷疑安養市場在未來幾年能否復甦。考量到股價在過去一年已上漲約 50%,獲利了結深具吸引力。

The question becomes where to put them.

關鍵在於資金的去向。

The Buy: Realty Income

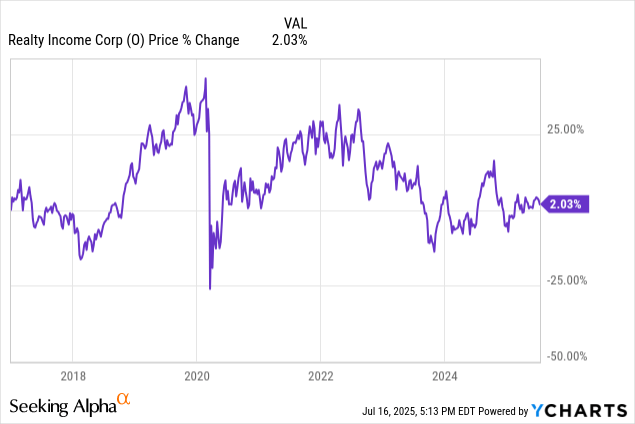

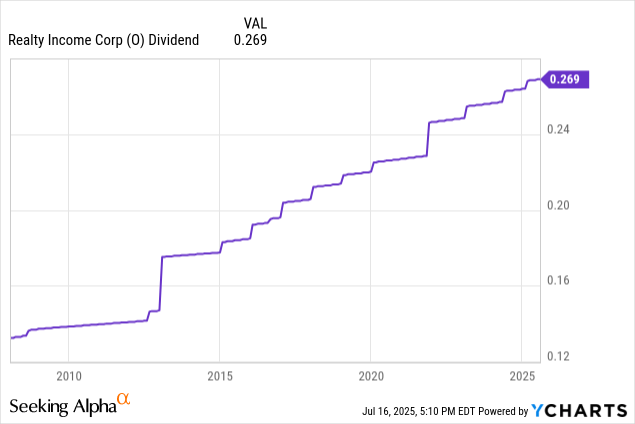

While O has established an impressive, generational track record, the company is facing a flat five year period. Shares appear to be stuck as the company faces increasing risks and a risk free rate that is challenging the value of the company's monthly dividend.

儘管 O 擁有輝煌的長期紀錄,但公司正邁入成長停滯的五年。由於風險增加,且無風險利率挑戰其月配息的價值,導致股價陷入僵局。

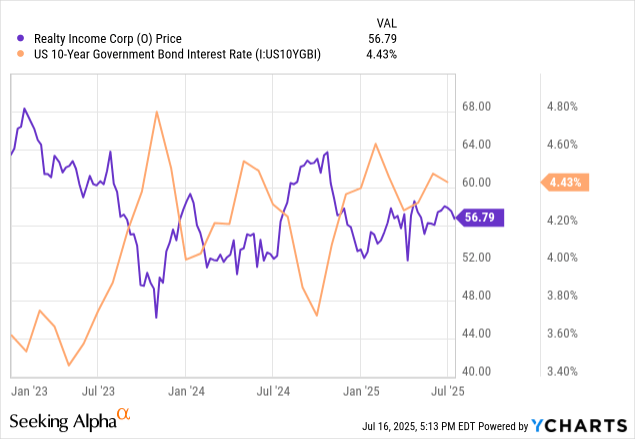

Shares have more or less been flat over the past seven years despite the company continuing to grow earnings per share and the dividend. While O's current dividend and AFFO yields are historically high, their attractiveness is limited when compared to a ten year treasury yielding 4.5%.

過去七年,儘管每股盈餘與股息持續成長,股價卻大致持平。目前股息與 AFFO 殖利率雖處於歷史高點,但相較於 4.5%的十年期公債,吸引力受限。

However, if rates are to decline, O presents a great opportunity. That said, the "if" in that sentence is powerful considering how long we have waited for some relief in rates. With that said, the tide appears to be turning.

如果利率下降,O 將是絕佳機會。但考量到漫長的等待,這個「如果」仍是關鍵變數。不過,趨勢似乎正在轉變。

Blackstone (BX) is making a considerable push into the net lease sector as long duration REITs become increasingly attractive. The massive alternative asset manager has been packing on net lease assets. Most surprisingly was the announcement that net lease real estate would become a material component of BX's mortgage REIT, the Blackstone Mortgage Trust (BXMT), as the fund struggles to redeploy repaid loans into a complicated commercial mortgage market. I suppose if you close your eyes and use your imagination, one could make the argument that net leased assets are a real estate credit investment.

由於長期型 REITs 的吸引力增加,黑石集團(BX)正大舉進軍淨租賃領域。更令人意外的是,旗下的抵押貸款 REIT——黑石抵押貸款信託(BXMT)也將把淨租賃房地產納為重要投資,以應對其在複雜商業抵押貸款市場中再投資的困境。此舉可解釋為將淨租賃資產視為一種房地產信貸投資。

"As we look ahead, we are leveraging the same Blackstone platform advantages and entrepreneurial DNA to look across the real estate credit universe and identify the best-suited incremental, strategic opportunities for our business," Katie Keenan, CEO of Blackstone Mortgage, said on the call. "With interest rates remaining elevated, a positive outlook for the U.S., consumer and essential needs-based retail showing resilient performance, we see a compelling setup today to build a credit-oriented, diversified net lease strategy."

黑石抵押貸款公司執行長 Katie Keenan 表示,公司將運用其平台優勢與創業精神,在不動產信貸領域尋找策略機會。她指出,在高利率、美國消費者前景樂觀及必需品零售業表現強韌的環境下,現在正是建立以信貸為導向、多元化的淨租賃策略的良機。

The important takeaways here is that the smart money begins to move towards long leased assets, it could be a leading indicator that interest could soon return to net lease. For O, the world's largest net lease REIT and the de facto net lease index fund, this could become a thematic play.

聰明錢開始流向長租期資產,這可能是市場對淨租賃領域重燃興趣的領先指標。對全球最大的淨租賃 REIT 公司 O 而言,這可能成為一個主題性投資機會。

While investors wait, the company's nearly 6% yield is ample to compensate us while we wait for the market to once again love the Big O. Better yet, investing today means buying in at 13.3x forward adjusted funds from operations per share. This is a far more reasonable earnings multiple than the >20x AFFO where O was priced several years ago. For a company with a solid balance sheet and a continued track record of dividend growth, this multiple is considerably more attractive and leaves plenty of room for future growth.

在等待市場復甦時,投資者可獲得近 6% 的殖利率。目前預期 AFFO 本益比為 13.3 倍,遠低於幾年前的 20 倍以上,估值更為合理。考量到公司穩健的財務與股息增長紀錄,此估值具吸引力並有未來增長空間。

O does not come without certain risks and challenges. Over the past year, I've published several critical articles of O mainly discussing their issue with Mission Creep, driving their attention away from their bread and butter business.

O 並非沒有風險與挑戰。我過去曾發表文章,主要討論其「使命偏離」(Mission Creep)問題,即將注意力從核心業務轉移。

My concern around O lies towards the future. As we illustrated, the company's growth has slowed over the past decade. Traditional growth drivers like acquisitions are no longer moving the needle as a percentage of enterprise value. This means changing share level metrics will also become more difficult as larger transactions become necessary.

對 O 的未來感到擔憂,因其過去十年增長放緩。公司規模龐大,導致傳統收購策略的增長效益有限,未來需靠更大規模的交易才能提升每股指標,執行上將更為困難。

Since I published that article in July, Realty Income has continued to expand and adapt their business including the addition of a private capital platform to generate asset management fees. While I see downsides, I must acknowledge their creativity and ingenuity. In the meantime, the longest running dividend in net lease continues to grow.

自七月以來,Realty Income 持續擴展業務,新增私人資本平台以賺取資產管理費。儘管我認為此舉有缺點,但仍肯定其創意。同時,其最悠久的淨租賃股利也持續成長。

Key Risks

As with any investment strategy, there are risks that need to be considered. In this case, there are two categories of risk that should be assessed: strategic risks and opportunity cost.

與任何投資策略一樣,需要考慮風險。在這種情況下,需要評估兩類風險:策略風險和機會成本。

In the first case, sector rotation carries key risks. The strategy involves timing the market by identifying low points and high points, which means trying to predict future trends. While using valuations as a guiding tool for identifying bubble-like situations across the market is helpful, it is not perfect. For example, people have been calling out tech as being due for a sector rotation for the past decade. Instead, the largest names have bucked the trend by delivering on their stratospheric growth estimates. Specific to the aforementioned trade, WELL could continue to deliver on peaking growth estimates and similarly, O could fail to make a timely turnaround. This possibility leads to the next risk which is opportunity cost.

首先,板塊輪動存在關鍵風險,因為該策略需要預測市場趨勢來抓準買賣時機。雖然用估值判斷市場泡沫有幫助,但並非萬無一失。例如,過去十年來,許多人預測科技股將面臨輪動,但大型科技公司卻逆勢實現了驚人的成長。同樣地,WELL 可能繼續維持其增長,而 O 則可能無法及時反彈,這種可能性帶來了機會成本的風險。

Assuming the prediction of a slowdown in senior living and revival of net lease are correct, there are additional risk factors. For example, switching between two specific names, such as WELL and O, presents opportunity cost risk as other sectors or net lease REITs could outperform O. Going one step further, trading into a specific net lease REIT also introduces a layer of risk at a company level. As I have outlined before, O's business is quickly changing leaving a degree of execution risk. This could be mitigated by opting for an ETF targeting the net lease sector, like the Fundamental Income Net Lease Real Estate ETF (NETL).

即使對產業的預測正確,從 WELL 轉換至 O 的策略仍有風險。首先是機會成本,因為其他資產的表現可能更好。其次,O 的業務轉型也帶來了公司層面的執行風險。投資淨租賃 ETF (如 NETL) 可幫助分散單一公司的風險。

Either risk would diminish the effectiveness of the proposed swap, even if the thematic predictions around each industry are correct. However, instead of focusing on making the perfect trade, there is value in identifying two sectors that are ready to rotate.

即便產業預測正確,風險仍可能影響交易成效。但重點不在於追求完美交易,而在於找出準備輪動的板塊。

Key Takeaways

This article was intended to highlight two REITs that are of similar quality, but currently sitting on two ends of the sentiment spectrum. While senior living demand skyrockets, driving the multiple of WELL to an extreme level, net lease remains largely in the penalty box. However, eyes are beginning to turn towards assets with long leases and creditworthy tenants. Sitting in that chair, I see a ripe opportunity for sector rotation between two of the largest real estate companies. Trading WELL for O means a considerable change in valuation and dividend cash flow to the shareholder.

本文旨在比較兩家品質相當,但市場情緒兩極的 REITs。老年住宅需求飆升,將 WELL 的估值推至極端,而淨租賃領域則持續受到冷落。然而,投資人目光已開始轉向具備長租約及優質租戶的資產。因此,現在是從 WELL 輪動至 O 的絕佳時機,此舉能為股東帶來更佳的估值與股息現金流。

As illustrated above, shares of O are yielding more than twice shares of WELL, while enjoying a similar credit rating. In fact, I would argue that O's balance sheet is more conservative and likely better positioned for the next three years than the expansive, growing WELL. I continue to emphasize the importance of valuation as a factor of shareholder return. In fact, I would call it the single most important piece of the puzzle. Time for a REIT rotation!

O 的殖利率是 WELL 的兩倍多,而兩者的信用評級相近。

相較於持續擴張的 WELL,O 的資產負債表更為保守,未來三年的前景可能更好。

估值是影響股東回報最重要的單一因素。

是時候進行 REIT 輪動了!

Comments (13)

我從 2005 年持有 WELL,2013 年持有 O。幾年前曾有人建議在 80 幾塊時賣掉 WELL,但我仍續抱這兩支股票。

兩者皆持有,且不賣出。

可考慮部分賣出 WELL 並買入 VICI。「O」雖有些過譽,但穩定的月配息仍適合退休人士。

我未持有任何部位。若持有 WELL,我會減碼而非出清;至於 O,除非跌至四十幾元,否則我會避開。

WELL 是優質股,而 O 則持有低收入商場。

租戶提供的服務受歡迎,代表他們能穩定支付租金,且不難找到新租戶。這是我巡視各地房地產,包含經濟衰退時期的實際經驗,而非空談。我認同本文觀點,也曾輪動操作其他零售型 REITs,例如賣掉在 COVID 低點買入的購物中心。然而,我一直持有 O。感謝您的分析。

零售店面空置期長,且更換租戶成本高。

幸運的是,儘管近期下跌,我仍滿倉 O。

幸好我沒持有 O 這支在 SA 上最被炒作的爛股

你應該閱讀我關於 O 的其他文章

為何?聰明錢早已撤出 REITs,我也不例外