In today’s post:

✅ In the Weekly Review, I wrote this could be a *critical* week — and a potential game-changer for markets.

✅ Markets are now *in motion* — and there may be a LOT more to come.

Strap yourself in…

On Saturday, I wrote:

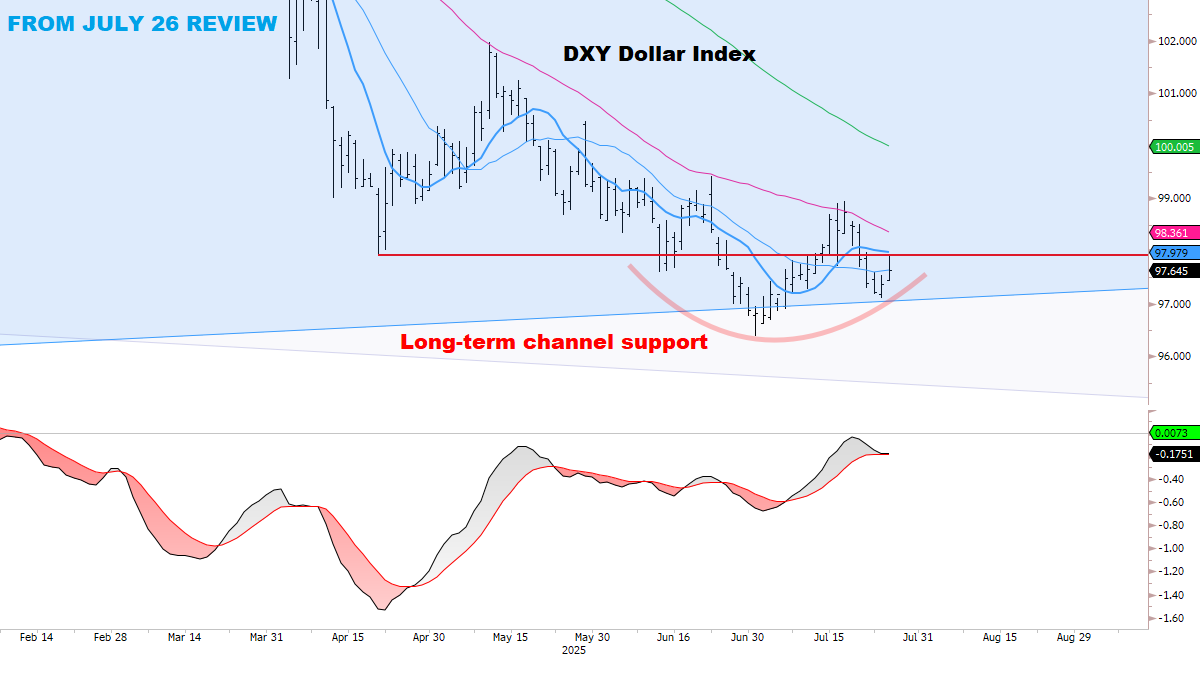

The Dollar may be finishing its base *right here right now*.

This is a critical moment — EVERYTHING converging for a decision next week.

Below, the Dollar is coiled in an *extremely tight* range between long-term support and downtrend resistance.

ANY push above ~98.30 next week would break through key resistance. If the Dollar can push through the 50dma it would be a MAJOR inflection point. Watch these levels closely next week.

ANY push below ~96 would be a complete breakdown. Think this is the less likely outcome, as Weekly charts continue to suggest *significant* upside potential.

Time for the Dollar to make a decision — next week’s economic news / Fed meeting could be big catalysts.

What the Dollar is doing now:

Undoubtedly already a BIG start for the week:

*But* the week is still beginning…

There’s a lot of market-moving data still to come in the next few days: Fed meeting, GDP, PCE, NFP, and ISM — to name a few.

With all this in mind, it’s starting to look like a DECISIVE move in the Dollar — and as before, ”the Weekly charts continue to suggest *significant* upside potential”.

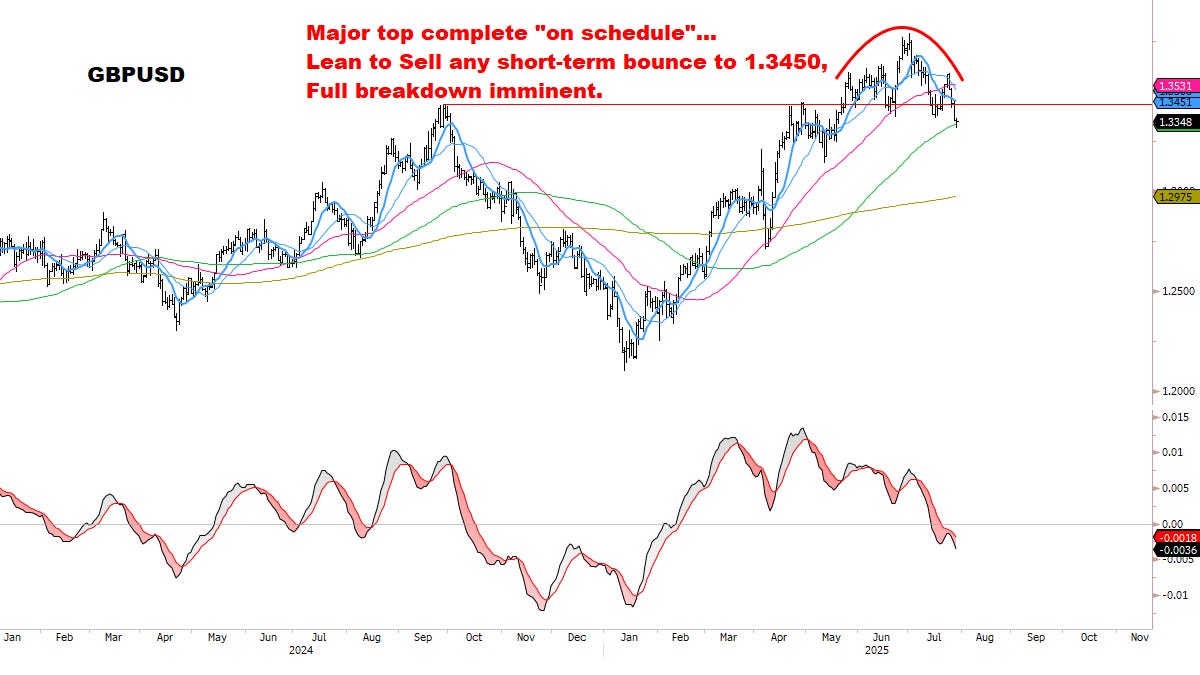

A major turn developing in the BIG FOUR:

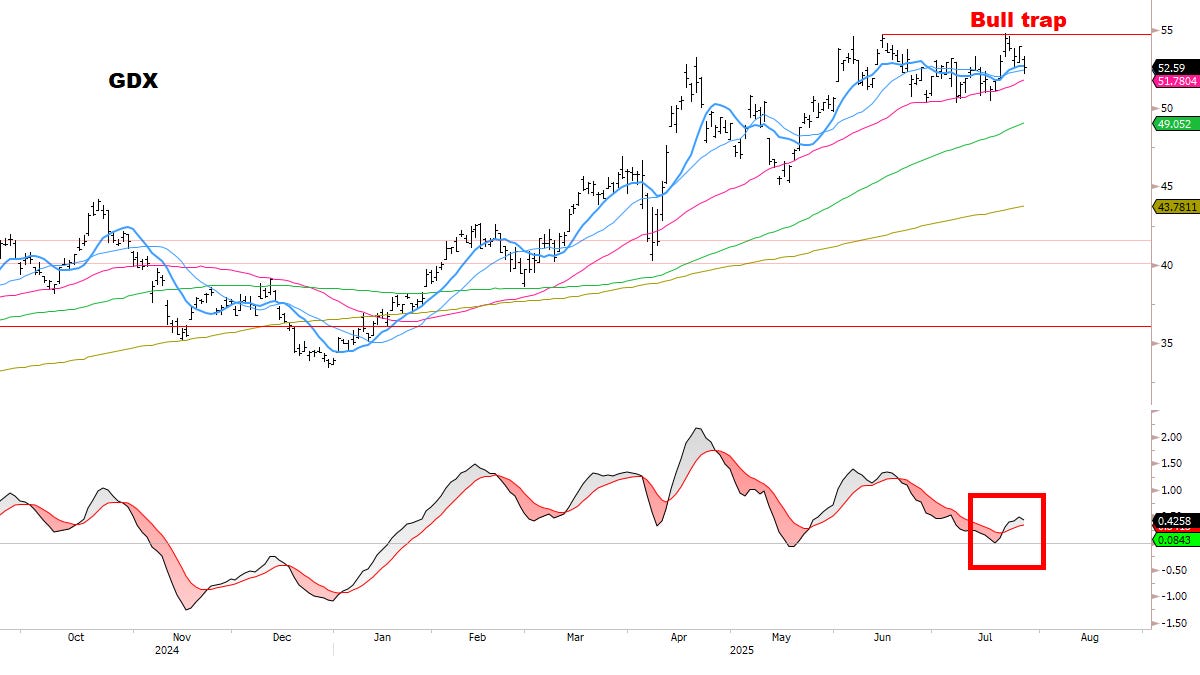

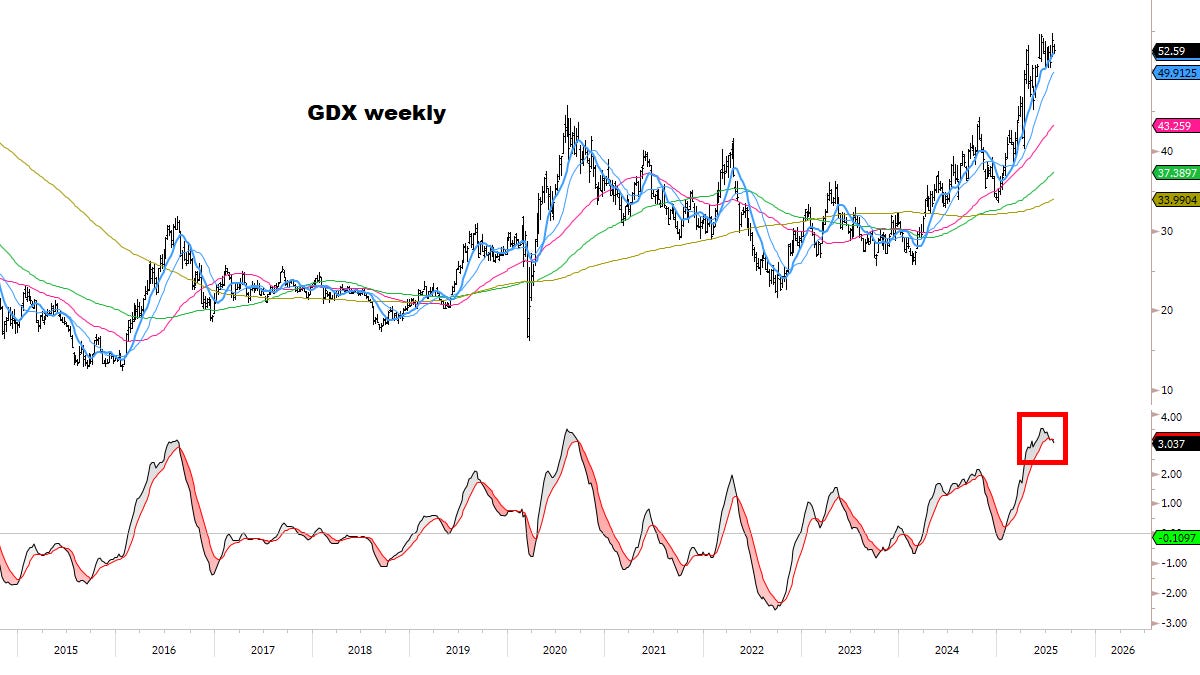

Similarly, a setup for a potential breakdown in Gold Miners:

GDX bull trap reversal after ticking a new high on July 22.

“Coming in hot” for potential daily Sell and break of 50dma — maybe this week.

A confirmed breakdown would target a multi-week correction to (ideally) 200dma, currently ~43 and rising. *If this were to happen, everyone who bought after mid-March would be underwater.

*I continue to avoid exposure to the group.

THE PAIN TRADE

Remember when they bought Europe at the top and it was the “end of American exceptionalism”?

Well:

Year-to-date, QQQ is now beating SX5E, CAC and UKX in local currency.

All the “outperformance” in Europe since MARCH has been from the currency.

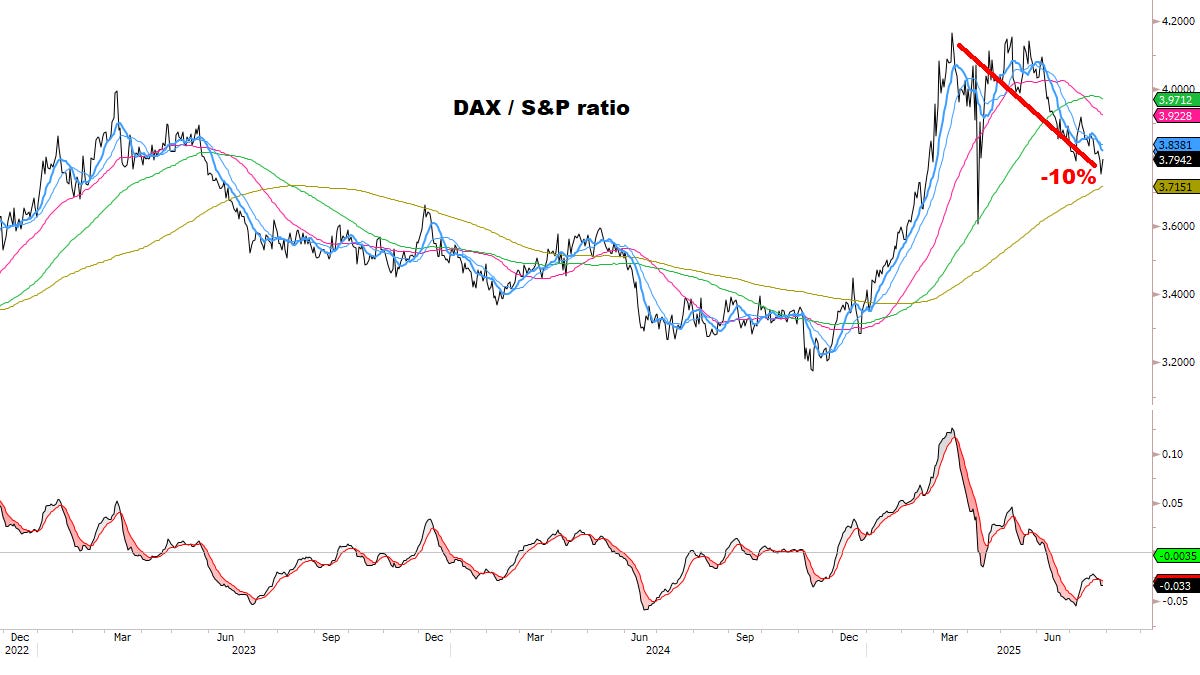

Ex-currency, DAX has underperformed S&P by -10% since March (not shown, DAX has underperformed NDX by -15% since March):

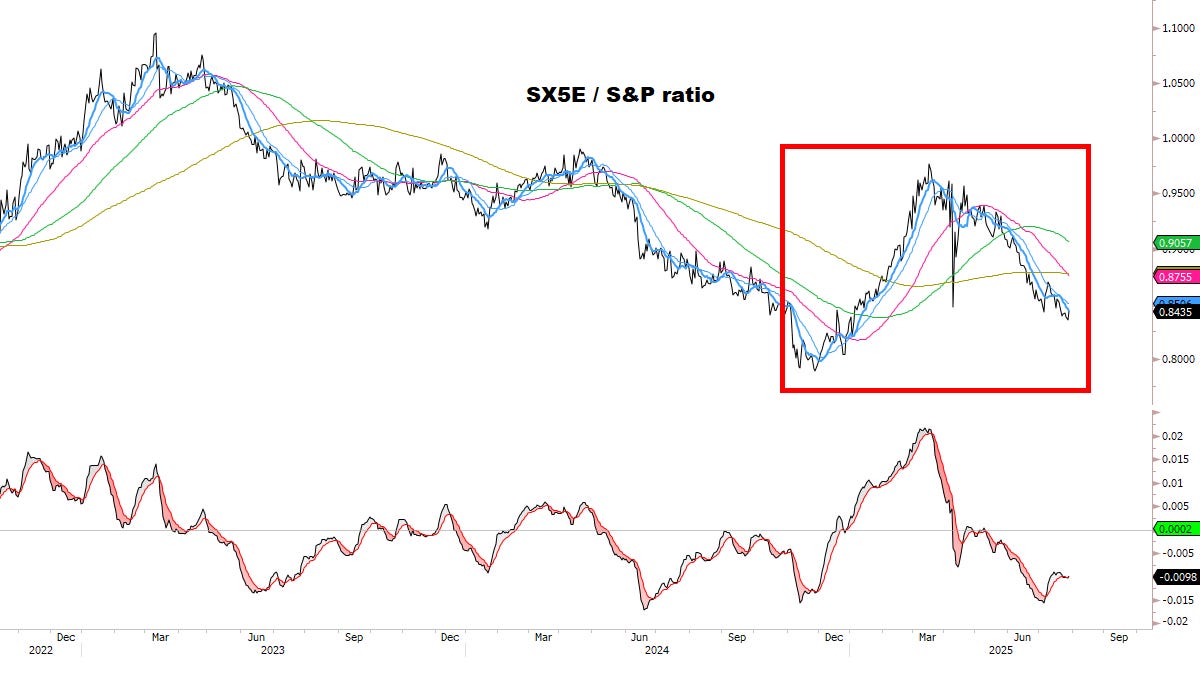

Even worse, SX5E has underperformed S&P by -15% since March:

And the most stunning chart of all… SX5E vs. NDX is almost back to ALL-TIME LOWS.

“Thanks for playing the end of American exceptionalism”

Meanwhile, NVDA is $4T and SX5E is flat since mid-February (nearly 6 months).

What happens to Europe longs treading water for months if EUR corrects?

Best guess: Max pain = capital stop-out / migration to U.S. assets.

What’s the narrative? U.S. is “safe” now that “uncertainty finally lifted”?

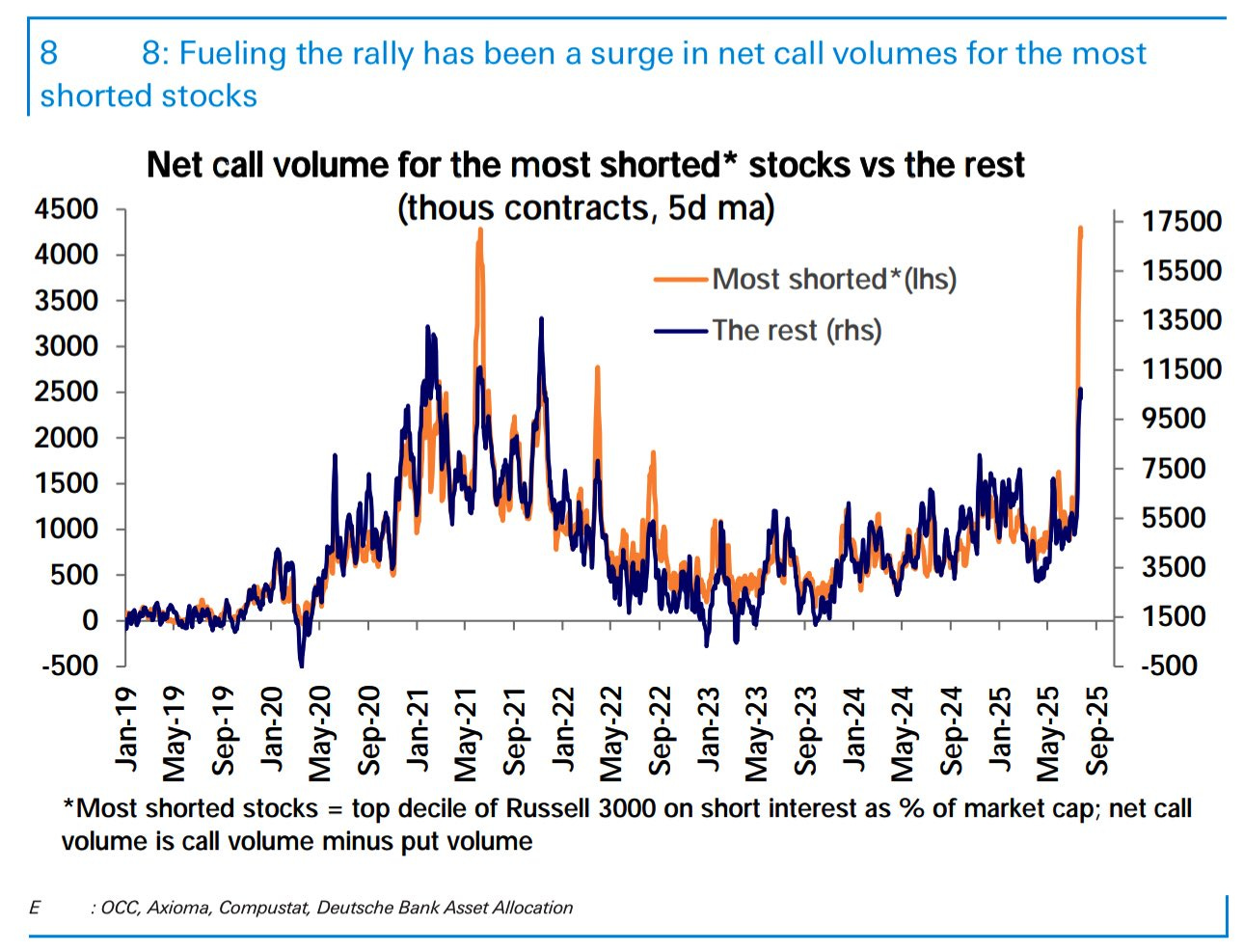

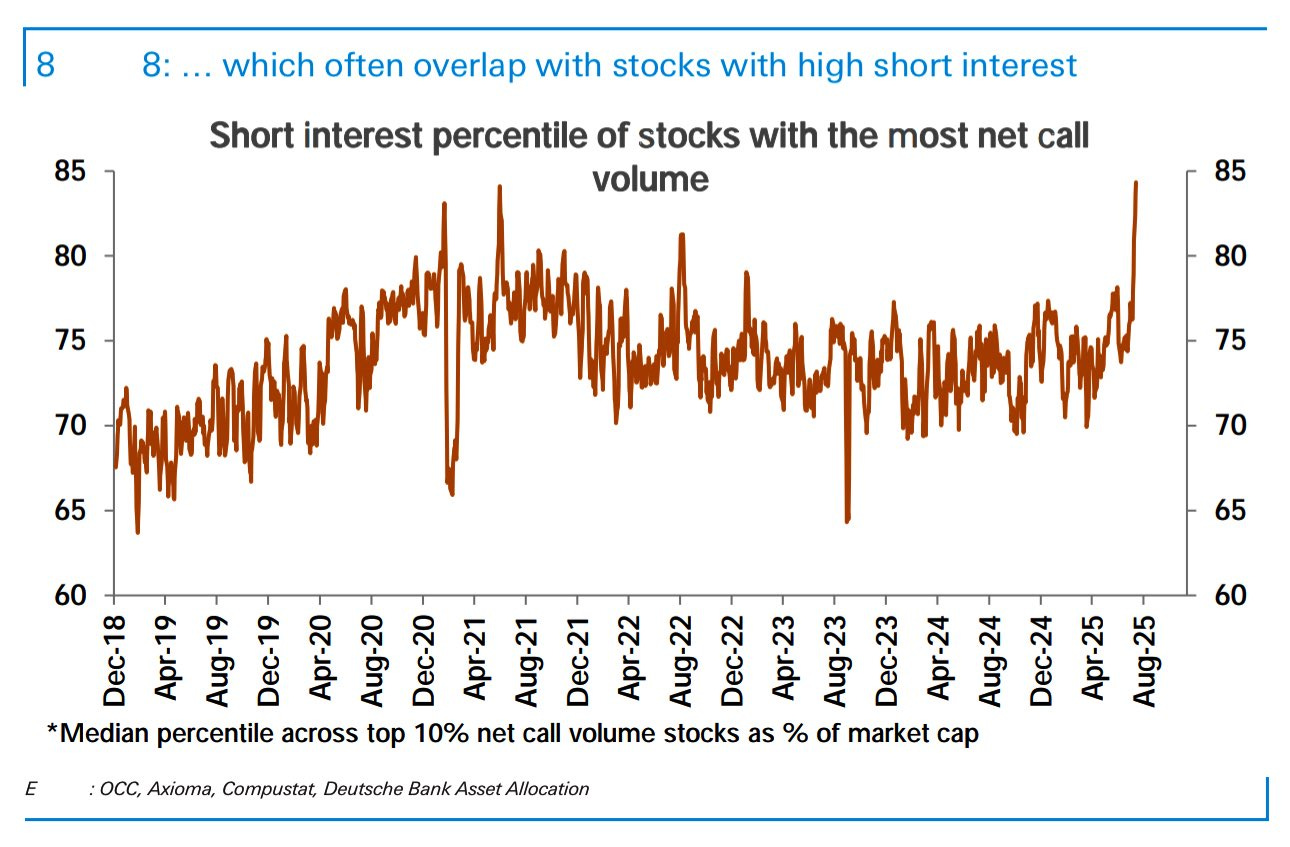

WHAT TOPS LOOK LIKE — A CHECKLIST:

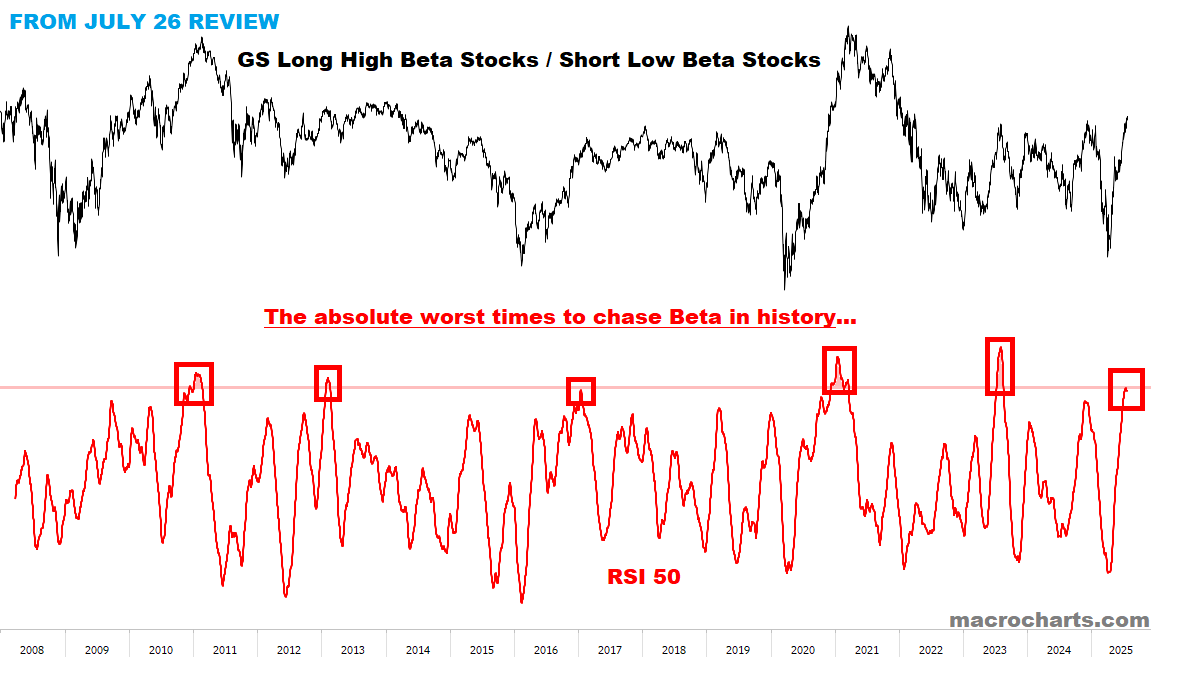

*Two charts which caught my attention yesterday — continuing the theme: